Huobi Growth Academy | Chainlink In-Depth Research Report: From Oracle to On-Chain Financial Infrastructure, LINK's Flywheel Mechanism and Future Path

TechFlow Selected TechFlow Selected

Huobi Growth Academy | Chainlink In-Depth Research Report: From Oracle to On-Chain Financial Infrastructure, LINK's Flywheel Mechanism and Future Path

As a leading project in oracle and cross-chain infrastructure, Chainlink holds unique strategic value in the wave of RWA tokenization.

Author: Huobi Growth Academy

I. Introduction

Chainlink, as a representative project of decentralized oracle networks, has gradually established an irreplaceable position in the cryptocurrency industry since its launch in 2017. Oracles are key infrastructure connecting the blockchain world with real-world data, serving core functions such as price data delivery, cross-chain communication, and onboarding real-world assets (RWA). Against the backdrop where decentralized finance (DeFi), cross-chain ecosystems, and asset tokenization have become major narratives in the crypto industry, Chainlink's value and strategic positioning are increasingly prominent. The purpose of this report is to systematically analyze the investment thesis and medium-to-long-term potential of LINK by synthesizing macro market trends, RWA industry development, Chainlink’s technology and economic model, token value capture mechanisms, competitive landscape, and future outlook.

II. Macro Market Trends and Strategic Opportunities

In recent years, tokenization of real-world assets (RWA) has emerged as one of the most watched growth sectors in the crypto market. RWA refers to the process of mapping real-world assets—such as bonds, foreign exchange, real estate, certificates of deposit, gold, carbon credits, intellectual property, and even computing power—onto blockchains, enabling programmable, transferable, and composable characteristics via smart contracts. According to market research, the potential size of the RWA market could reach tens of trillions of dollars. For example, just tokenizing the U.S. Treasury market—which exceeds $26 trillion—compared to the total crypto market cap of approximately $2.5 trillion at the beginning of 2025—suggests that once RWA scales, it could drive over tenfold growth in the crypto market. Research firms like M31 Capital predict global asset tokenization will reach $30 trillion within the next decade, becoming the biggest driver for blockchain adoption. Meanwhile, traditional financial institutions are accelerating their shift. BlackRock is pushing tokenized money market funds, JPMorgan Chase is testing tokenized Treasury settlements through its Onyx platform, and SWIFT and DTCC are conducting blockchain experiments for cross-border payments and clearing—all indicating that traditional finance is gradually entering the on-chain economy through compliant pilots. As the bridge between on-chain and off-chain systems, oracles are critical to unlocking the value of all tokenized assets. Chainlink, as the world’s largest oracle network, handles over 80% of data requests on major chains like Ethereum, making its role in RWA infrastructure irreplaceable. Therefore, amid the explosive development of RWA, Chainlink stands out as the most strategically positioned foundational asset.

