Pyth Network: Setting the Benchmark for Permissionless, Low-Latency, High-Fidelity DeFi Oracles

TechFlow Selected TechFlow Selected

Pyth Network: Setting the Benchmark for Permissionless, Low-Latency, High-Fidelity DeFi Oracles

The future of price oracles is not merely about finding prices and bringing them onto the blockchain.

Decentralized Finance (DeFi) has the potential to revolutionize how we manage money and empower individuals to take true control of their financial lives.

The vast majority of DeFi services rely on blockchain oracles—a secure and reliable way for blockchain applications to access real-world financial data.

Enter Pyth Network, the world’s largest first-party oracle network, continuously publishing financial market data on-chain.

Data on the network comes from over 90 first-party data providers, including some of the largest exchanges and market makers in the world. Pyth delivers real-time price feeds to smart contract developers across more than 40 blockchains, covering cryptocurrencies, stock pairs, forex pairs, ETFs, and commodities.

Since April 2021, contributors to the Pyth Network have been dedicated to bringing hundreds of real-time price feeds to Web3 developers. Pyth Network’s mission is to make all global financial market data accessible on blockchains for developers worldwide.

As the blockchain industry continues evolving toward a future of high-throughput DeFi, demand for low-latency, high-frequency on-chain data is rapidly increasing. This article explores the pivotal role Pyth Network plays in enabling this transformation.

Why Do We Need a New Oracle?

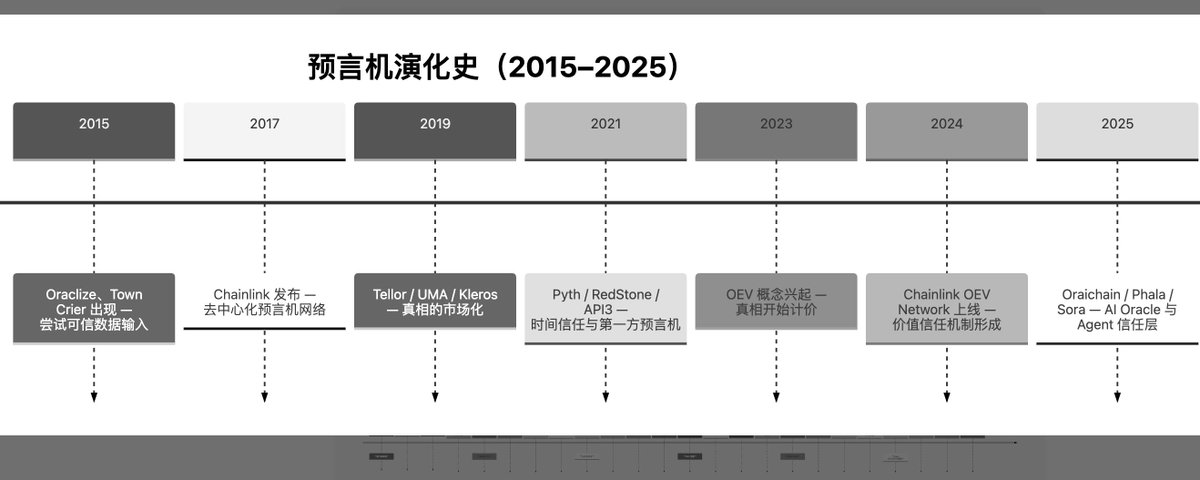

Pyth Network is not the first oracle on blockchains.

The contributors behind Pyth began the project in 2020 during the DeFi Summer, recognizing a critical gap: blockchain infrastructure was hindering the anticipated evolution of the blockchain ecosystem.

Simply put, at that time, there were no price oracles on blockchains capable of delivering ultra-low-latency, institution-grade market data. This gap presented three main challenges for Web3 developers:

-

Speed: Oracles weren’t updating fast enough for many on-chain financial use cases.

If on-chain prices update slower than real-world markets, DeFi services become inaccurate and vulnerable to malicious attacks. These limitations hindered developers from building complex on-chain financial services.

At the time, price oracles updated only every 10–60 minutes (“heartbeat”), clearly insufficient for financial scenarios requiring low latency and high-frequency price updates.

-

Asset Coverage and Availability: Developers couldn’t access the price feeds they needed.

Developers needed specific asset price feeds or trading markets for their users. If the required feed wasn’t available on their chosen blockchain, they couldn’t launch their service.

Traditional oracles might offer 200 price feeds on Ethereum but only 8 on newer chains like Base.

