Meme mania surges, SOL challenges Ethereum — is the crypto bull market inevitable?

TechFlow Selected TechFlow Selected

Meme mania surges, SOL challenges Ethereum — is the crypto bull market inevitable?

Historically, moments when Ethereum's market cap surpasses Bitcoin's are often clear signals that the ETH/BTC ratio has reached a peak.

Author: Ignas | DeFi Research

Translation: Yanan, BitpushNews

The market loves to shout "this time is different," but honestly, I'm kind of hoping for the same old script to play out again: if Bitcoin's four-year cycle continues as expected, we might see new price highs in Q4 of 2025.

Then comes the familiar sequence: once BTC rises, major altcoins like ETH and SOL follow suit, and soon after, a whole wave of tokens—perhaps memecoins leading the charge—catch the momentum and surge upward one by one.

But markets have their own temperament. After rising to a certain point, they inevitably turn, and then we enter a two-year “cooling-off” period. Think about it—nobody can keep sprinting nonstop all year long. So those two years of consolidation are like a well-deserved vacation for the market.

The crypto research team Delphi Digital predicted the Q4 2025 peak as early as mid-2023.

I've previously mentioned their forecast, and it’s gradually coming true. However, there were a few things the team didn’t anticipate: the approval of Ethereum ETFs, and the intense FOMO triggered by Bitcoin ETF approvals, which directly propelled BTC to surpass its previous all-time high in early March.

Huge thanks to Delphi for their insights!

With Trump's victory, the government may introduce more favorable cryptocurrency regulations, potentially serving as the final catalyst for an extremely wild bull run.

This current optimism stands in stark contrast to the cautiously optimistic market outlook I shared back in July. Now, the market no longer seems affected by negative factors such as Grayscale ETF outflows or the Mt. Gox situation.

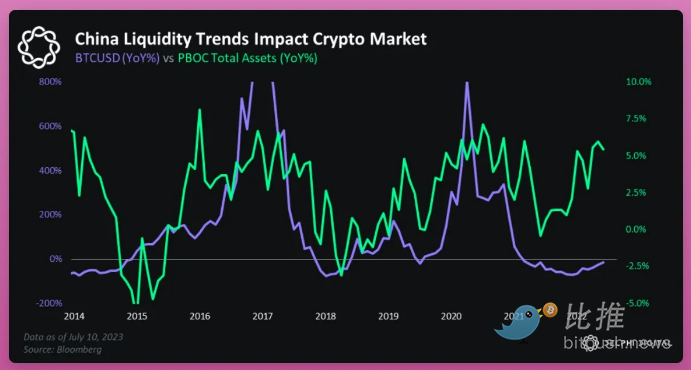

Delphi also noted that China, facing deflationary risks, is considering increasing money supply.

In fact, China has already rolled out its most aggressive stimulus measures since the pandemic, yet many still feel the efforts aren't strong enough and are calling for further "printing presses to be turned on."

Historically, whenever China injects liquidity into the economy, it tends to positively impact both the global economy and the cryptocurrency market.

Yet on social media platform X, few seem to notice the potential positive shift in China’s stance toward cryptocurrencies—not only possibly increasing monetary supply to stimulate the economy but also potentially easing restrictive regulatory policies on crypto.

The key point is that past Bitcoin halvings have always ultimately led to significant price increases, although this uptrend typically begins around six months after the halving event itself—so far, this time appears no different.

If everything proceeds as planned, this could become the most predictable and easiest-to-navigate bull market in history.

How Bullish Is the Market?

