Interpreting Messari's 100,000-Character Annual Report (2): Did ETH Underperform BTC Due to Marginalization or Pricing Challenges?

TechFlow Selected TechFlow Selected

Interpreting Messari's 100,000-Character Annual Report (2): Did ETH Underperform BTC Due to Marginalization or Pricing Challenges?

In an era where BTC remains the only macro anchor in the crypto market, ETH is more like a financial operating system built atop this anchor.

Author: Merkle3s Capital

This article is based on Messari's annual report, The Crypto Theses 2026, released in December 2025. The full report exceeds 100,000 Chinese characters, with an officially estimated reading time of 401 minutes.

This content is supported by Block Analytics Ltd X Merkle 3s Capital. The information provided here is for reference only and does not constitute any investment advice or offer. We are not responsible for the accuracy of the content nor do we bear any consequences arising therefrom.

Introduction: When ETH Starts Underperforming, Where Exactly Is the Problem?

Over the past year, ETH underperforming BTC has almost become a self-evident fact.

In terms of price performance, market sentiment, and narrative strength, BTC continues to be reinforced as the "sole primary asset":

ETFs, institutional allocations, macro hedging, dollar hedging... every narrative converges toward BTC.

In contrast, ETH finds itself in an awkward position.

It remains the most important underlying network for DeFi, stablecoins, RWA, and on-chain finance, yet it consistently lags behind in asset performance.

This leads to a frequently discussed but never thoroughly unpacked question:

Is ETH underperforming BTC because it's being marginalized, or because the market is pricing it incorrectly?

Messari’s latest 100,000-word annual report offers an answer that neither caters to emotions nor takes sides with any blockchain.

What they care about more is: where capital actually lands, and what institutions truly put on-chain.

From this perspective, the “problem” with ETH may be very different from what most people imagine.

This article won’t discuss faith, nor compare TPS, gas fees, or technical roadmaps. We’ll do just one thing:

Follow Messari’s data to clearly dissect why ETH is underperforming BTC.

Chapter One: ETH Underperforming BTC Is Not Abnormal

If you only look at price performance between 2024–2025, ETH underperforming BTC might lead many to an intuitive judgment:

Has something gone wrong with ETH?

But historically and structurally, ETH underperforming BTC is not an “anomalous phenomenon.”

BTC is a highly singular-narrative asset.

Its pricing logic is clear, consensus centralized, and variables minimal.

When markets enter phases of macro uncertainty, regulatory shifts, or institutional reassessment of risk assets, BTC often captures premium first.

ETH is entirely the opposite.

ETH simultaneously plays three roles:

-

A decentralized settlement layer

-

Infrastructure for DeFi and stablecoins

-

A “productive network” with a technical upgrade path and execution risks

This means ETH’s price doesn’t merely reflect “macro consensus,” but is also forced to absorb multiple variables such as technical pacing, ecosystem changes, and value capture structures.

Messari explicitly states in the report:

The issue with ETH isn’t “disappearing demand,” but rather “complexity in pricing logic.”

