Why Did AVAX Surge 15% Amid a Broad Market Downturn?

TechFlow Selected TechFlow Selected

Why Did AVAX Surge 15% Amid a Broad Market Downturn?

Over the past 7 days, AVAX has surged more than 80%, entering the top ten by market capitalization.

Written by: Asher, Odaily Planet Daily

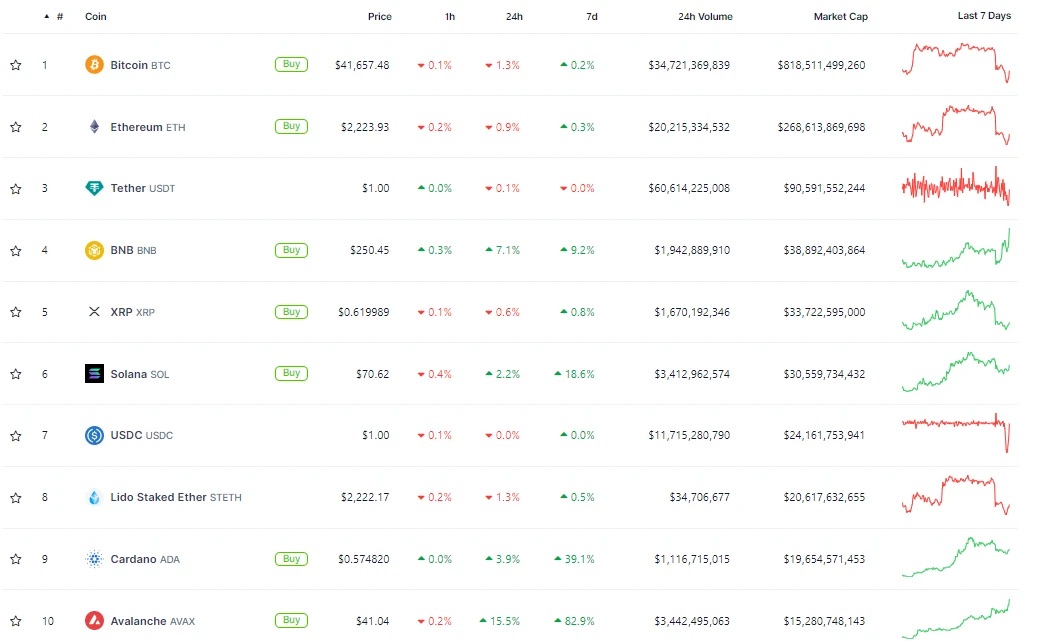

Yesterday, BTC entered a correction phase, briefly dropping below 41,000 USDT and hitting a low of 40,200 USDT. Other major cryptocurrencies (such as ETH and SOL) followed suit with downward movements. However, Avalanche (AVAX) defied the trend, rising to a morning high of 43 USDT—up over 15% in 24 hours and surging 82.9% over seven days—propelling its market cap ranking into the top ten.

(Image source: CoinGecko)

Although we may have missed AVAX’s recent rally, a deeper dive into its ecosystem could still uncover promising opportunities ahead. In this ever-changing crypto market, understanding Avalanche's ecosystem projects might lead us to new discoveries and investment prospects.

What Is Driving AVAX’s Price Surge?

Firstly, on-chain data shows that over the past month, Avalanche's TVL growth has matched—and even surpassed—that of Solana. This indicates significant achievements in attracting capital and users to the Avalanche ecosystem. Compared to other leading blockchain projects, Avalanche's total TVL has also demonstrated strong momentum.

