ETH/SOL Three-Year Holding Experience Summary: Market Data and Ecosystem Development Trends

TechFlow Selected TechFlow Selected

ETH/SOL Three-Year Holding Experience Summary: Market Data and Ecosystem Development Trends

Ethereum still leads by a wide margin.

Author: Zixi.eth

I've held ETH/SOL for three years. The market doesn't lie—users have voted with their feet over the past year and a half. In summary:

-

Ethereum still surpasses Solana overall in capital and developer activity;

-

Ethereum's users have largely migrated to L2s, but L1 still poorly captures value generated on L2s, while Solana’s user count far exceeds Ethereum L1;

-

This cycle, fewer assets are being priced in ETH compared to those priced in SOL;

-

Ethereum’s ecosystem direction has gone off track.

Historically, we’ve evaluated blockchains based on five criteria: 1. Capital (TVL); 2. Number of developers; 3. Users; 4. Ecosystem; (5. Presence of major backers or "whales"). We’ll analyze the current Ethereum (L1 + L2) and Solana ecosystems through these lenses.

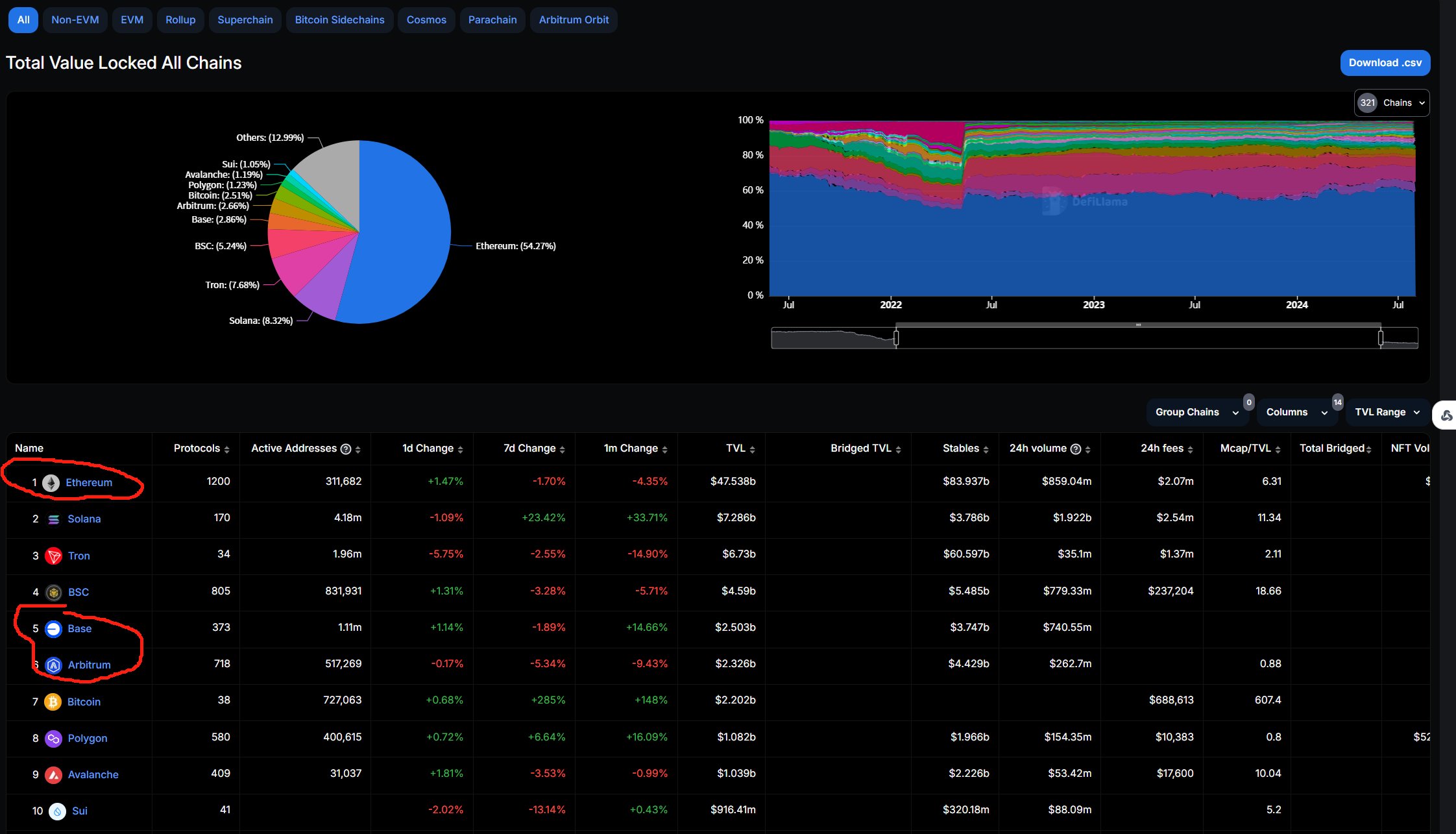

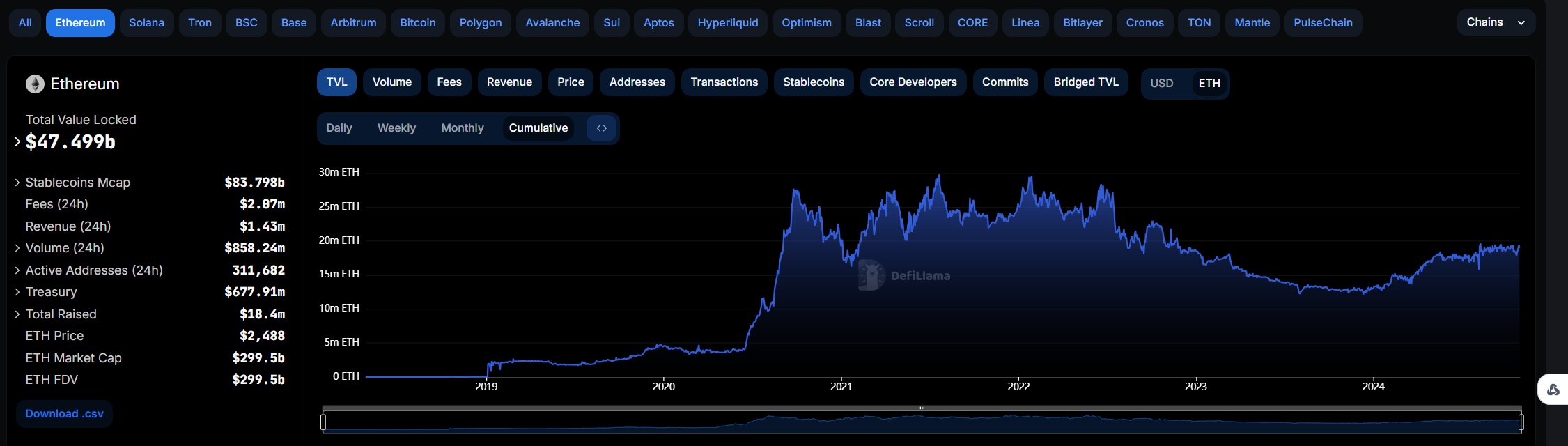

1. Capital (TVL)

Ethereum mainnet significantly outperforms Solana. This trend hasn’t changed over the past three years. Since 2021, Ethereum has consistently maintained 50%-60% of total TVL. Although Ethereum’s TVL dominance has recently declined slightly, when including Base and Arbitrum, its combined dominance remains around 60%—similar to the level seen during the 2021 bull market. Notably, however, Solana’s TVL has now grown to 8%, a significant increase from 1%-3% in 2021.

