DiamondHands: A Comprehensive Breakdown of AVAX, from Consensus to Subnets, Dynamics and Project Sharing

TechFlow Selected TechFlow Selected

DiamondHands: A Comprehensive Breakdown of AVAX, from Consensus to Subnets, Dynamics and Project Sharing

Avalanche: An open platform ideal for deploying DApps and enterprise-grade blockchains.

Surprisingly, although the core operational mechanism is extremely simple, these protocols yield highly idealized system outcomes, making them suitable for large-scale deployment.

——Avalanche Platform Whitepaper

The battle among Layer 1 blockchains continues. Recently, Terra has been shining brightly due to Luna hitting new all-time highs and its founder Do Kwon's high-profile bets. Cosmos remains resilient despite unfavorable market conditions and has garnered significant attention thanks to anticipated airdrops.

Meanwhile, Avalanche—a Tier-1 blockchain—has seemed somewhat silent lately.

Although subnets have sparked discussions, the market appears unclear about their potential or Avalanche’s overall vision.

Avalanche’s recently announced $290 million Multiverse incentive program has also seen parts overlooked by the “market.” As long-term observers of Avalanche, we believe these overlooked details actually highlight Avalanche’s clear vision and development potential.

This article will start from first principles to explain what Avalanche is, what subnets are, recent market moves by Avalanche, and several projects worth watching. The views expressed are personal and not investment advice. Feel free to join our Avalanche community at the end of this article to discuss further.

This article will not cover tokenomics, locked value, or similar topics. For those aspects, we recommend Galaxy Digital’s excellent piece titled Galaxy Digital Research on AVALANCHE, which covers these areas thoroughly. Reading it alongside this article would enhance your understanding.

What Is Avalanche?

Snowball + DAG: Avalanche is an open platform.

Avalanche defines itself as: an open platform suitable for deploying DApps and enterprise-grade blockchains. Because Avalanche supports the deployment of many blockchains, when comparing it with other Layer 1 chains, it's more appropriate to compare it with multi-chain parallel projects like Polkadot and Cosmos in the long term.

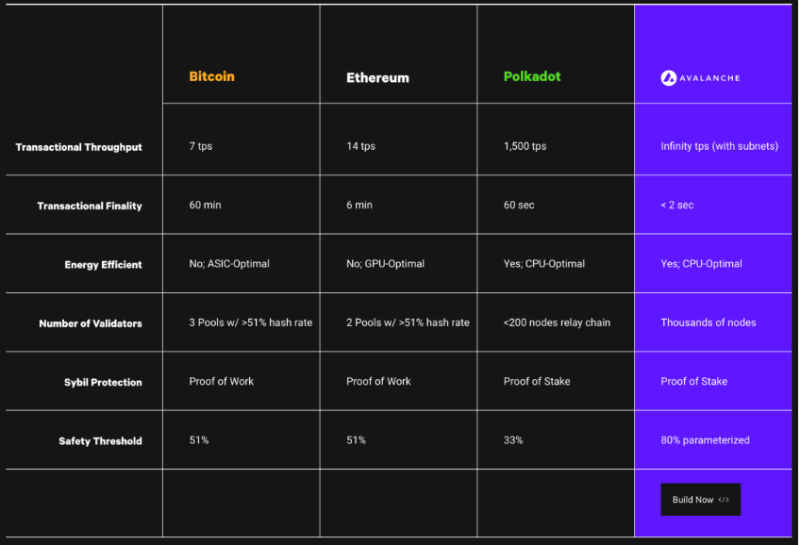

In terms of native chain performance, Avalanche also performs relatively well in transaction speed and decentralization. Even as the number of nodes increases, transaction speed and security remain largely unaffected. Compared to Cosmos, aside from Avalanche’s efforts in bringing traditional finance on-chain (discussed later), each subnet requires staking 2,000 AVAX, leading to stronger value accrual for Avalanche’s native token.

Avalanche’s key differentiator from other blockchains lies in its consensus protocol, which we’ll now explore.

The Evolution of Avalanche Consensus

Slush → Snowflake → Snowball → Avalanche: From simple repeated sampling to complete consensus.

Consensus refers to the process by which a series of independent voters (i.e., validators) reach agreement on a decision.

