Raydium: Decoding the Success of Solana's Largest DEX

TechFlow Selected TechFlow Selected

Raydium: Decoding the Success of Solana's Largest DEX

As a primary liquidity provider and automated market maker (AMM) on the Solana network, Raydium holds a unique strategic advantage in capturing emerging market trends.

Author: Kyle Cai

Translation: TechFlow

Disclaimer: The Artemis team does not endorse any specific financial, investment, or legal strategy. This article is for informational and educational purposes only and should not be considered financial, investment, or legal advice. All investments carry risk, and past performance is not indicative of future results. Always conduct your own research and consult a licensed financial advisor before making any investment decisions.

Overview

Solana has performed exceptionally well in the 2024 cycle, with memecoins being the dominant theme—and all major memecoins emerging on Solana. Solana is also the top-performing first-layer blockchain this year, with its price surging approximately 680%. While memecoins are closely tied to Solana, since its recovery in 2023, Solana as an ecosystem has regained significant attention, experiencing rapid growth. Protocols such as Drift (perpetual contracts DEX), Jito (liquid staking), and Jupiter (DEX aggregator) now have token valuations reaching billions of dollars. Solana’s active addresses and daily transaction volume exceed those of all other blockchains.

At the heart of this thriving ecosystem is Raydium, Solana’s leading decentralized exchange (DEX). As the saying goes, “During a gold rush, sell shovels.” This perfectly captures Raydium’s role: while memecoins attract public attention, Raydium supports these activities by providing liquidity and trading infrastructure. Fueled by sustained memecoin trading activity and broader DeFi usage, Raydium has solidified its position as critical infrastructure within the Solana ecosystem.

At Artemis, we believe the world is increasingly driven by fundamentals. Therefore, this article aims to analyze Raydium’s unique position in the Solana ecosystem through a data-driven, first-principles approach. Let’s dive in:

Introduction to Raydium

Launched in 2021, Raydium is an automated market maker (AMM) built on the Solana blockchain, offering permissionless liquidity pool creation, ultra-fast transactions, and yield-generating opportunities. Raydium stands out due to its architectural design—it was the first AMM on Solana and pioneered a hybrid AMM model compatible with order books in decentralized finance (DeFi).

At launch, Raydium adopted a hybrid AMM model that allowed idle pool liquidity to be shared with the central limit order book, whereas other DEXs at the time could only use liquidity within their own pools. This meant that liquidity on Raydium simultaneously created a market on OpenBook, tradable via any OpenBook DEX user interface.

While this feature was a key differentiator early on, it has since been disabled due to an influx of long-tail markets. Raydium currently offers three types of liquidity pools:

-

Standard AMM Pools (AMM v4), the original hybrid AMM

-

Constant Product Market Maker (CPMM) pools, supporting Token 2022

-

Concentrated Liquidity Market Maker (CLMM) pools

Each swap on Raydium incurs a small fee based on the specific pool type and fee tier. These fees are allocated to incentivize liquidity providers, repurchase RAY tokens, and fund the treasury.

We have documented Raydium’s transaction fees, pool creation fees, and protocol fees across different pool types. Below is a brief explanation of these terms and their corresponding fee levels:

-

Transaction Fee: Charged to traders when executing a swap.

-

Repurchase Fee: A portion of the transaction fee used to buy back Raydium tokens.

-

Treasury Fee: A portion of the transaction fee allocated to the treasury.

-

Pool Creation Fee: Charged when creating a new pool, designed to prevent abuse. Controlled by the protocol’s multisig, this fee covers infrastructure costs.

