Not chasing AI, not buying memes — the smart money is steadily earning on Avalanche C-Chain

TechFlow Selected TechFlow Selected

Not chasing AI, not buying memes — the smart money is steadily earning on Avalanche C-Chain

What is "smart money"? Not the wealthiest, but the longest-lasting.

Author: 0xResearcher

You may not have noticed, but Avalanche's C-Chain has quietly heated up again.

While most ecosystems are seeing slow declines in TVL and market attention is dominated by AI, restaking, and memes, the C-Chain is逆势 rebounding: active addresses have risen for three consecutive weeks, major protocols are seeing TVL climb once more, and even "forgotten" legacy projects like BENQI are making a strong comeback.

At the same time, Avalanche has launched a Visa virtual card, Core Wallet now supports gas-free operations, and on-chain infrastructure continues to upgrade—these signs all point to one fact:

The value of infrastructure is being repriced.

And smart money has already quietly boarded. They don't tell stories or chase trends, yet they're always ahead of the crowd.

What is "smart money"? Not the richest, but the longest-lasting

Many assume smart money means "whales," but in reality, "smart" ≠ biggest wallet. It means the highest long-term win rate.

Their three key principles:

-

Cool-headed betting, free from greed or fear: Not aggressive in bull markets, not pessimistic in bear markets. Those who survive three market cycles are the ones truly still alive.

-

Risk control first, returns second: They don’t care how explosive the APY looks—only whether the protocol’s code has been audited.

-

On-chain transparency, controllable liquidity: They’re fine with locked-up funds as long as terms are clear; they can handle price drops as long as data is accessible.

These people resemble a hybrid of Web3 fund managers and hackers: skilled in financial modeling and capable of reading smart contract code. Quiet most of the time, their moves often become ecosystem signals. The recent surge in BENQI’s liquidity is just one example of choices made by these "quietly intelligent" actors on-chain.

The risk-avoidance strategy of smart money: when not going crazy, go “Zen”

During the volatile and sentiment-weak second half of 2024, smart money began positioning into stable-yield protocols.

Take BENQI, a veteran project in the Avalanche ecosystem: its TVL surged to $520 million, with nearly 10 million AVAX in $sAVAX via Liquid Staking, hitting new highs almost daily.

What they’ve chosen isn’t a token “set to 10x,” but rather assets that offer:

-

Stable APR: currently around 5.2%

-

Reusable assets: sAVAX can be used in lending and staking without sacrificing liquidity

-

Clear, transparent mechanisms: no convoluted lock-up clauses

-

User-friendly interface: accessible even for non-technical users

You might not have noticed, but on-chain data doesn’t lie: certain addresses have consistently converted AVAX into sAVAX over several days, then deployed them into recursive lending loops totaling over a million dollars. This **“yield-mortgage-compound”** combo play is a classic “afraid to die but unwilling to sit idle” strategy employed by smart money.

Not discarded pieces, but trump cards

Many mistakenly believe that Avalanche’s push for Subnets means the main C-Chain will be sidelined. But the reality is—the C-Chain is becoming the core of infrastructure development.

Consider these “silent big moves”:

-

Avalanche Visa virtual card launch: USDT / USDC / AVAX can now be spent directly, even linked to Alipay.

-

Core Wallet enables gas-free transactions: significantly lowering the barrier for new users.

-

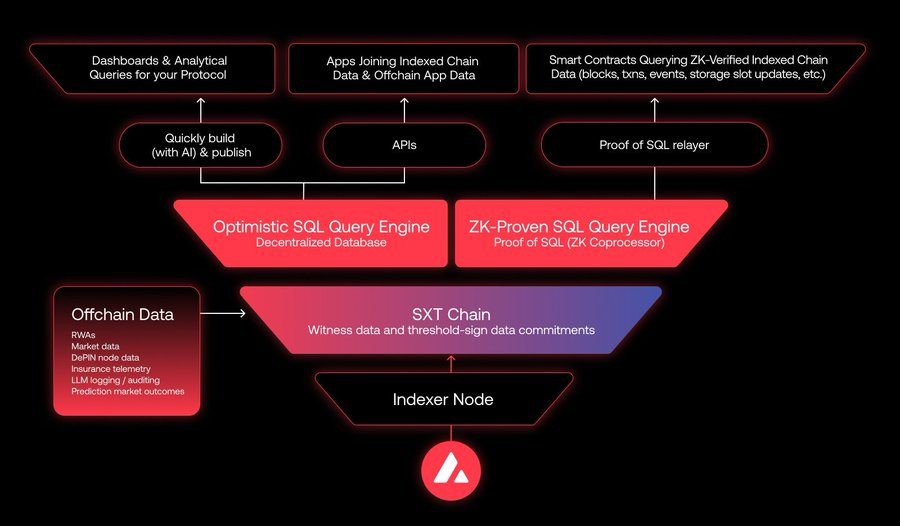

Upgraded on-chain data services: developers and investors can instantly query contract and asset data.

The significance? The C-Chain isn’t trying to show off—it’s preparing to absorb real user and asset inflows.

For smart money, this is precisely the logic behind their bet on Avalanche: when everyone else is spinning narratives, only infrastructure serves as armor capable of surviving market cycles. And BENQI, as part of the early infrastructure, is gradually being re-evaluated and repriced.

Stable yield isn’t just a “wait-for-bull-market” transition plan

Zoom out, and you’ll see that smart money isn’t betting on any single project—they’re backing a long-term thesis:

Stable yield is the moat during periods of market panic.

Whether it’s BENQI’s $sAVAX, Lido’s $stETH, or Frax’s sfrxETH, they’re all creating new pathways for “non-trading” assets to generate value.

You’ll also notice their continued positioning in:

-

Frax focusing on stable pools like sDAI to improve capital efficiency;

-

Pendle’s structured yield products gaining popularity, sparking innovation in arbitrage strategies through diverse APR curve combinations;

-

Maker launching SubDAOs to decentralize governance pressure and enhance long-term stability;

-

EigenLayer leveraging “restaking” to unlock new yield layers, drawing TVL back into the ecosystem.

These choices may seem conservative, but they’re laying the foundation for the next bull run—precise, transparent, and sustainable.

Don’t ask for stories—ask for fundamentals

If you’re still asking, “Which coin will 10x?” smart money would tell you:

“10x gains come from emotion, not value.”

What they truly care about is:

-

Can the protocol’s risk exposure be controlled?

-

Are the yield sources genuine and sustainable?

-

Is on-chain liquidity real? Is the TVL data solid?

-

Is the team actively iterating? Is the community active and responsive?

Only when all answers are YES do they press that familiar “Confirm” button.

The starting point of the next bull market isn’t some mythical chain or narrative—it’s these quiet yet resolute “smart decisions.”

Want to be smart? Start with these four steps

If you’ve read this far, congratulations—you’re already smarter than 90% of the market. Here’s a checklist to help you avoid pitfalls:

-

Check audits and open-source status: Has the project been audited by third parties? Are contracts open-source?

-

Verify on-chain data: Can you validate TVL, active wallets, and asset structure directly on-chain?

-

Analyze asset usability: After staking, can assets be borrowed against or combined in other strategies?

-

Evaluate team and community activity: Are there consistent product updates and community engagement?

The bull market isn’t far off—but first, learn to be smart. Trends may come, but foundations must be solid. Don’t chase hype—be the smart one.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News