Traditional consensus protocols fall mainly into two categories:

1. Classical Consensus Protocols

2. Nakamoto Consensus

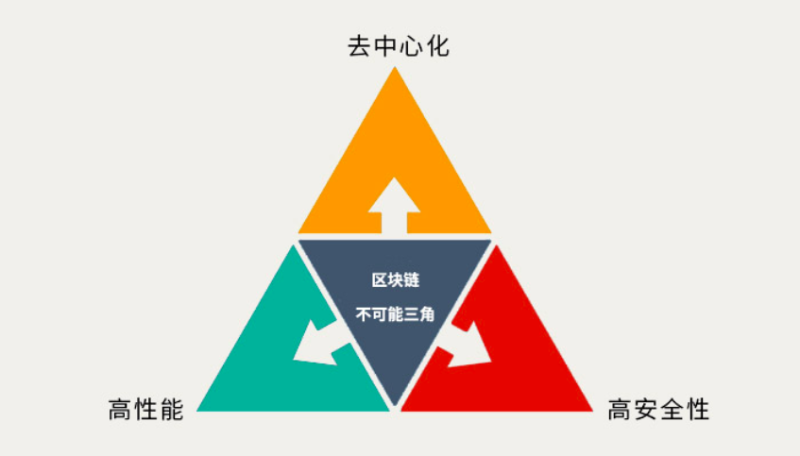

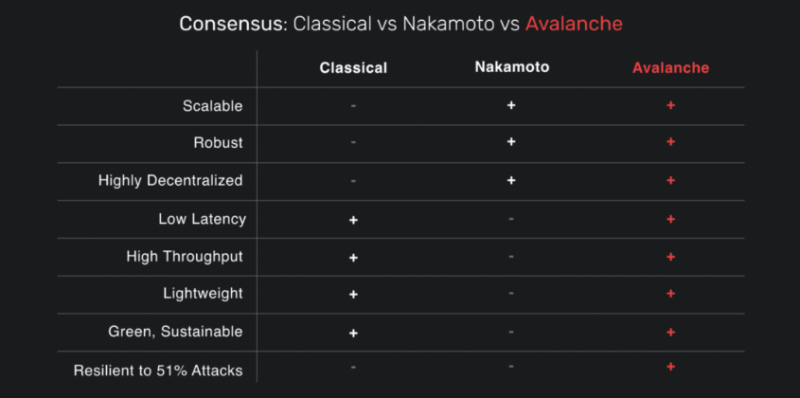

However, both make trade-offs regarding scalability and transaction speed, giving rise to the oft-discussed blockchain trilemma—decentralization, high performance, and high security cannot be simultaneously achieved.

Avalanche’s consensus mechanism claims to break the constraints of the blockchain trilemma. Below is the official comparison of different consensus mechanisms.

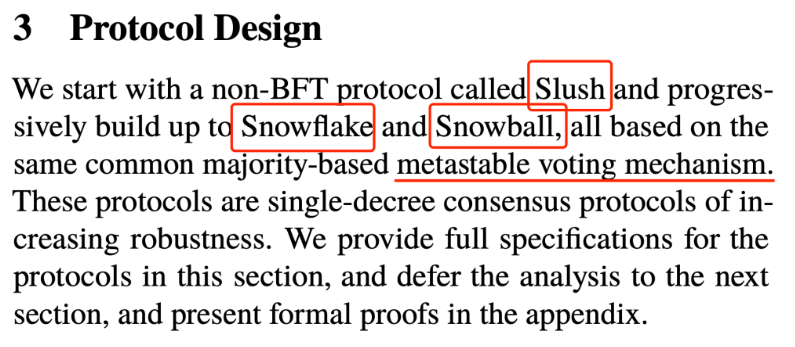

Avalanche’s consensus formation consists of four stages: Slush, Snowflake, Snowball, and finally the Avalanche consensus protocol formed by combining Snowball with DAG.

Before diving into the evolution of consensus, readers familiar with Avalanche may have heard the term "metastability."

Metastability refers to a state where a flip-flop fails to reach a definite state within a specified time period. This concept is closely tied to Avalanche’s repeated subsampling. Let’s begin with Slush.

Stage One: Slush — Introducing Metastability Through Simple Repeated Sampling

This is the foundation upon which Avalanche evolves. Slush draws inspiration from the Gossip Protocol (also known as the Epidemic Protocol), which Bitcoin uses to broadcast transactions and blocks.

To illustrate the Gossip Protocol vividly: imagine how rumors spread or how you hear gossip—usually one person tells you “what’s the news?”, then you pass it on to others, and eventually everyone knows.

Image credit: Zhihu user @juniway

Slush optimizes this “rumor-spreading” process by repeatedly verifying the rumor’s authenticity with peers until deciding whether to believe it. This process is called repeated subsampling.

At its core, assume you have three states:

1. Undecided: You haven’t received the information yet—you don’t know the rumor;

2. Believe: You believe the rumor is true;

3. Disbelieve: You believe the rumor is false.

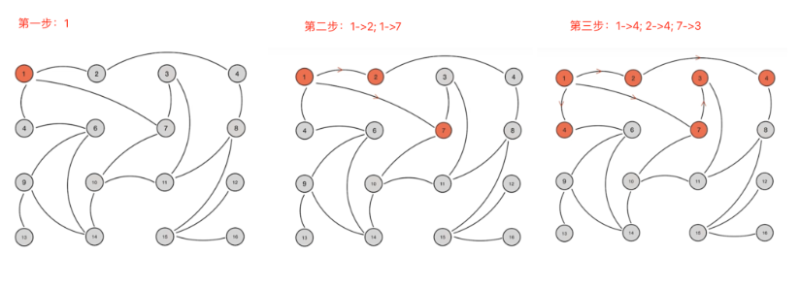

As an uninformed node, you go through the following steps to reach consensus:

a) Begin sampling with an initial belief or disbelief;

b) Sampled nodes return whether they believe or disbelieve;

c) Following majority rule, if most responses are “believe” (e.g., 3:2), the sampling node chooses “believe”; if most are “disbelieve” (e.g., 1:4), it chooses “disbelieve.”

