Hunker down for the next three months; a raging bull market may arrive by year-end

TechFlow Selected TechFlow Selected

Hunker down for the next three months; a raging bull market may arrive by year-end

Liquidity determines fate, and the next chapter of fate belongs to Bitcoin.

Author: arndxt

Translation: AididiaoJP, Foresight News

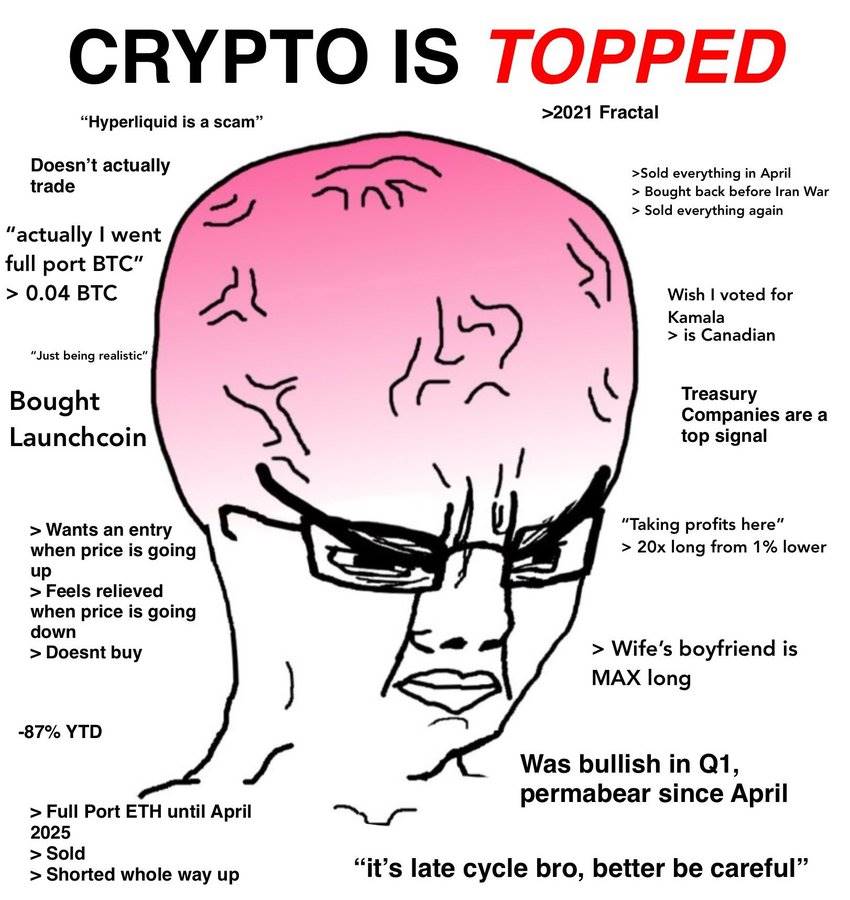

Ordinary Labor Doesn't Matter

"Ordinary labor doesn't matter" because under today's macro regime, a weak labor market does not prevent economic growth. It merely forces the Fed to cut rates and inject more liquidity into markets. Productivity, capital expenditure, and policy support mean capital continues to appreciate—even as individual workers suffer.

The individual worker’s importance to production is diminishing, as their bargaining power collapses in the face of automation and global capital spending.

The system no longer needs strong household consumption to drive growth—capital expenditure dominates GDP calculations.

Worker hardship directly fuels capital gains. For asset holders, labor market pain is good news.

Worker struggles do not disrupt the economic cycle. Markets no longer price for the "common man"—they now price for liquidity and capital flows.

Markets are being pulled once again by: liquidity.

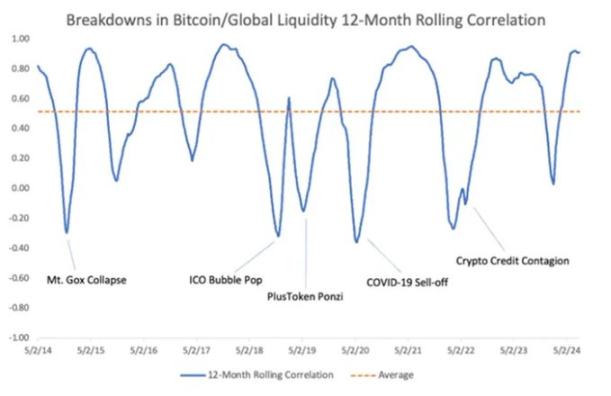

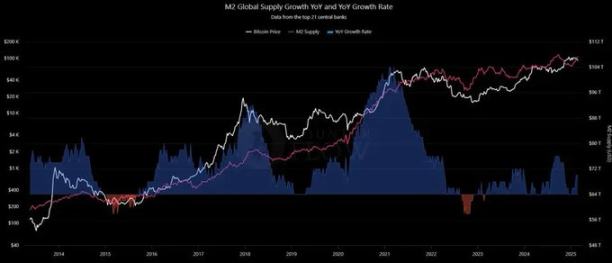

Global M2 has surged to a record high of $112 trillion. Over more than a decade of data, Bitcoin's long-term correlation with liquidity remains at 0.94—tighter than with stocks or gold.

