Mastering Market Rotation: Reviewing Capital Shifts Between SOL and AVAX

TechFlow Selected TechFlow Selected

Mastering Market Rotation: Reviewing Capital Shifts Between SOL and AVAX

Rather than pursuing perfection, it's better to pay attention to both simultaneously.

Author: Mercury

Translation: TechFlow

Market Rotation: An Opportunity for Wealth Growth

In any market, especially the crypto market, rotation presents a rare opportunity. It allows you to move profits earned from strong assets into underperforming ones, thereby compounding your wealth.

However, the key to success lies in understanding the concept of "relative strength." Only when you've secured sufficient profits from a strong asset do you have the capital to execute a rotation. This is precisely what this article focuses on:

When the market is in a highly bullish phase, many tokens can perform well (like now), and choosing where to rotate may feel overwhelming.

But that's actually a good thing.

Because at such times, there are more tokens worth watching;

And their "appeal" becomes even more pronounced.

Taking $SOL and $AVAX as Examples

We can observe this rotation phenomenon through the performance of $SOL and $AVAX:

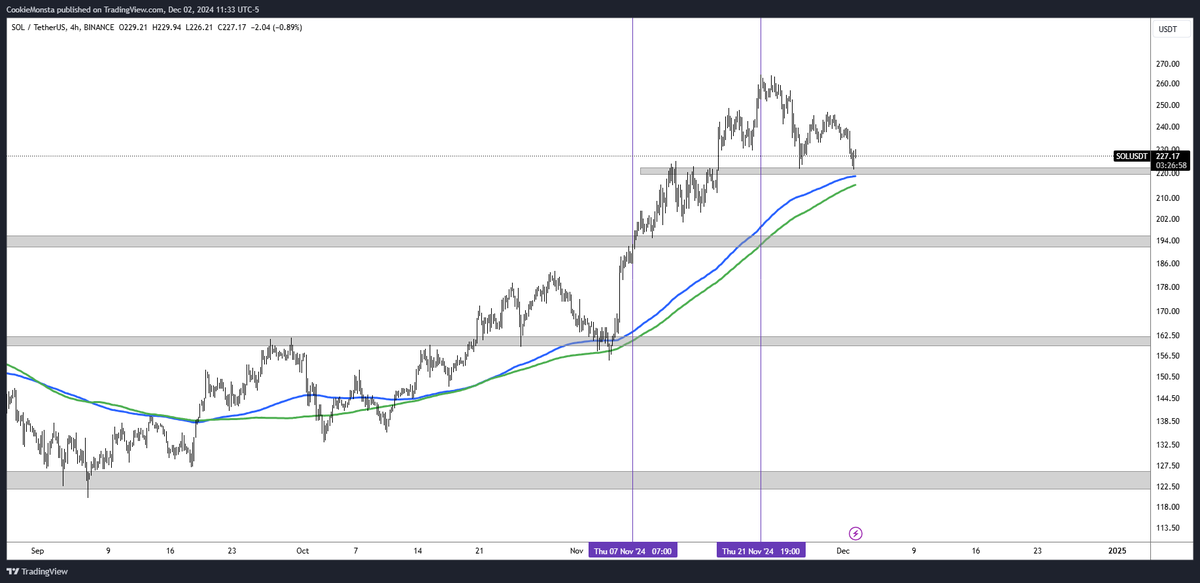

When SOL broke out of an 8-month consolidation range, AVAX hadn't even reached a higher high yet.