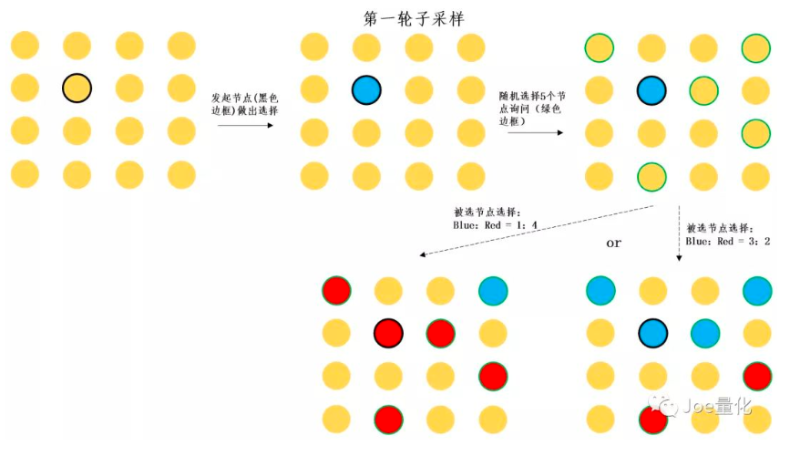

Node diagram provided by Zhihu user @JoeQuant-Jackal

For security, multiple rounds of sampling occur. Only after several consecutive consistent results does a node finalize its state change. The dynamic sampling process is shown below:

Diagram provided by Zhihu user @JoeQuant-Jackal

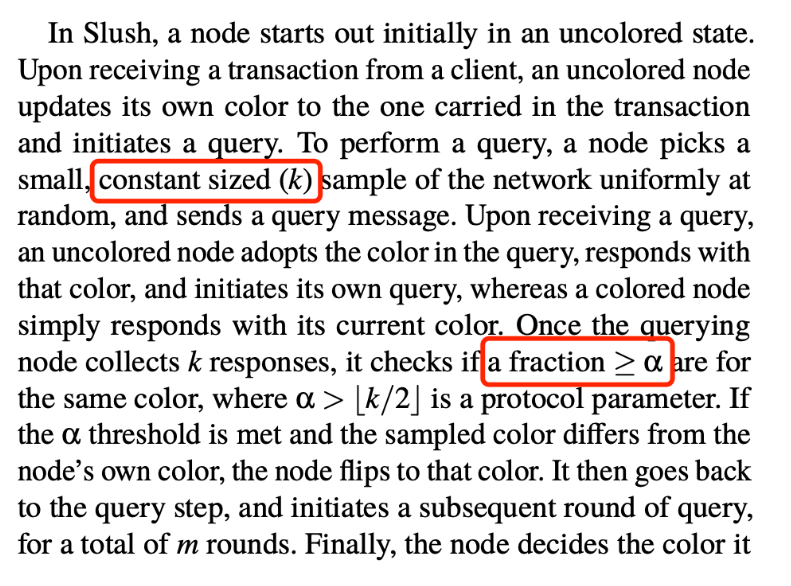

The number of nodes sampled and required consecutive matches correspond to parameters k and α mentioned in the whitepaper.

However, this sampling approach faces one issue:

If malicious nodes switch to the opposite state, preventing the sampling node from reaching final confirmation, network security is compromised.

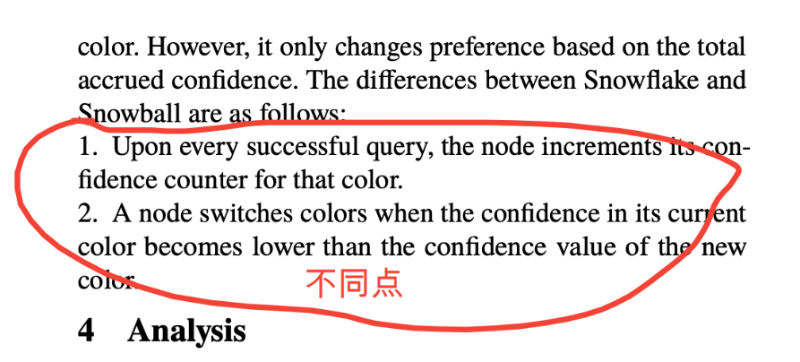

To address this, Snowflake adds a counter to Slush.