(Data source: DeFiLlama)

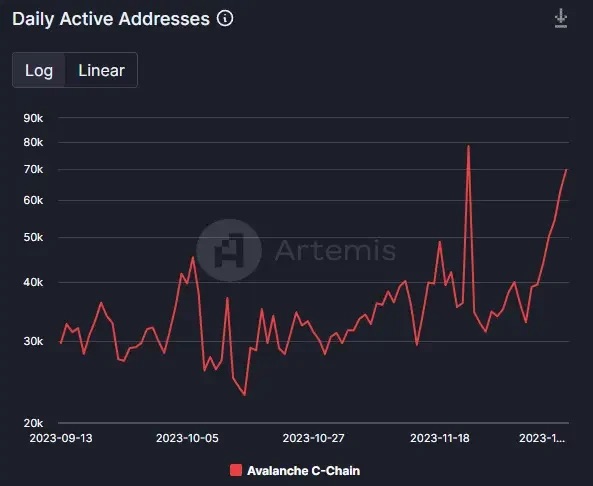

Secondly, daily active addresses on Avalanche surged from just 28.27K in early October to nearly 70K recently—an increase exceeding 147%. This remarkable growth not only reflects rapid expansion in user base but also signals strong investor and community interest in the ecosystem. Rising user engagement may be a key factor behind Avalanche's standout performance in the market.

(Image source: Artemis Terminal)

Lastly, analyzing daily transaction volume on Avalanche reveals a clear upward trend since October. This suggests increasingly frequent trading activity and growing user participation across the network. Such notable increases in transaction volume reflect the vitality of the Avalanche ecosystem and serve as an important signal for investors.

(Image source: Artemis Terminal)

The AVAX Rally: What Are Investors Chasing?

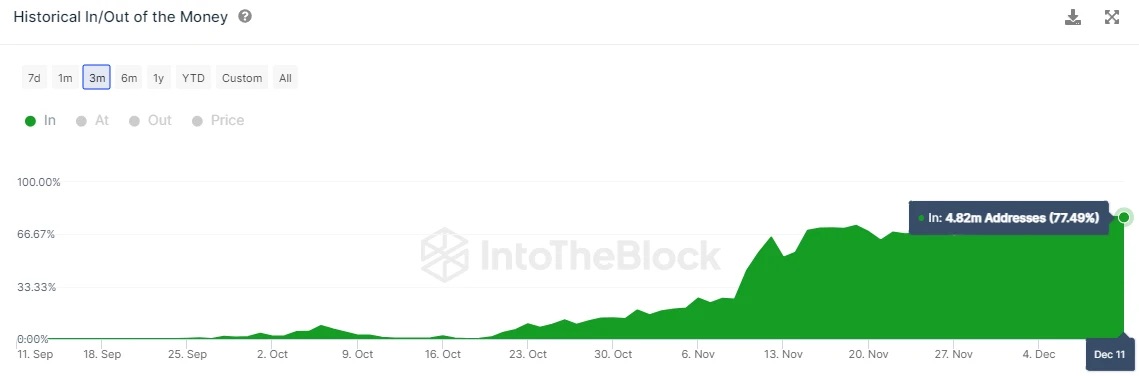

From capital flow data, it is evident that the Avalanche ecosystem has continuously attracted inflows over the past two months. Recently, more than 77% of addresses remain in net inflow status. So, what hot investment opportunities are these addresses pursuing within the Avalanche ecosystem?

(Image source: IntoTheBlock)

