Opinion: Will the crypto 4-year cycle be restructured? Institutional entry could extend the bull market to 2026

TechFlow Selected TechFlow Selected

Opinion: Will the crypto 4-year cycle be restructured? Institutional entry could extend the bull market to 2026

Institutional participation changes the rules of the game, potentially breaking traditional cycles.

Author: Aylo

Translation: TechFlow

First, it's nearly impossible to sell at the peak of a cycle. I can't do it, and I won't even try.

Cycle peaks usually appear on short-term trading frames (LTFs) and happen very quickly—often only becoming clear in hindsight when viewed through long-term trading frames (HTFs).

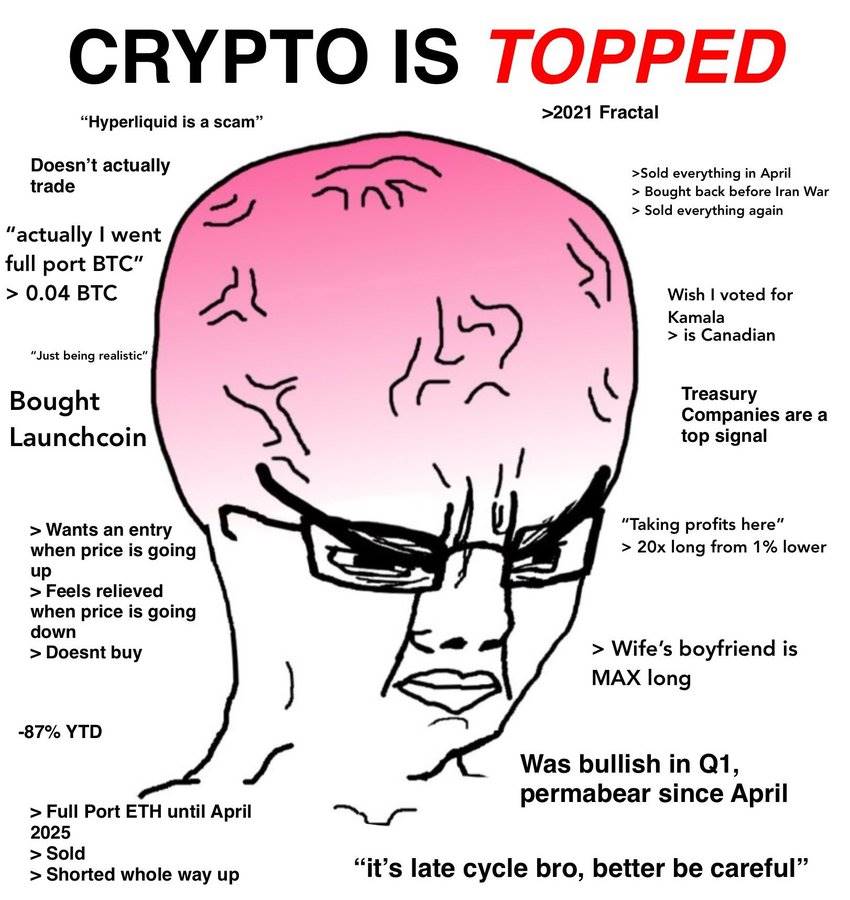

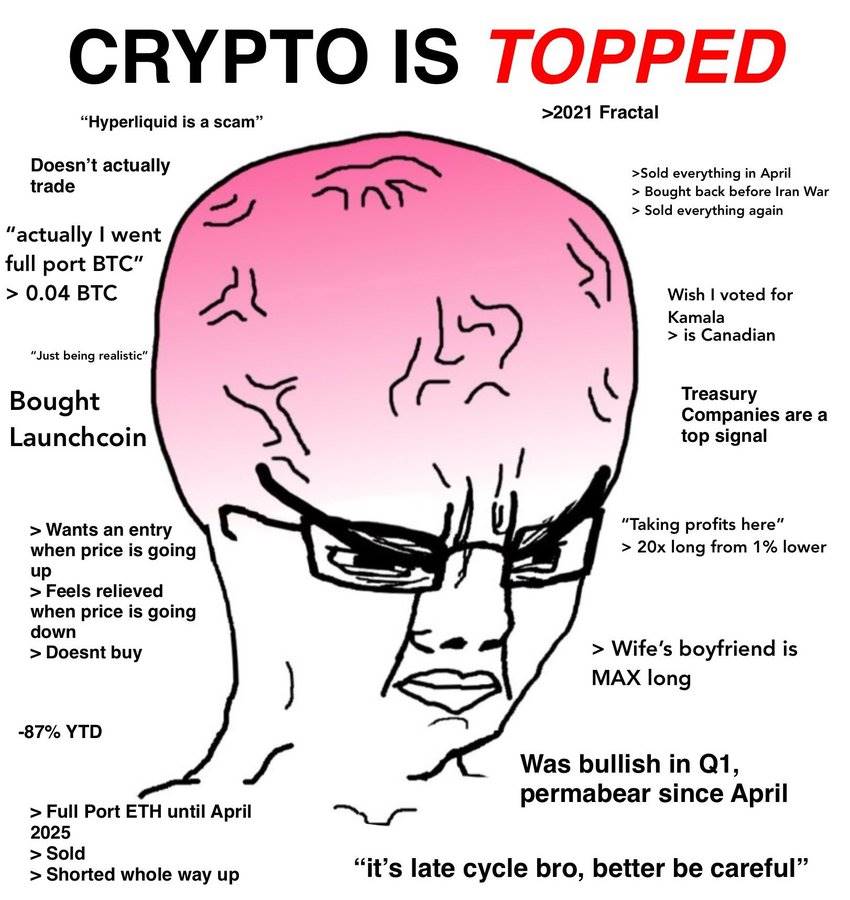

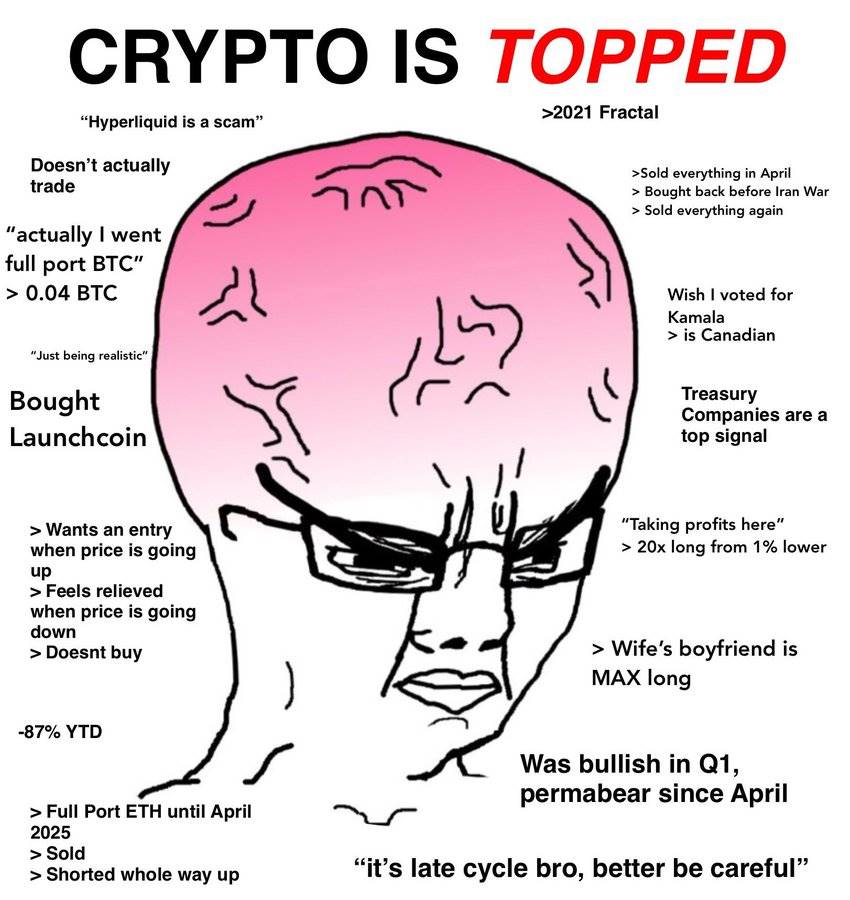

Intraday traders focused on short-term charts might catch cycle tops, but they've predicted and firmly believed in such peaks so many times that their calls have become meaningless. They often fail to consider the broader market context.

