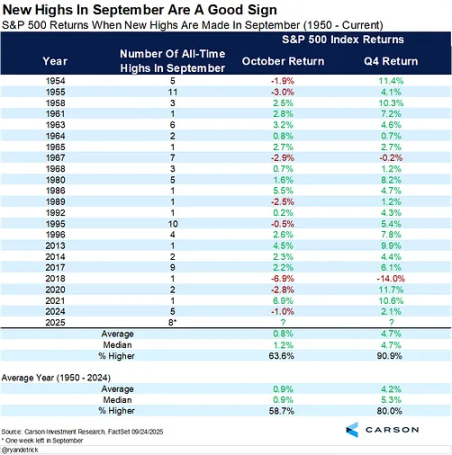

Local bull markets may become the norm, with market recovery expected in Q4

TechFlow Selected TechFlow Selected

Local bull markets may become the norm, with market recovery expected in Q4

Closely monitor the movement of the dollar, as its direction will determine whether this cycle continues or is interrupted.

Author: arndxt

Translation: AididiaoJP, Foresight News

The view that the economy is broadly rebounding is actually quite one-sided. The current recovery is primarily supported by assets from wealthy households and investments driven by artificial intelligence. For investors, this cycle cannot simply rely on broad market gains:

-

The core of long-term growth lies in semiconductors and AI infrastructure.

-

Increase exposure to scarce physical assets: gold, metals, and select real estate markets with potential.

-

Remain cautious toward broad market indices: the heavy weighting of the "Magnificent Seven" masks overall market fragility.

-

Closely monitor the direction of the US dollar: it will determine whether this cycle continues or breaks.

As was the case from 1998 to 2000, the bull market may persist for some time, but volatility will intensify, and asset selection will be key to winning in the market.

Economic Divergence

Market performance reflects the true state of the economy—so as long as equities remain near record highs, talk of economic recession remains unconvincing.

We are in a clearly diverging economic environment:

-

The top 10% highest-income group accounts for over 60% of consumption, building wealth through stocks and property.

-

Meanwhile, inflation continues to erode purchasing power among middle- and low-income households. This widening gap explains why, despite signs of "re-acceleration," the labor market remains weak and the cost-of-living crisis persists.

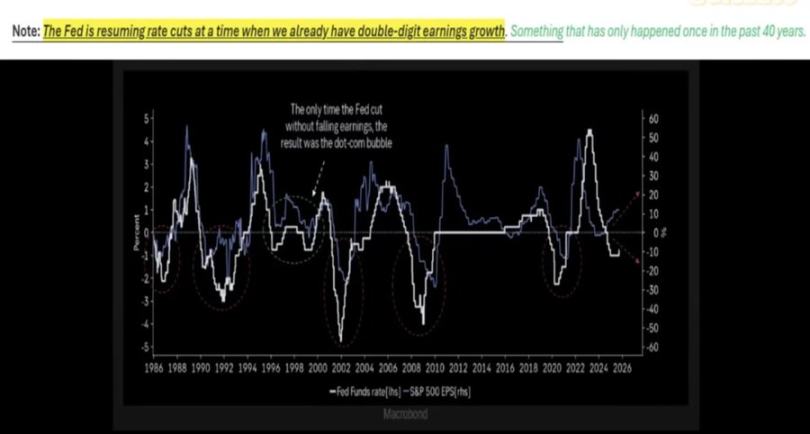

Uncertainty from Fed Policy

Prepare for policy volatility. The Federal Reserve must manage both inflation appearances and political cycles. This creates opportunities, but also means sudden downside risks if market expectations shift.

