Pyth Network In-Depth Research Report: The Benchmark of Permissionless, Low-Latency, High-Fidelity DeFi Oracles

TechFlow Selected TechFlow Selected

Pyth Network In-Depth Research Report: The Benchmark of Permissionless, Low-Latency, High-Fidelity DeFi Oracles

Pyth's Pull core mechanism aligns with the current rapid development needs of blockchain, especially DeFi.

Author: Da Peng Tong Feng Qi

Chapter One Project Overview

1.1 Project Introduction

Pyth Network is a next-generation oracle project primarily built on its own chain based on the Solana public blockchain. Its core mechanism, the Pull Price Update Model (traditional oracles operate using a push-based model), updates data only when requested by users. Compared to traditional oracles, Pyth offers significant advantages in speed (high update frequency of 300–400ms), asset coverage (supports real-time price feeds from over 90 providers across 50+ blockchains, serving 144 networks and 162 protocols—second only to Chainlink), and accuracy (high fidelity).

Additionally, its token economic model incentivizes data providers (22%) and ecosystem contributors (52%), effectively encouraging participation in data supply and ecosystem development.

As a result, Pyth has experienced rapid growth, securing $5.5 billion in value across 162 protocols on over 50 blockchains (ranked #1 in number of supported blockchains). In February 2024, Pyth oracle transactions accounted for an average of 20% of Solana’s total transaction volume, and data providers on Solana paid $225,000 in fees that month. On May 6, 2024, the cumulative trading volume of Pyth Data reached $2 billion.

Pyth has strong potential to become one of the top two oracle projects, competing with Chainlink for market leadership.

1.2 Investment Thesis

Oracles are essential infrastructure for blockchain development. With the rapid growth of blockchain technology, especially DeFi, the limitations of traditional push-model oracles—such as long latency, high costs, and reliance on limited free internet sources—have become increasingly apparent. Pyth’s pull model perfectly addresses these issues, enabling further acceleration in blockchain’s next phase of growth, particularly supporting the rapid expansion of decentralized finance (DeFi). The DeFi sector holds immense potential, with its total value locked (TVL) possibly reaching several trillion dollars.

Currently, compared to market-leading Chainlink, Pyth remains in an early stage of rapid development. However, it ranks second in both the number of supported networks and protocols, trailing only Chainlink, demonstrating broad applicability and influence, with substantial room for future growth—approximately four times the current size of Chainlink.

Moreover, Pyth’s founding team members are mostly from Jump Trading, bringing extensive experience in blockchain project development and operations.

1.3 Investment Risks

Despite Pyth Network's strong performance in delivering high-precision market data as a decentralized oracle network, it faces several potential risks:

(1) Data Accuracy and Reliability

Although Pyth uses multiple data providers to ensure accuracy, extreme market conditions may affect data quality. For example, highly volatile markets could lead to significant discrepancies among providers, impacting overall data reliability.

(2) Decentralization Risk

Pyth relies on multiple independent data providers and a decentralized oracle architecture, which introduces certain risks. If some providers fail or act maliciously, overall data integrity may be compromised. Additionally, the effectiveness of decentralized governance directly affects network stability and security.

(3) Smart Contract Vulnerabilities

As a smart contract-dependent oracle network, Pyth is exposed to smart contract vulnerabilities. Exploitable bugs could allow hackers to manipulate data or cause financial losses.

(4) Market Competition

Pyth faces intense competition from other oracle solutions such as Chainlink. These competitors continue improving their technologies, requiring Pyth to innovate continuously and offer differentiated services to maintain its edge.

(5) Regulatory and Compliance Risks

As global regulation of cryptocurrency and blockchain intensifies, Pyth may face regulatory and compliance challenges. Differing regional policies could impact its operations and development.

Chapter Two Technology, Business Development, and Competitive Analysis

2.1 Technology

Pyth Network is a next-generation oracle project initially launched on the Solana public blockchain before transitioning to its own dedicated chain—Pyth Network—built atop Solana.

