Hotcoin Research | Solana vs BSC Meme Ecosystem Comparison Analysis: Evolution and Future of the Meme Battlefield

TechFlow Selected TechFlow Selected

Hotcoin Research | Solana vs BSC Meme Ecosystem Comparison Analysis: Evolution and Future of the Meme Battlefield

Hotcoin Research

Introduction

Since late 2024, meme coins have transitioned from a niche subculture into one of the most explosive and controversial categories within the crypto market. They are neither products of technological innovation nor typical long-term value investments, yet through repeated waves of sentiment, they continue to reshape on-chain activity, capital flows, and retail participation. In this meme frenzy, Solana and BSC have emerged as the two primary battlegrounds for meme coins. Are the differences between Solana memes and BSC memes merely "thematic variations," or do they reflect fundamental divergences in user composition, capital characteristics, and speculative mechanisms across the two blockchains? And is the meme phenomenon evolving from isolated emotional spikes into a long-term tool for blockchains to attract new users and boost on-chain activity?

This article presents a systematic comparison of the meme ecosystems on Solana and BSC, dissecting the underlying logic and stage-specific gains and losses of each chain’s meme model across multiple dimensions—market landscape, launch platforms, market cap and trading volume, project lifecycle, thematic traits, community culture, and official support. Incorporating the latest market conditions as of early 2026, we also assess the future trajectory and investment risks of the meme sector, aiming to provide readers with a clearer picture of the Solana and BSC meme landscapes.

