Crypto Morning Brief: Grass launches airdrop checker page; Up Fintech rolls out trading for AVAX, LINK and other cryptocurrencies

TechFlow Selected TechFlow Selected

Crypto Morning Brief: Grass launches airdrop checker page; Up Fintech rolls out trading for AVAX, LINK and other cryptocurrencies

Bitcoin performs poorly after halving, signaling the possible end of the four-year cycle theory.

Author: TechFlow

Yesterday's Market Overview

10 Bitcoin ETFs saw net outflows of 5,514 BTC yesterday; 9 Ethereum ETFs saw net outflows of 4,551 ETH

According to Lookonchain data, 10 Bitcoin ETFs recorded a net outflow of 5,514 BTC (approximately $317.82 million) on that day. Fidelity accounted for an outflow of 2,835 BTC (around $163.38 million), and currently holds 175,515 BTC (worth about $10.12 billion).

On the same day, 9 Ethereum ETFs experienced a net outflow of 4,551 ETH (approximately $11.11 million). Grayscale (ETHE) saw an outflow of 6,412 ETH (about $15.65 million) and currently holds 1,800,954 ETH (valued at around $4.4 billion).

Tiger Brokers launches trading for AVAX, LINK, APT, and TON digital assets

According to reports from the Hong Kong Economic Times, Tiger Brokers (Hong Kong) announced the immediate availability of Avalanche (AVAX) and Chainlink (LINK) trading for retail investors, while Aptos (APT) and Toncoin (TON) are now available for professional investors. Since fully opening digital asset trading to retail investors on July 1, 2024, trading activity has significantly increased. Data from its investment platform Tiger Trade shows that in August 2024, both order volume and number of users participating in cryptocurrency trading among Hong Kong customers more than doubled compared to July.

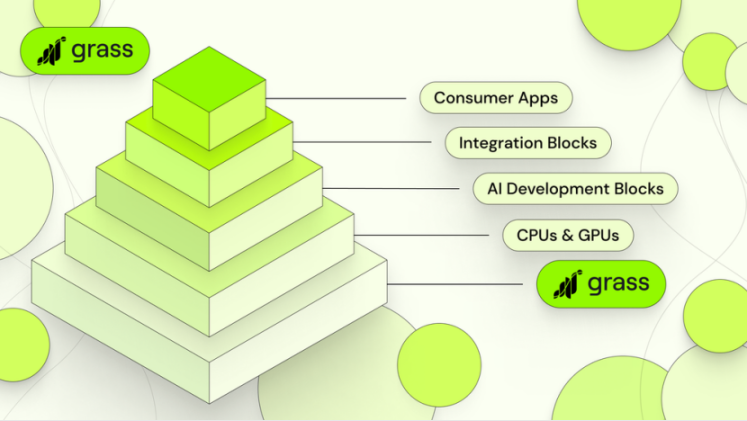

Solana-based DePin project Grass launches airdrop checker; first airdrop accounts for 10% of total supply

According to official announcements, Grass has launched its airdrop checker page. Currently, the checker only reflects allocations from Closed Alpha and Epochs 1–7, excluding the ongoing Bonus Epoch or any To Be Announced distributions. The total token supply will be 1 billion GRASS, with 10% allocated for the first airdrop.

CFTC sues Uniswap Labs and reaches settlement

According to an official announcement from the CFTC, it found that Uniswap Labs unlawfully provided leveraged or margined retail commodity transactions in digital assets through a decentralized digital asset trading protocol. The CFTC requires Uniswap Labs to pay a civil penalty of $175,000 and cease violations of the Commodity Exchange Act (CEA). The CFTC acknowledged Uniswap Labs’ proactive cooperation during the investigation, which contributed to a reduced penalty.

Outlier Ventures: Bitcoin underperforms post-halving, four-year cycle theory may be over

According to The Block, Jasper De Maere, Research Director at Web3 accelerator Outlier Ventures, released a report stating that Bitcoin’s price performance following the latest halving is the worst in history, urging investors to abandon the four-year cycle narrative. Data shows that within 125 days after this halving, Bitcoin’s price dropped approximately 8%, whereas previous halvings saw gains of 739% (2012), 10% (2016), and 22% (2020). De Maere believes 2016 was the last time halving had a significant impact on Bitcoin’s price, as block rewards have become negligible in an increasingly mature and diversified crypto market. Although Bitcoin reached a new high of $73,836 on March 14 this year, De Maere attributes this primarily to factors such as spot ETF approvals, not the halving event.