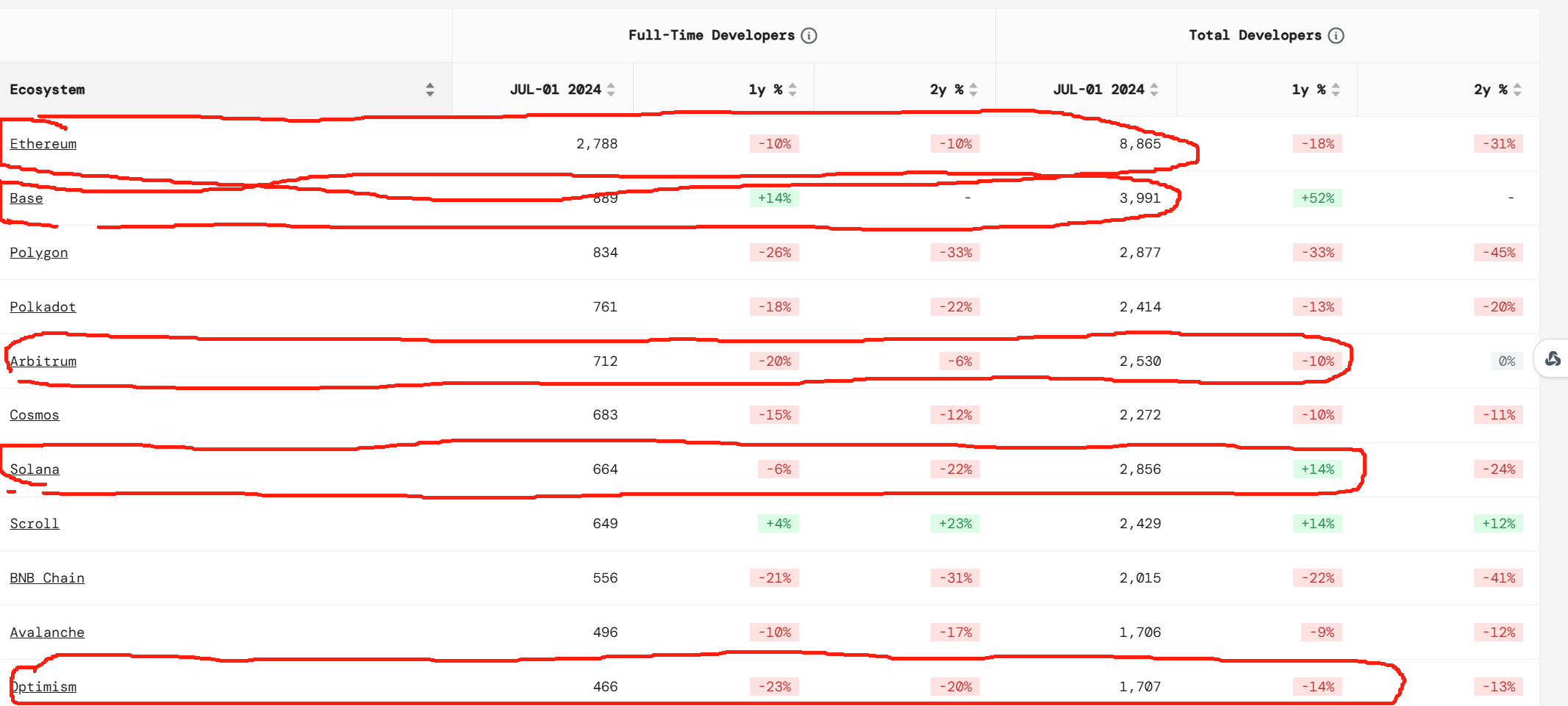

2. Developers

The total number of developers in the Ethereum ecosystem remains far ahead. Over the past year, Ethereum mainnet developers have slightly decreased, possibly due to migration to L2s such as Base. From 2022 to 2023, building on Ethereum was considered the pinnacle of "purity," and investors prioritized this “purity” above all else. During that time, I listened daily to projects claiming zk would change everything—exhausting, but I must admit zk is gradually becoming reality.

