LINK Research Report Analysis: The Hidden Big Winner in Dollar Tokenization, Where Does 30x Growth Potential Come From?

TechFlow Selected TechFlow Selected

LINK Research Report Analysis: The Hidden Big Winner in Dollar Tokenization, Where Does 30x Growth Potential Come From?

The market is still viewing LINK through an old lens, while its fundamentals have already undergone a fundamental transformation.

If you've been following the crypto market recently, you've surely noticed LINK's strong performance.

Public data shows that LINK has risen nearly 30% over the past month; for an older cryptocurrency with lukewarm narratives, this performance is impressive enough, and discussions about LINK on social media have been increasing recently.

Yet while most people are still debating whether LINK is just an "oracle token," major global financial institutions such as JPMorgan Chase, SWIFT, Mastercard, and DTCC have quietly placed Chainlink at the core of their blockchain strategies.

Recently, crypto investment firm M31 Capital released a 90-page in-depth research report, making a bold prediction: LINK still has 20-30x upside potential.

The report argues that the wave of tokenization of global financial assets will create a $30 trillion opportunity, and Chainlink is not merely a participant—it is the sole infrastructure monopolist in the blockchain middleware space.

TechFlow has interpreted and summarized this report, extracting its key insights and data for easier reading.

(Note: This report and analysis do not constitute any investment advice. The crypto market is highly volatile—please conduct your own research and judgment.)

Core Investment Thesis: Undervalued Asset, "Buy-Side" Narrative Emerges

The report overall considers LINK one of the best risk/reward investment opportunities in today's crypto market, based on several key arguments:

-

Primary Beneficiary of a $30 Trillion Megatrend - Global financial systems are transitioning toward tokenization

-

Complete Monopoly in On-Chain Financial Middleware - No competitor offers comparable technical reliability and institutional trust

-

Misunderstood Asset - Despite unmatched integration depth and dominant market share, its market cap remains far below its strategic value

-

Realistic 20-30x Upside Potential - In contrast, objectively inferior peer asset XRP trades at 15x the price of LINK

In detail, the report outlines three specific reasons why LINK is currently undervalued.

-

Silent Beneficiary of the RWA Wave

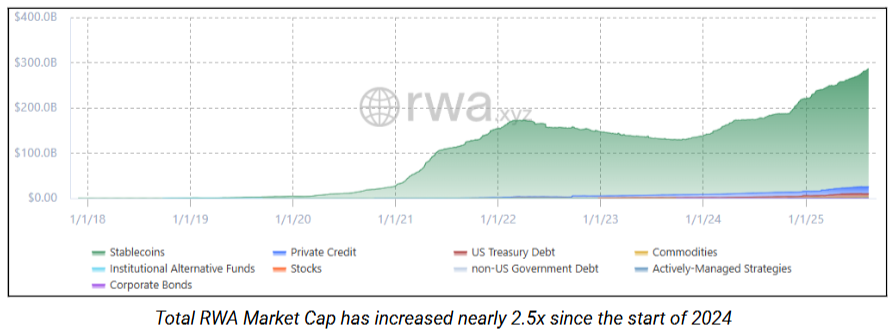

Since 2024, the market for tokenized real-world assets (RWA) has grown by 2.5x. BlackRock’s BUIDL tokenized money market fund has reached $2 billion in size; traditional finance giants like JPMorgan Chase, Goldman Sachs, and Charles Schwab are no longer in pilot mode—they’re actively deploying solutions.

But how does a tokenized U.S. Treasury know the current interest rate? How does a gold-backed token verify physical reserves? How can cross-chain asset transfers ensure security and compliance?

They all rely on Chainlink. Everything depends on having a trusted data and interoperability layer.

-

Business Monopoly, Yet Underpriced

Chainlink is a true monopoly in its domain:

-

+24 trillion USD in on-chain transaction value processed through Chainlink

-

$85 billion total value secured (TVS)

