Grass Holder Meeting Ends: What Information Hides the Wealth Code?

TechFlow Selected TechFlow Selected

Grass Holder Meeting Ends: What Information Hides the Wealth Code?

TL;DR: Second round of token airdrop, tentatively scheduled for the first half of next year.

Written by: TechFlow

Remember Grass, the star project from the last DePIN narrative?

On November 16, GRASS just hit a new all-time low of $0.26. But within a week, the token rebounded over 45%, outperforming the broader market during the same period.

There's a sentiment in the community that the sharp price movements were fueled by speculation around the anticipation of the project's first Token Holder Call, with hopes that the team would share stronger fundamental updates during this event open to all token holders.

Grass has now concluded its Token Holder Call. After reviewing the content, I found it less like a typical crypto AMA filled with vague talking points, and more akin to a financial earnings disclosure.

Revenue figures, customer composition, buyback plans, and the airdrop timeline—none of these had been publicly shared before today.

If you missed the meeting, we’ve quickly summarized the key data and insights from the video replay and official recap to help you identify which signals are worth paying attention to.

Meeting replay link: Click here

Did revenue grow from zero to tens of millions in just three quarters?

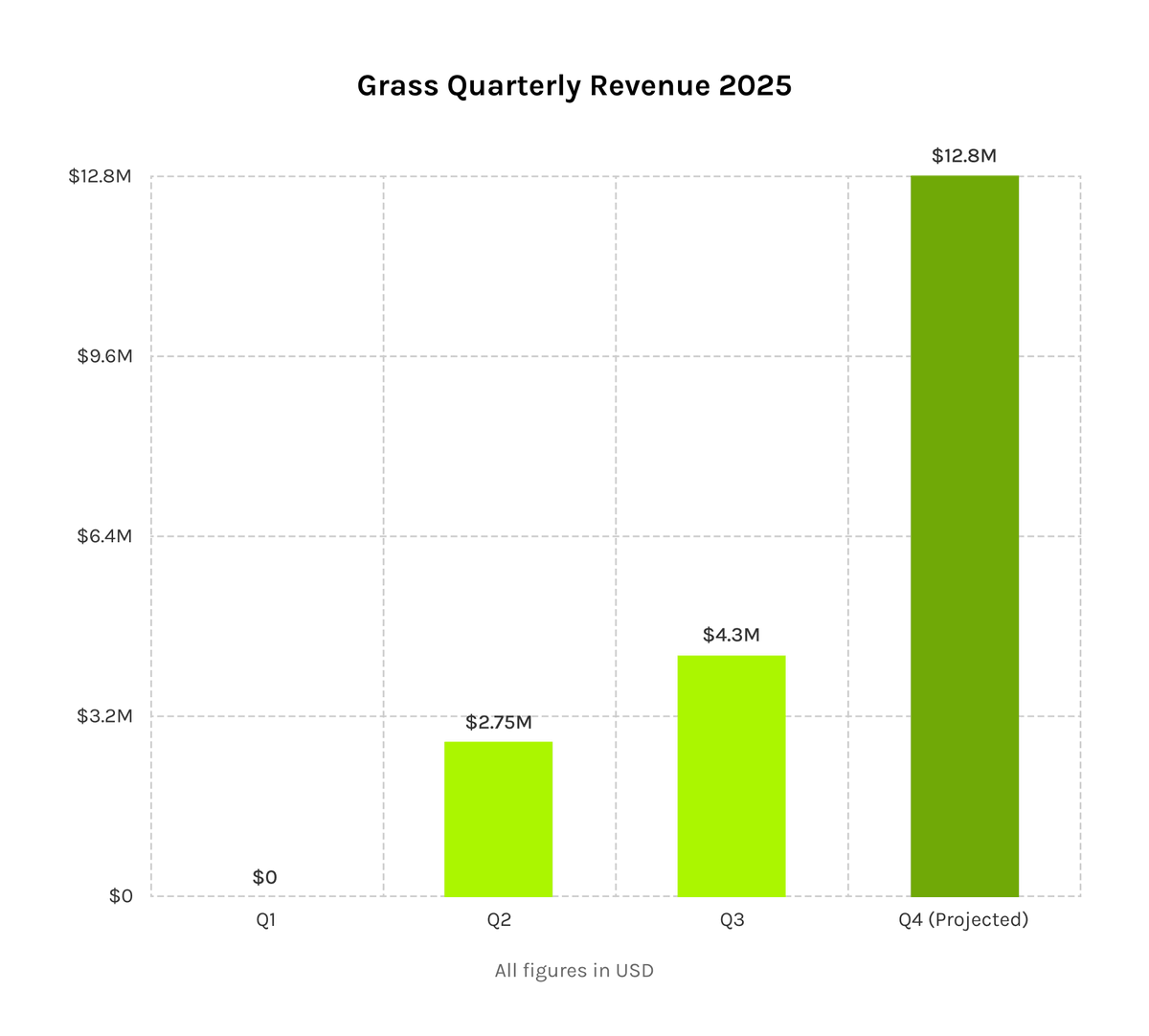

This is the first time Grass has publicly disclosed its revenue data:

-

Q1 2025: Nearly zero

-

Q2 2025: Approximately $2.75 million

-

Q3 2025: Approximately $4.3 million

-

Q4 2025 (forecast): Approximately $12.8 million

The team stated that expected revenue for October and November alone reached $10 million. It should be noted that Q4 figures are still projections and await real-world validation.