Web3 game Dimensionals drops blockchain features, shifts entirely to Web2 model

According to NFT Plazas, game developer Mino Games announced that its roguelike card-building game Dimensionals will fully transition to a Web2 model, completely abandoning previously integrated blockchain technology and NFT functionalities. Initially launched in March 2023 with the Genesis Stone NFT collection aimed at attracting mainstream players ahead of the game’s release, the project faced numerous challenges from the start: whitelist giveaways were overwhelmed by bots, the project suffered repeated DDoS attacks, and changes in the NFT market landscape caused royalty revenues to drop to zero. Despite launching a non-blockchain version on Steam in March 2024, CEO Sash MacKinnon admitted that the Web3 initiative ultimately resulted in significant financial losses. "We chose the wrong path," he said. The company has since decided to fully pivot to the Web2 gaming model to reach a broader audience.

Ripple CEO: Stablecoin RLUSD to launch in weeks, no interest in U.S. IPO

Ripple CEO Brad Garlinghouse revealed at the Seoul Blockchain Week in South Korea that the company is preparing to launch its dollar-pegged stablecoin RLUSD, which is currently in a “private closed testing phase” and expected to go live “within weeks, not months.” Garlinghouse said Ripple saw an opportunity to enter the stablecoin market following the USDC depeg event 18 months ago. He also stated he has “no interest” in conducting an IPO in the United States, citing the SEC’s “hostile stance” toward cryptocurrencies. He predicts that regardless of who wins the upcoming presidential election, the SEC will see new leadership, noting that current Chair Gary Gensler has lost bipartisan support. Regarding Ripple’s legal battle with the SEC, the company was fined $125 million last month—far less than the $2 billion initially sought by the SEC. Garlinghouse views this outcome as a victory for both Ripple and the industry. He also expressed regret over the SEC’s recent enforcement actions against NFT marketplace OpenSea, arguing that the SEC’s view of NFTs as securities is incorrect. Nonetheless, Garlinghouse remains optimistic about the next five years for crypto and hopes for clearer regulatory guidance from legislators rather than the SEC.

Grayscale August Report: Market likely to retest all-time highs by year-end; pessimism toward Ethereum unjustified

Grayscale Research released its August market report: While global markets appeared stable overall in August 2024, this masked significant intra-month volatility. On August 23, Federal Reserve Chair Jerome Powell signaled during his Jackson Hole annual symposium speech that “the time for policy adjustment has arrived,” partly reflecting rising “downside risks to employment.” Interest rate futures now suggest the Fed will cut policy rates by 100 basis points across its remaining three FOMC meetings this year.

Grayscale Research believes that if dollar weakness and declining interest rates persist, they could be favorable for Bitcoin valuation. Lower U.S. interest rates may erode the dollar’s competitive edge and potentially benefit Bitcoin. Ethereum notably underperformed during early August’s downturn, with excessive speculative positioning leading to a sharp price correction and limiting subsequent recovery. More fundamentally, the Ethereum network is undergoing major structural changes, creating uncertainty about its future for some investors. Ethereum aims to scale by moving more transactions to Layer 2 networks, which will periodically settle back to the Layer 1 mainnet. Grayscale Research argues that given clear evidence the scaling strategy is working, current market pessimism toward Ethereum is unwarranted. However, it may take time for broader market sentiment to turn more positive.

Market Performance

Suggested Reading

Compared to WeChat, how far is TON from achieving mass adoption?

Binance Research: Blockchain payments, a new beginning

Web3 Gaming Investment Trends 2020–2024: A Fleeting Past, A Reborn Future

What do we really mean when we talk about consumer-grade crypto applications?

Crypto market dips again: Can NFP, CPI, and Fed rate cuts bring a turnaround?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News