U.S. Department of Commerce "goes on-chain": Oracles take off

TechFlow Selected TechFlow Selected

U.S. Department of Commerce "goes on-chain": Oracles take off

This round of oracle's resurgence is different from previous emotional hype.

By: BitpushNews

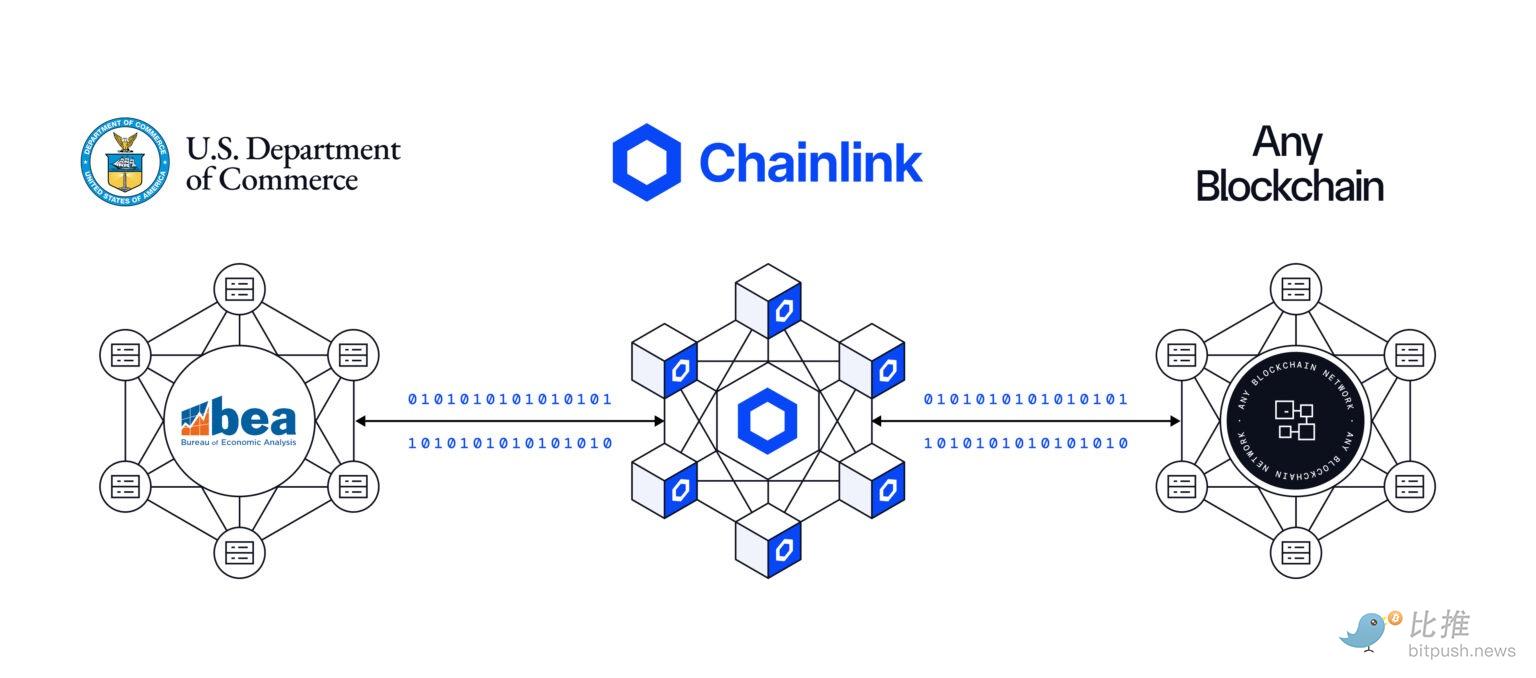

The U.S. Department of Commerce has announced a landmark initiative: partnering with blockchain data service Chainlink to bring six key macroeconomic indicators from the Bureau of Economic Analysis (BEA) directly onto the blockchain.