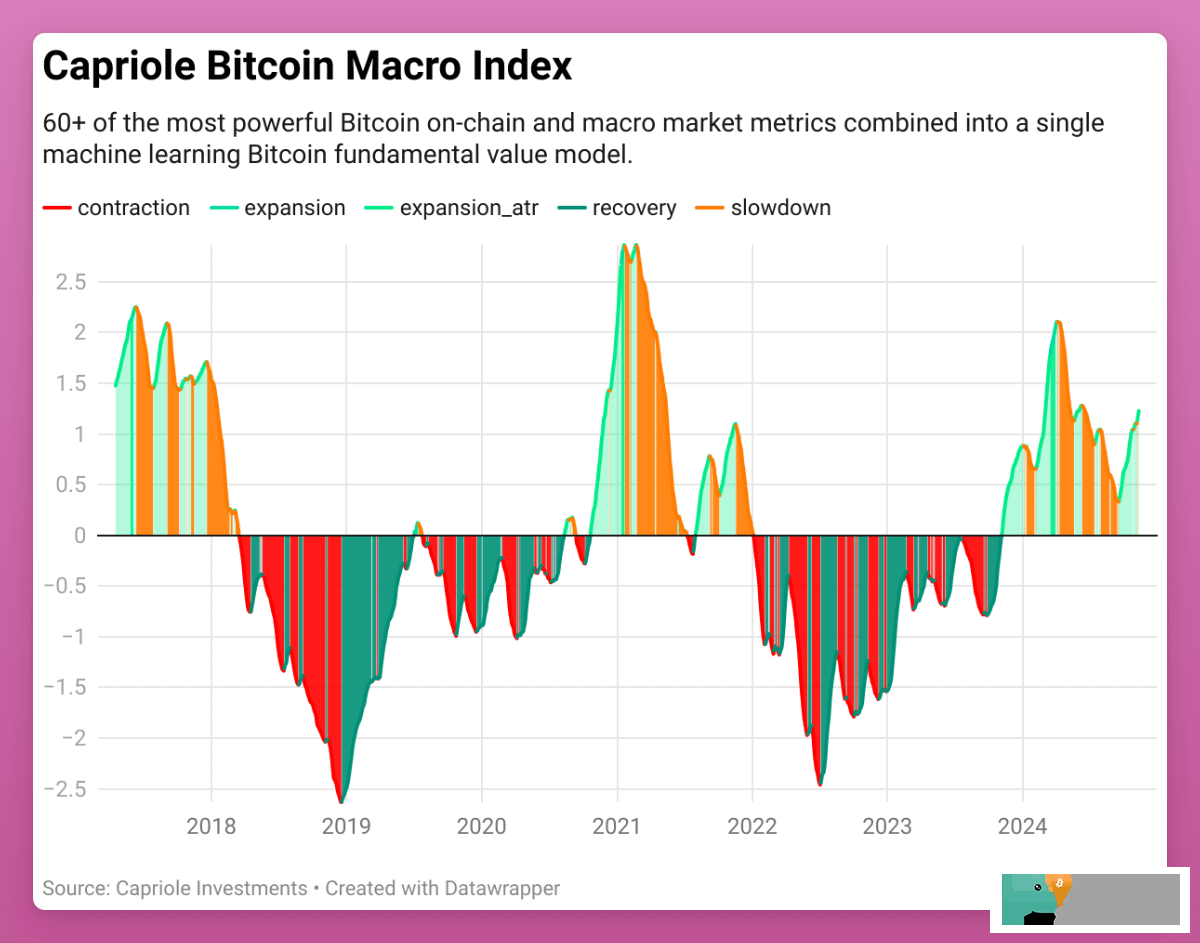

A chart from Capriole Investments offers particularly insightful research worth careful study.

Their flagship product—the Capriole Bitcoin Macro Index—integrates over 60 key metrics closely tied to Bitcoin, spanning on-chain data (such as dormant flows, supply distribution, hash rate distribution, active address counts), macroeconomic indicators, and stock market metrics.

The index is divided into several phases. Currently, we're in the second expansion phase; however, its level hasn't reached the March 2024 peak, let alone the market highs seen in 2017 and 2021.

In short: bullish outlook.

The founder of Capriole predicts that by Q4 2025, Bitcoin will reach at least $140,000. When I directly asked him about Ethereum (ETH), he confidently replied: "At least $5,000—and likely higher."

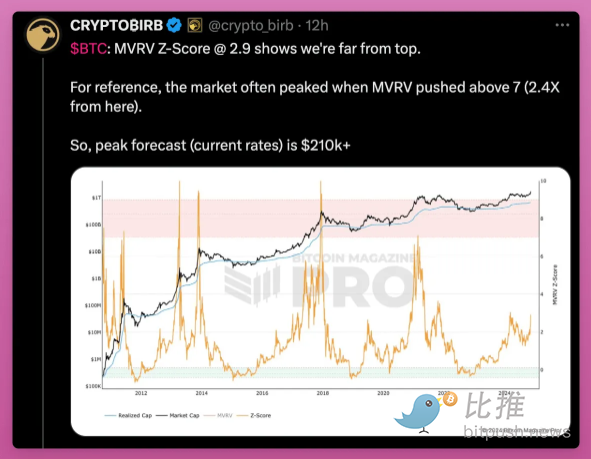

If you find these projections too conservative and favor technical analysis instead, you might estimate Bitcoin’s peak closer to $210,000.

I plan to stick with my strategy from the last cycle, as I'm deeply invested in SOL and ETH, while gradually expanding into DeFi and memecoins.

As Bitcoin climbs, many investors grow frustrated that their altcoins aren’t moving in sync. Don’t worry, dear investors—altcoins usually catch up after Bitcoin surges.

Moreover, the market still has ample room to rise.