How does Grass make money?

To understand the revenue, you need to understand Grass’s business model.

Grass is a decentralized bandwidth network. After users install its plugin or app, Grass uses their idle internet bandwidth to scrape publicly available web content—including text, images, and videos.

Because requests originate from ordinary residential IPs across the globe, they’re less likely to be blocked by websites—an advantage highly valuable to clients needing large-scale data collection.

Who are the customers? Primarily AI companies. Training large models requires massive datasets, and Grass helps them acquire such data at lower cost. Simply put, Grass “borrows” bandwidth from users, packages it into data collection services, and sells the service to AI firms, profiting from the margin.

Where does the revenue come from?

The call revealed that 90% of revenue comes from "multimodal data"—services involving video, audio, and image scraping—and 98% of revenue is related to AI model training.

This indicates Grass’s customer base is extremely concentrated: almost entirely AI companies buying training data.

Business focus is one thing, but conversely, this also means that if the AI training data market shifts, Grass’s revenue will be directly impacted.

About Customers

Grass does not disclose its client list, citing that AI companies treat training data as confidential. Information shared during the call includes:

-

In Q4, signed a hyperscaler—essentially a major cloud computing provider—and a leading lab in video generation

-

Almost all AI clients have repurchased services after initial contracts

However, these statements are self-reported, and external verification of their accuracy is nearly impossible.