Stage Two: Snowflake — Adding a Counter to Track Historical Consensus Counts

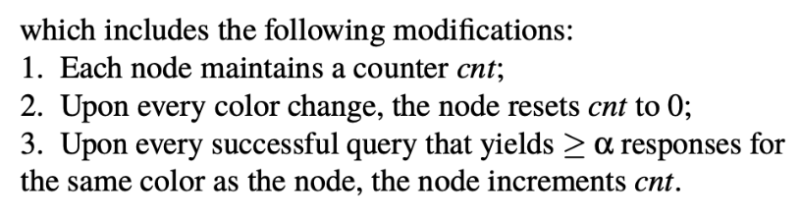

One feature of Slush is being memoryless—nodes only retain their final state, not sampling history. Snowflake introduces counters that track “consecutive matching sample counts.” Execution works as follows:

- Add a counter to each node;

- If the current sample differs from the previous, reset the counter to 0;

- If the current sample matches the previous, increment the counter by 1;

Once the “number of consecutive matching samples α” exceeds a predefined threshold β, the state is confirmed.

The benefit is that even if occasional incorrect samples occur, a node can still switch states if its accumulated α > β.

But this confirmation method still has a flaw—if malicious nodes frequently disrupt, the counter resets repeatedly, causing some nodes to endlessly resample without reaching consensus.

To solve this, Snowball improves upon Snowflake by replacing the counter with a confidence metric.

Stage Three: Snowball — Adding Confidence to Measure Historical Validation Quality

The core problem with Snowflake is that malicious nodes resetting the counter prevent consensus.

With the “confidence counter,” nodes no longer change state or reset the counter on a single mismatch. Instead, they reduce their confidence level. Color changes depend on confidence values.

This gives rise to the Snowball consensus, one of Avalanche’s core innovations.

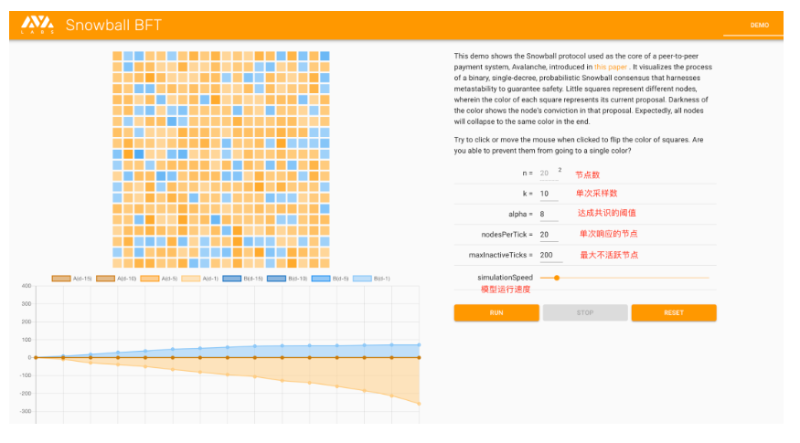

Interested readers can try the Snowball consensus demo, where dragging the mouse simulates malicious nodes.

Avalanche builds further upon this foundation.

