Has sector rotation in the crypto market really失效?

TechFlow Selected TechFlow Selected

Has sector rotation in the crypto market really失效?

Where are we in the cycle when BTC matures first, ETH follows with a lag, and SOL still has a way to go?

By: Ignas

Translated by: AididiaoJP, Foresight News

Why the Classic Crypto Rotation Pattern Has Failed This Cycle

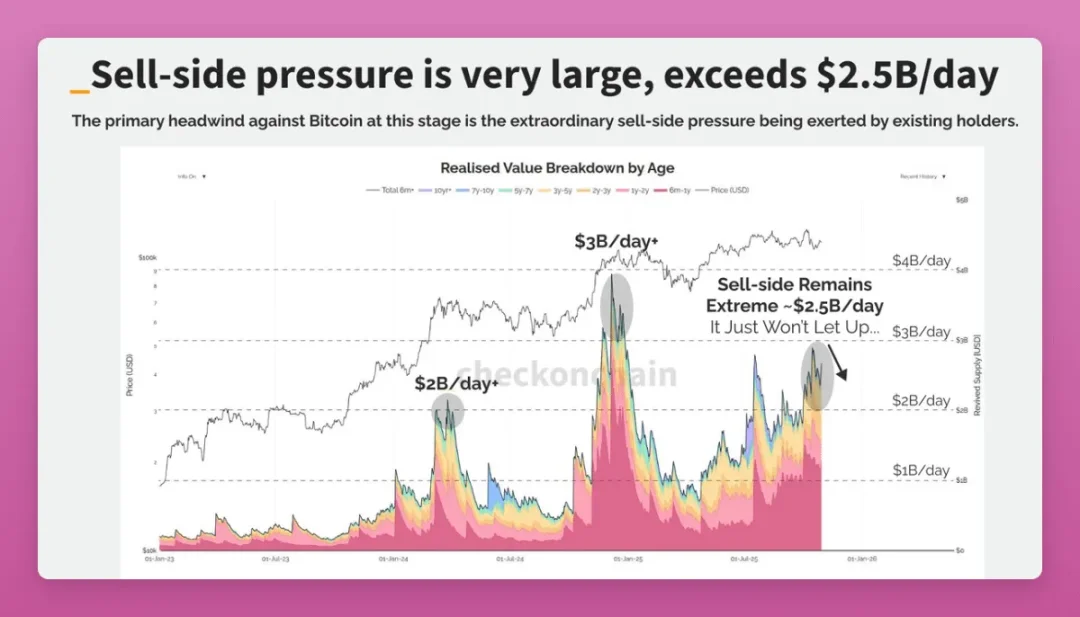

BTC holders have already realized outsized gains, and early believers are cashing out. This is not panic selling, but a natural shift from concentrated ownership to broader distribution.

Among many on-chain indicators, the most critical signal is whale selling activity.

