On-chain fees surpass Ethereum; is SOL really going to take ETH's place?

TechFlow Selected TechFlow Selected

On-chain fees surpass Ethereum; is SOL really going to take ETH's place?

How did Solana become the most popular blockchain in 2024?

Author: Joyce

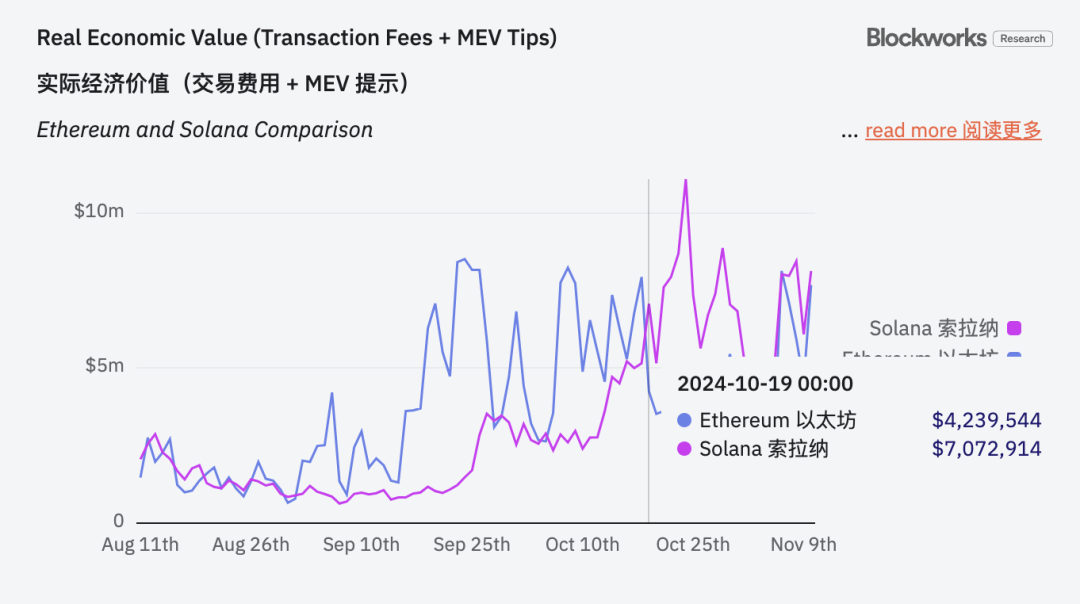

Recently, with the consecutive listings of memes such as Goat, Pnut, and Act on Binance, the Solana ecosystem has experienced a new wave of enthusiasm. According to statistics from Blockworks Research, since October 19, 2024, Solana's daily on-chain fees have consistently exceeded those of Ethereum, reaching over ten million dollars in revenue on October 24. The booming meme sector has driven continuous capital inflow into the Solana ecosystem, making it currently the hottest ecosystem in the industry.

It must be said that Solana is indeed the most talked-about blockchain in this bull market cycle—first dominating the DePIN trend with more than half of the standout projects emerging from its ecosystem, followed by successive waves of meme mania. It’s been anything but quiet.

So where exactly does Solana’s current high yield come from? And how sustainable is this explosive growth?

Overview of Solana’s On-Chain Fees

Similar to Ethereum, Solana’s on-chain income includes base transaction fees and MEV tips. After Ethereum implemented the EIP1599 proposal, all base fees are burned, while MEV tips are directly rewarded to validators. Solana has a similar burning mechanism, burning a fixed percentage (initially set at 50%) of base fees and distributing the remainder to validators.

Therefore, when comparing on-chain revenues between Ethereum and Solana, the burned base transaction fees are still included in total income calculations.

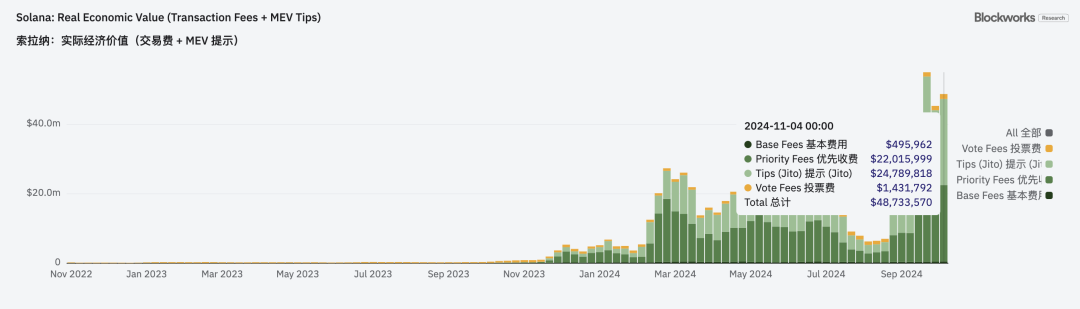

In detail, Solana’s on-chain income consists of base fees, priority transaction fees, tips (Jito), and voting fees, as shown in the chart below.