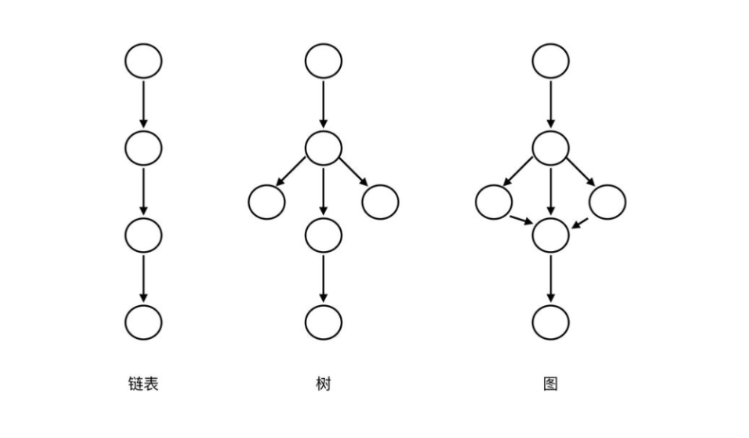

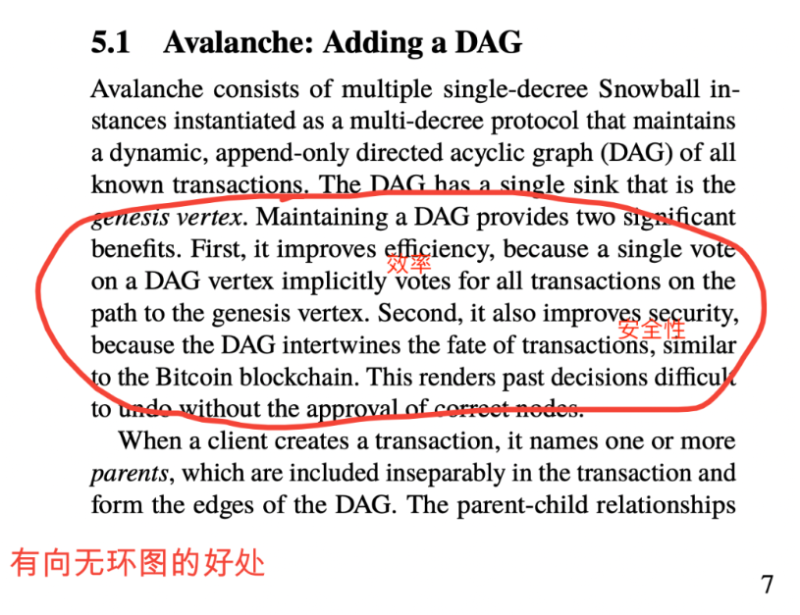

Stage Four: Avalanche — Integrating DAG to Enhance Transaction Efficiency and Security

To make the network more efficient and secure, Avalanche integrates the concept of DAG into Snowball.

DAG: Directed Acyclic Graph.

Blockchain data structures are linear (linked lists), while DAG is a graph structure, enabling parallel transaction processing and faster speeds.

Image credit: Zhihu user Peter Wang Guangzhong

Another advantage: since each transaction has a directed link (the “directed” aspect), parent-child relationships between transactions become interwoven. Tampering with one transaction increases complexity and cost, enhancing security.

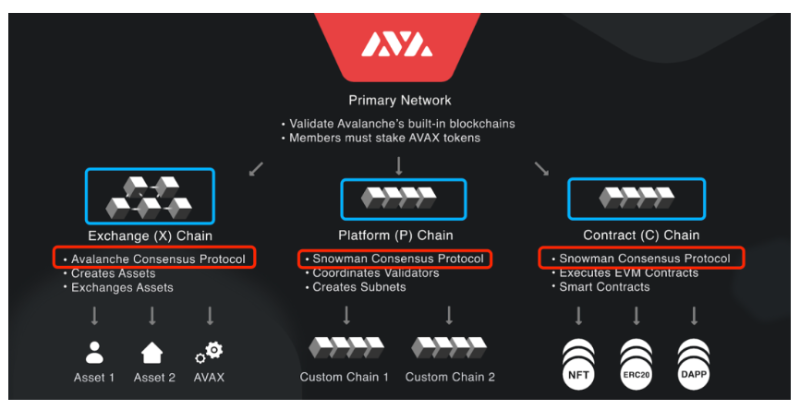

Thus, Snowball + DAG forms the Avalanche consensus protocol. Note: Not all three Avalanche chains use Avalanche consensus.

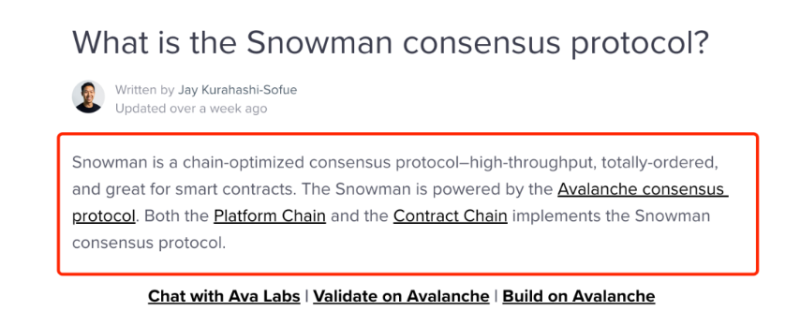

Since P-Chain and C-Chain data remain linear, Avalanche consensus applies only to X-Chain transactions. P-Chain and C-Chain use Snowman, a linear consensus customized for Avalanche.

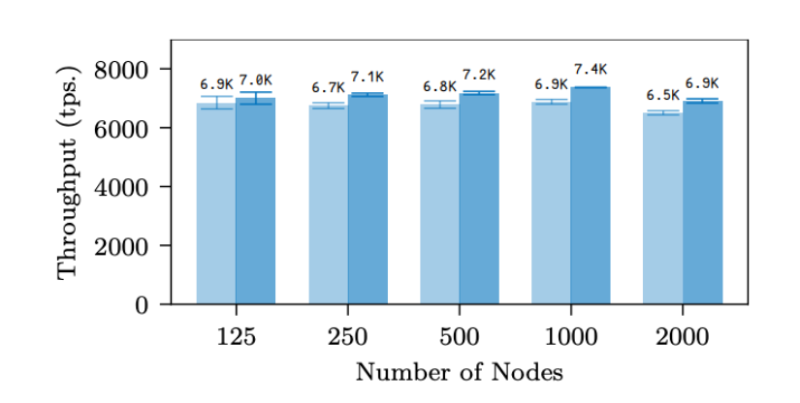

Based on Avalanche and Snowman consensus, official tests show throughput remains stable even as node count reaches 2,000. As node count grows, Avalanche consensus continues using “repeated subsampling,” theoretically maintaining high speed.