I. The Battle for Meme Supremacy: Solana vs. BSC

Market Landscape: Solana Meme vs. BSC Meme

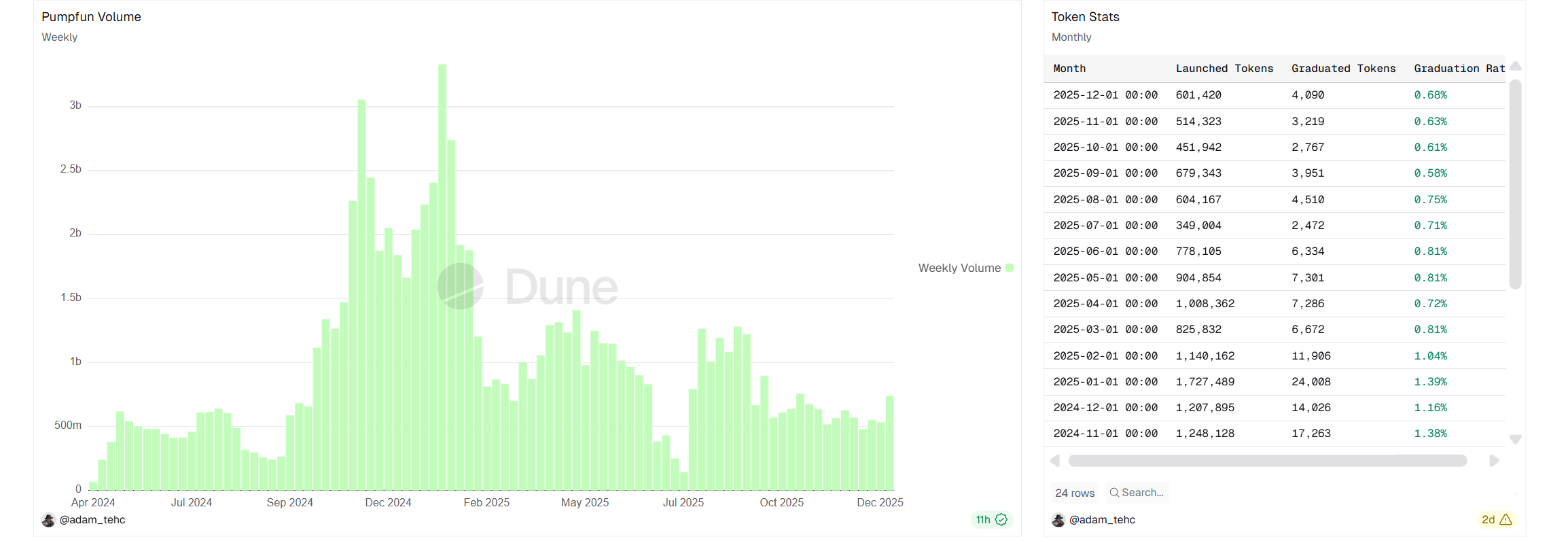

Since Pump.fun launched on Solana in late 2024, sparking the “Meme Summer,” meme tokens became the hottest phenomenon on-chain. The platform drastically lowered the barrier to token creation and at one point accounted for about 70% of all new tokens on Solana, driving network activity to its peak despite a graduation rate of less than 2%. In early 2025, Binance began actively embracing the meme trend, with tokens like TST and Broccoli, along with mubarak, fueling a surge in traffic on Four.meme. By mid-2025, capital started rotating between Solana and BSC. In Q4, BSC rode a wave of “Chinese memes” such as "Binance Life," "Hajimi," triggering cross-cultural FOMO. However, by late October, most of these projects crashed to zero. In early 2026, Chinese memes like "Wota Ma Lai Le (Here I Fucking Come)," "Life K-Line," "Lao Zi (Old Master)," and "Hei Ma (Dark Horse)" surged again but quickly lost momentum, now significantly retraced from their highs.

Looking back over the past two years, the meme ecosystems on Solana and BSC have alternated in leadership: Solana gained an early lead through Pump.fun by the end of 2024, reaching fever pitch in early 2025. Then, leveraging Binance's influence, BSC rapidly rose via Four.meme in 2025, shifting the main meme battlefield to the BSC chain. Nevertheless, Pump.fun maintains a clear cumulative advantage, far outpacing BSC in “meme minting factory” output. This is primarily due to narrative exhaustion within BSC’s meme ecosystem and lack of external growth drivers: growing backlash against the so-called “CZ/Yi He decree-style” hype model (mockingly termed “Crypto Shandong School”) has caused community division, while failure to attract overseas or cross-chain capital has led to drying liquidity and fading momentum.

