ETH vs SOL: The 2025 Crypto War, Trillion-dollar Capital Bets on New and Old Orders

TechFlow Selected TechFlow Selected

ETH vs SOL: The 2025 Crypto War, Trillion-dollar Capital Bets on New and Old Orders

One沉淀ates into institutional assets, the other erupts as the main consumer chain.

Author: Ethan

"2021 was the year of Layer 1 rivalry, 2024 the meme狂欢盛宴. So where will the market's main narrative head in 2025?"

This question, widely debated on X, is being clearly answered by mainstream capital: with the successful passage of the GENIUS Act and stablecoins formally integrated into U.S. sovereign regulatory frameworks, a new multidimensional financial narrative combining "stablecoins × RWA × ETF × DeFi" is rapidly emerging.

In this profound evolution of cross-chain finance, the central focus is no longer Bitcoin or meme coins, but rather the clash between old and new orders—Ethereum versus Solana. The two blockchains differ fundamentally in technical architecture, compliance strategy, scalability paths, ecosystem models, and even foundational value propositions.

Currently, this competition determining future market structure has entered a critical phase where capital is aggressively placing real-money bets.

Capital Allocation Preference: From "BTC Faith" to "ETH/SOL Choice"

Unlike previous crypto bull markets driven by macro monetary trends and broad-based rallies, the 2025 market shows clear structural divergence. Top projects no longer move in sync—capital is concentrating on selected battlegrounds, revealing a clear survival-of-the-fittest dynamic.

The most direct signal comes from shifts in institutional buying strategies:

On the ETH side: Multiple U.S. public companies are beginning large-scale accumulation of Ethereum assets.

-

On July 22, GameSquare announced an increase in its digital asset treasury authorization to $250 million, adding 8,351 ETH with the explicit goal of "allocating to high-quality Ethereum ecosystem assets to generate stablecoin yield";

-

SharpLink Gaming has cumulatively acquired 19,084 ETH this month, bringing total holdings to 340,000 ETH, valued at over $1.2 billion;

-

A new wallet address purchased over 106,000 ETH worth nearly $400 million via FalconX over the past four days;

-

The Ether Machine announced plans to complete a SPAC listing using 400,000 ETH, backed by over $1.5 billion in funding from top-tier institutions including Consensys co-founders, Pantera, and Kraken, aiming to become the "largest public ETH yield company."

On the SOL side: Purchase volumes are equally staggering, exhibiting more explosive speculative characteristics.

-

Public company DeFi Development Corp announced an acquisition of 141,383 SOL, bringing total holdings close to 1 million;

-

SOL treasury firm Upexi announced a purchase of 100,000 SOL for $17.7 million, bringing total holdings to 1.82 million SOL with unrealized gains exceeding $58 million;

-

According to CoinGecko data, PENGU has reached a market cap of $2.785 billion, surpassing BONK ($2.701 billion) to become the largest Solana-based meme coin by market cap.

These phenomena indicate that both ETH and SOL have become preferred foundational assets in institutional multi-asset portfolios. However, their investment rationales show significant differences: ETH is treated as "on-chain treasury + premium asset base + institutionally compliant spot ETF candidate," while SOL is being positioned as the "high-performance consumer application chain + primary battlefield for the new meme economy."

These two betting approaches represent contrasting expectations for crypto’s future: ETH as a regulated financial engine, SOL as a capital-aggressive speculative track.

ETH: The Misunderstood Institutional Backbone Fulfilling Its Financial Asset Mission

Over the past two years, Ethereum's narrative faced skepticism over perceived stagnation. From lackluster post-merge staking yields and fragmented Layer 2 ecosystems to persistently high gas fees and migrations of key projects like dYdX and Celestia, market expectations for ETH once hit rock bottom.