I'm still navigating the market and learning continuously. I haven't lived through enough market cycles to consider myself an expert, so I'm simply sharing my genuine thoughts and observations here.

Please draw your own conclusions and make your own financial decisions. I don’t know more than anyone else, and I regularly update my views based on new data.

Arguments Supporting a Four-Year Cycle Peak

Pattern Recognition View:

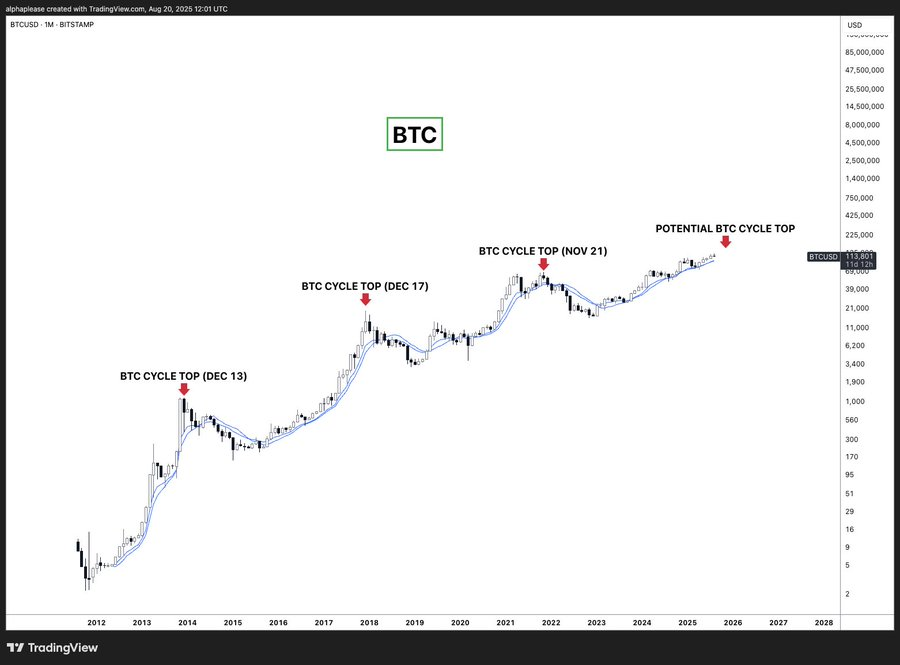

Looking back at historical charts, there’s an undeniable pattern: December 2013, December 2017, November 2021. The four-year cycle has been remarkably consistent, and patterns in markets tend to persist until fundamentally disrupted.

Why This Pattern Might Continue:

-

Deeply Embedded Psychology: The four-year cycle is now deeply ingrained in the crypto market’s collective consciousness.

-

Self-Fulfilling Prophecy: Widespread awareness could trigger coordinated selling pressure, potentially amplified by hidden leverage in the system (possibly DATs?).

-

Halving Effect Correlation: Bitcoin halvings cause supply shocks and historically occur 12–18 months before cycle peaks (though in this cycle, this seems more narrative-driven than impactful).

-

Occam’s Razor: The simplest explanation is often correct—why complicate a pattern that has worked three times already?

We’re clearly in the mid-to-late stage of this cycle—Bitcoin has already seen substantial gains from its lows. The pattern suggests we may be approaching a potential peak window.

Counterarguments to the Four-Year Peak (The 2026 Thesis):

Fundamental Shift View:

I pose a simple question: Can a cycle driven by institutions truly unfold identically to the two previous retail-driven cycles?