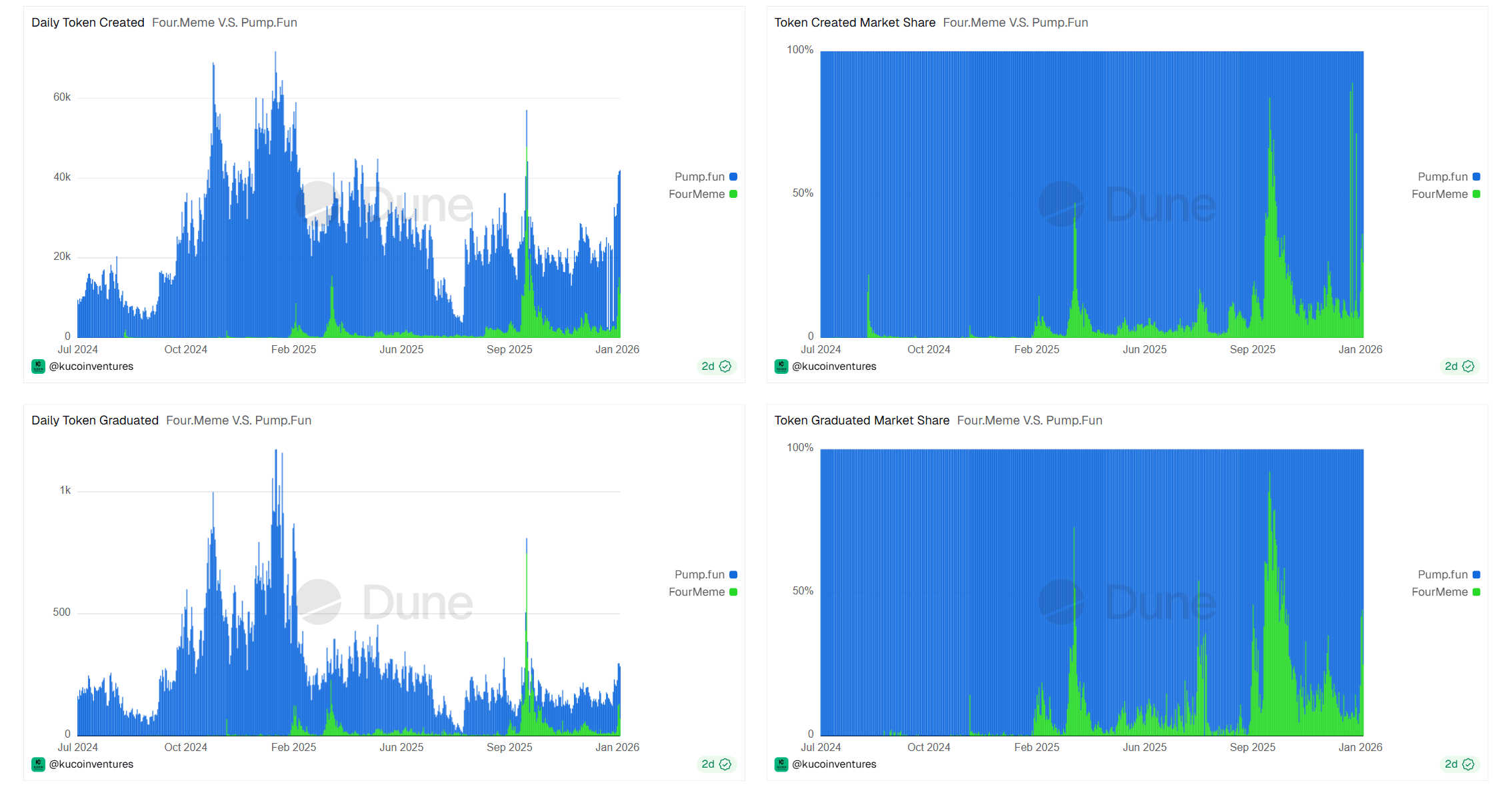

Meme Launch Platforms: Pump.fun vs Four.meme

As representative meme launchpads for Solana and BSC respectively, the rivalry between Pump.fun and Four.meme has defined the entire meme cycle. Pump.fun benefited from first-mover advantage, establishing dominance early in the 2024 meme wave and becoming virtually unavoidable on Solana, once seeing daily new account creations exceed 100,000. Four.meme, backed by Binance’s ecosystem, surged in 2025—from fewer than 500 daily new users to over 20,000—achieving a weekly growth rate of 325%, despite starting at just 40% of Pump.fun’s scale. Throughout 2025, the two platforms engaged in fierce competition, repeatedly swapping market share. Their rivalry reflects a broader struggle between the Solana and BSC ecosystems for users and capital. Beyond these giants, other meme platforms have emerged—such as LetsBonk and Moonshot on Solana—but BSC remains dominated by Four.meme, solidifying its role as the foundational meme infrastructure on the chain.

Both Pump.fun and Four.meme issued native tokens—PUMP and FORM—and implemented incentive mechanisms to boost user retention. PUMP holders can earn a share of platform revenue or receive fee discounts. Four.meme adopted a “trading mining” plus future airdrop model, potentially lower in short-term profitability but stronger in user stickiness. This highlights differing operational philosophies: Pump.fun operates more like a traditional business, focused on transaction volume and fees; Four.meme emphasizes community engagement, tapping into BNB Chain’s tradition of “fun mining” to drive participation.

