Avalanche Chases ETF: Riding U.S. Market Hype, but Faces Leadership Turmoil and Ecosystem Challenges

TechFlow Selected TechFlow Selected

Avalanche Chases ETF: Riding U.S. Market Hype, but Faces Leadership Turmoil and Ecosystem Challenges

Despite a recent recovery in on-chain activity, its ecosystem faces significant challenges in achieving a full rebound due to management turmoil and external market pressures.

By Nancy, PANews

During the previous bull market, Avalanche—championing the "Ethereum killer" narrative—achieved robust ecosystem growth through strategic positioning in sectors such as DeFi, briefly entering the top ten by market capitalization. However, amid a broad crypto market downturn and intensifying competition, this once high-performance blockchain has gradually faded from prominence. Today, Avalanche is exploring new growth paths via technological upgrades, ecosystem expansion, and real-world applications. Despite recent signs of improved on-chain activity, challenges including management instability and external market pressures pose significant hurdles to a full-scale ecosystem recovery.

On-Chain Activity Rebounds Slightly, But Ecosystem Challenges Remain

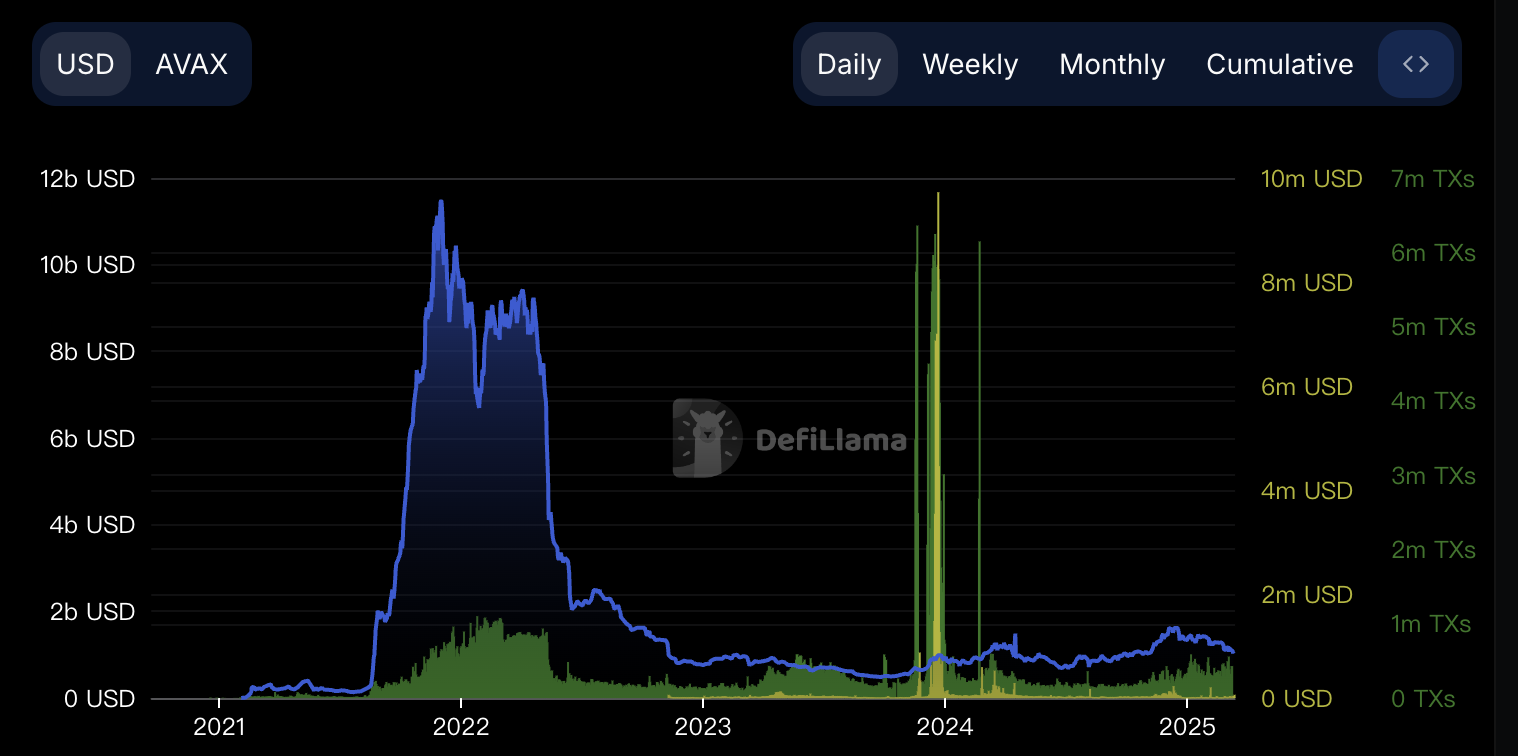

In this current crypto market cycle, most Layer 1 blockchains have gradually receded from mainstream attention, with only a few maintaining sustained activity. Avalanche is no exception. Overall ecosystem vitality has significantly declined from its peak, with on-chain activity languishing and key metrics—including total value locked (TVL), transaction volume, and user engagement—sharply retreating.

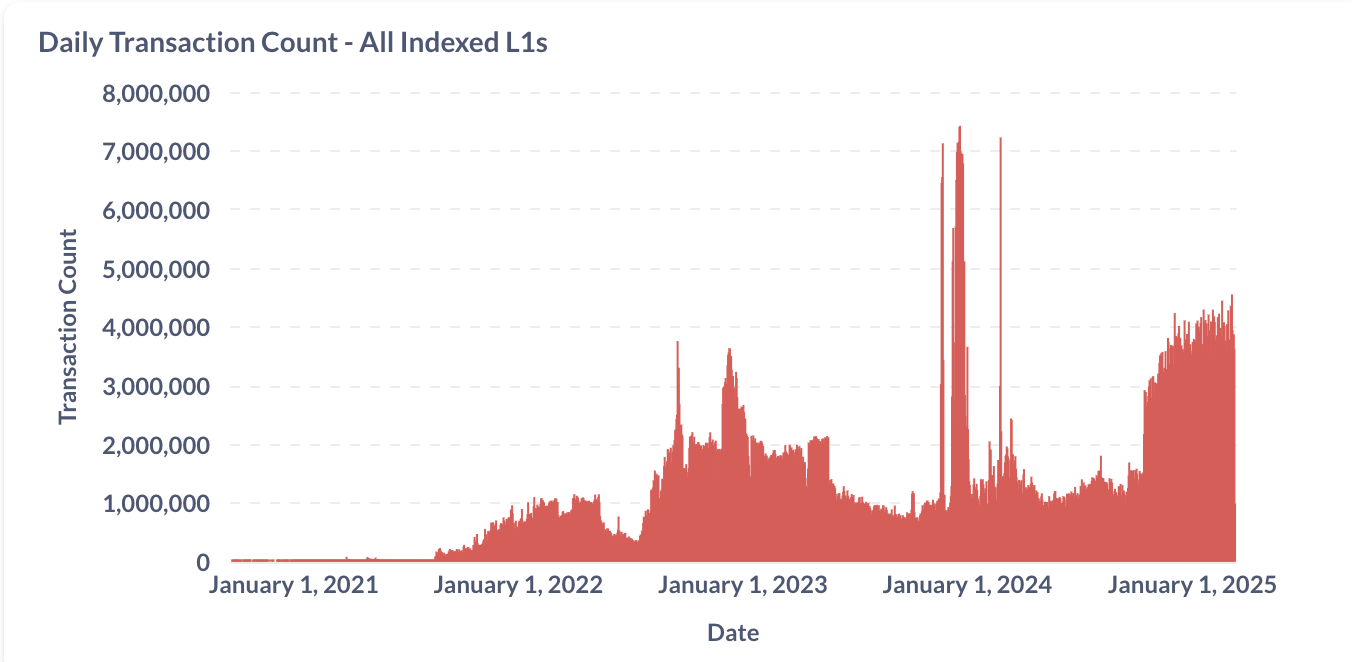

According to DefiLlama data, as of March 11, Avalanche’s TVL stood at approximately $1.02 billion, down roughly 91.1% from its all-time high. Meanwhile, daily transactions on Avalanche have plummeted from 6.36 million in June 2023 to the current 427,000. Daily revenue has similarly declined from $9.72 million at the end of 2023 to around $60,000. Although Avalanche’s ecosystem decline is not isolated and reflects broader crypto market weakness, these figures underscore the severe challenges facing its ecosystem scale and economic vitality.