Figure 1. Raydium Fee Structure

Solana’s Decentralized Exchange (DEX) Ecosystem

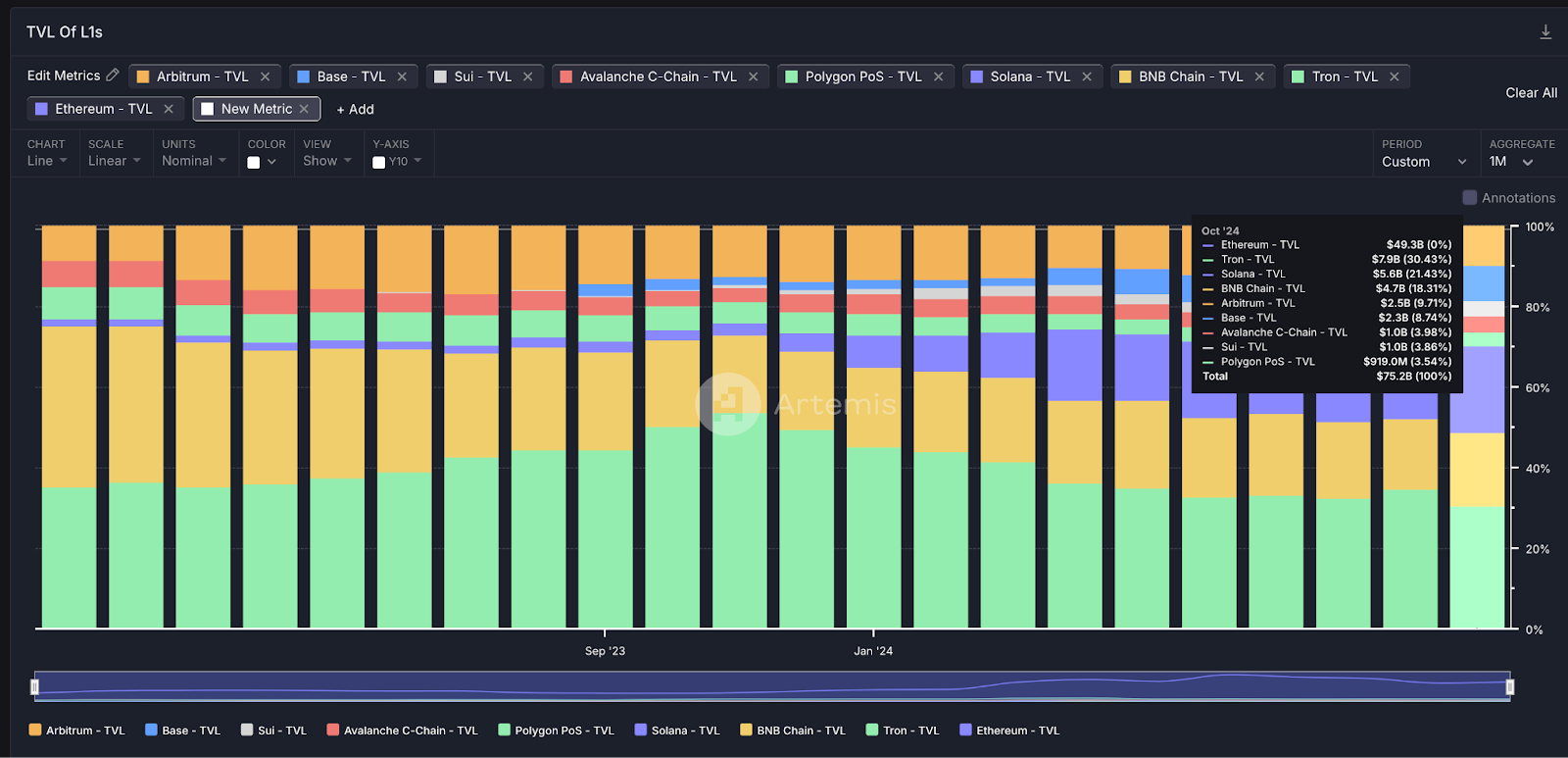

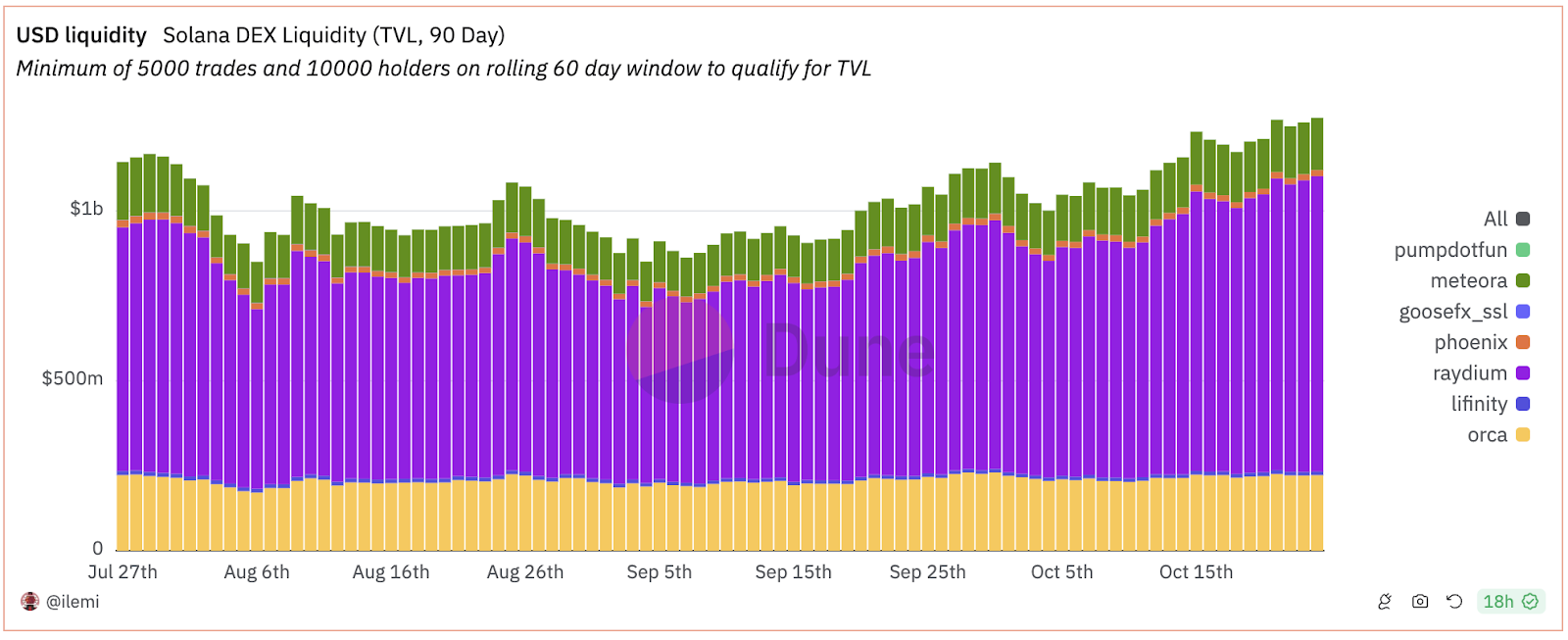

Figure 2. Total Value Locked (TVL) Across Solana DEXs

Source: Artemis

After dissecting Raydium’s operational mechanics, we will now assess its position within the Solana DEX ecosystem. Clearly, Solana has rapidly risen during the 2024 market cycle to become the third-largest chain by total value locked (TVL), trailing only Ethereum and Tron.

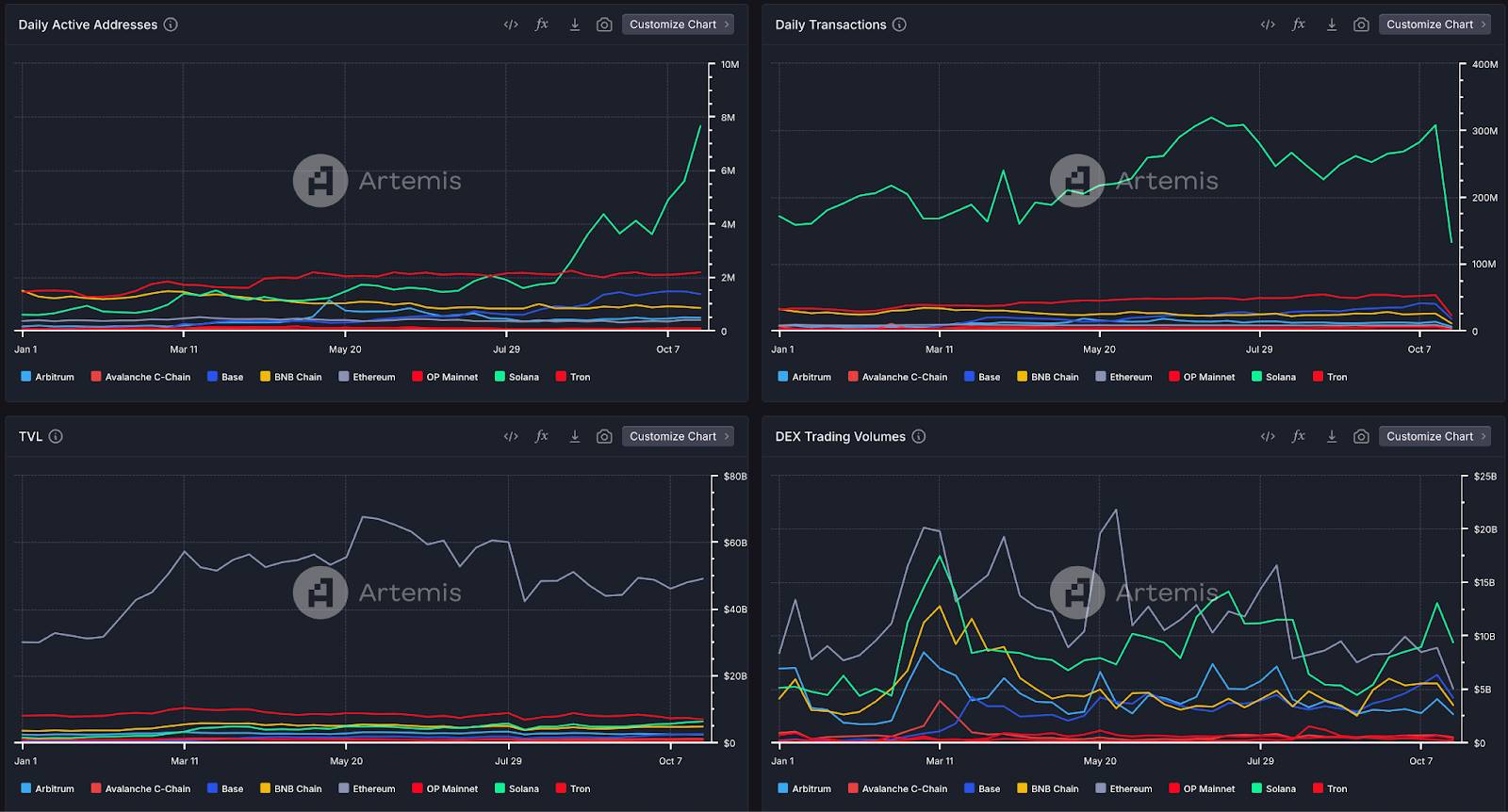

Figure 3. Daily Active Addresses, Daily Transaction Volume, TVL, and DEX Volume Across Chains