These data points include Gross Domestic Product (GDP), the Personal Consumption Expenditures (PCE) price index, and final sales to domestic purchasers by private entities—covering both overall economic scale and growth as well as inflation and consumption trends. They are widely regarded as the most critical metrics in macroeconomic analysis.

Technically, the data will be delivered on-chain via Chainlink Data Feeds, initially covering ten major public blockchains including Ethereum, Arbitrum, Optimism, and Avalanche. Meanwhile, the emerging Pyth Network has also been selected to distribute and verify part of the economic data. In other words, this marks the first time the U.S. government has entrusted its core economic data to decentralized infrastructure for dissemination.

This move is widely interpreted within the industry as institutional endorsement. Previously, interfaces between blockchain and the real economy were mostly driven by private initiatives or experimental projects. Now, with official backing, this data-on-chain initiative signals that blockchain is evolving from a "closed system for crypto finance" into a "public data layer" serving broader economic systems.

Markets Anticipate Change

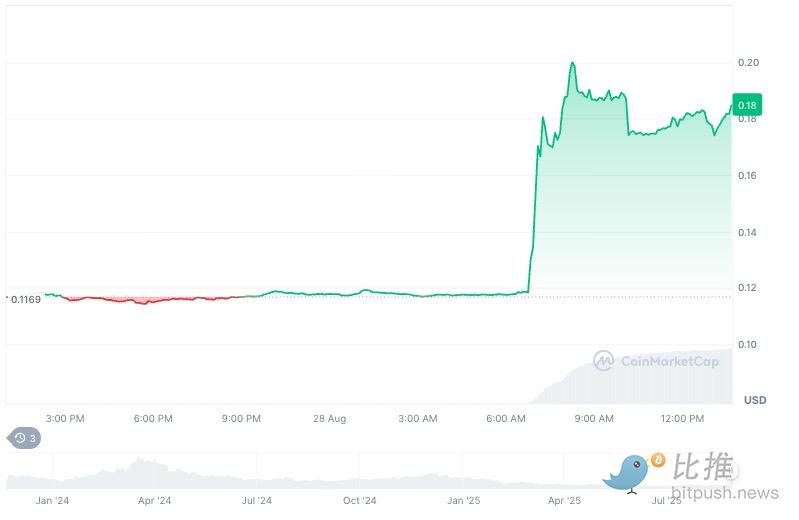

In fact, price movements in the oracle sector had already signaled this shift. Chainlink (LINK) began a steady rise from late July, gaining over 40% in one month—significantly outperforming mainstream assets like Ethereum. After the announcement, Pyth (PYTH) became a market focal point, surging more than 50% in a single day and surpassing a $1 billion market cap for the first time.

In comparison, other secondary projects such as Band Protocol, UMA, API3, and RedStone also saw varying degrees of rebound, but their scale and momentum were far behind LINK and PYTH.

This trend is no coincidence. As the RWA (real-world assets) narrative gains traction and governments openly collaborate with oracles, investor risk appetite is shifting toward infrastructure tokens. In the new market cycle, oracles may reclaim their position as essential "bull market holdings."

Expanding Use Cases: Beyond Just a Tool

For years, oracles have largely been seen as "behind-the-scenes assistants" in blockchain systems.

During the DeFi boom of 2020–2021, the primary role of oracles was price feeds—transmitting off-chain exchange prices to smart contracts for loan liquidations and derivatives settlements. Nearly every lending protocol, DEX, and synthetic asset platform relied on oracles. Yet this supporting role kept them invisible, rarely drawing attention like exchanges or popular applications.

The Department of Commerce's decision to put data on-chain changes this dynamic. For ordinary investors, it could fundamentally redefine where blockchain adds value.