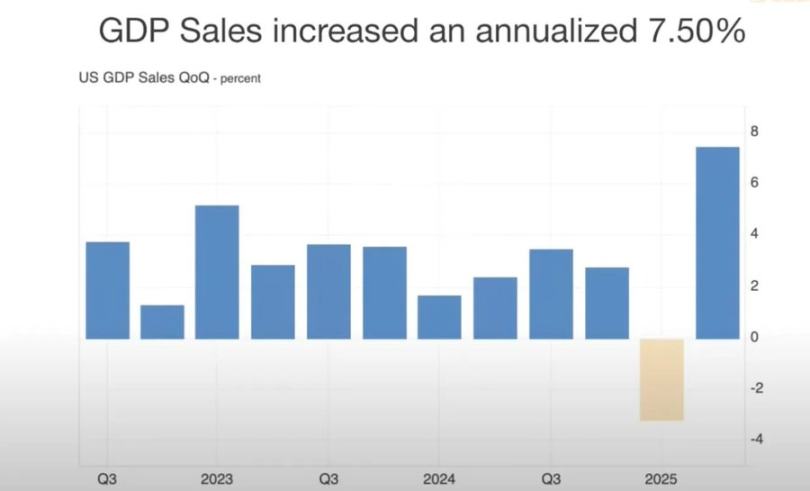

The Fed currently faces a dilemma:

-

On one hand, strong GDP growth and resilient consumption support a slower pace of rate cuts;

-

On the other, stretched market valuations mean delaying cuts could trigger "growth concerns."

Historical experience shows that cutting rates during strong earnings (as in 1998) can extend bull markets. But this time is different: inflation remains stubborn, the "Magnificent Seven" report strong profits, while the remaining 493 companies in the S&P 500 show mediocre performance.

Asset Selection in a Nominal Growth Environment

Hold scarce physical assets (gold, key commodities, real estate in supply-constrained areas) and productivity-driven sectors (AI infrastructure, semiconductors), while avoiding excessive concentration in stocks inflated by online hype.

The coming period is unlikely to see broad-based prosperity, resembling more a localized bull market:

-

Semiconductors remain central to AI infrastructure, with related investments continuing to drive growth.

-

Gold and physical assets are regaining their role as hedges against currency depreciation.