Source: Artemis

In terms of user activity metrics—daily active addresses, daily transaction volume, and DEX trading volume—Solana consistently leads. This surge in activity and liquidity can be attributed to several factors, the most notable being the “memecoin craze” on Solana. Solana’s high-speed transactions, low costs, and excellent user experience for decentralized applications have accelerated on-chain trading. With tokens like $BONK and $WIF reaching multi-billion dollar market caps and platforms like Pump.fun enabling easy memecoin launches, Solana has become a central hub for memecoin trading.

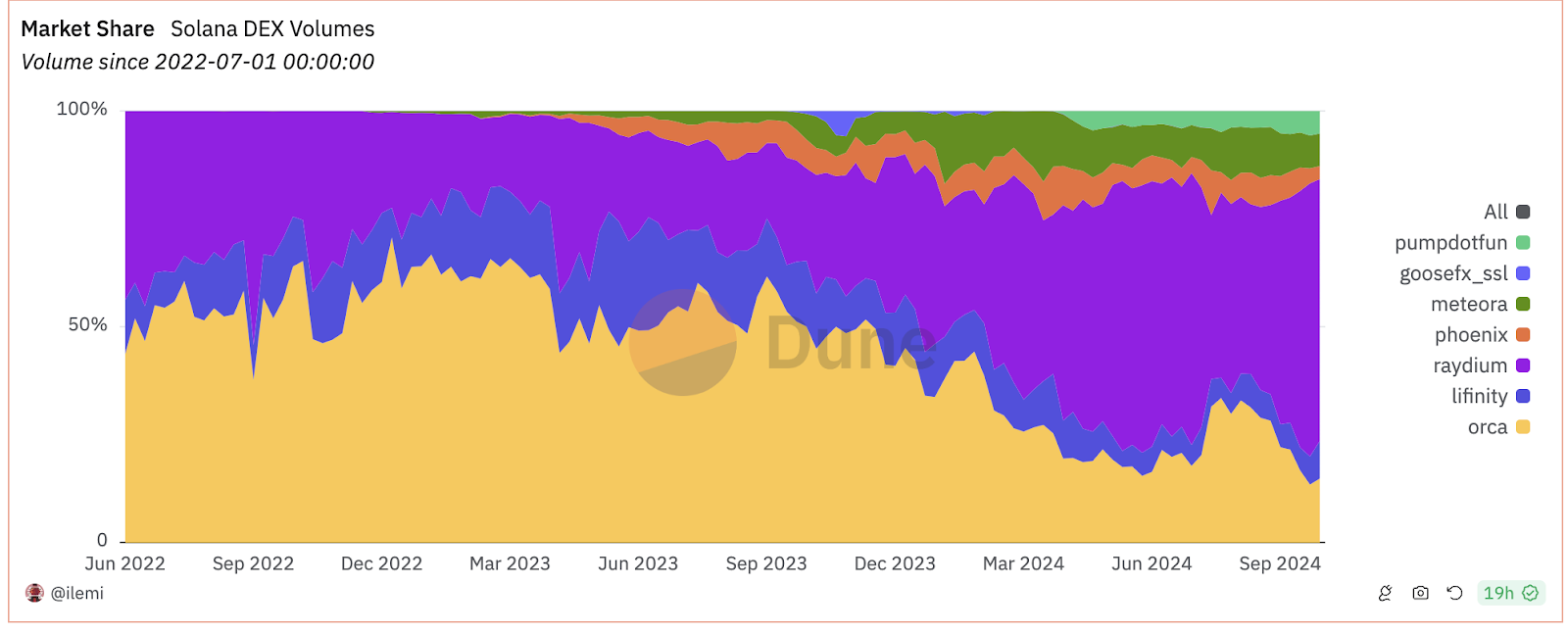

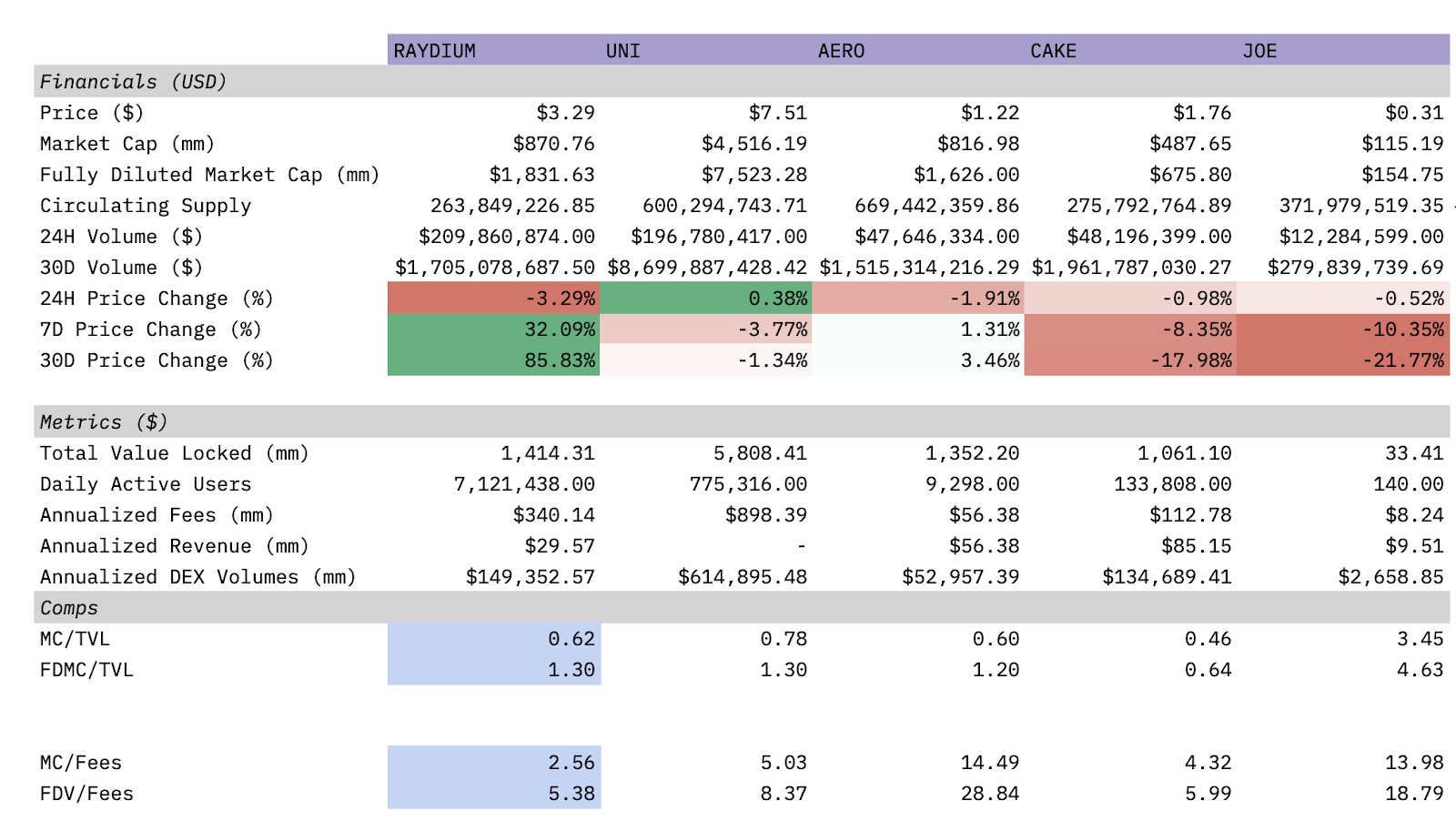

Figure 4. Market Share of Trading Volume Across Solana DEXs

Source: Ilemi’s Raydium Dune Dashboard

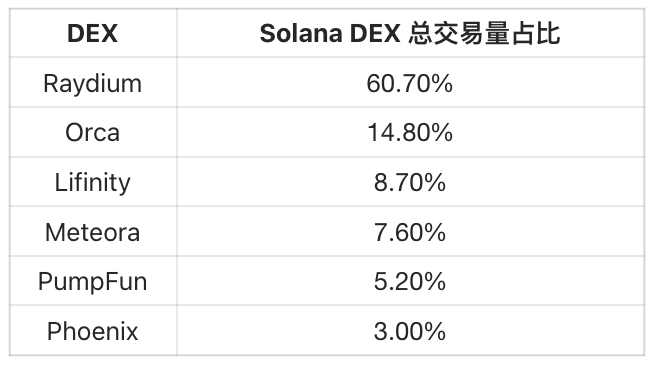

In this cycle, Solana has emerged as the most popular Layer 1 blockchain, continuing to lead in transaction activity among other L1s. As transaction volume increases, Solana’s decentralized exchanges (DEXs) benefit significantly—more traders generate more fees, increasing protocol revenue. Among the many DEXs, Raydium stands out, capturing a substantial market share. As shown below:

Figure 4. Market Share of Solana DEX Trading Volume by Platform

Source: Ilemi’s Raydium Dune Dashboard

