Top-tier exchanges launch SOL liquid staking solutions, and the market's "smart money" has already made its choice

TechFlow Selected TechFlow Selected

Top-tier exchanges launch SOL liquid staking solutions, and the market's "smart money" has already made its choice

Top-tier exchanges entering the Solana restaking race will undoubtedly bring new vitality to the entire ecosystem, while leveraging their own resource advantages to create more use cases for their respective SOL liquid staking tokens.

Author: Carl

According to market news, in October 2024, major exchanges including Binance, Bybit, and Bitget announced the launch of their respective liquid staking tokens for SOL, entering the Solana restaking sector. Seemingly influenced by the release of liquid staking tokens such as BNSOL and BGSOL, SOL's price rose from $135 at the beginning of October to over $170 today. This appears to be a signal, prompting questions: Why are these leading platforms choosing to enter this sector now, and what opportunities can these liquid staking solutions bring to ordinary investors?

Solana Restaking Sector Unlocks New Opportunities

Liquid restaking is a narrative that has only recently emerged within the crypto industry over the past two years. It allows users to reuse assets already staked across other blockchain networks or DApps. Liquid restaking tokens meet real-world demands from AVS (Actively Validated Services), extending the security of PoS-based original chains into broader ecosystem applications.

Platforms or DApps utilizing restaked assets distribute part of their revenue or airdrop rewards back to participants. Liquid restaking not only enhances network security and activity but also promotes the prosperity of the ecosystem economy. Thus, liquid restaking has evolved into a complete system with clear supply and demand. Participating in liquid restaking contributes to the crypto ecosystem while increasing participants' potential returns.

In the past year, Solana has rapidly accumulated substantial technical resources and a large user base thanks to its technological advantages and the booming meme market, emerging as one of the most outstanding public blockchain projects. Solana’s ecosystem is expanding quickly, encompassing wallets, DeFi infrastructure, NFTs, and various DApp applications.

According to SOLSCAN data, by October 2024, the market value of staked SOL reached as high as $65.7 billion, accounting for 67% of SOL’s total market cap. Faced with such a multi-billion-dollar market, the liquid restaking segment has naturally become a key focus in Solana’s current ecosystem development phase.

Top-Tier Exchanges Launch SOL Liquid Staking Solutions

BGSOL (Bitget), bbSOL (Bybit), and BNSOL (Binance) are essentially liquid staking tokens—liquid staking solutions jointly launched by centralized exchanges and decentralized restaking protocol providers, with minimal differences in underlying mechanisms. As Bitget recently announced the launch of BGSOL, we will use BGSOL as an example to explain the core principles and participation methods of such services.

BGSOL is a liquid staking token and a more flexible staking solution co-launched by Bitget and Solayer. Users can obtain BGSOL on the platform by staking SOL or directly purchasing it via trading pairs.

BGSOL is a liquid staking token and a more flexible staking solution co-launched by Bitget and Solayer. Users can obtain BGSOL on the platform by staking SOL or directly purchasing it via trading pairs.

It should be noted that the exchange ratio between BGSOL and SOL is not 1:1, because the underlying value of BGSOL consists of two components: the SOL itself and the ongoing staking yield earned on-chain (currently with an annualized yield of around 8%). For instance, if a user initially stakes 10 SOL and receives 9.725 BGSOL, after one month when converting BGSOL back to SOL, they would expect to receive approximately 10.06 SOL—the excess amount representing accumulated on-chain rewards.

As previously mentioned, the biggest advantage of such liquid staking tokens is the ability to earn both base on-chain yields and additional layered rewards through restaking. Bitget launched BGSOL on October 22, 2024, and simultaneously introduced a one-month wealth management campaign on its finance platform, achieving a combined annualized yield of up to 30%.

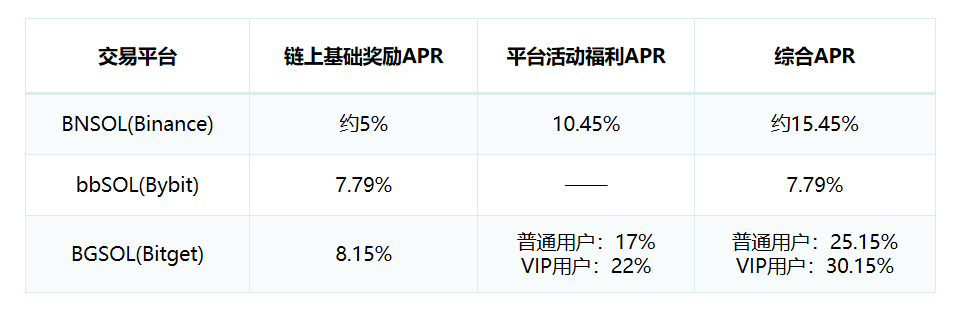

Interest rate statistics across platforms as of: October 24, 2024

While all major platforms offer competitive returns on their liquid staking products, Bitget currently stands out as having the highest-yielding investment option available in the market.

Users may also consider other factors such as asset security or future use cases for liquid staking tokens. Regarding security, Solayer deserves special mention. Solayer is one of the leading projects in the Solana restaking space, known for its extensive development experience and focus on maximizing staking yields—including native SOL staking, MEV-boost, and AVS earnings. Collaborations between Bitget, Binance, Bybit, and Solayer establish the first layer of security for SOL restaking.