However, over the past year, I’ve personally observed the rise of Solana’s developer community. This was especially evident at Breakpoint 2024—it’s been a long time since a major blockchain executed an ecosystem event so successfully. The Solana Foundation continues hosting hacker houses, and many teams around me have shifted to Solana, corroborating data showing a 20% increase in Solana developers over the past year.

3. Users

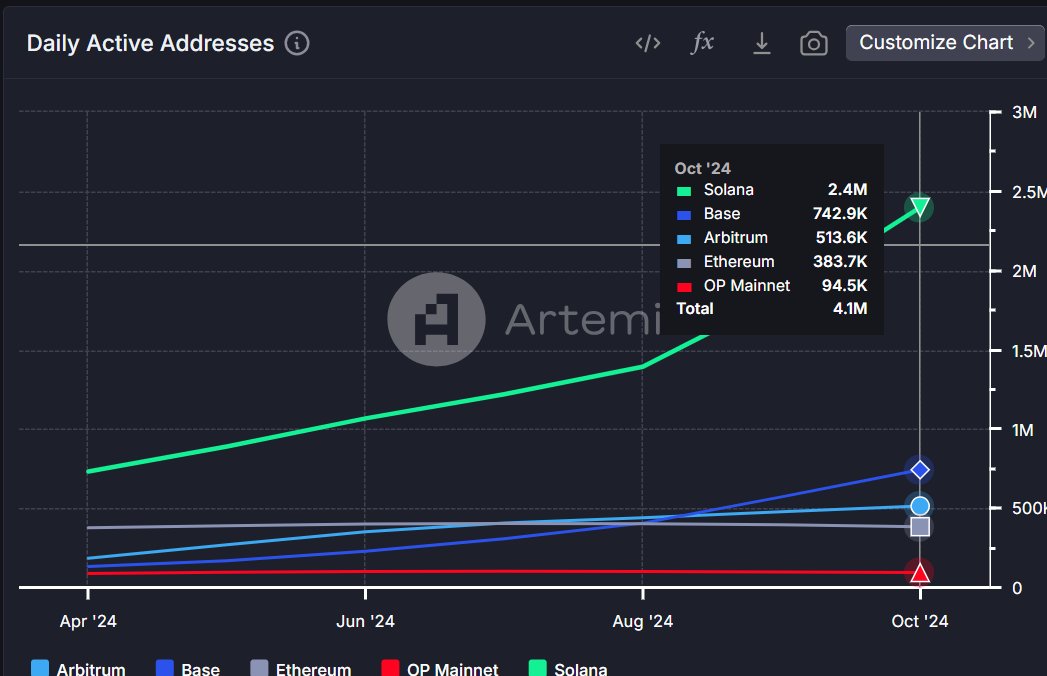

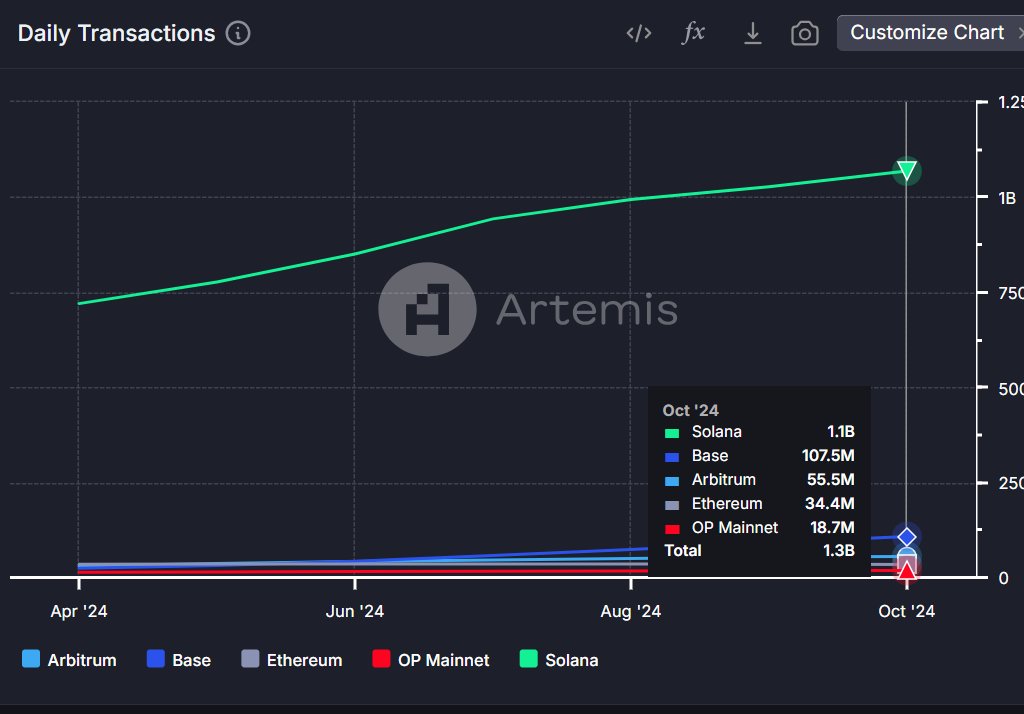

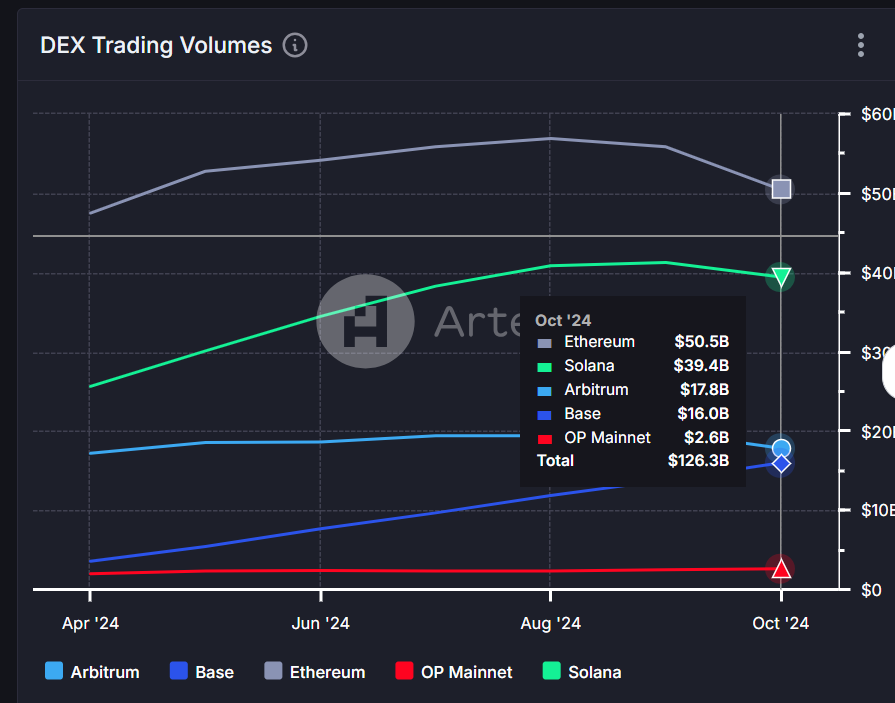