Token buybacks happened—but not much

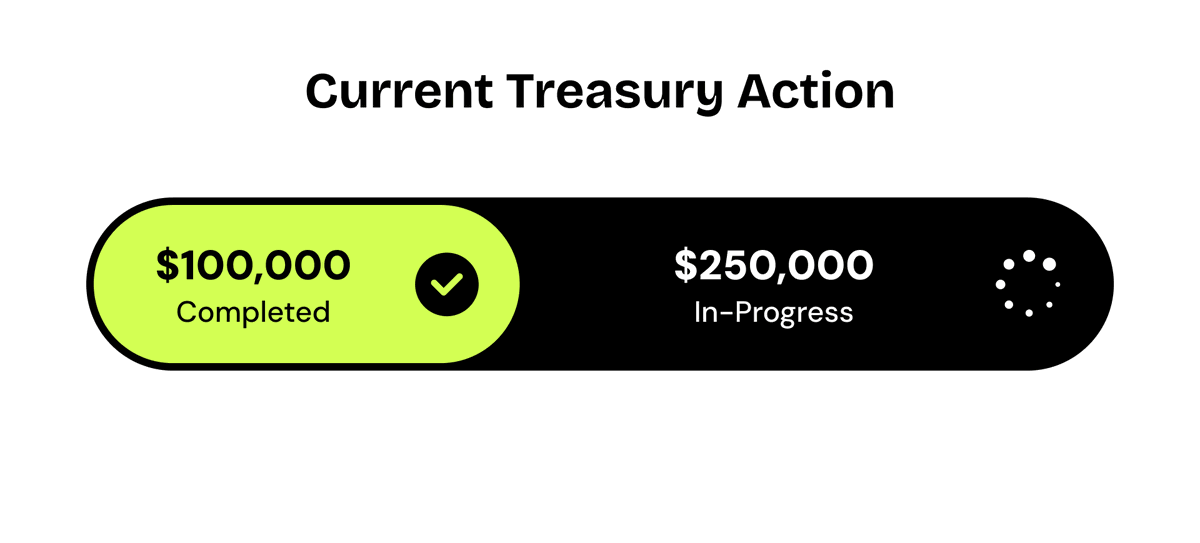

It was disclosed that Grass has used business revenue to buy back GRASS tokens on the open market: approximately $100,000 last week and about $250,000 currently being executed this week.

These buyback funds come from revenue generated in the first three quarters of the year. To address skepticism about whether buybacks are actually happening, the team said they will publish the wallet address holding the repurchased tokens.

The total buyback amount so far is around $350,000. Compared to roughly $7 million in combined revenue from Q2 and Q3, this represents about 5%—not a significant sum, more symbolic than material.

The team mentioned future buybacks will shift from manual decisions to automated execution, though no specific rules were provided.

It’s important to note, however, that buybacks aren’t foolproof catalysts. Both HYPE and PUMP have implemented buybacks and possess real revenue, yet still experienced sharp token price declines at times.

The team also emphasized two things: conducting buybacks and reinvesting most revenue into growth. The balance between the two remains unspecified. Whether buybacks can continue or scale up ultimately depends on whether revenue keeps growing.

Second airdrop scheduled for the first half of next year

Grass conducted its first airdrop last year, distributing GRASS tokens to early participants. This meeting confirmed the timeframe for the second airdrop:

H1 2026.

Distribution method will change

Unlike the first airdrop, Airdrop 2 won’t be claimable via external wallets. Instead, it will be distributed through an upcoming built-in wallet developed by Grass. This wallet, based on account abstraction technology, will be embedded directly into the Grass application interface.

In other words, you won’t need to connect third-party wallets like MetaMask—you’ll receive the airdrop directly within the Grass platform.

Rewards rules will change

The team stated the new airdrop will “emphasize long-term network contribution” more heavily. However, specifics—such as how contribution is calculated, what qualifies as “long-term,” and how different devices or behaviors are weighted—have not been released. These details will only become clear after the wallet launches.

What this means for current users

If you're currently running a Grass node, this meeting didn’t provide clear action steps. The only certainty is that rules will change, and the event will occur in H1 2026, using a new calculation method. Whether your current points, levels, or number of devices will carry over remains unknown.

The current market is bearish, and it’s uncertain whether overall crypto conditions will improve by mid-2026. Given GRASS’s vague airdrop timeline, I believe this is somewhat of a delaying tactic in response to the ongoing bear market.

