Interpreting Bluefin V3: Bringing Low-Cost, High-Efficiency Derivatives Trading to Sui

TechFlow Selected TechFlow Selected

Interpreting Bluefin V3: Bringing Low-Cost, High-Efficiency Derivatives Trading to Sui

Bluefin V3's off-chain margin engine is at the core of its operations, delivering remarkable throughput and low latency.

Written by: Chaos Labs

Compiled by: TechFlow

Chaos Labs recently published an article highlighting its DeFi partner protocol Bluefin, a decentralized perpetual contracts protocol deployed on the Sui network. TechFlow has compiled the full text.

(Editor's note: Chaos Labs is a cloud platform that enables teams to create high-fidelity replicas and scenario-based simulations on mainnet forks, providing a realistic testing environment. The company aims to expand cryptocurrency adoption by delivering customized and automated economic security tools for protocols.)

Introduction

Bluefin is a decentralized perpetual contracts protocol deployed on the Sui network, driving over 90% of on-chain trading volume on Sui. Initially launched on Arbitrum as Bluefin V1, V2 was optimized specifically for Sui and has delivered impressive growth to date.

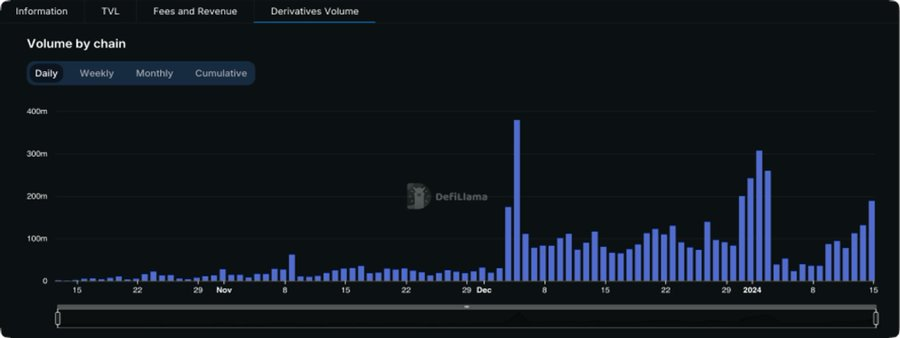

Bluefin’s trading volume continues to grow steadily, exceeding $3.2 billion in December 2023.

V3 Coming Soon

While V2 continues evolving, the Bluefin team plans to launch V3 in Q2 2024. This version will represent a highly optimized iteration of the product, featuring reduced fees, lower transaction execution latency, and cross-margin accounts.

V3 aims to deliver impressive performance. Let’s dive into the transaction mechanisms enabled by Sui, including support for parallel computation and frameworks designed to enhance transaction processing efficiency.

Transactions with Single-Owner Objects

Sui-owned object transactions include token transfers and smart contract deployments. These are processed by Sui without requiring consensus, enabling massive parallelization while locking only relevant data.

Low-Latency Validation

Sui processes transactions individually, avoiding block batch processing. As a result, each transaction experiences lower latency, faster finality, and rapid confirmation.

Efficient Transaction Submission

Transactions are sent to an orchestrator driver, which broadcasts them to validators. Validators check and sign valid transactions; the orchestrator then assembles these into certificates, finalizing transactions upon successful validation.

Scalability via Causal Ordering

Sui applies causal ordering to transactions involving owned objects, enabling large-scale parallelization and sharding across multiple machines. This approach significantly enhances scalability.

Bluefin V3 and Owned Object Transactions

Bluefin V3 leverages these transaction mechanisms to achieve its goals:

-

Cross-margin support: Bluefin V3 will introduce cross-margin trading accounts, a key feature for trading platforms.

-

Sub-30ms transaction confirmation: Bluefin V3 ensures users experience rapid confirmation regardless of on-chain processing times. It achieves off-chain transaction confirmation in under 30 milliseconds at speeds of approximately 30,000 TPS. On-chain finality in 400ms: Fast on-chain finality will ensure Bluefin V3 remains efficient and responsive even during high traffic periods.

-

Gas costs: Bluefin transaction calls typically consume between 1,000 and 2,000 gas units, with average gas costs around $0.01, ensuring low cost and predictability. These gas fees are covered by the Bluefin Foundation.

At the core of Bluefin V3’s operation is its off-chain margin engine, delivering remarkable throughput and low latency. Users enjoy a trading experience powered by Sui, ensuring fast and final confirmation.

For more information about Bluefin V3, click here.

Final Thoughts

Bluefin faces several upcoming challenges, including implementing cross-margin functionality, new market listings, and account abstraction. As Bluefin’s partner, Chaos Labs will continue providing real-time insights into both V2 and the upcoming V3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News