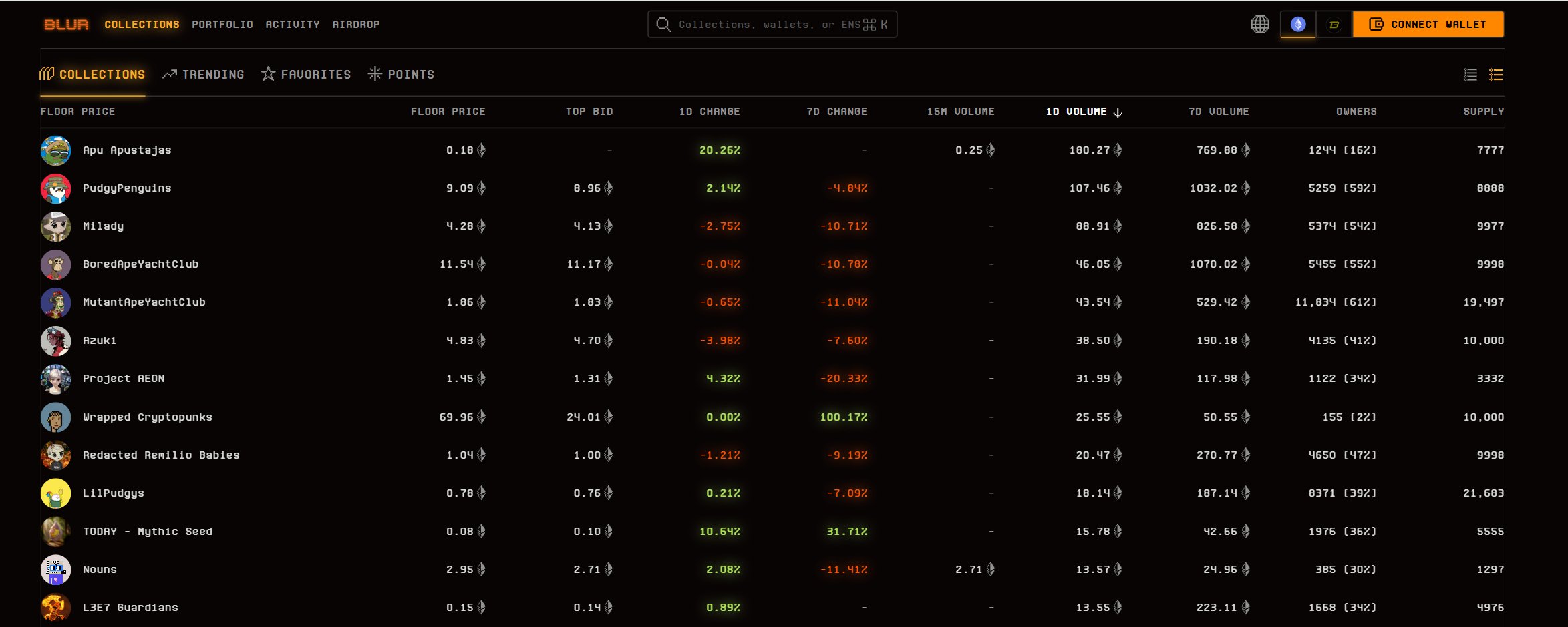

Solana is clearly leading. Solana’s daily active users (58%) outnumber the combined total of Ethereum and its L2s (42%). Moreover, Solana’s transaction volume (84%) vastly exceeds that of the entire Ethereum ecosystem (16%). However, core asset trading volume still primarily resides within Ethereum and its L2s. This aligns with Solana’s current positioning as a launchpad for meme coins. Additionally, keep a close eye on Base, which is rising rapidly.

4. Meme Coin Asset Pricing in the Ecosystem

Meme coin pricing reflects the health of a blockchain’s ecosystem. In 2020–2021, Ethereum leveraged DeFi and NFTs to establish ETH as the standard unit of account. People quoted DeFi TVL in thousands or tens of thousands of ETH, and NFT prices were denominated in ETH. Whether in actual demand or psychological valuation, ETH became the default benchmark—even though these tokens were eventually passed along like hot potatoes.

Similarly, during BSC’s GameFi boom in 2021, users priced ecosystem assets in BNB, fueling BNB’s massive price surge.

