WEEX Labs: Meme Sector Leads the Rally, What Are the Highlights of This Market Rebound?

TechFlow Selected TechFlow Selected

WEEX Labs: Meme Sector Leads the Rally, What Are the Highlights of This Market Rebound?

Market liquidity is not entirely locked up by the meme sector; instead, it is replenishing high-quality assets that have been excessively oversold and possess sustainable growth narratives through the heat brought by memes.

Summary: The current rebound in the cryptocurrency market is notably characterized by the Meme sector leading the gains. After nearly three months of correction, the overall market cap of Meme coins has risen by approximately 30%. Currently, value narrative sectors such as PayFi, AI, and DePIN are taking over as the leaders.

This indicates a rapid recovery in market risk appetite, with liquidity spreading from sentiment-driven Meme coins to quality assets backed by sustainable growth narratives.

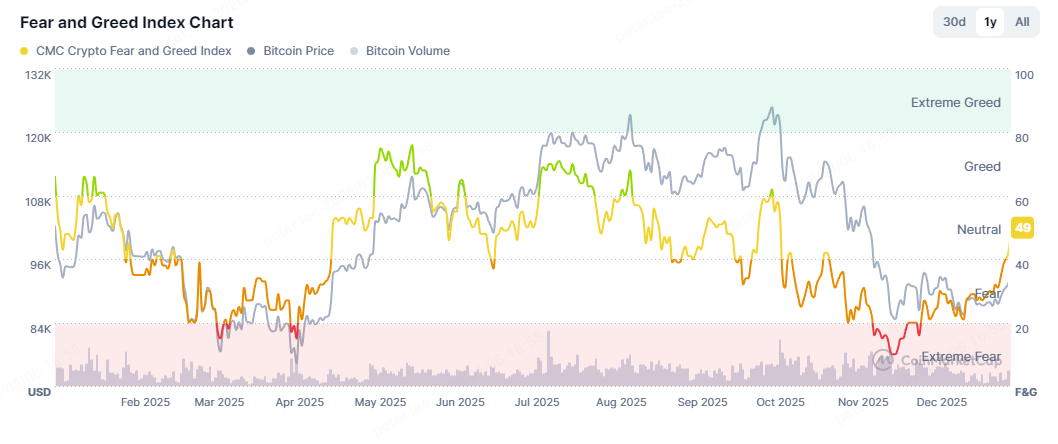

After nearly three months of volatile correction, the cryptocurrency market has finally experienced a long-awaited broad-based rally.

Notably, this rebound exhibits a clear "staggered rhythm": the Meme sector, acting as a sentiment vanguard, took the lead at the beginning of this month, with its overall market cap rising by about 30%. While it is still premature to discuss a full-fledged bull market rally, the recent market action undoubtedly sends a clear signal of rapidly recovering risk appetite.

Source: https://coinmarketcap.com/zh/charts/fear-and-greed-index/

Delving deeper into this market movement, we can identify three distinct characteristics:

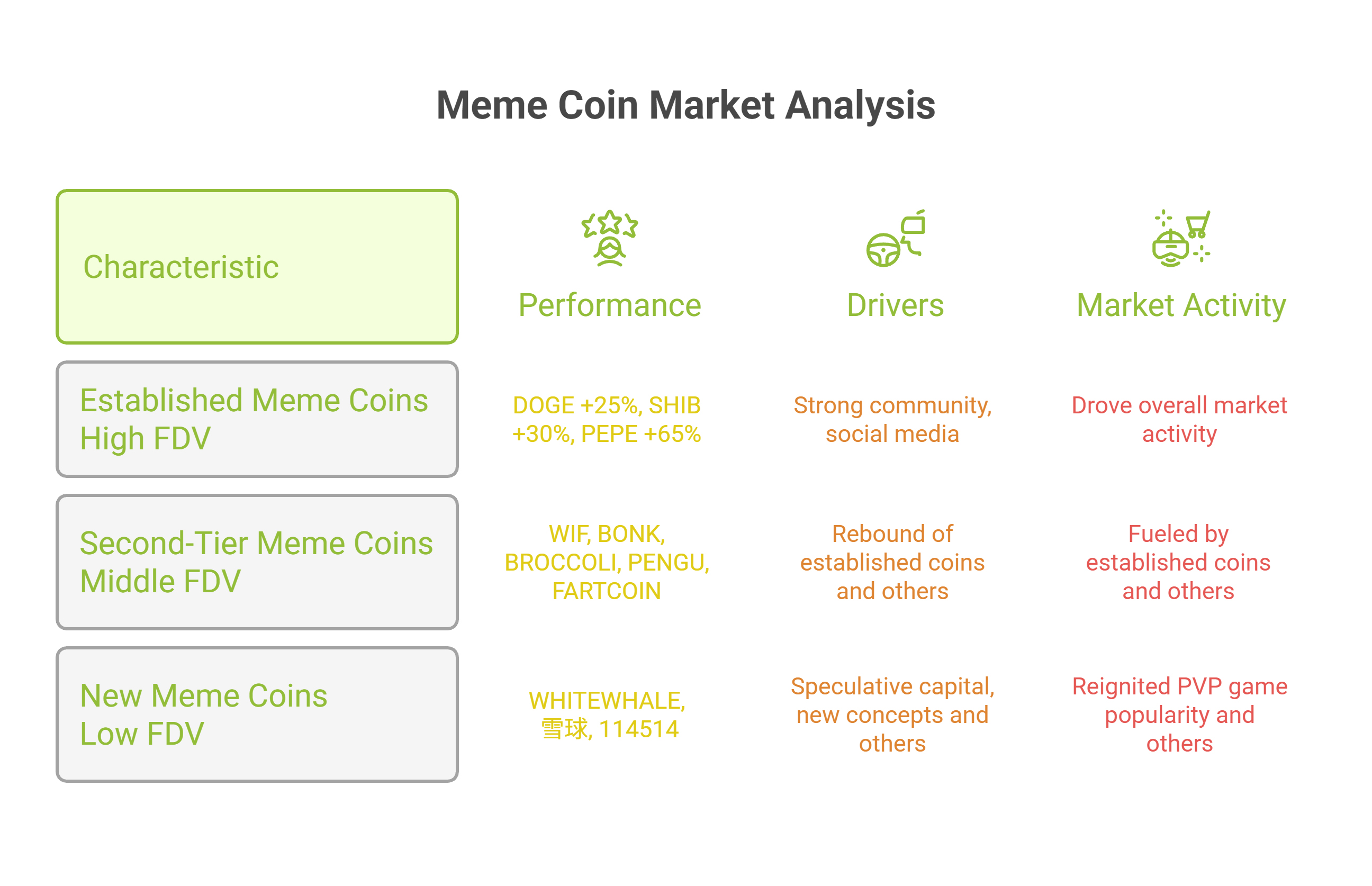

First, high-liquidity established Meme coins first captured the high ground, establishing a wealth effect. This rebound did not stem from indiscriminate surges of on-chain Meme coins but was initiated by established, high-market-cap Meme coins like Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE). Among these, PEPE surged by 65% this month, becoming the sector leader.

Leveraging their solid community foundations and the amplification power of social media, these projects quickly recovered their losses after the market stabilized and successfully triggered catch-up rallies in blue-chip coins like WIF, BONK, BROCCOLI, and PENGU.

Second, on-chain activity began to recover, reigniting PVP (Player vs. Player) trading fervor. The explosive rise of blue-chip Meme coins opened up the market's imagination, prompting speculative capital to seek more explosive "new concepts" on-chain.

From WHITEWHALE, paying homage to OG traders, to "Snowball" capitalizing on social media buzz, to 114514, bearing the mark of internet subculture, these new concept coins were rapidly speculated upon and repeatedly hit new highs in a short period.

Although such assets lack traditional logical support, their underlying "cultural consensus" and "viral propagation" precisely align with the core DNA of Meme coins: "dissolving seriousness, consensus is king." In reality, the core appeal of Meme coins lies in their entertainment value and viral nature, not rigorous logic, which explains their rapid rise driven by sentiment.

Finally, the capital spillover logic is clear, with value sectors already showing signs of taking the baton. Although the Meme sector still retains some warmth, today's market shows that practical narrative sectors like PayFi, AI, and DePIN have begun to lead the gains. Standout performers such as Ripple (XRP), Stellar (XLM), and Render (RENDER) are also mostly mature projects that have weathered multiple market cycles.

In fact, this signal of capital spreading from "sentiment-driven products" to "value logic" is highly instructive: it indicates that market liquidity is not entirely locked within the Meme sector. Instead, leveraging the heat brought by Meme coins, it is flowing back to oversold, quality assets with sustainable growth narratives.

In summary, although discussions about Altcoin Season or Memecoin Season are not as fervent as before, recent performance proves that structural opportunities remain abundant. On one hand, Meme coins have evolved into the market's "risk thermometer" and may continue to serve as a leading indicator for sentiment recovery and liquidity return. On the other hand, capital is shifting from pure speculation back to "narratives with support"—even for Meme coins seen as speculative, it's the established ones with stronger consensus that are being targeted first. This suggests the future market will likely present a structural bull run dominated by value regression, supplemented by sentiment catalysts. This aligns closely with our judgment in "Looking Ahead to 2026, What Significant Opportunities Are You Bullish On?".

Next, let's wait and see whether capital will rotate to the RWA or DeFi sectors to speculate on those blue-chip value coins.

Note: All tokens mentioned above have spot trading pairs available on WEEX. The mentioned tokens are solely for describing market conditions and do not constitute investment advice or conclusions from the author.

About Us

WEEX Labs is the research department under WEEX Exchange, dedicated to tracking and analyzing cryptocurrencies, blockchain technology, and emerging market trends, providing professional assessments.

The team adheres to principles of objective, independent, and comprehensive analysis. Through rigorous research methods and cutting-edge data analysis, we aim to explore frontier developments and investment opportunities, delivering comprehensive, rigorous, and clear insights for the industry, and providing all-around construction and investment guidance for Web3 startups and investors.

Disclaimer

The views expressed in this article are for reference only and do not constitute an endorsement of any products or services discussed, nor do they constitute any investment, financial, or trading advice. Readers should consult qualified professionals before making financial decisions. Please note that WEEX Labs may restrict or prohibit all or part of its services from restricted regions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News