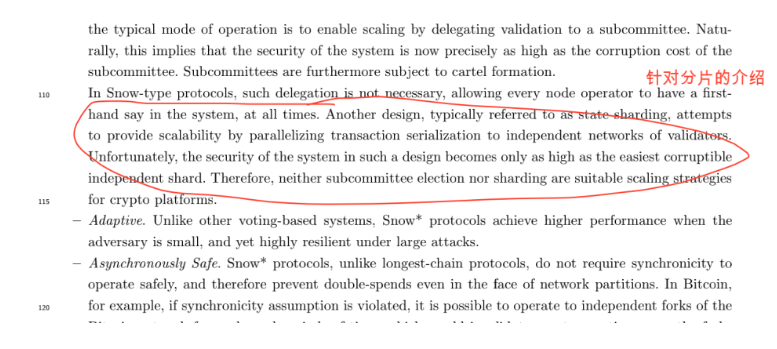

This concludes our core introduction to Avalanche’s consensus. The whitepaper includes additional details—such as handling transaction conflicts, node changes’ impact on latency, and Avalanche’s view on sharding—but space limits prevent further discussion here.

We’ve annotated the whitepaper lightly. Interested readers can reply “AVAX” in our WeChat public account to receive our annotated version and join the community.

Clarifying Key Avalanche Concepts

X/P/C Chains, Primary Network, Validators, Subnets, and Their Relationships.

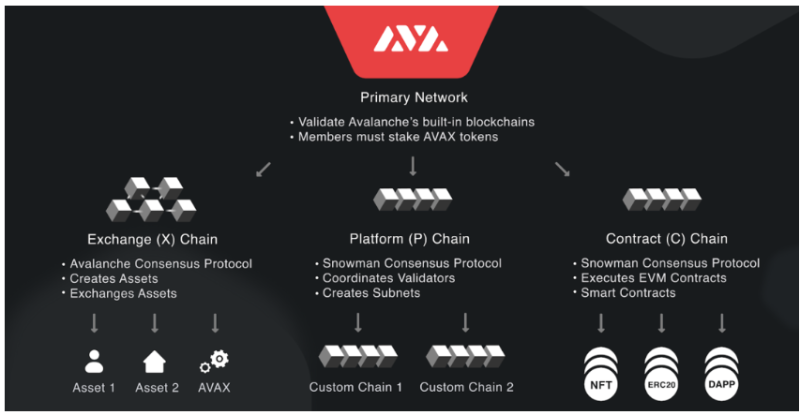

The following diagram is commonly seen in the market, detailing the structure and features of the Primary Network.

Simply put:

X-Chain: Used for creating and trading assets;

P-Chain: Holds metadata for the Avalanche network, coordinates validators, and enables subnet creation;

C-Chain: An EVM-compatible chain used for deploying EVM-based smart contracts.

Note: Only X-Chain uses Avalanche consensus, so it belongs to AVM (Avalanche Virtual Machines). Currently, common X-Chain use involves interacting Avalanche wallets with exchange wallets—but this doesn’t reflect X-Chain’s full potential or broader use cases.

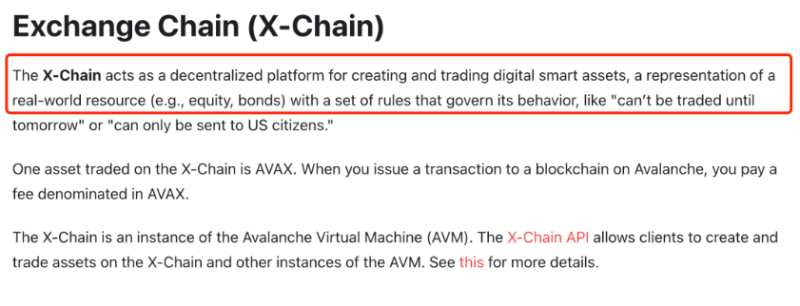

Avalanche envisions bringing more traditional financial assets on-chain, requiring asset customization—for example, restricting trades to certain countries, specific time windows, or other custom scenarios.

X-Chain is defined as: a decentralized platform for creating and trading digital assets. This functionality enables Avalanche’s vision and represents another widely overlooked strength.

Given increasing discussions around subnets, concepts involving validators and their relationship with X/P/C chains require a clearer diagram.