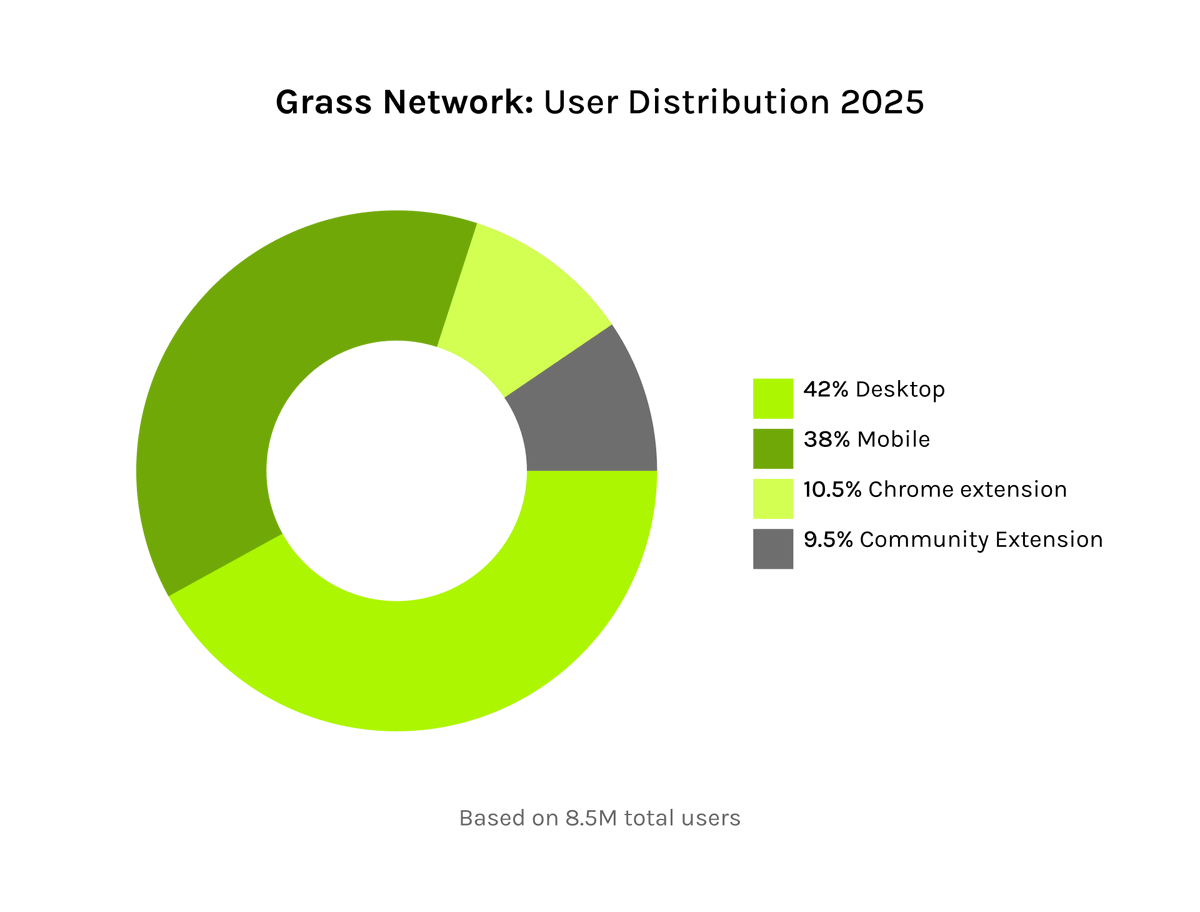

Monthly active users grew from 3 million to 8.5 million—next step is becoming a real-time AI data source

Grass’s network size has grown significantly over the past year. Official data shows monthly active participants increased from about 3 million at the time of the first airdrop to around 8.5 million today. Mobile users account for approximately 38%, meaning over one-third contribute bandwidth via the mobile app rather than a desktop plugin.

The team claims Grass has accumulated over 250PB of multimodal data (video, audio, images). One PB equals about 1 million GB. According to the team, this volume is “sufficient to train a state-of-the-art video generation model.”

New direction: From selling training data to enabling real-time queries

Grass is developing a new product line called Live Context Retrieval (LCR), literally “real-time context retrieval.”

