Trend Research: Why Are We Bullish on ETH?

TechFlow Selected TechFlow Selected

Trend Research: Why Are We Bullish on ETH?

In a scenario of relatively loose expectations between China and the U.S. that suppress downside asset volatility, ETH remains in a favorable buying "sweet spot" during extreme panic, when liquidity and sentiment have not yet fully recovered.

Author: Trend Research

Since the market crash on October 11, the entire crypto market has been sluggish, with market makers and investors suffering heavy losses. It will take time for capital and sentiment to recover.

However, what the crypto market never lacks is new volatility and opportunities, and we remain optimistic about the future outlook.

This is because the trend of mainstream crypto assets integrating with traditional finance into a new business model remains unchanged—and during this market downturn, such integration is rapidly building competitive moats.

1. Strengthening Wall Street Consensus

On December 3, U.S. SEC Chair Paul Atkins stated in an exclusive interview with FOX at the NYSE: "Over the next few years, the entire U.S. financial market may migrate onto blockchains."

Atkins noted:

(1) The core advantage of tokenization lies in the fact that if assets exist on a blockchain, ownership structures and asset attributes become highly transparent. Currently, public companies often don't know exactly who their shareholders are, where they're located, or where shares are held.

(2) Tokenization could enable "T+0" settlement, replacing the current "T+1" cycle. In principle, on-chain delivery-versus-payment (DVP) / receipt-versus-payment (RVP) mechanisms can reduce market risk and enhance transparency. The current time lag between clearing, settlement, and fund transfer is one source of systemic risk.

(3) He believes tokenization is an inevitable trend in financial services, with major banks and brokers already moving toward it. The world may not even need 10 years—perhaps just a few years—for this to become reality. We are actively embracing new technologies to ensure the U.S. remains at the forefront in areas like cryptocurrency.

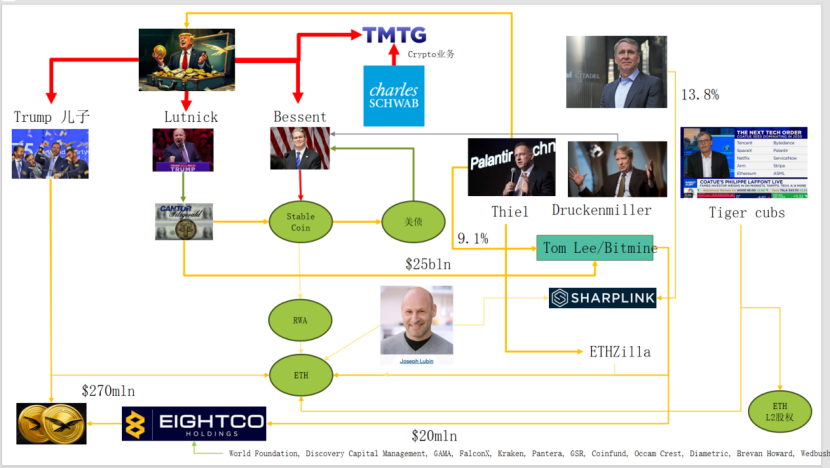

In fact, Wall Street and Washington have already established a deep capital network into crypto, forming a new narrative chain: U.S. political and economic elites → U.S. Treasuries (national debt) → stablecoins / crypto treasury firms → Ethereum + RWA + L2

This diagram shows the complex connections among the Trump family, traditional bond market makers, the Treasury Department, tech companies, and crypto firms, with green elliptical links forming the backbone:

(1) Stablecoin (USDT, USDC, WLD-backed USD assets, etc.)

The majority of reserves consist of short-term U.S. Treasuries and bank deposits, held through brokers like Cantor.

(2) U.S. Treasuries (U.S. national debt)

Issued and managed by the Treasury / Bessent side

Used by Palantir, Druckenmiller, Tiger Cubs, etc., as low-risk interest rate holdings

Also the yield-generating asset sought after by stablecoins and treasury firms.

(3) RWA

From U.S. Treasuries, mortgages, accounts receivable to housing finance

Tokenized via Ethereum L1 / L2 protocols.

(4) ETH & ETH L2 Equity

Ethereum serves as the main chain supporting RWA, stablecoins, DeFi, and AI-DeFi

L2 equity / tokens represent claims on future transaction volumes and fee cashflows.

This chain illustrates:

USD credit → U.S. Treasuries → stablecoin reserves → various crypto treasuries / RWA protocols → ultimately settling on ETH / L2.

In terms of RWA TVL, while other blockchains continued declining after October 11, Ethereum was the only chain that quickly recovered and began rising. Its current TVL stands at $12.4 billion, accounting for 64.5% of total crypto market TVL.

