Understanding dumpy.fun: Solend's new product after rebranding, allowing shorting of Meme coins to intensify PVP battles

TechFlow Selected TechFlow Selected

Understanding dumpy.fun: Solend's new product after rebranding, allowing shorting of Meme coins to intensify PVP battles

The outcome of drinking games on stage is hard to predict, but those who set up and dismantle the stage always profit.

Written by: TechFlow

Project rebranding is common in the crypto space, though usually limited to branding and marketing adjustments.

But rebranding while launching a completely new product? That’s rare.

Yesterday, Solend—a well-known lending protocol on Solana—rebranded to Save, literally meaning “save” or “safety.” But the new product it introduced carries a scent of both danger and excitement.

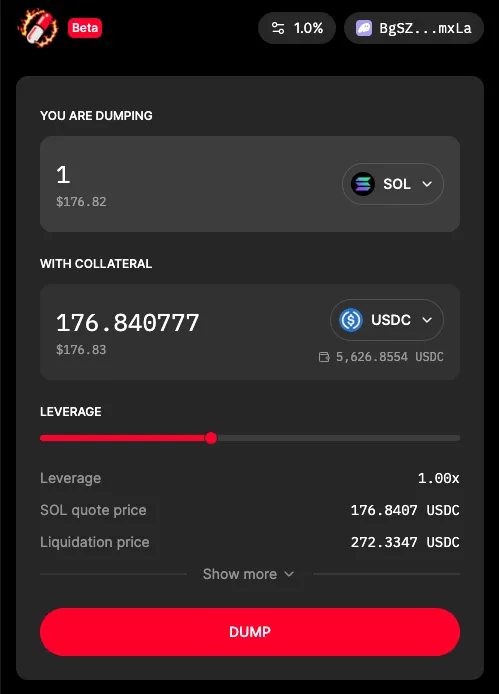

In addition to new assets like SUSD and SaveSOL, Solend (now Save) has launched a platform enabling short-selling of meme coins — dumpy.fun (X: @dumpydotfun).