The current business involves helping AI companies collect bulk data for model training—a high-volume, one-off process. LCR differs by providing real-time data during AI model inference. For example, if a model needs to check the current content of a webpage, Grass can instantly fetch and return it.

Currently in early stages, the team refers to it as a "V0 version," and is testing it with three SEO companies and one AI lab.

The rationale given: training data deals are large but infrequent, making them unsuitable for on-chain settlement. LCR enables small, frequent transactions—each query corresponds to a micro-payment—making it better suited for token-based payments.

If LCR succeeds, the GRASS token could gain more utility in actual operations. But this remains speculative; LCR currently generates no revenue.

Meanwhile, the hardware device Grasshopper, originally slated for release this year, has been delayed due to supply chain issues caused by tariffs. A new release date will be announced later.

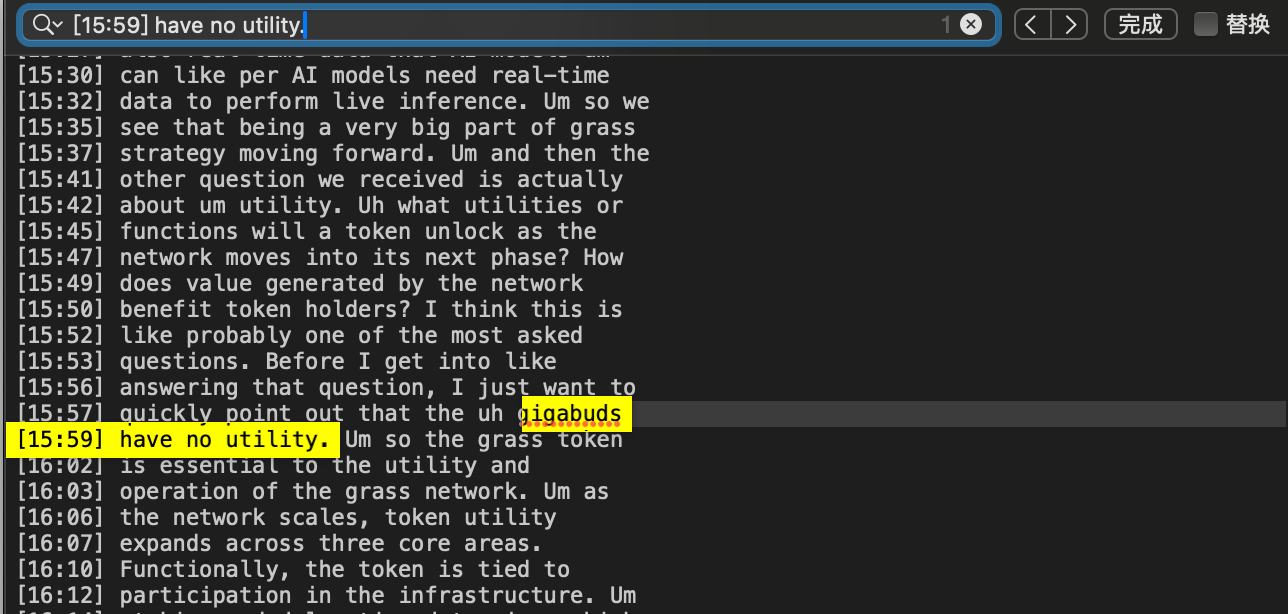

A sentence deleted from the official summary

During the discussion on token utility, Grass CEO Andre said: “Gigabuds have no utility,” meaning Gigabuds serve no functional purpose.

However, this statement did not appear in the official written summary released after the meeting.