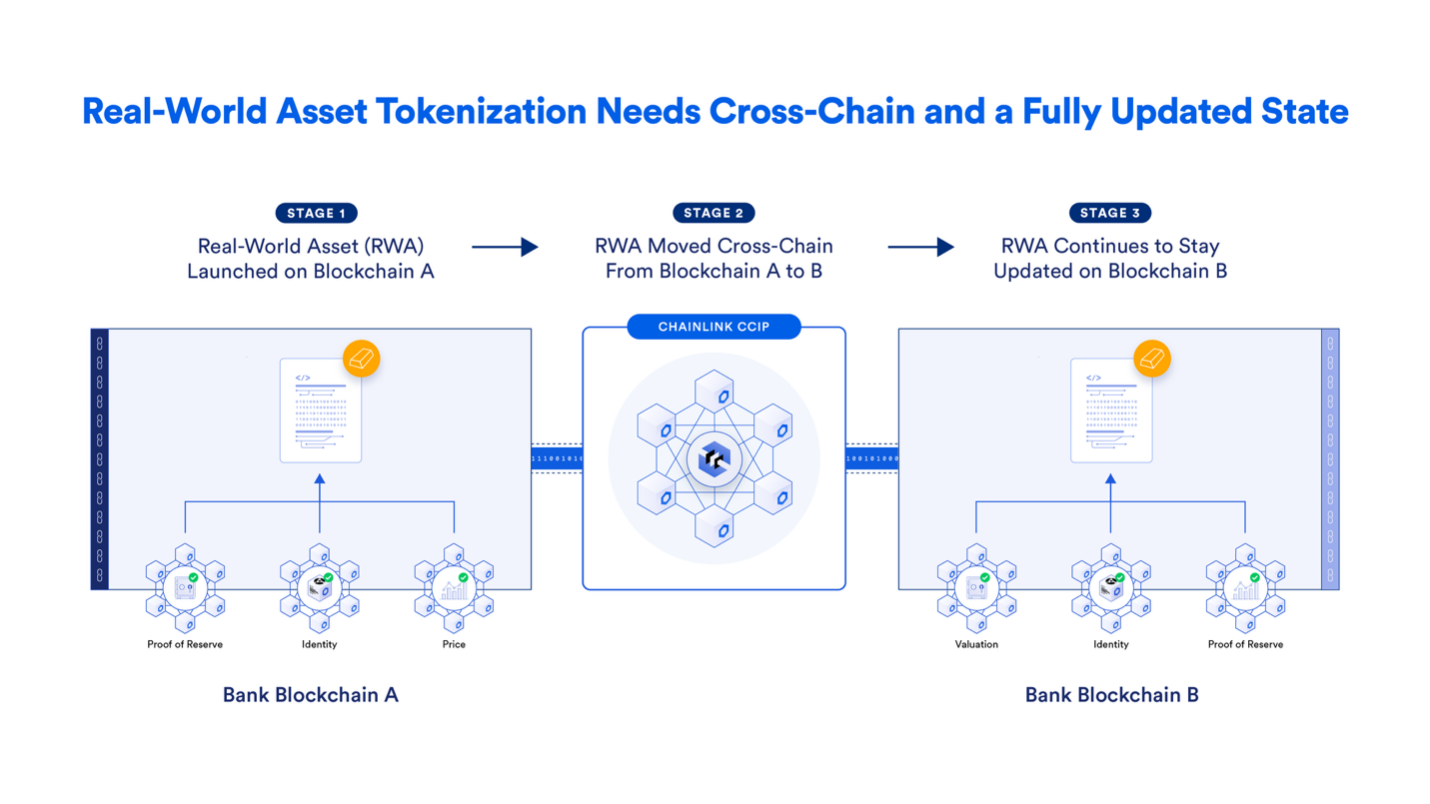

RWA and institutional onboarding represent the strongest current narrative, requiring a “three-piece suite” of “trusted data + cross-chain settlement + compliant execution” on-chain. Taking U.S. stocks and ETFs as examples, on-chain products require not only price data but also awareness of trading hours, circuit breakers/halts, and data freshness—so-called “contextual metadata”—to prevent erroneous triggering of clearing and risk controls. In August 2025, Chainlink formally standardized this “traditional-market-context-aware” data stream into Data Streams, which has already been adopted by top-tier protocols such as GMX and Kamino, covering high-interest assets including SPY, QQQ, NVDA, AAPL, and MSFT. Data Streams are now available across 37 networks, significantly lowering the barrier for developers to build compliant-grade derivatives, synthetic assets, and collateral/lending protocols. The RWA market is currently estimated by industry data platforms to exceed $100 billion, with multiple leading institutions forecasting it will reach the trillion-dollar scale before 2030. Within this trend, oracles and compliance-focused interoperability are “necessities,” not “options.” Furthermore, SWIFT’s multiple rounds of experiments and PoCs from 2023–2024 have validated the feasibility of “connecting banks to multi-chain using existing SWIFT standards plus Chainlink infrastructure.” DTCC’s Smart NAV pilot places key reference data such as fund NAV on-chain, explicitly using CCIP as the interoperability layer—these represent key paradigms for traditional financial infrastructure moving “data—rules—settlement” onto the chain.

Chainlink’s core value lies in its oracle service capability. Blockchains like Ethereum cannot directly access off-chain data; oracles fulfill the task of providing accurate, reliable, and decentralized data inputs. Chainlink leverages thousands of independent nodes to jointly ensure data accuracy, avoiding single points of failure and manipulation. Its technical offerings span multiple dimensions, including price feeds, verifiable random function (VRF), and Cross-Chain Interoperability Protocol (CCIP). According to latest statistics, Chainlink’s Total Value Secured (TVS) exceeds $11.3 billion, capturing about 46% of the oracle market—far ahead of competitors such as Pyth and Band. In the Ethereum DeFi ecosystem, over 90% of lending protocols and derivatives platforms use Chainlink data, with core protocols like Aave, Synthetix, and Compound relying on Chainlink price feeds. Compared to other high-market-cap but limited-application tokens like XRP, LINK demonstrates a clear advantage in actual integration and revenue generation. Studies show XRP’s market cap was once more than 15 times that of LINK, yet its level of ecosystem integration and institutional adoption lags far behind Chainlink. This indicates that LINK remains significantly undervalued and has substantial room for revaluation and catch-up growth in the long term.

