Huobi Growth Academy | In-Depth Research Report on the Oracle Track: The Intelligence Hub of the On-Chain World

TechFlow Selected TechFlow Selected

Huobi Growth Academy | In-Depth Research Report on the Oracle Track: The Intelligence Hub of the On-Chain World

The era of structural红利 in the oracle赛道 has arrived.

Executive Summary

As a critical bridge connecting on-chain contracts with off-chain real-world data in the blockchain ecosystem, oracles are gaining increasing importance and evolving from simple data relays into the "intelligence hub" of the on-chain world. This report provides an in-depth analysis of the oracle sector, first outlining the industry foundation and development trajectory of oracles as the blockchain’s “intelligence hub,” explaining why they have become essential for the trustworthy execution of smart contracts. Next, by mapping the market landscape, it compares in detail the technological and commercial competition between traditional centralized oracles and emerging decentralized projects, highlighting the value transformation brought by decentralization. In terms of potential, oracle applications have expanded beyond financial information transfer to infrastructure for on-chain real-world assets (RWA), propelling the blockchain ecosystem into a new phase. Finally, based on structural trend analysis, the report offers investment recommendations, focusing on three key directions: modular oracles, AI-integrated oracles, and RWA identity-binding oracles. It emphasizes that oracles are transitioning from supporting roles to becoming “value anchors” of on-chain order, presenting structural investment opportunities.

1. Industry Foundation and Development Trajectory: Why Oracles Are Blockchain’s “Intelligence Hub”

The essence of blockchain is a decentralized trust machine, ensuring immutability of on-chain data and system autonomy through consensus mechanisms, cryptographic algorithms, and distributed ledger structures. However, due to its inherent closed and self-contained nature, blockchain cannot natively access external data. From weather forecasts to financial prices, from voting results to off-chain identity verification, on-chain systems cannot “see” or “know” changes in the external world. Therefore, oracles serve as the crucial information bridge between on-chain and off-chain environments, playing the role of “perceiving the external world.” They are not mere data couriers but function as the intelligence hub of blockchain—only when off-chain information provided by oracles is injected into smart contracts can on-chain financial logic execute correctly, thereby linking the real world with the decentralized universe.

1.1 Information Silos and the Emergence of Oracles

Early networks like Ethereum or Bitcoin faced a fundamental problem: on-chain smart contracts were “blind.” They could only compute based on data already written to the chain and could not actively retrieve any off-chain information. For example: DeFi protocols couldn’t obtain real-time ETH/USD prices; GameFi games couldn’t sync real-world sports scores; RWA protocols couldn’t determine whether physical assets (e.g., real estate, bonds) had been liquidated or transferred.

The emergence of oracles was precisely aimed at resolving this existential flaw of information silos. Through centralized or decentralized means, they extract data from the external world and transmit it on-chain, giving smart contracts “context” and “world state,” thus enabling more complex and practical decentralized applications.

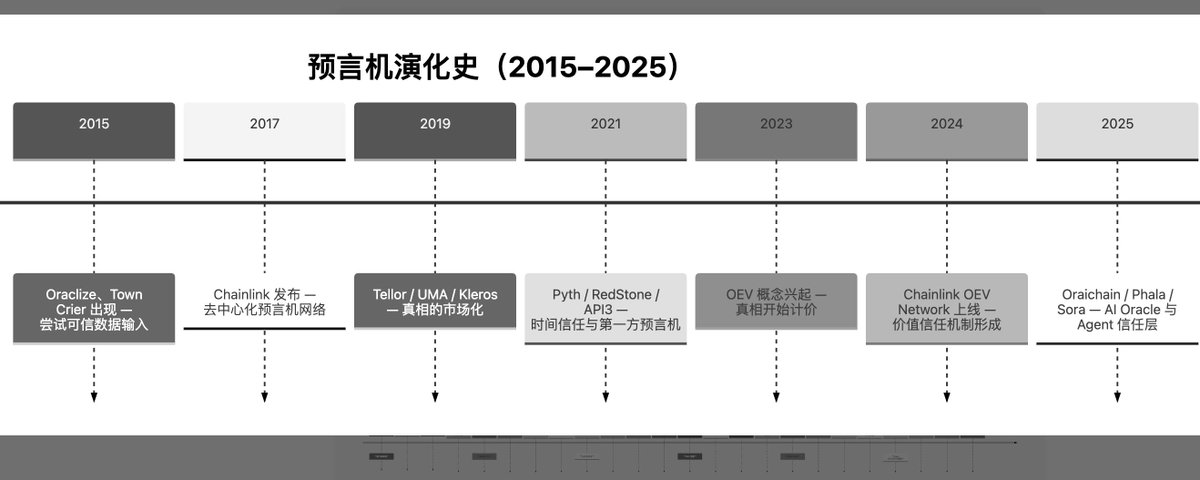

1.2 Three Key Evolutionary Stages: From Centralized to Modular

The development of oracle technology has gone through three stages, each significantly expanding its role within the blockchain world:

Stage One: Centralized Oracles – Early oracles mostly adopted a single data source plus centralized node push model, such as early Augur or Provable. However, these offered extremely low security and censorship resistance, making them highly vulnerable to tampering, hijacking, or service outages.

Stage Two: Decentralized Data Aggregation (Chainlink Paradigm) – The emergence of Chainlink elevated oracles to a new level. By combining multiple data providers (Data Feeds), a node network, aggregation, and staking with incentive mechanisms, it built a decentralized data provisioning network. This greatly enhanced security and verifiability and became the industry standard.

Stage Three: Modular, Verifiable Oracles (Verifiable & Modular Oracles) – With growing demand and new technologies like AI, modular oracles have become a trend. Projects such as UMA, Pyth, Supra, RedStone, Witnet, Ritual, and Light Protocol have introduced innovative mechanisms including “crypto-proofed data,” “ZK-Proofs,” “off-chain computation verification,” and “custom data layers,” advancing oracles toward flexibility, composability, low latency, and auditability.

1.3 Why Are Oracles an “Intelligence Hub” Rather Than a Peripheral Tool?

In traditional narratives, oracles are often likened to the “sensory system” of blockchain—the eyes, ears, nose, and mouth. But in today’s highly complex on-chain ecosystem, this analogy falls short. In DeFi, oracles define the “benchmark reality” for liquidations, arbitrage, and trade execution; delays or manipulation of data can trigger systemic risks. In RWA, oracles perform the synchronization function of “digital twins of off-chain assets” and serve as the sole trusted interface proving the existence of real-world assets on-chain. In the AI+Crypto domain, oracles become the “data ingestion port” feeding models, determining whether intelligent agents can operate effectively. In cross-chain bridges and restaking protocols, oracles also handle tasks such as “cross-chain state synchronization,” “security bootstrapping,” and “verifying consensus correctness.”

This means oracles are no longer just “senses,” but rather the neural and intelligence center of the complex on-chain ecosystem. Their role has evolved beyond mere “perception” to establishing consensus reality and serving as core infrastructure synchronizing the on-chain universe with the off-chain world.

From a national perspective, data is the oil of the 21st century, and oracles are the gatekeepers of data flow. Controlling the oracle network means controlling the generation of “reality perception” on-chain: whoever defines prices controls financial order; whoever synchronizes truth shapes cognitive structures; whoever monopolizes access defines the standards of “trusted data.” Thus, oracles are becoming core infrastructure within DePIN, DeAI, and RWA modules.

2. Market Landscape and Project Comparison: The Head-on Clash Between Centralized Legacy and Decentralized Newcomers

Although oracles are regarded as the “intelligence hub” of blockchain, in reality, control over this hub has long been in a quasi-centralized monopolistic state. Traditional giants like Chainlink, while instrumental in building industry infrastructure, have also been the biggest beneficiaries of established order. However, with the rise of emerging trends such as modularity, DePIN paradigms, and ZK verification paths, the oracle market is undergoing an explicit power restructuring. This shift is not merely product competition but a philosophical confrontation over “who defines on-chain reality.”

The significance of Chainlink to the oracle space mirrors that of early Ethereum to smart contracts. It pioneered a complete network architecture combining data aggregation, node staking, and economic incentives, becoming the irreplaceable “on-chain benchmark reality provider” after the DeFi summer. Financial protocols like Aave, Compound, Synthetix, and Layer 2 networks like Polygon and Arbitrum all heavily rely on Chainlink’s data feeds. Yet, this very indispensability brings two vulnerabilities: first, over-reliance creates single points of failure in on-chain systems; second, hidden centralization leads to transparency crises and potential data censorship. While Chainlink’s node network is nominally decentralized, in practice it concentrates among a few validators such as Deutsche Telekom, Swisscom, and Blockdaemon. Moreover, decisions around its Off-Chain Reporting (OCR) mechanism, data source selection, and update frequency are largely opaque and lack community governance. It functions more like a centralized publishing system pushing a “trusted version of reality” into the blockchain world, rather than a truly decentralized, censorship-resistant data market. This gap created the opening for new entrants.