-

18+ billion verified messages delivered

-

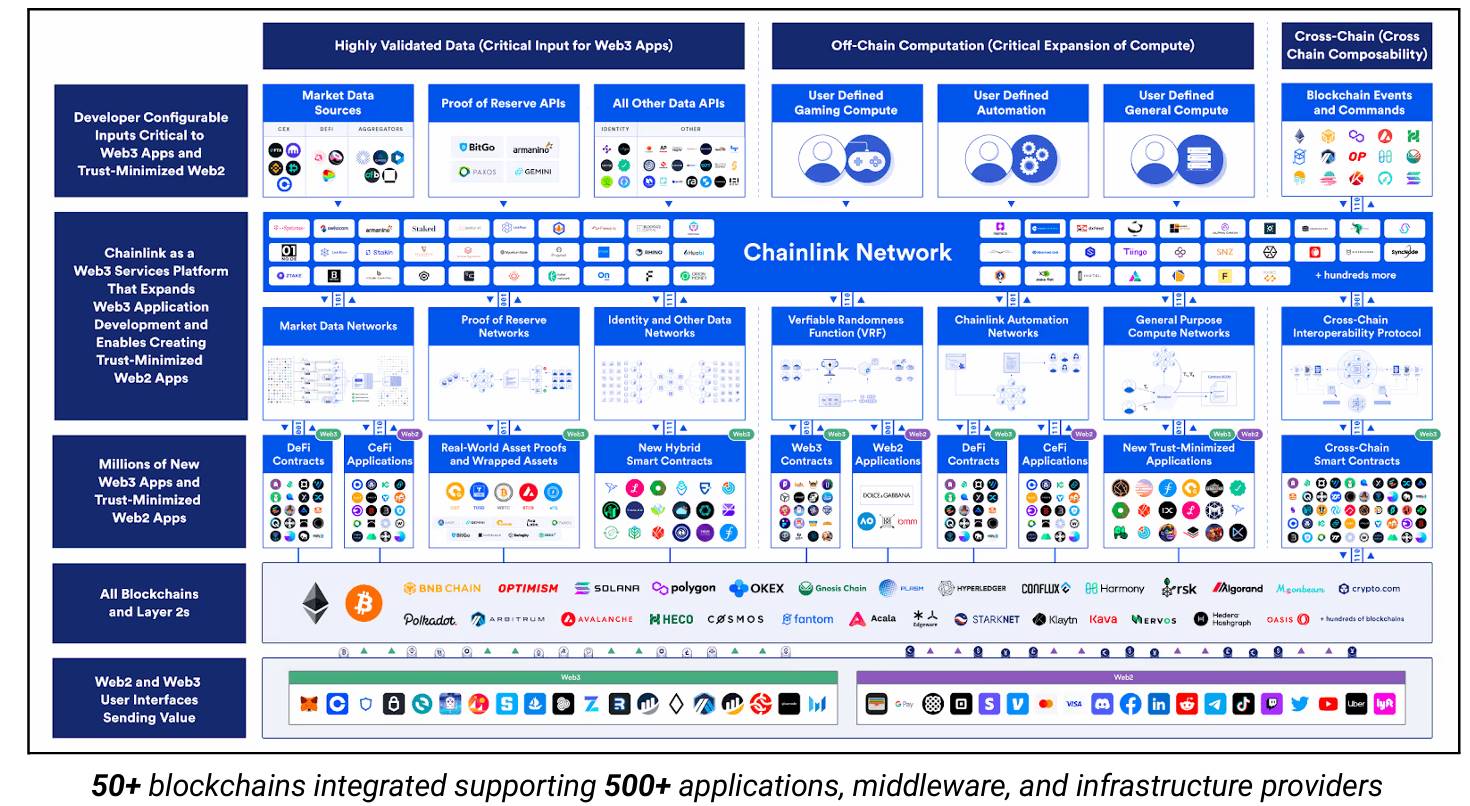

50+ blockchain integrations, 500+ application integrations

No competitor combines Chainlink’s technical reliability, product breadth, compliance capabilities, and institutional trust. Once integrated, it becomes mission-critical infrastructure with high switching costs and self-reinforcing network effects.

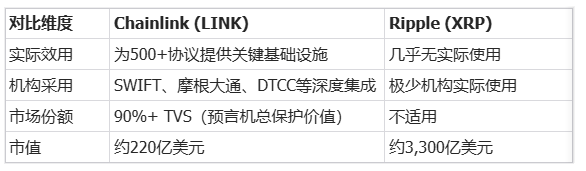

By comparison, XRP has a market cap 15 times larger than LINK, yet lacks even one-tenth of LINK’s real-world value.

-

Narrative Reversal

For years, LINK has carried the negative narrative of "team dumping." But the launch of the LINK reserve mechanism in August 2024 changed that.

Before: Chainlink Labs funded operations by selling tokens, creating continuous sell pressure

Now: Hundreds of millions in corporate revenue automatically converted into LINK purchases, generating sustained buy-side demand

With more partnerships expected and more institutional pilots moving into production within the next 12–18 months, verifiable on-chain revenue is set to surge dramatically.