Yet the reality is: ETH never left—it has instead become the core asset most deeply tied to institutional narratives. This is supported by deep institutional alignment across three dimensions:

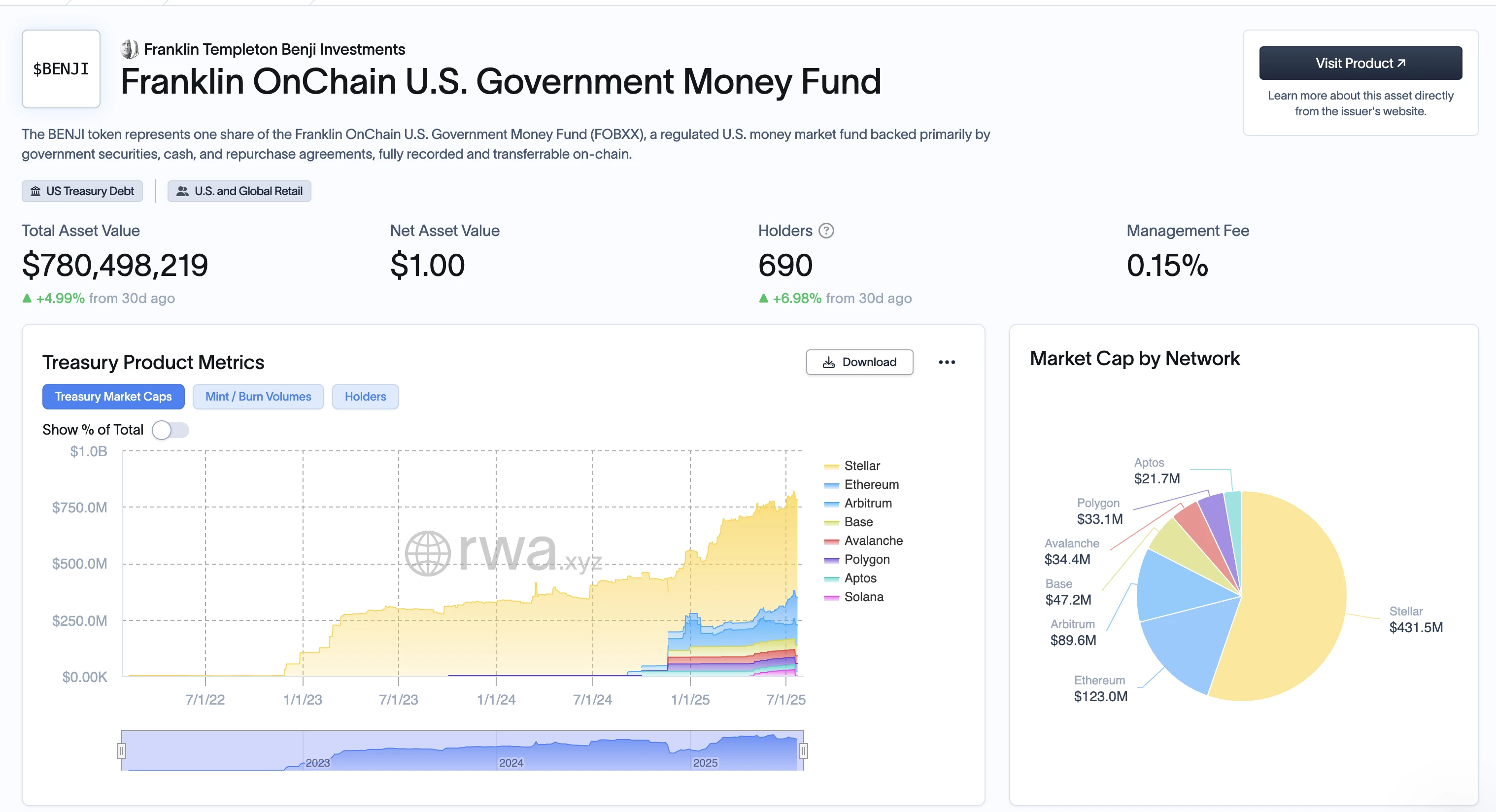

RWA Core Hub Status Established

Current on-chain RWA issuance exceeds $4 billion, over 70% of which occurs on Ethereum's mainnet and L2 networks. Key products such as BlackRock’s BUIDL, Franklin Templeton’s BENJI, Ondo’s USDY, and Maple’s cash funds all rely on ETH as a critical peg layer or liquidity medium (e.g., WETH). The larger the RWA scale, the more indispensable ETH becomes.