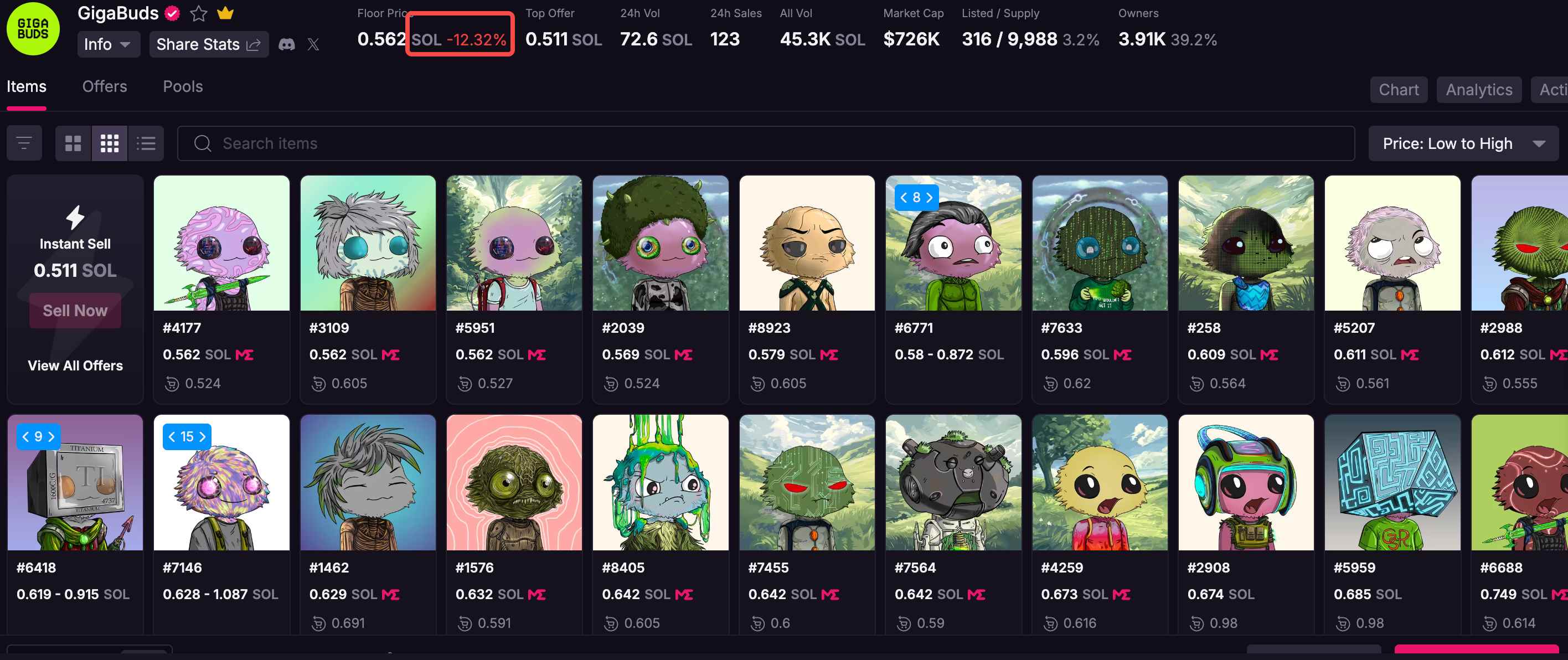

What are Gigabuds?

Gigabuds is an NFT series launched by Grass. Some holders may have expected them to grant advantages in future airdrops or network rights, but this statement clearly shuts down that expectation.

The drop in floor price might reflect the market’s reaction to this announcement.

Why wasn't it included in the official summary? The team hasn’t explained. Possible reasons include avoiding negative sentiment among NFT holders or deeming it irrelevant to core business information.

The statement was indeed made during the call—the subtitles confirm it.

If you hold Gigabuds based on the expectation that they’d eventually have utility, this is an unambiguous official rejection. Whether the NFTs retain collectible or secondary market value is another matter, but the path to functional utility has now been officially closed.