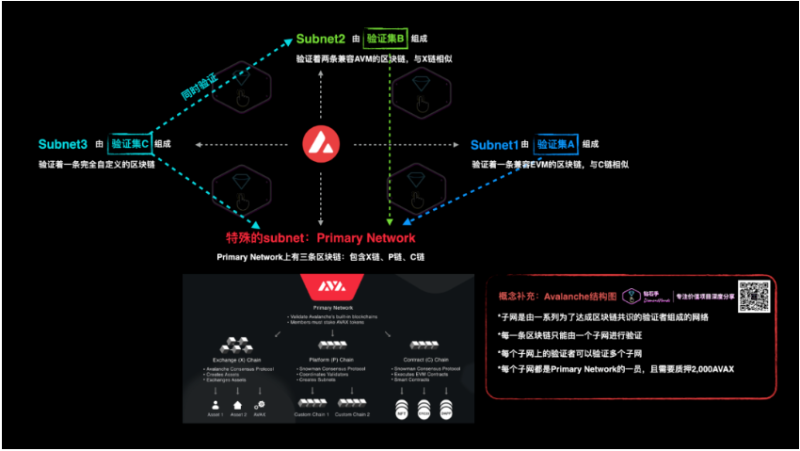

We summarize the relationships among Primary Network, X/P/C chains, subnets, and validators in the diagram below. Key prerequisites to clarify:

1. A subnet is a network composed of validators agreeing on blockchain consensus;

2. Each blockchain can be validated by only one subnet;

3. Validators in a subnet can validate multiple subnets;

4. Every subnet is a member of the Primary Network and requires staking 2,000 AVAX.

The diagram shows three subnets (Subnet1/2/3), each validated by validator sets A/B/C respectively.

Delving deeper into subnets reveals their rules and potential.

As shown, each subnet is part of the Primary Network, and the P-Chain serves all subnets—this explains why custom subnets enjoy the security of Avalanche’s overall network while tailoring their own rules.

Additionally, Subnet3 can validate Subnet2 but not Subnet1. Thus, custom subnets can choose to validate only networks they care about, avoiding unnecessary validation overhead.

These are structural benefits of subnets.

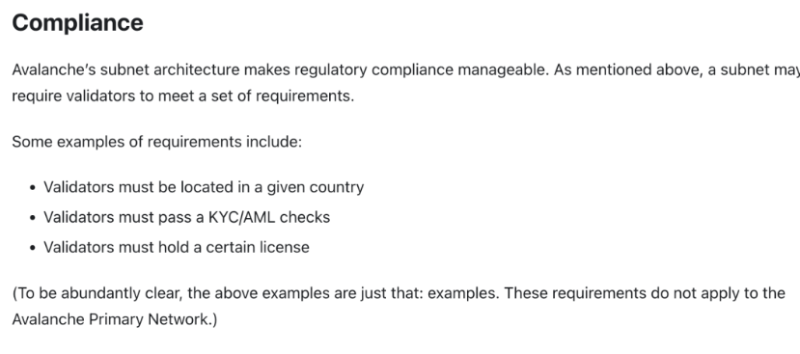

More importantly, subnets allow custom network rules, enabling chains optimized for specific business needs. For instance, restricting asset trades to certain nationalities—or requiring validators to use devices from specific countries—or applying other constraints to build tailored blockchains.

For gaming-focused blockchains, you might require validators to meet higher hardware specs and enforce such requirements.

Two popular gaming subnets recently gaining traction are Swimmer Network led by Crabada and DFK Chain led by Defi Kingdom. Both boost network speed and incentives while using their main tokens as gas fees on the new chains, expanding native token utility (and consumption).

Custom blockchains can also support custom virtual machines. As shown in Subnet3 above. While Avalanche’s C-Chain is currently EVM-compatible, developers could theoretically create various VMs on Avalanche—even using Go language.

Currently, few projects on Avalanche have announced subnet plans. Besides Crabada and Defi Kingdom, others include Ascenders, Shrapnel, Cryptoseal, etc.—mostly game-related and still in development.

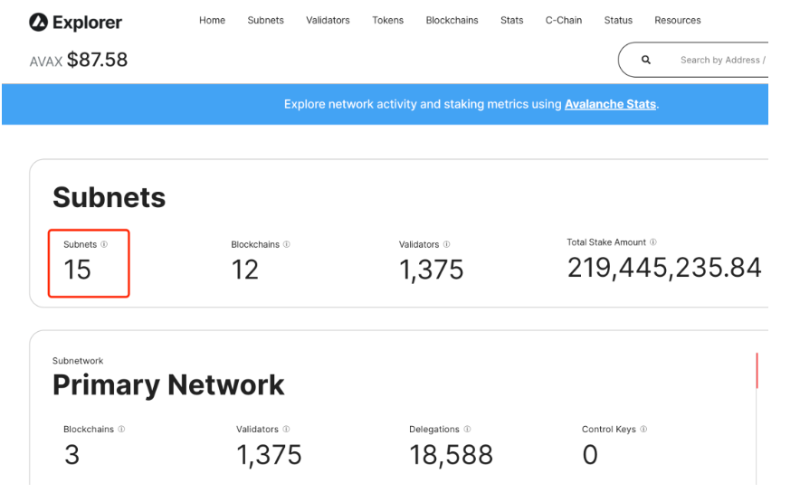

While Avalanche previously partnered with Deloitte on custom blockchains, subnet potential remains largely untapped. Current subnet count on Avalanche—interested readers should monitor progress.

Recent Developments and Projects on Avalanche

Hackathons and the Multiverse Incentive Program.

