Deep Dive into Bluefin: Building Sui's High-Performance Decentralized Finance Network, TGE Imminent

TechFlow Selected TechFlow Selected

Deep Dive into Bluefin: Building Sui's High-Performance Decentralized Finance Network, TGE Imminent

This article will introduce Bluefin's upcoming updates and TGE details,讲述 the development journey and grand vision of Bluefin.

Author: TechFlow

Introduction

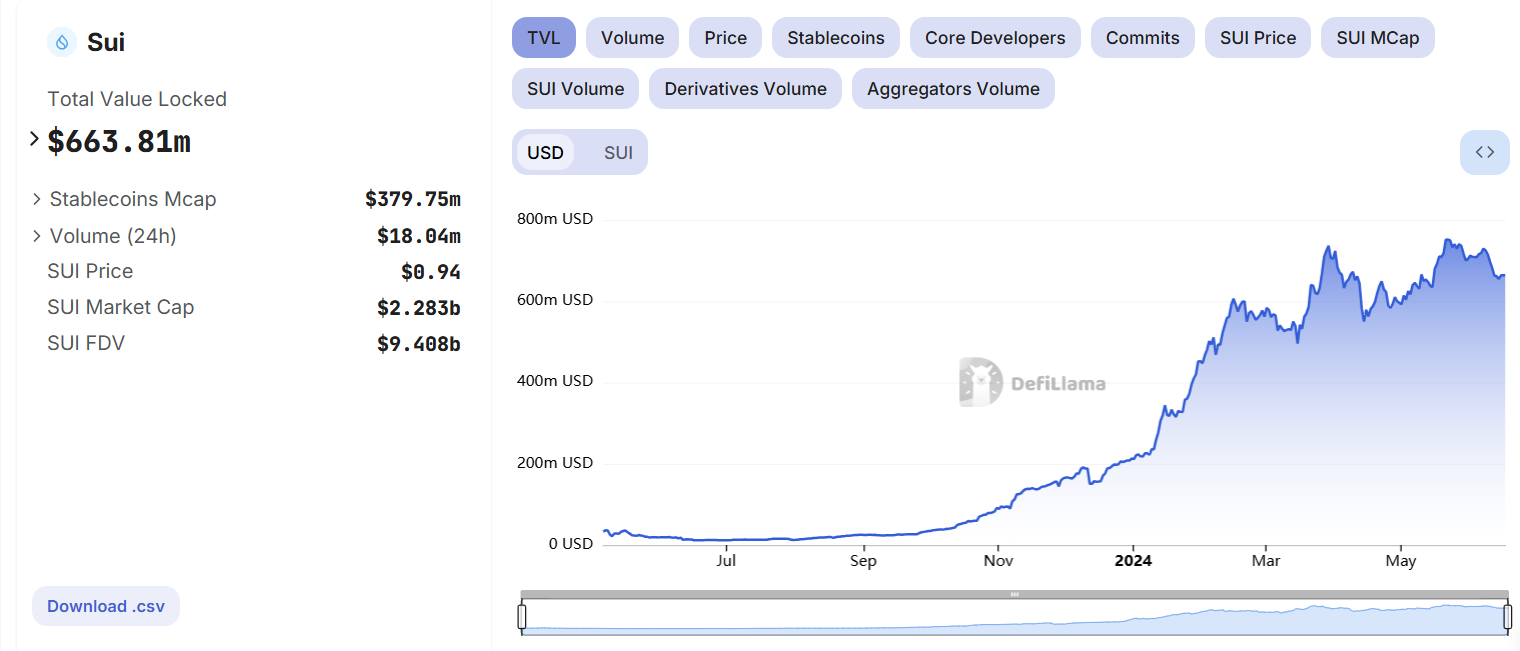

With the arrival of the bull market, Sui—the much-anticipated star layer-1 blockchain during the bear market—has shed its previous low profile. Not only has its token price surged, but its ecosystem TVL has also continuously grown beyond $600 million, showing strong momentum for further growth.

The continuous inflow of capital has drawn significant market attention, making Sui’s technical strengths—such as high throughput, low latency, and strong scalability—more widely recognized. Developer community activity is steadily increasing, and various protocols within the ecosystem are beginning to flourish.