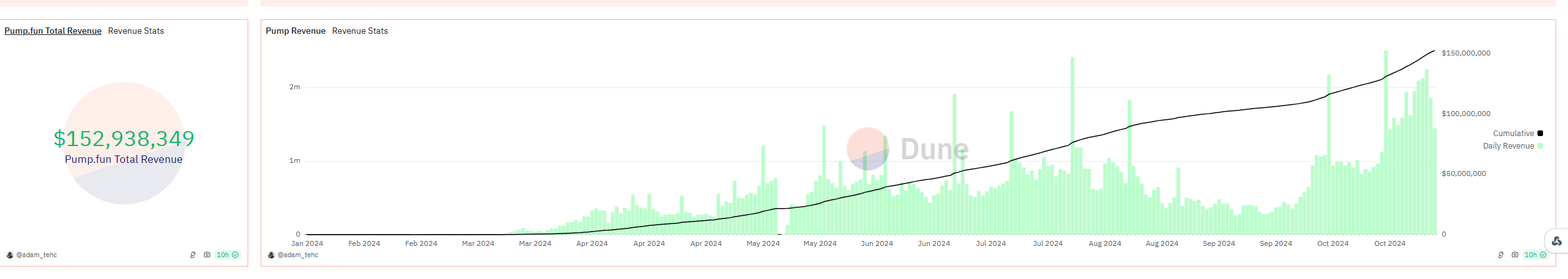

Recently, Solana’s biggest success has been @pumpdotfun, which continuously attracts new buyers by launching new meme coins using a pyramid-style distribution model and creating rare stories of ordinary users becoming rich overnight. Over time, this conditions users to naturally price meme assets in SOL. By the way, pump.fun is the third most perfectly designed product I’ve seen in the past three years (the top two will be mentioned shortly).