Pyth Network emerged as a direct challenge to Chainlink’s model. Instead of copying traditional data aggregation, Pyth grants data upload rights directly to data sources themselves—exchanges, market makers, and infrastructure providers. This “first-party data upload” model drastically reduces off-chain relay layers, improving timeliness and authenticity, transforming oracles from “data aggregators” into “primary pricing infrastructure.” This is especially attractive for high-frequency, low-latency use cases such as derivatives trading, perpetual contracts, and on-chain game logic. However, it raises deeper concerns: most of Pyth’s data sources come from crypto exchanges and liquidity providers—actors who are both information suppliers and market participants. Whether this “player-as-referee” structure can truly avoid price manipulation and conflicts of interest remains an unproven trust gap.

Unlike Pyth, which focuses on data sources and update efficiency, RedStone and UMA take alternative approaches by targeting the structural layer of the oracle’s “trust path.” Traditional oracles operate via “price feeding” and “confirmation”—nodes upload data broadcast to smart contracts, which then adopt it as state basis. The main issue with this mechanism is the absence of a true “verifiable data path” on-chain. In other words, contracts cannot verify whether uploaded data genuinely originated from designated off-chain sources or whether its transmission path remained neutral and intact. RedStone’s “verifiable data packet” mechanism addresses this: it cryptographically packages off-chain data into signed data units that on-chain contracts can immediately unpack and validate, greatly enhancing determinism, security, and flexibility in data usage.

Likewise, UMA’s “Optimistic Oracle” paradigm is even more radical. It assumes the oracle does not need to provide perfectly accurate data every time, but instead relies on economic games to resolve disputes when disagreements arise. This optimistic approach delegates most data processing off-chain, only resorting to on-chain governance via dispute resolution modules when challenged. The advantage lies in high cost efficiency and scalability, ideal for complex financial contracts, insurance, and long-tail information scenarios. However, its downside is equally clear: poorly designed incentive mechanisms can easily lead to repeated attacks and manipulation through gaming the dispute process.

Newer projects like Supra, Witnet, and Ritual innovate at finer levels: some build bridges between “off-chain computation” and “cryptographic verification paths,” others modularize oracle services for flexible deployment across different blockchain environments, and still others redesign the incentive structures between nodes and data sources to create customizable “trusted data supply chains.” While these projects haven’t yet achieved mainstream network effects, they signal a clear shift: the oracle race has moved from “consensus wars” to “trust-path wars,” from “single-price provision” to full-scale competition over “trusted reality generation mechanisms.”

We are witnessing a transformation of the oracle market—from “infrastructure monopoly” toward “diversity of trust.” Established players enjoy strong ecosystem lock-in and user path dependency, while newcomers leverage verifiability, low latency, and customization to exploit cracks left by centralized oracles. Regardless of position, one reality must be acknowledged: whoever defines “truth” on-chain holds the benchmark control over the entire crypto world. This is not merely a technical battle, but a “battle for definitional authority.” The future of oracles will never again be as simple as “moving data onto the chain.”

3. Potential and Boundary Expansion: From Financial Data Flow to On-Chain RWA Infrastructure

The essence of oracles is providing “verifiable real-world inputs” to on-chain systems, giving them a far more central role than mere data transmission. Looking back over the past decade, oracles began by serving DeFi with basic “price feeds” but are now expanding into broader domains: evolving from foundational data providers for on-chain financial transactions into central systems for mapping real-world assets (RWA), bridging nodes for cross-chain interoperability, and even becoming the “empirical bedrock” supporting on-chain legal frameworks, identity, governance, and AI-generated data.

Infrastructure for Financial Data Flow: During the golden age of DeFi (2020–2022), oracles primarily served “price feeding”—supplying real-time market prices to on-chain contracts. This drove rapid growth in projects like Chainlink, Band Protocol, and DIA, spawning the first generation of oracle standards. But as DeFi contracts grew in complexity, oracles were forced to “go beyond price”: insurance protocols needed climate data, CDP models required economic indicators, perpetual contracts demanded volatility and volume distributions, and structured products needed multi-factor inputs. This marks the evolution of oracles from price tools to multivariate data access layers, gradually becoming “systemic.”