The market still views LINK through outdated lenses, while fundamentals have fundamentally shifted. This perception gap is precisely where massive investment opportunity lies.

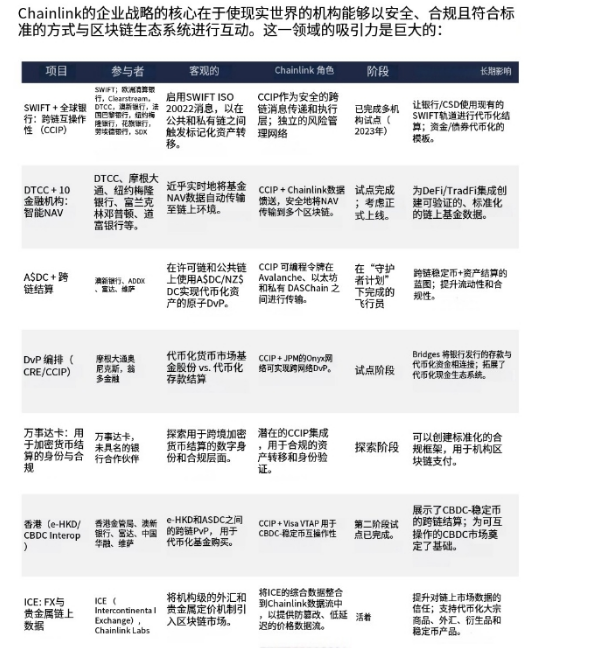

Deployment Map: Global Financial Giants Using Chainlink

The report also lists key use cases, especially among traditional financial institutions.

-

SWIFT: November 2024, used Chainlink CCIP to trigger on-chain token actions via traditional SWIFT messages

-

Participating institutions include ANZ, BNP Paribas, BNY Mellon, Citibank, Clearstream, Euroclear, Lloyds Banking Group, etc.; successfully simulated tokenized asset transfers between public and private blockchains

-

JPMorgan Kinexys: June 2025, JPMorgan’s blockchain division Kinexys completed the first cross-chain Delivery vs Payment (DvP) settlement with Ondo Finance

-

Chainlink’s role: CRE (Corporate Run Environment) coordinated workflows, CCIP protocol ensured secure cross-chain messaging

-

White House Recognition, Technological and Policy Endorsement:

-

Invited to the White House Crypto Summit—founder Sergey Nazarov attended and directly engaged in dialogue with the President and cabinet officials

-

White House Digital Assets Report – Chainlink officially recognized as core infrastructure of the digital asset ecosystem

-

Chainlink published detailed plans for 10+ blockchain use cases across federal agencies

Critically, these are not isolated experiments—each successful pilot represents a viable use case. ChainLink is present in all of them, even if it's not always in the spotlight.

(Typical enterprise collaboration cases of Chainlink, AI translation)