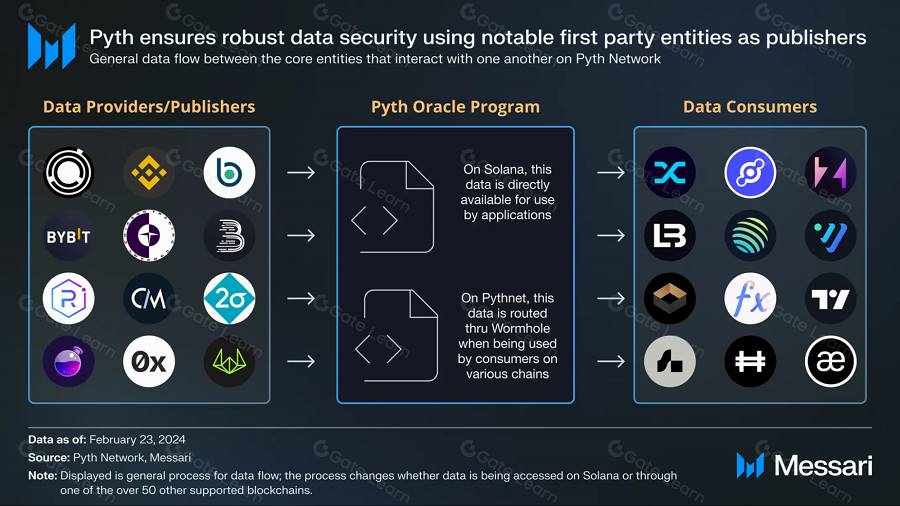

Pyth consists of three core components: data providers (primarily exchanges), the Pyth Oracle protocol (an aggregation algorithm that combines data from different providers to create a unified price and confidence interval every 400 milliseconds), and data consumers (end users such as applications on Pyth-supported blockchains that read aggregated price feeds and seamlessly integrate them into their smart contract logic).

The core mechanism of Pyth—the Pull Price Update Model (in contrast to the traditional push-based oracle model)—updates prices only upon user request, offering distinct advantages in speed, asset coverage, and accuracy:

(1) Speed: High update frequency of 300–400ms, far surpassing traditional oracles that refresh every few minutes or hours (even market leader Chainlink); low latency due to off-chain price updates.

(2) Broad Asset Coverage: The Pyth protocol can scale to thousands of price feeds, supporting real-time pricing from over 90 data suppliers across traditional finance, crypto markets, forex, and commodities. This scalability benefits from Solana’s high throughput and ultra-low transaction costs. In terms of number of supported networks, Pyth ranks second, serving 144 networks, behind only Chainlink’s 353.

(3) Accuracy (High Fidelity): Accurate, first-hand pricing data sourced directly from traditional and decentralized financial data creators. A key advantage of Pyth’s focus on first-party data is enhanced price accuracy. Pyth partners with and supports over 40 leading institutions in traditional finance and crypto markets, including Bloomberg, Hong Kong Stock Exchange, Nasdaq, Jump Trading, Virtu Financial, GTS, and Solana.

The working principle of Pyth’s Pull Price Update Model is as follows:

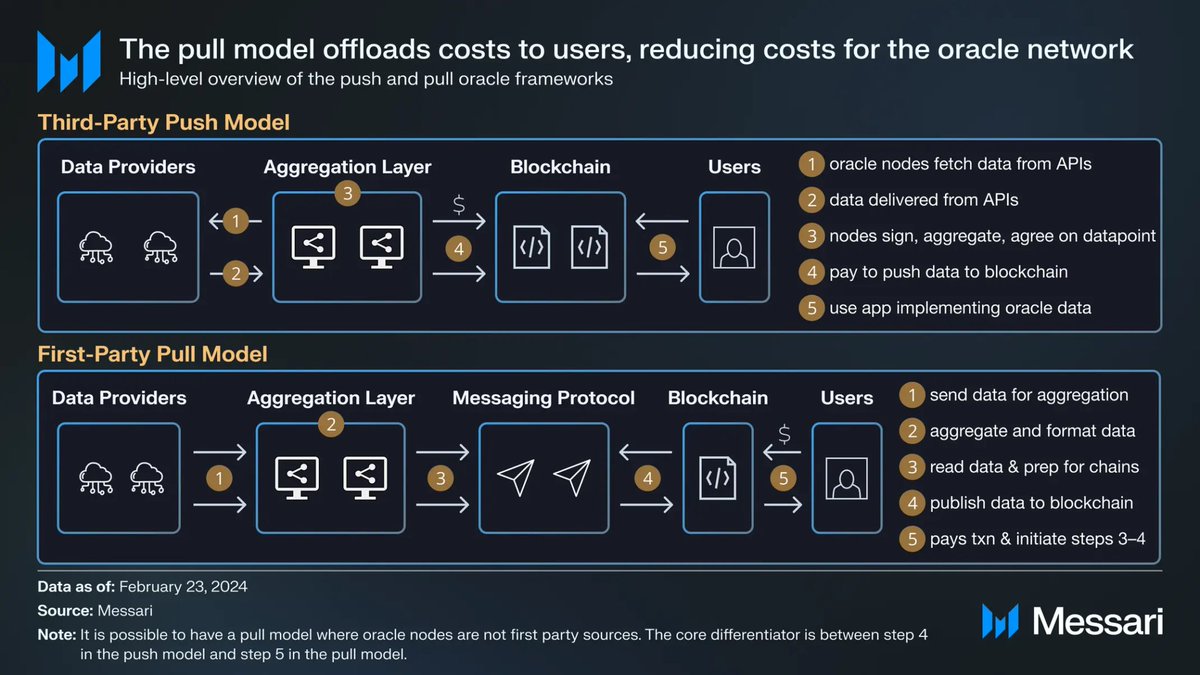

Oracles typically use either push or pull models. Most oracles rely on third-party nodes using the push model, where oracle nodes obtain data from primary sources (e.g., exchanges) or secondary aggregators (e.g., CoinGecko and Kaiko). For instance, Chainlink’s primary price source nodes fetch data from secondary sources.

In push models, price updates are periodically pushed to individual blockchains, each requiring gas fees. Adding more price sources or reducing update latency increases costs for the oracle network, hindering scalability. Furthermore, data retrieval involves multiple trust assumptions: the primary source must be accurate and stable; the secondary source must be accurate and stable; and the oracle network itself must be reliable.

Due to these drawbacks of the push model, Pyth Network introduced the pull model. First, through its network of first-party data providers, Pyth eliminates two trust assumptions associated with third-party data reliability. First-party data comes directly from exchanges, market makers, and DeFi protocols within the network (e.g., Jane Street, Binance, Raydium). These providers are incentivized via token rewards (explained in the tokenomics section) to act honestly, deliver robust and accurate data, maintain good reputations, and avoid being banned by the protocol.

Second, the pull model shifts costs to end data users, lowering overall network expenses. Price updates occur on-demand rather than at fixed intervals. When a data consumer requests an update, it pulls the new price onto-chain within the same DeFi transaction (e.g., swapping assets, settling perpetual swaps). Pyth redirects these costs efficiently, enabling scalable expansion—as evidenced by its frequent updates across 451 price sources.

Pyth Network is not limited to a single blockchain. Over 45 blockchains actively receive Pyth’s real-time market data to power their DeFi ecosystems. After 400+ data sources publish and aggregate prices on Pythnet (Pyth’s application-specific chain), price updates are cross-chain transferred via Wormhole, extending asset price data to dozens of blockchains.

