Lookonchain: $LINK surges—Who's behind it? How are whales and smart money positioning?

TechFlow Selected TechFlow Selected

Lookonchain: $LINK surges—Who's behind it? How are whales and smart money positioning?

In this article, on-chain data analysis firm Lookonchain takes you behind the surge of $LINK.

Author: Lookonchain

Compiled by: TechFlow

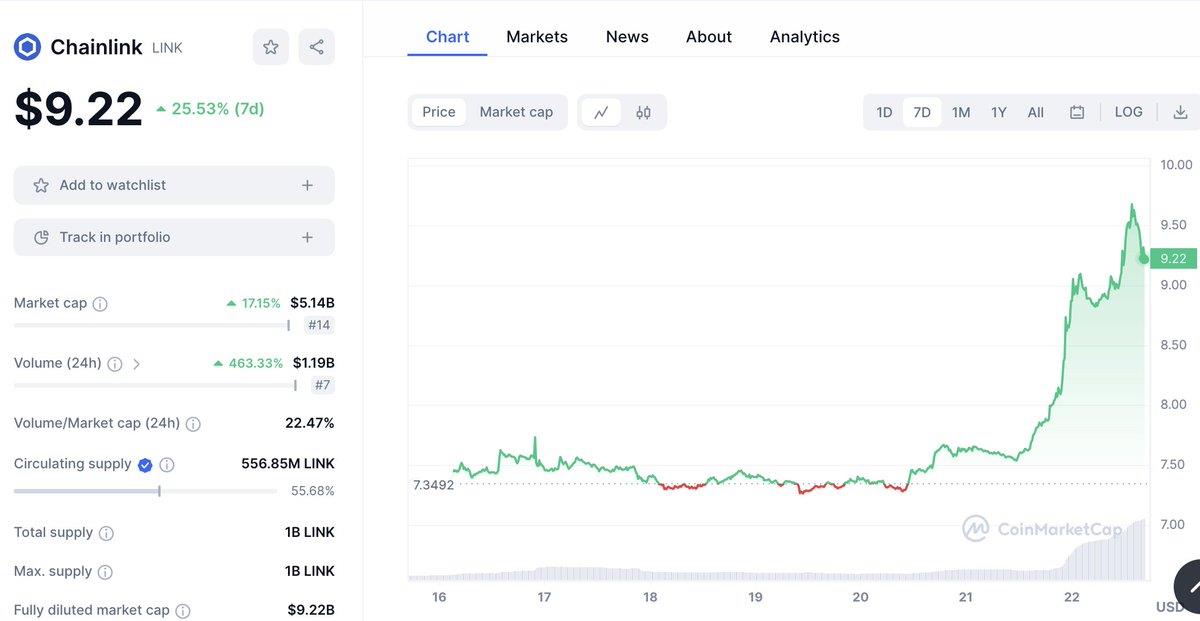

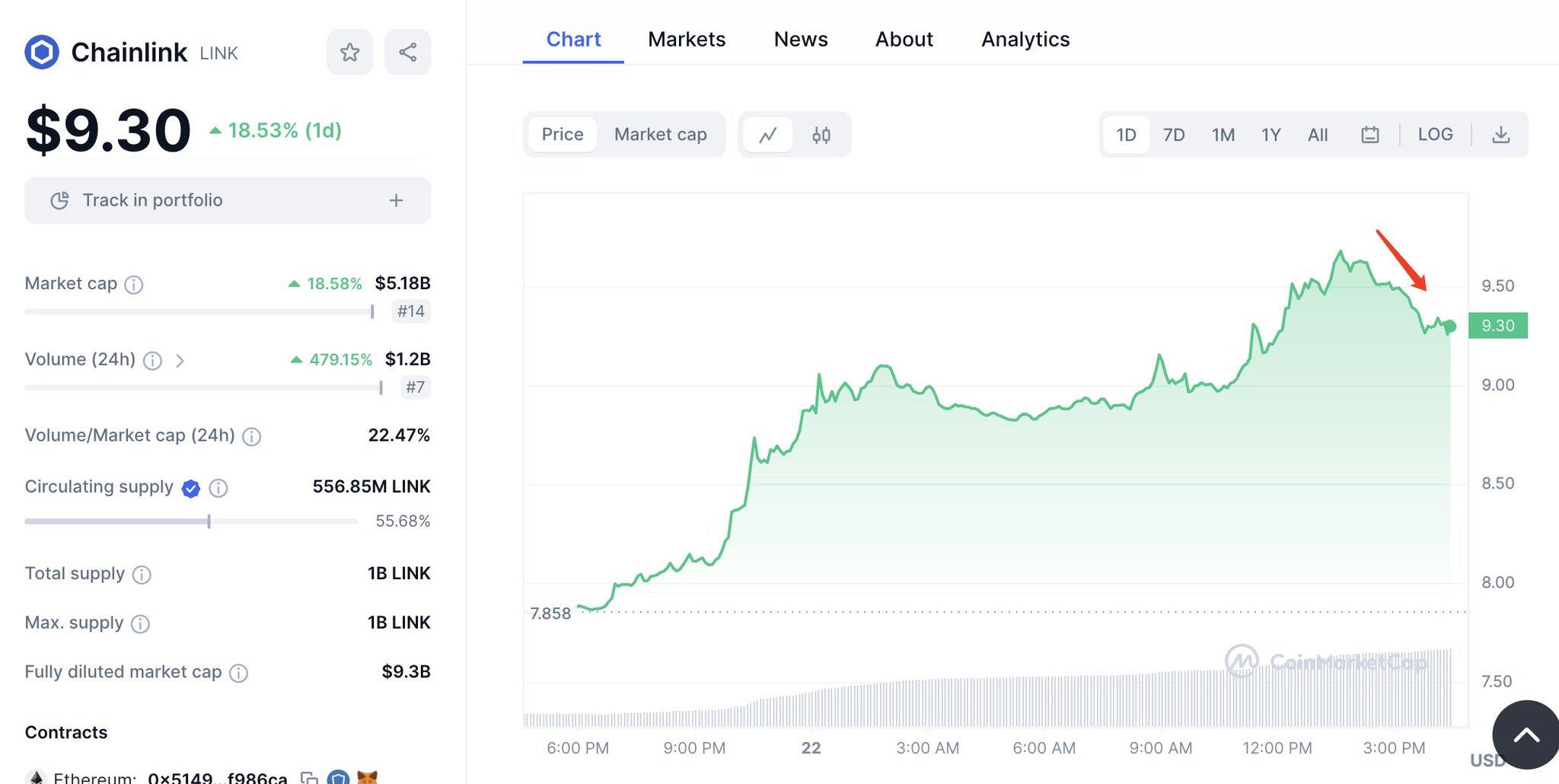

Over the past two days, the price of $LINK has surged significantly. Who is driving this rise in $LINK's price? What have whales and smart money been doing recently? In this article, on-chain data analytics firm Lookonchain takes you behind the scenes of $LINK’s sharp rally.

