BiB Exchange: Exploring the Oracle of Hidden Corners

TechFlow Selected TechFlow Selected

BiB Exchange: Exploring the Oracle of Hidden Corners

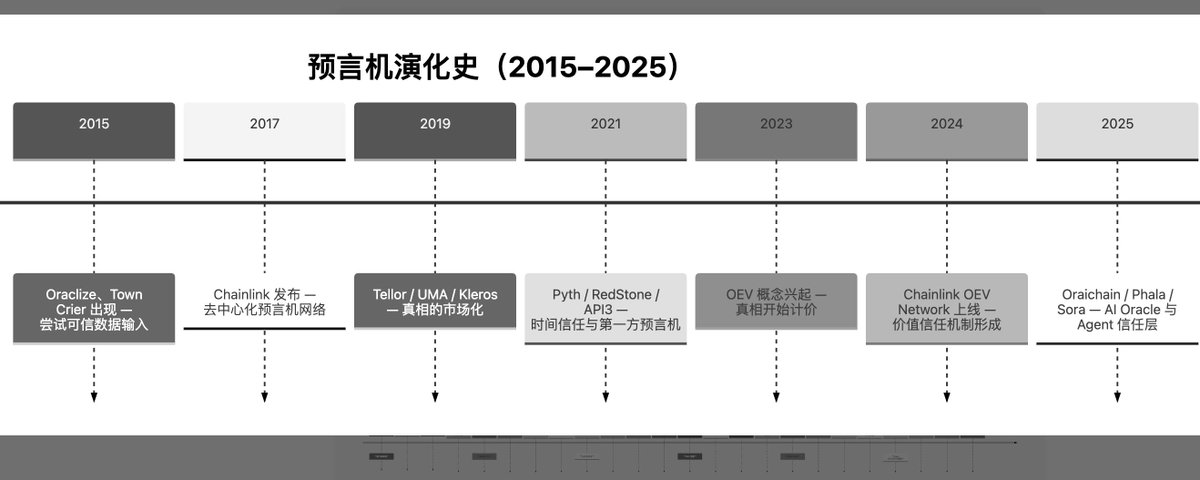

The future development direction of oracles will be influenced by the demands of the blockchain and smart contract ecosystem, technological innovations, and the regulatory environment.

Author: BiB Exchange

According to data from the official BiB Exchange website, on June 10, 2023, the LINK price was 4.7 USDT. By December 10, 2023, it had reached 17 USDT—an increase of nearly 300% in just six months! Among the top 15 market-cap projects (currently ranked 12th), LINK has achieved one of the highest gains, significantly outperforming leaders like BTC and ETH, as well as prominent projects in sectors such as L2 solutions, Litecoin, exchange tokens, and Ethereum scaling initiatives.

I. Definition of Oracles

An oracle is a tool that brings real-world data onto blockchains, enabling connectivity between blockchain systems and external data sources. Oracles extract data from the real world and deliver it onto the blockchain for smart contracts to call and use. This allows blockchain systems to securely and reliably utilize off-chain data, thereby expanding the application scope of smart contracts.

Here, it's important to understand what a "smart contract" is. Typically, when we refer to smart contracts, we mean narrow-sense smart contracts—code segments deployed at specific blockchain addresses designed by developers to perform functions such as invocation, allocation, or automated matching. The essence of a smart contract is an automatically executing program that runs once predefined conditions are met.

However, due to the deterministic nature of blockchain environments—which do not allow uncertain events—smart contracts generally produce consistent results. Therefore, virtual machines (Virtual Mechanism) prohibit smart contracts from making network calls (Network Call), and smart contracts cannot perform I/O (Input/Output). As a result, they can only access on-chain data and cannot actively retrieve off-chain data; they can only passively receive it. This limitation underscores the mission of oracles: serving as a bridge between the real world and on-chain information.

The asset management team at BiB Exchange believes that through their bridging role, oracles empower smart contracts with the ability to use external data as input and execute logic based on this input—crucial for decentralized prediction markets that rely on external information. An oracle itself is not the original source of data but rather an intermediate layer that queries, verifies, and authenticates external data sources. It filters and ensures data accuracy before delivering it onto the blockchain in a trusted manner. Oracles facilitate data transmission by establishing a bridge between on-chain smart contracts and off-chain data nodes.