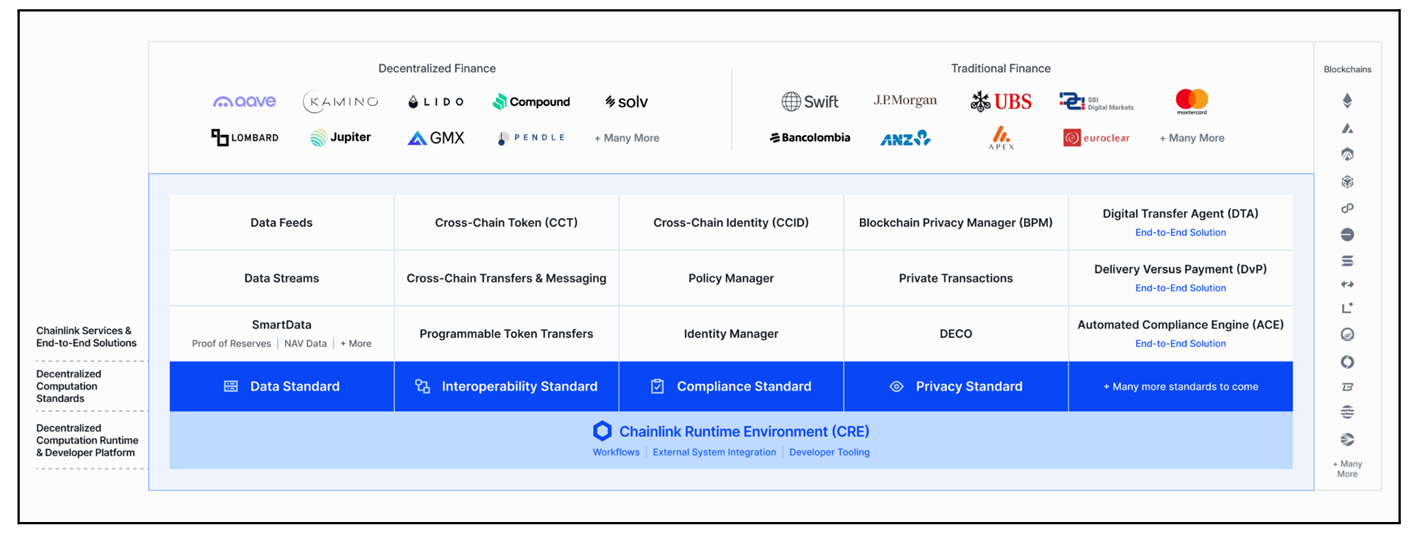

More Than Oracles: Dominance in Middleware

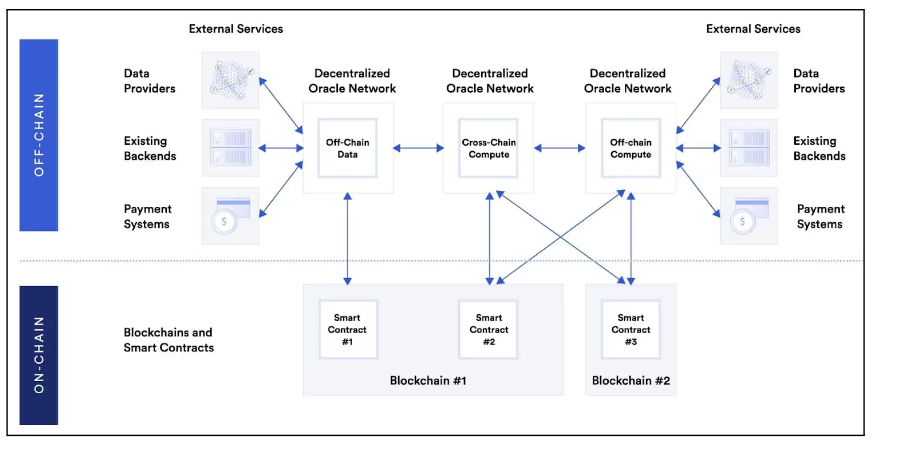

Many still think of Chainlink only as a "price oracle." In reality, Chainlink has built a full blockchain middleware ecosystem, becoming an indispensable bridge between blockchains and the real world.

Its products span five critical areas:

-

Data

-

Provides market data feeds (e.g., price sources), Proof-of-Reserve, Verifiable Randomness, and ultra-low-latency data streams.

-

These features ensure blockchain applications can reliably access off-chain data, supporting financial apps, gaming, insurance, and more.

-

-

Compute

-

Offers off-chain computation (e.g., complex calculations via Functions) and event-driven automation.

-

Enables blockchains to handle complex logic without excessive on-chain resource consumption.

-

-

Cross-Chain Interoperability

-

Provides CCIP (Cross-Chain Interoperability Protocol), supporting multi-network risk management.

-

CCIP enables secure transfer of assets and data across different blockchains, solving cross-chain communication challenges.

-

-

Compliance

-

Offers Automated Compliance Engine (ACE), allowing regulatory rules to be programmatically enforced.

-

Crucial for institutional users to meet compliance requirements.

-

-

Enterprise Integration Layer

-

Provides Chainlink Runtime Environment (CRE), coordinating workflows between private and public chains.

-

CRE enables seamless integration between blockchain and legacy systems, reducing friction and risk.

-

These are not standalone products but parts of a cohesive system. When SWIFT uses Chainlink, they’re not just using an oracle—they’re accessing a complete infrastructure stack.