As the leading trading platform in the Sui ecosystem, Bluefin offers users a diverse trading experience across derivatives and spot markets, thanks to its efficient transaction processing speed, transparent on-chain security mechanisms, and user-friendly interface.

Beyond being just a trading platform, Bluefin aims to build core infrastructure and foster a decentralized financial ecosystem on the Sui network.

Amidst a volatile broader market, now is an ideal time to explore promising public chain ecosystems. Bluefin is set to launch its Token Generation Event (TGE) soon, with plans to release a spot asset aggregator and the official version of Bluefin Pro later this year.

This article will detail Bluefin’s upcoming updates and TGE information, tracing its development journey and ambitious vision.

Bluefin’s Strategic Positioning in the Sui Ecosystem

Market Demand and Performance Supply Are Misaligned

Despite Sui's reputation for high performance and user-friendliness, these advantages have yet to be fully realized across many applications. As a result, Sui’s high performance and low latency remain underutilized. Many applications still feature complex, non-intuitive designs that fail to leverage Sui’s usability, leaving ordinary users facing steep learning curves. These issues hinder wider adoption and application expansion within the Sui ecosystem.

Derivatives trading is increasingly becoming a focal point for DeFi users. However, existing platforms often fall short in performance and user experience, failing to meet demands for fast, low-latency trading. Additionally, high transaction fees remain a widespread issue—especially during periods of heavy volume or market volatility—where users face significant gas costs. These challenges pose obstacles to the broader development of the DeFi sector.

Sui Needs a Breakout Catalyst

The steadily rising TVL clearly shows that Sui is progressing toward becoming a major public blockchain. However, despite increasingly robust infrastructure, most projects within the Sui ecosystem remain in early stages. There is currently a lack of innovative applications capable of attracting mainstream users, and no strong user base or community influence has coalesced. To shine like Solana or Base in this "no-momentum bull market," Sui lacks a breakout catalyst—an event or product powerful enough to capture mainstream attention.

In this context, Bluefin emerges as a unique protocol. Recognizing Sui’s untapped high-performance potential, Bluefin leverages the network’s distinctive architecture to overcome current market limitations, carve out its niche, and break through ecosystem boundaries through sheer capability.

Speeding Up: How Bluefin Leverages the Sui Ecosystem

As an early explorer among DEXs, Bluefin’s maturity and excellence stem from repeated technical iterations by its team.

Initially, Bluefin v1 testnet launched on Arbitrum in 2023. However, the team quickly identified limitations in scalability and cost efficiency on Arbitrum. Drawn by Sui blockchain’s unique architecture and advantages, Bluefin began adapting its codebase for Sui, eventually deploying Bluefin v2 on the Sui mainnet by the end of 2023—achieving over $3.2 billion in trading volume in December 2023 alone.

As anticipated, the transition to Sui enabled Bluefin to align perfectly with its goals of high performance and superior user experience.

From the initial Bluefin Classic to Bluefin v2, and soon-to-launch Bluefin Pro, Bluefin has evolved through multiple versions. Each iteration significantly improved performance and user experience, allowing Bluefin to solidify its position as a top-tier trading platform. Looking ahead, Bluefin aims to expand into financial services and infrastructure, building foundational tools on Sui and creating a comprehensive on-chain financial network.

Sui: A High-Speed Lane for Trading

Within the Sui network, Single-Owner Objects enable extremely high efficiency and parallel processing. Operations such as token transfers and smart contract deployments are processed by Sui without requiring consensus, enabling massive parallelization while locking only relevant data.

Additionally, Sui processes each transaction individually, avoiding batch block processing bottlenecks, resulting in shorter transaction latency. After validation, arbitration drivers assemble these transactions into certificates to finalize them. Furthermore, Sui applies causal ordering to transactions involving owned objects, enabling large-scale parallelization and sharding across multiple machines, greatly enhancing the network’s scalability.

Sui’s high performance, low cost, and strong scalability allow Bluefin to achieve sub-second settlement speeds comparable to centralized exchanges, along with ultra-low transaction costs.

Minimizing Wallet Friction, Maximizing User Experience

Bluefin uses account abstraction to make on-chain interactions invisible to users, allowing seamless trading without needing a wallet.

By integrating with zkLogin, Bluefin simplifies user registration—users can log in directly using their Google account and start trading immediately, all without setting up a wallet. Zero-knowledge proofs ensure sensitive user data remains private.

