Why is LINK the "invisible engine" of institutionalized bull market?

TechFlow Selected TechFlow Selected

Why is LINK the "invisible engine" of institutionalized bull market?

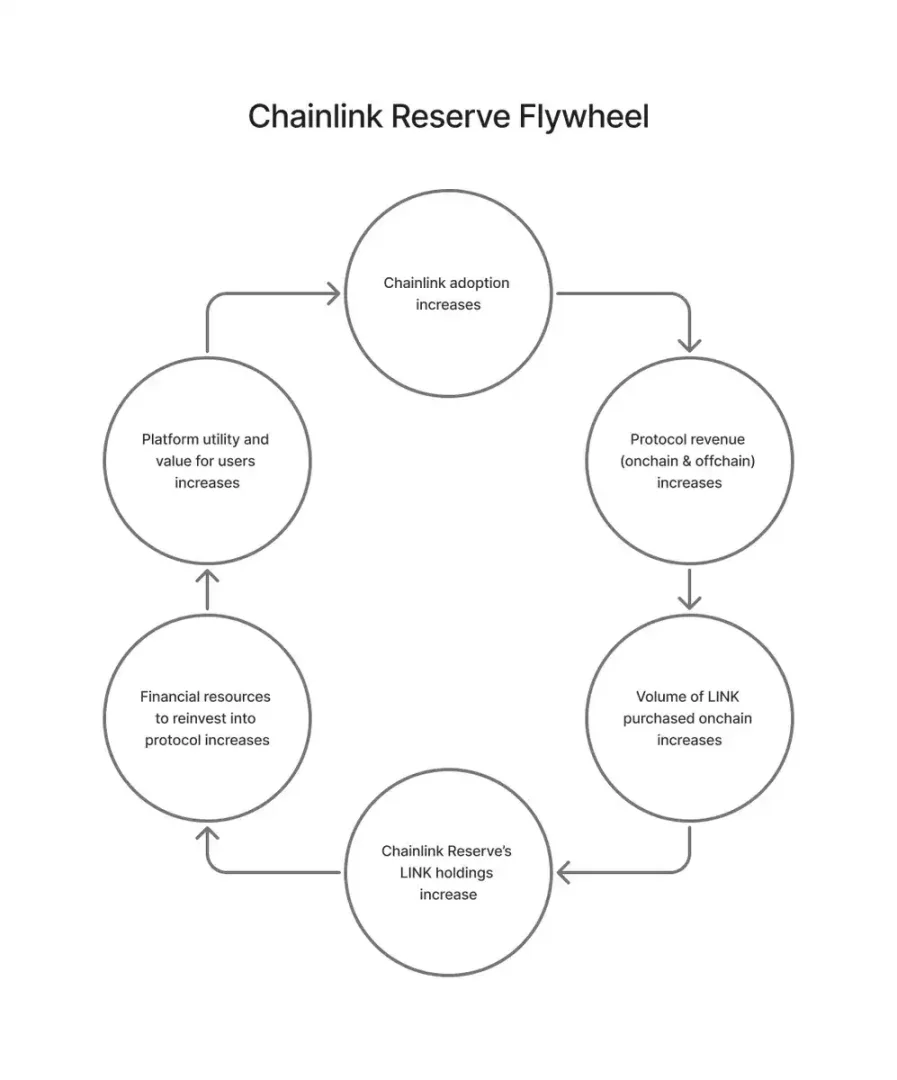

Chainlink is more than just a project; its value capture mechanism creates a powerful "flywheel effect."

Author: Miles Deutscher, crypto KOL

Translation: Yuliya, PANews

As RWA tokenization and institutional adoption become central narratives of this bull cycle, Chainlink, serving as critical infrastructure connecting traditional finance with the digital world, is poised to emerge as one of the biggest winners. Miles Deutscher points out that Chainlink is more than just a project—its value capture mechanism creates a powerful "flywheel effect," where increased network usage directly translates into sustained buying pressure and value accumulation for the $LINK token.

Notably, Chainlink's recently launched "$LINK Reserve" mechanism has demonstrated the real driving force behind this flywheel effect. By automatically converting and accumulating revenues from enterprise partnerships and on-chain services into $LINK tokens, this mechanism directly ties the network's fundamental growth to the token's value. Since the announcement, the price of $LINK has risen nearly 50%.