Raydium continues to maintain its status as the most liquid decentralized exchange (DEX). Notably, DEX operations often involve economies of scale—traders typically prefer the most liquid exchange to minimize slippage. Higher liquidity attracts more traders, which in turn draws liquidity providers seeking fee income, creating a virtuous cycle that further attracts traders aiming to avoid slippage.

When comparing different DEXs, liquidity is often overlooked but critically important—especially evident when trading memecoins on Solana. Memecoins are typically illiquid and require a centralized trading venue. If liquidity is fragmented across multiple DEXs, it degrades user experience and makes trading memecoins inconvenient across platforms.

Exploring the Relationship Between Memecoins and Raydium

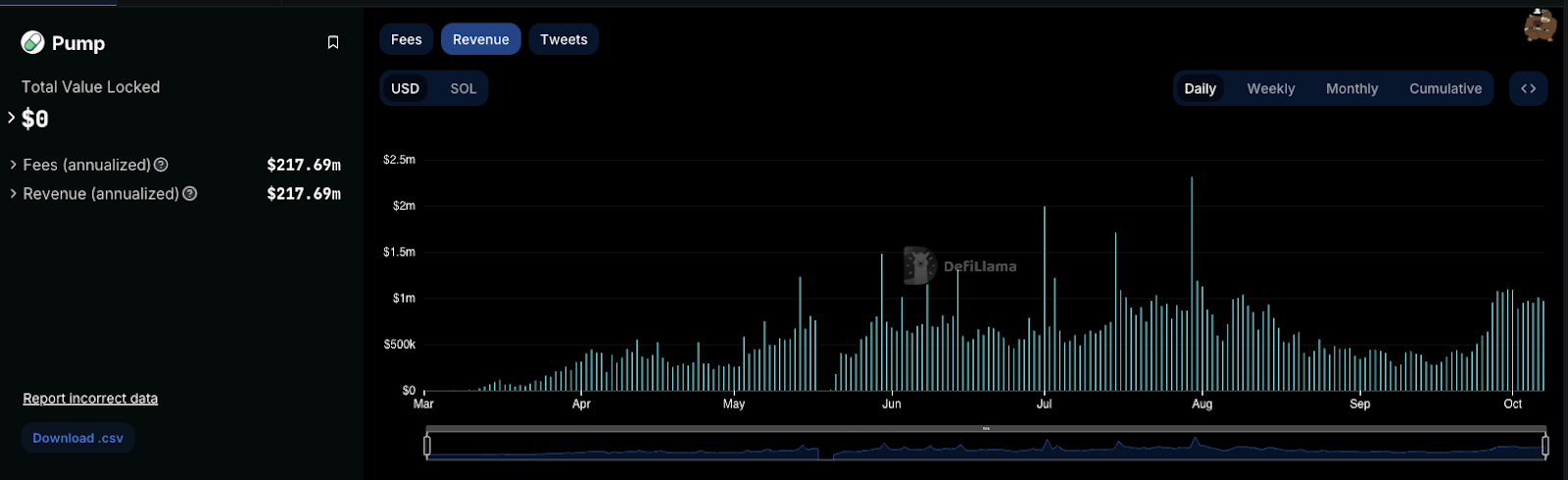

Raydium’s popularity is also linked to the resurgence of memecoins on Solana, particularly through the memecoin launch platform PumpFun. Since its inception earlier this year, PumpFun has earned over $100 million in fees via its platform.

Memecoins launched on PumpFun have a close partnership with Raydium. When a token launched on Pump.fun reaches a market cap of $69,000, PumpFun automatically injects $12,000 worth of liquidity into Raydium. This mechanism makes Raydium the most liquid platform for trading memecoins. This creates a positive feedback loop: PumpFun connects to Raydium → memecoins launch on Raydium → users trade there → liquidity increases → more memecoins launch → even greater liquidity, and so on.