To deliver a user experience on par with centralized exchanges, the team has streamlined the deposit process as much as possible.

Bluefin has integrated Wormhole, offering users a seamless cross-chain solution directly within the platform, enabling one-click deposits from any blockchain. For Web3 newcomers or users from centralized exchanges like Binance, Bluefin will support direct fiat onboarding and direct deposits from CEXs.

Bluefin aims to completely eliminate the need for Web3 wallets. Users can bypass wallet setup entirely and enjoy faster, friendlier, and more secure trading experiences—all without compromising technical integrity.

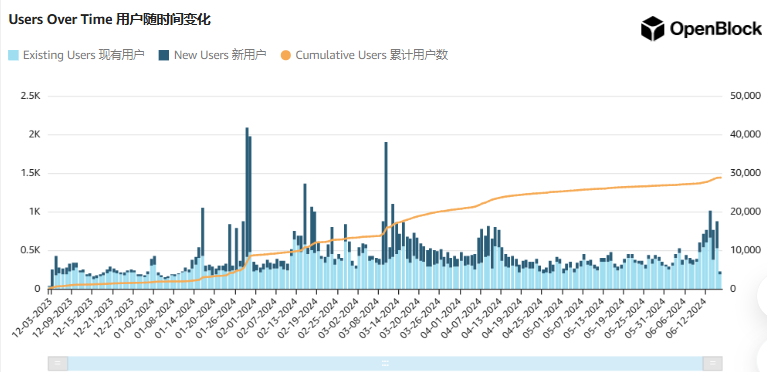

Bluefin’s focus on user experience has yielded tangible results—since the launch of v2, its user base has consistently grown.

Team Background and Ecosystem

Bluefin’s leadership team hails from renowned companies including Meta, Goldman Sachs, Amazon, and NYSE. Founder Rabeel Jawaid is a research scientist at the Singh Center for Nanotechnology at the University of Pennsylvania and formerly served as an investment analyst at Optimus Capital Management.

According to available data, excluding undisclosed pre-seed funding, Bluefin has raised $29.2 million, led by Polychain, Three Arrows Capital, and DeFiance Capital, with participation from numerous prominent institutions and individuals.

Currently, Bluefin collaborates with leading market makers and firms such as Wintermute, Amber, Keyrock, Meta, Goldman Sachs, and Amazon.

Bluefin is already interconnected with multiple on-chain financial protocols including CetusProtocol, Turbos Finance, KriyaDEX, and AVEO. It also partners with well-known NFT communities such as Pudgy Penguins, MadLabs, and Azuki, and will distribute $BLUE token airdrops to members of partner project communities at TGE. Going forward, Bluefin plans to collaborate with more high-quality projects to co-build a thriving on-chain financial network.

The Future Is Here: Technical Highlights of Bluefin Pro

While Bluefin v2 continues evolving, the Bluefin team will launch Bluefin Pro in the second half of this year—a highly optimized version of the product featuring reduced fees, lower transaction execution latency, and cross-margin accounts.

Leveraging Owned Object Transactions

-

Cross-Margin Support: Bluefin Pro introduces cross-margin trading accounts—a critical feature for advanced trading platforms.

-

30ms Transaction Confirmation: Bluefin Pro ensures rapid transaction confirmation for users, achieving sub-30ms off-chain confirmation at speeds up to ~30,000 TPS, regardless of on-chain processing times.

-

400ms On-Chain Finality: Fast on-chain finality ensures Bluefin Pro remains efficient and responsive even under high traffic.

-

Gas Cost: Bluefin transaction calls typically consume 1,000–2,000 gas units, with average gas costs around $0.01, ensuring low and predictable fees. The Bluefin Foundation covers these gas expenses.

Illustration: Single-Owner Objects vs. Owned Object Transactions

In Bluefin Pro’s technical architecture, “Single-Owner Objects” and “Owned Object Transactions” are closely related yet distinct concepts: Single-owner objects form the foundation, while owned object transactions leverage this structure for efficient processing.

Using a library book borrowing analogy: Sui acts as the entire library management system, tracking each book’s status and borrower, assigning every book a unique ID (ownership). Bluefin functions as the librarian, using Sui’s system to quickly process checkouts and returns.