II. Analysis of Performance Differences

Market Cap and Scale

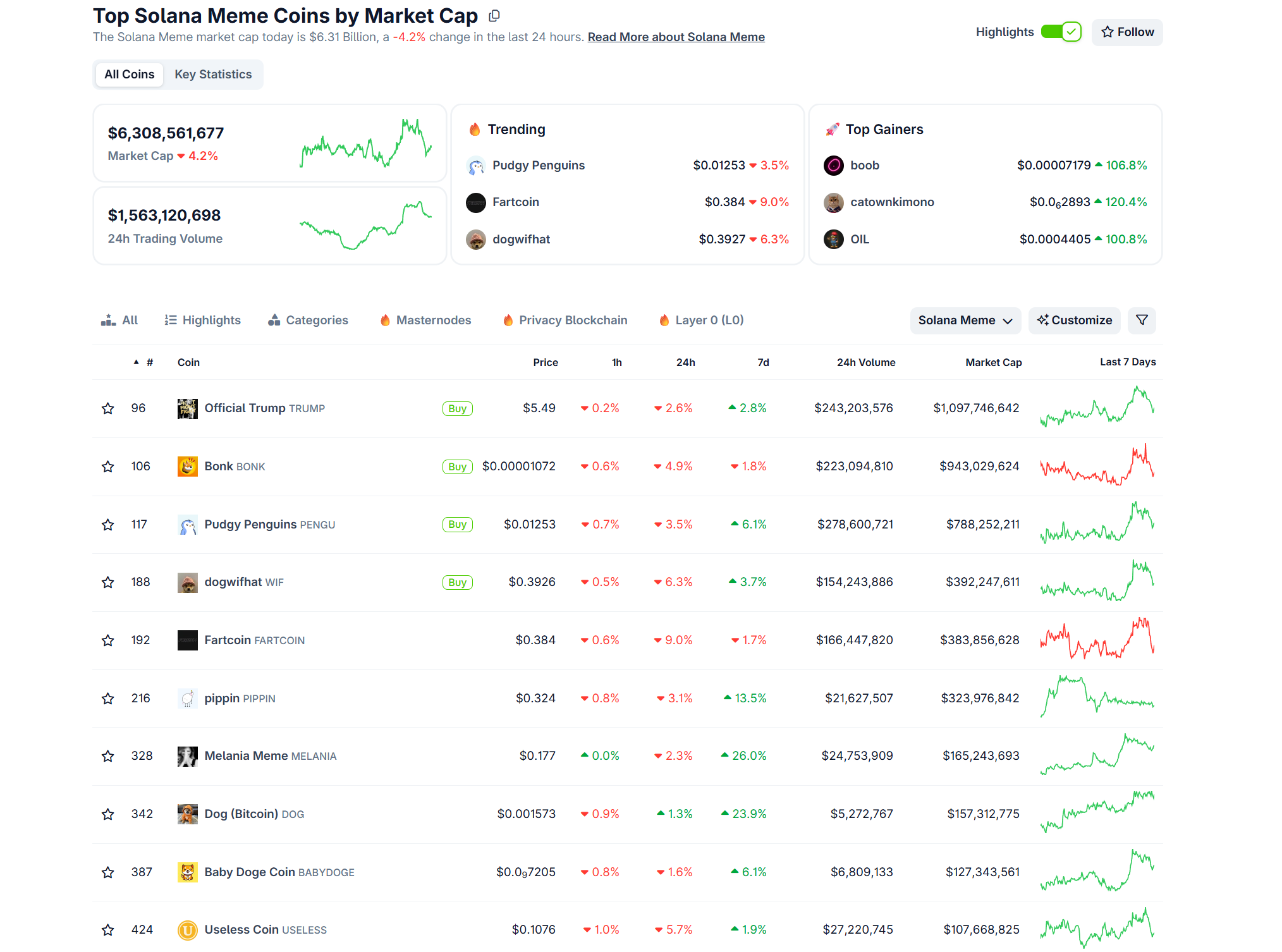

The meme coin ecosystems on both Solana and BSC have become significant in scale. According to CoinGecko data, as of January 15, 2026, the total market cap of Solana meme coins stood at approximately $6.3 billion, with 24-hour trading volume reaching $1.5 billion. The top 10 meme coins on Solana each boast market caps exceeding $100 million, with some ranking among the highest-valued cryptocurrencies globally.