$LINK may be one of the most obvious large-cap investment opportunities in this cycle, yet most people might miss it. It stands as the top beneficiary of cryptocurrency institutionalization and the explosive growth of stablecoins, tokenization, and RWAs (real-world assets).

This bull market aligns closely with Chainlink’s narrative, driven primarily by the following factors:

Alignment With Macro Trends

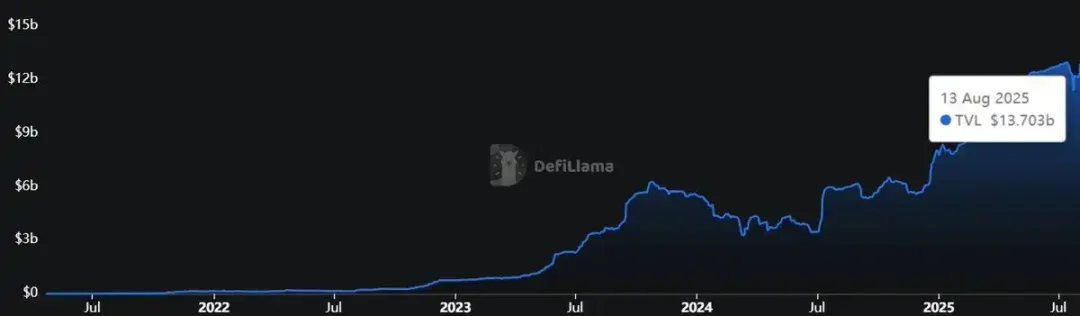

RWA total value locked has surged 13-fold over the past two years, growing from approximately $1 billion to over $13 billion, making it one of the fastest-growing sectors in crypto.

Institutions have recognized the slowness and inefficiency of the traditional SWIFT system and no longer wish to endure fragmented settlement processes. Instead, they seek complete end-to-end platforms. This explains why Wall Street giants like BlackRock are actively pushing asset tokenization, and why companies such as Stripe (launching Tempo chain) and Circle (launching ARC chain) are building their own blockchains.

In a fragmented, multi-chain environment, a "universal translator" is needed to enable interoperability—and Chainlink provides exactly that solution. Any tokenized stock, bond, or real estate requires oracles to bring its value on-chain, and $LINK is the market leader, holding an 84% share of the oracle market on Ethereum alone, positioning it as core infrastructure for this multi-trillion-dollar transformation.

It's difficult to predict which L1 blockchain will ultimately win, especially with numerous enterprise chains entering the market, and equally uncertain which RWA application will rise to prominence. But what is certain is that Chainlink powers them all, making it the quintessential "picks and shovels" play in the gold rush.

For a long time, the market widely believed XRP would represent institutional adoption. Yet in many ways, LINK has achieved even greater real-world traction than XRP, and given its valuation, offers more attractive upside potential.

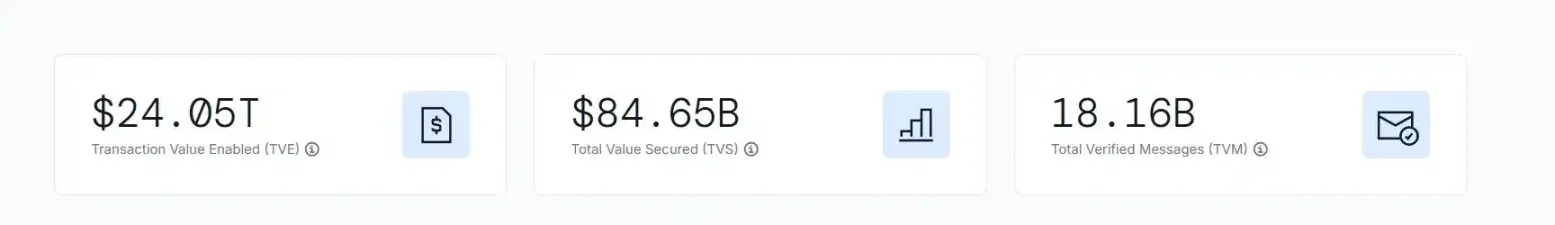

Data Comparison

· XRPL DeFi TVL: ~$85 million

· Chainlink Total Value Secured: ~$84.65 billion

Chainlink secures over 1,000 times more capital on-chain than XRPL, and its market share across DeFi continues to grow, now reaching 68%. Despite this, XRP's market cap remains approximately 12.1 times larger than LINK's, making LINK significantly more attractively valued at current levels.

