DeFi Oracle Breakthrough? In-Depth Analysis of Pyth Network

TechFlow Selected TechFlow Selected

DeFi Oracle Breakthrough? In-Depth Analysis of Pyth Network

Pyth Network is an oracle network that allows users to access prices for cryptocurrencies, real-world stocks, and other assets, helping them stay informed about the latest prices of various assets such as cryptocurrencies and stocks.

Basic Information

Token Name: PYTH

Pyth Network is an oracle network that allows users to access prices for cryptocurrencies, real-world stocks, and other assets. It helps users stay informed about the latest prices of various assets such as cryptocurrencies and equities. The platform offers a unique price feed service that not only provides the current price of an asset but also includes a "confidence interval," which represents a probabilistic range indicating the accuracy of the given price.

This price and confidence interval are derived by aggregating data from multiple sources—market participants such as exchanges and financial institutions—that supply up-to-date and authentic market information. By consolidating inputs from diverse providers, Pyth Network ensures that even if certain actors attempt to manipulate prices or spread false information on other platforms, it remains difficult to influence the final aggregated price. This mechanism is how Pyth maintains price reliability.

Figure 1: Pyth AUD/USD Price Feed (Pyth, n.d.)

The native token of Pyth is PYTH, which will be used to pay for oracle updates. A price feed on Pyth will remain unchanged until someone pays this fee to trigger an update. The token will also be used for governance over the following matters:

- Setting the size of update fees

- Distribution of publisher rewards

- Approval of on-chain program upgrades

- Process for listing new price feeds, including any reference data

- Granting permissions to publishers

Competitors

Chainlink | Price: $15.53 | Market Cap: $893,252,853

Chainlink is a data-providing oracle that enables smart contracts to access real-world data. Its latest feature, the Cross-Chain Interoperability Protocol (CCIP), offers users a single interface across multiple blockchains. LINK, Chainlink’s native token, is used for node staking.

Band | Price: $1.46 | Market Cap: $199,256,414

Band Protocol is another data-providing oracle. Like Chainlink, it retrieves real-world data, but it can also directly connect APIs to smart contracts. Its native token BAND is similarly used for node staking.