Even when supporting multiple chains, many oracles offered only a few feeds across all supported networks. These constraints delayed protocol milestones.

-

Data Sources and Quality: Data was opaque and sourced from aggregated third-party providers.

An oracle may secure billions of dollars in smart contract value, yet if its ultimate data sources are unclear, developers and users cannot trust the quality of the price data.

Moreover, it's difficult to trust the reliability of data pulled from public aggregation servers or web scrapers, especially when such methods are used by oracles.

How Does Pyth Work?

The Legacy Model for Data Distribution

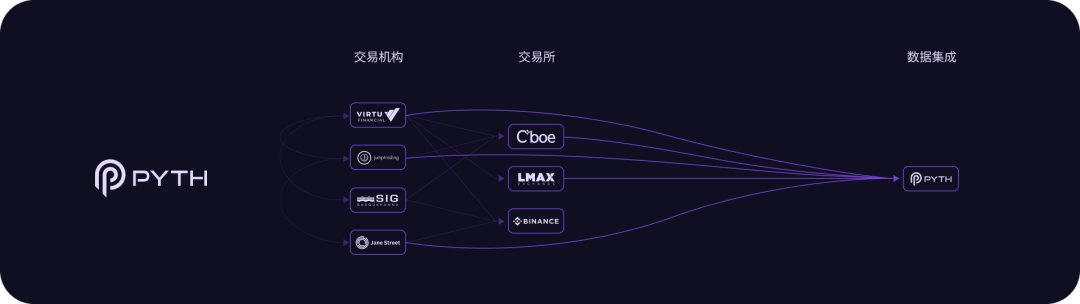

The root cause of these three issues lies in traditional oracles’ fundamental misunderstanding of how financial data works. Pyth Network was built to solve all three.

Many traditional oracles operate under an implicit assumption: all data—including financial data—is freely available in the Web2 world.

Based on this, oracle providers merely need to incentivize network participants to fetch data, reach consensus, and push it on-chain.

A network of nodes collects or scrapes data from public sources, including third-party aggregators with unverified origins. This method may work for public datasets like weather or sports scores.

However, when it comes to financial data, oracles must compromise on data quality, cost, and scalability. Furthermore, intellectual property restrictions prevent free reuse of certain financial data.

A New Model for Data Distribution

Pyth Network operates on a different premise: financial data is valuable and not freely available.

Instead of offering rough approximations, the Pyth protocol supports and incentivizes the original owners of financial data to contribute directly to blockchains. Pyth’s data sources are “first-party” because they are created and owned by the entities providing them.

To understand this, imagine Pyth as a decentralized marketplace for market data. On one side, creators of proprietary data act as suppliers; on the other, applications using the data are consumers.

Just as Airbnb unlocked more vacation homes and spare rooms for travelers, Pyth Network unlocks higher-quality data for the blockchain industry by incentivizing data owners to contribute.

The Future of DeFi is First-Party

One might ask why Pyth Network’s architecture will become the essential financial oracle for the industry. The answer lies in the long-term impact of first-party price data.

Pyth Network’s first-party data model ensures DeFi can expand into new asset classes—such as energy, treasury rates, and real-world assets—that lack freely available internet data sources.

The distribution rights brought by Pyth’s community of first-party data publishers ensure the network is always ready for DeFi expansion. As DeFi grows to serve millions or even billions of users, it will inevitably create new trading markets. Oracles must become the cradle of DeFi’s growth.

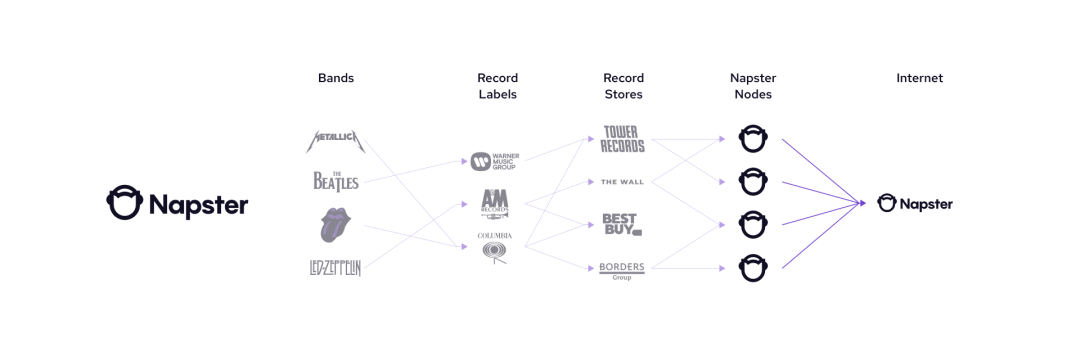

A helpful analogy involves music streaming services. Reporter oracle networks resemble Napster, where users who purchased CDs acted as network nodes, distributing original music content over the internet.

