After the rate cut, a major pullback—has the crypto bull market ended?

TechFlow Selected TechFlow Selected

After the rate cut, a major pullback—has the crypto bull market ended?

What will the future market trend be like?

Author: kkk

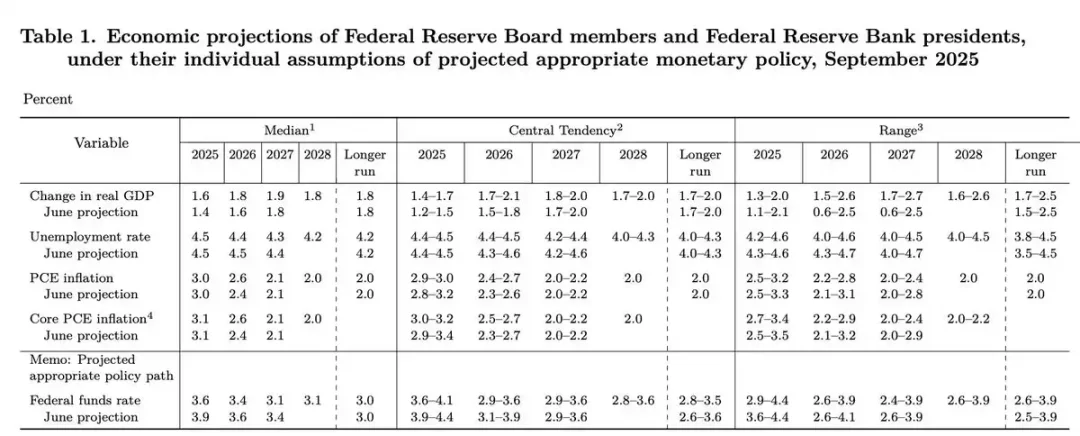

On September 24, just one week after the Federal Reserve's first rate cut in 2025, Chair Powell spoke publicly again, sending a complex and nuanced signal. He warned that the U.S. labor market is weakening and economic prospects are under pressure, while inflation remains above 2%, creating a "two-way risk" dilemma for policymakers, stating there is "no risk-free path forward."