When central banks ease policy, Bitcoin rises. When they tighten liquidity, Bitcoin suffers.

Let’s review history:

-

2014–15: M2 contraction, Bitcoin crash.

-

2016–18: Steady expansion, BTC’s first institutional bull run.

-

2020–21: COVID-driven liquidity flood, parabolic Bitcoin rally.

Today, M2 is rising again, and Bitcoin is outperforming traditional hedges. We are once again in the early phase of a liquidity-driven cycle.

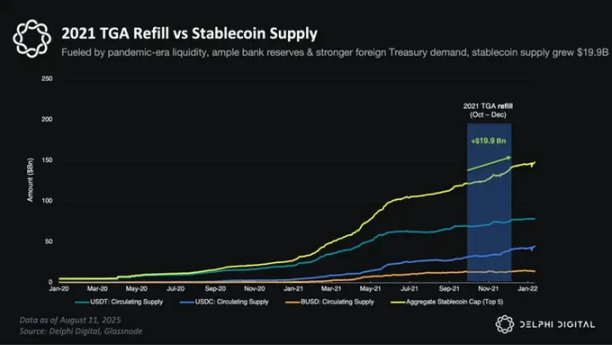

TGA (Treasury General Account) replenishment in 2025 poses greater risk than previous cycles, as the overnight reverse repo buffer has effectively been depleted. Every dollar raised now directly drains liquidity from active markets.

Crypto will signal stress first. September’s stablecoin contraction will be a leading indicator, flashing red well before equities or bonds react.

The resilience hierarchy is clear:

-

During stress: BTC > ETH > altcoins (Bitcoin absorbs shocks best).

-

During recovery: ETH > BTC > altcoins (as funding flows and ETF demand re-accelerate).

Base case outlook: A volatile September to November marked by liquidity tightness, followed by stronger momentum toward year-end as issuance slows and stablecoin growth stabilizes.

In broad view, the picture is clear:

-

Liquidity is expanding.

-

The dollar is weakening.

-

Capital expenditure is surging.

-

Institutions are reallocating into risk assets.

But what makes this moment unique is the confluence of forces.

The Fed Trapped Between Debt and Inflation

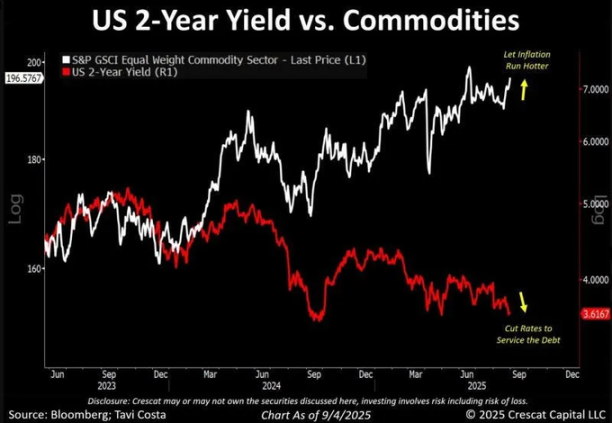

The Fed is trapped—debt servicing costs are becoming unaffordable, yet inflationary pressures persist.

Yields have already plunged: the US 2-year Treasury yield has dropped to 3.6%, while commodities hover near all-time highs.

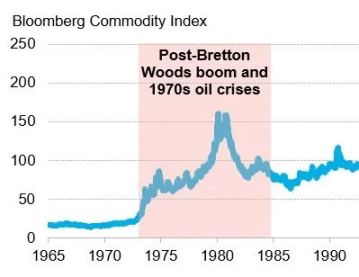

We’ve seen this movie before: in the late 1970s, softening yields alongside soaring commodities led to double-digit inflation. Policymakers had no good options then—and even fewer today.

For Bitcoin, this tension is bullish. In every historical period when policy credibility broke down, capital sought inflation-resistant assets as safe havens. Gold captured those flows in the 1970s; today, BTC is positioned as a hedge with higher convexity.

Weak Labor, Strong Productivity

The labor market tells a telling story.

