Healing from the Crypto "Downturn": How to End the Meme Coin Value Funnel?

TechFlow Selected TechFlow Selected

Healing from the Crypto "Downturn": How to End the Meme Coin Value Funnel?

The responsibility does not lie with the current providers, but with consumers who need to evolve; the market will naturally adapt.

Author: @0xIT4I

Translation: AididiaoJP, Foresight News

All memecoins are ultimately destined to decline—they are tokenized representations of trends, and trends are inherently meant to be replaced.

Occasionally they reflect certain social movements, but human history shows that even movements rise and fall. Only a rare few withstand the test of time (e.g., DOGE, SPX).

Ghibli-style Hype Wave, March 25–27, 2025

Shitcoins are the basement of the crypto world—permanently filled with pump-and-dumps, rug pulls, scams, bundled trades, and insider manipulation. That’s its nature. Yet these are precisely why we love this basement: without risk there is no edge, and edge is the foundation of this fiercely competitive market we thrive in. This article won’t change the macro environment, but it might shift the ground beneath our feet.

Monetary policy and waves of innovation are the two forces shaping each cycle. Policy determines how much oxygen the market has; innovation decides whether there’s anything worth breathing. Current policy is tightening, and apart from the real-world AI chip boom, our sector lacks new catalysts (perhaps privacy and perpetual DEXs count, but they’re distant from grassroots battlegrounds), so market performance aligns with expectations.

Before expressing an opinion, ask yourself: how much of your view stems from fear over depreciating holdings or anxiety about declining business revenue? This piece isn't an attack on infrastructure builders like @Pumpfun or @AxiomExchange—I admire @a1lon9 and work closely with many outstanding founders in the space under discussion.

My goal is user empowerment: delivering knowledge that could become the foundation of the next competitive landscape, ultimately promoting fairness and repairing fixable parts of the industry.

Core Problem

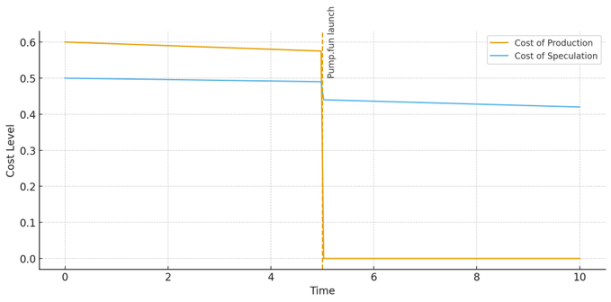

The fundamental contradiction in today’s memecoin space lies in the massive imbalance between production cost and speculation cost.

Zero-cost token creation brought positive effects: lowered barriers for external builders, broke technical monopolies, and fostered a more competitive and open market.

But the resulting gap between production and speculation is unsustainable. This structure acts like a system vulnerability—value drains faster than it accumulates.

The issue isn’t limited to launch platforms or trading terminals—it runs deeper into the project layer.

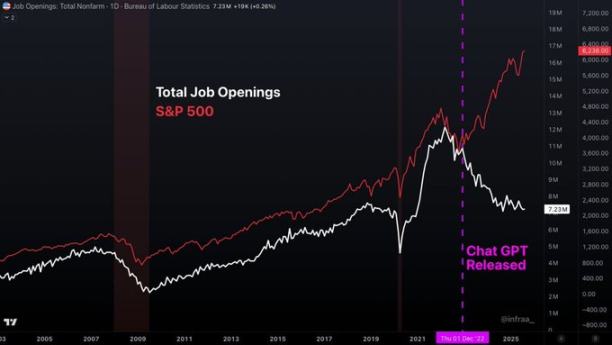

AI has shattered professional barriers: work that once took Harvard technocrats three months can now be done by a teenager in Australia within a week. The decades-long link between labor and growth has already broken.

This has profound implications, but in the context of this article, it exacerbates the same issue: production hasn't just become cheap at the token issuance level—it's also cheapened across project operations and content creation.

The broken link between labor and growth means "shitcoin flooding" has spread across every blockchain.

Current Speculation Ecosystem Landscape

Trading terminals like @AxiomExchange, @gmgn_ai, and Telegram bots such as @SigmaTrading (where I proudly serve as advisor) and @MaestroBots all charge around 1% fees. Launch platforms like @Pumpfun charge approximately 1% before tokens reach $3–4 million market cap (most never break through). Four.meme also charged 1% prior to migration. According to @bonkfun website data, $2.4M trading volume over the past 24 hours generated $23K in fees—still roughly 1%.

Thus, the de facto industry standard for grassroots speculation is 2% (1% launch fee + 1% terminal fee).

For comparison, spot trading fees on major coins:

-

@binance 0.10% / 0.10%

-

@krakenfx 0.16% / 0.26%

-

@okx 0.08% / 0.10%

Of course, I know large traders and KOLs get rebates, and centralized exchanges have tiered volume-based rates. Let’s generously estimate:

The fee gap remains 10–15x.