Each book carries a unique tag indicating who borrowed it—this represents a “Single-Owner Object,” where each object (book) has a clear owner (borrower).

When you borrow or return a book, the library only needs to verify that specific book’s tag—not the status of all books. This mirrors “Owned Object Transactions,” where only relevant objects and owners are checked, eliminating the need for global system validation.

TGE Approaches: How to Participate in Bluefin

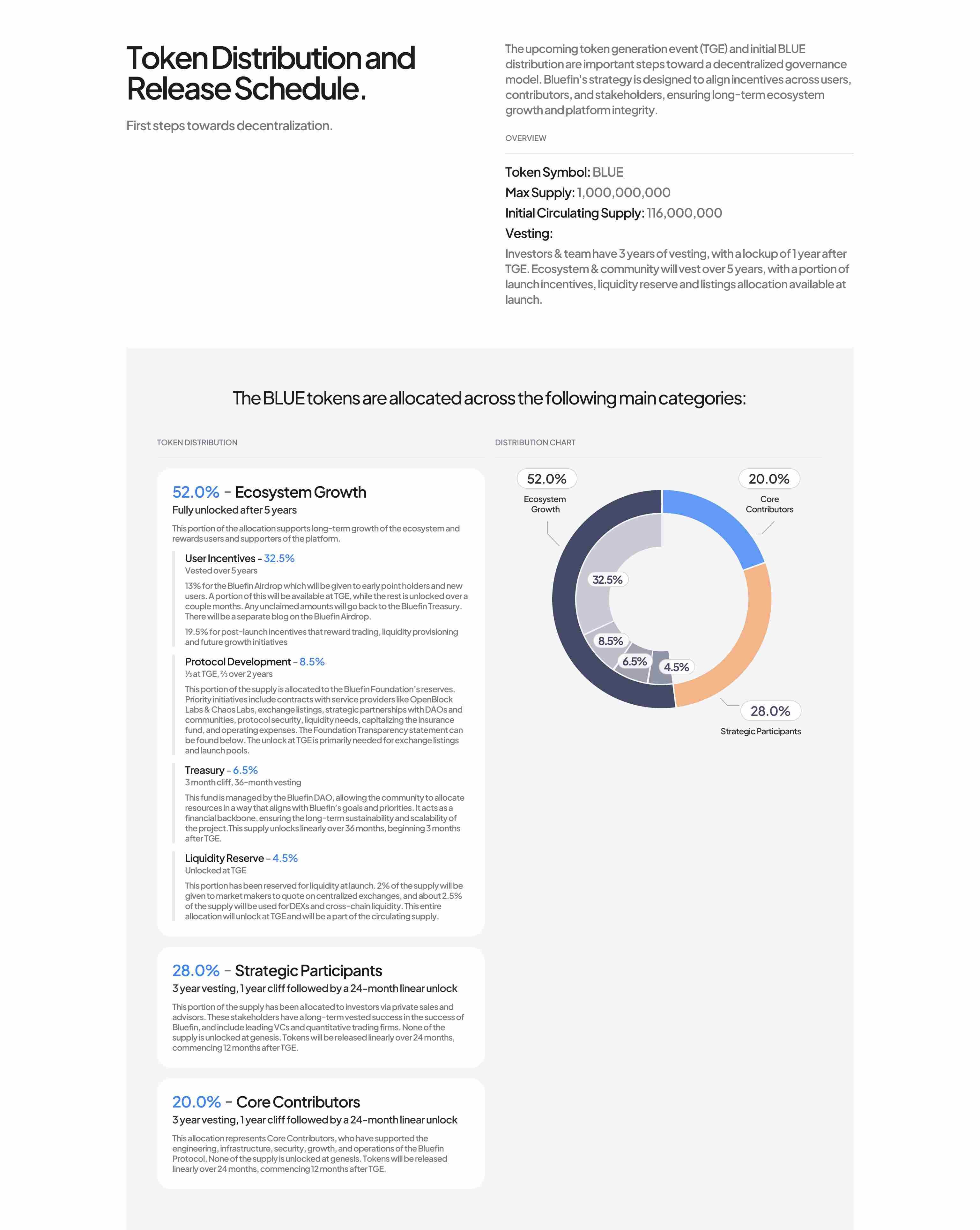

Looking ahead, $BLUE token distribution will prioritize ecosystem growth incentives (52%): 13% allocated to airdrops, 19.5% for trading rewards, liquidity provider incentives, and future growth programs, and 4.5% reserved for initial liquidity at TGE—all unlocked at launch.