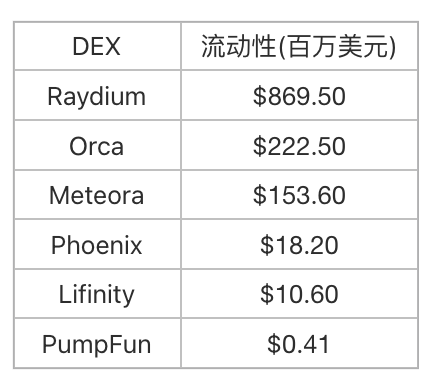

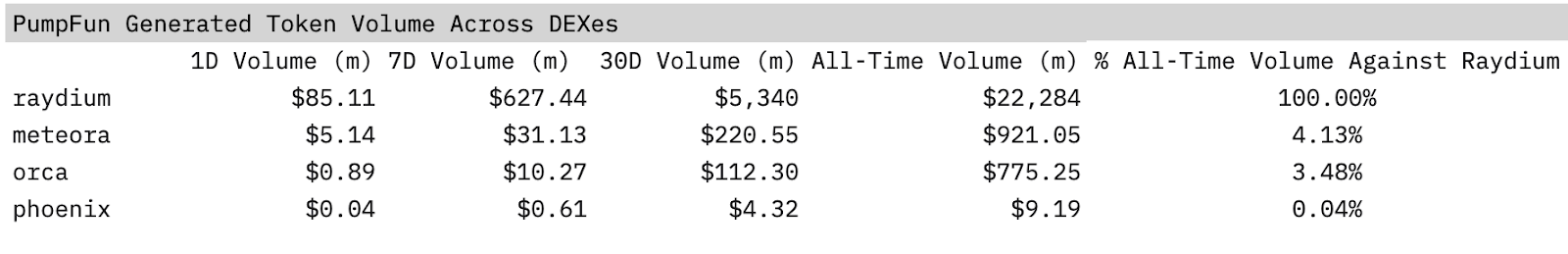

Figure 6. Trading Volume of Tokens Generated by PumpFun Across DEXs

Source: Hashed_em’s Memecoin Volume Dune Dashboard

As a result, Raydium follows a power law distribution, with over 90% of memecoins generated by PumpFun traded on Raydium. Like a major shopping mall in a city, Raydium is the largest “mall” on Solana—meaning most users choose to “shop” here, and most “merchants” (tokens) want to set up “stores” within it.

Figure 7. Comparison of 30-Day Trading Volume per Trading Pair Across Solana DEXs vs. Raydium

(Red represents memecoins, blue represents non-memecoins)

Source: Ilemi’s Raydium Dune Dashboard, Raydium

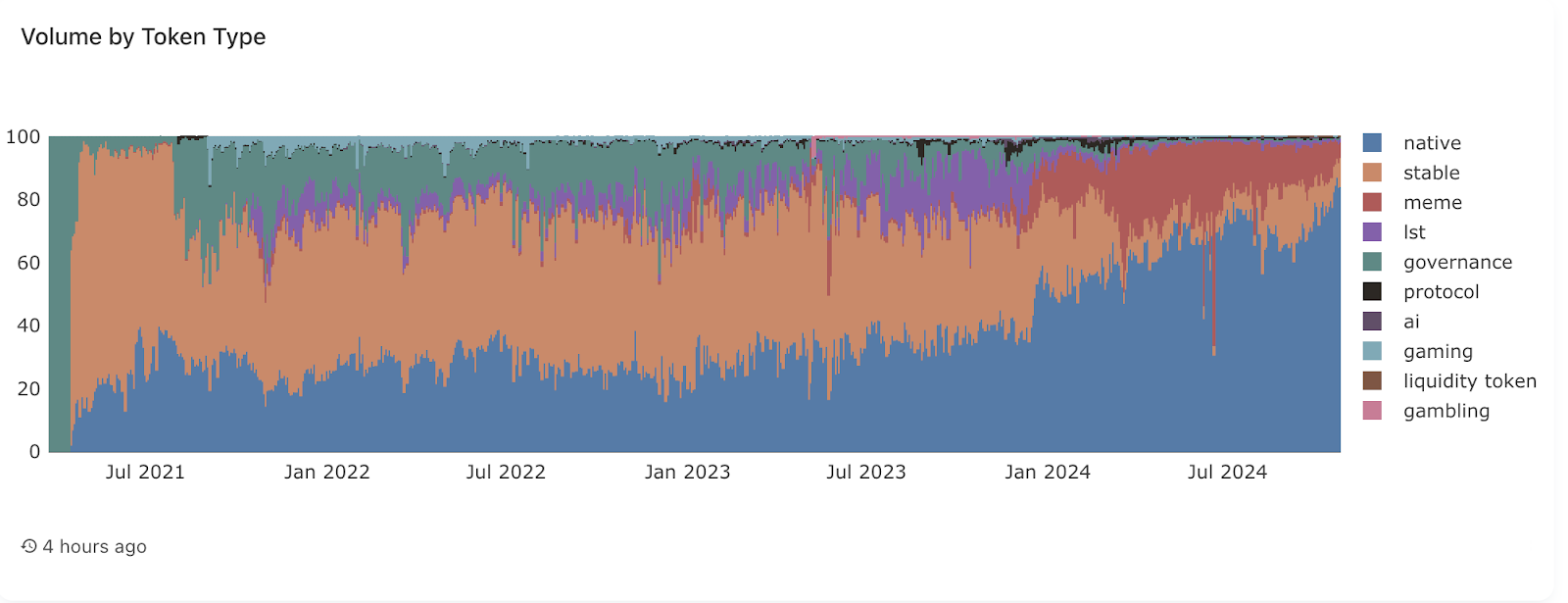

Figure 8. Raydium Trading Volume by Token Type

Source: Full Raydium Dashboard

However, it’s important to note that although PumpFun relies on Raydium, Raydium does not entirely depend on memecoins for its trading volume. In fact, according to Figure 8, the two largest trading pairs over the past 30 days were SOL-USDT and SOL-USDC, together accounting for over 50% of total trading volume. (Note: The two SOL-USDC pairs are separate pools with different fee structures.)

Figures 7 and 9 further confirm this. Figure 7 shows the SOL-USDC pair far outpacing other DEX trading pairs in volume. Even though Figure 7 includes all DEXs, it indicates that overall ecosystem volume isn’t solely driven by memecoins. Figure 9 further illustrates Raydium’s trading volume by token type, with “native” tokens accounting for over 70% of volume. Thus, while memecoins are a significant component of Raydium, they do not represent the entirety of its trading activity.

Figure 9. PumpFun Revenue

Source: Defillama

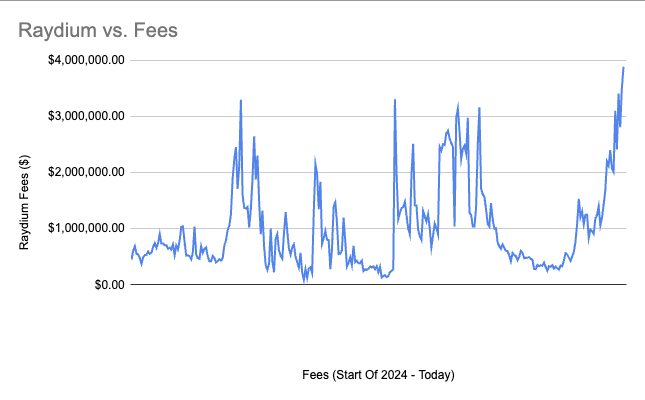

Figure 10. Raydium Revenue

Source: Artemis Excel Plugin

Nonetheless, memecoins are highly volatile, and volatile pools typically charge higher fees. Therefore, despite memecoins potentially having lower trading volumes than Solana-based pools, they contribute significantly to Raydium’s revenue and fee generation. This was evident in September’s data—since memecoins are highly cyclical assets, their performance tends to sharply decline during downturns as risk appetite wanes. PumpFun’s revenue dropped 67% from an average of $800,000 per day in July–August to around $350,000 per day in September; we observed a similar decline in Raydium’s fees during the same period.