Notably, beyond Bitcoin and Ethereum, Chainlink leads all other protocols in adoption within traditional finance (TradFi), having been integrated by multiple TradFi giants including:

· SWIFT

· DTCC (Depository Trust & Clearing Corporation)

· Euroclear

· JPMorgan Chase

· Mastercard

Tokenomics: Building the Value Flywheel

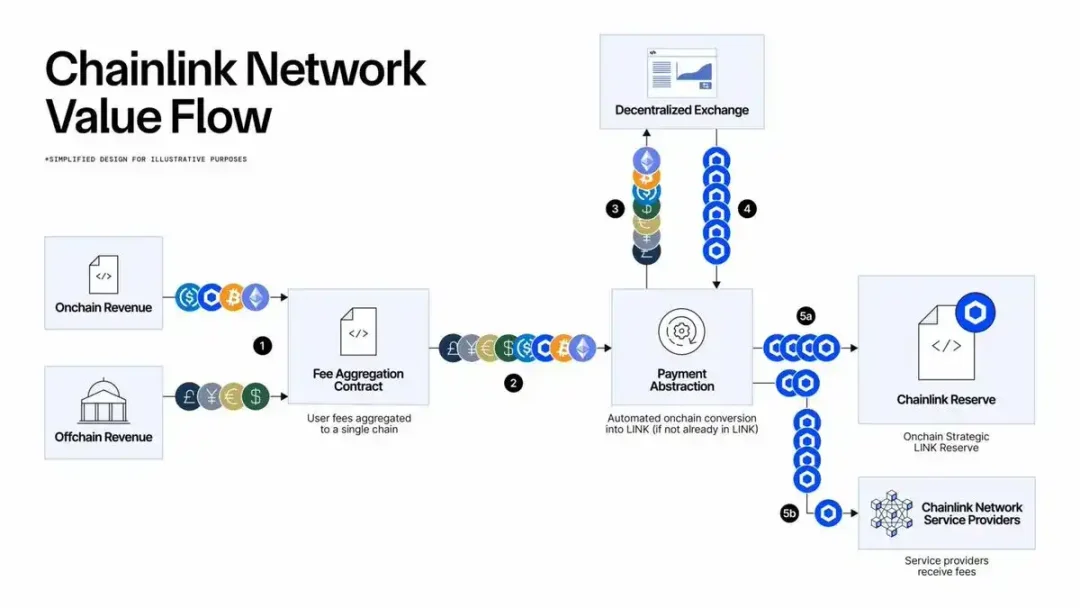

Chainlink's value flow operates primarily through the following mechanisms, with two main sources of revenue:

1. On-chain fees: Generated when its services are used across different blockchain networks. These fees fund network operations and $LINK token buybacks.

2. Enterprise partnerships: Agreements with major corporations and institutions like SWIFT or JPMorgan, who pay to integrate Chainlink's solutions. A portion of these funds flows into the Chainlink reserve to support long-term development.

Currently, the protocol automatically converts all income—including $ETH or $USDC fees from private chains—into $LINK and deposits it into a strategic treasury.