The remaining 48% is allocated to investors and core contributors, released linearly starting 12 months after TGE.

Users can participate in four ways:

-

Trading Mining

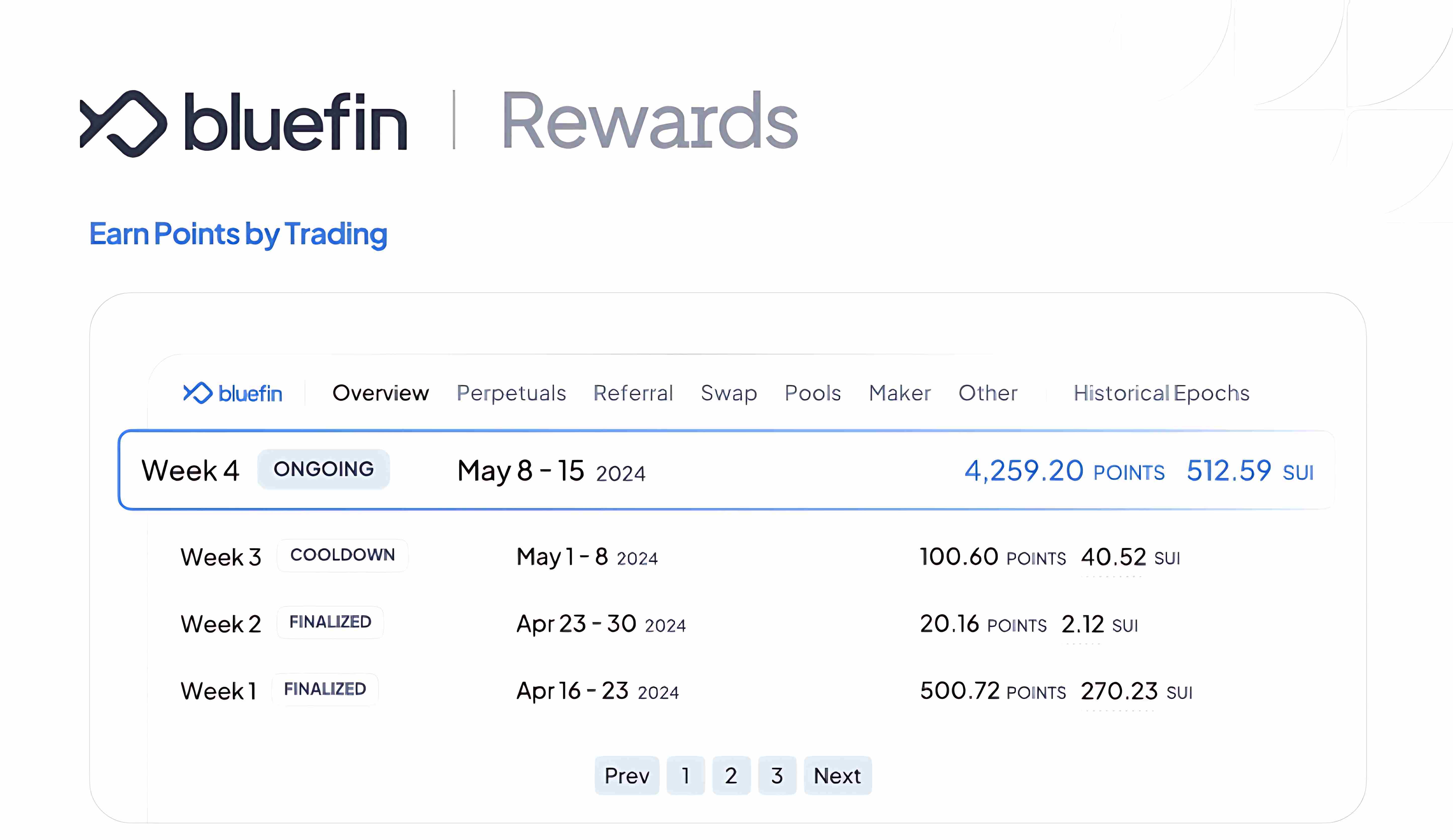

Currently, users can earn points by trading on Bluefin. The Bluefin Trading Rewards Program distributes Blue Points and SUI weekly based on fees paid by traders during the week. Click the “Reward Pool” button on the Bluefin Rewards Dashboard to view the weekly reward pool.