II. Use Cases of Oracles

For example, during the 2022 World Cup, Cosmo predicted Argentina would win the championship and placed a bet of 10 ETH on Argentina lifting the trophy. In such cases, a decentralized prediction market dApp requires an oracle to confirm the final champion. These predictive factors may include off-field elements such as odds from online betting platforms, lottery payout rates, and offline bookmaker lines, as well as on-field elements including team lineups, referees, coaches, and even player morale states of Messi, Martínez, Griezmann, and Mbappé. Additionally, the oracle might assess Cosmo’s spending habits, savings levels, and recent payment records—off-chain information—to determine his eligibility for placing the bet.

Oracles have broad applications across financial derivatives trading platforms, lending platforms, IoT, package tracking/IoT, stablecoins, gambling games, insurance, and prediction markets. The BiB Exchange team believes that especially within DeFi, projects involving stablecoins and decentralized leveraged trading require oracles to provide external data.

1. Oracles in Gambling Platforms

Most gambling games generate random numbers online or more commonly manipulate probabilities via algorithms against players. Using accurate oracle predictions could reduce the randomness and appeal of gambling, potentially harming profitability. Conversely, if house operators leverage oracle-based predictions, ordinary players would struggle to compete, creating unfairness.

The core of gambling games lies in unpredictable yet verifiable random numbers that determine betting outcomes. However, generating truly random numbers on-chain is either impossible or vulnerable to prediction and exploitation. This is where oracles come in—providing secure, unpredictable random numbers from external sources to smart contracts. Thus, oracles represent a love-hate relationship for gambling platforms: used wisely, they can analyze user betting behaviors using big data; without proper defensive mechanisms, they risk being exploited by malicious actors to steal assets.

2. Oracle Usage Scenarios on Blockchains

Next, let’s follow the perspective of the BiB Exchange team to better understand how oracles operate:

-

Data Provision: Oracles obtain relevant data from external sources such as price feeds or exchanges.

-

Data Verification: Oracles typically employ mechanisms to verify the authenticity and accuracy of the data provided—such as cross-referencing multiple sources or using digital signatures.

-

Data Submission to Blockchain: Once verified, the oracle submits the data to the Ethereum blockchain so it becomes available for smart contracts.

-

Smart Contract Execution: Smart contracts then execute actions based on the oracle-provided data—for instance, adjusting collateral ratios or updating stablecoin supply.

Through this simple process, we can see clearly how vital oracles are for projects like DeFi. DeFi widely uses oracles to provide asset prices, collateral values, interest rate information, etc. Popular “price oracles” in DeFi include Chainlink Price Feeds, Compound Protocol’s Open Price Feed (opens in a new tab), Uniswap’s Time-Weighted Average Price (TWAP) (opens in a new tab), and the Maker Oracle (opens in a new tab).

MakerDAO’s Needs

In MakerDAO, oracles serve three main purposes: First, MakerDAO must regularly evaluate the value of collateral to ensure it sufficiently backs issued stablecoins. Oracles provide external data to help the system determine the real-time value of collateral.

Second, oracles are used to predict the price of the DAI stablecoin. By integrating data from multiple oracles, the system adjusts collateralization ratios and controls DAI issuance to maintain its soft peg to $1.

Third, oracles supply data for various system parameters such as stablecoin interest rates and minimum collateral requirements, helping the system adapt dynamically to market changes.

Oracles on Curve

Curve uses oracles to obtain external data, ensuring accurate pricing information that influences protocol operations and liquidity providers’ returns. Curve employs what is known as an “oracle feed mechanism”—a process of acquiring asset prices via oracles. Key aspects of this mechanism typically include: multi-source feeds combined with weighted schemes, different data sources assigned varying weights; consensus mechanisms to determine asset prices; and frequent update cycles.