So ordinary retail investors pay 10–15 times more to buy cheaply produced assets than institutional investors pay for hard-to-produce ones?

If that doesn’t strike you as a problem, maybe go back to playing Fortnite.

How Did We Get Here?

Multiple reasons: network effect barriers from competition, early-stage market dynamics, inexperienced young participants, builder capability gaps, or bad intentions.

But at its core, it’s due to the unique culture of this space.

Most tokens represent "trends"—holding them feels like joining a "team," "movement," or "cultural circle."

Participants mistakenly extend this cultural identity to infrastructure choices, prioritizing sentiment over efficiency and fairness.

Project teams fully understand this—and exploit it for profit.

It’s like a small Eastern European football club: willing to spend money on flags and merch, but refusing to roof the stadium; happy to watch games in the rain, losing potential fans who value comfort.

Imagine Bitcoin maximalists proving their point by paying 15x fees on an exchange called “No Second Best”—absurd, right?

Solutions

You can only fix what you understand. While no perfect solution exists, criticism without constructive input is meaningless.

My suggestions fall into two categories: users and providers.

Users need collective action: read and share content like this, define what “better” means, and actively demand it. Give new platforms a chance—test them, provide feedback. You might discover the next big opportunity. Find a competitor with lower fees? Try it immediately. If enough people do, the market will naturally rebalance toward fairness.

For providers, reform requires greater courage:

Launch platforms and trading terminals will eventually converge toward 0.1% fees—aligning with traditional financial markets. Though inevitable, it may be premature today. Therefore, I suggest:

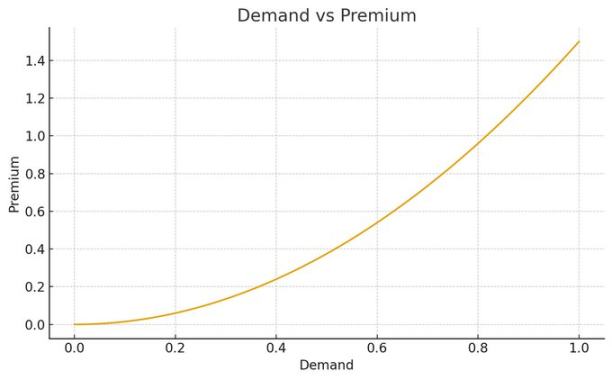

Fees should dynamically match demand—a standard logic in modern service industries:

-

Hotels raise prices during holidays

-

Electricity costs rise during heatwaves

-

Delivery fees increase in heavy rain

-

Shipping costs spike during trade peaks

-

Shorting fees rise during exploit outbreaks

-

Gas fees climb when Bitcoin or Ethereum networks congest

Countless examples prove: dynamic balance ensures sustainability.

So why should we pay 2% to speculate on ignored shitcoins?

A simple formula to assess “demand”: trading volume ÷ time × market cap. This reflects the intensity of trading demand for an asset at a given moment. Note: the core is trading demand—not the asset’s intrinsic value.

-

There is trading demand → charge base premium

-

High demand → increase premium

-

Dormant high-potential coin → zero fees

This approach creates multiple positive effects:

-

Incentivizes early value discovery—low fees during potential stages

-

Rewards early finders with first-mover advantage

-

Motivates project teams to execute roadmaps—earn hype through results

-

Directs capital toward quality assets—make empty hype self-sustaining via higher costs

-

Extends price cycles, reduces volatility by curbing FOMO, enabling healthier growth

For trading terminals and bots, the challenge is even greater.

We can learn from @vnovakovski’s model via @Lighter_xyz revolutionizing perpetual DEXs: free core features + paid premium services.

-

Need low latency? Upgrade to Pro

-

Want API access? Subscribe

-

Multi-wallet management?

-

Accumulating airdrop points?

Many options exist—be creative.

Dear terminal operators, face reality: user loyalty is nearly zero. When most platforms’ revenues have dropped over 90% from peak levels, the next wave will bring someone—either you or your competitor—offering the same technology with fairer terms.

“I’m a realist. Not doing it for honor. Doing it for money.”

Final Chapter

The next industry windfall belongs to those who resist greed. Charge less, earn more—that’s the inevitable law of modern markets. Platforms that align with users’ fundamental desire for fairness will win the future.

Users must demand better—and that requires cognitive upgrade. The responsibility doesn’t lie with current providers, but with consumers who need to evolve. The market will adapt accordingly.

Solutions aren’t limited to what’s outlined here. This is merely one path I firmly believe in.

I’ll always be grateful to Pumpfun, Trojan, and Banana Bot—they were the foundation of my growth. But times change, and so does responsibility.

My core message is this: recognize and drive the inevitable change.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News