Figure 11. Raydium TVL Over Time

Source: Artemis Excel Plugin

However, like other areas of the crypto industry, this sector is highly cyclical, so metric declines during bear markets are normal as risk gets washed out. Conversely, we can view TVL as a measure of a protocol’s true antifragility—while revenue is highly cyclical and fluctuates with speculative activity, TVL reflects the sustainability of a DEX and how well it withstands the test of time. TVL is like a mall’s “occupancy rate”—even if trends change and foot traffic varies seasonally, as long as occupancy remains above average, we can consider it successful.

Like a consistently busy shopping mall, Raydium’s TVL has remained stable over the long term. This indicates that although its revenue may fluctuate with market prices and investor sentiment, Raydium has proven itself as a core product in the Solana ecosystem and the premier, most liquid DEX on Solana. Therefore, while memecoins contribute to its revenue, Raydium’s trading volume isn’t always dependent on them—liquidity continues to concentrate on Raydium regardless of market conditions.

Raydium vs. Aggregators

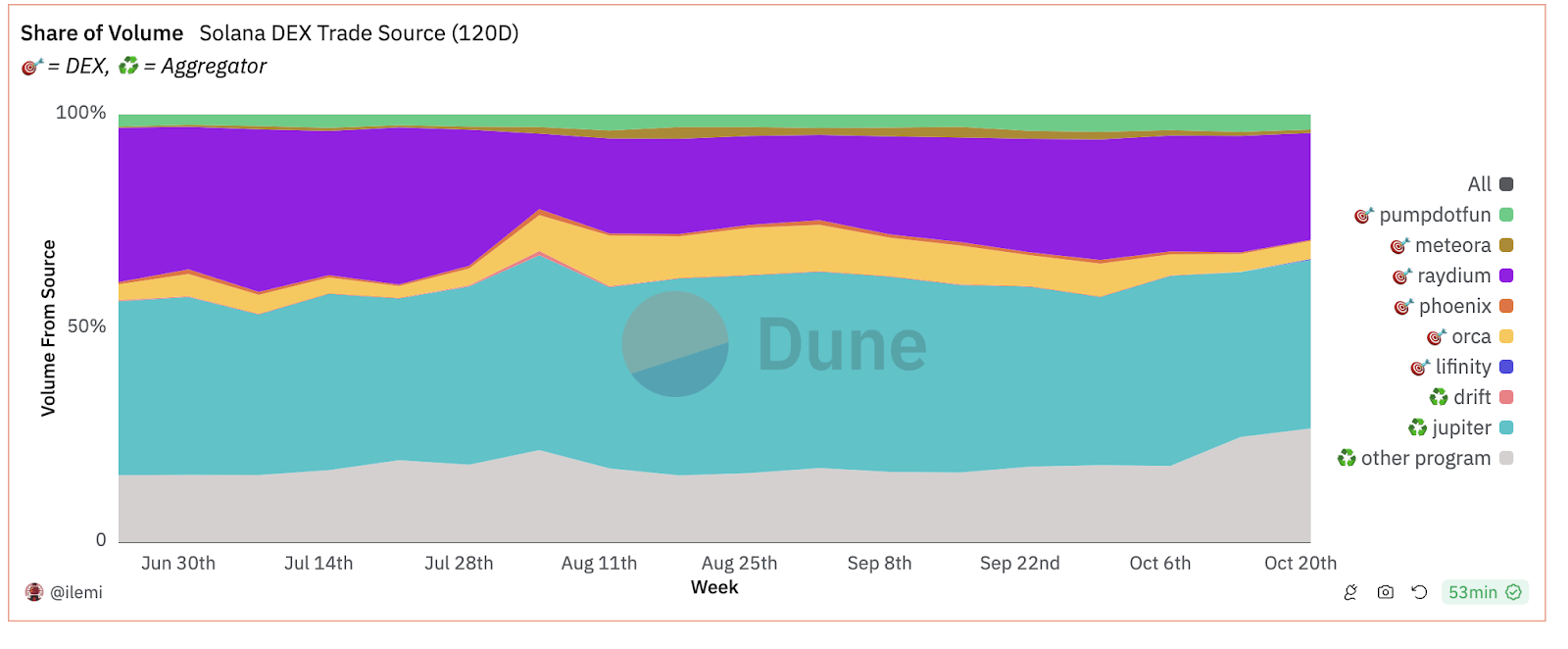

Figure 12. Sources of Solana DEX Transactions

Source: Ilemi’s Raydium Dune Dashboard

While Jupiter and Raydium don’t directly compete, Jupiter plays a crucial role as an aggregator in the Solana ecosystem, routing trades across multiple decentralized exchanges (DEXs), including Raydium. Jupiter is essentially a meta-platform that sources liquidity from multiple DEXs—such as Orca, Phoenix, and Raydium—to ensure users get the best prices. In contrast, Raydium acts as a liquidity provider, supplying deep liquidity pools for Solana tokens and supporting many trades routed through Jupiter.

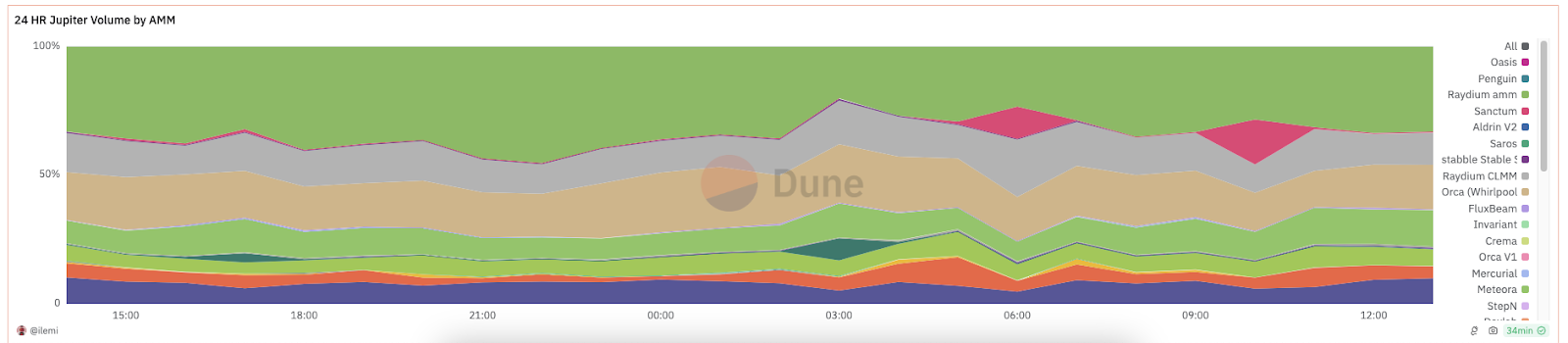

Figure 13. 24-Hour Jupiter Trading Volume by AMM

Source: Ilemi’s Jupiter by AMM Dune Dashboard

Although Raydium and Jupiter work closely together, it's noteworthy that the proportion of direct trading volume on Raydium is gradually increasing, while the share coming from Jupiter is decreasing. At the same time, Raydium accounts for nearly half of Jupiter’s maker volume.

This suggests Raydium has succeeded in building a stronger, more self-sufficient platform capable of attracting users directly without relying on third-party aggregators like Jupiter.