Anchored Asset for Spot ETFs and Stablecoin Policy

Following the passage of the GENIUS Act, stablecoin issuers like Circle and Paxos have emphasized "on-chain reserve transparency" and "short-term U.S. Treasury-backed collateral structures." In Circle’s latest asset allocation, WETH now accounts for 6.7%. Meanwhile, institutions like Grayscale and VanEck are accelerating preparations for spot Ethereum ETFs. After BTC, ETH is highly likely to become the next ETF focal point.

On-Chain Locked Value and Developer Ecosystem Maintain Absolute Dominance

As of July 22, total TVL across Ethereum mainnet and L2s reached $110 billion, representing 61% of global crypto TVL. Monthly active ETH developers remain above 50,000—four times Solana’s and over eight times other L1s. This means that regardless of shifting narratives, ETH’s role as the “primary financial layer” for on-chain asset governance, value accumulation, and liquidity distribution remains institutionally robust and ecologically sticky in the short term.

On pricing, ETH is approaching the $4,000 mark. As BTC breaks and stabilizes above $120,000, ETH’s resurgence isn’t about creating new stories—it’s about rediscovering old value.

SOL: Native On-Chain Consumption Power and the Capital Logic Behind Its Explosiveness

While Ethereum positions itself as a "financial hub," Solana functions more like consumer infrastructure in high-frequency scenarios. Its narrative has successfully evolved from "the chain with optimal tech specs" to "the native factory for on-chain viral hits," achieving structural breakthroughs in 2024–2025.

MemeCoin as a Native Market, Not a Secondary Transfer Zone:

In this wave of "crypto consumerism," the number and liquidity of meme coins on Solana have reached record highs. Market data shows that as of July 22, BONK leads with a $2.67 billion market cap, followed by PENGU ($2.32 billion) and TRUMP ($2.2 billion)—together surpassing Dogecoin. Thanks to Solana’s ultra-low gas fees and high TPS, these projects enable a rapid closed loop: "low-cost experimentation → community-driven FOMO → high-frequency trading stimulation." On Solana, memes have become native on-chain consumer behavior.

Capital Bets on "On-Chain Activity," Not Technical Roadmaps:

Massive purchases by public firms like DeFi Development Corp and Upexi signal that mainstream capital views SOL as a triple-threat asset: "tradable asset + user growth metric + narrative vehicle." Their focus lies on ecosystem activity, trading depth, and the consumptive nature of "on-chain stories"—not technical minutiae.