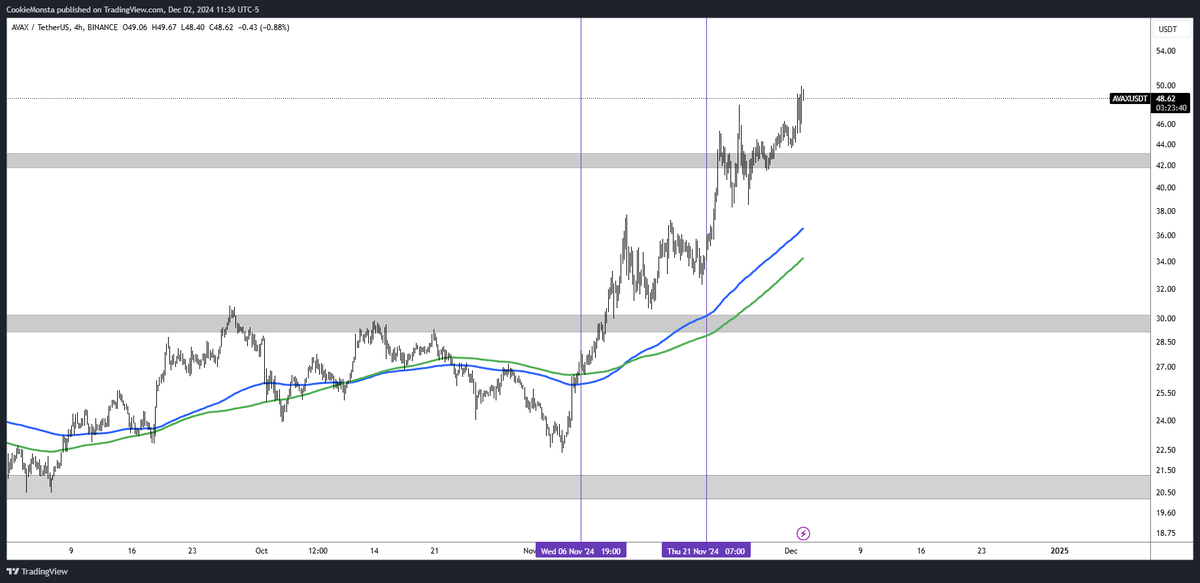

After SOL broke out, it slowly rose by 15%, while AVAX surged 45% during the same period.

Following that, both entered a consolidation phase after local peaks. During this time, SOL led again, rising 30% and setting a new all-time high (ATH).

As SOL made new highs (and potentially topped locally without us knowing), AVAX formed a higher low and then rallied another 45%.

Now, as AVAX once again makes a higher high, SOL has pulled back to its high-timeframe (HTF) trend support level.

The "Ping-Pong Effect" of Rotation

This phenomenon resembles a game of ping-pong, bouncing back and forth between two assets:

-

One asset rallies strongly while the other stalls;

-

Sometimes they rise together moderately;

-

Sometimes they consolidate together.

But the most eye-catching moves—the ones that grab attention and spark social media buzz—typically occur when the other asset is stalling or pulling back.

The Attention Economy of Markets

For those who don’t deeply understand market dynamics or haven’t built a clear trading system and strategy foundation, these shifts can feel confusing.

You might find yourself selling AVAX at a local low to buy SOL, only to see SOL pull back while AVAX takes off—or vice versa.

In trading, patience often pays off. If you’ve established a position at a favorable point on a high-timeframe (HTF) setup, you should generally avoid frequent rotations.

Simply put, just because the market shifts capital from one sector or token to another doesn’t mean you must follow.

In reality, very few people successfully capture all major upward moves in SOL and perfectly time shifting all their capital into AVAX for maximum gain. This kind of "perfectionism" rarely works in trading.

Instead of chasing perfection, consider paying attention to both. From a broader market perspective, both SOL and AVAX show strong potential on high-timeframes.

For example, SOL is breaking out of an 8-month consolidation range and appears poised to continue its uptrend into a price discovery phase.

Meanwhile, AVAX recently broke out of a six-month downtrend weeks ago and has just cleared a month-long resistance zone in recent days.

Overall, neither is definitively “right” or “wrong.” Perhaps when SOL pulls back to its HTF trend support (see first chart), AVAX is approaching its $55 resistance level.

Or perhaps, when SOL retests support and resumes its rally over the coming days or weeks, AVAX could pull back from its resistance.

In such scenarios, profits taken from one token can serve as liquid capital to seek new opportunities or add positions in the other—this is the practical meaning of "rotation" in similar contexts.

The key is that both exhibit relative strength compared to the broader market, which remains in a downtrend or lacks significant momentum.

How many tokens right now are reclaiming multi-month ranges or breaking out of high-timeframe trends? While dozens indeed are, we’re still far from a phase where "blindly buying anything makes money."

Therefore, rather than obsessing over short-term micro-rotations, it’s better to patiently wait for entry points in either asset—or use small rotations at key turning points to rebalance your portfolio.

Lastly, it’s important to note that this is just a very small example of rotation.

When discussing rotation, different timeframes can lead to vastly different interpretations of the concept.

Rotations can be narrow, like the example above, or broad—such as long-dormant tokens surging after two years of stagnation, a trend we’re only beginning to see.

Still, whether large or small, the core logic remains consistent—only the scope and magnitude differ.

I might write a part two on rotation later, but that’s it for today—I’m tired.

Hope this helps.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News