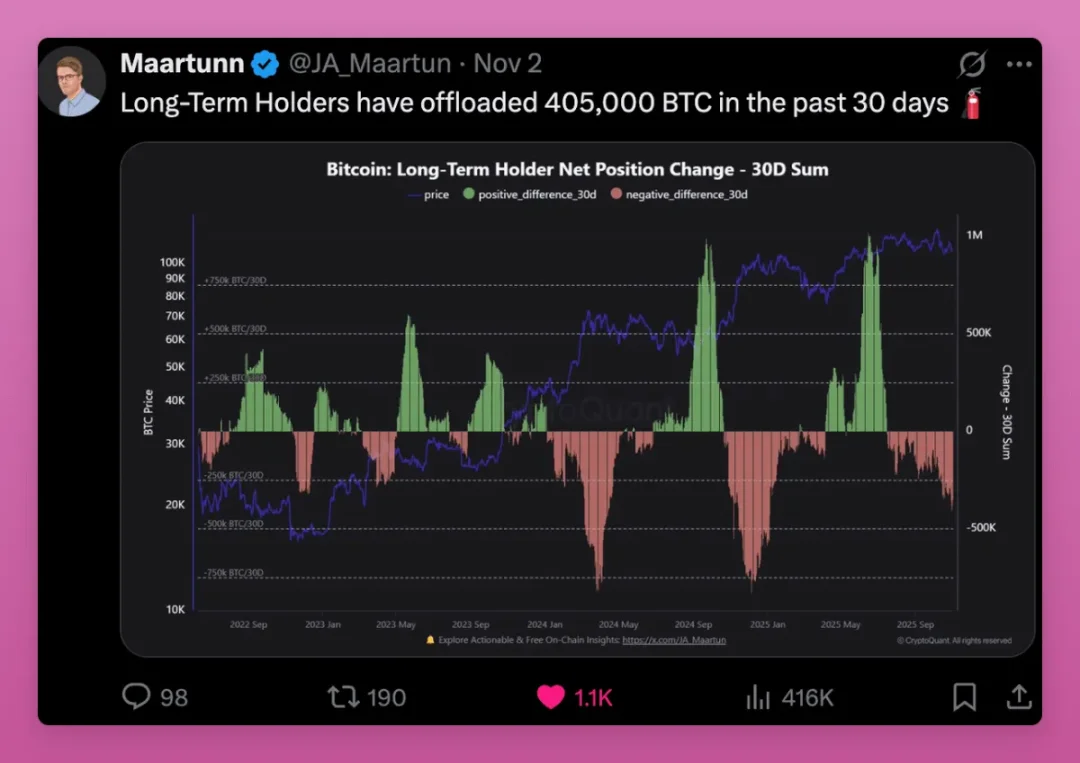

Long-term holders have sold 405,000 BTC within just 30 days—1.9% of Bitcoin’s total supply.

Take Owen Gunden as an example:

A veteran Bitcoin whale who conducted large transactions on Mt. Gox, accumulated a massive position, and previously served on the board of LedgerX. Wallets linked to him hold over 11,000 BTC, ranking among the largest individual holders on-chain.

Recently, his wallets began transferring large amounts of BTC to Kraken. The batched movement of thousands of tokens typically signals selling. On-chain analysts believe he may be preparing to liquidate a position worth over $1 billion.

Although his Twitter account has been inactive since 2018, this move perfectly validates the "super rotation" theory. Some whales are shifting toward ETFs for tax advantages or diversifying their assets through sales.