Tokenomics

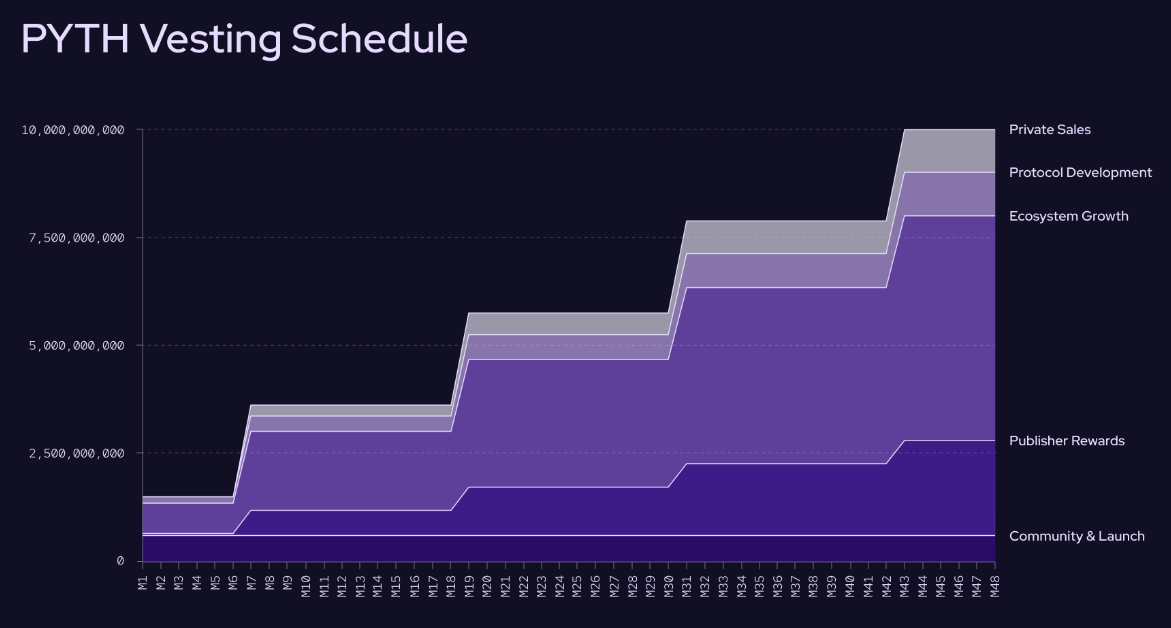

Figure 2: PYTH Token Release Schedule (Pyth Network, 2023)

The total release period spans approximately 42 months—a notably long duration. It's worth noting that a significant portion of tokens will be released around May 2024—coinciding roughly with the next Bitcoin halving event. Additionally, apart from community and launch allocations, all other rewards will be distributed at the same rate and timeline.

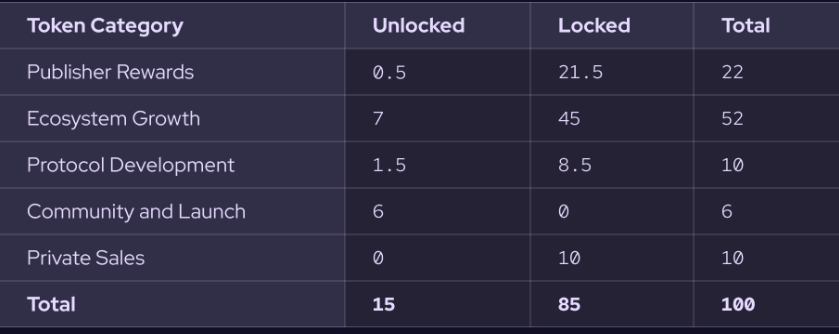

According to their published information, a substantial portion of tokens will be allocated toward ecosystem development, broken down as follows:

Figure 3: PYTH Token Distribution Table (Pyth Network, 2023)

Investors

Top five investors (out of 13 total):

- CMT Digital

- Everstake Capital

- IMC Trading

- Jump Crypto

- Kucoin Labs

It is also notable that PYTH received a grant of 40,000 OP tokens from the OP Foundation.

Bullish Fundamentals

- Advantage in Data Aggregation:

Pyth Network stands out competitively by aggregating data from multiple sources to deliver price information. Other platforms may suffer from delays or inaccuracies in data transmission, leading to discrepancies in reported prices. By integrating inputs from various providers, Pyth effectively reduces such inaccuracies.

- Enhanced Market Transparency:

Pyth Network could serve as a highly valuable tool for the cryptocurrency market by enhancing transparency. Greater transparency may attract investors who were previously unfamiliar with or hesitant to enter the crypto space.

- User Willingness to Pay:

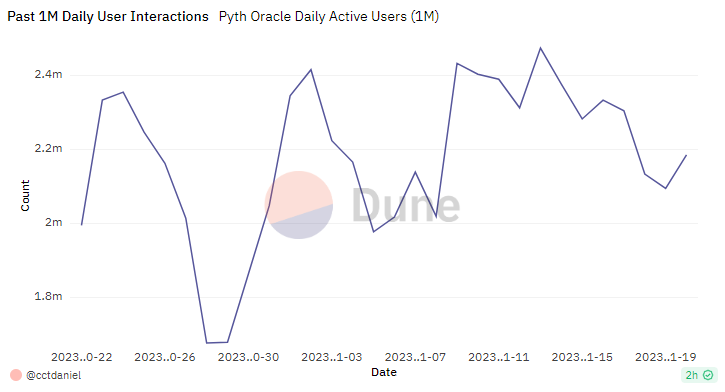

Currently, users clearly demonstrate a willingness to pay for higher-quality, more frequently updated data. This indicates that the services provided by Pyth Network hold tangible value. However, some uncertainty remains regarding sustained payment behavior (as discussed under bearish fundamentals).

