Bluefin Delivers Strong DeFi Results Leveraging Sui's Performance

TechFlow Selected TechFlow Selected

Bluefin Delivers Strong DeFi Results Leveraging Sui's Performance

Sui's network performance and zkLogin functionality enabled Bluefin's DeFi platform to achieve tens of billions of dollars in trading volume in a short period.

By Sui Network

The founders of Bluefin aimed to deliver advanced, capital-efficient derivatives trading on a decentralized platform. To compete with traditional finance counterparts, the platform needed to excel in performance, cost-efficiency, and accessibility for both institutional and individual users.

In 2023, Bluefin’s beta launch on Arbitrum helped it explore DeFi's potential. That year, Bluefin’s original platform attracted over $2.1 billion in trading volume. However, the team realized that Arbitrum could not support their ambitious vision.

While exploring alternatives, Bluefin discovered that Sui not only met its technical performance requirements but also offered a user experience unlike any other blockchain platform. Additionally, gas fees on Sui were significantly lower than those on other blockchains.

“From day one, we wanted to prioritize user experience in DeFi—a missing piece we saw in the industry and a massive opportunity,” said Bluefin co-founder Rabeel Jawaid.

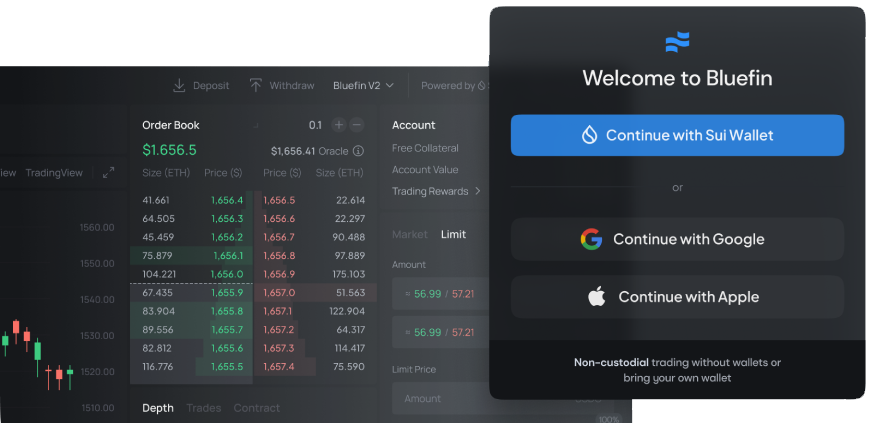

Bluefin v2 launched on Sui in Q4 2023, featuring performance and interface designed for both Web3 and Web2 users

With its second-generation product, Bluefin v2, the company developed and launched its DeFi platform on Sui, achieving exceptionally fast transactions and a seamless account creation process. Despite launching in Q4 2023, Bluefin v2 achieved over $3.2 billion in trading volume in December alone, capturing more than 80% of the ecosystem’s market share.

Derivatives Market

Among the many available DeFi services, Bluefin sees derivatives trading as one of crypto’s most significant use cases. Unlike direct exchanges, derivatives traders agree to buy a specific amount of cryptocurrency at a set price on a future date—essentially betting whether a token’s future price will rise or fall.

Traders can enter fixed contracts or pay for options to purchase at a specific price. In the former, if the token price rises, the trader profits. With options, if the token price falls below the set strike price, the trader can choose not to buy.

In Bluefin’s recently added perpetual contracts, traders enter agreements to buy crypto at a set price without a fixed expiration date. Traders who expect prices to rise (long positions) aim to sell when the token price exceeds their entry point. Others may open perpetual contracts anticipating falling prices (short positions). On both sides of these trades, funding rates are paid to maintain positions.

Milliseconds Matter

Derivatives trading has become popular in crypto markets because users can go long or short, use leverage, and deploy capital more efficiently—for example, using the same collateral to go long on BTC while shorting ETH. These instruments are also typically more liquid and cheaper to trade on most exchanges. However, until recently, blockchains weren’t optimized enough to support the performance demands of derivatives.

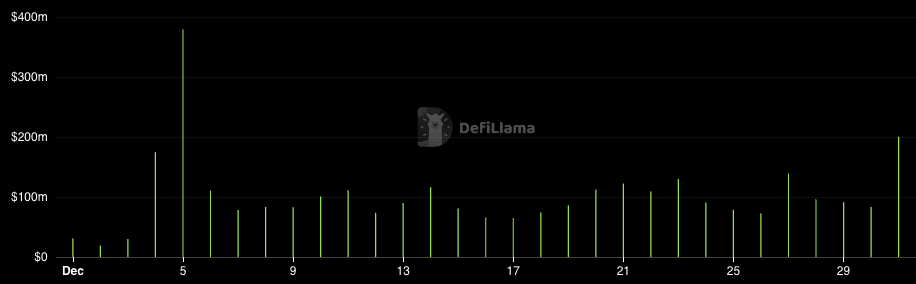

In December 2023, Bluefin averaged over $100 million in daily trading volume

Source: DeFiLlama

“Derivatives trading in DeFi requires high-performance blockchains. Until now, no decentralized protocol has been able to match leading CEXs due to poor on-chain user experiences,” said Rabeel. “We’re changing that—and Sui enables us to do so.”

Bluefin found Sui met its performance needs across two key metrics: TPS and transaction confirmation time. On other chains, high trading volumes often create TPS bottlenecks. Sui reached a peak TPS of 5,414 in 2023—still far from its theoretical or practical limits. Additionally, Bluefin can achieve fast transaction confirmations within 30 milliseconds and final settlement in approximately 550 milliseconds—both figures aligning with expectations from traditional financial platform users.

Bluefin v2 processes transactions rapidly, driving impressive DeFi trading volumes

Timely execution is only part of the success story. “A major reason behind Bluefin’s strong performance is eliminating the need for wallets,” Rabeel said. “This aligns with our goal of mimicking a Web2 trading experience while retaining the decentralized advantages of an on-chain protocol.”

Bluefin leverages Sui’s native zkLogin feature to seamlessly onboard new DeFi users. While existing DeFi users can begin trading by connecting a wallet, the platform also allows users to create accounts using Google or Apple login credentials. As a native Sui feature, zkLogin does not rely on intermediaries—using zero-knowledge proofs to verify user identity without requiring Bluefin to store IDs or passwords.

Bluefin uses zkLogin to quickly register users via their existing trusted service accounts

Looking Ahead

Despite Bluefin v2’s strong early performance, the company is not resting and plans further improvements. Currently, it uses shared objects on Sui, which require consensus for finality. Bluefin is redesigning its architecture so that trades between parties use shared objects for trusted transactions, bypassing consensus to settle as quickly as possible.

“We’ve already benchmarked these transactions—they complete on-chain in about 400 milliseconds,” Rabeel said. “Combined with our redesigned off-chain order book that intelligently partitions trade submissions by user, we expect to reach 30,000 parallel transactions per second from unique users before encountering execution latency.”

Beyond infrastructure upgrades, Bluefin aims to further enhance user experience. “In the coming weeks, users will be able to log into our exchange, create an account using Google, deposit funds, and start trading seamlessly,” Rabeel said.

Future offerings will include the exchange’s BLUE token and access to spot markets through DeepBook, Sui’s first native liquidity layer. With a strong finish in 2023, Bluefin is poised for even greater growth in 2024.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News