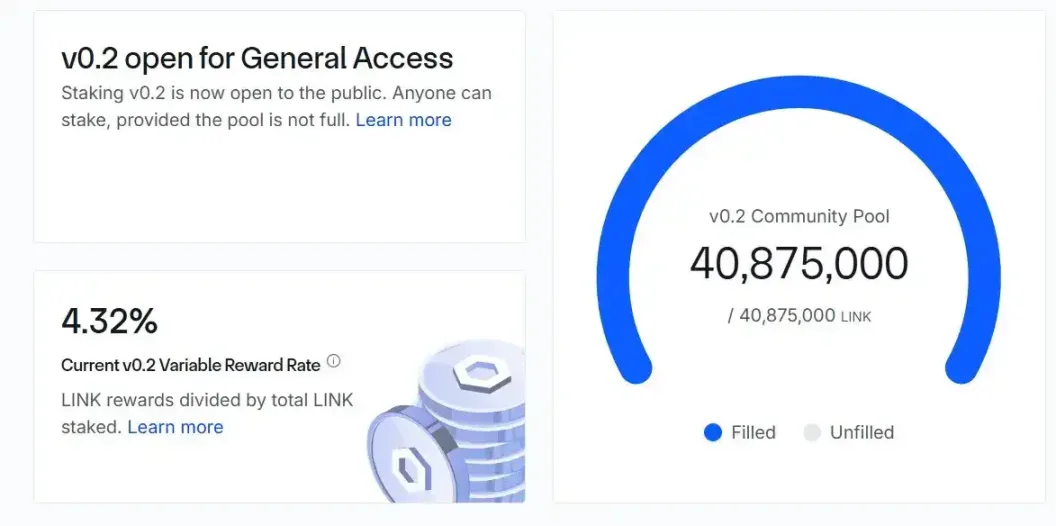

In addition, the staking mechanism plays a crucial role. Users lock $LINK to secure the network and earn a sustainable annual yield of approximately 4.32%. This creates a continuous supply contraction, removing tokens from the open market.

This establishes a permanent, automated buyback mechanism that directly converts network adoption into buying pressure, forming a powerful value flywheel:

Increased adoption → Higher revenue → More $LINK purchased and locked → Enhanced network security and resources → Greater utility

Technical Analysis and Summary

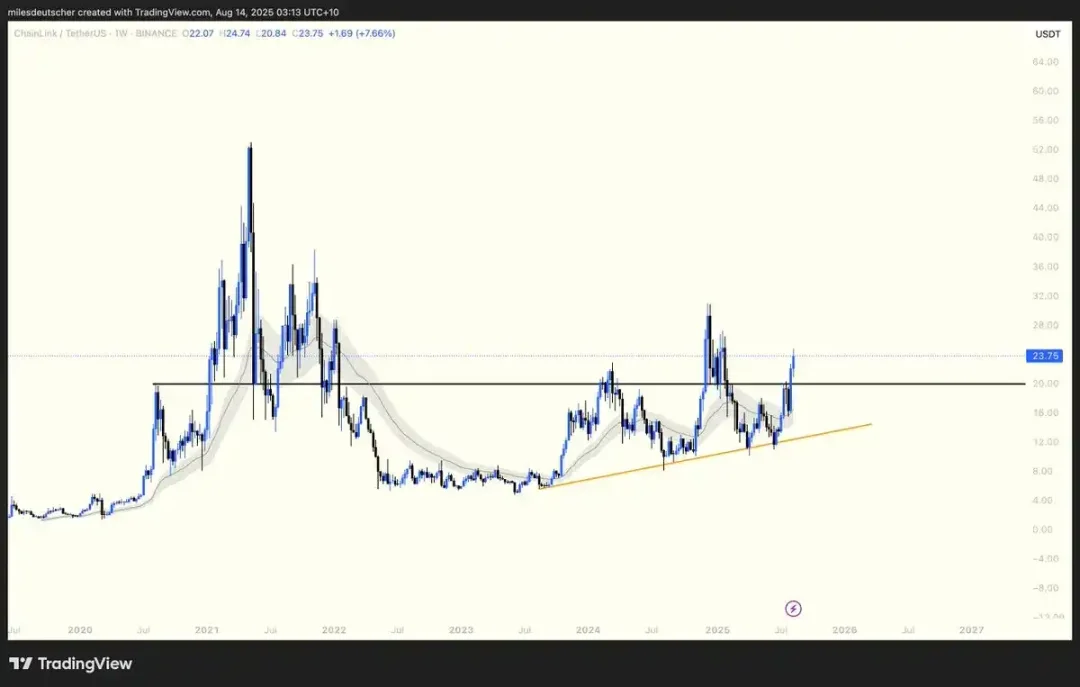

From a technical chart perspective, $LINK has broken above the weekly resistance zone at $20. This level has long served as a key battleground between bulls and bears, with significance comparable to ETH’s $4,000 level.

In summary, consider Chainlink’s value this way: If AWS, Azure, and GCP—the three major cloud service providers—were spun off from their parent companies, their standalone valuations would reach several trillion dollars. Chainlink is the foundational B2B infrastructure powering the entire on-chain economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News