Source: https://www.coingecko.com/en/categories/solana-meme-coins

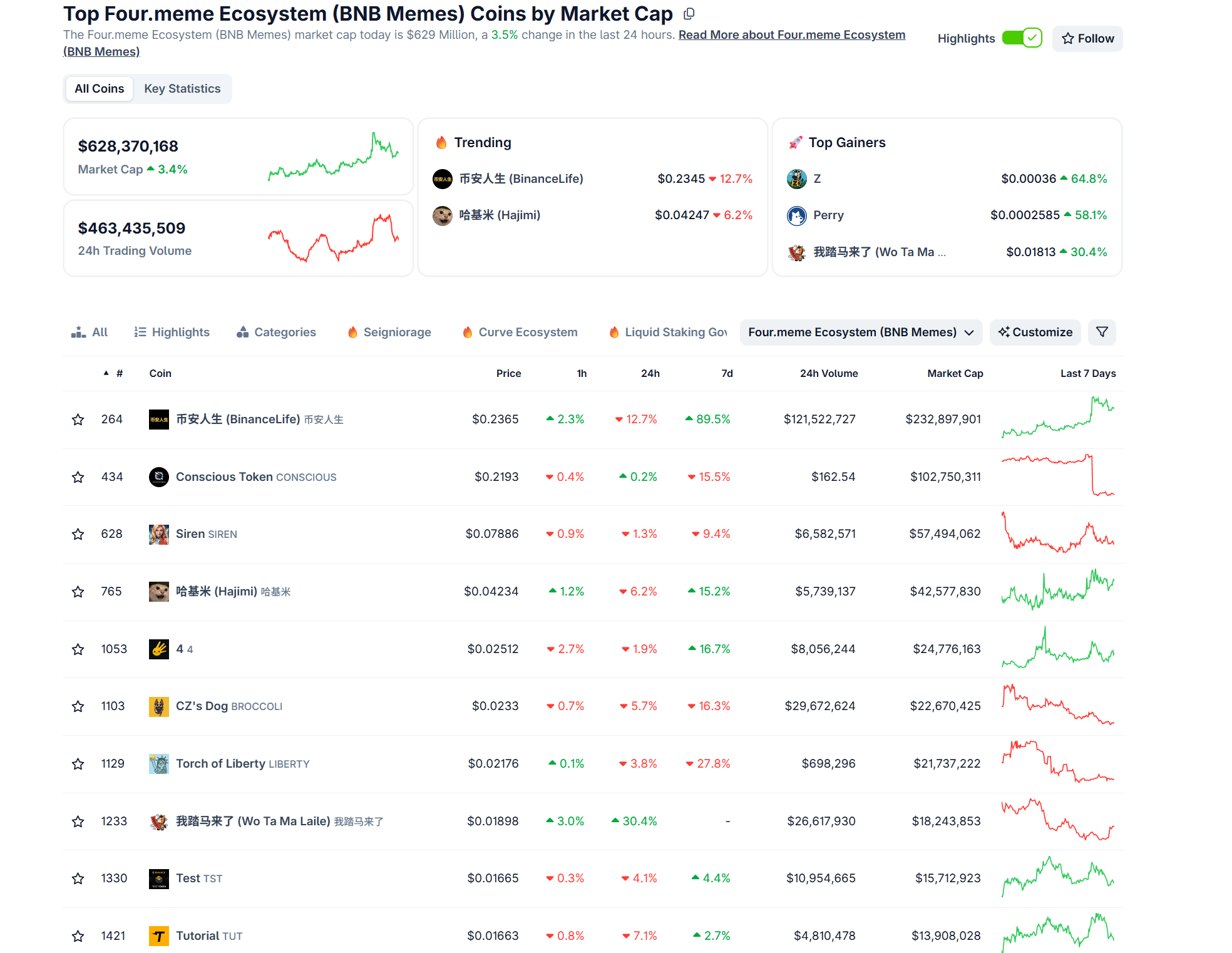

In contrast, the total market cap of BSC memecoins launched via Four.meme was around $620 million, with 24-hour trading volume at approximately $460 million. Clearly, Solana leads in overall meme sector size due to its first-mover advantage and emergence of large-cap projects. However, BSC has shown faster growth—from virtually no dedicated meme segment at the end of 2024 to hundreds of millions in market cap and daily trading volumes regularly in the billions by the end of 2025. This dynamic shift reflects capital reallocation between ecosystems: during H2 2025, when BSC meme valuations spiked, Solana’s meme sector temporarily contracted; later, as BSC cooled, capital flowed back into Solana, lifting certain tokens. Such rotation may persist in the future.

Source: https://www.coingecko.com/en/categories/four-meme-ecosystem

Trading Volume and Activity

In terms of trading activity, both chains have had their moments. On Solana, meme trading peaked between Q4 2024 and Q1 2025, with Pump.fun recording single-day trading volumes exceeding $300 million. Even after the hype subsided, Pump.fun maintained daily trading in the tens of millions, indicating sustained engagement. Throughout 2025, Pump.fun contributed over 40% of Solana’s DEX transaction count and remained a top earner among Solana-based applications.