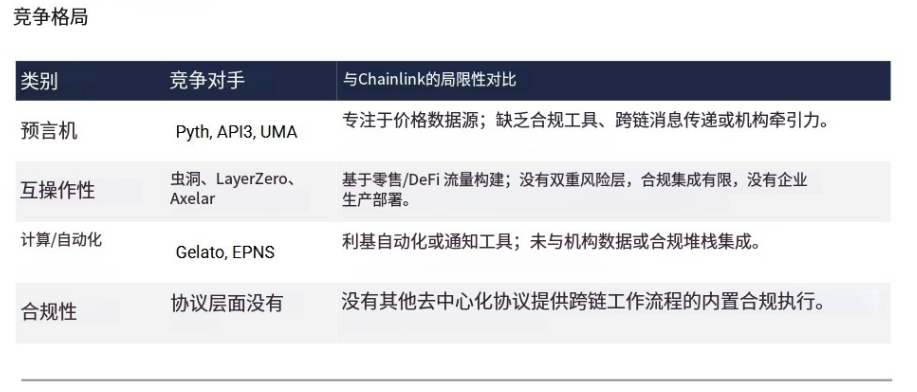

The competitive advantage is that other players typically cover only one or two areas, while Chainlink is the only solution covering all critical domains.

The benefit for institutions is being able to use ChainLink as a single integration point, significantly reducing complexity and risk.

This full-stack capability, combined with years of proven security and institutional trust, creates a technological moat that is nearly impossible to replicate.

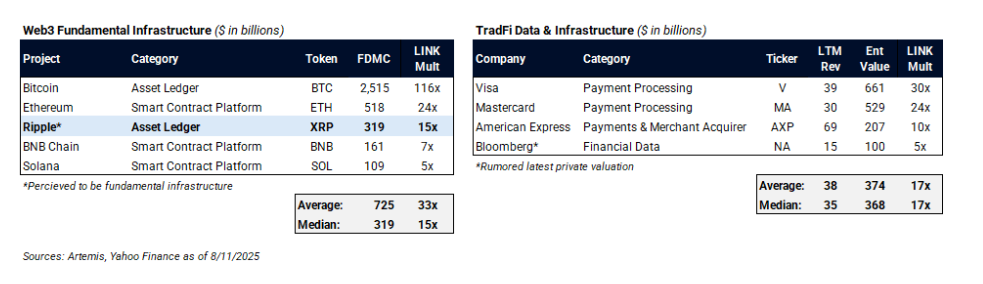

How Should LINK Be Valued?

Now we arrive at the most crucial question: What should LINK actually be worth?

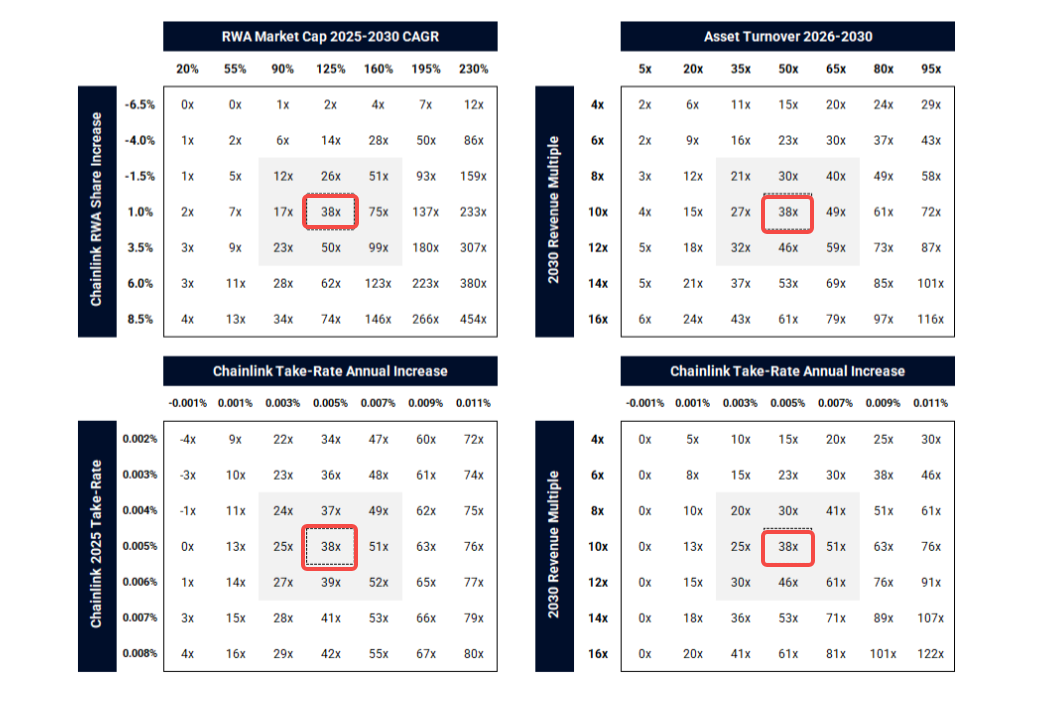

The report employs several independent valuation methods—all pointing to similar conclusions.