III. Classification of Oracles

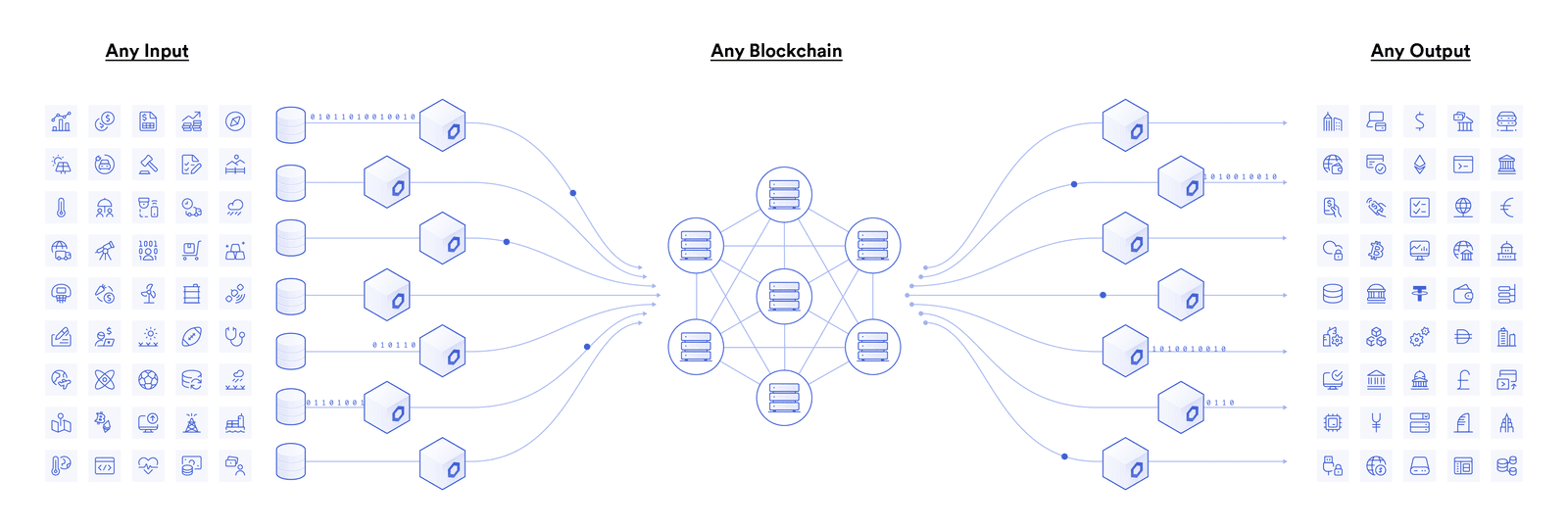

Oracle classification primarily arises from general standards. Typically composed of on-chain smart contracts and off-chain components, these systems receive data requests from other smart contracts and forward them to off-chain components (known as oracle nodes). These oracle nodes query data sources—such as via APIs—and send transactions to store the requested data into the smart contract’s storage. Based on different criteria, the BiB Exchange asset management team categorizes oracles as follows:

1. Classification by Critical Data Attributes

Key differences mainly involve data sources, trust models, and system architecture. Below is a classification based on these factors:

-

Data Sources: One key difference among oracles is their data sourcing. Oracles may pull information from one or multiple external sources—including internet-based data such as weather, prices, event outcomes, etc.

-

Trust Model: This refers to the level of confidence users place in the reliability and security of the data provided. Centralized oracles are controlled by a single entity, while decentralized oracles enhance data reliability through multiple sources and consensus mechanisms.

-

System Architecture: Describes how the oracle interacts with both the blockchain and the outside world. Three primary models exist: immediate read (real-time data fetching), publish-subscribe (subscribing to specific events and receiving notifications upon occurrence), and request-response (actively requesting data from the oracle when needed and waiting for a response).

2. Classification by Degree of Centralization

1) Centralized Oracles: Controlled by a single entity responsible for aggregating off-chain information and updating oracle contract data upon request. They offer high efficiency.

Single point of failure risk: Even if the provider appears reputable, there remains potential for misconduct or hacking.

Smart contracts become vulnerable to attacks; if the oracle is compromised, contracts execute based on incorrect data;

Poor incentive compatibility; incentives in centralized oracles are often poorly designed, leading to inaccurate data reporting.