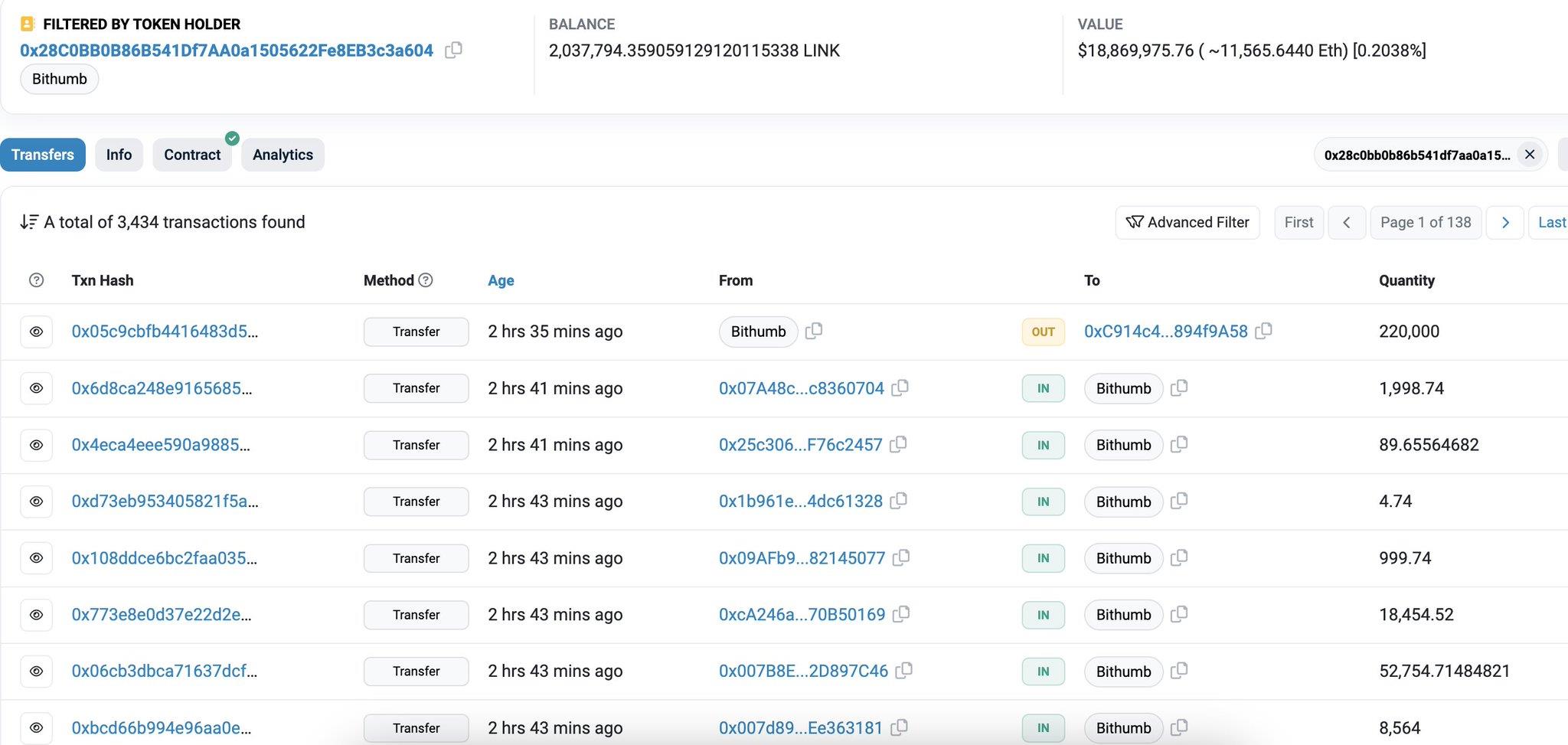

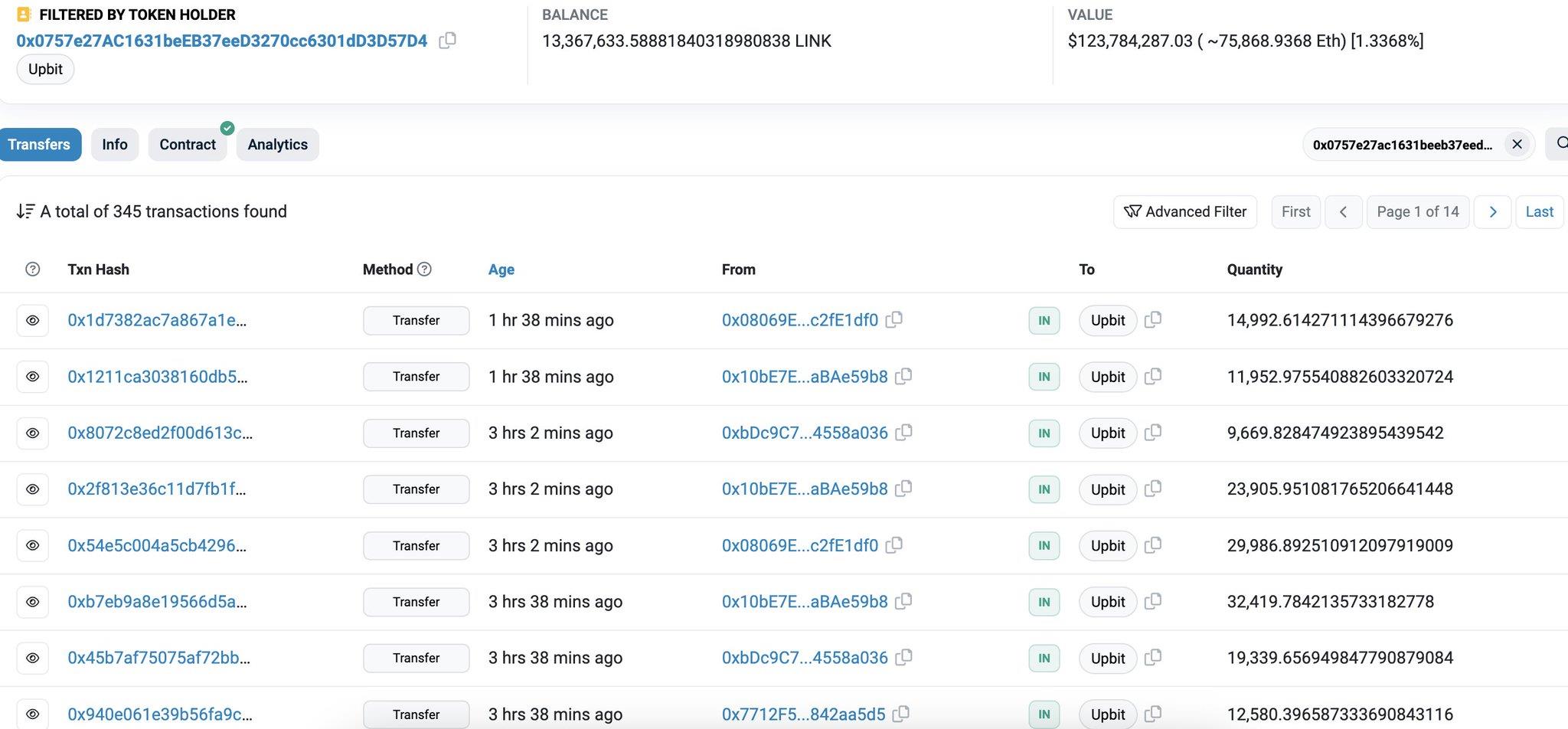

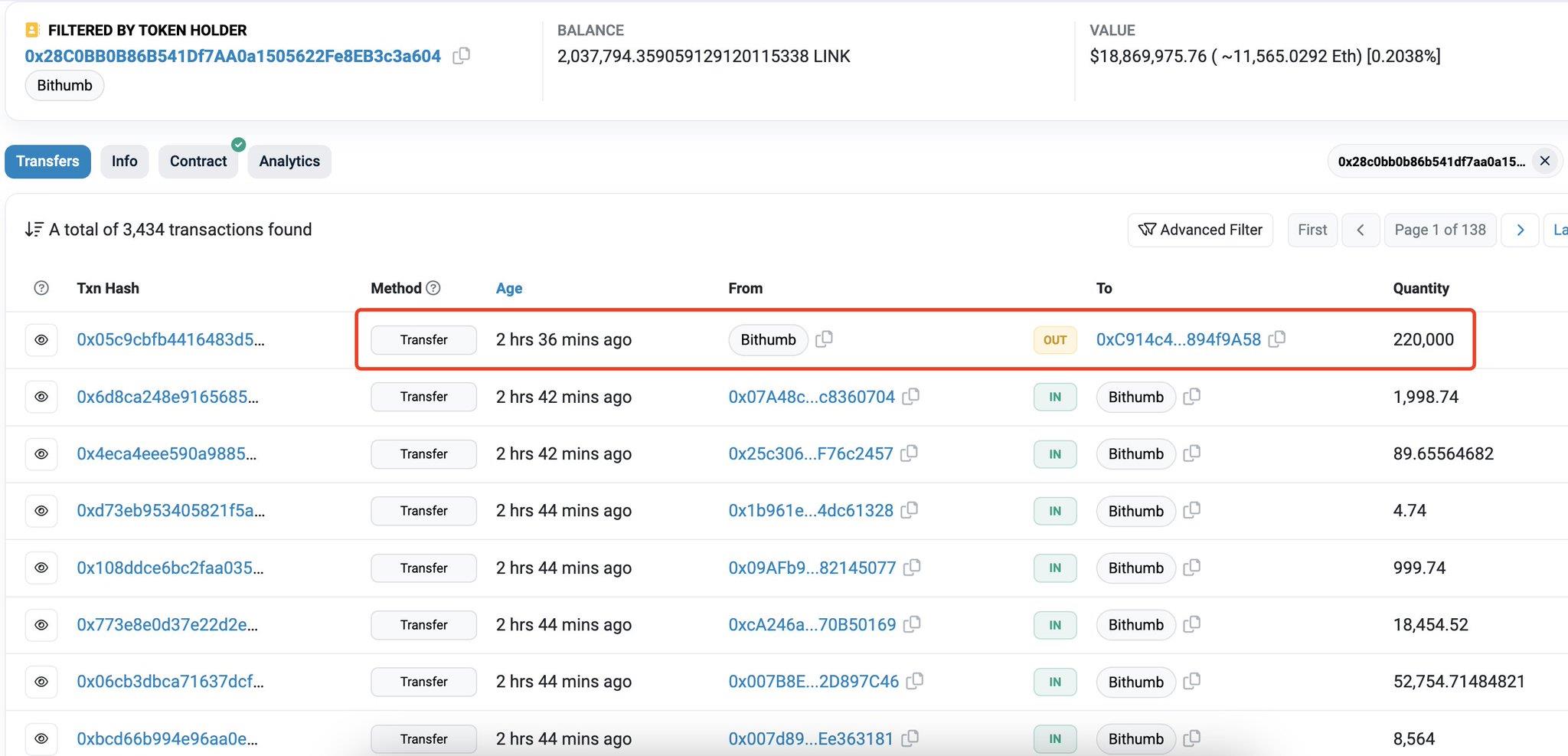

We observed that during the recent price increase of $LINK, South Korean exchanges Bithumb and Upbit collectively acquired 940,000 $LINK (worth $9 million).

The surge in $LINK’s price is closely tied to activity from Bithumb and Upbit.

Bithumb has now halted its accumulation and transferred out 220,000 $LINK ($2.05 million) just two hours ago. Shortly after, the price of $LINK began to decline from its peak.