III. Core Value Capture Mechanisms and Expansion into RWA

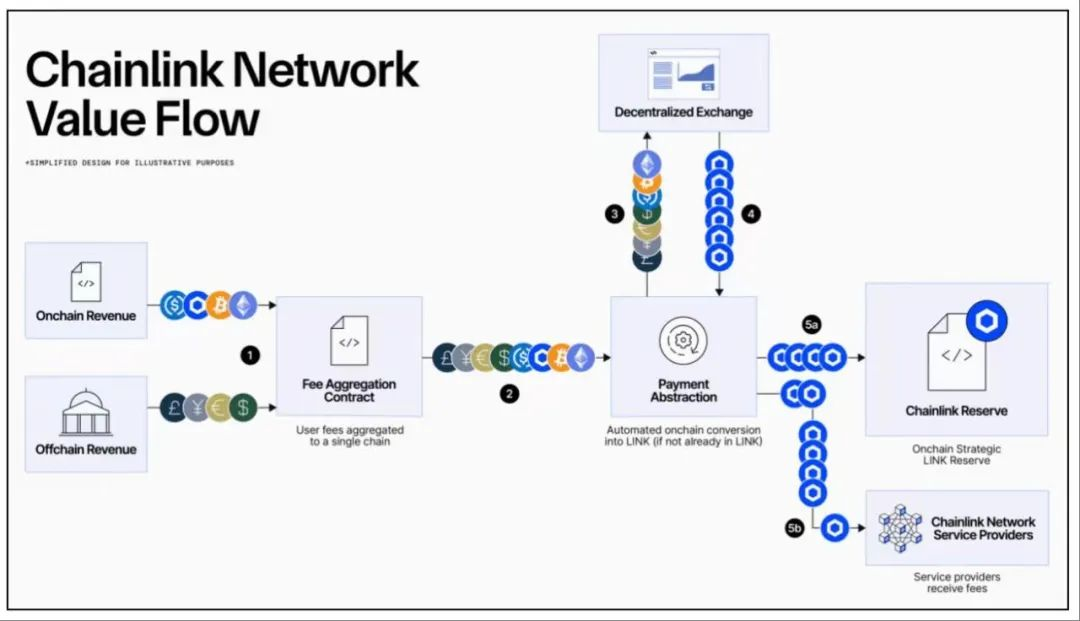

The most innovative aspect of Chainlink’s economic model is its value-capture flywheel mechanism. First, protocol users must pay fees in LINK tokens to access data, with part of these fees going to node operators and another portion allocated to the “LINK Reserve” mechanism. The reserve automatically uses income to repurchase LINK and hold it in reserve, creating sustained buy-side pressure that drives up the token price. Second, as RWA and DeFi applications grow, demand for high-frequency data calls and cross-chain communication increases exponentially, leading to exponential growth in protocol revenues. This further strengthens the reserve buyback effect, boosting LINK’s value. Third, LINK’s staking mechanism offers holders a stable annual yield (~4.3%), encouraging long-term holding and node participation, thereby reducing circulating supply. Ultimately, adoption, revenue, buybacks, price appreciation, and ecosystem expansion form a positive feedback loop—the so-called flywheel effect. From late 2023 to early 2025, LINK’s price rose nearly 50%, reflecting strong market confidence in this mechanism.

On the revenue front, Chainlink has begun demonstrating commercial viability. Statistics indicate its 30-day revenue exceeds $110,000, with a clear upward trend. While still modest compared to transaction fee volumes of major DeFi protocols, oracle services operate as B2B infrastructure, meaning revenue growth is inherently more stable. At the same time, Chainlink maintains overwhelming market dominance, with over 46% market share, effectively establishing itself as the industry standard. Compared to rivals like Pyth and Band, Chainlink leads in node count, depth of partnerships, and integration with financial institutions. Once RWA use cases go live, the volume of data requests generated by asset tokenization will vastly exceed current DeFi levels, significantly amplifying LINK’s revenue potential.