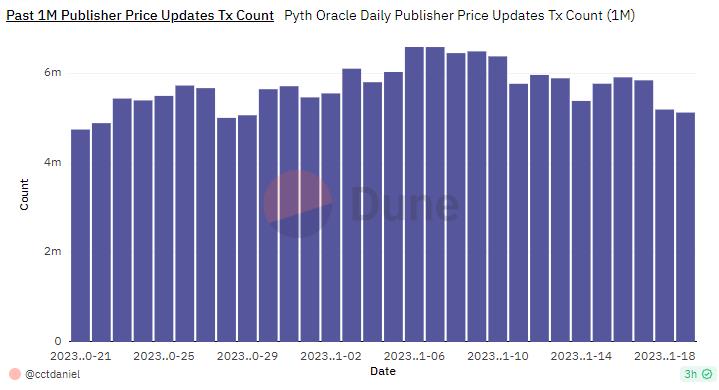

Figure 4: Number of Data Updates in the Past Month (@cctdaniel, n.d.)

Figure 5: User Interaction Count in the Past Month (@cctdaniel, n.d.)

Platforms partnering with Pyth Network:

- Vela Exchange

- Unidex

- HMX

- Synthetix

These are data providers for Pyth Network. Each platform contributes data within its specific domain, which Pyth uses to construct more comprehensive and accurate market pricing. Through these partnerships, Pyth captures market dynamics from multiple angles, delivering richer data and insights to users.

Bearish Fundamentals

Saturation in the Data Provider Market:

The data provider market is already highly saturated. Pyth Network only supplies price data, meaning the volume of data it offers may be significantly less than that of its competitors. Although Pyth’s inclusion of confidence intervals gives it a slight edge, competing providers could easily adopt similar features.

Risk of Malicious Data Submission:

- A sufficient number of publishers is required.

- Multiple simultaneous attacks must not occur (if they do, even more publishers would be needed to mitigate impact).

- In the past week, only 39 active publishers were observed.

Currently, the system requires broader participation to ensure greater security.

-

Pyth primarily relies on data aggregation to prevent malicious data submissions. (Permissioned publishers can upload data for free.) However, for its price oracle to function smoothly, the following conditions must be met:

Pyth’s Fee Structure:

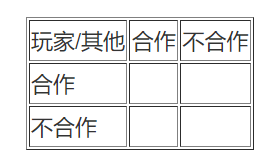

Pyth’s payment model follows the game-theoretic concept of the “volunteer’s dilemma”:

Notes:

- i describes the individual benefit gained from having the information

- l describes the loss incurred by the individual due to possessing the information

- p describes the cost associated with updating the information

From this, it follows that maximum token rewards for data update nodes are achieved only when nodes cooperate and collectively publish accurate data.

Treating the above table as a payoff matrix, if users must individually pay to update information—and can only access it after paying—they might be more inclined to pay (leaving only scenarios (2,1) and (2,2)). However, due to the possibility of freeloading (accessing information without paying), users may be reluctant to pay immediately and instead wait for others to update. For example, if David wants to invest in Ethereum (ETH), he might choose to wait a day to see if an update occurs rather than paying to update it himself. This leads not only to reduced revenue but also to delayed updates, resulting in stale prices. Research shows that such models require extensive integration with decentralized applications (dApps) or smart contracts that automatically request price updates at regular intervals—eliminating user hesitation or reliance on free access.

This section highlights potential challenges Pyth Network faces in its payment and incentive mechanisms. Because users may wait for others to pay update fees and then benefit freely, data updates could become infrequent, undermining both efficiency and profitability. This suggests Pyth may need to develop more effective incentive structures and deeper integrations to encourage timely and consistent data updates.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News