I generally believe in market cycles, so I won’t dive into claims of a “supercycle,” but I think cycles can be shortened or extended due to other factors.

Why This Time Could Be Different:

-

Institutional vs. Retail Behavior Patterns

-

Spot ETF flows combined with traditional exchange dynamics have created entirely new liquidity patterns.

-

Institutions take profits more systematically and smoothly, less prone to panic, unlike the more volatile behavior of retail investors.

-

Traditional Indicators May Be Failing

-

We have numerous cycle analysis tools (like NVT, MVRV, etc.), but their historical basis stems from retail-driven markets.

-

Institutional participation fundamentally changes what "overextension" means.

-

Bitcoin hasn’t even surpassed its previous cycle high when priced in gold—hardly a bubble sign.

-

Regulatory Environment Revolution

-

This cycle operates under a completely different regulatory landscape, with clear institutional frameworks established by U.S. authorities and the SEC.

-

Past cycles were partly ended by regulatory shocks (e.g., the 2018 ICO crackdown).

-

The risk of such systemic, sudden cycle terminations has significantly decreased.

-

Macroeconomic and Fed Dynamics

-

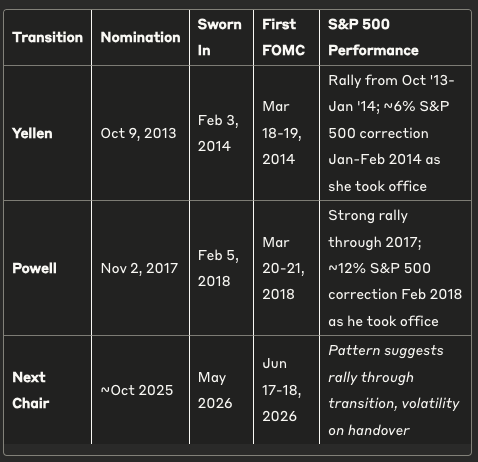

Chair Powell’s term ends in May 2026, and Trump is expected to announce a successor by late 2025.

-

The “shadow Fed chair” dynamic weakens current policy effectiveness while potentially creating early buying pressure as markets anticipate Trump nominating a moderate chair.

-

The incoming chair’s first FOMC meeting is scheduled for June 17–18, 2026—potentially acting as a cycle catalyst.

-

The transition period could extend the “Goldilocks environment” (stable economy, moderate rates).

Historical Fed Chair Transition Pattern: Past transitions offer a compelling template for market cycles.

Consistent Pattern:

Both transitions showed a similar sequence: nomination announcements triggered market rallies extending into the transition phase, but the S&P 500 corrected precisely when the new chair took office.

-

During Yellen’s handover, the S&P 500 fell about 6% from January to February 2014.

-

When Powell took over, the S&P 500 saw about a 12% correction in February 2018.

This pattern suggests Trump’s likely announcement in late 2025 could sustain the bull market into the transition, with heightened volatility probable during the May–June 2026 handover—potentially aligning with a cycle peak window.

-

Market Structure Changes

-

Concerns Over Currency Devaluation: This factor is creating new demand drivers beyond traditional risk-on cycles.

-

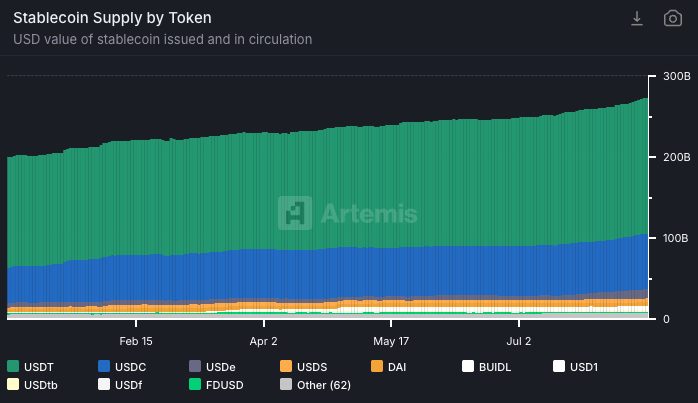

Stablecoin Market Cap as a Leading Indicator: Its steady growth makes it a key measure of market “dry powder” (latent buying power).