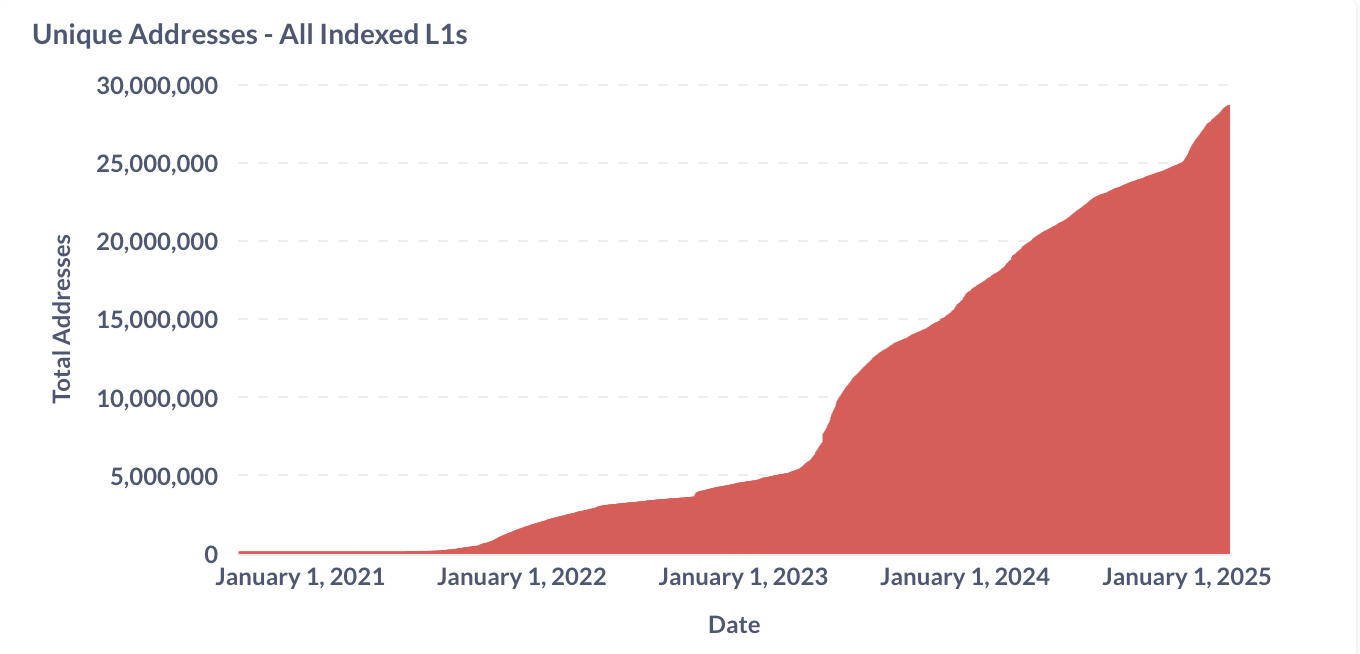

Nonetheless, recent technical and ecosystem adjustments have shown signs of recovery. Official data indicates that as of March 11, Avalanche’s daily transaction count reached a year-high of up to 4.55 million this year. The total number of unique addresses has climbed to approximately 28.66 million, with daily active addresses peaking at 359,000—the best performance since February 2024.

In addition, according to Avalanche’s official website and Staking Rewards, as of March 13, nearly 250 million AVAX tokens were staked, representing a staking ratio of 56.16%, making it the tenth-largest PoS blockchain network.

In the community’s view, the rebound across multiple on-chain metrics suggests Avalanche has not entirely lost competitiveness. However, comprehensive ecosystem recovery still faces multiple challenges. Especially as survival space for most L1 blockchains continues to shrink, Avalanche’s revival will depend not only on an improving external market environment but also on meaningful ecosystem revitalization and breakthroughs.