Furthermore, as projects like MakerDAO, Centrifuge, Maple, and Ondo integrate large-scale off-chain debt, government bonds, and fund shares, the oracle’s role shifts toward becoming a trusted registrar for on-chain RWA (Real-World Assets). In this process, oracles cease being mere “data pipes” and evolve into certifiers, state-updaters, and executors of yield distribution for RWA on-chain—a neutral system with “fact-driven capabilities.”

The Root of RWA Trustworthiness: The core challenge of RWA has never been “technical difficulty,” but rather “how to align on-chain representations with off-chain legal status and asset conditions.” In traditional systems, consistency is ensured by lawyers, auditors, regulators, and paper trails. In blockchain, oracles become the key to reconstructing this mechanism. For instance, if an on-chain bond is backed by an off-chain property, how can the smart contract know if that property has been seized, appraised, rented, sold, or mortgaged? All such information exists off-chain and cannot be natively on-boarded. Here, the oracle’s task goes beyond “data syncing.” It must connect government registries, IoT devices, audit processes, and reputation systems to construct an “on-chain trust snapshot,” continuously refreshed to maintain alignment between contract states and real-world conditions. This capability pushes oracles into increasingly complex application frontiers, requiring integration with legal, physical, and political trust systems.

We also observe collaborations such as RedStone with Centrifuge, uploading cash flows, maturity statuses, and default information of RWA assets in modular data formats to provide atomic-level inputs for trading, risk management, and liquidation in liquidity markets. Such standardized and trustworthy update mechanisms are akin to building an “audit chip” for on-chain financial systems—the foundational layer enabling Web3 finance to mirror reality.

The “Cross-Asset Layer” Evolution of Oracles: Another notable trend is the shift of oracles from “data provisioning layer” to “cross-asset coordination layer.” As cross-chain protocols like LayerZero and Wormhole rise rapidly, single-chain data barriers are breaking down, yet synchronization of asset states remains severely fragmented. For example, an Ethereum-based stablecoin may depend on clearing prices from Arbitrum, while a Solana-based structured product might rely on the yield of RWA debt on Polygon. These multi-chain financial architectures require a “logical hub” to coordinate data acquisition, updates, validation, and broadcasting. Future oracles—especially those supporting cross-chain deployment, off-chain coordination, and composable contracts—will resemble “on-chain API middleware.” They won’t just deliver data but possess capabilities to invoke, verify, transform, integrate, and distribute it, becoming the data intelligence layer for the entire Web3 application stack.

Once oracles achieve stability in RWA, the next frontier will be mapping data about “people” and “behavior.” That is, they will not only record “the state of things” but also capture “human actions”—on-chain credit systems, DID (decentralized identity), on-chain litigation arbitration, and authenticity verification of AI-generated content will all require “auditable on-chain input interfaces.” This direction is already emerging in projects like EigenLayer, Ritual, and HyperOracle: whether validating off-chain model outputs, integrating AI results into on-chain workflows, or having auditors assume factual responsibility via staking models.

This trend indicates that the boundaries of oracles have expanded from “financial data flow” to the entire data spectrum of “on-chain order generation,” becoming foundational infrastructure for the transition from the real world to on-chain civilization. Oracles are no longer mere megaphones for price transmission but digital bridges linking information, value, and trust.

4. Outlook and Investment Recommendations: Structural Opportunities Have Arrived, Focus on Three Key Directions

The maturity and attention given to oracle technology often exhibit “non-linear cyclical breakthroughs”—after public chain infrastructure enters a stage of saturated competition, oracles, as the most critical “data foundation” linking on-chain systems with the real world, gain even greater strategic prominence. Whether due to the rise of Layer 2, the adoption of RWA, or the convergence of AI and on-chain computing, oracles have become unavoidable “trust anchors.” Therefore, looking ahead three years, the investment thesis for oracles will shift from “market cap speculation” to “cash flow revaluation driven by structural growth.”

4.1 Clear Structural Trends, Supply-Demand Curves Realigning

As traditional financial institutions accelerate integration with on-chain protocols, the status of real-world assets, legal conditions, and human behaviors must enter on-chain systems in structured, standardized, and verifiable formats. This trend drives two fundamental shifts:

Demand for high-frequency, customized data streams is surging, turning oracles from simple price relays into computational nodes supporting complex logic such as automatic liquidation, yield mapping, and state transitions;

The “economic attributes” of data are becoming more pronounced, with pricing models shifting from “gas cost + node incentives” to “B2B enterprise subscriptions + SLA data agreements + contractual liabilities,” creating stable cash flows.