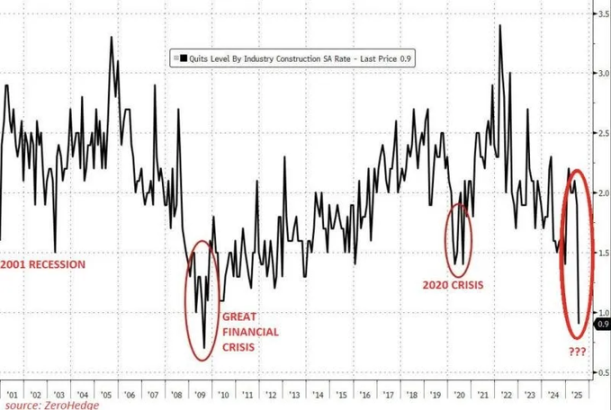

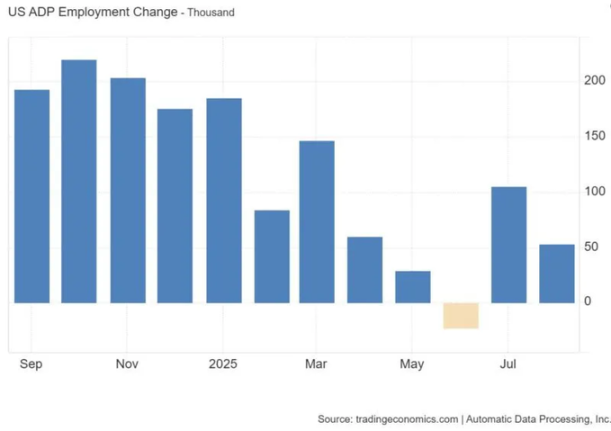

Quit rates have plunged to 0.9%, ADP employment is below long-term averages, and confidence is eroding. Yet unlike 2008, productivity is rising.

The driver: an AI-led supercycle in capital expenditure.

Meta alone has committed $600 billion by 2028, with trillions flowing into data centers, onshoring, and energy transition. Workers are being replaced by AI—but capital is appreciating. This is the paradox of the current economy: real economy suffering, Wall Street financial markets booming. The outcome is predictable: the Fed cuts rates to cushion the labor market, while productivity stays strong. This combination funnels liquidity into risk assets.

Gold’s Quiet Accumulation

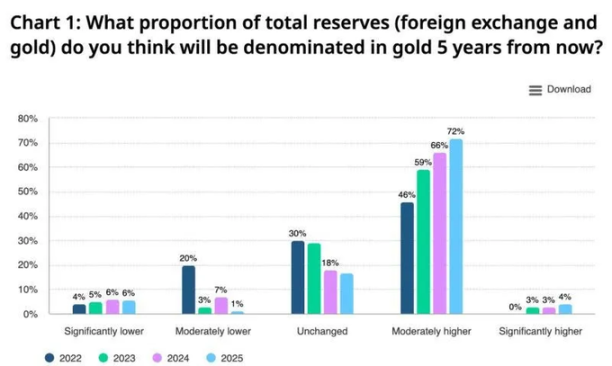

As equities waver and labor cracks emerge, gold has quietly re-emerged as a systemic hedge. Last week alone saw $3.3 billion flow into GLD (SPDR Gold ETF). Central banks are the main buyers: 76% intend to increase reserves, up from 50% in 2022.

Measured in gold, the S&P 500 is already in a stealth bear market: down 19% YTD, and 29% since 2022. Historically, three consecutive years of equity underperformance against gold mark long-term structural shifts (1970s, early 2000s).

But this isn’t retail-driven frenzy—it’s patient institutional money, strategic capital, quiet accumulation. Gold is assuming the stabilizer role once played by bonds and the dollar. Yet Bitcoin remains the higher-beta hedge.

Dollar Decline and the Search for Alternatives

The dollar is experiencing its worst six-month stretch since the 1973 collapse of Bretton Woods. Historically, whenever Bitcoin diverges from the dollar, systemic shifts follow. In April, the Dollar Index (DXY) broke below 100—echoing November 2020, which was the starting gun for a liquidity-fueled crypto rally.

Meanwhile, central banks are diversifying. The dollar’s share in global reserves has slipped to around 58%, and 76% of central banks plan to increase gold holdings. Gold is absorbing these quiet capital shifts, but Bitcoin is poised to capture marginal flows—especially from institutions seeking returns above passive hedging.

Near-Term Pressure: Treasury Account Replenishment

Note: Treasury account replenishment refers to actions by the U.S. Treasury to increase cash balances in its Federal Reserve account (TGA), which drains liquidity from the financial system.

Treasury account replenishment approaching $500–600 billion.

In 2023, ample buffers (RRP, foreign demand, bank balance sheets) softened the impact. Today, those buffers are gone.

Every dollar replenished is directly withdrawn from markets. Stablecoins—the cash rails of crypto—contract first; altcoin liquidity dries up.

This means the next 2–3 months will be turbulent. BTC is expected to outperform ETH, and ETH outperform altcoins—but all assets will feel pressure. Liquidity risk is real.

Treasury replenishment may weaken trends, but it’s just a storm in the rising tide. By end-2025, as issuance slows and Fed policy turns dovish, Bitcoin is poised to test $150,000–$200,000—not only supported by liquidity, but also by structural inflows from ETFs, corporations, and sovereign nations.

The Thesis

This is the beginning of a liquidity cycle where capital appreciates while labor fragments, the dollar weakens while alternatives strengthen, and Bitcoin evolves from speculative asset to systemic hedge.

Gold will play its role. But Bitcoin—with its higher liquidity beta, institutional access, and global reach—will be the flagship asset of this cycle.

Liquidity determines fate—and the next chapter of fate belongs to Bitcoin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News