-

Trading Tier League

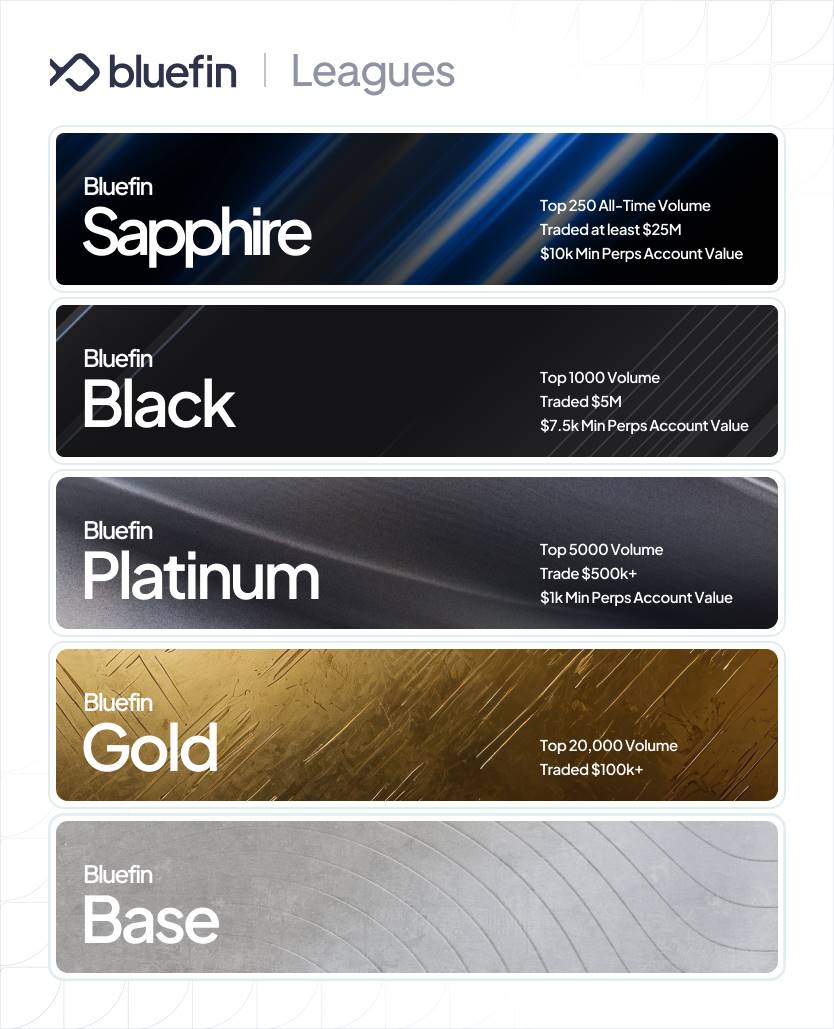

The tier league complements trading mining: users participating in Bluefin trading receive different levels of NFTs based on their trading activity, with higher tiers unlocking richer airdrop rewards.

Under this tier system, users can freely strategize—whether concentrating volume on one account to climb ranks or spreading across multiple accounts for baseline gains—each approach offers predictable returns.

-

Bluefin Stable Pools

Users can support order book liquidity via Bluefin Stable Pools to earn stable yields while minimizing downside risk.