From the trend of Solana’s daily on-chain fees shown in the chart above, compared to the other two categories, base transaction fees and voting fees haven’t changed significantly. However, priority transaction fees and tips have seen rapid growth since March this year.

What exactly are these two types of fees? Priority fees are straightforward—they are additional payments users make to speed up their transactions, typically added during submission. Tips (Jito), on the other hand, are extra payments made directly to validators, usually for MEV-related transactions and targeted routing.

The sharp rise in both indicates increased network activity on Solana, growing DeFi usage causing congestion, users’ willingness to pay higher priority fees for faster execution, and more MEV opportunities captured by validators through optimized transaction ordering.

Then, what specific DeFi activities are driving Solana’s on-chain traffic? Is it entirely meme-driven?

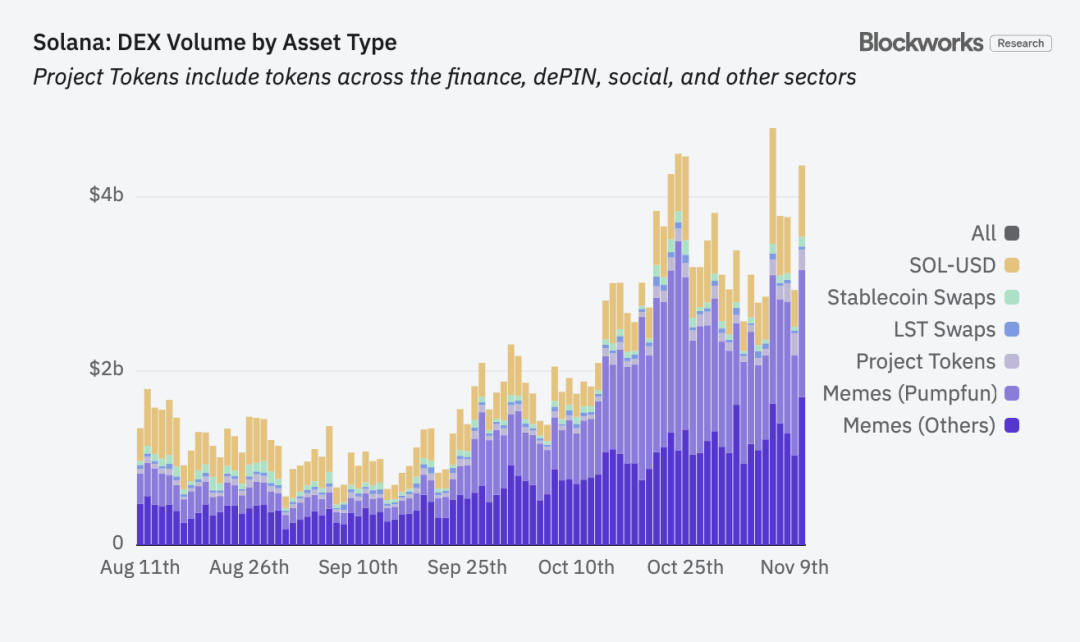

Data from the chart clearly shows that Solana’s on-chain transactions mainly consist of Memes (Pumpfun), Memes (others), project tokens, LST tokens, stablecoins, and SOL trades. Project tokens include not only the listed categories but also DePIN, SocialFi, and others.

Over the past two months, the share of meme-related trading volume has risen from 48% to 74%. Of course, the significant drop in other categories doesn’t mean their absolute volume has decreased—during this bullish period, trading volumes of project tokens, LSTs, stablecoins, and SOL have all grown substantially. However, the surge in meme trading has been extraordinary, increasing by 667% over the last two months, which makes other categories appear proportionally smaller.

This corroborates earlier data—driven by the explosive growth in meme trading and the belief that “time is money” within meme trading culture, users are naturally more willing to pay priority fees. And the more active on-chain trading becomes, the greater the MEV opportunities grow.