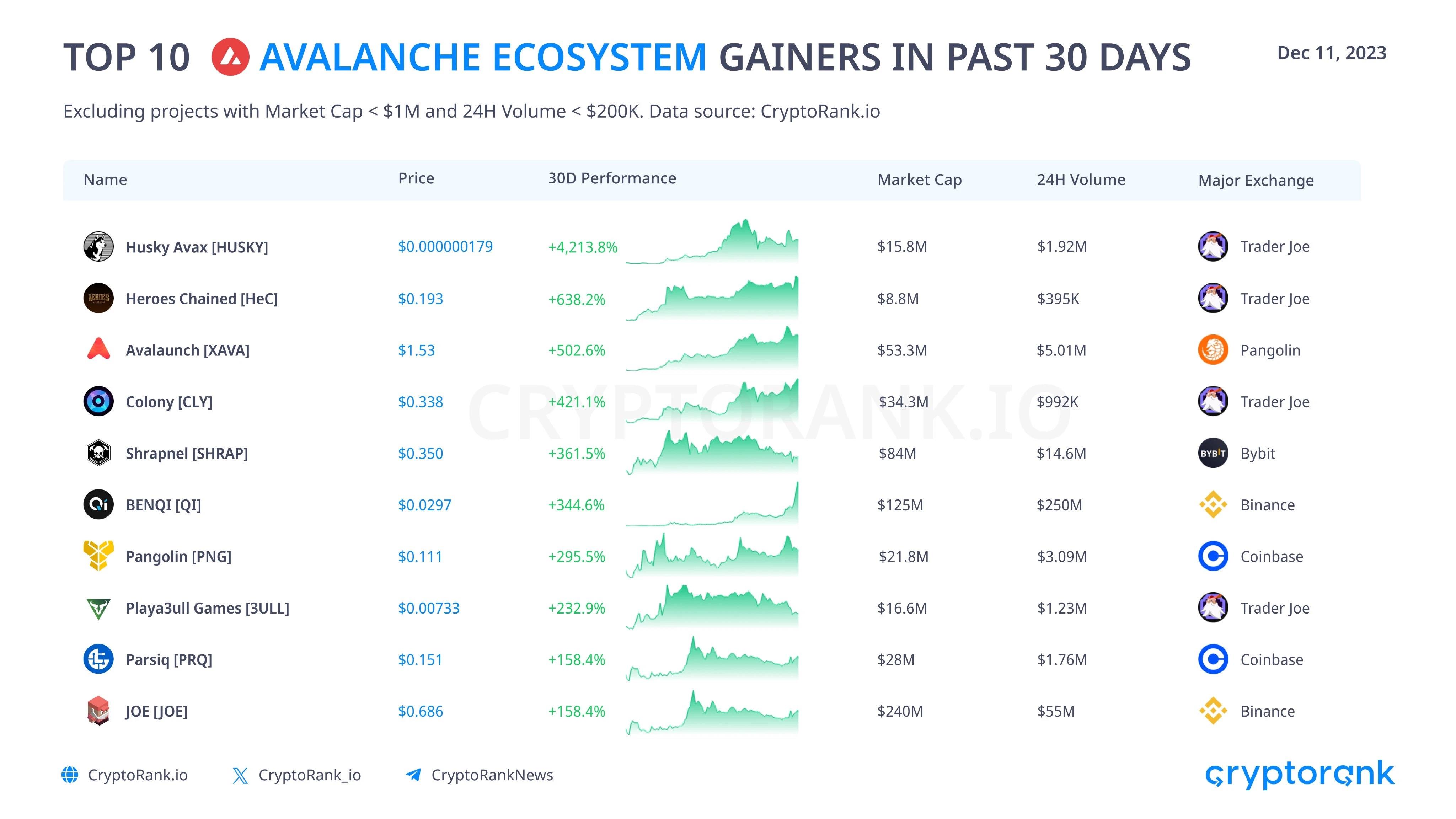

As AVAX price rises sharply, sectors such as memes, DeFi, and GameFi within the Avalanche ecosystem have seen varying degrees of explosive growth. The chart below highlights top-performing tokens in the Avalanche ecosystem over the past 30 days. The following section provides detailed analysis by sector.

(Image source: Cryptorank)

First, the most hyped sector currently is meme coins, and Avalanche-based meme tokens are no less vibrant than those on other public chains. HUSKY—the first “dog” token on Avalanche—has surged over 4,200% in the past 30 days, drawing widespread attention. Additionally, COQ is a newly launched meme coin introduced last week. Within less than a week, it has become one of the most prominent meme coins on Avalanche, with some in the community dubbing it the "PEPE of Avalanche."

Second, in the DeFi space, Trader Joe—the leading DEX on Avalanche—and BENQI—the dominant lending protocol—remain central to this rally. Trader Joe primarily focuses on spot trading, with its TVL increasing over 67% in the past month to reach $117 million. Its native token JOE has gained over 158% in the last 30 days. BENQI also performs impressively, holding the highest TVL in the Avalanche ecosystem, while its token QI has surged 344% over the same period.