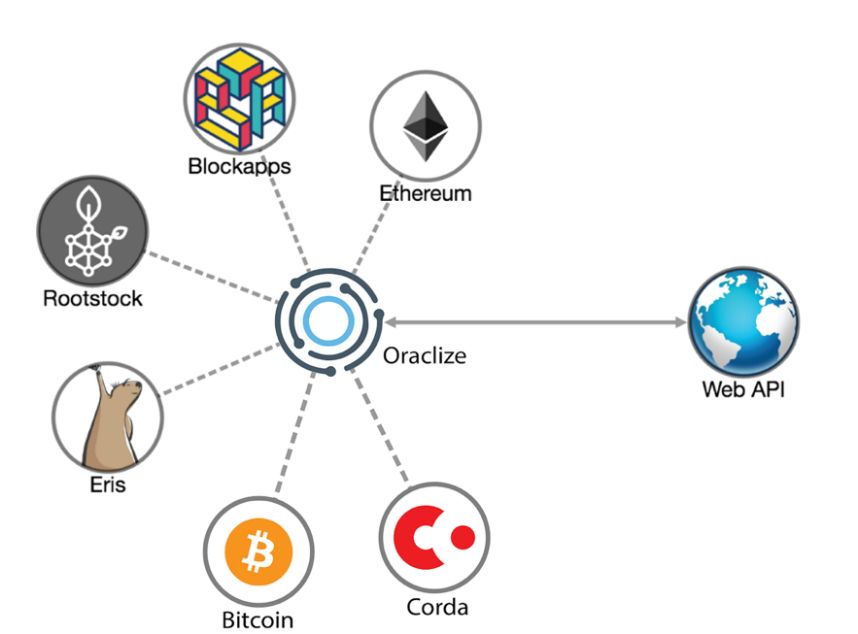

A typical example of a centralized oracle service is Oraclize. Oraclize acts as an intermediary between smart contracts and external data sources, retrieving various types of data from the internet—such as weather, stock prices, sports results—that smart contracts need but cannot directly access. Oraclize’s oracle service is centralized, meaning the company operates and maintains the infrastructure, giving it control over data provision. Built on Amazon AWS and TLSNotary technology, it offers a provably honest oracle service.

2) Decentralized Oracles: Designed to overcome limitations of centralized oracles by eliminating single points of failure. Decentralized oracles use various methods to ensure data correctness—such as proofs verifying the authenticity and integrity of returned data, and requiring multiple parties to collectively agree on the validity of off-chain data.

Avoids single failure points: Services consist of multiple participants in a peer-to-peer network. Only after consensus is reached among many participants is data sent to the smart contract, proving authenticity and requiring collective validation of off-chain data.

Improves data reliability—a point emphasizing Transport Layer Security (TLS) proofs and Trusted Execution Environment (TEE) attestation. The former involves oracle nodes retrieving data from external sources via secure HTTPS connections based on TLS protocols. Some decentralized oracles use authenticity proofs to validate TLS sessions (confirming information exchange between node and server) and verify session content hasn’t been tampered with.

Trusted Execution Environment (TEE) Attestation: A TEE (opens in a new tab) is a sandboxed computing environment isolated from the host system’s operating processes. It ensures integrity, confidentiality, and immutability of any code or data stored/used within. Users can also generate attestations proving an application instance is running inside a TEE.

Decentralized oracles adopt diverse incentive designs to prevent Byzantine behavior among oracle nodes.

3. Other Classification Methods

1) Software Oracles

Process online data, analyzing trends and patterns using machine learning, data mining, and other algorithmic techniques based on historical data.

Continuously collect market information and input new data, improving prediction algorithms, upgrading software, refining models—all aimed at increasing prediction accuracy.

2) Hardware Oracles

Handle physical-world data—for example, computational oracles perform complex tasks off-chain to improve efficiency, reduce blockchain load, or handle intensive computations.

Use custom hardware circuits simulating biological neural networks for pattern recognition and forecasting, such as sensor data.

Hardware systems are generally fixed, difficult to modify or upgrade, with performance and prediction capabilities tied closely to hardware specs.