-

Open Referral

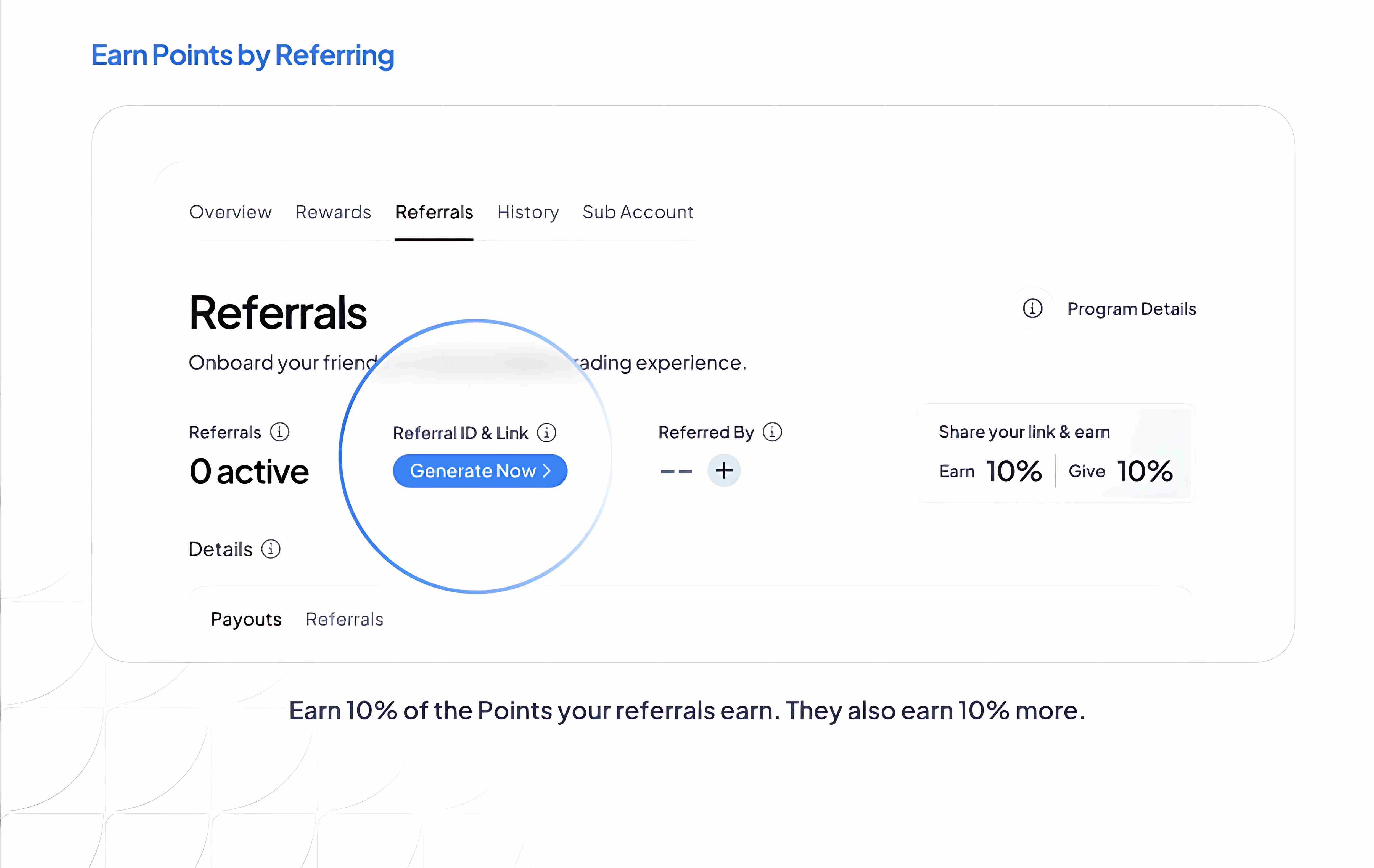

Through the Open Referral program, users can create personalized referral links and both referrer and referee enjoy a 10% bonus.

Conclusion

Bluefin effectively fills a gap in today’s market. As a high-performance on-chain trading platform, Bluefin recognizes the immense potential behind Sui’s advanced technical architecture. Through innovative application-layer design, it fully showcases Sui’s technological strengths. Beyond excelling in transaction speed and cost-efficiency, Bluefin prioritizes user experience—making it accessible even to complete beginners. With Bluefin, users can directly experience Sui’s powerful performance, enhancing trading satisfaction while driving broader adoption and usage of the Sui ecosystem.

Not only does Bluefin align deeply with Sui in technical performance, but it also boosts user engagement and community loyalty through unique reward mechanisms and community initiatives, injecting new vitality and sustained attention into the Sui ecosystem. In the future, Bluefin will continue expanding its financial network, refining the spot market, and building essential ecosystem infrastructure.

As the $BLUE token launch draws near, Bluefin—now fully prepared—may become the long-awaited breakout catalyst for the Sui ecosystem, leading it into a more mature financial era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News