Source: https://dune.com/adam_tehc/pumpfun

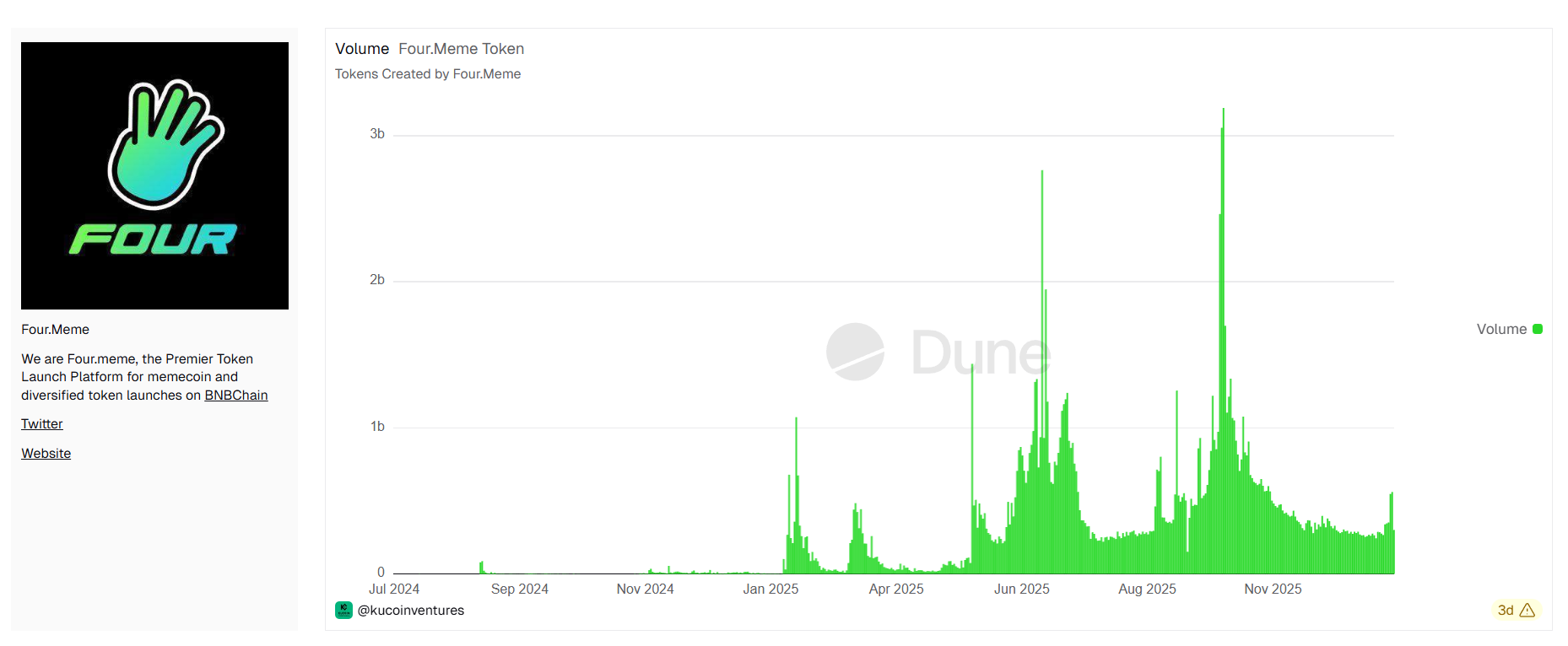

BSC’s meme trading volume hit record highs around October 2025: on October 7, 2025, BSC meme-related trading surged to ~$6.05 billion. During that month, Four.meme averaged daily trading volumes in the tens of millions, rivaling Pump.fun. However, BSC meme trading follows a “volcanic eruption” pattern—extreme short-term spikes followed by rapid decline. For example, in early January 2026, Chinese memes saw multi-fold increases in 24-hour trading volume over two days, only to drop over 50% shortly after. Solana’s meme activity, while also peaking dramatically, shows a more gradual decline. Platform revenues remained above bear-market averages well into late 2025. This suggests Solana has cultivated a base of resident speculators, creating a stable sector effect less dependent on broad market sentiment. In contrast, BSC’s meme ecosystem remains in an experimental phase of boom-and-bust cycles, exhibiting strong seasonality.

Source: https://dune.com/kucoinventures/four

Lifecycle and Survival Rate

Short lifespans are common to meme tokens on both chains, though survival rates differ slightly. Data from Pump.fun shows fewer than 2% of tokens launched there successfully graduate and remain active. Most tokens collapse to zero within one or two weeks, many seeing trading dry up within days. This ephemeral nature is widespread on both Solana and BSC. Yet, due to its head start, Solana has seen relatively longer-lived meme projects like FARTCOIN and PIPPIN still operating with established communities. BSC memes generally show even shorter longevity. Of the Chinese memes from October 2025, only “Binance Life” and “Hajimi” retain any traction; others like “Customer Service Xiao He,” “Cultivation,” and “Nailong” have vanished. Even in the January 2026 wave, flagship “Wota Ma Lai Le” struggles with staying power. The script is now predictable: “cold start → engagement → alpha leak → dump.”

Source: https://dune.com/kucoinventures/four

Solana’s meme sector, having already weathered bubble bursts, appears more mature. Many investors now accept the “in-and-out fast” norm and avoid blindly holding (“diamond handing”). As a result, despite high project mortality, capital turnover efficiency has improved—when one meme dies, another quickly replaces it, allowing sector热度 to be repeatedly reignited. BSC memes are still going through this painful cycle and may need one or two more rounds of winnowing before sustainable projects emerge.

III. Project Characteristics and Community Culture Comparison

Meme Themes and Style

Meme coins on Solana and BSC exhibit distinct thematic styles. Solana memes are diverse and international, drawing from Western internet culture and absurd creativity. Bonk, the first major Solana meme coin launched via airdrop in early 2023, is often called the “Solana version of Dogecoin” and still holds a market cap around $900 million. From 2024–2025, Pump.fun spawned countless bizarre names like FARTCOIN, TRUMP, PENGU, PNUT. These projects feature humorous names and exaggerated visuals, tapping into global crypto memes with strong satire and social flair—an international celebration of crypto subculture.

