Fed Engulfed in "Civil War," December Rate Cut Becomes a Coin-Flip Gamble

TechFlow Selected TechFlow Selected

Fed Engulfed in "Civil War," December Rate Cut Becomes a Coin-Flip Gamble

The Federal Reserve faces a serious policy divide, with the focus on whether to cut rates in December, while Powell's silence intensifies market uncertainty, and political pressure combined with missing economic data complicates decision-making.

Author: White55, Mars Finance

The Federal Reserve is experiencing its most intense policy divide in recent years. According to the latest data, among the 12 FOMC members who have voting rights this year, five have clearly indicated a preference for holding rates steady in December, while others—including influential New York Fed President Williams—support further rate cuts.

Since the Fed's most recent interest rate decision on October 29, Chair Powell has unexpectedly remained silent, while his colleagues have flocked to media outlets and public forums to voice their positions, openly exposing internal divisions to the public.

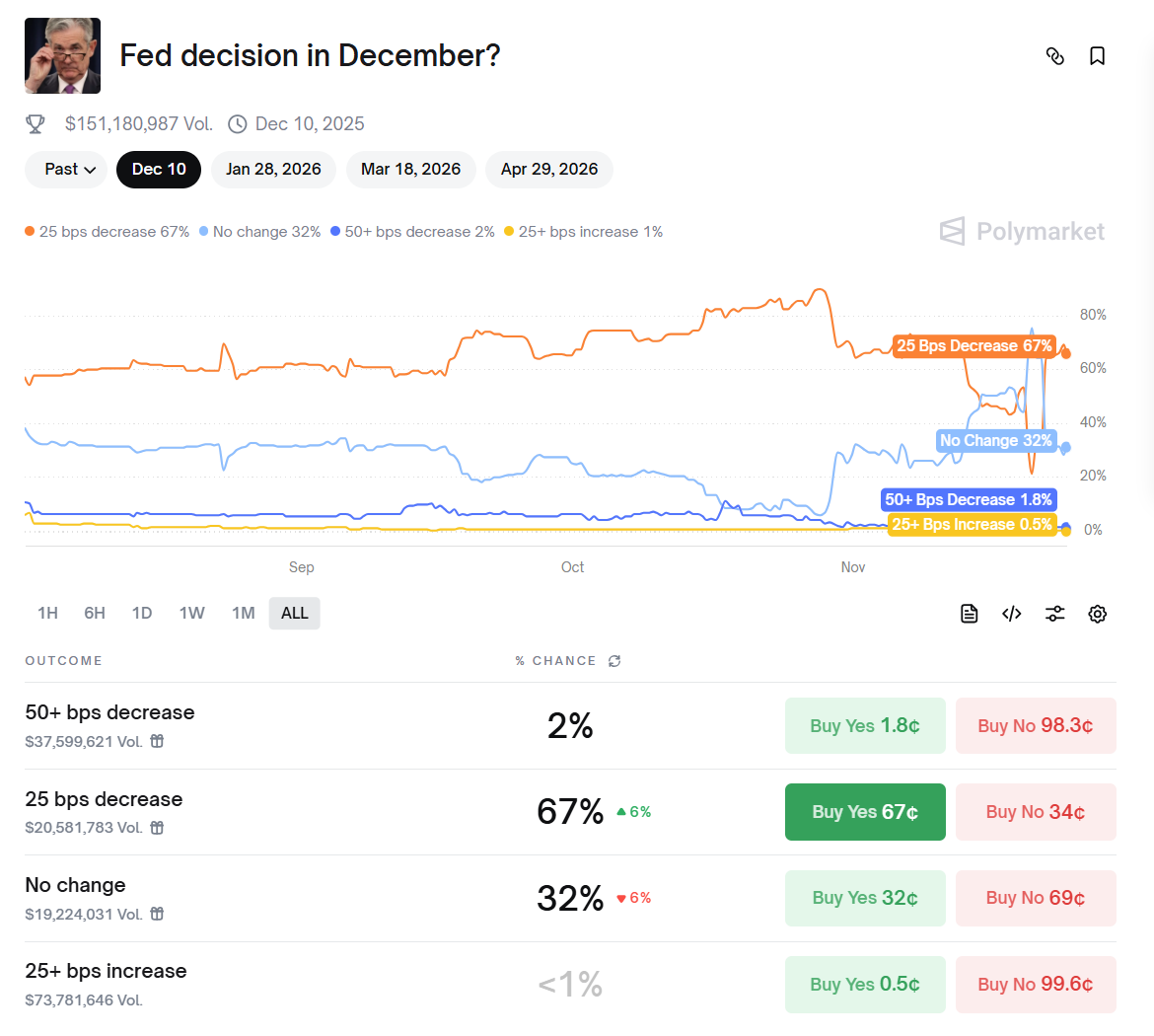

Polymarket data shows the probability of a rate cut rising above 67%

The depth of this split is evident in the wild swings of market expectations: within just a few weeks, the odds of a December rate cut plunged from a high of 95% to below 30%, then quickly rebounded to over 60% following Williams' remarks. Behind this rollercoaster of expectations lies an irreconcilable conflict of policy philosophies within the Fed.

Silent Powell and a Divided Committee

Powell’s unusual silence has sparked widespread speculation. Claudia Sahm, a former Fed economist, interpreted it as intentional: "By staying quiet now, Powell allows every FOMC member to express their views and be heard." In today’s complex environment, she said, this hands-off approach to internal debate is "actually a good thing." Yet as Powell remains silent, internal divisions are becoming increasingly public.