Due to this model, Napster faced severe legal consequences and spam attacks.

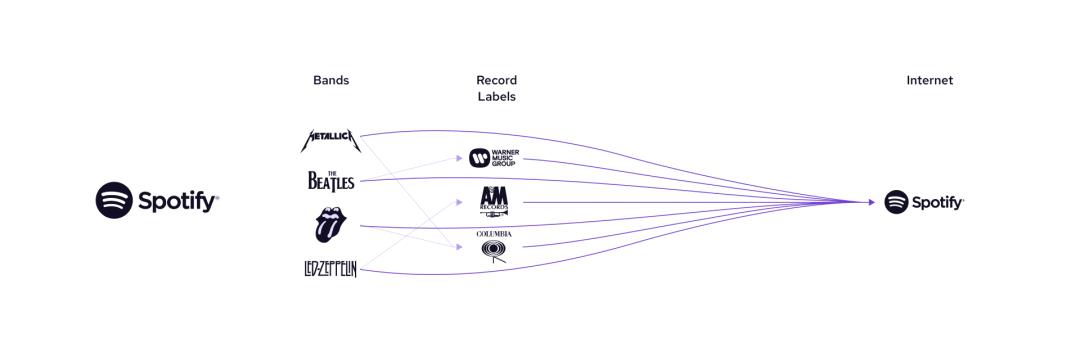

Spotify offered a streamlined solution: musicians and record labels could directly stream music to subscribers and earn revenue through the platform’s economic model. In acknowledging and rewarding intellectual property owners, Pyth resembles Spotify—but in Pyth’s case, the intellectual property is financial data.

Pyth Network is the largest publisher oracle network, with over 90 first-party data sources directly publishing data onto the network. Here, nodes own and publish their data on-chain directly.

Because Pyth’s data providers are also the owners of the data they supply, financial data can be freely transmitted and distributed across blockchain spaces and beyond.

This data distribution model maximizes information availability while eliminating intermediary costs for data users. This design brings speed and cost advantages, allowing Pyth to scale to thousands of price feeds and near-infinite blockchain coverage.

In contrast, most traditional oracles are reporter oracle networks, where nodes pull data from API endpoints and push it on-chain. In this design, nodes must purchase data from first-party or intermediate sources before transmission.

These networks are constrained by the cost, speed, and output formats of the data they purchase. You can read more about the sustainability differences between publisher and reporter oracle networks here.

While there is no single correct way to design an oracle network, Pyth Network’s architecture enables scaling without limitations on speed, pricing, or data distribution scenarios. Pyth aims to drive the emergence of next-generation Web3 capital markets.

Next, we’ll dive into the core components of Pyth Network and explain how its key products work.

Pyth Network Core Components

Pyth Network allows market participants to publish price information on-chain for application use. The protocol consists of three primary roles:

-

Data Publishers submit price information to Pyth’s oracle program. Each price feed product on Pyth has multiple data publishers to enhance system accuracy and robustness.

-

Pyth Protocol aggregates data from publishers to generate a single composite price and confidence interval.

-

Data Users read the price information generated by the oracle program.

Note that Pyth Network itself is not a source of data. Data publishers supply the data, and data users consume it.

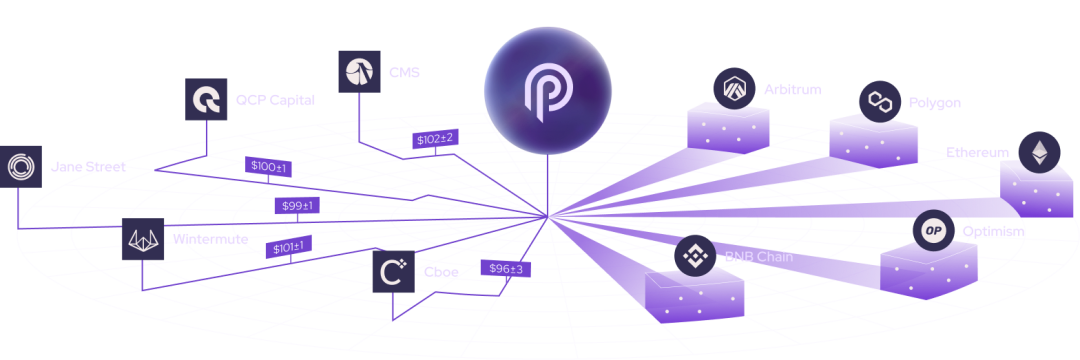

The Pyth Protocol acts as a decentralized data marketplace, aggregating contributions from data publishers to deliver required data to applications across multiple blockchains.