BSC memes, by contrast, are distinctly localized and community-driven, heavily imitative and referential. Tokens like TST, Broccoli, and mubarak are tied to Binance or CZ himself. Chinese memes such as “Binance Life,” “Hajimi,” “Wota Ma Lai Le,” and “Lao Zi” draw almost exclusively from Chinese slang and online jokes. These projects revolve tightly around internal crypto figures and inside jokes, often self-deprecating. This self-contained meme culture, dubbed “Crypto Shandong School” by Odaily—for its resemblance to Shandong locals obsessing over fish-head direction during festivals to please superiors—has made Chinese memes increasingly “tacky.” It also explains why Chinese memes struggle overseas: foreign audiences fail to grasp the references, resulting in minimal English discussion and no lasting external capital inflow, leading inevitably to silence.

Community and Users

The demographics of meme enthusiasts also differ. Early Solana meme communities were dominated by young Western investors and existing Solana users inspired by successes like Pepe in 2023, eager to replicate meme miracles on a fast, emerging chain. Solana’s meme boom was thus a collective effort by global retail investors. In contrast, BSC meme players include a large number of Chinese-speaking users and existing Binance traders—highly alert and fast-moving, but prone to herd behavior chasing short-term trends. Once internal capital disperses, the game collapses. This explains the fleeting nature of Chinese meme waves.

Solana’s meme community is broader, encompassing KOLs on Western social media, NFT collectors, and DeFi users—making its ecosystem more attractive to outside attention. At its peak, even Ethereum investors migrated to Solana to catch the trend. BSC, overly reliant on Chinese speakers, suffers limited reach on international social media—a key constraint on its meme ambitions.

Capital Size and Hype Dynamics

From a capital structure perspective, speculation differs too. On Solana, retail and small-scale investors dominate. Pump.fun champions the idea of “democratized minting,” where people invest tens or hundreds of dollars trying to launch or buy new tokens, betting on rare high-return outcomes. This results in many flash-in-the-pan projects, but also allows gems like FARTCOIN and PIPPIN to build enduring communities.

BSC sees significant whale influence alongside retail. BSC memes are often ignited by whales who accumulate early in illiquid markets. Once market cap and liquidity reach thresholds, they use social media or rumors to trigger viral pumps. When retail floods in, whales already hold massive paper gains. While similar dynamics exist on Solana, BSC’s close ties to CZ/He Yi statements amplify centralized control. During the Broccoli token chaos, numerous fake projects were pumped and dumped by hidden operators. In short, Solana memes resemble chaotic crowd gambling; BSC memes lean toward manipulation by a few insiders. Hence, BSC meme price swings are more extreme and cycles shorter—confirmed repeatedly during 2025 rallies.

Media and KOL Influence

The information environments differ as well. Solana’s initial meme surge was driven by overseas KOLs on Crypto Twitter, who delighted in sharing oddities from Pump.fun, creating viral loops. Overall, Solana’s team remained restrained, letting the community lead organically. On BSC, every move by Binance executives carries amplified weight. Tweets from CZ and He Yi are treated as “meme decrees,” with KOLs scrambling to decode subtle hints for the next big name. Some voices in the Chinese community now advocate for decentralized, de-idealized meme creation, urging creators not to constantly orbit around leaders—a sentiment particularly loud in early 2026 discussions.

Thus, the cultural atmospheres diverge: Solana leans toward entertainment-first, celebrating creativity and subversion; BSC veered toward authority worship, turning memes into ironic tributes to leadership. This shaped differing community values: the former imbues memes with self-mocking, satirical spirit; the latter chases headlines and hype in a short-term, fast-paced manner, lacking enduring narratives. This explains why some Solana memes survive post-boom, while most BSC copycats vanish instantly.

IV. Meme Market Status and Outlook for 2026

Current Market Situation

By mid-January 2026, the overall meme market has cooled from its peak, but sector effects persist and thematic rotations continue. On Solana, Pump.fun’s daily active users and trading volumes are far below highs, yet thousands of new tokens are still created daily, supported by a user base in the tens of thousands. Rising network activity on Solana continues to feed organic traffic into the meme space. On BSC, following a brief resurgence of Chinese memes over the past two weeks, the ecosystem is now in consolidation. Yet, activity hasn’t died: players are exploring new themes—such as AI-related memes or memes from other linguistic cultures—seeking the next story. Meanwhile, Binance closely monitors community sentiment and may soon launch initiatives to reignite interest. Clearly, meme coins have become entrenched on both Solana and BSC and will likely experience periodic revivals. Investor attitudes have grown more cautious—after experiencing wild swings, participants now approach memes with greater restraint. Recent listings of meme coins on Binance showed sharp run-ups followed by quick pullbacks, signaling subdued speculative fervor compared to earlier cycles. This reflects signs of market maturation.