2.2 Business Development

Pyth’s business development has been extremely rapid, currently securing over $5.5 billion in asset value and supporting price information for cryptocurrencies, stocks, forex pairs, ETFs, and commodities across more than 50 blockchains and 162 protocols.

Pyth oracles protect 95% of the value on blockchains. As of January 2024, Pyth also secured over 90% of the value on nine other blockchains and over 50% on another 16 blockchains.

In February 2024, Pyth oracle transaction volume averaged 20% of Solana’s total transaction volume; meanwhile, Pyth data providers on Solana paid $225,000 in fees during that month.

On May 6, 2024, Pyth Network announced on X that the cumulative trading volume of Pyth Data had reached $2 billion.

With ongoing support across numerous blockchains, many projects have adopted Pyth’s oracle network. Below are some notable examples:

Synthetix

Synthetix is a decentralized liquidity protocol that enables the creation of synthetic assets (Synths), which track the value of cryptocurrencies and real-world assets like currencies, commodities, and stocks. Synthetix allows users to gain exposure to various assets without holding them directly, expanding investment opportunities and enhancing liquidity in the crypto market. A critical component of Synthetix is its integration with Pyth Network oracles, which provide high-fidelity, real-time price feeds essential for maintaining the accuracy of Synth values.

Helium

Helium is a decentralized Internet of Things (IoT) network that uses a token-based incentive system to encourage participants to deploy wireless devices and provide network coverage. Helium leverages Pyth Network oracles to provide accurate on-chain market prices for its native token HNT. These prices are crucial for various network activities, including converting burned HNT into Data Credits (DC) and accurately measuring fund distribution. While Helium is not a DeFi project, its use of Pyth oracles highlights the importance of accurate data in managing protocol economics—even beyond traditional DeFi applications.

Eclipse

Eclipse recently raised $50 million in Series A funding to launch the first Layer 2 blockchain using SVM (Solana Virtual Machine) for execution and Celestia for data availability, while leveraging Ethereum as a settlement layer for security. Eclipse aims to attract liquidity from Ethereum users and direct it toward decentralized applications on Solana’s Layer 2. As Solana’s leading oracle, Pyth will support many applications expanding to and launching on Eclipse.

2.3 Competitive Analysis

2.3.1 Market Position

Pyth Network is currently considered the fourth-largest oracle project, with a total value locked (TVL) of $2.112 billion, behind Chainlink, WINkLink, and Chronicle.

In terms of number of supported networks, Pyth ranks second, serving 144 networks, just behind Chainlink’s 353.

CertiK assigned Pyth a security score of 87.53, placing it in the top 10% among protocols evaluated.

2.3.2 Competitive Landscape

The oracle space is dominated by Chainlink and highly competitive. Critics refer to Chainlink as a “black box” due to the lack of transparency in how its oracle nodes source data. Data origins are neither identified on-chain nor on Chainlink’s oracle node websites. In contrast, any data point on the Pyth network can be traced back to individual provider public keys by copying transaction hashes from Pyth’s price feed page into any Solana block explorer. While Chainlink data can also be traced to oracle nodes, Pyth’s data providers are first-party sources. Unlike Chainlink, Pyth discloses that its data originates internally from operational entities such as exchanges, trading firms, and market makers. However, provider public keys are not publicly linked to their identities, introducing a trust layer managed by Pyth, originally composed of permissioned providers.

Pyth focuses specifically on traditional finance and cryptocurrency price data, whereas Chainlink offers a broader suite of products, including interoperability protocols (CCIP), proof-of-reserves feeds, developer tools (VRF, API functions, automation services), and market data sources. Thus, Pyth’s main product directly competes with Chainlink’s leading market data feed, although Pyth also offers a random number generator via Pyth Entropy.

Application comparison:

Pyth secures $5.5 billion in funds through 162 protocols across over 50 blockchains.

Chainlink secures $38.7 billion in assets through 371 protocols across 19 blockchains.