Active Dapps on Solana

1) DEXs

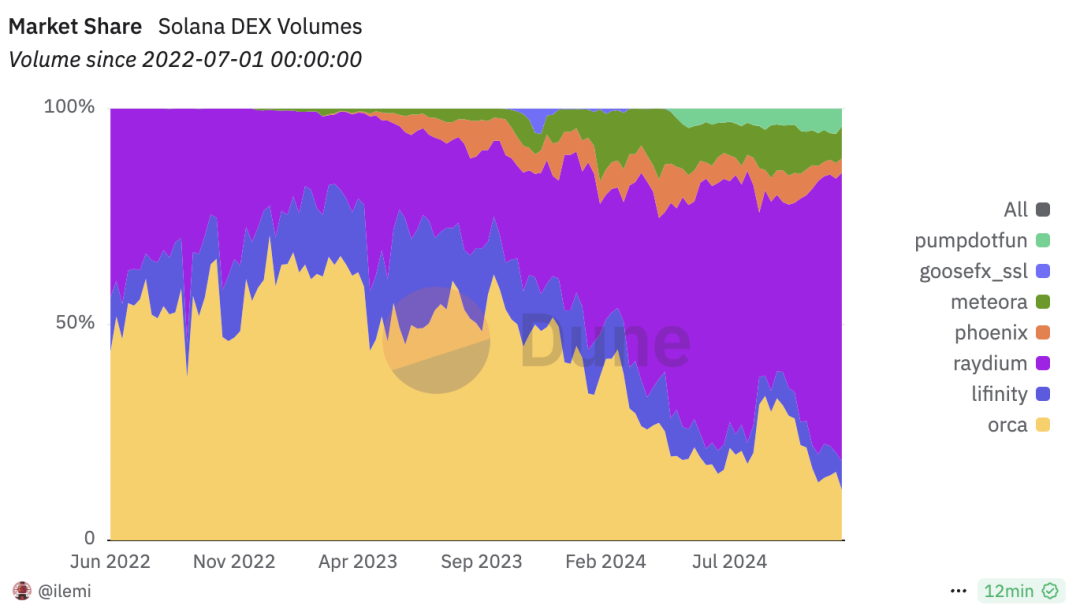

Currently, meme trading dominates Solana, so naturally, DEXs are the most active dapps. Among all DEXs in the Solana ecosystem, Raydium is currently the most popular. As shown in the chart below, Raydium, deeply tied to the meme boom, now accounts for 63.5% of the entire Solana ecosystem’s trading volume. Orca, which once held an overwhelming lead in the Solana ecosystem, has seen its market share steadily eroded by the surge in meme trading, dropping from over 60% to around 15% today.

PumpFun, as a meme launchpad, has also seen its built-in meme trading function account for nearly 5% of total trading volume during this meme explosion, with a gradually increasing trend.