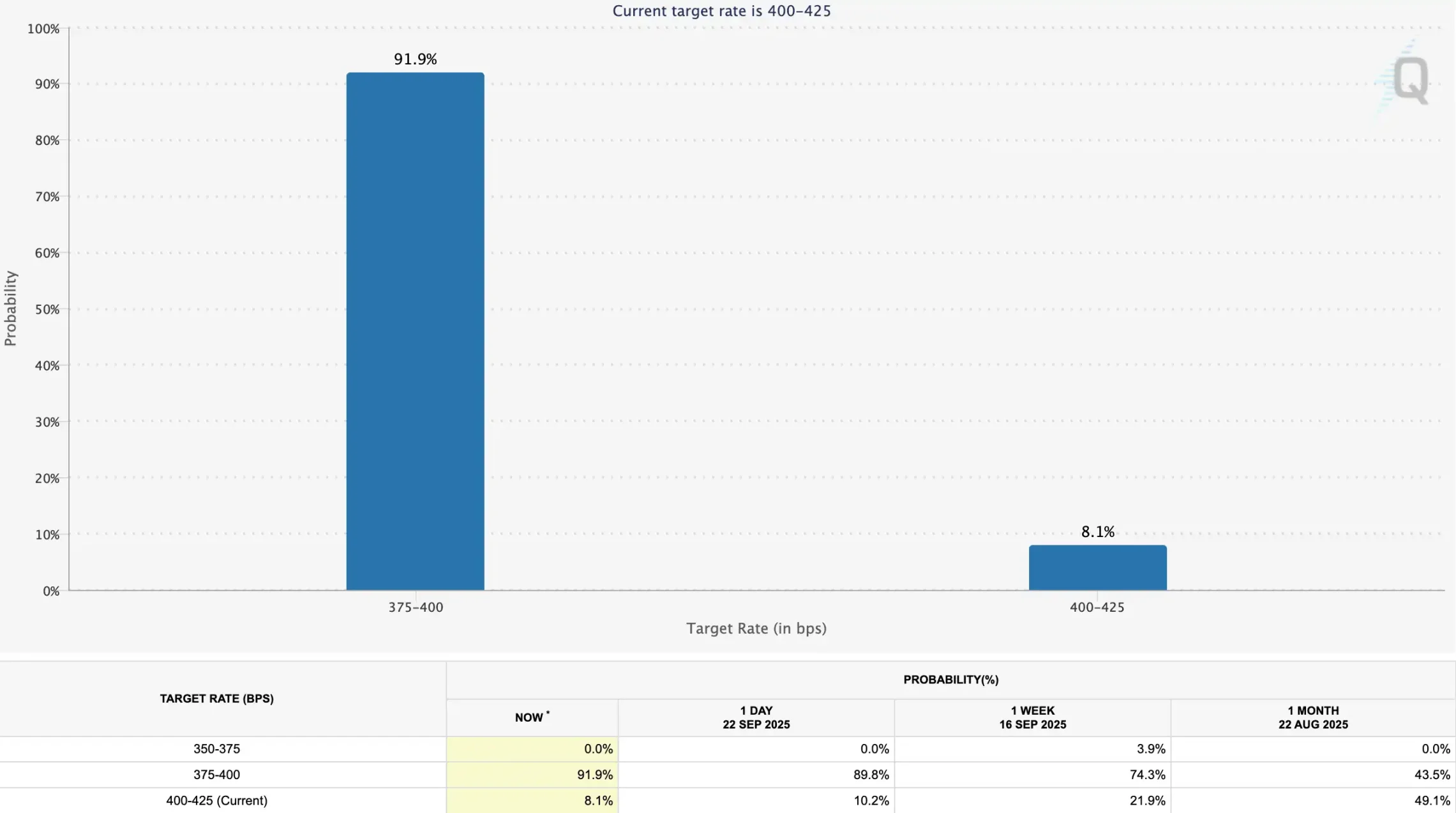

Powell also noted that stock market valuations are quite high, but emphasized it is "not a period of rising financial risks." Regarding the October FOMC meeting, Powell said there is no preset policy course. Markets interpreted this speech as "dovish": immediately after, the probability of a rate cut in October rose from 89.8% to 91.9%, with markets now largely pricing in three rate cuts this year.

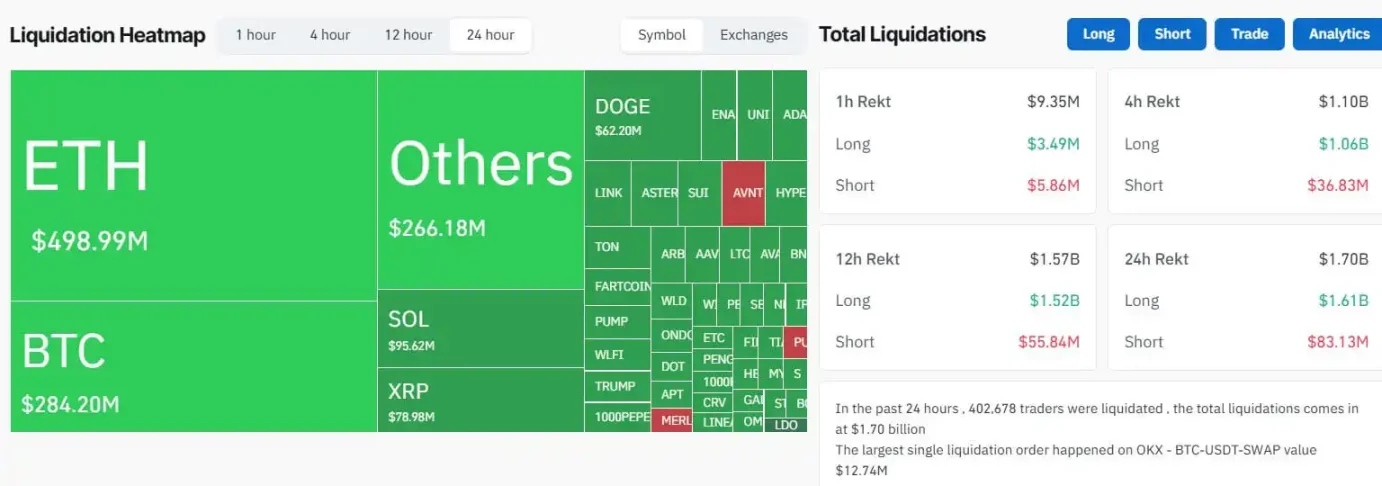

Fueled by expectations of looser monetary policy, U.S. equities have repeatedly hit new highs, while the crypto market presents a starkly different picture. On September 22, the crypto market saw $1.7 billion in liquidations in a single day—the largest clearing since December 2024. Below, BlockBeats compiles traders' views on the upcoming market outlook to help guide your trading decisions this week.

@0xENAS

Trader Pigeon believes various signs indicate the crypto market is gradually weakening.