2. Ethereum’s Pursuit of Value Capture

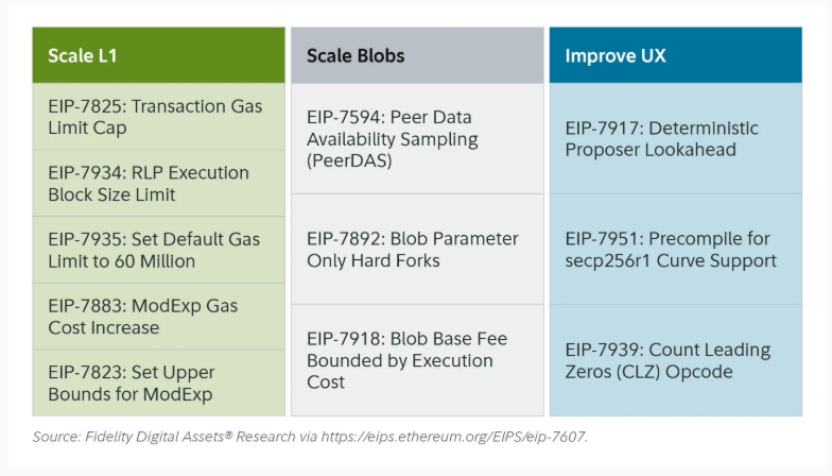

Recently, Ethereum's Fusaka upgrade did not generate much market excitement. However, from the perspective of network architecture and economic model evolution, it represents a "milestone event." Fusaka is not merely about scaling via EIPs like PeerDAS—it aims to address the long-standing issue of insufficient value capture on the L1 mainnet due to L2 growth.

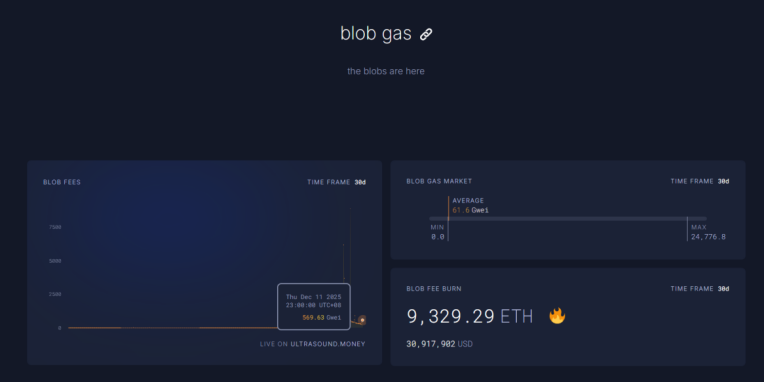

Through EIP-7918, ETH introduces a "dynamic floor price" for blob base fees, linking their minimum level to the L1 execution layer base fee, requiring blobs to pay data availability (DA) fees at approximately 1/16 of the L1 base fee. This means rollups can no longer occupy blob bandwidth at near-zero cost over the long term; instead, associated fees are burned and returned to ETH holders.

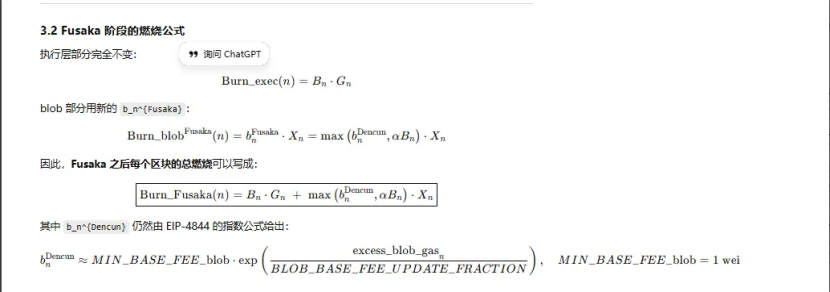

Ethereum has had three major upgrades related to "burning":

(1) London (single dimension): Only burns execution-layer fees; ETH begins structural burning based on L1 usage.

(2) Dencun (dual dimension + independent blob market): Burns both execution-layer and blob fees; L2 data written to blobs also burns ETH, but blob fees drop nearly to zero under low demand.

(3) Fusaka (dual dimension + blob tied to L1): To use L2 (blobs), users must pay and burn fees at a fixed proportion relative to the L1 base fee, more stably mapping L2 activity to ETH burning.