DEX Market Share in Solana Ecosystem, Source: Dune.com

2) Aggregator DEXs and Trading Bots

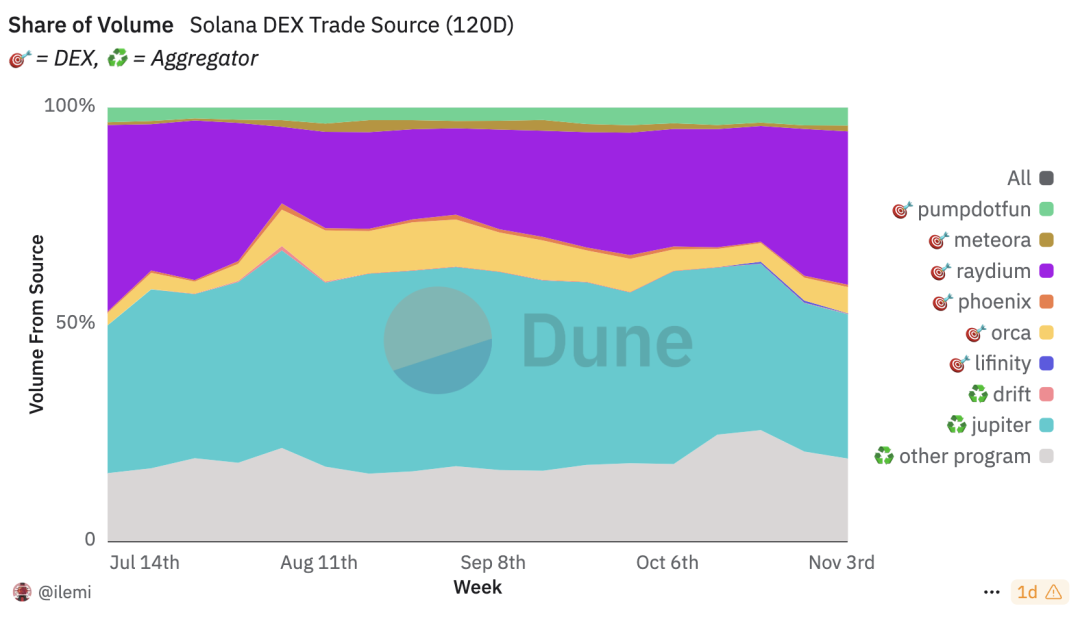

Besides direct DEX trading, aggregator DEXs and trading bots are also highly active in the Solana ecosystem. The chart below shows DEX market share broken down by transaction source. Latest data indicates Jupiter accounts for 33% of trading volume, while other protocols—including trading bots—account for 19%.

Solana DEX Market Share by Transaction Source, Source: Dune.com

Jupiter, the largest aggregator DEX in the Solana ecosystem, has recently reached a new high with TVL surpassing $1.57 billion—and it’s been particularly active lately:

-

On October 2, a proposal to use unclaimed 230 million JUP tokens to extend and fund the Active Stake Rewards (ASR) program was approved, extending ASR rewards for another year;

-

On October 8, it launched a mobile app supporting Apple Pay, credit cards, and other payment methods, seen as a new fiat on-ramp;

-

On October 17, it introduced the Solana MemeCoin terminal “Ape Pro,” aiming to provide MEV protection and reduce sandwich attacks in trading;

-

Following these moves, the JUP token price has remained strong.

Beyond aggregators, trading bots in the Solana ecosystem are also extremely active, contributing over 10% of total transactions. The top four earners are Photon, Trojan, BONKbot, and Banana Gun. Photon generated $29.85 million in revenue over the past thirty days, becoming the second-highest earning protocol in the Solana ecosystem after Solana itself. Excluding Solana mainnet and Pump protocols, the remaining three spots among the top five highest-earning protocols in Solana are all occupied by trading bots—demonstrating their exceptional revenue-generating power.

Top-Earning Protocols in Solana Ecosystem, Source: DefiLlama

3) Other Dapps

Despite the intense focus on meme-related DEXs, aggregators, and trading bots during this meme season, the overall surge in Solana activity has also boosted protocols involving staking, restaking, lending, borrowing, and leverage, as SOL’s price continues to climb. Below are some of the currently trending dapps.

Jito

Jito is now the DApp with the highest TVL in the Solana ecosystem, exceeding $3 billion—over one-third of Solana’s total ecosystem TVL. Jito allows users to deposit SOL or LST tokens for restaking. Compared to other staking protocols, Jito’s key differentiator is its MEV suite: it captures MEV revenue from transactions across the Solana ecosystem and distributes it to stakers, thereby increasing their yields.

Jito’s restaking deposit cap has now reached the hard limit of $25 million, indicating that the upper limit will be raised in phase two to meet growing user demand.

Kamino

Kamino is a leading yield platform for stablecoins and LST assets in the Solana ecosystem, integrating lending, liquidity provision, and leveraged strategies. Its total protocol TVL has reached $2 billion.

Kamino supports one-click auto-compounding concentrated liquidity strategies, enabling users to maximize returns through controlled borrowing. Additionally, Kamino plans to launch Lend V2 in Q4 this year, allowing permissionless creation of various lending markets to serve broader user needs, along with introducing automated single-asset lending vaults and cross-market liquidity aggregation, aiming to become the foundational financial layer on Solana.

Marinade

Marinade is another liquid staking protocol in the Solana ecosystem, currently ranking fifth with a TVL of $1.79 billion, just behind Raydium. However, despite being in the same category as Jito, Marinade’s yield performance lags significantly. Recently, Marinade has been actively promoting institutional-grade Solana staking services, driving its TVL up nearly 50% over the past six weeks.

Summary

The meme craze has undoubtedly fueled the entire Solana ecosystem, most directly reflected in Solana’s on-chain revenue and user engagement.

However, memes are ultimately a product of specific conditions during a bull market. Once a bear market arrives and meme activity slows, maintaining Solana’s leading position among blockchains will become a critical challenge. Just like the NFT boom before it—after the party ends, there’s often little left behind. Can Solana leverage the current meme momentum to build a healthier, more sustainable revenue structure for its ecosystem?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News