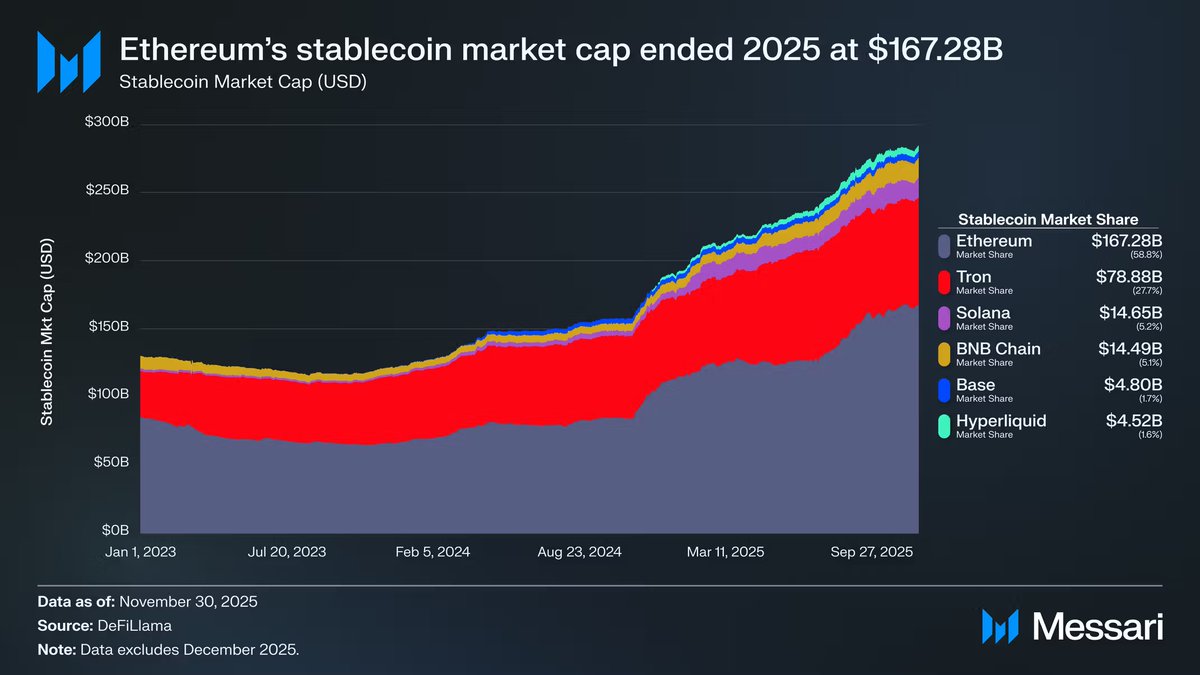

In 2025, ETH still dominates key metrics like on-chain activity, stablecoin settlements, and RWA hosting.

However, this growth doesn’t immediately translate into asset premiums like BTC’s ETF or macro narratives do.

In other words, ETH underperforming BTC doesn’t mean the market has rejected Ethereum.

It more likely means the market temporarily doesn’t know how to price it.

What’s truly concerning isn’t the “underperformance” itself,

but whether usage of ETH can continue feeding back into the ETH asset when it’s being heavily used.

This is the real issue Messari cares about.

Chapter Two: Usage Grows, But Value Doesn't Follow? ETH’s Value Capture Dilemma

What truly makes the market start doubting ETH isn’t its price underperformance against BTC,

but a sharper reality: Ethereum is being heavily used, yet ETH itself isn’t benefiting proportionally.

Messari presents a set of key data in the report:

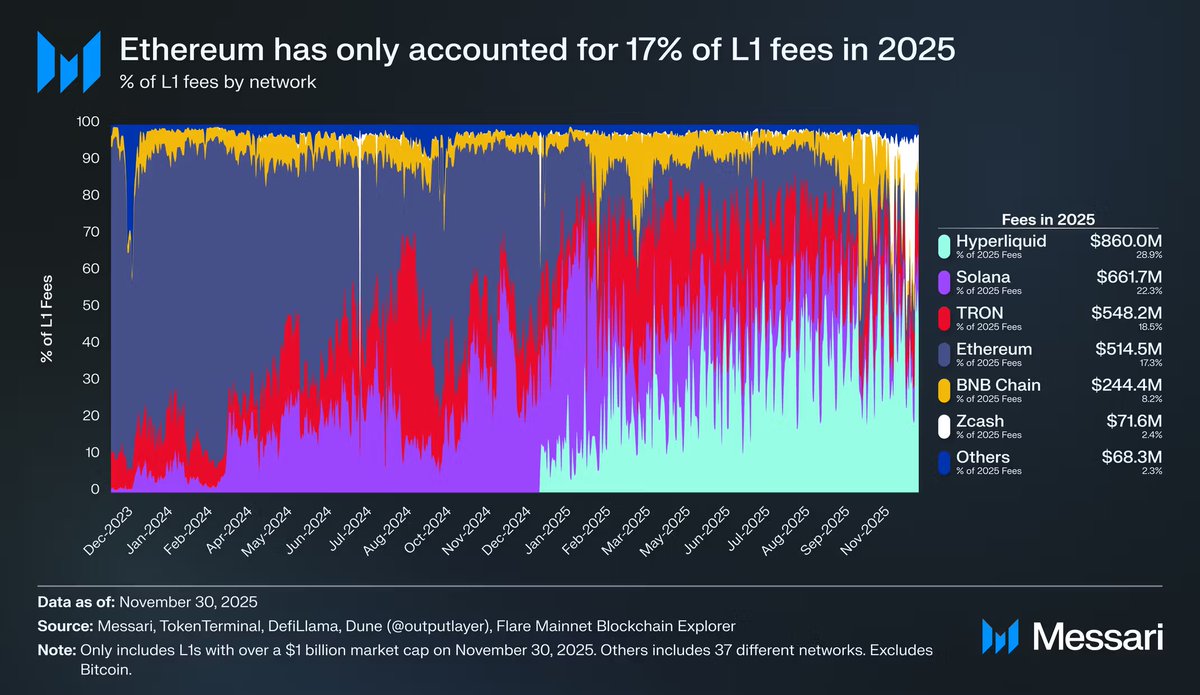

With the rise of competing L1s, Ethereum’s share of L1 fees has steadily declined.

