A less "hawkish" hawkish rate cut, and balance sheet expansion that's "not QE"

TechFlow Selected TechFlow Selected

A less "hawkish" hawkish rate cut, and balance sheet expansion that's "not QE"

The Fed cut interest rates by 25 basis points as expected, still projecting one rate cut next year, and launched RMP to purchase $40 billion in short-term bonds.

Source: Wall Street Horizon

The Federal Reserve cut interest rates as expected, maintaining its regular pace, but revealed the biggest internal split among voting members in six years, signaling a slower pace of action next year and possibly no immediate moves. The Fed also launched reserve management as anticipated by Wall Street, deciding to buy short-term Treasuries by year-end to address pressures in money markets.

On Wednesday, December 10, Eastern Time, the Federal Open Market Committee (FOMC) announced after its monetary policy meeting that the target range for the federal funds rate would be lowered from 3.75%–4.00% to 3.50%–3.75%. This marks the third 25-basis-point rate cut this year. Notably, the Fed's decision faced three dissents—the first time since 2019.

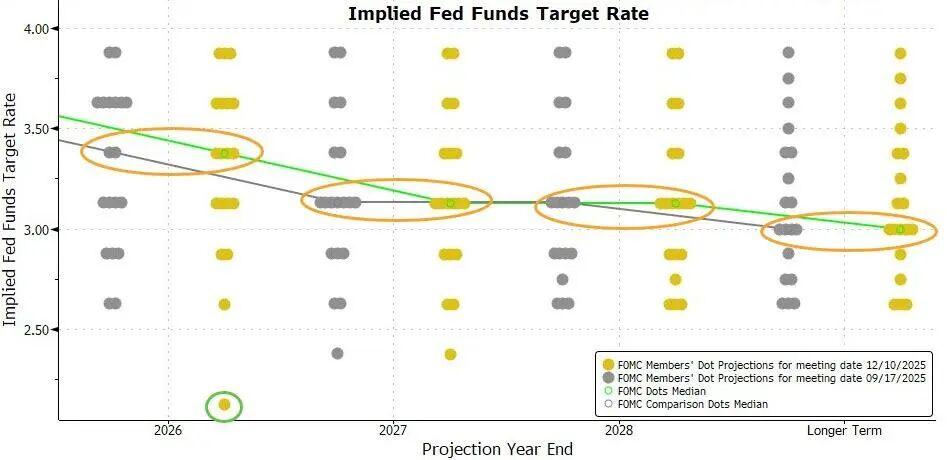

The post-meeting dot plot shows that policymakers' projections for the interest rate path remain unchanged from the one released three months ago, still forecasting one additional 25-basis-point cut next year. This implies a significantly slower pace of easing compared to this year.

As of Tuesday’s close, CME Group tools indicated that futures markets priced in an almost 88% probability of a 25-basis-point cut this week, while the likelihood of another cut of at least 25 basis points wouldn't reach 71% until June next year. Probabilities for such cuts at the January, March, and April meetings all remained below 50%.

This CME-reflecting outlook can be summarized by the recently debated term “hawkish cut.” It means the Fed is cutting now but simultaneously suggesting it may pause soon, with no further near-term reductions likely.

Nick Timiraos, a veteran Fed reporter known as the "new Fed whisperer," wrote immediately after the meeting that the Fed “signaled it might temporarily hold off on further cuts,” due to a “rare” internal divide over whether inflation or the labor market poses greater concern.

Timiraos noted that three officials dissented against the 25-basis-point cut, with stalled disinflation and a cooling job market making this one of the most divided meetings in recent years.

In his post-meeting press conference, Powell emphasized that he does not believe “the next move will be a hike” is anyone’s base case assumption. The current level of interest rates allows the Fed to be patient and observe how the economy evolves. He added that current data suggest the economic outlook has not fundamentally changed, and Treasury purchases could remain elevated over the coming months.

01 Fed Cuts Rates by 25 Bps as Expected, Still Projects One Cut Next Year; Launches RMP to Buy $40 Billion in Short-Term Debt

On Wednesday, December 10, Eastern Time, the Federal Reserve announced after its FOMC meeting that the target range for the federal funds rate would be reduced from 3.75%–4.00% to 3.50%–3.75%. With this, the Fed has now cut rates at three consecutive FOMC meetings, each time by 25 basis points, totaling 75 basis points in cuts this year. Since last September, the current easing cycle has cumulatively delivered 175 basis points in rate reductions.

Notably, the Fed's rate decision faced three dissenting votes—the first time since 2019. Governor Michelle Bowman, appointed by Trump, continued advocating for a 50-basis-point cut, while two regional Fed presidents and four non-voting members favored holding steady—seven officials in total opposed the decision, reportedly marking the largest internal split in 37 years.

Another major change in this meeting’s statement compared to the previous one lies in the rate guidance. Although the committee decided to cut rates, it no longer broadly states that further adjustments will depend on assessing incoming data, evolving outlooks, and risk balances. Instead, it now more explicitly considers the “magnitude and timing” of potential cuts. The revised statement reads:

“In considering the appropriate magnitude and timing of any further adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

The statement reiterated that inflation remains somewhat elevated and that downside risks to employment have increased in recent months. It removed the phrase “unemployment remains low” and instead noted a slight rise through September.