When I re-entered the market after a two-week break, I coincided with the largest liquidation pullback of the year. This time, the "buy-the-dip" opportunities—which historically rebound eight out of ten times—continued to fall instead. This misalignment is a very clear red flag. That 20% failure rate usually means: there are no longer enough marginal buyers left in the market; nobody wants to catch the baton for the next rally.

I suspect we’ll increasingly decouple from the logic tied to U.S. equities and other "risk assets," starting to break key support levels. My watchpoints are: BTC breaking below its $100K structural level, ETH falling below $3,400, and SOL dropping below $160.

@MetricsVentures

We believe the global asset bubble cycle has most likely entered its warm-up phase, and ignition appears only a matter of time. This bubble cycle unfolds against the backdrop of AI-driven job displacement and social fragmentation, supported by globally fiscal-led economic cycles and political-economic ecosystems, and accelerated by the shared desire of the two major powers—against a clearer backdrop of global polarization—to export inflation to resolve domestic tensions. It is expected to enter mainstream discourse within the coming months.

Looking ahead, beyond the digital currency market—which hasn’t seen significant volatility in nearly a year and stands as a potential big winner—global cyclical minerals and AI derivative investment chains will continue generating excess returns. In terms of coin-equity plays, ETH’s success in coin-equity pairing will spark a wave of imitations. We expect combinations of large-cap, heavily-backed coins and heavily-backed equities to become the brightest niche over the coming months.

As leading competitive nations begin considering investment accounts for newborns, relaxing pension fund investment restrictions, and elevating capital markets—historically used mainly as financing channels—to new heights, financial asset bubble formation has become highly probable.

We welcome the dollar market’s growing embrace of crypto-native volatility and its provision of ample liquidity pricing—a scenario unimaginable two years ago, much like how MSTR’s success was an unpredictable financial magic trick from our vantage point two years prior.

In short, we clearly favor the digital currency market over the next 6 months, and global minerals, pro-cyclical markets, and AI derivative产业链 over the next 1–2 years. At this point, economic data matters less—echoing the joke in crypto circles that “economic data is always good news.” Before the roaring locomotive of history, aligning with trends and embracing bubbles may have become the most important task of our generation.

@Murphychen888

According to the "three-line alignment" pattern, after October 30 this year, MVRV will enter a long-term downtrend, fully aligning with Bitcoin’s historical four-year cycle timing规律.

However, based on current macro expectations, the overall signal suggests "soft landing + cooling inflation + gradually looser monetary policy."

The future is always uncertain, but if this holds true, the four-year cycle theory might truly be broken, and Bitcoin could enter an "eternal bull market."

@qinbafrank

The reason U.S. equities outperform crypto during broad-range consolidation lies in the market’s underlying concern about future inflation trends. Equities remain strong due to robust fundamentals driven by accelerating AI, enabling them to press higher despite inflation worries. Crypto, driven by capital flows and sentiment, suffers when macro concerns slow external funding velocity.

The deeper structure of today’s crypto market involves traditional capital—from ETFs and corporate purchases—acting as buyers, while ancient whales and trend-following traders taking profit act as sellers. Most price swings, surges, and dips stem from the tug-of-war between these two forces. In the short term, economic strength, inflation trends, and rate expectations affect the speed of buyer inflows: positive sentiment accelerates inflows, while negative sentiment halts or even reverses them.

Currently, although the Fed has resumed cutting rates, inflation is slowly creeping up again, raising market fears that rate cuts could be interrupted once more. Under such conditions, buyer inflows are affected—as evidenced by changes in ETF net inflow volumes. Meanwhile, the core AI narrative in equities is nearing 10% penetration; once crossed, it will enter a golden era of rapid adoption—the oft-repeated idea that "AI is accelerating its own acceleration." From this perspective, the divergence in strength becomes clear.

Future market direction depends on macroeconomic data:

1) Best case: inflation rises slower and weaker than expected—positive for both crypto and equities.

2) Base case: inflation evolves as expected—more favorable for equities due to stronger fundamentals; crypto may hold up relatively well but likely remains in broad-range consolidation.

3) Worst case: a sharp, unexpected inflation spike occurs—both equities and crypto would correct, with equities seeing a mild pullback and crypto experiencing a moderate-to-severe correction.

@WeissCrypto

The impact of Federal Reserve rate cuts on liquidity won't flow into the crypto market until mid-December. Their model suggests sideways movement could last 30 to 60 days, with a clear bottom possibly emerging around October 17. Notably, Weiss Crypto recently predicted a peak around September 20.