Method One: Relative Valuation Compared to XRP

Take XRP—a so-called "bank coin" launched in 2012—that has yet to deliver on its promised use cases and sees almost no real institutional adoption, yet boasts a fully diluted market cap of $330 billion.

In contrast, Chainlink is adopted by top-tier global financial institutions, yet its market cap is only 1/15th of XRP’s.

If LINK were valued at least equally to XRP, then given that XRP’s current market cap is 15x that of LINK, this presents investors with a highly attractive risk/reward opportunity.

If we consider Chainlink’s clearly superior fundamentals, LINK’s valuation should instead be compared to traditional financial firms like Visa and Mastercard—companies with similar positioning in payment processing and data infrastructure.

Using those companies’ valuations as benchmarks, LINK has 20-30x upside potential.

Method Two: Market Share Approach Using Traditional Company Logic

By 2030, approximately $19 trillion in real-world assets globally are expected to be tokenized.

As the “data pipeline” and “cross-chain bridge” for these assets, Chainlink is projected to capture 40% market share—serving around $7.6 trillion in tokenized assets.

These assets would enable Chainlink to process roughly $380 trillion in annual transaction volume. With gradually increasing fees (currently charging 0.005% per transaction), Chainlink could generate $82.4 billion in annual revenue by 2030.

With $82.4 billion in annual revenue and applying a 10x price-to-sales (PS) ratio, Chainlink’s enterprise value would reach approximately $824 billion.

Assuming LINK’s total supply remains around 1 billion, an $824 billion network value implies a theoretical price of $824 per LINK. Given the current price is around $22, this suggests about 38x upside.

Of course, this 38x is seen by the translator as a theoretical valuation—any change in assumptions would significantly alter the outcome.

Recent Catalysts (Q3/Q4)

LINK Reserve Mechanism

For years, Chainlink subsidized services to drive industry growth, which obscured its profit potential and forced Chainlink Labs to rely on token sales for funding. The newly launched LINK Reserve mechanism changes this completely:

-

Capital flows reverse: hundreds of millions in off-chain corporate revenue will automatically be used to repurchase LINK from the market

-

Market dynamics shift from persistent sell pressure to net buy pressure

-

Confirms ChainLink’s enterprise-level profitability

Expansion of Data Services

-

Data Streams Covering Traditional Financial Assets: Officially supports real-time pricing for U.S. stocks and ETFs starting August 4, enabling data support for tokenized funds, synthetic assets, and on-chain structured products

-

ICE Partnership: Announced on August 11 integrating Intercontinental Exchange’s forex and precious metals composite data feeds, providing critical support for institutional-grade on-chain pricing

-

CCIP Launches on Solana: CCIP went live on Solana’s mainnet in May, enabling cross-ecosystem settlements and message passing between EVM and SVM environments

Product Upgrades: Focus on Privacy and Staking Yields

Privacy and Permission Features, including private transactions via CCIP to meet banks’ confidentiality requirements for cross-chain transfers; Chainlink Privacy Manager ensures sensitive data isn’t exposed on public chains

Privacy and security are prerequisites for banks to move from pilot programs to full production using ChainLink.

Staking v0.2 and Fee Distribution are already live, supporting staking across more service types.

After future upgrades, user fees will be directly rewarded to stakers; as data stream and CCIP transaction volumes grow, staking yields will increase significantly.

This is somewhat analogous to Ethereum’s staking rewards post-Merge, but backed by real enterprise-level revenue.

Conclusion

Chainlink offers one of the most asymmetric risk/reward profiles in all of finance.

No competitor matches Chainlink’s advantages in integration breadth, technical reliability, regulatory compliance, and institutional trust. High-profile pilot projects will scale into production within the next 12 to 18 months. Each new integration deepens its moat through high switching costs, network effects, and entrenched compliance processes.

Financially, Chainlink generates diversified, recurring, and scalable revenue streams—from CCIP transaction fees and institutional data subscriptions to Proof-of-Reserve certifications and automated services—creating a durable growth engine directly tied to the adoption of tokenized assets. As global tokenization is expected to reach tens of trillions of dollars, the addressable market is vast and largely untapped.

Despite these fundamental strengths, LINK remains a mispriced asset, valued more like a speculative project than a monopolistic financial infrastructure provider.

As the tokenized economy matures and Chainlink integrations move into production, the market will be forced to revalue LINK significantly—to reflect its systemic importance, revenue potential, and irreplaceable role in the global financial system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News