Different from Solana restaking providers like Solayer, Jito, and Cambrian, top-tier exchanges provide a second layer of financial protection due to their emphasis on brand reputation. For example, following abnormal price fluctuations in BGB recently, Bitget fully compensated all affected users within 72 hours, reinforcing strong user confidence.

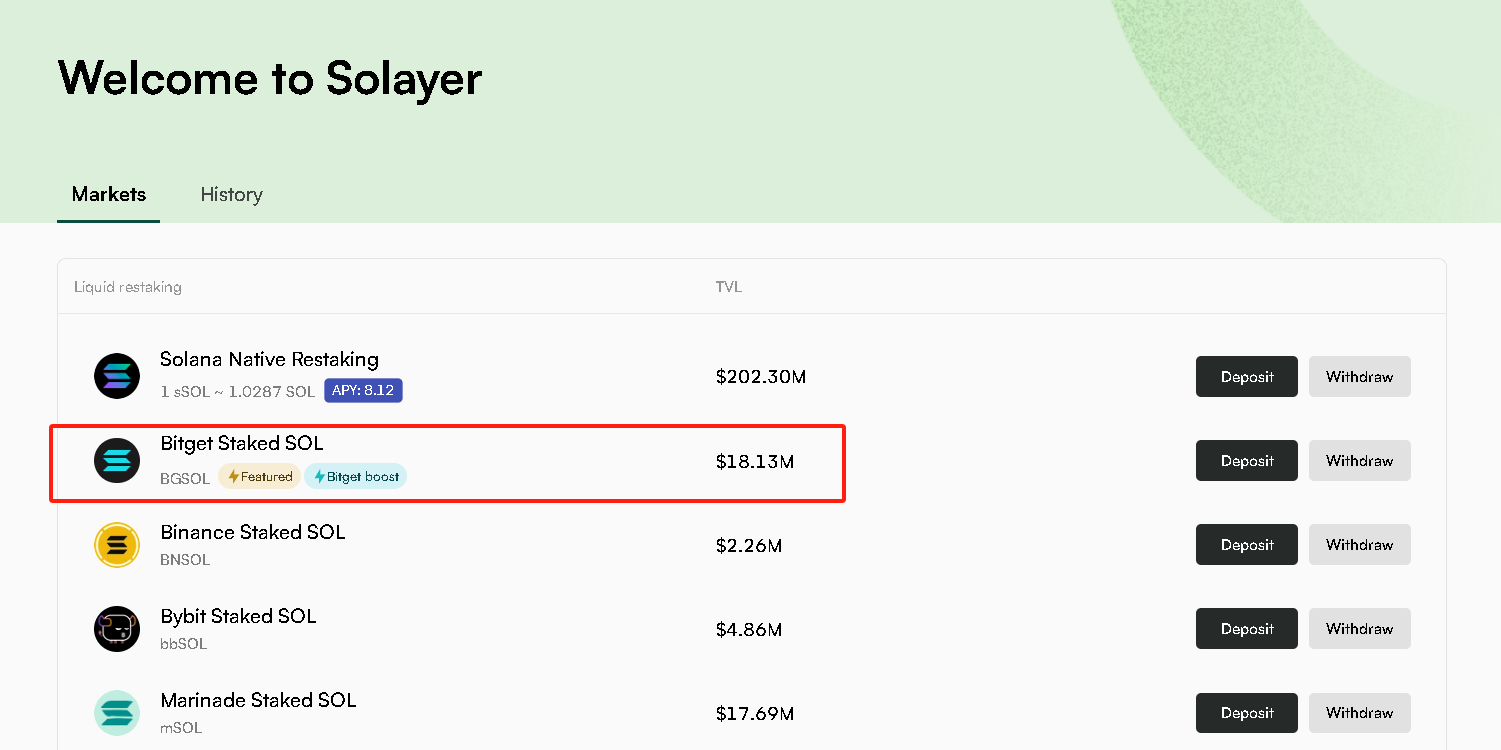

In terms of application scenarios, there is currently little difference among the liquid staking tokens offered by various exchanges. However, on-chain data shows that on October 22, a whale address staked 6,653.9 SOL (worth approximately $1.1 million) into BGSOL. Additionally, according to Solayer’s dashboard, BGSOL’s total staked amount has exceeded $18 million, significantly surpassing both BNSOL and bbSOL.

Data source:https://app.solayer.org/dashboard

Judging from this comprehensive comparison, it seems the "smart money" in the market has already made its choice.

Solana Restaking Returns May Go Far Beyond Current Expectations

The greatest allure of the crypto world lies in unexpected wealth creation—just as early participants in Ethereum ecosystem applications or protocols received generous airdrops. Although Solana’s ecosystem still lags behind Ethereum’s in scale, given its current growth trajectory, numerous new projects are expected to emerge soon, bringing even greater potential opportunities.

The entry of leading exchanges into the Solana restaking sector will undoubtedly inject fresh momentum into the entire ecosystem. Leveraging their own resource advantages, these platforms will expand the use cases for their respective SOL liquid staking tokens. Investors will then be able to flexibly convert BGSOL into other liquid tokens and deploy them into more attractive applications based on their needs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News