This leap in supply-demand dynamics shifts project valuation models from “narrative-driven” to “revenue-driven,” offering new investment anchors for long-term holders and strategic capital. Especially for leading RWA projects, AI compute chains, and DID architectures, selecting reliable, stable, high-throughput oracle services represents an irreplaceable dependency at the contract level.

4.2 Three Key Areas with Long-Term Alpha Potential

Under this new paradigm, we recommend focusing on three oracle development paths, each representing an extension of the oracle’s role as an “intelligence hub” across different dimensions:

1) Modular, Application-Native Oracles: Proximity to business equals proximity to value. Unlike traditional “general-purpose” oracle models, next-gen projects like RedStone, PYTH, and Witnet emphasize “on-demand service” and “local deployment,” embedding oracle logic directly into application contracts or VM layers. This better serves the needs of high-frequency trading and structured asset protocols, enabling faster data transmission, higher accuracy, and lower costs. The advantage lies in natural “product-to-protocol” stickiness—once a DeFi or RWA project adopts a specific oracle, migration costs are prohibitively high, ensuring long-term binding revenue and defensive moats.

2) AI-Oracle Integration Narrative: The Interface Layer for Verification, Filtering, and Fact Generation. As AI models deeply integrate into the crypto ecosystem, verifying the authenticity of their generated content, behavioral predictions, and external calls becomes an unavoidable foundational issue. Oracles serve as the logical anchor: they don’t just provide data but verify whether it originates from trusted computation and satisfies multi-party consensus. Projects like HyperOracle, Ritual, and Aethos are already experimenting with zkML, trusted hardware, and cryptographic inference to deliver “provable AI outputs” to on-chain contracts via oracle interfaces. This direction features high technical barriers and strong investor interest, positioning it as a potential high-beta breakout point.

3) RWA and Identity-Binding Oracles: Off-Chain Legal State Mappers. From Chainlink’s collaboration with Swift on universal asset messaging standards, to Centrifuge’s multi-asset yield synchronization, to Goldfinch’s integration of third-party assessment models, RWA is rapidly building a trust mechanism reliant on a “neutral information layer.” At the core of this mechanism are oracle systems capable of reliably bringing off-chain legal records, asset registrations, and behavioral credit on-chain. These projects follow an “infrastructure-first” logic, with development closely tied to regulatory policies. But once industry standards emerge (e.g., Chainlink’s CCIP), they can achieve exponential network effects, making them ideal long-term “gray-consensus assets.”

4.3 Restructuring Investment Logic: From “Price Feed Story” to “On-Chain Order” Pricing

Historically, markets treated oracles as “ancillary tools” of hot DeFi sectors, with valuations and investments largely following market cycles. But going forward, oracles will gain independent valuation mechanisms because: they play irreplaceable roles as fact injectors in on-chain protocols; they generate stable, monetizable protocol revenues (e.g., Chainlink’s B2B subscription model); and they serve as foundational coordinators across structurally growing sectors like RWA, AI, and governance, exhibiting multiplicative effects.

Therefore, investors should not assess oracle projects solely by “market cap” or “trading volume,” but rather evaluate them along three core lines: depth of native integration with protocols, chains, and financial institutions; establishment of a closed-loop business model from “data → facts → consensus”; and scalability advantages in next-generation use cases (RWA, AI, cross-chain).

In summary, oracles are no longer peripheral players in the crypto narrative but are evolving into the “factual benchmark systems” and “order-generating engines” of the on-chain world. Structural opportunities have formed, and investment logic urgently needs reconstruction.

5. Conclusion: The Era of Structural Dividends in the Oracle Sector Has Arrived

The oracle sector stands at the forefront of blockchain ecosystem evolution, fulfilling the core role of bridging on-chain worlds with real-world information. As on-chain applications grow in complexity and demand for real-world asset tokenization increases, oracles are no longer just price data providers but have become the “intelligence hub” and “order-generating engine” for trustworthy smart contract execution. Technological advancements across multiple dimensions and deepening application scenarios have created unprecedented growth potential and value re-rating opportunities for oracles.

Going forward, oracle projects will evolve toward greater decentralization, modularity, and use-case specificity. The convergence of AI and on-chain data, along with the continued tokenization of RWA, will fuel sustained growth. Investors should evaluate oracle projects through three lenses: depth of protocol and institutional integration, closure of the “data-fact-consensus” business loop, and scalability in next-generation scenarios. Overall, the oracle sector is transitioning from a supporting role to the “intelligence hub” of the blockchain world. Its ecosystem value and investment potential cannot be overlooked—the era of structural dividends has arrived.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News