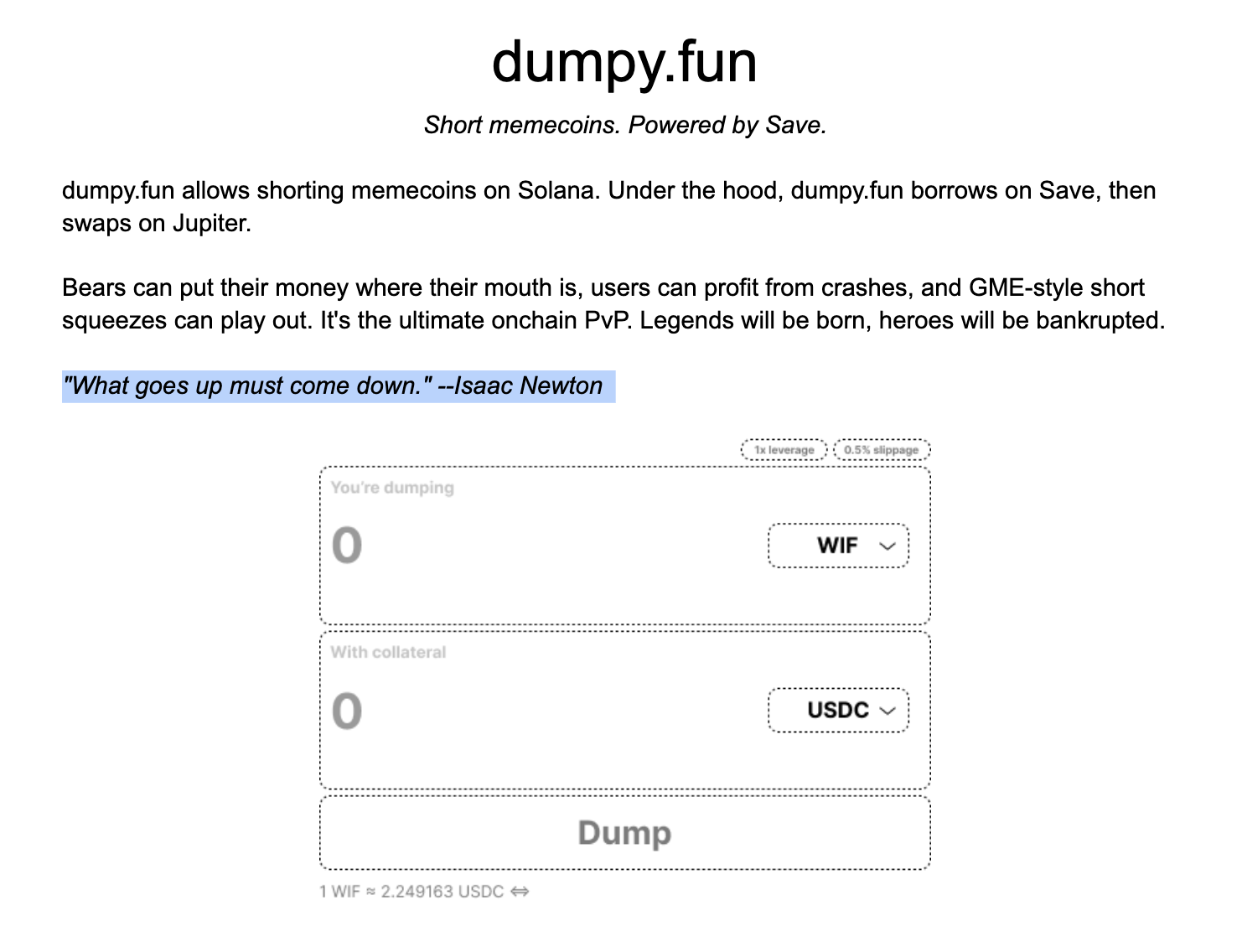

The name speaks for itself. First came Pump.fun, triggering a bullish frenzy of freely launching meme coins; now dumpy.fun emerges as its opposite, aiming to spark an airdrop-driven bearish狂欢 by shorting meme coins.

In Save’s (formerly Solend) blog post introducing dumpy.fun:

"Memecoins have reached fever pitch, but scamming and arbitrage are harming communities. dumpy.fun is a platform to short memecoins, allowing users to profit from corrections. Leveraging the deepest on-chain liquidity, it serves as a superior alternative to perpetual contracts. dumpy.fun is powered by Save."

Since the product hasn’t officially launched yet, we’ve reviewed its whitepaper to understand how shorting meme coins actually works.

Short-Selling Designed with On-Chain DEX Mechanics

“What goes up must come down”—Newton.

The dumpy.fun whitepaper opens with this classic law of gravity, humorously implying that meme coins will eventually crash to zero—so they’re building a platform to short them accordingly.

Platform Nature: Not a traditional DEX (decentralized exchange). It's more accurately described as a financial tool platform specialized for shorting, integrating lending and trading functionalities.

Operating Principle:

dumpy.fun leverages existing platforms (such as Save, formerly Solend) for borrowing operations—lending being Save’s core business.

It then uses Jupiter for token swaps.

This combined design allows users to short assets without directly holding them.

However, since all operations are fully on-chain, where does the capital supporting these short positions come from?

dumpy.fun answers: by utilizing depositors’ funds from Save, and attracting additional deposits through higher interest rates offered on its own platform.

The yield paid to depositors comes from:

-

Interest paid by borrowers: Short-sellers pay interest to borrow assets.

-

Trading fees: The platform may take a cut from transactions.

-

Liquidation fees: When short positions get liquidated, part of the fee may be distributed to depositors.

Perhaps the following example can help clarify dumpy.fun’s mechanism:

Suppose you want to short WIF.

Step 1: Deposit Collateral

You deposit 100 USDC as collateral.

Step 2: Borrow WIF

The platform borrows WIF worth 100 USDC on your behalf (from Save or dumpy.fun’s own pool). Assuming WIF is priced at 1 USDC, you receive 100 WIF.

Step 3: Sell Borrowed WIF

The platform immediately sells those 100 WIF on the market, receiving 100 USDC.

Current Status:

You owe the platform 100 WIF;

The platform holds your 100 USDC collateral plus the 100 USDC from selling WIF.

Step 4: Wait for Price Movement

Assume WIF drops 50%, now valued at 0.5 USDC per coin.

Step 5: Close Position

You decide to close the position. The platform uses 50 USDC from its balance to buy back 100 WIF (since each now costs 0.5 USDC).

Step 6: Repayment and Settlement

The platform uses the repurchased 100 WIF to repay your loan;

The remaining 50 USDC becomes your profit;

Your original 100 USDC collateral is returned.

Final Outcome:

You earn 50 USDC profit;

Your initial 100 USDC collateral is safely returned;

The benefit of dumpy.fun is that it automates this entire process—you don't need to manually execute each step—and integrates multiple platforms (like Save for lending and Jupiter for trading) to deliver this functionality.

PvP Intensifies: Winner Takes All, Loser Pays

If most meme coins are destined to go to zero, wouldn’t continuously shorting them guarantee profits?

dumpy.fun clearly doesn’t endorse this view—it seems to favor intense PvP-style battles instead.