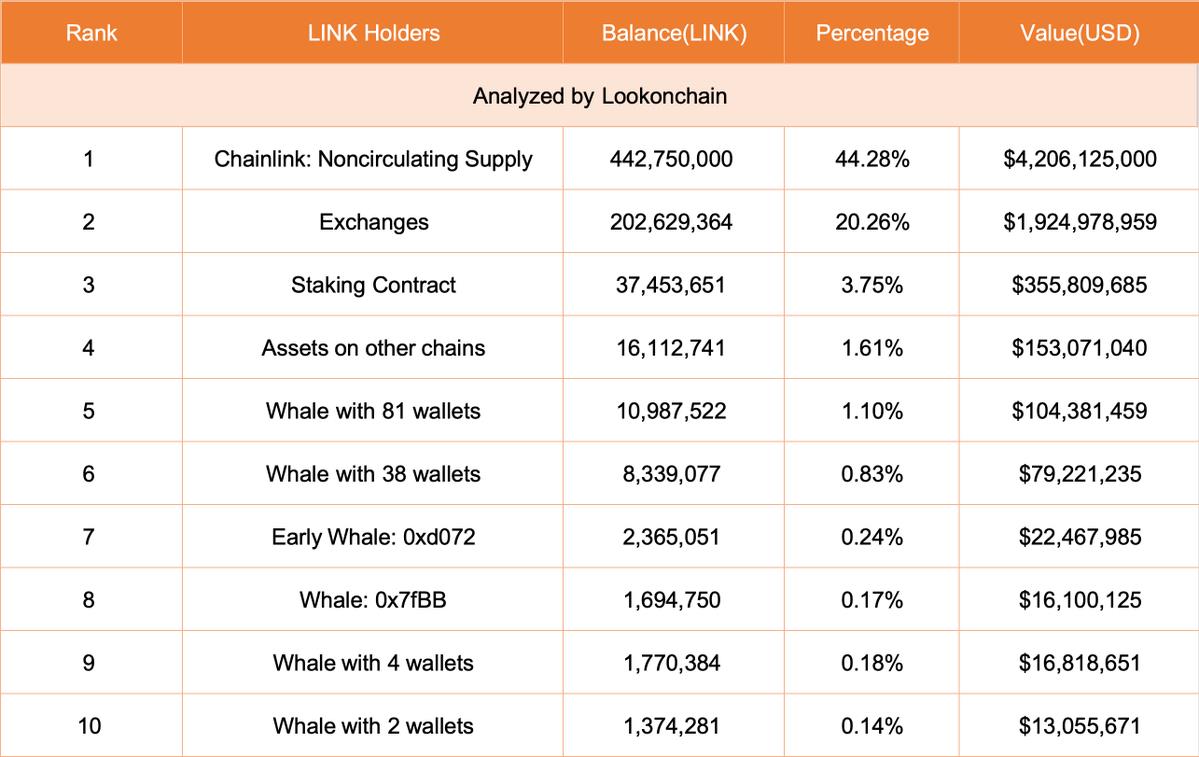

We analyzed $LINK holders. Exchanges currently hold 202.6 million $LINK (worth $1.9 billion, accounting for 20.26% of total supply). Holders have collectively staked 37 million $LINK (worth $355.8 million).

We also identified several large whales holding significant amounts of $LINK.

We previously highlighted a whale cluster consisting of 81 addresses, which has cumulatively purchased 11 million $LINK (worth $80.32 million) from Binance since September 19.

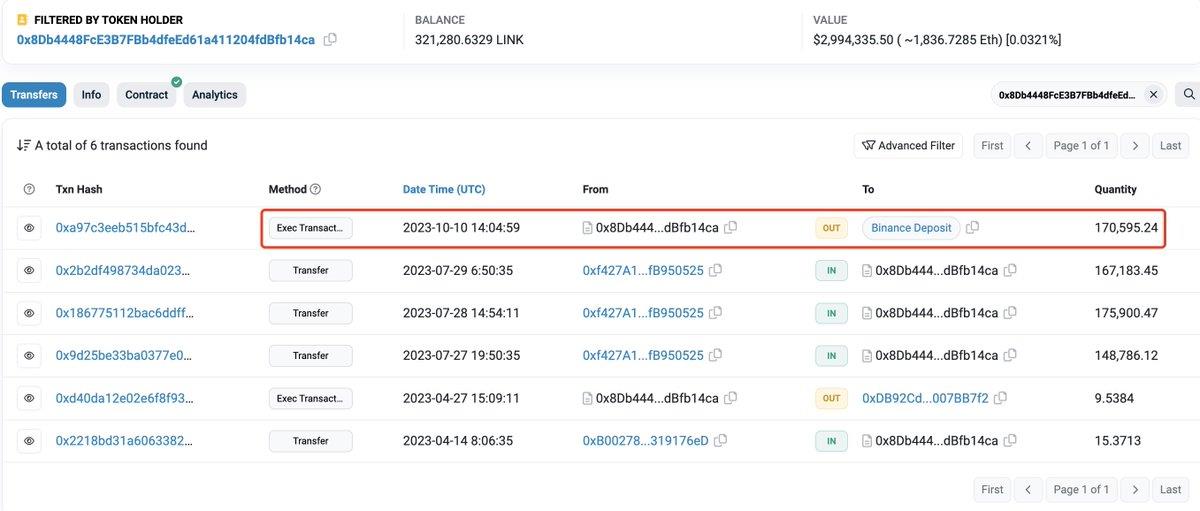

Another whale, operating at least 38 addresses (possibly more), began accumulating $LINK starting in February, with some of these addresses beginning to sell $LINK in October. This whale currently holds 8.34 million $LINK (worth $79.22 million).

This whale purchased 1.25 million $LINK (worth $9.5 million) on-chain at an average price of $7.58 and has already realized a profit of $2.1 million based on current prices.