The rise in direct trading volume indicates that traders find value in using Raydium’s native interface and liquidity pools, as users seek the most efficient and comprehensive DeFi experience without needing to go through an aggregator. Ultimately, this trend underscores Raydium’s independent status as a primary liquidity provider in the Solana ecosystem.

Raydium vs. Other Platforms

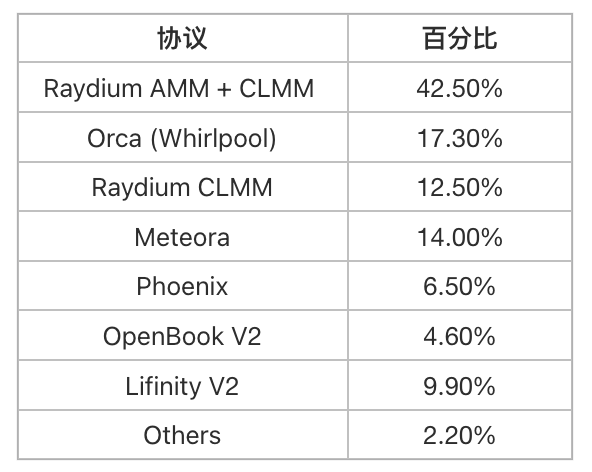

Finally, we used the Artemis plugin to create a comparison table showing Raydium versus other DEXs on Solana, including aggregators.

Figure 14. Raydium Compared to Other DEXs on Solana

Source: Artemis Excel Plugin

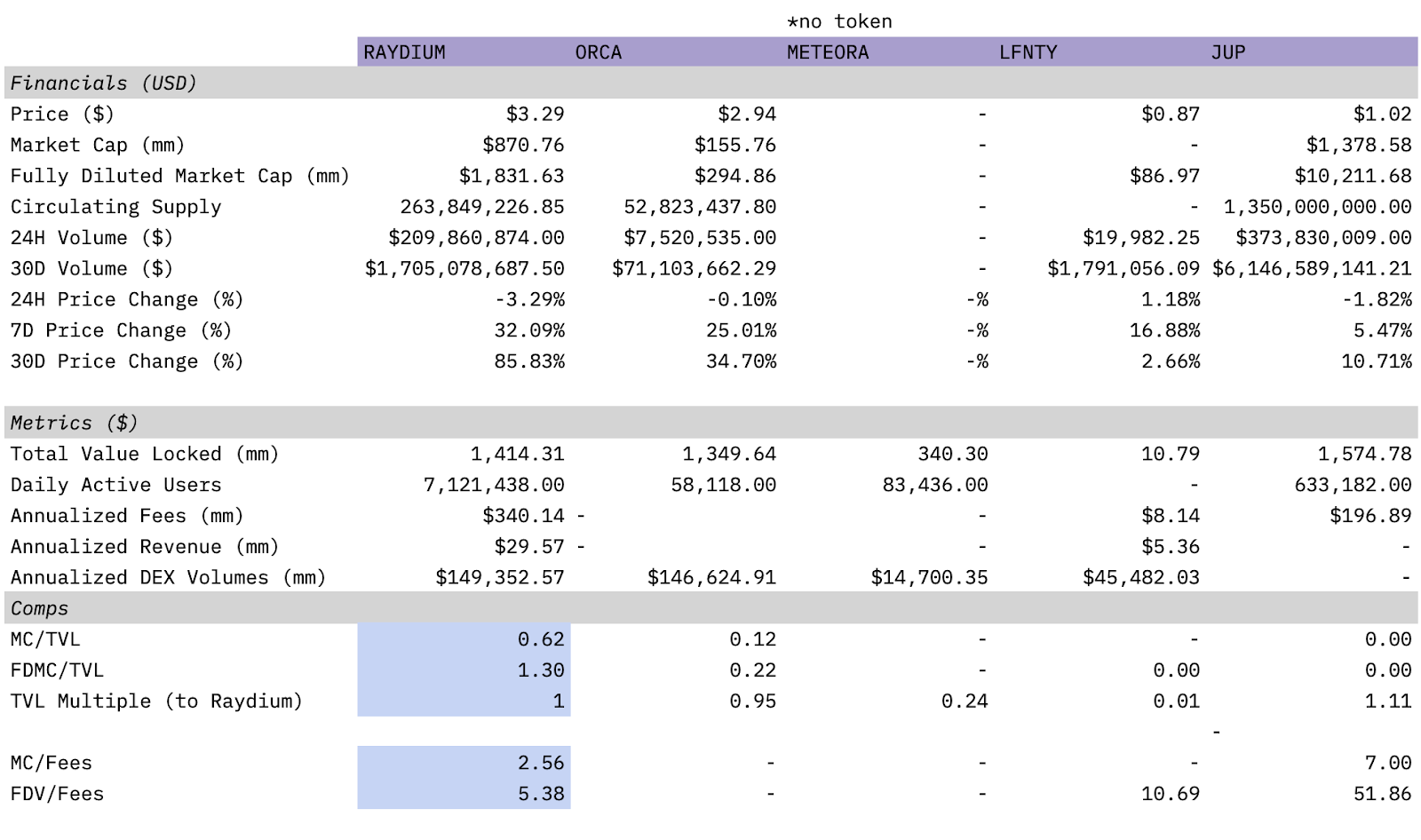

Figure 15. Raydium vs. Other Popular DEXs

Source: Artemis Excel Plugin

In Figure 13, we compare Raydium with the most popular DEXs on Solana, including Orca, Meteora, and Lifinity—the four platforms collectively account for 90% of Solana’s total DEX trading volume. We also include Jupiter as an aggregator for comparison. Although Meteora has no token, we still include it in the analysis.

The data shows Raydium has the lowest market cap/fee ratio and FDV/fee ratio among all DEXs. Raydium also has the highest number of daily active users. Excluding Jupiter (classified as an aggregator rather than a DEX), all other DEXs have over 80% less TVL than Raydium.

In Figure 14, we compare Raydium with traditional DEXs on other chains. Raydium’s annualized DEX trading volume is more than twice that of Aerodrome, yet its market cap/revenue ratio is lower.

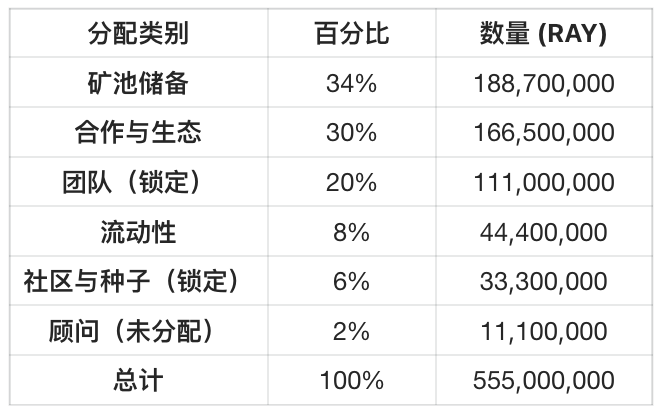

Raydium Tokenomics

Below are the detailed tokenomics of Raydium:

Note: Team and seed round tokens (25.9% of total supply) were fully locked for the first 12 months after the token generation event (TGE) and linearly unlocked daily from month 13 to 36. The lock-up period ended on February 21, 2024.