The October meeting already revealed signs of polarization—the Fed voted 10-2 to cut rates by 25 basis points. More surprisingly, the pro-cut camp is now fracturing. St. Louis Fed President Musalem, who supported rate cuts last month, has shifted toward skepticism, stating, "We must proceed with caution at this moment, and that is crucial."

Even more telling, Chicago Fed President Goolsbee, once considered a dove, now hints at a more cautious stance. During nearly three years at the Fed, Goolsbee never cast a dissenting vote, but now he says: "If I end up firmly supporting a position contrary to everyone else, so be it. I think that’s healthy."

Hawks vs. Doves—A Clash of Philosophies Amid Data Gaps

The Fed is currently divided into three main camps.

One group, led by Kansas City Fed President Schmid, represents the hawkish wing, emphasizing that inflation risks can no longer be ignored. Schmid warned, "Given that inflation remains too high, monetary policy should restrain demand growth to create space for supply expansion."

The other side, led by Fed Governor Michelle Bowman, takes a dovish stance—not only supporting rate cuts but even calling for a 50-basis-point reduction at the December meeting. Bowman argues, "There is now ample evidence that inflation is falling rapidly and the labor market is weakening, making further easing necessary."

The middle ground is represented by San Francisco Fed President Daly, who remains open to rate cuts but stresses caution. Daly noted, "We also don’t want to make the mistake of keeping policy rates too high for too long, only to later realize it harmed the economy. Getting policy right requires an open mind."

This division was foreshadowed as early as the July meeting, when Governors Waller and Bowman became the first in 32 years to vote against the chair, breaking the Fed’s long-standing consensus culture.

Data Blackout and the Fed’s Dilemma Amid Government Shutdown

A major challenge in this decision cycle is the absence of key economic data. The U.S. federal government shutdown has halted official data releases—the Bureau of Labor Statistics has confirmed it will not publish the October jobs report, and November’s CPI data won’t be released until December 18, after the Fed’s December meeting.

Powell himself likened the situation to "driving in heavy fog," where "you slow down." With official data unavailable, the Fed must rely on private-sector indicators, which paint a contradictory picture of the economy.

On one hand, inflation remains elevated. The September Consumer Price Index rose 3% year-over-year, well above the Fed’s 2% target. Particularly concerning is the persistence of service-sector inflation—core services such as housing and healthcare continue to rise more than 3.5% annually.

On the other hand, the labor market shows signs of cooling. According to consulting firm Challenger, U.S. companies announced 153,000 job cuts in October, an 183% surge from September and the highest level in over two decades for that month. A Chicago Fed estimate suggests the U.S. unemployment rate may have edged up to 4.4% in October—the highest in four years.

Market Vote-Counting and a 50-50 Rate Cut Outlook

Faced with such clear internal divisions, market participants have shifted strategy—from watching for Fed consensus to literally counting votes. This change reflects the breakdown of the Fed’s communication framework and has led to extreme volatility in market expectations.

Morgan Stanley analysts note that missing data and delayed labor market reports mean the Fed "will face a significant information shortfall when making its December decision." This uncertainty has kept traders highly tentative about the December outcome. Last Friday, New York Fed President Williams briefly reshaped market dynamics. As the Fed’s third-highest official, Williams stated that "rate cuts could be appropriate in the near term," pushing investor expectations for a December cut sharply higher.

But Boston Fed President Collins poured cold water on the market the next day. She argued there is "no need for the Fed to continue cutting in December," stressing that "inflation risks remain, and a moderately restrictive policy helps ensure inflation comes down."

Currently, the CME FedWatch Tool shows a 71% chance of a 25-basis-point rate cut in December, with a 29% chance of unchanged rates. However, many analysts believe the reality is more nuanced. While some, like Deutsche Bank senior economist Brett Ryan, think Williams’ comments have locked in a cut, former Fed economist Claudia Sahm admits: "I truly think it’s still 50-50."

Historical Precedents and the Battle to Preserve Fed Independence

Such internal divisions are not unprecedented in Fed history. In the 1980s, when the Fed raised rates to punitive levels to fight high inflation, and in the 1990s, when persistent concerns about price pressures made many policymakers wary of excessive easing, dissenting votes were common.

What makes this episode different is the unprecedented political pressure. President Trump has repeatedly expressed dissatisfaction with Powell, even "half-jokingly threatening" at the U.S.-Saudi Business Forum to fire Treasury Secretary Besent if rates aren't lowered. This mix of political pressure and internal conflict has raised serious concerns about the Fed’s independence. Economists warn that strained relations between the White House and the Fed could undermine the central bank’s monetary autonomy and its ability to control inflation. Dallas Fed President Logan highlighted the core dilemma: "Uncertainty is a pervasive feature of macroeconomics and policymaking. Policymakers can never fully know the current state of every relevant aspect of the economy—but they must still make decisions."

The probabilities on Fed-watching tools keep changing, but more analysts are beginning to agree with Claudia Sahm’s assessment—that this debate is truly evenly split. Regardless of the outcome of the December 10 meeting, Powell will face a fractured committee, and his leadership will be tested as never before.

The market has realized that the era when the Fed could easily reach consensus is over. As Fed Governor Waller put it: "You might see the least groupthink behavior from the FOMC that we’ve seen in a very long time."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News