-

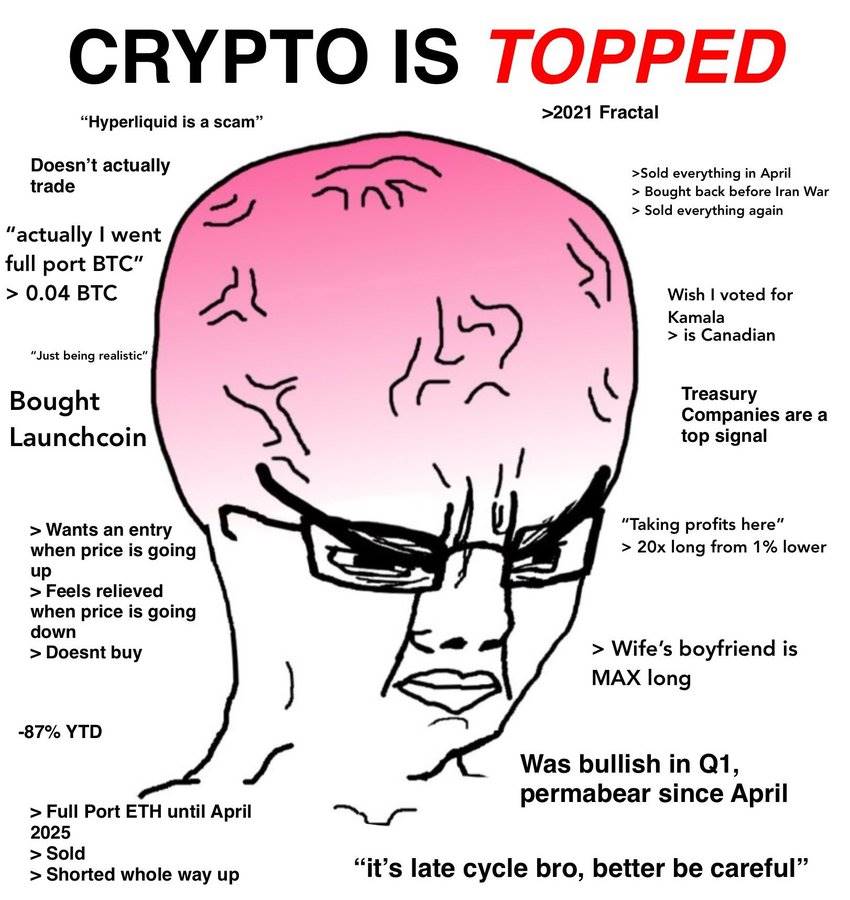

Cryptocurrencies currently face pressures from deleveraging and excess Treasury supply, but structurally, they are closely tied to the same liquidity cycle driving gold.

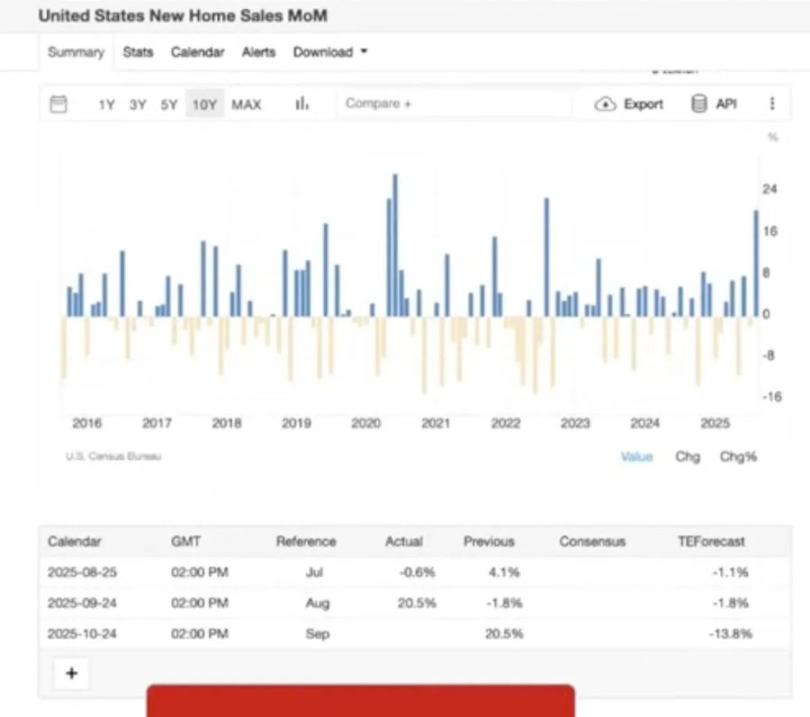

Real Estate and Consumption Dynamics

If real estate weakens alongside equities, the "wealth effect" supporting consumption will be undermined.

Real estate may see a brief rebound with minor rate cuts, but deep structural issues remain:

-

Supply-demand imbalances caused by demographic shifts;

-

Rising default rates as student loan and mortgage forbearance periods end;

-

Significant regional disparities (older populations have asset buffers, younger households face severe pressure).

Dollar Liquidity and Global Positioning

The US dollar is a key systemic factor. If global economies weaken while the dollar strengthens, more fragile markets may falter before the US does.

An overlooked risk is shrinking dollar supply:

-

Tariff policies reduce trade deficits, limiting the scale of dollar repatriation into US assets;

-

Fiscal deficits remain high, but weakening foreign demand for US Treasuries could trigger liquidity problems;

-

Futures market data show short-dollar positions at historic extremes, raising the risk of a dollar short squeeze that could destabilize risk assets.

Political Economy and Market Psychology

We are in the late stage of a financialized cycle:

-

Policymakers aim to "maintain stability" until key political events (e.g., elections, midterms) pass;

-

Structural inequalities (rent rising faster than wages, wealth concentrating among older generations) fuel populist pressures, prompting policy adjustments in education, housing, and other areas;

-

The market itself is reflexive: extreme concentration in just seven large-cap stocks both supports valuations and sows seeds of fragility.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News