The public blockchain that fate gifts you has already been quietly assigned its purpose.

TechFlow Selected TechFlow Selected

The public blockchain that fate gifts you has already been quietly assigned its purpose.

The future of the industry, the future of public blockchains, remains undecided.

Written by: TechFlow

Looking back at the last market cycle, the dominant activity can essentially be summarized as PVP.

PVP here, PVP there—PVP on any chain that still has some heat and narrative left.

Now in 2025, these chains have long entered a phase of competition over existing users and capital. Gone are the days when dozens of chains fought to become the "Ethereum killer." Today, most chains are dismissed with labels like “not even a dog would use it,” while the few survivors are struggling just to feed themselves.

It's not just the PVP traders engaging in this battle—the chains themselves are also locked in PVP.

Every chain seems eager to replicate Solana’s vibrancy, but no matter what they do, none have managed to recreate Solana’s Meme-fueled spectacle.

Just as each region nurtures its own people, perhaps each public chain is only fit for one purpose.

Every surviving public chain has already been silently assigned its function.

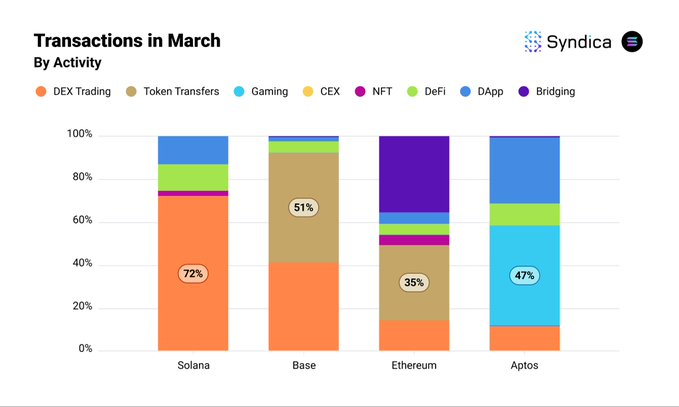

A recent March L1/L2 data insights report from overseas news and research firm Syndica (@Syndica_io) makes this sense of destiny more tangible through numbers:

-

72% of all transactions on Solana are related to decentralized exchanges (DEX), clearly aligning with your typical "meme coin trading" perception.

-

51% of Base transactions are token transfers;

-

Nearly 40% of Ethereum transactions involve cross-chain bridging (purple bars in chart above)

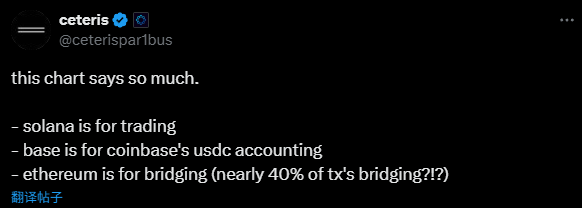

@ceterispar1bus, Research Head at Delphi Digital, cut straight to the core when commenting on this data:

-

Solana is for trading

-

Base is for Coinbase to keep USDC accounts

-

Ethereum is for moving assets across chains

At this stage of industry development, projects are no longer just competing on technology—they must find their own “anchor point,” a natural and sustainable use case.

An Identity Tag, and Also a Destiny

On the surface, a blockchain’s primary use appears to emerge organically from user behavior and market forces. But upon closer inspection, it's more accurately the result of predetermined advantages—resources and background—that quietly set the price.

To summarize the identity tags of these three blockchains:

Solana is the hotbed for trading, Base has become Coinbase’s “accountant,” and Ethereum is held hostage by bridges, accelerating asset outflows.

Behind each chain’s current state lies a dual driver: technological and non-technological factors.

Let’s start with Solana.

In 2025, Solana remains the liveliest ecosystem for Meme coin trading within the industry.

Its DEX trading volume has consistently ranked first for two consecutive months, leading the market by a wide margin. Since October 2024, Solana has seen over 500,000 new meme coins created monthly—an endless “meme party.”

PVP traders patiently grind and hunt for angles; traders monitor pools and frontrunners. For anyone who’s played meme coins, the first thought about Solana is: "Isn’t this chain just one big casino?"

Solana’s high throughput (TPS 12x that of Base) and low cost (high proportion of transactions under $0.01) form the foundation of its status as a trading hub. According to the Syndica report, Solana leads in small-value transactions (under $100), making it ideal for high-frequency meme trading.

Decentralization? In practice and user experience, it doesn’t seem to matter much.

More importantly, Solana had early advantages in resource endowment.

Between 2019 and 2023, Solana received backing from top investors like a16z and Multicoin Capital, attracting DeFi and meme coin developers through grants and incubators.