-

Solana re-established itself as a high-performance execution layer in 2024,

-

Hyperliquid rapidly scaled up in 2025 through on-chain derivatives,

-

Together, both squeezed Ethereum’s share in the dimension of “direct monetization of economic activity.”

By 2025, Ethereum’s share of L1 fees had dropped to around 17%,

falling to fourth place among L1s.

Just a year earlier, it firmly held the top spot.

Fees aren’t the only metric for network value, but they’re an extremely honest signal:

Where fees are collected, real trading behavior and risk appetite reside.

This is where ETH’s core contradiction begins to surface.

Ethereum hasn’t lost users. On the contrary, its position in stablecoins, RWA, and institutional settlements has become even stronger. The problem is that these activities increasingly occur on L2s or application layers, rather than directly translating into L1 fee revenue.

In other words: Ethereum as a system grows more important, while ETH as an asset increasingly resembles a “diluted equity.”

This isn’t a technological failure, but an inevitable outcome of architectural choices.

The rollup scaling roadmap successfully reduced transaction costs and increased throughput, but objectively weakened ETH’s ability to directly capture usage value.

When usage is “outsourced” to L2s, ETH’s income stems more from abstract security premiums and monetary expectations, rather than cash flows.

This is why the market hesitates when pricing ETH:

Is it an asset that compounds with usage growth, or an increasingly neutral settlement layer resembling “public infrastructure”?

This question has been further amplified amid intensifying multi-chain competition.

Chapter Three: Multi-chain Isn’t the Threat—Real Pressure Comes From “Execution Layer Substitution”

If viewed purely from a narrative standpoint, ETH seems to have more and more competitors.

Solana, various high-performance L1s, app-specific chains, and even dedicated trading chains keep emerging,

easily leading to the conclusion: ETH is being marginalized by the “multi-chain world.”

But Messari’s assessment is calmer—and harsher.

Multi-chain itself isn’t ETH’s threat.

The real pressure comes from the continuous substitution of the execution layer, while the value of the settlement layer remains difficult for the market to price directly.

Take Solana as an example:

-

Solana reclaimed dominance in high-frequency trading and retail activity during 2024–2025,

-

It significantly leads in spot trading volume, on-chain activity, and low-latency experience.

Yet this growth manifests more in “trading experience” and “traffic density,” rather than stablecoin clearing, RWA custody, or institutional-grade settlement.

Messari repeatedly emphasizes one fact in the report:

When institutions truly put money on-chain, they still overwhelmingly prefer Ethereum.

Stablecoin issuance, tokenized T-bills, on-chain fund shares, compliant custody pathways—these most “boring” yet critical financial infrastructures remain highly concentrated within the Ethereum ecosystem.

This explains a seemingly contradictory phenomenon: ETH’s asset performance faces pressure, yet Ethereum further consolidates its leading edge in the dimension of “blockchains institutions are willing to use.”

The issue is, the market won’t automatically grant premium just because “you’re important.”

When execution-layer revenue is captured by other chains, and settlement-layer value resides more in “security” and “compliance credibility,” ETH’s pricing logic inevitably becomes abstract.

In other words:

ETH isn’t facing “replacement,” but is being forced into a role more akin to public infrastructure.

And with infrastructure, the higher the usage, the harder it often is to justify asset premiums.

This is precisely where the fundamental divergence between ETH and BTC becomes stark.

Chapter Four: ETH Still Can’t Escape BTC’s “Macro Anchor”

If the first three chapters answer one question—Has ETH been marginalized?

Then this chapter confronts a harsher, more realistic judgment:

Even if ETH hasn’t been replaced, at the asset pricing level, it remains deeply dependent on BTC.

Messari repeatedly highlights a widely overlooked fact in the report:

The market isn’t pricing “blockchain networks,” but rather things that can be abstracted as macro assets.