@joao_wedson

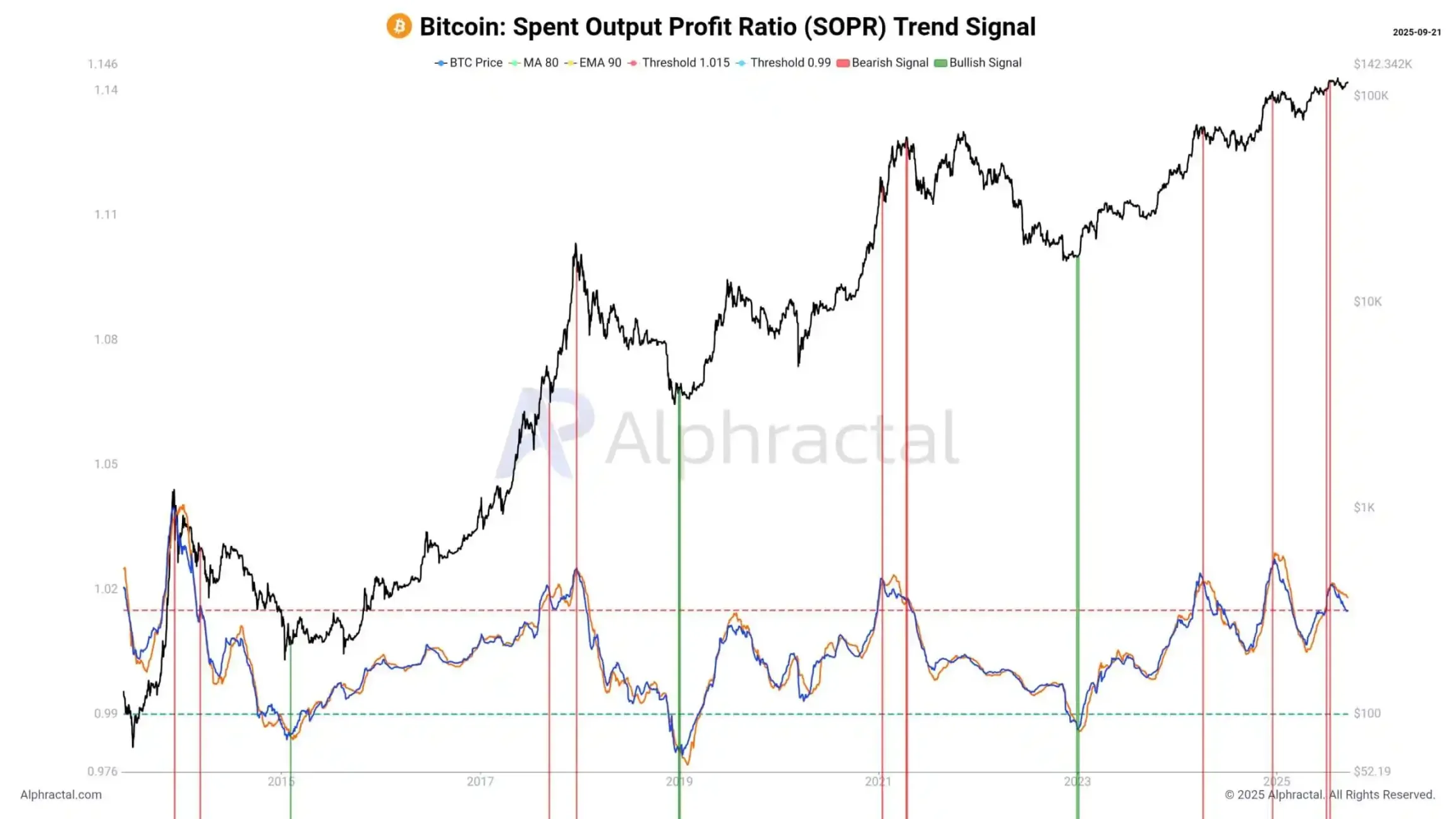

Joao Wedson, founder of blockchain analytics platform Alphractal, said Bitcoin is showing clear signs of cyclical exhaustion. He pointed out that SOPR trend signals tracking on-chain realized profitability indicate investors are buying at historical highs, while profit margins are already shrinking. The current actual price for Bitcoin short-term holders is $111,400—a level institutional investors should have reached earlier. He also noted that Bitcoin’s Sharpe ratio, a measure of risk-adjusted return, has weakened compared to 2024.

He stated, "Those who bought BTC at the end of 2022 were satisfied with +600% gains, but those accumulating in 2025 should reconsider their strategy," adding that market makers tend to sell BTC and buy altcoins, which are expected to perform better going forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News