Both systems have distinct strengths and weaknesses in market data delivery. Pyth’s model is better suited for scaling the number of price feeds while maintaining high update frequencies. However, Pyth’s ability to maintain high-fidelity data depends on the assumption that the cost of reputation loss and consensus penalties outweighs any potential gains from malicious behavior. Network stability also relies on Wormhole functioning correctly. In contrast, Chainlink’s model requires less trust in raw data sources and in the relationship between the oracle network and supported blockchains, as it pulls data from secondary aggregators and publishes directly to target chains. However, expanding data feeds and supporting more blockchains incurs higher costs. Therefore, as the cryptocurrency market grows, new protocols must carefully weigh cost and risk when choosing oracle price feed solutions.

Chapter Three Team and Funding

3.1 Team Background

The startup behind Pyth is Douro Labs, with core team members including:

CEO: Michael Cahill, previously led special projects at Jump Crypto.

COO: Ciaran Cronin, formerly at Jump Trading, holds a Master’s degree in Financial Economics from University College Cork.

CTO: Jayant Krishnamurthy, Chief Technology Officer at Douro Labs (Pyth’s development company) and former software engineer at Jump Trading, holds a Ph.D. in Computer Science from Carnegie Mellon University.

CIO: Harnaik Kalirai, former Chief Integration Officer at Jump Trading, brings years of system integration and operations experience, graduated from De Montfort University in the UK.

In addition, apart from the above executives, key members from Jump Trading are currently the most significant code contributors to Pyth:

Jeff Schroeder: Head of Technology at Jump Trading, primarily responsible for Pyth’s core code;

Samir Islam: Head of Technology at Jump Trading, holds a Master’s in Computer Science from Oxford, contributed to Pyth’s codebase;

Evan Gray: Vice President of Engineering at Jump Trading, involved in Pyth’s development;

Alex Davies: Head of Product Development at Jump Trading, one of the first ten employees at Jump’s European office, also contributed to Pyth’s code.

3.2 Funding Status

According to Rootdata, Pyth has received investments from institutions including Delphi Digital, Ailliance Dao, GBV Capital, Republic Capital, HTX Venture, KuCoin Labs, and Ryze Labs, with a current market valuation exceeding $500 million. Notably, PYTH also received a grant of 40,000 OP tokens from the OP Foundation.

To support Pyth’s growth, the Switzerland-based Pyth Data Association was established, with members including major Wall Street institutions such as Jump, Jane Street Capital (former employer of SBF), SIG, and market maker Virtu Financial.

Chapter Four Tokenomics

4.1 Token Supply and Distribution

The maximum supply of PYTH tokens is 10 billion, with an initial circulating supply of 1.5 billion (15%). Initially, 85% of the total supply is locked and will be unlocked at 6, 18, 30, and 42 months after the token launch, distributed as follows:

Publisher Rewards: 2.2 billion PYTH allocated to data providers on the Pyth Network, representing 22% of total supply.

Ecosystem Development: 5.2 billion PYTH allocated to support contributors to the Pyth Network, including developers, educators, researchers, etc., representing 52% of total supply.

Protocol Development: 1 billion PYTH allocated to core contributors building oracle tools, products, and infrastructure, representing 10% of total supply.

Community and Launch: 600 million PYTH allocated for initial launch-related activities and initiatives, fully unlocked on day one, representing 6% of total supply.

Strategic Contributors (Private Sale): 1 billion PYTH allocated to strategic contributors from two historical funding rounds, all tokens locked and released according to the above schedule, representing 10% of total supply.

4.2 Token Unlock Schedule

On May 20, 2024, 21.25% of the total supply was unlocked: 250 million PYTH for strategic contributors, 212 million PYTH for protocol development, 1.12 billion PYTH for ecosystem development, and 537 million PYTH for publisher data providers.

On May 20, 2025, another 21.25% will unlock, with the same proportions; May 20, 2026: 21.25%; May 20, 2027: 21.25%.