The addition of “magnitude and timing” in considering future cuts is seen as signaling a higher bar for further easing.

Another key change in the statement is the inclusion of a new paragraph specifically indicating plans to purchase short-term Treasuries to maintain ample reserves in the banking system. The statement says:

“The Committee judges that reserve balances have declined to levels consistent with ample supply and will begin purchasing short-term Treasury securities as needed to sustain ample reserve levels over time.”

This effectively announces the launch of so-called reserve management, rebuilding a liquidity buffer for money markets. Year-end periods often bring market stress, as banks typically reduce repo market activity to manage balance sheets for regulatory and tax reporting purposes.

The statement notes that reserves have reached ample levels and that purchases of short-term debt will begin this Friday to maintain them. The New York Fed plans to buy $40 billion in short-term Treasuries over the next 30 days, with Reserve Management Purchases (RMP) expected to remain high into the first quarter of next year.

The median rate projections released after Wednesday’s meeting show that officials’ expectations are identical to those published in September.

Fed officials currently expect that after three cuts this year, there will likely be one 25-basis-point cut each in both next year and the year after.

Many had expected the dot plot to reflect a more hawkish shift in future rate projections. However, this update showed no such tendency—in fact, it leaned slightly more dovish than before.

Among the 19 Fed officials providing forecasts, seven projected the rate to be between 3.5% and 4.0% next year, down from eight in the previous round. This means one fewer official expects no cuts next year compared to the prior survey.

The post-meeting economic projections show that Fed officials have raised their GDP growth forecasts for this year and the following three years, and slightly lowered the unemployment rate forecast for 2027—that is, two years out—by 0.1 percentage point, while keeping unemployment forecasts unchanged for other years. This adjustment suggests the Fed sees greater resilience in the labor market.

At the same time, officials slightly reduced PCE and core PCE inflation forecasts for this year and next by 0.1 percentage point each, reflecting somewhat stronger confidence in disinflation over the near term.

02 Powell: We Can Be Patient at Current Rates; No One Assumes 'Next Move Is a Hike'

With today’s rate cut, the Fed has cumulatively lowered policy rates by 75 basis points over the past three meetings. Powell said this will help gradually bring inflation back toward 2% once the effects of tariffs fade.

He noted that adjustments made to the policy stance since September have brought the policy rate within various estimated ranges of “neutral rates.” The median projection among FOMC members indicates that the appropriate level for the federal funds rate is 3.4% by the end of 2026 and 3.1% by the end of 2027—unchanged from September’s projections.

Powell stated that currently, upside risks dominate for inflation, while downside risks are growing for employment—an especially challenging situation.

A reasonable baseline judgment is that the inflationary impact of tariffs will be relatively transitory, essentially a one-time upward shift in the price level. Our responsibility is to ensure this one-time price increase does not evolve into persistent inflation. At the same time, downside risks to employment have risen in recent months, shifting the overall risk balance. Our policy framework requires balancing both sides of our dual mandate. Therefore, we judged that a 25-basis-point reduction in the policy rate at this meeting was appropriate.

With progress on disinflation stalling, Fed officials had signaled ahead of this meeting that further rate cuts might require clearer evidence of labor market weakening. At the press conference, Powell said:

“We are now in a position where we can afford to be patient and see how the economy evolves.”

In the Q&A session, when asked whether the current policy rate being closer to neutral implies the next move must necessarily be downward, or if policy risks have truly become two-sided, Powell responded that no one is treating a rate hike as a base case assumption, and he had not heard such views expressed. Currently, there are differing opinions within the committee: some members believe the current stance is appropriate and advocate holding steady while observing further; others think additional cuts may be needed this year or next, possibly more than once.

When members write down their assessments of the policy path and appropriate rate levels, expectations center on several scenarios: either holding at current levels, modest cuts, or somewhat larger cuts. Powell emphasized that rate hikes are not part of the prevailing consensus.

Powell added that, as a separate decision, the Fed has chosen to begin purchasing short-term U.S. Treasuries, with the sole purpose of maintaining ample reserve supplies over time, thereby ensuring the Fed can effectively control the policy rate. He stressed that these actions are distinct from the monetary policy stance itself and do not represent a shift in policy direction.

He noted that the scale of short-term Treasury purchases could remain high over the coming months. The Fed isn’t strictly “concerned” about tightness in money markets, but conditions have tightened slightly faster than expected.

Powell also said that according to guidance from the New York Fed, initial asset purchases will reach $40 billion in the first month and could remain elevated in the following months to alleviate anticipated short-term pressures in money markets. Afterward, the pace is expected to decline, depending on market conditions.

Regarding the labor market, Powell said that although official employment data for October and November have not yet been released, available evidence suggests layoffs and hiring remain at low levels. At the same time, households’ perceptions of job availability and firms’ sense of hiring difficulty continue to decline. The unemployment rate has continued to edge up to 4.4%, and job growth has clearly slowed compared to earlier this year. Additionally, the Fed removed the phrase “unemployment remains low” from its statement.

In the subsequent Q&A, Powell said that after adjusting for potential overestimation in employment data, job growth may have turned slightly negative since April.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News