Chainlink primarily operates on a B2D/B2B2C pay-per-use model (including pricing/data service fees, CCIP cross-chain fees, PoR audit/monitoring fees, Data Streams subscription fees, etc.). Fees are routed through the network to nodes and security budgets, integrated within the Economics 2.0 framework alongside staking/collateral, alerts, and slashing penalties, creating a virtuous cycle of “higher economic security → higher willingness to pay → higher service fees → stronger security budget.” Staking v0.2 increased the pool cap to 45 million LINK (with ~40.875 million from the community and the remainder from node operators), introducing an unbonding mechanism (28-day cooldown + 7-day withdrawal window) to balance security and flexibility. Node staking includes a base reward rate with optional “delegation rewards,” and as user fee distributions increase in weight, staking’s “cash flow characteristics” are expected to strengthen. Media and research reports in 2025 frequently mentioned the “LINK reserve” (an on-chain reserve funded periodically by enterprise/service fee sources to purchase LINK), aimed at improving exchange float liquidity and supply elasticity. However, it should be emphasized that this mechanism is currently described mainly in media and industry analysis, without official systematic whitepaper-level validation. Thus, we treat it as a “scenario-dependent parameter” rather than a baseline fact in valuation assumptions.

Moreover, Chainlink is actively expanding its RWA infrastructure. First, its collaboration with ICE brings off-chain FX and precious metals pricing onto blockchains, providing trusted quotes for tokenized assets. Second, the CCIP cross-chain interoperability protocol enables asset transfers and data exchanges across different blockchains—an essential condition for RWA assets to move across multi-chain environments. Third, products like the DeFi Yield Index attempt to generate trackable yield indices by aggregating multiple DeFi yields, offering financial institutions integrable on-chain index tools. Beyond that, Chainlink is becoming the standard interface for data and value onboarding in areas such as agricultural assets, intellectual property, computing power, and cross-border money market funds. As a structural opportunity across industries, RWA tokenization fundamentally depends on trusted data input and inter-chain settlement—giving Chainlink a deep moat.

IV. Product Features and Ecosystem Partnerships

Chainlink’s product suite can be divided into four layers: (1) Data: Price Feeds, Proof of Reserve (PoR), State Pricing (a DEX-traded asset valuation method), and Data Streams (low-latency, high-frequency, and contextual metadata); (2) Interoperability: CCIP (cross-chain messaging/value transfer, programmable transfers, CCT standards), with version 1.6 in 2025 integrating Solana as the first non-EVM mainnet and significantly reducing cross-chain execution costs while accelerating deployment to new chains; (3) Computation and Automation: Functions, Automation, VRF, etc.; (4) Compliance and Governance: Risk control, monitoring, and compliance modules aligned with financial market regulations (recently highlighted capabilities such as ACE). Notably, beyond Solana, CCIP v1.6 claims support for “57+ chains” on mainnet and designates several chains as “canonical cross-chain infrastructure.” On Solana, Zeus Network was among the first to adopt CCIP and PoR, enabling cross-chain movement of assets like zBTC across Base, Ethereum, Solana, and Sonic, expanding BTCFi use cases. On the data side, the August 2025 integration of ICE Consolidated Feed as an institutional-grade data source for FX and precious metals—combined with Data Streams’ low latency and anti-manipulation mechanisms—enables lower noise-to-signal operation of institution-friendly asset classes like forex and gold/silver on-chain.

Ecosystem and partnership network: Chainlink builds network effects by engaging across four fronts—“financial institutions, public chains, DeFi protocols, and data providers.” On the institutional side: SWIFT’s multiple experiments demonstrate how existing messaging standards combined with CCIP can connect to multi-chain; the 2024 Swift/UBS/Chainlink pilot bridged tokenized assets with traditional payment systems; DTCC’s Smart NAV pilot from 2024–2025 explicitly adopted CCIP as the interoperability layer; in August 2025, ICE and Chainlink announced a data partnership, bringing ICE’s consolidated FX and precious metals feed into Data Streams to serve over 2,000 on-chain applications and institutions. On the asset management and banking side, ANZ, Fidelity International, and Sygnum appear on Chainlink’s official “Capital Markets Collaboration” list. On the public chain and protocol side: after steady operation of CCIP on Ethereum, Arbitrum, Optimism, Polygon, Base, Avalanche, and BNB EVM chains, the 2025 integration with Solana enabled Kamino and GMX-Solana to connect to Data Streams, further enabling institutional-grade derivatives and collateralized lending use cases in non-EVM ecosystems using U.S. stock and ETF data. On the data front: beyond traditional crypto market aggregation, Chainlink began extending into U.S. equities/ETFs, FX, and precious metals in 2025, forming broad multi-asset coverage.