3) Inbound and Outbound Oracles

Inbound: External data input—refers to oracles retrieving external data for use by on-chain smart contracts. For example, fetching real-time price data to adjust financial contracts.

Outbound: Data output—sending information from the blockchain to off-chain applications. This may involve passing smart contract execution results to external systems, influencing real-world actions.

4) Consensus-Based Oracles

Data derived from prediction markets; market maker oracles consist of a peer-to-peer network of off-chain nodes (“relayers” and “feeders”) who stake collateral to submit market prices, along with an on-chain “medianizer” contract to prevent manipulation;

Schelling Point mechanism; referenced in “BiB Exchange: A Comprehensive Insight into Game Phenomena in the Cryptocurrency Industry,” extending game theory concepts—the assumption that multiple entities independently converge on the same solution without communication.

IV. Specific On-Chain Oracle Projects

There are numerous blockchain oracle projects in the market. With the rise of DeFi in recent years, the term “oracle” has become increasingly well-known. Below, the BiB Exchange asset management team introduces major oracle projects currently available:

1. Chainlink

Chainlink is a decentralized oracle network that connects blockchains with real-world data sources via off-chain nodes, providing trustworthy data to smart contracts. By utilizing multiple nodes for data provision, aggregation, and verification, Chainlink ensures data reliability and security.

Well known as the first decentralized oracle solution on Ethereum. Recently, Chainlink’s staking program rapidly raised $640 million. Its “v0.2” community staking mechanism opened early access at noon Eastern Time, attracting approximately 32.8 million LINK staked within 30 minutes. Six hours later, the community pool reached a new capacity of 408.75 million LINK, quickly filling the reserved portion. The expanded staking pool now supports up to 450 million LINK—up from 250 million under v0.1—including allocations for both the community pool and separate node operator pools.

Why so much staking? Staking is part of the company’s Economic 2.0 initiative, designed to enhance Chainlink’s security. Chainlink staking enables node operators (engineers retrieving external data) and community members to support oracle service performance by staking LINK, earning rewards in return. This is also why LINK token prices surged, as discussed earlier.

2. Band Protocol

Band Protocol is a cross-chain oracle solution allowing blockchain smart contracts to access real-time data. It integrates multiple data sources and uses agent nodes to provide, aggregate, and validate data, ensuring high-quality inputs for smart contracts.

3. Pyth

Pyth is an oracle project launched by the Solana ecosystem focused on delivering real-time financial market data. It collects, validates, and transmits financial market data via special contracts (Oracle programs) on the Solana blockchain, aiming to provide low-latency, highly reliable real-time data.

4. Redstone

Redstone is a decentralized oracle project aiming to provide real-time, verifiable data for financial contracts on blockchains. Using a decentralized node network, Redstone ensures data reliability and security through node-provided and validated data.

Here, the BiB Exchange asset management team provides a simple classification of current market oracles:

V. Risks and Challenges of Oracles

Attack incidents in DeFi projects highlight the importance of decentralized oracles and reveal risks associated with centralized ones. While oracles have widespread applications in blockchain and smart contract ecosystems, they also face several potential risks and challenges. The BiB Exchange team identifies the following key issues:

-

Data Source Credibility: Oracle reliability depends heavily on the trustworthiness of its data sources. If sources are unreliable, vulnerable to attack, or easily manipulated, the oracle may deliver inaccurate or misleading information.

-

Manipulation Risk: Attackers may attempt to manipulate information by targeting either the oracle’s data source or the oracle itself, affecting smart contract execution. This could lead to unintended outcomes and potential financial losses.

-

Cost Issues: High-quality data sources may charge significant fees, increasing the cost of using oracles—an obstacle for some adopting projects.

-

Privacy and Security Concerns: Some oracles involve transmission of sensitive information, making privacy and security critical considerations.

-

Single Point of Failure: If a single oracle serves as the sole data provider, it becomes a system-wide vulnerability. Any issue with the oracle could disrupt overall functionality.

-

Smart Contract Security: If a smart contract overly relies on oracle-provided data without properly handling exceptions, it becomes susceptible to attacks. Developers must ensure sufficient robustness to handle various scenarios.