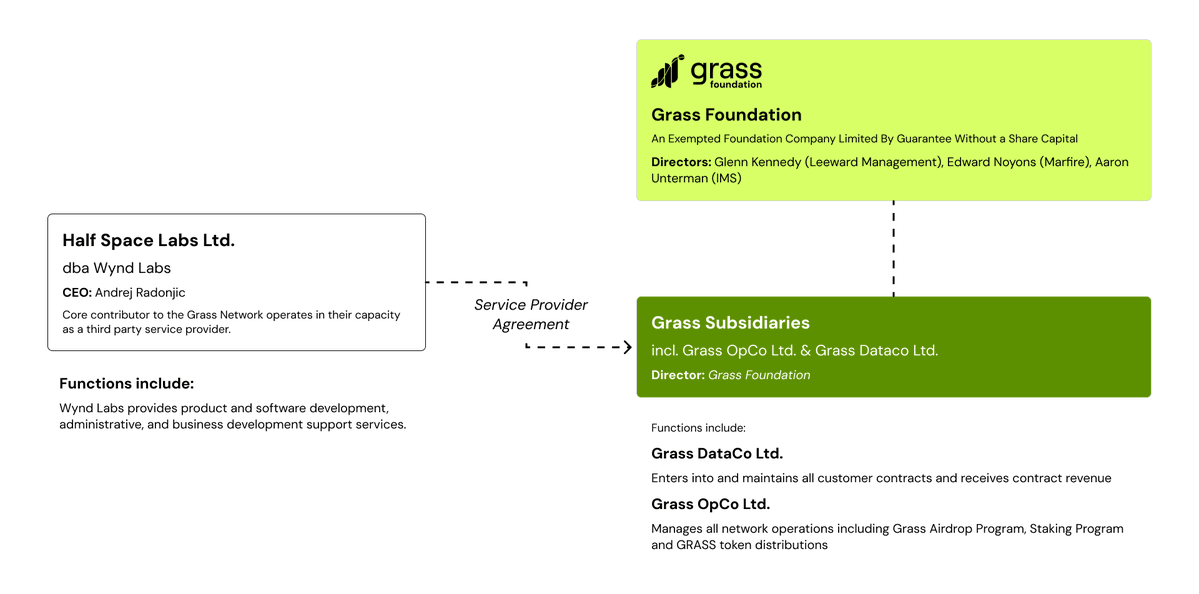

Revenue goes to the foundation; development team receives service fees

Many crypto projects lack transparent corporate structures, leaving users unclear about who controls revenue, tokens, or the relationship between developers and the project. In this meeting, Grass clarified its organizational setup.

Three entities, each with distinct roles

The Grass Foundation is a Cayman Islands-registered foundation with no shareholders. It owns two subsidiaries:

-

Grass OpCo: Responsible for network operations, managing airdrops and staking

-

Grass DataCo: Handles B2B operations—signs all client contracts and receives all revenue

The development team is outsourced

The product development team, Wynd Labs, is not a subsidiary of Grass but an independent third-party service provider. Wynd Labs earns fees for services rendered and does not share in Grass’s revenue.

The team emphasized: even if Wynd Labs brings in clients, contracts are signed by Grass DataCo, and revenue flows to Grass DataCo.

How much are the service fees?

The exact amount was not disclosed. Therefore, the actual cost of development remains opaque to outsiders.

In summary:

This meeting covered revenue data, buyback progress, airdrop timeline, product direction, and corporate structure. For a DePIN project, this level of information disclosure is uncommon.

What wasn’t discussed: the identities of specific clients, the scale and continuity of future buybacks, detailed rules for Airdrop 2, or when new products will generate revenue. On these questions, the team either said they couldn’t disclose or promised updates later.

This was Grass’s first such meeting, and the team said more will follow. For token holders, tracking operational progress may prove more valuable than short-term price fluctuations.

Hopefully, more crypto projects will follow this example and openly share their business revenue. In a market where everyone’s competing over who’s less broken, this level of transparency is already rare.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News