Why Is It So Hard to Make Money in a Bull Market? From Psychological Biases to Operational Traps—Avoid These 10 Habits That Cost You Money

TechFlow Selected TechFlow Selected

Why Is It So Hard to Make Money in a Bull Market? From Psychological Biases to Operational Traps—Avoid These 10 Habits That Cost You Money

Overconfidence is a major pitfall in investing.

Author: BTC_Chopsticks

Compiled by: TechFlow

During bull markets, people often become greedy due to rapid price increases, eager to catch the "last big surge." However, once the market reverses, such impulses can cause you to lose gains you've already secured.

How can you avoid these risks? Below are 10 common mistakes we've identified, along with practical solutions.

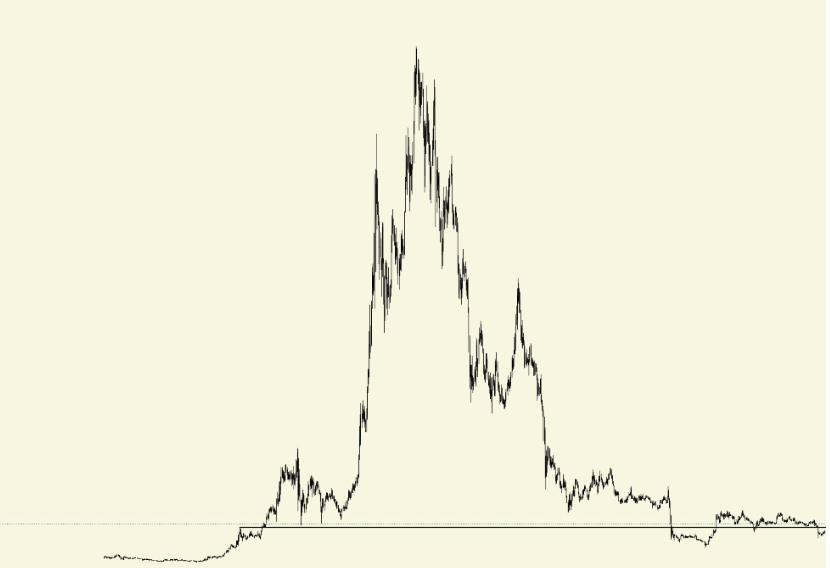

1. FOMO Without a Plan

When a trending project suddenly gains popularity, many may impulsively buy in out of fear of missing out (FOMO). Yet, after prices peak, enthusiasm often fades quickly, leading to investor losses.

How to avoid:

-

Ensure you have a clear investment rationale and defined goals before investing.

-

Avoid blindly following market sentiment or making impulsive trades.

2. Ignoring Risk Management

Overconfidence is a major pitfall in investing—it can lead to reckless decisions like going all-in, using high leverage, or allocating solely to high-risk assets. These actions expose your portfolio to significant risk.

How to avoid:

-

Diversify wisely—allocate part of your funds to stablecoins or low-risk assets to balance overall exposure.

-

Use stop-loss orders (automatically selling when an asset drops to a certain price) to limit potential losses.

3. Lacking Patience and Exiting Too Early

Some investors sell before a project has fully realized its potential, missing out on larger gains. This impatience often stems from overreacting to short-term market fluctuations.

How to avoid:

-

Trust your research and don’t abandon your plan due to temporary volatility.

-

Reduce how frequently you check market prices, giving your investments time to grow.

4. Overly Complex Strategies

Some investors rely heavily on numerous technical indicators or complex analytical tools, which can lead to hesitation and missed opportunities.

How to avoid:

-

Simplify your strategy—focus on a few key metrics like market trends and fundamental analysis.

-

Maintain clarity and decisiveness in decision-making; avoid being overwhelmed by excessive information.

5. Excessive Trading Erodes Profits

Frequent trading not only incurs high fees but also increases the likelihood of emotionally driven mistakes.

How to avoid:

-

Reduce trading frequency—focus only on opportunities you truly believe in.

-

Let your investments grow naturally—avoid over-managing or reacting to short-term movements.

6. Selling Strong Performers to Chase “High-Potential” Coins

A common mistake during bull markets is selling top-performing coins to invest in speculative "hidden gems" in hopes of catching the next big move. This often results in reduced returns or even losses.

How to avoid:

-

Hold patiently onto winning investments and let them continue growing.

-

Don’t abandon proven, valuable projects for untested, risky new ones.

7. Blind Overconfidence During Bull Markets

The broad market rise in a bull cycle can make investors mistakenly attribute success entirely to skill, ignoring the role of luck. This overconfidence may lead to risky behaviors like over-investing or increasing leverage, raising the chance of losses.

How to avoid:

-

Stay humble—recognize market unpredictability and avoid overconfidence.

-

Control position sizes and avoid allocating too much capital to any single project to reduce risk.

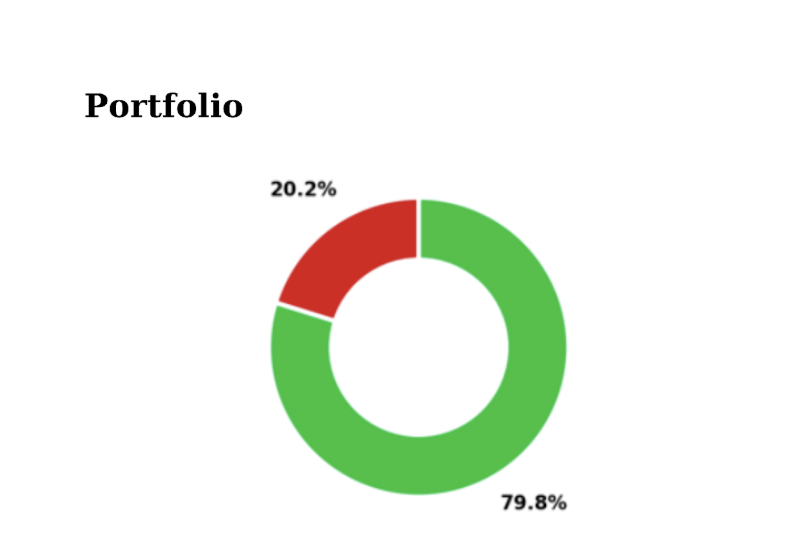

8. Over-Diversification

Trying to chase every opportunity can lead to an overly diversified portfolio, spreading your attention thin and diluting returns. Instead of prioritizing quantity, focus on a few truly promising projects.

How to avoid:

-

Concentrate on 2–3 projects you’ve thoroughly researched and genuinely believe in.

-

Remember—quality trumps quantity. A focused, high-conviction strategy is more likely to succeed.

9. Chasing the Dream of “100x Gains”

Many investors in bull markets become obsessed with finding the next “100x return” project. But such projects often lack solid fundamentals and typically end in losses.

How to avoid:

-

Prioritize projects with strong fundamentals—such as technical strength and experienced teams—and real-world use cases.

-

Approach the market rationally—don’t be blinded by get-rich-quick fantasies. Long-term holding of quality assets is often the true path to substantial returns.

10. Final Advice

Success during an altcoin season isn’t just about capturing upward momentum—it’s equally about avoiding costly mistakes that could wipe out your gains.

No matter how volatile the market becomes, maintaining discipline and executing a clear strategy is the key to long-term success. Stay focused on your goals and make every investment decision with care. Good luck!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News