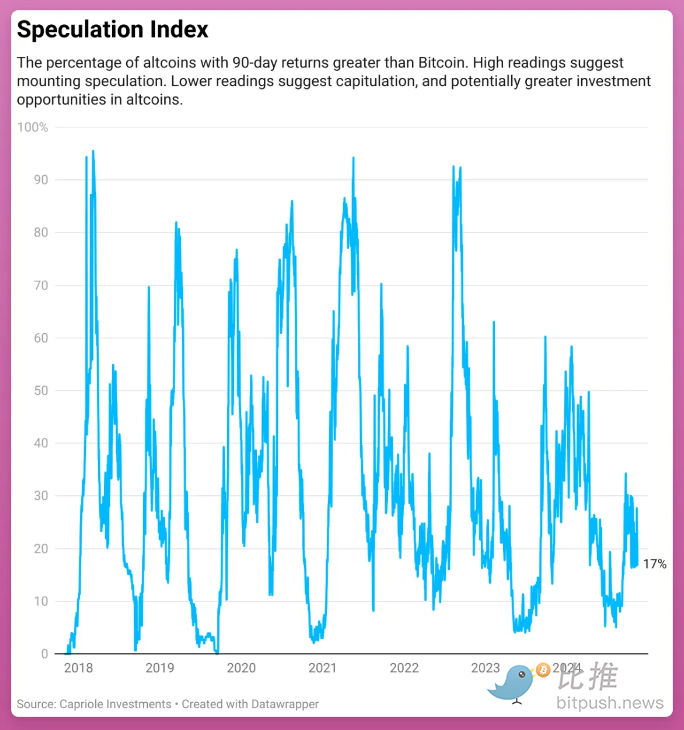

According to Capriole Investments’ Altcoin Speculation Index, the rebound in altcoins hasn’t even truly begun. The index shows that high percentages indicate intense speculative activity, while low percentages suggest reduced speculation—and potentially better investment opportunities in altcoins.

Everything feels almost too good to be true, which naturally brings some concern.

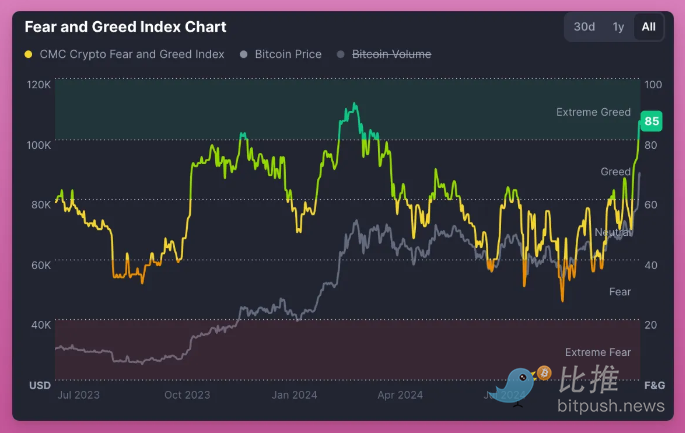

We’ve already entered a state of extreme greed.

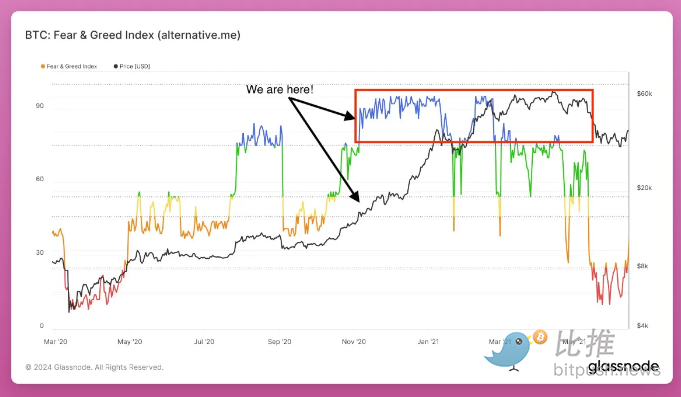

However, such greedy sentiment can persist for quite some time. From November 2020 to March 2021, the index remained above 80, with very limited pullbacks during that period. (Source: Crypto Koryo)

In summary, even though conditions look excellent now, we should stay calm and avoid blindly relying on leverage.

Memecoins

The other day, I read a Financial Times article titled “Bitcoin’s astonishing rise cannot be ignored.”

The comments from regular readers were quite amusing—phrases like “Ponzi scheme,” “scam,” and “it’s worthless” popped up repeatedly.

These self-proclaimed smart people clearly missed the point. And suddenly, it hit me.

Early crypto adopters hold similar biases against memecoins: calling them scams, valueless, meaningless, etc.

Yet Bitcoin has endured despite skepticism, and memecoins have surprised even veteran crypto skeptics. Both have seen relentless price gains—an unstoppable force indeed. Just recall the stunning performance of memecoins post-election: within just ten days, major memecoins doubled in price.

Memecoins have crossed a critical milestone: listings on Binance and Coinbase mark a significant step toward institutionalization.