V. Investment Valuation Logic and Potential Upside

From a technical price perspective, LINK broke above the key resistance level of $20 at the end of 2024 and has since formed a new support range between $22 and $30. If this range holds firm, it will lay the foundation for the next upward leg. Historically, ETH entered an exponential rise shortly after breaking above $400 in 2020, suggesting LINK may replicate a similar structural breakout. Whale wallet activity shows large amounts of LINK being moved from exchanges to cold wallets or staking contracts, indicating long-term capital accumulation. Combined with buy pressure from the reserve mechanism, both technical and capital flows point to a medium- to long-term bullish trend.

Third-party data aggregators consistently rank Chainlink first in the Oracles category, with overall market share estimates fluctuating between approximately 46% and 68%. In Ethereum DeFi data provisioning, many studies and media outlets estimate its share at over 80%, aligning with its strategy of “high-value use cases first, followed by steady expansion.” Meanwhile, competitors like Pyth gained traction in 2023–2024 through exchange direct connections and high-frequency data, temporarily boosting TVS growth—but failing to challenge Chainlink’s comprehensive lead in “high-value, multi-scenario, and institutionally compliant” offerings. Our comparative analysis highlights three key differentiators: first, institutional-grade interoperability and compliance pathways—with high-value collaborations involving Swift, DTCC, and ICE; second, product evolution from “price feeds” to “contextual data + risk control metadata,” meeting traditional market requirements; third, coverage across both EVM and non-EVM chains, with Solana integration marking a significant milestone. Conclusion: short-term market share fluctuations are normal, but in the complex arena of “multi-asset + multi-chain + compliance,” standardization and ecosystem stickiness matter more.

In terms of valuation logic, Chainlink can be viewed both as a foundational infrastructure investment and as a leveraged beneficiary of the RWA bull market. M31 Capital research suggests LINK has 20–30x upside potential in an RWA breakout scenario. This assessment rests on two pillars: first, the RWA market could reach $30 trillion, with Chainlink already established as the standard data layer; second, LINK’s current market cap remains undervalued relative to projects like XRP, revealing a significant mispricing. From a risk-reward standpoint, LINK offers both fundamental revenue support and revaluation potential, making it suitable for long-term investors seeking low-cost, medium-term exposure.

LINK has a maximum supply of 1 billion tokens. The commonly cited initial distribution is: 35% public sale, 35% node incentives/ecosystem rewards, and 30% company/treasury (SmartContract.com/Chainlink Labs)—a structure repeated by multiple research and educational sources including Glassnode, Crypto.com University, and Sygnum. With Staking v0.2, network security and value capture are now tightly linked. As user fees are introduced, LINK’s return profile is shifting from pure “growth expectations” toward a combination of “service fee cash flow + network security budget returns.” We recommend distinguishing three layers of demand in valuation: (1) “usage demand” (data/service/cross-chain fees paid upon protocol integration); (2) “security demand” (node and community staking); and (3) “liquidity/strategic demand” (market making, governance, and potential “reserve” purchases). On the supply side, the release schedule and allocation of “node incentives/ecosystem rewards” over the coming years—whether direct node subsidies or market-based service procurement—will directly impact secondary market supply-demand dynamics.

Industry media and third-party trackers recorded Chainlink’s TVS in the hundreds of billions of dollars in 2025, maintaining leadership in protocol count and multi-chain coverage. The official homepage also claims “cumulative support for on-chain transaction volumes in the tens of trillions of dollars.” On the fee side, aggregation platforms show Chainlink’s revenue is still in a “ramp-up phase,” yet we observe that penetration into high-quality use cases—such as GMX/Kamino adopting Data Streams and new categories like U.S. stocks/ETFs/FX/precious metals—may trigger a qualitative inflection point. The staking pool quickly reached full capacity after v0.2 launched, reflecting strong community and node willingness to back network security budgets. We propose a forward-looking metric: “unit TVS fee weighted by high-quality use case coverage across chains,” rather than relying on simplistic linear extrapolation of total network TVS.