-

More Diversified Sources of Bitcoin Demand: Including ETFs, DATs (Digital Asset Treasuries), pension funds—far broader than in prior cycles.

What Could End the Cycle Early and Reaffirm the Four-Year Pattern?

DAT Leverage Risk: I see the strongest bearish case in digital asset treasury companies potentially deleveraging faster than expected. Major forced sellers could overwhelm buyers and alter market structure. However, there’s a difference between losing buying demand (mNAV approaching 1) and becoming active forced sellers triggering “violent downside.”

Still, the loss of major DAT buying power would clearly be significant. Many speculate this is already happening, especially with Strategy and major ETH DATs seeing sharply declining mNAVs. I’m not blind to this, nor should you be—so it warrants close attention.

Macro Risks: A resurgence of inflation would be the primary macro risk, but I currently see no evidence of that. Crypto markets are now highly correlated with macro conditions, and we remain in a “Goldilocks” state (stable economy, moderate rates).

Missing Elements of a Cycle Top

-

No Mania Yet:

-

The market remains cautious—every 5% pullback triggers peak predictions (this has been going on for 18 months).

-

Lack of sustained mania or consensus bullish conviction.

-

No “blow-off top” behavior yet (though not strictly necessary).

-

-

Potential Signal: If crypto surges dramatically later this year and significantly outperforms equities, such a “blow-off top” signal might indicate a crypto cycle peak occurring earlier than the broader business cycle expected to last into 2026.

Stablecoin Leading Indicator

A particularly important metric to watch: Growth in stablecoin market capitalization.

In traditional finance (TradFi), increases in M2 money supply typically precede asset bubbles. In crypto, stablecoin market cap plays a similar role—it represents the total available “dollar” supply within the crypto ecosystem.

Past major cycle peaks often coincided with stagnation in stablecoin supply 3–6 months before the peak. As long as stablecoin supply continues growing significantly, crypto may still have “fuel” to drive further upside.

My Current View

Straight talk: Based on current observations, I believe a major cycle peak is unlikely before 2026 (a vague view that could change quickly).

We have limited data points on the four-year cycle (only three instances), and institutional involvement has brought fundamental structural changes. The Fed chair transition dynamic alone could extend the “Goldilocks” environment into 2025—I find this particularly significant, especially as crypto’s correlation with macro conditions reaches unprecedented levels.

Market participants today are far more aware of the “four-year cycle” pattern, which leads me to believe the outcome may differ. After all, when have the masses ever correctly timed the market? Will everyone really sell according to the four-year script and collectively walk away wealthy? That deserves serious reflection.

That said, I acknowledge the four-year cycle pattern has performed remarkably consistently, and market patterns tend to persist until broken. The widespread awareness of this cycle could indeed create a self-fulfilling prophecy that ultimately ends it.

As Bitcoin dominance (BTC.D) declines, I’ll continue taking profits from overheated altcoins, but I’m still holding Bitcoin and believe it will reach new highs in 2026. Note that regardless of the broader cycle, your altcoins could hit their individual cycle peaks at any time.

Final Thoughts

The four-year cycle pattern is the strongest argument for a 2025 peak—it’s worked three times, and simple logic is often persuasive. Yet, institutional structural shifts, Fed chair transition dynamics, and the absence of market mania suggest this cycle could extend into 2026.

Many things could change in the coming months, so there’s no need to be dogmatic or rigid.

Regardless, accept one truth: you can’t perfectly time the absolute market top. A systematic exit strategy is the smarter approach.

The right portfolio exposure is the one that lets you sleep peacefully at night. If you’ve made solid gains, selling “too early” is perfectly acceptable.

I welcome all perspectives, including those that disagree with mine. The purpose of this article isn’t just to help me clarify my own thinking, but also to learn and grow publicly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News