(Image source: DeFiLlama)

Third, in the GameFi sector, notable projects include Shrapnel and HeroesChained. Shrapnel is a sci-fi-themed first-person shooter (FPS) game developed by Neon Machine. The studio secured a $20 million Series A round at the end of October, led by Polychain Capital, with participation from Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures, and Tess Ventures. The funding will support further development of Shrapnel, whose team released an early access version this month. The game’s token SHRAP has risen over 361% in the past month. Another popular title, HeroesChained, is a fantasy action RPG with its native token HEC also showing solid gains.

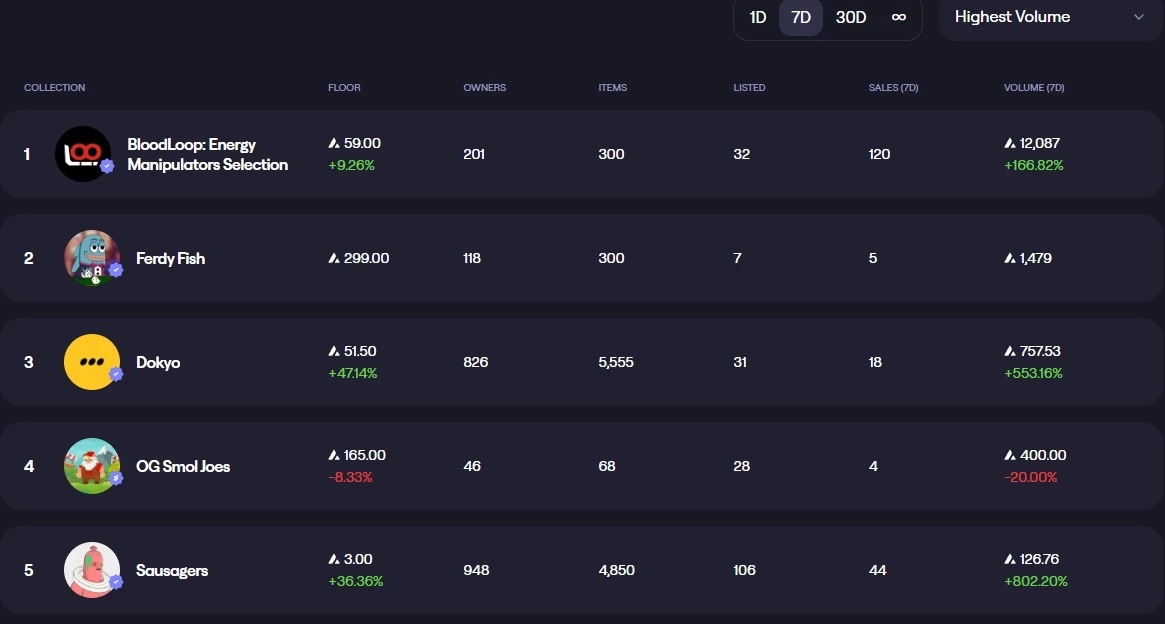

Fourth, regarding the NFT sector, JoepegsNFT—created by the Trader Joe team—is the primary marketplace for NFTs on Avalanche. According to 7-day trading volume rankings, BloodLoop ranks first on JoepegsNFT with a floor price of 59 AVAX, up 9% from a week ago. Dokyo World stands out for its impressive floor price performance, currently at 51.5 AVAX, with weekly trading volume up over 553%, earning it comparisons to Mad Lads within the Avalanche community.

(Image source: Joepegs)

Fifth, beyond the commonly discussed sectors, others are gaining traction—especially Launchpad platforms. As market conditions improve and new projects emerge, XAVA—the token of a prominent launchpad in the Avalanche ecosystem—has also shown strong appreciation.

Conclusion

Overall, multiple sectors within the Avalanche ecosystem—including memes, DeFi, GameFi, and NFTs—are experiencing rising momentum. Therefore, the current spotlight projects warrant continued attention.

At the same time, although inscriptions have received relatively little discussion so far, given their popularity in broader markets, they may soon make a notable impact within Avalanche’s ecosystem. Hence, we should stay vigilant and closely monitor future developments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News