For example, if future bonds or savings products can be directly pegged to PCE inflation data, individuals' on-chain investments could truly synchronize with real-world economies. Similarly, putting GDP data on-chain could enable derivatives or structured products tied to economic growth—such as "GDP options" or "inflation-hedging bonds." These instruments are complex and cumbersome in traditional markets, but blockchain-based smart contracts can implement them at lower cost.

Moreover, prediction markets stand to undergo a transformation. Historically, they've lacked authoritative data sources, limiting credibility. Now, prediction contracts based on official economic indicators could attract larger participation and serve as tools for policy and market research. For academics, media, and even governments, such markets could become genuine "sentiment barometers."

Another potential application lies in risk management. Stablecoin issuers or DeFi protocols could use real-time inflation and GDP data to dynamically adjust interest rates, collateral ratios, and reserve levels. In essence, macroeconomic factors would be embedded directly into the logic of on-chain protocols, strengthening the resilience of the entire crypto financial system.

These use cases show that oracles are no longer just tools for DeFi—they're becoming the bridge between real-world data and the on-chain world. As more government and institutional data goes on-chain, the importance of this interface will only grow.

Landscape: One Dominant Leader, One Strong Challenger, Long Tail Experimenting

In terms of market capitalization, the oracle sector is highly concentrated. Chainlink, with a market cap of approximately $16.6 billion, holds over 70% of the sector’s total share, making it the undisputed "sole leader." It has long been the standard choice for DeFi applications, and its collaboration with the U.S. government further solidifies its dominant position.

Pyth has emerged over the past year as the clear "strong second." Leveraging advantages in high-frequency financial data and cross-chain distribution, Pyth rapidly gained traction within exchange ecosystems. Now receiving official endorsement, market expectations for its potential have risen significantly. Though its market cap is only about one-tenth of LINK’s, its growth rate and ecosystem expansion make it the only newcomer with a realistic chance of challenging the status quo.

The long tail includes projects like Band, UMA, API3, and RedStone. These typically have market caps between $100 million and $200 million, playing supplementary roles. For instance, Band once had visibility in Asian markets, UMA promotes an "optimistic oracle" model, and RedStone explores modularized data services. However, their smaller scale limits their influence in shaping broader trends. Investors often view them as "marginal opportunities" rather than core players in the sector.

This "one dominant, one strong + long tail experimenting" structure reinforces capital concentration. Market attention and funding are rapidly converging on Chainlink and Pyth, creating an oligopolistic effect similar to traditional tech sectors.

A Victory for Public-Private Collaboration?

Behind this partnership lies more than just technology. Chainlink has long engaged in compliance and policy outreach, having direct dialogues with the SEC and the Senate Banking Committee. Pyth also acknowledges maintaining close communication with the Department of Commerce team for months. Gaining access to the U.S. Department of Commerce's data isn't just about code and nodes—it also requires political connections and regulatory competence.

Commerce Secretary Howard Lutnick publicly stated the goal is to make U.S. economic data "immutable and globally accessible." This statement not only affirms blockchain’s value but also represents a rethinking of U.S. data governance. In other words, blockchain is no longer viewed as a "disruptor," but rather as a "tool" integrated into governmental frameworks.

Does this mean that only projects combining government and commercial strengths will succeed going forward? At least in the oracle space, the answer appears to be yes. Accessing core real-world data means navigating government and institutional gatekeepers. On-chain experiments can ignite through market sentiment, but scalability requires institutional endorsement.

Investment Implications

This resurgence of oracles differs from previous speculative rallies—it combines real demand, official validation, and sound capital logic. Chainlink remains solid as foundational infrastructure, while Pyth emerges as a rising force powered by speed and momentum. For investors, oracles are no longer just "backstage players in DeFi," but integral components of the global data infrastructure.

As a result, the market may increasingly favor projects capable of bridging policy and commerce. Even the most advanced technology may fail to take root without institutional access. Conversely, projects with official backing stand a strong chance of becoming long-term winners.

This oracle revival may mark a turning point—where blockchain transitions from narrative-driven hype to real-world impact.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News