Data Providers

Pyth Network’s data provider community consists of global exchanges, trading firms, market makers, institutions, and decentralized market participants. These providers are both creators and owners of their price data.

Data providers submit asset price data to the network—for example, a Bitcoin price feed.

Although counterintuitive, there is no single “true” price for any asset.

There are prices at which you can trade an asset—set by exchanges—and the latest traded price—generated by traders. Pyth’s data provider community specializes in both types of price data.

Pyth Protocol

The Pyth Protocol aggregates price data published by data providers, generating a composite price and confidence interval for each feed every 400ms.

This aggregation mechanism runs on a purpose-built application-specific blockchain called Pythnet.

Take the BTC/USD price feed as an example. Each data provider sends their asset price and estimated confidence interval to Pyth’s BTC/USD feed.

For instance, a provider might report $30,000 ± $5. Multiple providers contribute data for each feed, producing a robust, accurate aggregate price.

Pythnet is configured as a proof-of-authority blockchain. It runs a modified version of Solana validators and operates as a network fully independent from Solana Mainnet-beta.

The Pythnet application chain processes data from various publishers, combines inputs, and generates a unified aggregate price and confidence interval for each feed.

The aggregation algorithm is designed to be resilient against outliers and price manipulation, appropriately weights each data source based on accuracy, and reflects variations in the aggregated confidence intervals across publishers.

The aggregated price data stream is then sent to Wormhole, ready for dApp usage: the output is a signed price data package verifiable on any Pyth-supported chain.

Data Users

Data users on any Pyth-supported blockchain can read price feeds and integrate them into their smart contract logic.

Pyth Network introduced a unique architecture called the pull-model oracle. With this design, data users can “pull” or request a price update from the Pyth Protocol only when needed.

Using this architecture, decentralized applications can request a fresh price update only when necessary.

Data users submit a signed price message to Pyth’s smart contract on their blockchain, verify its authenticity, and then use the updated price.

This process enables Pyth price updates to be delivered to any supported blockchain.

In contrast, traditional oracles typically use a push-model design, running off-chain processes that periodically “push” price updates on-chain. This often wastes gas on unused price updates.

The inefficiency of push-model oracles may force data users to subsidize gas fees, result in lower update frequency, and make it hard to deliver prices during network congestion.

The Pyth Protocol allows data users to request and use on-chain price updates by paying a small data fee. Pyth users currently send tens of millions of price updates across chains to various supported blockchains each month.

Although the data fee is currently set to the smallest denomination of the native blockchain token (e.g., 1 wei), this parameter and others can be determined via future governance mechanisms.

Common use cases for Pyth data include spot and derivatives exchanges, structured product vaults, lending platforms, stablecoin protocols, yield optimizers, asset management solutions, and analytics tools.

You may already have used applications powered by Pyth. Notable examples include Synthetix (Optimism), Vela Exchange (Arbitrum and Base), Alpaca Finance (BNB Chain), and Solend (Solana).

Pyth Network Products

Pyth Network currently offers two flagship products for DeFi applications: Pyth Price Feeds and Pyth Benchmarks.

Integrating Pyth data is permissionless, meaning developers can access Pyth data directly without subscriptions or sales team coordination. This design reflects Pyth’s commitment to Web3 principles.

Pyth Price Feeds

Pyth Network offers over 350 low-latency price feeds covering cryptocurrencies, forex rates, stocks, ETFs, and commodities.

Each feed updates every 400 milliseconds: high-frequency updates ensure on-chain prices closely track real-world market prices. High-resolution data is crucial for time- and price-sensitive applications.

Each Pyth price feed provides a spot price and confidence interval, shown as a range around the price. The confidence interval represents the range within which the true price likely resides, according to the (aggregated) data providers.

This confidence interval informs data users about the reliability of the price output. Data providers can adjust their confidence intervals based on liquidity conditions, and smart contracts can use this information for safer operations.