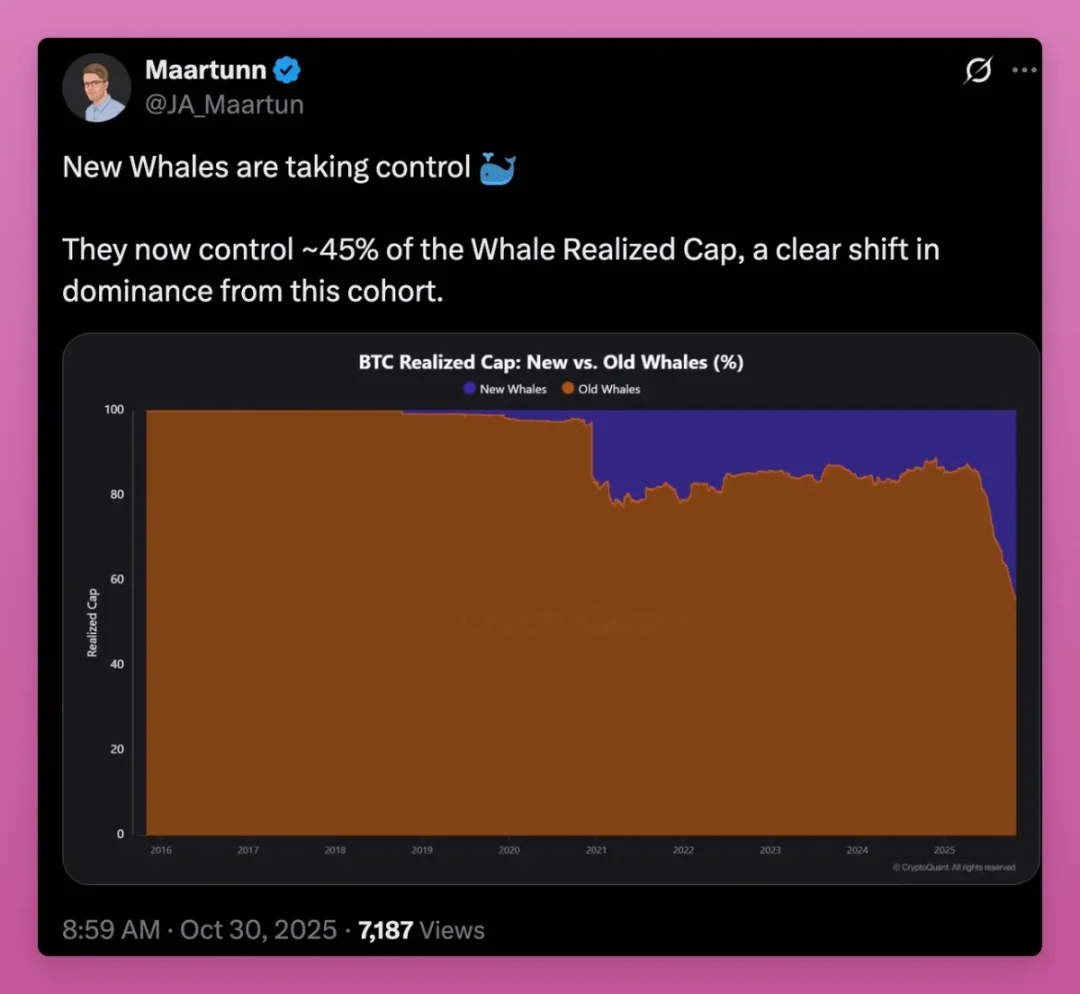

As tokens flow from early holders to new buyers, unrealized profit levels continue rising—indicating a new generation of whales is taking market leadership.

The rising MVRV ratio confirms this trend: the average cost basis is shifting from early miners to ETF buyers and new institutional investors.

On the surface, this could appear bearish: long-term whales enjoyed massive profits, while new whales now face unrealized losses. The current average cost basis is as high as $108,000. If BTC remains weak, these new whales might choose to sell.

However, the rising MVRV actually signifies broader ownership distribution and market maturation. Bitcoin is transitioning from a few ultra-low-cost holders to a more distributed base with higher entry costs—an inherently bullish signal.

What Awaits Altcoins?

Ethereum's Game

BTC has emerged victorious—but what about ETH? Can we observe the same major rotation pattern in ETH?