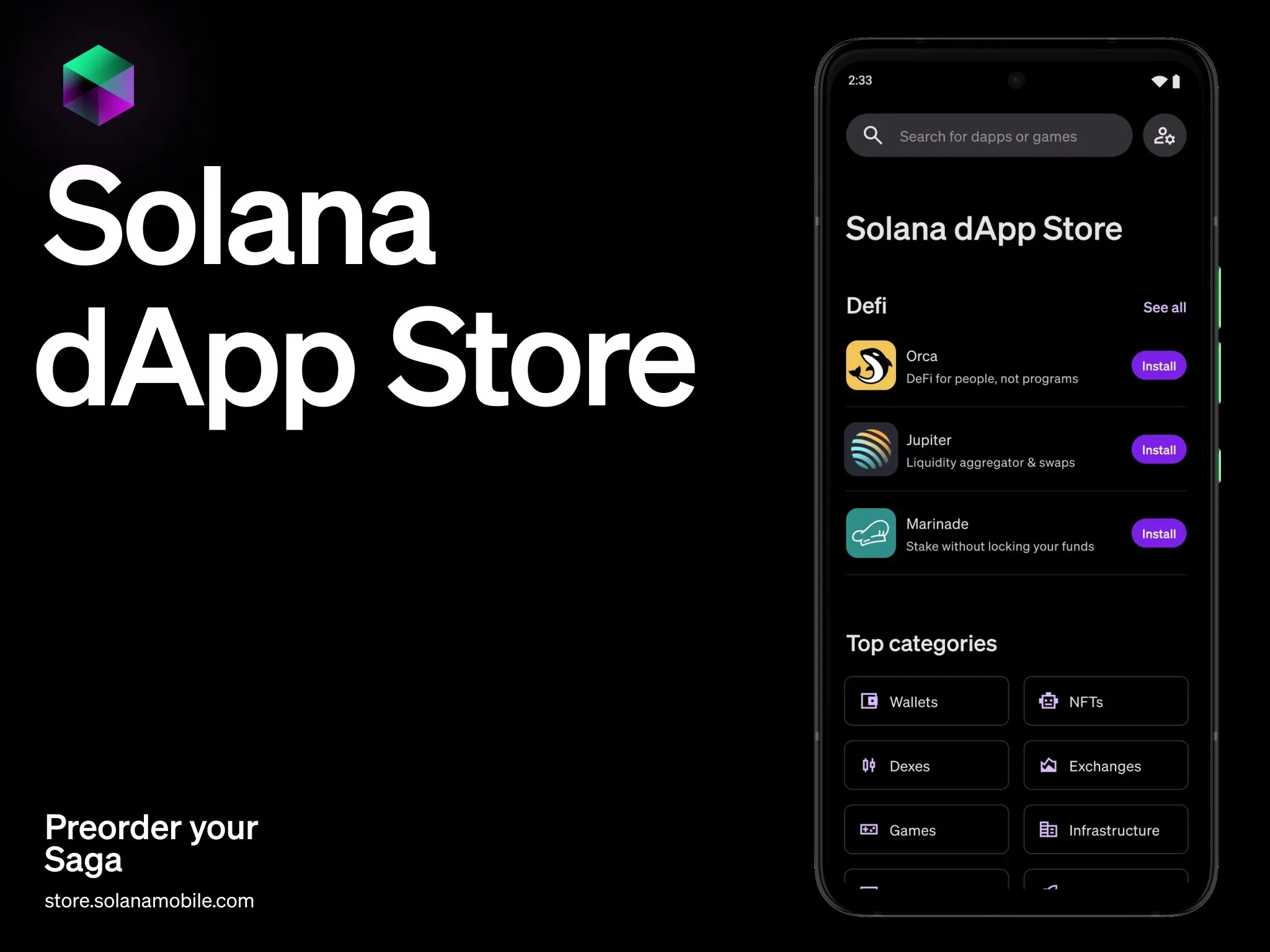

Ecosystem Products Evolving from Viral Hits to "Basic Consumer Layer":

From Jupiter’s DEX experience and Backpack mobile wallet to the Solana phone and the upcoming Solana App Store, the entire ecosystem is building a seamless experience closer to Web2 user habits. Native on-chain consumption—including memes, DePIN, mini-games, community points, and social media—has become Solana’s "local life," creating organic use cases for SOL. While its TVL is only 12% of Ethereum’s, Solana’s transaction frequency, per-user interaction volume, and total gas consumption already exceed Polygon and BNB Chain. It functions more like a "daily active gateway" for crypto natives than a pure financial "pricing anchor."

Price Signal: Breaking $200, Entering High-Volatility Main Uptrend:

As BTC stabilizes at $120,000 and ETH pushes toward $4,000, SOL has recently reclaimed the $200 level. High volatility amid high热度 is itself a precursor to new narratives and major position shifts. What we’re seeing isn’t just speculative frenzy, but a shrinking feedback loop between "on-chain behavior" and "price response."

This is a model where consumption data drives trading expectations—a paradigm ETH can't replicate, but SOL has mastered.

Whale Battles and Policy Catalysts: Who Can Catch the Bullets of Major Position Rotation?

Technology defines a blockchain’s "narrative potential," while capital and policy determine its "transaction capacity"—especially crucial when BTC breaks $120,000 and the market enters a main uptrend, making the identification of the next "capital convergence zone" vital.