Pyth Benchmarks

Pyth Benchmarks allow users to query historical archived price data from Pyth price feeds. Benchmarks are standardized reference series used in finance to guide decisions and settle payments.

Examples include reference rates like the Bitcoin Reference Rate, indices like the S&P 500, and interest rates like LIBOR or the Federal Funds Rate.

Pyth Benchmarks provide standardized calculation and representation methods, ensuring consistency in settlement and valuation measurements.

Common use cases for Pyth Benchmarks include decentralized options vaults (DOVs) like Aevo on Ethereum and backfill pricing for perpetual contract settlements like Synthetix on Optimism.

Addressing Traditional Oracle Limitations

How do Pyth Network’s products address the traditional oracle challenges of speed, asset coverage, and accuracy?

The key lies in Pyth Network’s architectural innovation: the pull-model oracle. This efficiency brings significant advantages in latency, scalability, and data resolution.

-

Low-Latency, High-Frequency Updates

High Update Frequency — Pythnet updates each price feed multiple times per second off-chain. The output stream is relayed via Wormhole, and data users can receive it through public APIs.

Pushing every price update on-chain would make such frequent updates impractical. However, due to the high cost of frequent updates, push-model oracles typically update less frequently than block times.

Low Latency — Pythnet performs price updates off-chain at high frequency, so decentralized apps can use the latest off-chain prices in every transaction.

This means users get fresher prices compared to push-model oracles relying on the last pushed on-chain price.

-

Price Feed Coverage and Multi-Chain Availability

Broad Asset Coverage — Pythnet’s technical capabilities enable the protocol to scale to thousands of price feeds, thanks to Solana’s strengths in high throughput and ultra-low-cost transactions.

Multi-Chain Availability — By default, Pyth Network’s price feeds are available on all Pyth-supported blockchains because price publication and aggregation occur on Pythnet, and updates are relayed cross-chain via Wormhole.

When a new Pyth price feed launches, it becomes immediately available across all supported chains, eliminating the need for separate deployments on each target chain.

This makes Pyth the fastest oracle for launching new price feeds, as Pyth can instantly extend an asset’s price data to dozens of blockchains.

-

High-Resolution, High-Fidelity, Transparent Data

Accurate, First-Party Prices — Pyth sources data from traditional and decentralized financial data creators. A key advantage of focusing on first-party data is price accuracy.

Pyth’s data providers are active participants in price discovery—they truly understand the fair value of assets. Pyth incentivizes these data owners to contribute their proprietary pricing data and aggregates these inputs to produce accurate, representative market prices.

Transparent Aggregation — Pyth Network’s aggregation mechanism is designed to be transparent and verifiable. The source of each data point can be traced to the data provider’s public key. The aggregation and transmission process can be publicly audited using widely available tools (e.g., Solana block explorer and Pyth Publisher Metrics).

Reputational Alignment — Pyth’s data providers include established players from both traditional finance and blockchain industries.

Attempting to unfairly influence oracle performance contradicts their economic interests, as their price inputs are public. Malicious behavior would damage their reputation and harm their core businesses.

Beyond this alignment, the aggregation mechanism prevents minority data providers from manipulating prices.

Ecosystem and Governance

The Pyth Network ecosystem includes diverse stakeholders—from data owners and decentralized applications to individual blockchain participants. On-chain governance is crucial for the protocol’s self-sustainability and decentralization.

As discussed in Pyth Network’s Tokenomics, governance structures are being developed to empower the community to guide the protocol’s evolution.

Governance will oversee parameters such as data fee settings, reward distribution mechanisms for data providers, and listing criteria for products on Pyth and its reference data. Read the whitepaper for more details.

Summary

Contributors to Pyth Network believe past oracles were built on flawed assumptions about how financial data works. Traditional oracles served the early stages of DeFi well.

Yet they inherently face limitations in latency, asset coverage, and data quality that constrain DeFi’s growth.

The future of price oracles isn’t just about finding and bringing prices onto blockchains—it’s about bringing the owners and creators of those prices into DeFi. Pyth Network’s pull-model oracle architecture addresses these core limitations.

Pyth Network’s products are permissionless, transparent, low-latency, high-fidelity, and scalable alongside Web3 itself. We’re excited for you to join Pyth Network’s journey. There’s much more to build.

Consider joining the Pythian community and exploring our official social channels. Stay tuned for network updates and announcements: follow the news and listen to our contributors on podcasts and keynote talks.

Last updated: November 4, 2023.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News