The Raydium token serves multiple purposes: holders of $RAY can stake to earn additional tokens. Additionally, $RAY is used as mining rewards to incentivize liquidity providers, thereby deepening liquidity pools. While $RAY is not currently a governance token, related governance mechanisms are under development.

Although market interest in token emissions waned after DeFi Summer, it’s worth noting that Raydium has a very low annual inflation rate and one of the strongest annualized buyback programs in DeFi. Currently, about 1.9 million RAY are issued annually, with 1.65 million allocated to staking—a relatively modest amount compared to peak issuance levels of other popular DEXs. At current prices, this amounts to approximately $5.1 million in annual token issuance. By comparison, Uniswap, before full unlock, issued tokens worth around $1.45 million daily—over $529 million annually.

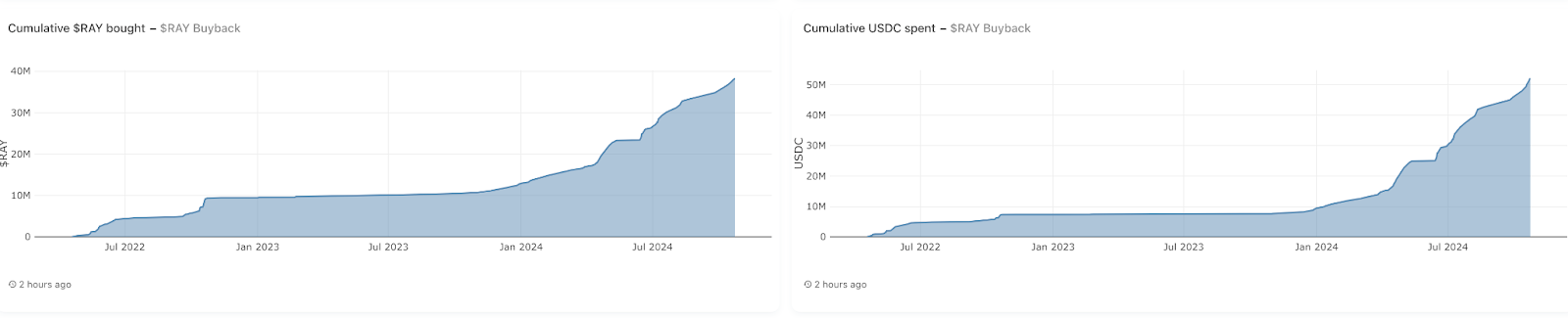

Every transaction on Raydium incurs a small fee. According to official documentation, “Depending on the pool’s fee structure, this fee is distributed to incentivize liquidity providers, repurchase RAY tokens, and fund the treasury. Overall, regardless of the pool’s fee tier, 12% of all transaction fees are used to repurchase RAY.” Combined with Raydium’s trading volume, this mechanism produces significant effects.

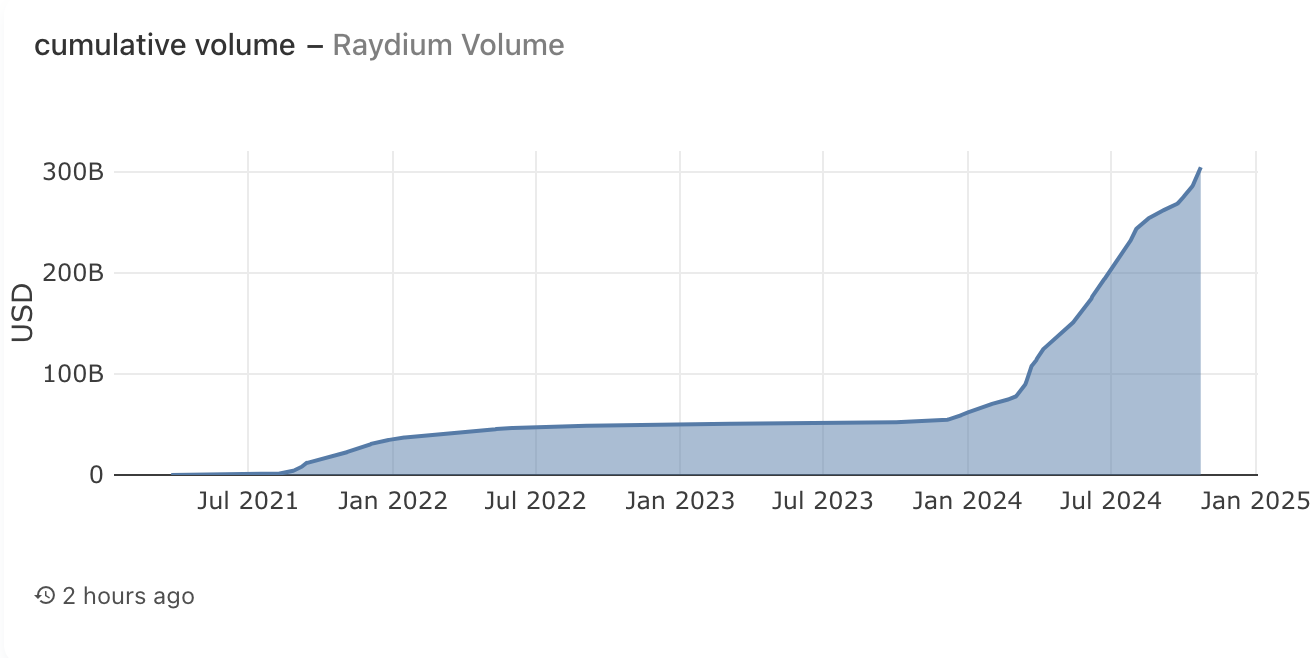

Figure 16. Cumulative Trading Volume on Raydium

Source: Full Raydium Dashboard

Figure 17. Raydium Buyback Data

Source: Full Raydium Dashboard

The data speaks for itself: Raydium has achieved remarkable results. Cumulative trading volume has exceeded $300 billion, and Raydium has successfully repurchased approximately 38 million RAY tokens, worth around $52 million. Raydium’s buyback program is the strongest in the entire decentralized finance (DeFi) space, cementing its leadership among all decentralized exchanges (DEXs) on the Solana network.

Raydium’s Future Outlook

In summary, Raydium holds a significant advantage among decentralized exchanges on the Solana network and is optimally positioned amid Solana’s ongoing development. Over the past year, Raydium’s trajectory has been impressive, and with memecoins continuing to dominate the crypto market, Raydium’s growth momentum shows no signs of slowing. Recent memecoin trends have centered around artificial intelligence (AI), such as $GOAT.

As the primary liquidity provider and automated market maker (AMM) on the Solana network, Raydium holds a strategic advantage in capturing emerging market trends. Furthermore, Raydium’s commitment to innovation and ecosystem development is evident in its frequent system upgrades, strong incentives for liquidity providers, and active community engagement. These factors suggest that Raydium is not only well-prepared to adapt to the evolving DeFi landscape but also poised to lead it.

As essential infrastructure within a rapidly growing blockchain ecosystem, Raydium’s future growth prospects appear highly optimistic if it maintains its current trajectory.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News