20x in 2 Days: A Quick Look at the New Memecoin Snowball's Automated Market Making Mechanism

TechFlow Selected TechFlow Selected

20x in 2 Days: A Quick Look at the New Memecoin Snowball's Automated Market Making Mechanism

The market lacks hotspots, and memes are rehashing old tunes.

By: David, TechFlow

The crypto market in December is as cold as the weather.

On-chain trading has been dormant for a long time, and new narratives are hard to come by. Just look at what Chinese CT is discussing these days—infighting and gossip—and you'll know that almost no one is left playing in this market.

But in the English-speaking community, there's something new being discussed lately.

A meme coin called Snowball launched on pump.fun on December 18th and reached a $10 million market cap within four days, still hitting new highs—yet barely mentioned in Chinese circles.

In today’s environment where there are no fresh narratives and even meme coins can’t attract interest, this stands out as one of the few things recently that spark attention and show localized wealth effects.

And "Snowball," when translated, literally means the snowball effect—the very story it wants to tell:

A mechanism designed to let tokens “grow themselves bigger and bigger.”

Turning transaction fees into buy orders, rolling the snowball for market making

To understand what Snowball is doing, first you need to know how tokens on pump.fun usually make money.

On pump.fun, anyone can create a token in minutes. The creator can set a "creator fee"—essentially taking a cut from every transaction into their own wallet, typically between 0.5% and 1%.

Theoretically, this money could be used for community building or marketing, but in practice, most developers choose to simply cash out once enough is collected.

This is part of the typical life cycle of a shitcoin: launch, pump, collect trading fees, then exit. Investors aren't betting on the token itself—they're gambling on the developer's integrity.

Snowball takes a different approach: it doesn't take that creator fee at all.

To be precise, 100% of the creator fees go not into any individual wallet, but automatically into an on-chain market-making bot.

This bot performs three actions periodically:

First, it uses accumulated funds to buy the token on the open market, creating buying pressure;

Second, it adds the purchased tokens and corresponding SOL into the liquidity pool, improving trading depth;

Third, with each operation, it burns 0.1% of the tokens, creating deflation.

Meanwhile, the creator fee isn't fixed—it fluctuates between 0.05% and 0.95% based on market cap.

When market cap is low, the fee is higher, allowing the bot to accumulate capital faster; when market cap rises, the fee decreases to reduce trading friction.

In one sentence, the logic of this mechanism is: every time you trade, a portion automatically becomes buy-side support and liquidity instead of going into a developer's pocket.

It's then easy to see how the snowball effect works:

Trading generates fees → fees become buy orders → buy orders push up price → rising price attracts more trading → more fees… theoretically, it can keep rolling on its own.

On-chain data overview

Mechanism explained—now let’s check the on-chain data.

Snowball launched on December 18th—just four days ago. Its market cap surged from zero to $10 million, with over $11 million in 24-hour trading volume.

For a pump.fun shitcoin, this performance is already impressive given current conditions.

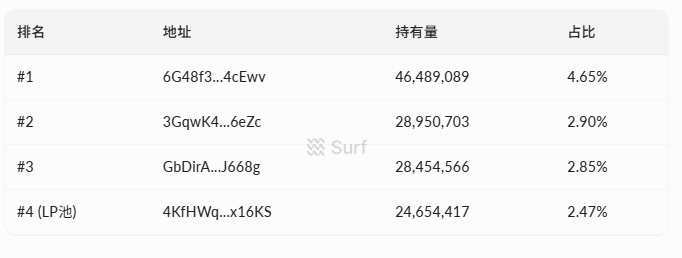

In terms of holder distribution, there are currently 7,270 addresses holding the token. The top ten holders combined own around 20% of total supply, with the largest single holder owning 4.65%.

Data source: surf.ai

No single address holds 20-30%, indicating relatively decentralized distribution.

On the trading front, there have been over 58,000 transactions since launch—33,000 buys and 24,000 sells. Total buy volume is $4.4 million, sell volume $4.3 million, net inflow roughly $100,000. Buying and selling are nearly balanced, with no overwhelming sell pressure.

The liquidity pool holds about $380,000—half in tokens, half in SOL. For its market cap size, depth is modest, so large trades will still experience noticeable slippage.

Another notable point: Bybit Alpha announced listing the token less than 96 hours after launch, confirming its short-term popularity.

Perpetual motion meets a cold market

Looking around, discussions in the English community focus mainly on the mechanism itself. Supporters argue straightforwardly:

This is the first meme coin to lock 100% of creator fees directly into the protocol. Developers cannot withdraw funds and run, making it structurally safer than other shitcoins—at least in design.

The dev team reinforces this narrative: developer wallet, market-making bot wallet, and transaction logs are all public, emphasizing "on-chain verifiability."

@bschizojew labels himself as "on-chain schizophrenic, 4chan special forces, first-gen meme coin veteran"—a self-mocking, degenerate tone that resonates well with native crypto communities.

But structural safety doesn't guarantee profitability.

The snowball effect only works if sufficient trading volume continuously generates fees to fuel the bot's buybacks. More trading → more fees → stronger buy pressure → higher price → more traders join...

This is the ideal state of any meme coin's "buyback flywheel" during a bull market.

The problem? The flywheel needs external force to start.

What’s the current crypto market like? On-chain activity is sluggish, overall meme coin热度 is declining, and capital willing to chase shitcoins is scarce. Under these conditions, if new buying dries up, trading volume shrinks, fees collected drop, buyback strength weakens, price support erodes, and trading interest declines further.

The flywheel can spin forward—or backward.

A more realistic concern: the mechanism solves only one risk—developer exit scams—but meme coins face many other risks.

Whale dumps, insufficient liquidity, fading narratives—any one of these can render 100% fee-based buybacks largely ineffective.

People have been burned too many times. As one Chinese community member aptly put it:

Play for fun, don’t get greedy.

More than one snowball rolling

Snowball isn’t the only project telling this automated market-making story.

Within the same pump.fun ecosystem, a token called FIREBALL is doing something similar—automated buybacks plus token burning, packaged as a protocol other tokens can integrate. But its market cap is much smaller than Snowball’s.

This suggests the market is responding to the idea of "mechanism-driven meme coins."

Traditional tactics like shilling, pumping, and community hype are increasingly ineffective at attracting capital. Designing mechanisms to tell a story of "structural safety" may be the latest meme coin playbook.

Still, designing artificial mechanisms isn't a new trick.

OlympusDAO’s (3,3) in 2021 was the classic example—using game theory to frame staking mechanics around the idea that "if nobody sells, we all profit." At its peak, it hit a multi-billion dollar valuation. We all know how it ended: a death spiral, losing over 90%.

Earlier still was Safemoon’s model—"tax every transaction and redistribute to holders"—also marketed as innovative mechanism design, which eventually led to SEC lawsuits and fraud charges against its founder.

Mechanisms can serve as powerful narrative hooks, capable of gathering funds and attention quickly, but mechanisms themselves don't create value.

Once external capital stops flowing in, even the most elegant flywheel grinds to a halt.

Finally, let’s summarize what this little gem is actually doing:

It turns meme coin creator fees into an "automated market-making bot." The mechanism isn’t complex, and the problem it solves is clear: prevent developers from running off with funds.

Just because the dev can’t exit doesn’t mean you’ll make money.

If after reading this you find the mechanism interesting and want to participate, remember one thing: it’s first and foremost a meme coin—secondarily, an experiment in new mechanisms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News