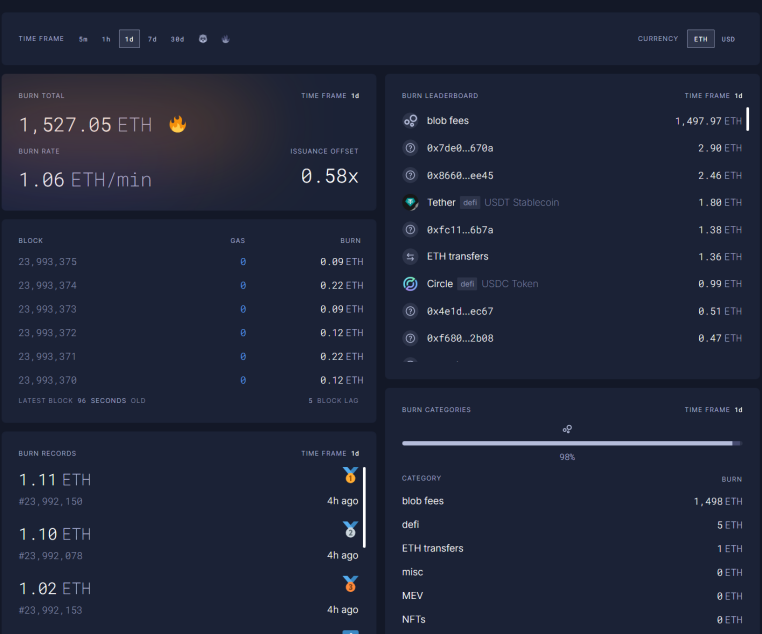

Currently, blob fees at 23:00 on December 11 reached 569.63 billion times their pre-Fusaka level, burning 1,527 ETH in one day. Blob fees now contribute 98% of total burning—the highest proportion ever. As ETH L2 activity grows further, this upgrade could return ETH to deflationary status.

3. Ethereum’s Technical Strength Improves

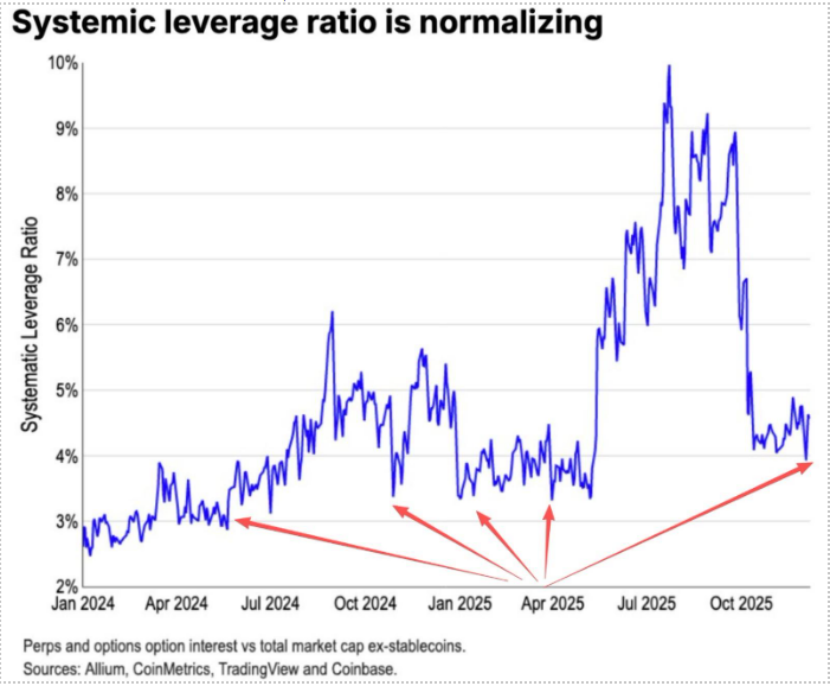

During the October 11 downturn, leveraged ETH futures positions were thoroughly liquidated, eventually affecting spot leveraged positions. Many lacking strong conviction in ETH, including early OGs, reduced their holdings and exited. According to Coinbase data, speculative leverage in crypto has dropped to a historical low of 4%.

A significant portion of past ETH shorts came from the traditional Long BTC / Short ETH pairs trade, which historically performed well during bear markets—but this time, something unexpected happened. The ETH/BTC ratio has remained range-bound and resilient since November.

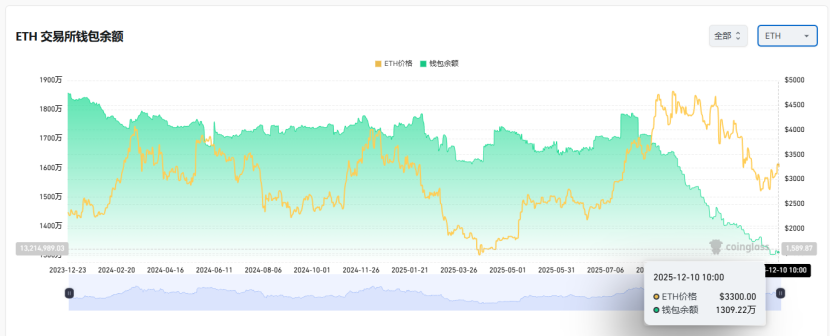

Ethereum’s current exchange supply stands at 13 million ETH—about 10% of total supply—at a historical low. With the Long BTC / Short ETH trade failing since November, extreme market panic may gradually create a "short squeeze" opportunity.

As 2025–2026 approaches, both China and the U.S. have signaled friendly monetary and fiscal policies ahead:

The U.S. is expected to pursue tax cuts, rate cuts, and relaxed crypto regulation, while China will adopt moderate easing and financial stability measures (suppressing volatility).

Under expectations of relatively loose policies from both nations and suppressed downside volatility, amid extreme fear and incomplete recovery of capital and sentiment, ETH remains in a favorable buying "sweet spot."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News