Earlier discussions about oracle usage on CURVE referenced researcher Daniel Von Fange, who disclosed on Twitter that Curve faces oracle manipulation risks that are hard to detect during attacks. Specifically: in most pools, attackers can manipulate Curve’s price oracle to show prices 10x to 500x higher than normal within a single block—and this manipulation can be hidden so well that no signs appear when inspecting the pool.

Strategies to defend against Curve price oracle manipulation: Curve v1 pools have four factors—actual price, price oracle, last_price, and EMA price. After manipulation, a single transaction altering the price_oracle can reset all values to match.

BiB Exchange analysis indicates the core attack strategy aligns actual price, fast oracle, and slow scale. Actual price is easy to control since it can be instantly manipulated. The attacker briefly inflates the price, restores it in the next block, waits several blocks until the falling oracle price meets the rising price_scale. Maintaining a high actual price for just one block suffices to disrupt the oracle, causing price_scale to follow suit.

In June 2019, Synthetix—a decentralized synthetic asset (Synths) issuance and trading platform that uses on-chain assets as collateral—suffered a centralized oracle attack, losing over 30 million sETH. The attack unfolded as follows:

-

Synthetix relied on multiple centralized oracles to provide price data for assets like Bitcoin, determining exchange rates for Synths on the platform.

-

Attackers compromised one oracle and altered Bitcoin’s price on the Synthetix platform.

-

Based on false pricing, Synthetix allowed attackers to exchange large amounts of sBTC (Bitcoin Synth) for minimal ETH collateral.

-

Attackers sold the obtained sBTC on external exchanges for real Bitcoin, profiting substantially.