On-chain data reveals starkly different "on-chain accumulation" strategies among three major institutions since Q2 2025: Grayscale steadily accumulated ETH from May to July (172,000 ETH, ~$640 million), explicitly for its spot ETH ETF foundation; Jump Trading has frequently rebalanced positions on Solana since June, focusing on BONK, PENGU, and Jupiter, while accumulating nearly 280,000 SOL across multiple addresses; public firms DeFi Development Corp and Upexi continue announcing SOL purchases, each holding over a million tokens (total market value near $500 million) with substantial unrealized gains.

This isn’t simply a "winner-takes-all" bet—it reflects market segmentation: ETH for "structural asset allocation," SOL for "short-cycle volatility tools."

Divergent policy winds fuel "dual-track growth." On July 19, President Trump signed the GENIUS Act into law, establishing the U.S.'s first federal stablecoin regulatory framework. Combined with Coinbase and BlackRock filing S-1 forms for spot ETH ETFs, ETH’s path into the compliant framework grows increasingly clear. Meanwhile, Solana teams collaborate with exchanges like OKX and Bybit to pilot "compliant issuance of consumer assets." For example, OKX launched a Solana-exclusive Launchpad in July, introducing light KYC for meme coin launches.

This "dual-path compliance" means policy benefits are being distributed based on use case, capital type, and risk profile: ETH continues absorbing traditional capital, while SOL becomes a compliant testing ground for younger users and consumer applications.

Short-term policy outlook: ETH benefits more visibly, while SOL faces fewer constraints. Though ETH leads in ETF and RWA-related policy advantages, it also faces multiple hurdles from the SEC regarding securities classification and staking definitions. SOL’s ecosystem, with less centralized issuance and complex staking mechanisms, allows its tokens and apps easier access to regulatory "gray safe zones." This results in ETH’s price trajectory being steadier but longer-term, while SOL’s is steeper and more volatile.

Who Defines the Future? Hedge Allocation, Not Binary Choice

Looking at the market trajectory post-BTC breaking $120,000, the divergence between ETH and SOL is no longer a linear "who replaces whom" question, but a distributed answer to "who defines the future within which cycle."

ETH: The Mid-to-Long-Term Narrative Driver Under Structural Support

Backed by the GENIUS Act, ETH’s integration into the financial compliance system is clear. Whether through spot ETF progress or its role as a "clearing and settlement layer" in RWA models, ETH has become the "core asset" for Wall Street’s blockchain allocations.

From the positioning logic of institutions like BlackRock and Fidelity, ETH is evolving from a "gas token" to a "foundational financial platform." Its valuation anchor is shifting from on-chain activity to treasury yield models and staking rates. ETH’s victory isn’t explosive—it’s cumulative.

SOL: The Short-Term Explosive Force Within Structural Cracks

Contrasting ETH’s stability, SOL dominates capital battles in high-frequency trading, meme narratives, end-user applications, and native consumer products (like the Saga phone). From BONK to PENGU, and JUP’s governance experiments, Solana has built a highly liquid, deeply penetrating "native narrative market."

Combined with on-chain performance: SOL maintains leadership in TPS, cost efficiency, and terminal response speed; SVM’s ecosystem independence frees it from EVM’s congestion and redundant development.

More importantly, SOL is one of the few "narrative洼地 capable of absorbing capital while embracing high volatility," making it a prime short-cycle option for capturing fast capital rotation after BTC’s main uptrend begins.

Therefore, this is not a "choice," but a "cycle博弈":

For those betting on institutional transformation and long-term structural entry of traditional capital, ETH is the top choice. For participants seeking to capture capital rotation and narrative explosions, SOL offers higher-beta exposure.

Beyond narrative vs. institution, volatility vs. accumulation, ETH and SOL may no longer be opposing options, but components of an optimal portfolio shaped by era-specific misalignment.

Who defines the future? For now, the answer may not be a single project, but the ongoing fine-tuning of this "portfolio weighting" process.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News