We break down LINK’s value into three components: (A) “platform option value”—the premium earned when RWA and institutional onboarding explode, treating data and interoperability as “tax-like” infrastructure; (B) “operating cash flow”—estimated by multiplying active contract counts across data services, cross-chain services, proof of reserve, automation, etc., by average revenue per user (ARPU), adjusted for chain expansion and non-EVM penetration elasticity; (C) “security budget and staking returns”—becoming increasingly visible as staking/delegation scale and user fee sharing grow. We construct three scenario curves: conservative assumes only native crypto derivatives and stablecoin ecosystems expand, with LINK gaining share steadily in high-quality use cases; neutral adds mid-to-high frequency applications driven by Data Streams (e.g., U.S. stocks/ETFs/FX/precious metals), leading to notable ARPU growth; optimistic includes institutional cross-border settlement and multi-market tokenization (e.g., fund NAV distribution, custody, automated settlement), driving CCIP message and value transfer volumes higher, increasing user fees and revenue shares. Key metrics to track include: (1) active Data Streams channels and protocol count; (2) monthly CCIP cross-chain message and value transfer volume; (3) asset value under PoR monitoring; (4) staking net inflows and node yields; (5) subscription and call frequency for ICE/U.S. stock ETF data; (6) milestones from “standard institutions” like Swift and DTCC.

VI. Potential Risks and Strategic Recommendations

Despite Chainlink’s current market leadership, several risks warrant attention. First, shifts in competitive dynamics: high-frequency data and exchange-direct models offer cost advantages in niche segments and could erode market share in certain use cases. Second, slower-than-expected fee generation and value capture: if commercialization of Data Streams and CCIP follows a flatter curve, the realization of LINK’s “cash flow attributes” may be delayed. Third, regulatory uncertainty: cross-border data, FX, and securities regulations and licensing requirements may affect product rollout timelines. Fourth, technical and operational risks: low-latency data and cross-chain messaging require long-term robust “defense in depth” and sound node governance. Fifth, new mechanisms like the “LINK reserve,” mentioned in media but not yet officially systematized, should be treated cautiously in terms of marginal impact on secondary market supply-demand; they should not carry heavy weight in base-case valuations.

For investors, LINK is best approached with a medium-to-long-term holding strategy, using dollar-cost averaging or phased entry to mitigate volatility. For those interested in staking, the 4.3% annual yield offers additional returns while helping reduce circulating supply. For project teams, continued deepening of partnerships with financial institutions and enterprises—further standardizing RWA data sourcing and settlement mechanisms—can expand application scope. For ecosystem developers, Chainlink provides stable data and cross-chain service interfaces, enabling the future construction of more DeFi, cross-chain, and RWA applications.

We position LINK (Chainlink) as a core asset in “onchain finance universal infrastructure + data/interoperability hub,” driven by three long-term themes: first, data and compliance-focused oracles will underpin the entire journey from crypto-native to traditional asset onboarding, with Chainlink already the de facto standard (third parties like DeFiLlama consistently show Chainlink dominating oracle rankings; multiple studies estimate its market share between ~46%–68%, and over 80% in Ethereum DeFi data provision); second, the cross-chain interoperability layer CCIP continues evolving from public chains to institutional applications—from Swift to DTCC to Solana—making its network effects and standardization path increasingly clear; third, the data product suite (price oracles, Proof of Reserve, Data Streams, State Pricing, etc.) combined with institutional data providers (e.g., ICE) forms a “high-frequency, low-latency, and modular-compliant” product matrix, enabling expansion from crypto-native assets to broader traditional assets such as U.S. equity ETFs, FX, precious metals, and fund NAVs. On the on-chain value capture front, Chainlink’s economic model revolves around a cycle of “fees → services → staking → nodes → ecosystem reinvestment” (via Economics 2.0 and Staking v0.2), supplemented by supply-side initiatives like the BUILD program and the “LINK reserve” referenced in media—aimed at coupling network usage fees with security budgets and ecosystem growth, gradually enhancing LINK’s utility and potential cash flow characteristics. Considering institutional partnerships (Swift, DTCC, ICE), multi-chain coverage, surging RWA and cross-chain demand, and inclusion of non-EVM ecosystems like Solana, we assess that LINK retains a unique combination of beta and alpha characteristics in the next cycle.

VII. Conclusion

In summary, Chainlink, as the leading oracle and cross-chain infrastructure project, holds unique strategic value in the wave of RWA tokenization. Its value-capture flywheel, LINK reserve buyback mechanism, and staking incentives collectively form a robust economic model. As the RWA market expands, Chainlink’s applications will span more financial use cases, driving continuous growth in both revenue and token value. From a valuation perspective, LINK remains undervalued compared to other high-market-cap tokens lacking real application support, leaving significant room for catch-up and revaluation. Despite risks related to technology, competition, and regulation, from a long-term view, Chainlink is well-positioned to become a silent winner in the on-chain economy, driving deeper integration between the crypto industry and traditional finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News