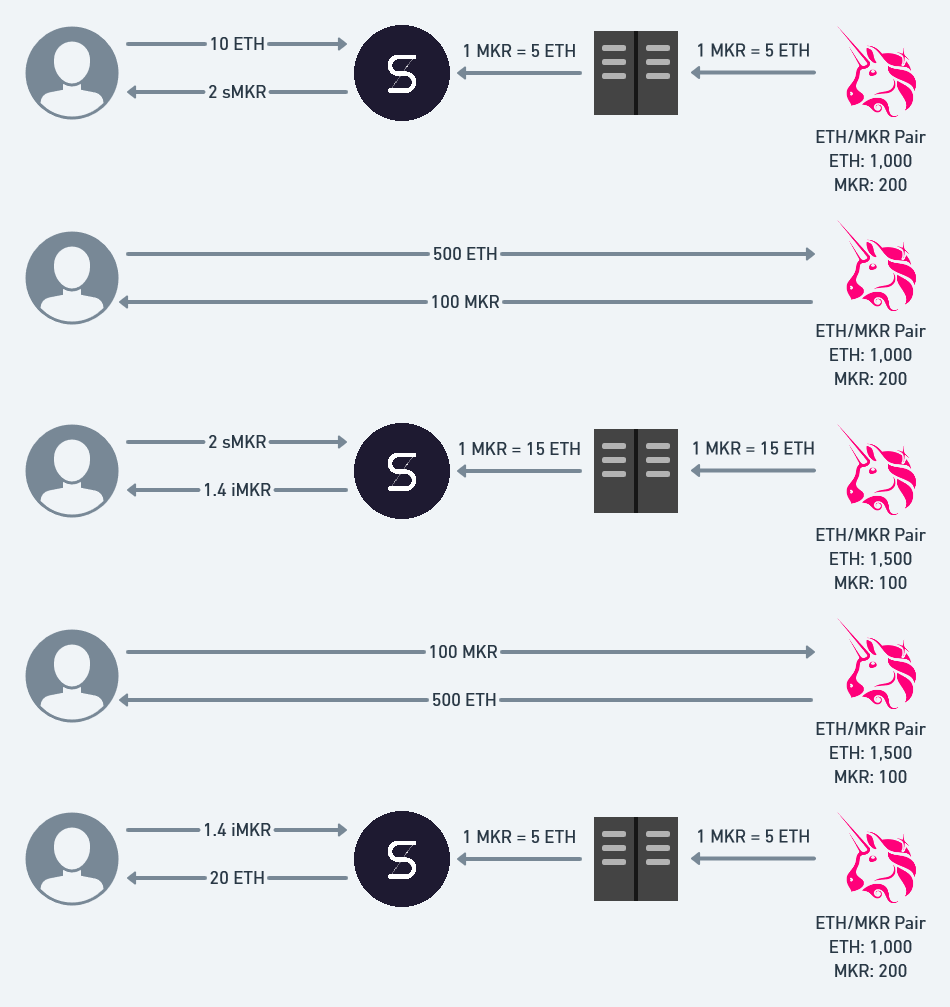

This incident exposed Synthetix’s overreliance on centralized oracles, which used a custom off-chain price feed mechanism. Embarrassingly, in December 2019, after switching to a decentralized oracle mechanism, Synthetix suffered another attack, losing $2.6 million due to price oracle manipulation. The attack steps were:

-

Buy sMKR on Synthetics;

-

Purchase MKR on spot markets like Bitfinex, Kucoin, and Uniswap to inflate its price;

-

Wait for Synthetics’ oracle price to update;

-

Short MKR on Synthetics;

-

Sell MKR on spot markets to depress the price;

-

Wait for Synthetics’ oracle price to update again, then loop back to step one.

From these steps, it’s clear that although Synthetix believed it used off-chain data, it actually relied on on-chain price data. The underlying logic enabled attackers to move MKR prices arbitrarily via Uniswap trades. Deep down, BiB Exchange analysts suspect Synthetix’s off-chain feed ultimately depended on MKR’s on-chain price, which lacked sufficient liquidity for arbitrageurs to correct mispricing effectively.

VI. Future Development of Oracles

As oracle technology matures, more DApps leveraging blockchain–real-world data interaction will successfully launch. The BiB Exchange team believes oracle development will be shaped by demands from blockchain and smart contract ecosystems, technological innovation, and regulatory environments. As these factors evolve, oracle capabilities and performance are expected to continuously improve, offering more reliable, secure, and efficient external data support for blockchain applications.

Multimodal Oracles: Capable not only of text-based predictions but also analyzing multimodal data such as images, video, and audio for more comprehensive and accurate forecasts. Oracles won’t just deliver results—they’ll explain reasoning and inference chains, enhancing credibility and interpretability.

Diversified Data Sources: To enhance reliability and resist attacks, future oracles may emphasize greater diversity in data sourcing. Integrating inputs from multiple APIs and providers reduces reliance on any single source. Multidimensional forecasting will go beyond isolated events, analyzing inter-event relationships for holistic predictions.

Template-Based Contract Prediction Evolution: As algorithms and computing power advance, oracle accuracy will improve and forecast horizons extend. Standardized contract templates tailored to specific industries or use cases may become common, lowering technical barriers for developers and enabling broader adoption of oracle services.

Off-Chain Computation and AI Integration: Advancing off-chain computation technologies may allow oracles to handle complex tasks more efficiently and deliver richer data types. Oracles will gain stronger natural language understanding and generation abilities, enabling smoother, more human-like AI interactions.

Stronger Security Mechanisms: Future oracles may adopt advanced cryptographic techniques and security protocols to withstand evolving cyber threats, ensuring data integrity and reliability—while also prioritizing user-friendliness and enhanced privacy protection.

VII. Conclusion

This article by the BiB Exchange asset management team primarily explains oracle-related mechanisms, significance, and underlying logic without extensive evaluation of specific oracle projects or future valuations. Nevertheless, it’s evident that oracles already play a pivotal role in smart contracts, DeFi applications, and cryptocurrency trading. Compared to the thousands of blockchain projects—especially the flourishing L2 landscape—the number of mature oracle projects remains negligible, with perhaps only Chainlink enjoying notable market attention. The BiB Exchange team believes that the future giants of the oracle space may still be confined behind closed doors—lacking sunlight, nourishment, and exposure. Once that door cracks open, a wave of innovative oracle projects could emerge rapidly. We believe oracles will undoubtedly shine in helping transition from Web2 to Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News