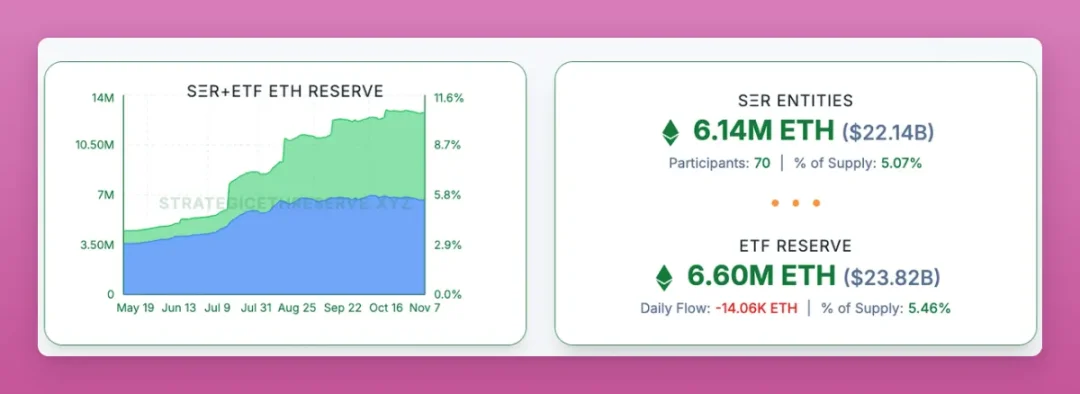

While part of ETH’s price lag may stem from this dynamic, ETH appears successful on the surface: both have ETFs, DATs, and institutional attention (albeit differing in nature). Data shows ETH is undergoing a similar transitional phase—only earlier and more complex.

In fact, on one key metric, ETH is rapidly catching up to BTC: approximately 11% of ETH is held by DATs and ETFs...

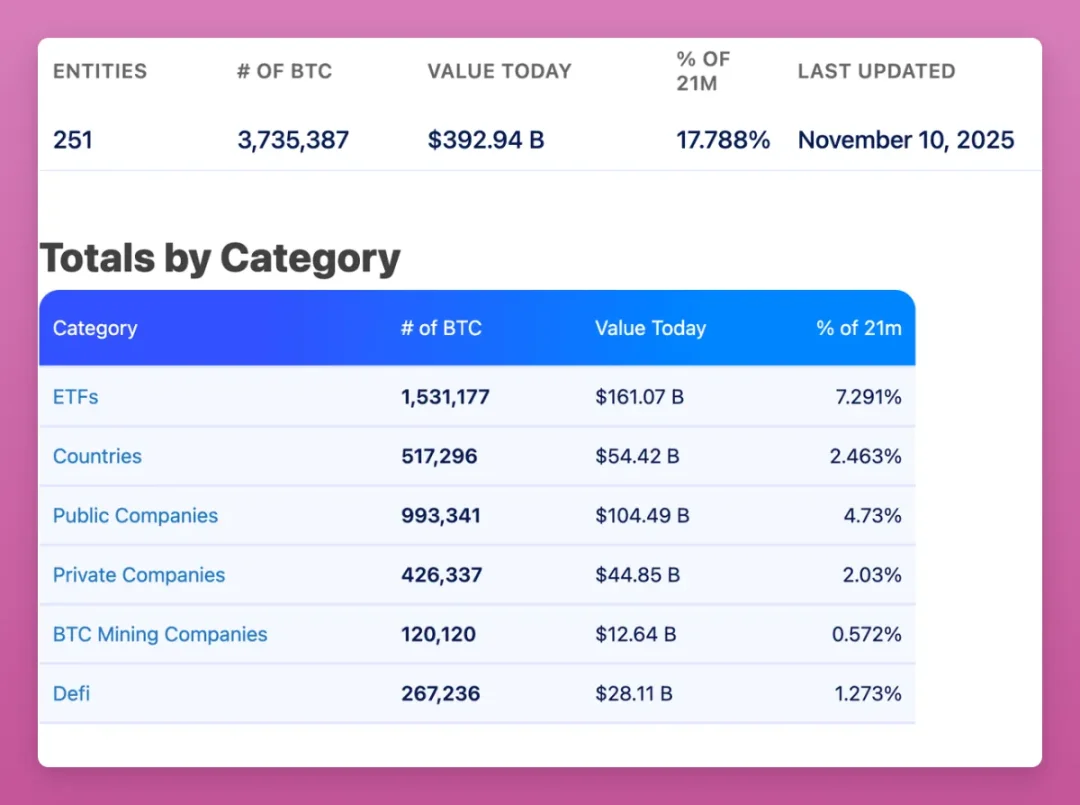

Compared to 17.8% of BTC held by spot ETFs and large treasuries. Considering Saylor’s ongoing accumulation, ETH’s pace of catch-up is astonishing.