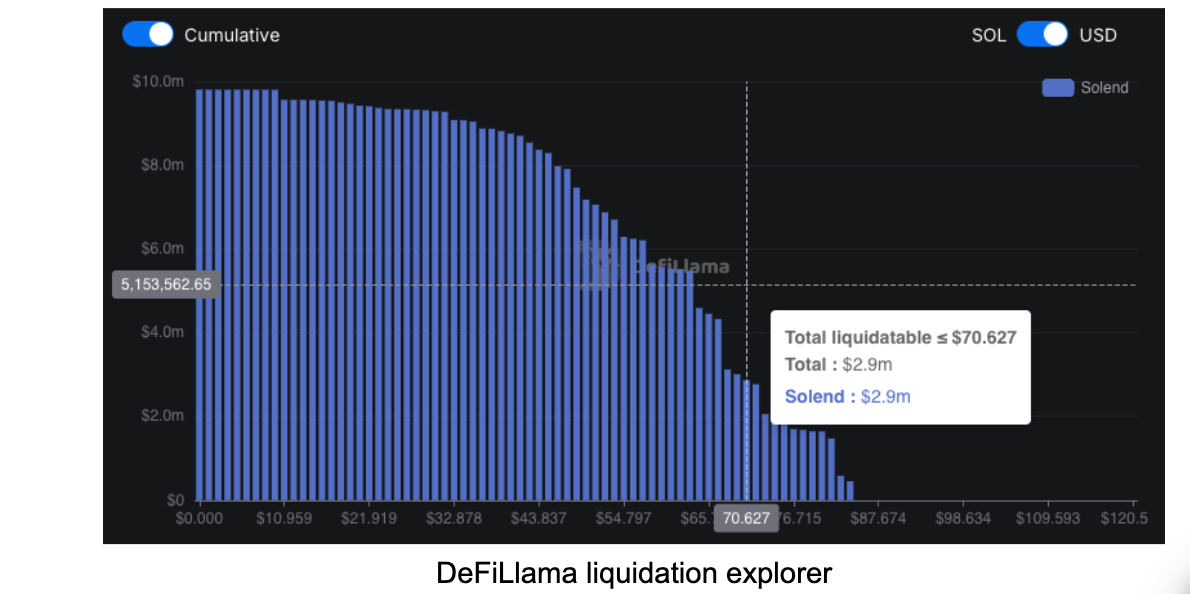

To this end, the platform provides a "Squeeze Explorer" interface showing the liquidation thresholds of open short positions.

For those unfamiliar, a "short squeeze" occurs when a heavily shorted asset suddenly surges in price, forcing short-sellers to buy back quickly to cover their positions, further driving up the price.

This design effectively reveals all short positions and the exact capital needed to trigger liquidations—fully transparent to everyone.

So if you're a long-holder or a strong whale bullish on a particular meme coin, and you see significant short interest, you can calculate the cost and choose to buy aggressively to push the price up and force liquidations.

In the context of dumpy.fun:

-

If many users have shorted a meme coin (e.g., WIF).

-

Other users (possibly via the "Squeeze Explorer") decide to collectively buy it.

-

This could trigger a short squeeze, rapidly increasing the token’s price.

-

Short-sellers may face heavy losses, while buyers who triggered the squeeze could gain substantial profits.

Clearly, mindlessly opening short positions won’t work—the Squeeze Explorer is designed to intensify the battle between bulls and bears.

May the winner laugh, while the loser’s fate hangs in the balance.

With short-selling enabled, PvP in the meme coin space will become even fiercer, perhaps even brutal.

Dumpy’s own tweet confirms this:

"Next time someone says your coin sucks, tell them to vote with money."

This has clear instigator energy—if you dislike a meme coin, don’t just talk trash, open a short. The unspoken message: I’ll set the stage, let’s see who wins—bears or bulls.

But we all know one thing:

Whoever wins the fight is uncertain—but the one who builds and runs the ring always profits.

DUMP, the Platform Token

With the platform launch, it will also introduce its native token: DUMP.

Key Functions:

a) Governance: Holders can participate in platform decisions.

b) Fee Sharing: A portion of trading and liquidation fees generated by the platform will be distributed to DUMP holders, creating a passive income stream that incentivizes long-term holding.

c) Collateral: DUMP can be used as collateral for trading or borrowing on the platform, increasing its utility and demand.

d) Liquidity Mining: Users can earn additional DUMP tokens by providing liquidity, helping enhance platform stability and depth.

The platform may implement a buyback and burn mechanism, using part of transaction fees to repurchase and destroy DUMP tokens, creating deflationary pressure.

However, the product has not yet launched, and DUMP has not undergone TGE.

Currently, dumpy’s website only offers an email waitlist sign-up. Interested users can join the project’s Telegram for more information.

Within the official Telegram community, the platform has already initiated a meme coin voting process to determine which tokens will be listed and available for shorting.

Again, buying memes can be fun—shorting them can be just as thrilling.

Just hope you’re not the source of someone else’s joy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News