Technology, Ecosystem, and ETF Narrative Align—But Internal Crisis Looms

From technical upgrades and real-world application rollouts to potential ETF narratives, recent developments indicate Avalanche is attempting to reignite ecosystem vitality through multi-dimensional efforts. However, internal governance crises and external market pressures are introducing uncertainty.

On the technical front, at the end of December 2024, Avalanche launched the Avalanche9000 upgrade, significantly reducing the cost of deploying subnet blockchains and executing smart contracts. It also optimized the validation model and lowered the C-Chain base fee—from 25 nAVAX to just 1 nAVAX. Notably, the upgrade introduced support for independent chain operation via the “Etna” module, substantially cutting project launch costs and enabling compliance with diverse regulatory requirements. In the same month, the Avalanche Foundation raised $250 million from investment firms including Galaxy Digital, Dragonfly, and ParaFi Capital to support deployment of the upgrade, with expectations that hundreds of tier-one blockchains will launch in the coming months.

Earlier this month, Avalanche unveiled its 2025 roadmap, featuring major updates such as the Etna network upgrade, the global adoption initiative Avalanche9000 Campaign, and the rebranding of subnets as Avalanche L1 to enhance flexibility—further demonstrating Avalanche’s ongoing commitment to deep technical optimization.

On the ecosystem front, Avalanche is showing diversified momentum. On one hand, it is refining its core products—for example, Avalanche’s flagship wallet, Core, received a comprehensive upgrade earlier this month, featuring a refreshed brand identity and UI improvements for both mobile and browser extensions. The new version, expected in early spring, aims to lower barriers for new users and improve ecosystem stickiness through a simplified interface and enhanced features such as AI-driven interactions. On the other hand, Avalanche is expanding real-world use cases: in February, the Avalanche Visa card launched, allowing users to spend AVAX, wrapped AVAX, and stablecoins USDT and USDC at any merchant accepting Visa. Additionally, partnerships with Republic, New York Red Bulls, Dantewada district in India, disclosure solution provider Bluprynt, and crypto payment platform NOWPayments are driving adoption in areas such as film, sports, land ownership, and payments. Furthermore, Avalanche is expanding into new domains like AI—through a $100 million infraBUIDL(AI) Program launched by the Avalanche Foundation in collaboration with Aethir to support AI innovation within the ecosystem.

As a U.S.-based project, Avalanche’s parent company Ava Labs may benefit from a gradually opening U.S. regulatory environment. Ava Labs CEO and founder Emin Gün Sirer revealed last year that Avalanche was engaging in discussions with the incoming U.S. administration. However, he emphasized that the team would not boast about political connections on social media, instead choosing to deliver results “in true Avalanche fashion,” advising the community to “plan accordingly.”

Additionally, according to Delaware corporate registration records, VanEck filed for a “VanEck Avalanche ETF” on March 10, 2025. Alongside Avalanche, VanEck has also submitted applications for spot ETFs for Solana and Ripple. While such filings could attract greater institutional interest and capital inflows if approved, they are currently seen by the market as largely speculative and hype-driven rather than grounded in solid ecosystem fundamentals, making it difficult to translate into sustainable long-term growth.

Despite promising external developments, Avalanche faces internal turbulence. According to a recent statement posted on X by Omer, former director of the Avalanche Foundation, three board members—including Omer, Aytunç Yildizli, and Vikram Nagrani—have formally resigned from their roles on the foundation and its subsidiary boards this week. Executive Director Aytunç Yildizli ceased duties on February 28, 2025. This collective resignation, described as a difficult decision, has left the board in a state of stagnation while it seeks a path forward. Management instability could undermine strategic execution and erode community confidence, particularly during a market downturn.

In summary, current technical upgrades and real-world applications are injecting vitality into the Avalanche ecosystem, while U.S. regulatory tailwinds and ETF potential expand its narrative appeal. Yet whether Avalanche can successfully mount a comeback depends not only on strengthening its internal technological and ecosystem foundations but also on favorable shifts in broader market conditions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News