4.3 Token Governance Model

PYTH is an SPL token on Solana (equivalent to ERC-20 on Ethereum), primarily used for governance. PYTH holders can stake tokens and vote on Pyth Improvement Proposals (PIPs) to guide protocol development. To date, voted or pending proposals include elections for the Pythian Council and approval of the Pyth DAO Constitution. Governance covers typical modifiable topics such as:

On-chain software updates

Reward structures for data providers

Rules for creating permissioned providers

Size, denomination, and existence of oracle update fees

Adding new price sources and determining who supports them

Pyth DAO consists of the Pythian Council and the Price Feed Committee. Elections are held every six months to rotate members. Members who participate less than one-third of the time are ineligible for re-election, ensuring active engagement aligned with Pyth’s goals. Both committees vote on and execute certain operational PIPs.

Pythian Council: The Pythian 7-of-9 multisig wallet includes eight members and an operational wallet holder as signers. Four members are replaced in each election. They have voting rights on operational PIPs related to oracle program updates, validation mechanisms, oracle update fees and denominations, and PGAS (gas token allocated/delegated to Pythnet validators).

Price Feed Committee: The Price Feed 5-of-8 multisig wallet includes seven members and an operational wallet holder as signers. Three members are replaced per election. Authorized to vote on operational PIPs involving management of provided price feeds, selection of publishers, and feed requirements (minimum and maximum providers per source). Currently, proposal creators must hold 25 million PYTH tokens to submit a proposal.

Pyth DAO comprises two types of PIPs: constitutional and operational. Constitutional PIPs involve protocol updates, structural decisions, and governance direction for Pyth DAO, requiring over 67% support to pass. Operational PIPs cover finances, elections, and management of the Pythian Council and Price Feed Committee. These can be delegated to committee members and require over 50% support to implement.

Chapter Five Target Valuation

Currently, Pyth’s circulating market cap is $643.43M, with an FDV of $4.29B. At the same time, Chainlink’s circulating market cap is $9.71B, with an FDV of $16.54B.

Although Pyth ranks fourth, behind Chainlink, WINkLink, and Chronicle, the other three use push-model oracle architectures, while Pyth is the only decentralized pull-model oracle. Moreover, Pyth supports over 50 blockchains—far exceeding Chainlink’s 19—and serves 144 protocols, ranking second only to Chainlink and significantly ahead of third place. Combined with the rapid growth of the decentralized finance (DeFi) market—where TVL could reach several trillion dollars—Pyth has enormous growth potential and a strong chance of becoming one of the top two oracle projects.

Therefore, we estimate Pyth’s valuation at half of Chainlink’s market cap, factoring in the current bull market cycle (with prices already surpassing 1.15 this year), giving Pyth a 4x valuation upside. Based on the current price of 0.4253, our target price is 1.7, with sell recommendations above that level.

Chapter Six Price Trends and Market Sentiment

6.1 Price Trend

Pyth’s price shows an overall upward trend, peaking above 1.15 in early March, then correcting along with the broader market down to 0.4. As the bull market resumes, the price is expected to resume its upward trajectory.

6.2 Market Sentiment

Market interest in Pyth remains highly positive. From the three images below, we can clearly see:

Although Pyth’s price corrected due to overall market downturns, market sentiment and KOL attention have remained consistently positive, with a noticeable recent uptick in influencer engagement—further reflecting confidence in Pyth’s technological advantages and future prospects.

Chapter Seven Conclusion

Overall, Pyth’s core Pull mechanism aligns well with the fast-paced development needs of blockchain, especially DeFi. Its high speed, broad asset coverage, and high-fidelity characteristics make it essential infrastructure for future blockchain growth. Currently in an early development phase, Pyth already ranks second only to Chainlink in supported blockchains, served networks, and protocol count, offering approximately four times the growth potential compared to Chainlink. Its future outlook is highly promising.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News