Major ongoing initiatives on Avalanche include the Barcelona Summit, Asia Hackathon, and the newly launched $290 million Multiverse Incentive Program.

These efforts aim to continuously inject vitality into the Avalanche ecosystem. We won’t elaborate further on hackathons or Multiverse—interested readers can explore independently.

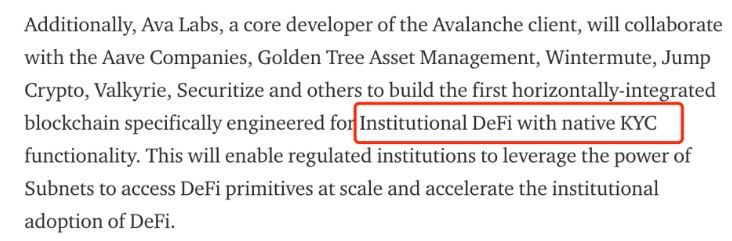

However, one widely overlooked point deserves emphasis: Within the Multiverse plan, Avalanche stated it will provide native on-chain KYC functionality for institutions.

This feature marks another critical step toward Avalanche’s goal of bringing traditional finance on-chain.

Mainstream Projects Related to Avalanche and Subnets

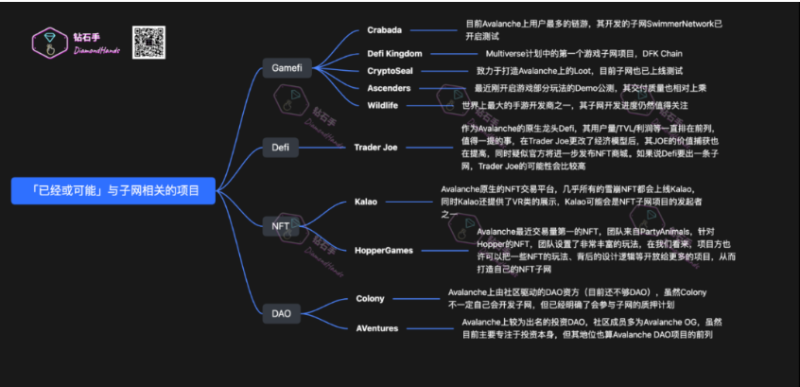

We categorize by GameFi / DeFi / NFT / DAO.

GameFi

1. Crabada: As Avalanche’s most popular on-chain game, its subnet Swimmer Network has entered testing;

2. Defi Kingdom: The first gaming subnet project under the Multiverse program;

3. CryptoSeal: Aiming to build Loot on Avalanche, its subnet is already in test phase;

4. Ascenders: Recently launched a demo of gameplay with high delivery quality;

5. Wildlife: One of the world’s largest mobile game developers—its subnet development progress remains noteworthy.

DeFi (No officially announced subnet projects yet—feel free to add)

Trader Joe: As Avalanche’s leading native DeFi platform, it consistently ranks high in users, TVL, and profits. Notably, after updating its economic model, JOE’s value capture has improved. Rumors suggest an NFT marketplace launch soon. If a DeFi subnet emerges, Trader Joe is a strong candidate.

NFT (No officially announced subnet projects yet—feel free to add)

1. Kalao: Avalanche’s native NFT marketplace. Nearly all Avalanche NFTs launch on Kalao, which also offers VR-based displays. Kalao could potentially initiate an NFT subnet.

3. HopperGames: Recently the top NFT by trading volume on Avalanche, developed by PartyAnimals. Hopper NFTs offer rich gameplay mechanics. In our view, the team could open-source some design logic to enable others to build on their NFT subnet.

DAO

1. Colony: A community-driven DAO funding body on Avalanche (still evolving toward full DAO status). While Colony may not develop its own subnet, it has confirmed participation in subnet staking programs.

2. AVentures: A well-known investment DAO on Avalanche, with members mostly Avalanche OGs. Though currently focused on investments, it holds a leading position among Avalanche DAOs.

None of the above constitutes investment advice—only an overview of projects potentially linked to subnets. Reply “AVAX” in our WeChat public account to join the community and discuss with us.

After understanding AVAX’s technical architecture and possible subnet developments, we gain a clearer picture of Avalanche as a whole. Also, while reviewing the whitepaper, this quote stood out:

Literal translation: Surprisingly, although the core operational mechanism is extremely simple, these protocols yield highly idealized system outcomes, making them suitable for large-scale deployment.

In Web3 terms: x*y=k (Uniswap’s core principle—constant product)

In Web2 terms: Simplicity is the ultimate sophistication

New projects emerge every year, but infrastructure doesn’t evolve as fast as people think. This may surprise you, but there aren't that many fundamentally different technologies—Ted Yin, Co-founder of Avalanche.

True technological innovation is rare, but once achieved, its impact can be extraordinary.

What the market truly needs is innovation—not endless clones. And when we research and explore innovation, the value gained personally often exceeds expectations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News