Solana’s annual Breakpoint conference often sparks meme coin inspiration. Remember when Toly wore that green cartoon dragon costume onstage two years ago, igniting massive attention around the viral meme coin SillyDragon?

Founders deliberately crafting their image, subtly hinting at meme associations—this has now become a common playbook.

(See: Vitalik's Cat, Toly's Dragon: When Memes Target Founders’ Pets)

The community culture has “predestined” Solana as fertile ground for memes. Through social media (like X) and meme coin contests, Solana has become a playground for grassroots players. Coins like PEPE, BONK, and POPCAT have created positive feedback loops.

User perception is locked in: “Solana = trading.” Developers flood in, good and bad alike, making the rise of platforms like Pumpfun feel inevitable.

Now consider Base.

Base does have memes, and during the recent AI Agent wave, some standout tokens emerged. But these were largely spillovers from Solana’s capital flows and low-difficulty arbitrage opportunities.

March data shows 51% of Base transactions are token transfers. The deeper reason lies in the relationship between Coinbase and Circle.

Coinbase and Circle co-founded the Centre Consortium in 2018, responsible for issuing and managing USDC. As co-founders, both companies jointly promoted USDC adoption and established operational standards through Centre.

As Coinbase’s “homegrown chain,” Base naturally became the preferred channel for USDC transfers.

Moreover, Circle’s recent IPO filing reveals a clear profit-sharing arrangement with Coinbase—Coinbase receives 50% of the yield generated from USDC reserves.

This means every USDC transaction settled or promoted by Coinbase directly increases its share of revenue.

(See: Circle Files for IPO, Coinbase Earns 50%: A Win-Win Stablecoin Game)

Base’s low cost and high efficiency perfectly suit this “accounting” need—whether it’s internal fund transfers within Coinbase or user-driven USDC transactions. Base efficiently records and manages these on-chain activities, including transfers, liquidity management, and settlements. This “bookkeeping” not only reduces Coinbase’s operational costs but also generates direct income via USDC yield sharing.

Culturally, Base leans toward institutional and compliant users. With over 100 million users, Coinbase’s base consists mostly of “serious players.” Naturally, developers aren’t inclined to launch wild “meme parties” on Base.

From day one, Base was strategically destined by Coinbase and Circle to be USDC’s “accountant,” firmly locked into this partnership’s economic loop.

Finally, Ethereum—the perennial disappointment.

Nearly 40% of its transactions relate to cross-chain bridging, turning it into a mere “transit hub” for other chains.

ETH’s value feels increasingly drained, as if perpetually roasted over fire. Despite remaining the DeFi leader—with over 60% share of total value locked (TVL) according to Syndica—negative sentiment continues to spread in the community.

Ethereum’s “bridging fate” stems technically from prohibitively high gas fees.

During bull markets, regular users are already overwhelmed, forced to move assets via bridges to cheaper chains. In bear markets, there’s hardly anything worth doing at all.

Besides, Ethereum’s mainnet throughput is limited, far behind Solana’s performance, making transaction inefficiency another driver of cross-chain demand.

But the deeper cause lies in fragmentation of historical dominance.

As the original smart contract platform, Ethereum accumulated the most assets and dApps, naturally becoming the central hub for cross-chain bridges.

Path dependency keeps DeFi projects and capital concentrated on Ethereum, yet high costs push users away—making bridging a “necessary choice.”

Meanwhile, the rise of Layer 2s siphons off users, repeated shifts in Ethereum Foundation strategy, Vitalik being criticized for appearing with women instead of coding, and falling prices where even breathing feels wrong...

The dream was a “world computer,” but the reality is a “cash-out machine.”

Ethereum’s fate seems sealed by network effects and market evolution—transformed from DeFi kingpin into an asset transit zone. Its path to breakout looks far harder than either Solana or Base.

Accepting Destiny, Finding an Anchor

In 2025, the public chain competition is no longer the frenzied race of the “hundred-chain war,” but a cold game of existing-user battles.

The key to survival for any public chain boils down to one principle: “accept destiny, find an anchor.”

Trading can be an anchor. Stablecoin circulation can be an anchor. Even cross-chain bridging can serve as one. But once an anchor solidifies, it also compresses the chain’s room for imagination.

Can Solana shed its label as a “meme casino”? Can Base escape its role as a “bookkeeper”? Can Ethereum break free from being a “transit station”?

There are no answers yet.

More ironically, most PVP traders don’t care about these questions at all.

They rush to whichever chain is hot to “play memes,” and jump to wherever there’s arbitrage to “pull wool.” To them, the battle among public chains is nothing more than a backdrop behind every passerby desperate for quick profits and 1000x returns.

Perhaps only the arrival of the next market cycle will provide real answers—only those who bring in new users and capital can discover a new “anchor.”

The future of the industry, the future of public chains, remains undecided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News