In this regard, the divergence between BTC and ETH is extremely clear.

BTC’s narrative has been completely simplified into three things:

-

Macro hedge asset

-

Digital gold

-

A “monetary asset” acceptable to institutions, ETFs, and national balance sheets

ETH’s narrative, however, is far more complex.

It’s both a settlement layer and a technical platform; it hosts financial activity while continuously undergoing upgrades and structural adjustments.

This makes it difficult for ETH to be directly incorporated into a “macro asset basket” like BTC.

This difference is especially evident in ETF fund flows.

When ETH spot ETFs first launched in early 2024, the market briefly believed institutions showed almost no interest in ETH.

In the first six months, ETH ETF inflows were clearly weaker than BTC’s, reinforcing the narrative that “BTC is the only institutional asset.”

But Messari points out this conclusion is misleading.

As ETH prices and the ETH/BTC ratio rebounded together in mid-2025, capital behavior began shifting.

-

ETH/BTC rose from a low of 0.017 to 0.042, a gain over 100%

-

ETH’s USD-denominated price rose nearly 200% in the same period

-

ETH ETF inflows began accelerating significantly

At certain points, new inflows into ETH ETFs even briefly surpassed those into BTC ETFs.

This indicates one thing:

Institutions weren’t unwilling to buy ETH—they were waiting for “narrative certainty.”

Yet even so, Messari still delivers a sobering conclusion:

ETH’s monetary premium remains a “secondary derivative” of BTC’s monetary consensus.

In other words, the market’s willingness to embrace ETH again at certain stages isn’t because ETH has become an independent macro asset, but because BTC’s macro narrative still holds, spilling over along the risk curve.

As long as BTC remains the pricing anchor for the entire crypto market, ETH’s strength or weakness will inevitably be measured in BTC’s shadow.

This doesn’t mean ETH lacks upside potential. On the contrary, when BTC trends hold, ETH often exhibits higher elasticity and stronger beta.

But it also means:

ETH’s asset narrative has not yet completed “de-BTCification.”

Until ETH demonstrates, over longer cycles, lower correlation with BTC, more stable independent demand sources, and clearer value capture pathways,

it will still be perceived by the market as:

A second-tier belief asset built upon BTC.

Chapter Five: Is ETH Under Threat? The Real Issue Was Never About Winning or Losing

By now, we can answer a frequently raised question:

Will ETH be “replaced” by other chains?

Messari’s answer is clear:

No.

At least in the foreseeable future, Ethereum remains the default base layer for on-chain finance, stablecoins, RWA, and institutional settlement.

It’s not the fastest chain, but it’s the first allowed to carry real capital.

What’s truly worth worrying about isn’t “whether ETH will lose to Solana, Hyperliquid, or the next new chain,”

but a more uncomfortable question:

Can ETH, as an asset, continue to benefit from Ethereum’s success?

This is a structural issue, not a technical one.

Ethereum is becoming increasingly like “public financial infrastructure”:

-

Usage is growing

-

Systemic importance is rising

-

Institutional reliance is deepening

Yet at the same time, ETH’s value capture increasingly depends on:

-

Monetary premium

-

Security premium

-

Spillover from macro risk appetite

Rather than direct cash flows or fee growth.

This is why ETH’s asset performance increasingly resembles a “high-beta BTC derivative asset,” rather than a network equity with an independent pricing framework.

In a multi-chain world, execution layers can be competed for, traffic can be diverted, but settlement layers don’t migrate frequently.

Ethereum stands precisely at this most stable—and hardest to reward via market sentiment—position.

So, ETH underperforming BTC doesn’t mean failure.

It’s more like an outcome of role specialization:

-

BTC carries macro narratives, monetary consensus, and asset anchoring

-

ETH carries settlement, financial infrastructure, and system security

The issue is simply that the market prefers to pay a premium for the former, while remaining cautious toward the latter.

Messari’s conclusion isn’t radical, but it’s honest enough:

ETH’s monetary story has been repaired, but not completed. It can surge significantly when BTC trends hold, but it hasn’t yet proven it can be independently priced without relying on BTC.

This isn’t a rejection of ETH, but a阶段性 positioning.

In an era where BTC remains the sole macro anchor in the crypto market,

ETH is more like a financial operating system built atop that anchor.

It’s important, irreplaceable, but for now, it’s still not the “first-priced asset.”

At least not yet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News