We attempted to verify whether ETH also exhibits the old-whale-to-new-whale transfer phenomenon, but due to ETH’s account model (different from Bitcoin’s UTXO model), obtaining reliable data proved difficult.

The core difference lies in direction: ETH sees flows from retail → whales, whereas BTC experiences legacy whales → new whales.

The chart below more clearly illustrates the trend of ETH ownership shifting from retail to whales.

The realized price of large wallets (holding 100,000+ ETH) is sharply rising, indicating new whales are accumulating at higher costs while retail continues selling. Cost basis curves across wallet types (orange, green, purple) are converging, suggesting low-cost legacy tokens have largely transferred to new holders.

Such cost basis resets typically occur at the end of accumulation phases and before price breakouts—structurally confirming that ETH supply is becoming more centralized and stable.

Outlook for ETH

This rotation logic holds because of:

-

Widespread adoption of stablecoins and asset tokenization

-

Launch of staking-based ETFs

-

Deployment of institutional-grade applications

These factors drive continuous accumulation by whales and funds, while retail loses faith in ETH—viewing it merely as a "gas fee tool"—and faces competition from emerging public chains.

Whales see ETH as an income-generating asset and collateral, holding firmly for long-term on-chain yields. As BTC establishes dominance and ETH remains in a gray zone, whales are front-running institutional entry channels.

The combination of ETFs and DATs makes ETH’s ownership structure more institutional, but its linkage to long-term growth remains questionable. The biggest concern comes from cases like ETHZilla selling ETH to repurchase stock. While not panic-inducing, it sets a dangerous precedent.

Overall, ETH still fits the rotation theory, though its ownership structure is more complex, use cases richer (e.g., liquid staking concentrating tokens into fewer large wallets), and on-chain activity more frequent—making the rotation pattern less clear than Bitcoin’s.

Solana's Advance

Determining Solana’s positioning in this rotation is particularly challenging (even identifying team wallets faces hurdles), yet patterns emerge:

Solana is replicating Ethereum’s institutionalization path. Last month, a U.S. spot ETF quietly launched without much market fanfare. Though total assets stand at only $351 million, it maintains consistent daily net inflows.

Early DAT allocations to SOL are equally impressive:

2.9% of circulating SOL ($2.5 billion worth) is now held by DATs. Thus, Solana has established traditional financial infrastructure (regulated funds + corporate treasuries) similar to BTC and ETH—only differing in scale.

Despite messy on-chain data and supply concentration among early teams and VCs, tokens are steadily flowing to new institutional buyers via ETF/treasury channels. The great rotation has reached Solana—just one cycle late.

Compared to BTC and ETH nearing the end of their rotations with explosive price moves imminent, SOL’s trajectory appears even more predictable.

Future Outlook

With BTC maturing first, ETH following behind, and SOL needing more time—where are we in the cycle?

Past cycles followed a simple logic: BTC leads → ETH follows → wealth effect spreads to small-cap altcoins.

This cycle stalls at the BTC stage: even if BTC surges, early whales either shift holdings to ETFs or exit entirely, leaving no spillover wealth effect—only lingering trauma from FTX and endless sideways movement.

Altcoins have abandoned competing with BTC over “money” status, instead vying for utility value, yield potential, and speculative space—with most destined for elimination.

Surviving sectors include:

-

Public chains with real ecosystems: Ethereum, Solana, and a few promising projects

-

Products generating cash flow and returning value

-

Assets with irreplaceable demand (e.g., ZEC)

-

Infrastructure capturing fees and traffic

-

Stablecoins and real-world asset sectors

-

Ongoing crypto-native innovation

The rest will fade into noise.

The activation of Uniswap’s fee switch is a milestone: although not the first, it forces all DeFi protocols to share revenue with token holders. Half of the top ten lending protocols have already implemented profit sharing.

DAOs are evolving into on-chain corporations. Token value will increasingly depend on their ability to generate and redistribute earnings—this will be the core battleground of the next rotation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News