Future Outlook

Looking ahead, Solana and BSC meme ecosystems may evolve along divergent paths. For Solana, the meme craze validated its high-performance chain’s ability to handle mass adoption and brought a wave of active users. Post-bubble, Solana’s meme ecosystem has the potential to crystallize culturally valuable IPs. Future Solana memes might expand into NFTs, GameFi, and other use cases, forming cross-domain entertainment ecosystems. For instance, the Bonk team has already launched NFTs and games, adding utility to extend token lifespan, moving toward quality and community focus.

For BSC, the 2025 success proved it can capture social traffic beyond DeFi. Binance will clearly continue supporting this sector. The key for BSC’s future lies in breaking out of the Chinese-speaking bubble and appealing to a wider audience. This may require creating globally resonant meme themes or integrating with broader internet pop culture, rather than relying solely on internal jokes. Additionally, BSC’s 2025 roadmap—including performance upgrades, lower fees, and anti-MEV mechanisms—will make it better suited for high-frequency trading and micro-speculation, potentially boosting meme trading activity further. When market sentiment improves, BSC memes could return with renewed strength, possibly spawning more sustainable projects. Binance may also integrate meme elements into its broader ecosystem strategy, using them as a “soft landing” zone to onboard new Web3 users.

Investor Risk Warning

At their core, meme coins remain high-risk speculative vehicles. Investors must participate with calm rationality—survival matters more than profit. Whether on Solana or BSC, short lifespans and extreme volatility are immutable laws; chasing momentum often leads to heavy losses. Recommendations for retail investors:

- Small positions, entertainment mindset: Treat meme investing as recreation, allocating only a tiny fraction of your portfolio. During hot markets, deploy a small “adventure fund” for high-reward bets—but mentally prepare for total loss. View profits as windfalls, losses as tuition.

- Follow trends, enter and exit fast: Meme rallies are driven by social media buzz, with fragmented, fast-moving information. Monitor Twitter, Telegram, and community channels closely for early signals. If participating, adopt a short-term strategy: enter quickly, take partial profits during upward momentum. Exit decisively if trading volume weakens or sentiment cools.

- Read on-chain signals: Use blockchain explorers and data tools to track whale behavior. Watch top holder changes—if large wallets begin transferring out, it may signal dumping. Analyze capital inflows/outflows across the sector. Leverage on-chain transparency to avoid being the last bagholder.

- Diversify risk, never go all-in: Spread exposure across multiple meme opportunities. Miss one wave? Wait for the next. Avoid putting everything into a single token—even within one chain. Small bets across many targets increase chances of catching a winner and offsetting losses. After all, hitting a “100x” is extremely rare; casting a wide net improves odds.

- Beware scams and hacks: Low barriers invite bad actors. Watch for fake tokens (e.g., mimicking popular contracts but adding sneaky fees or burn addresses). Always verify contract sources via official links or trusted explorers. Avoid clicking unknown meme airdrop links—phishing sites abound. Use hardware wallets for such high-risk plays to protect your entire portfolio from being wiped out by one failed bet.

Conclusion

The meme coin frenzy on Solana and BSC has been a unique spectacle in recent crypto history. One side blends tech geeks and viral memes, turning Solana into a creative “meme factory”; the other combines Binance’s traffic power with Eastern meme culture, transforming BSC into a high-stakes speculative casino. Together, they’ve driven meme culture forward while exposing its bubbles and risks. Looking ahead, both ecosystems may mature and coexist long-term, continuing to inject fresh users and narratives into the industry. But regardless of market shifts, investors should maintain humility and engage rationally.

About Us

TechFlow Research, the core research arm of Hotcoin Exchange, is dedicated to turning professional analysis into practical tools for your trading success. Through our “Weekly Insights” and “Deep Dive Reports,” we unpack market dynamics. Our exclusive column “Top Picks” (powered by AI + expert screening) helps you identify promising assets and reduce trial-and-error costs. Every week, our analysts host live streams to discuss hot topics and forecast trends. We believe that informed guidance paired with human touch empowers more investors to navigate market cycles and seize Web3’s value opportunities.

Risk Disclaimer

Cryptocurrency markets are highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate under strict risk management frameworks to safeguard capital.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News