5. Has Ethereum’s ecosystem underperformed in recent years?

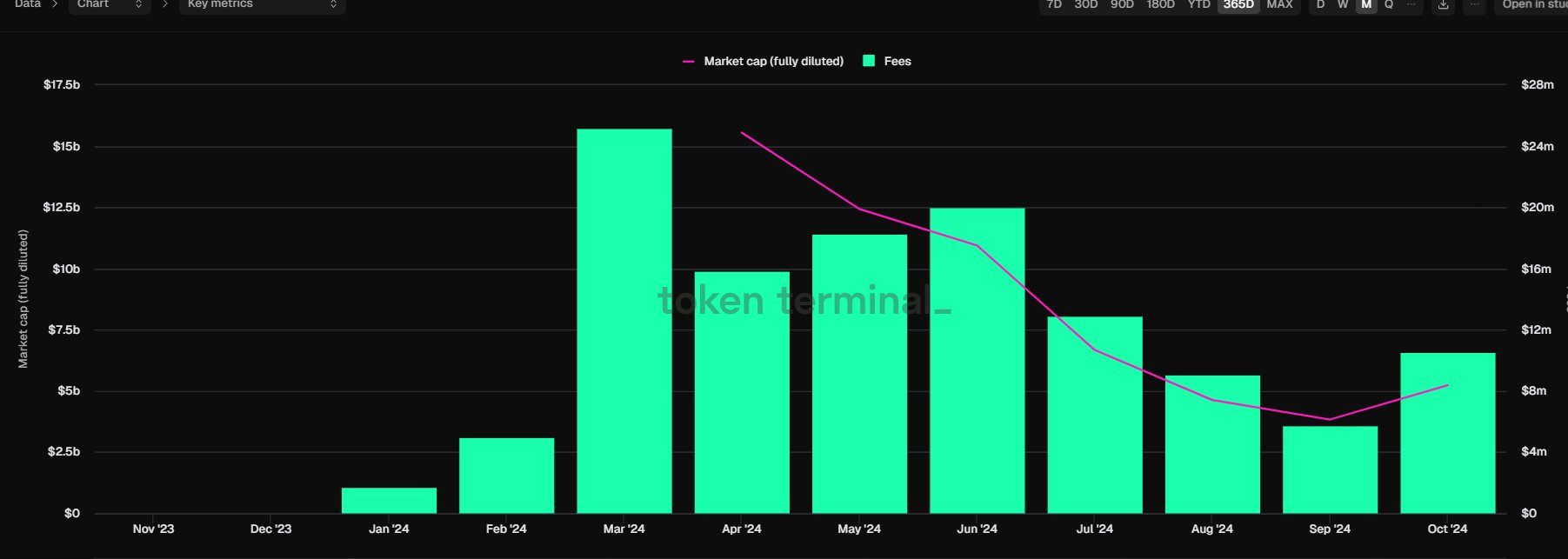

On the contrary, I believe it has performed very well. In my view, the two most perfectly designed products in the past three years are @ethena_labs and @Polymarket. Ethena democratized funding rate arbitrage—previously accessible only to a select few—making it available to decentralized retail users. It generated $100 million in protocol revenue over 251 days, achieving a win-win-win for the team, investors, and users. That said, its token utility design does have flaws.

Polymarket brought prediction markets on-chain, leveraging blockchain to solve payment and regulatory issues inherent in traditional prediction markets. It capitalized on election cycles effectively, and today, global media outlets reference Polymarket’s election data for polling insights.

Ethena created real yield opportunities for users with capital, while Polymarket used blockchain to solve practical problems in Web2 prediction markets and achieved mainstream recognition. Both extended Ethereum’s legacy of success. However, what did they bring to Ethereum’s price? Unlike the DeFi/NFT era, when ETH was the primary unit of account across the ecosystem, these two successful pioneers struggle to replicate that same glory.

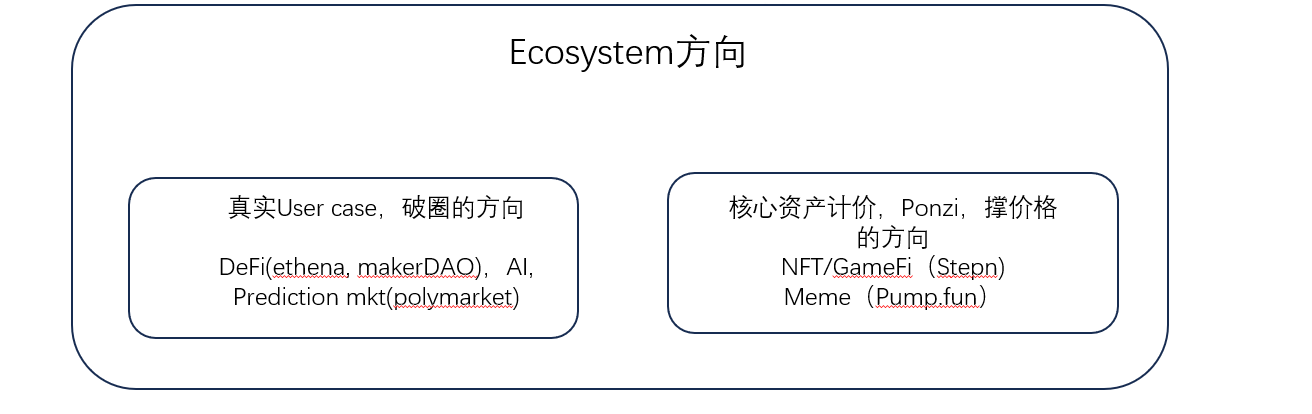

6. Future Outlook for Ecosystems

I believe future ecosystems should evolve in two complementary directions. On one hand, we need real use cases—such as @ethena_labs and @Polymarket on Ethereum, and more PayFi applications on Solana. This is the true path forward for blockchain development. On the other hand, we also need @pumpdotfun-style momentum-driven projects to boost core asset prices. Both elements are essential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News