Prior to listing numerous memecoins, Binance released an in-depth research report stating that retail investors are actively exploring new paths to wealth creation, and memecoins embody the core principles of transparency and accessibility—“striving to reduce insider advantages and create a fairer environment for global investors.”

Memecoins are not merely investment vehicles—they represent a profound convergence of value and cultural significance amid modern financial transformation.

Given Binance’s natural tendency to list assets with strong upside potential, I believe they will continue adding more memecoins in the future.

SOL vs Ethereum

Oh, dear Ethereum, when will your time finally come?

Watching memecoin prices soar while my portfolio grows heavier by the day.

FOMO keeps tempting me to jump into faster-rising coins,

but I’m holding firm—hoping my decision proves right.

In this current crypto cycle, Ethereum and its entire ecosystem appear unlikely to relive the glory days of previous bull runs.

The amount of capital needed to move Ethereum—a giant with a $382 billion market cap—alongside established DeFi projects and newly launched tokens with low circulating supply but high FDV, could instead spark massive movements across multiple emerging sectors. These include decentralized science (DeSci), Runes, Solana-based DeFi, other L1s, and yes, the aforementioned memecoins.

Ethereum and DeFi token holders made huge profits in the last cycle and now aim for another 3x to 5x gain to achieve financial freedom. But maybe the market won’t hand them that opportunity so easily? Perhaps these assets need to grind a bit longer.

The capital required to push Ethereum up 3x might enable ecosystems introducing fresh ideas to grow 10x.

This possibility is entirely real.

Recently, Justin Drake’s proposed ETH 3.0 (Beam Chain) roadmap failed to generate much excitement within the community. Besides, the plan isn’t expected to materialize until late in the 2020s—clearly missing the current market cycle.

On the other hand, Solana is riding high at the moment.

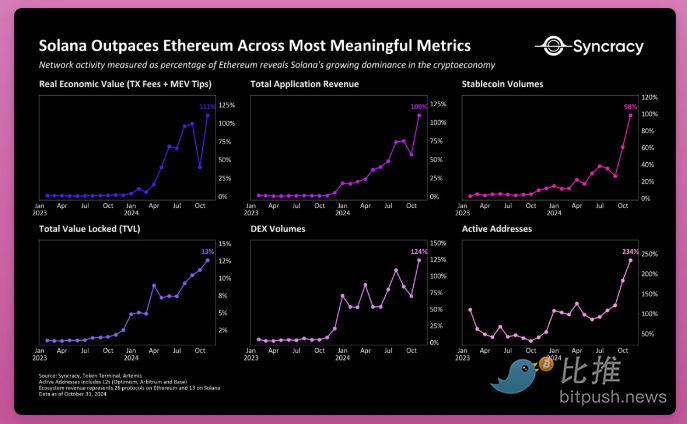

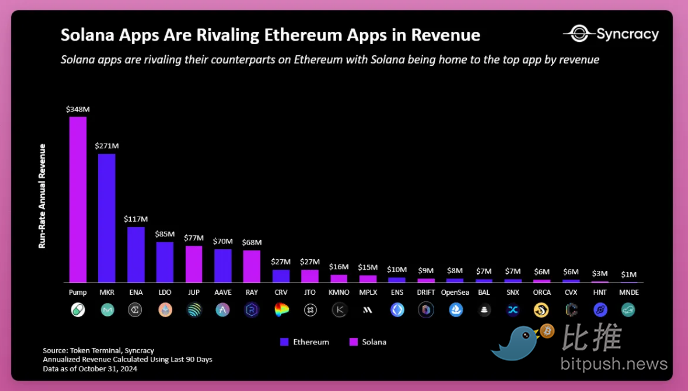

A recent research report from Syncracy provides a clear comparison between Ethereum and Solana.

Last time Solana rose, it was driven by future potential; this time, it's powered by solid fundamentals.

Comparing network activity reveals Solana excelling in total value locked (TVL), DEX trading volume, stablecoin transaction volume, and active address count.

Objectively speaking, comparing Solana directly to Ethereum’s L1 may seem somewhat unfair, since theoretically, Ethereum’s L2s should also be included in the comparison. However, because L2s are still largely perceived as “parasites” dependent on Ethereum’s mainnet, average investors remain uncertain about their true value and struggle to assess them accurately.

Even when looking at dApp revenue, Solana’s dApps now rival those on Ethereum, demonstrating comparable strength.

Nonetheless, Solana’s market cap remains only about one-third of Ethereum’s. Given its strong economic indicators, this suggests substantial growth potential—and perhaps one day, valuation parity with Ethereum.

Will SOL really rise by stepping over ETH? In my view, when talk of “SOL overtaking ETH” becomes increasingly widespread, that might be precisely the moment to consider rebalancing and returning to ETH.

Historically, moments when Ethereum’s market cap approached or exceeded Bitcoin’s often signaled clear peaks in the ETH/BTC ratio.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News