What will Staking and CCIP bring to Chainlink and $LINK?

TechFlow Selected TechFlow Selected

What will Staking and CCIP bring to Chainlink and $LINK?

Since its launch, Chainlink has become a fundamental component of DeFi.

Written by: Lo

Compiled by: TechFlow

Since its launch, Chainlink has become a fundamental component of DeFi.

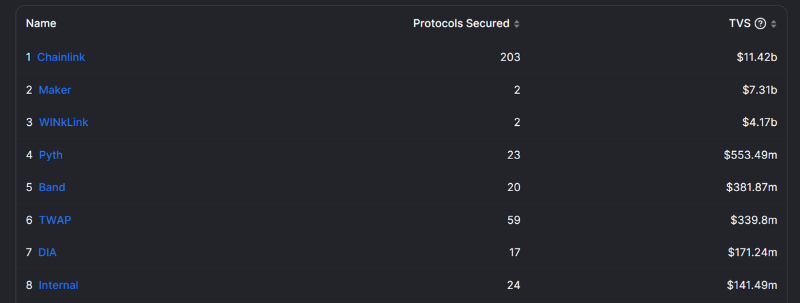

Their price feeds remain the most trusted, with many DeFi protocols relying on Chainlink's price oracles to provide accurate pricing data.

$LINK dominates the oracle space, and I believe this situation won't change anytime soon.

Major catalysts for $LINK: Staking and CCIP are coming soon.

Let’s take a look at how these use cases may evolve in the future.

LINK Staking

One major criticism of $LINK since inception has been that token holders don’t receive any share of protocol revenue—and $LINK staking will change that.

With the launch of V0.1, $LINK stakers will earn approximately 4–5% annual $LINK rewards, depending on the node they stake with. The V0.1 staking pool will start with a cap of 25 million $LINK and is planned to scale up to 75 million $LINK over the following months.

This will change once V1 arrives, where rewards will be distributed based on user fees and the duration for which you lock your $LINK. The cap will also be removed, and subsidies will be replaced by user fees.

An interesting aspect of the $LINK staking mechanism is that nodes with larger $LINK stakes will receive higher job value compared to nodes with smaller $LINK backing, potentially generating more income for node operators.

We might then see a scenario where node operators buy more $LINK to outcompete others, potentially leading to increased revenue or reinvesting their LINK rewards into their own pools. Top-performing nodes could attract more $LINK holders, further growing the staking pool.

According to Sergey Nazarov at SmartCon, $LINK staking is expected to go live in December this year.

CCIP

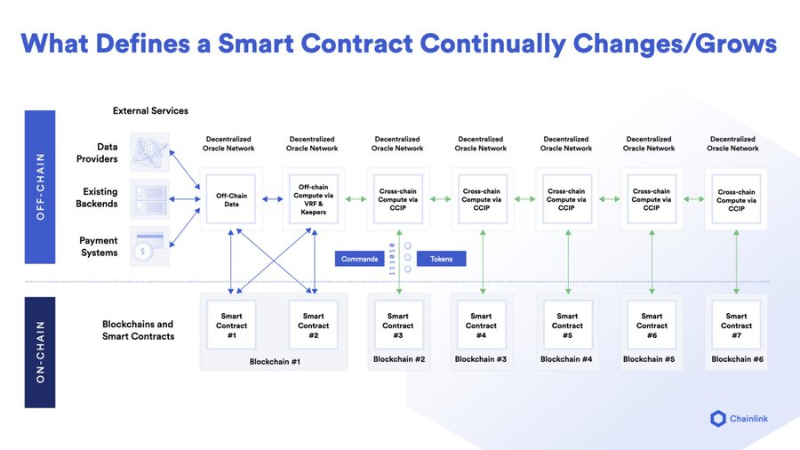

Another major update from Chainlink is CCIP (Cross-Chain Interoperability Protocol). In simple terms, CCIP is a system that allows developers to build cross-chain smart contracts.

CCIP is infrastructure designed to reduce complexity arising from blockchain fragmentation and enable true interoperability across blockchains.

This will be a big deal, but development is still ongoing, so I don’t expect it to launch very soon.

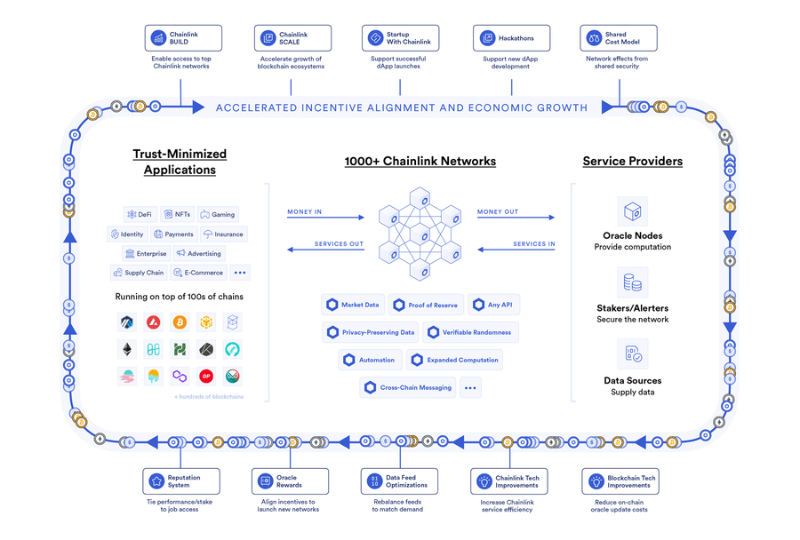

Looking at all the products Chainlink is developing—Oracles, VRF, Keepers, DECO, and CCIP—it’s clear that Chainlink aims to become the foundational infrastructure layer for all blockchain technologies.

And Chainlink isn’t just focused on blockchain within DeFi—they’re also betting on traditional systems, believing these will eventually migrate to blockchain and bring new problems to solve. We’ve already seen examples like using Chainlink for weather data and crop insurance.

In short, Chainlink is making a long-term bet on the continued expansion of blockchain technology and becoming the infrastructure supporting all associated data.

Imagine a world where automating traditional sectors like insurance markets via blockchain becomes a standard enterprise solution.

Revenue and Team Tokens

Regarding revenue, last month about 490,000 $LINK were paid as rewards to node operators. At the current price of $8 per token, this equates to roughly $48 million in annualized revenue (possibly including subsidy incentives). A tricky part about Chainlink's revenue is that a portion of the $LINK rewards is likely sold by node operators to cover operational costs.

However, similarly, once staking launches, node operators will likely stake part of their LINK rewards to maintain competitiveness against other operators.

Another important point is that the Chainlink team has retained LINK tokens since launch to fund operations.

Currently, the team wallets appear to hold around $150 million worth of LINK tokens used to fund expenses. It seems they haven’t recently sold, but tracking this is time-consuming because $LINK funds have been transferred across different wallets over time.

Operating expenses are also something I’ve struggled to find exact figures for. Since the team uses $LINK to fund allocations, it's best to view these $LINK holdings as long-term reserves used to support development and temporary incentives.

In my view, betting on $LINK is a bet on blockchain technology going mainstream and being directly adopted in enterprise solutions. The more protocols that use Chainlink, the more revenue node operators will generate, potentially increasing demand for $LINK ownership.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News