Be cautious—whales may continue selling $LINK to secure profits.

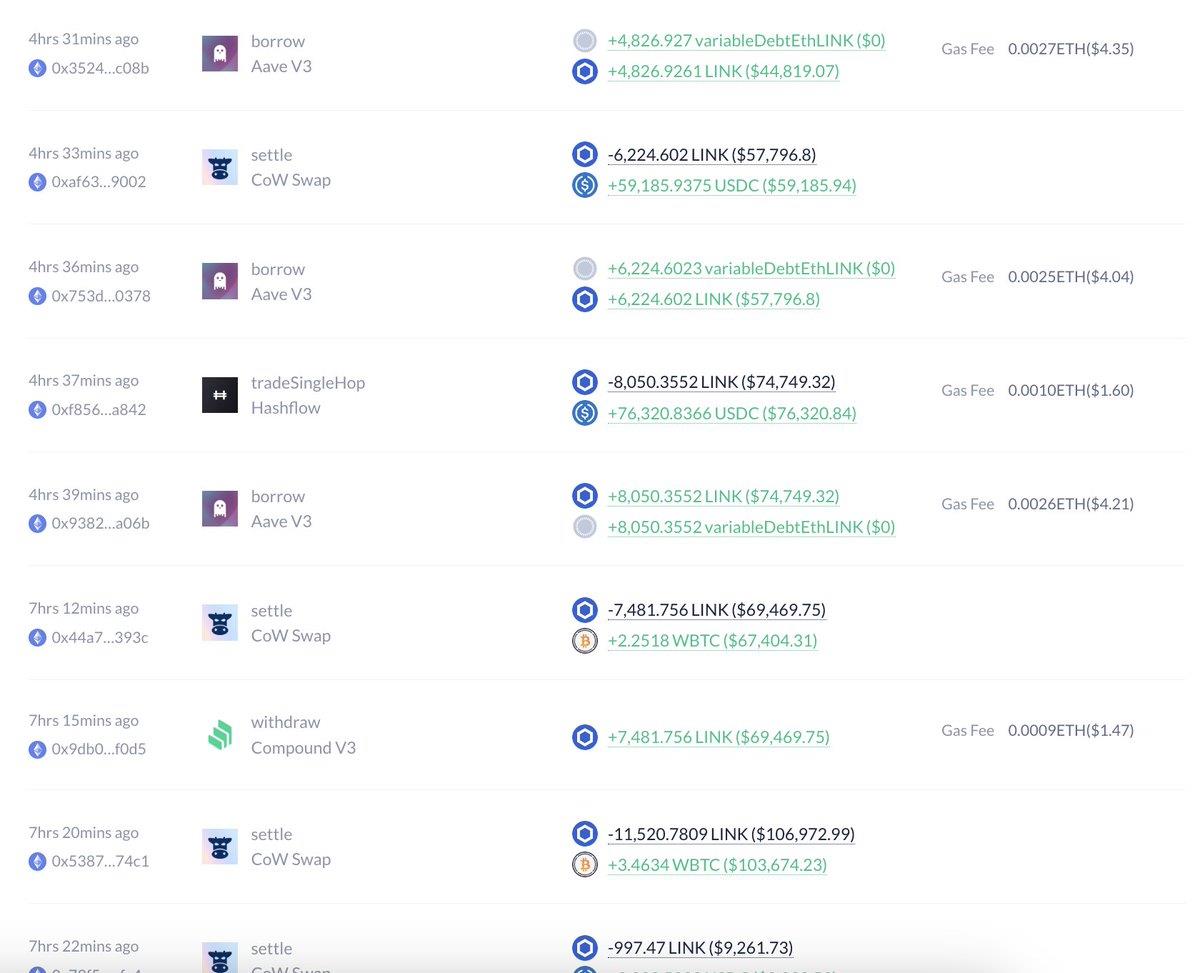

What are smart money wallets doing following the $LINK price surge? Some profit-seeking wallets are shorting $LINK to capitalize on volatility. Whale C sold all 38,381 of their $LINK holdings at $9 ($346,000), then borrowed 38,747 $LINK ($369,000) from Aave and sold them at $9.50.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News