Hyperliquid Market Cap Surpasses $10 Billion: Why Bluefin Could Be the Next Miracle in the Sui Ecosystem?

TechFlow Selected TechFlow Selected

Hyperliquid Market Cap Surpasses $10 Billion: Why Bluefin Could Be the Next Miracle in the Sui Ecosystem?

This article will introduce why Bluefin is worth paying attention to and how to participate now.

Author: Biteye

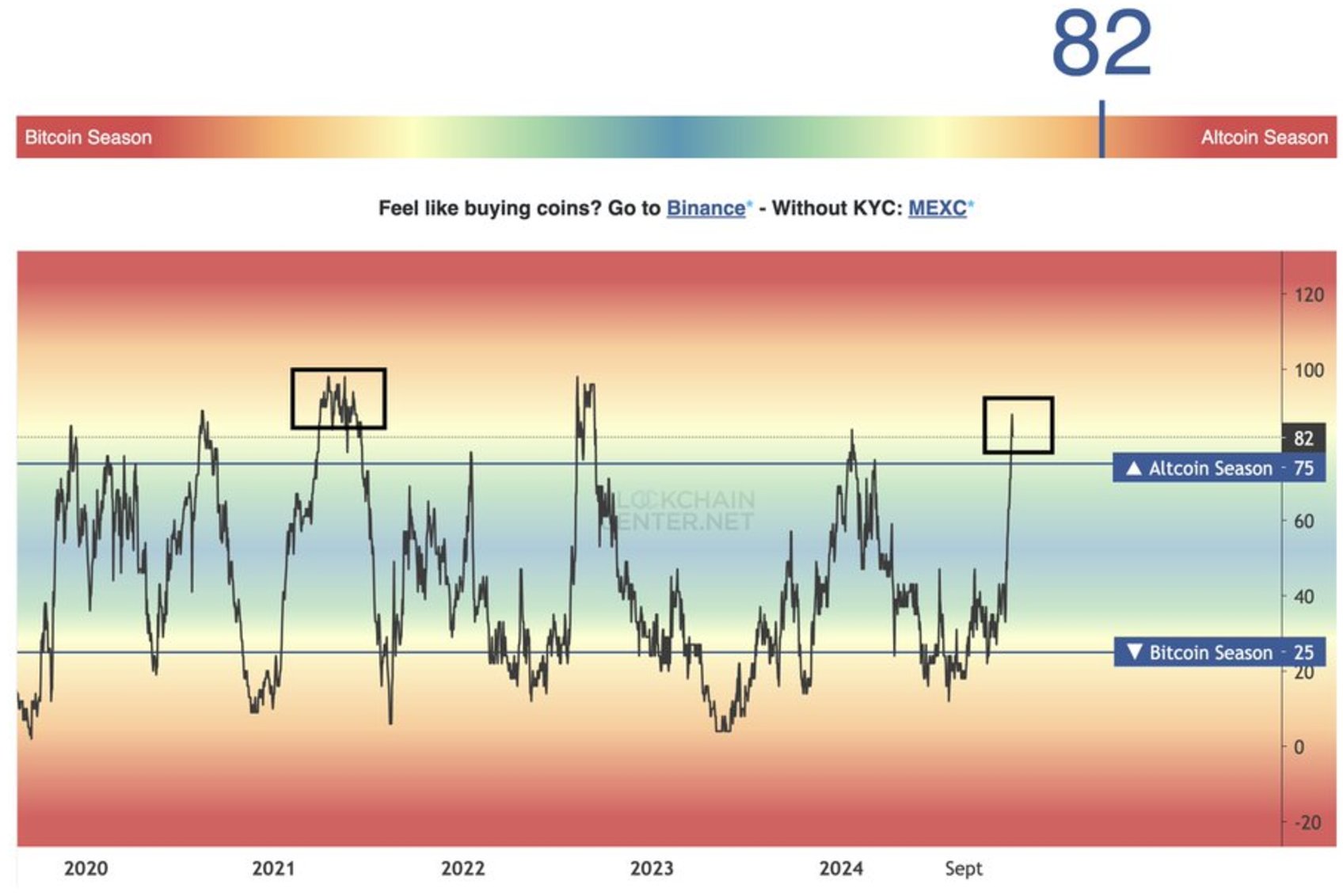

Finally, the alt season has arrived! The last alt season lasted 88 days; this time, we've just completed a highly rewarding week. Last Friday, Bitcoin experienced a deep pullback, yet alts surprisingly held strong—what else could this be if not the start of alt season? Everything familiar is back, and it might just be the beginning.

After its TGE, Hyperliquid's token price surged past a $10 billion valuation without looking back. Sui, as the most powerful L1 following Solana, continues to hit new highs. Hyperliquid on Sui—@bluefinapp—launched its TGE at the perfect moment, capitalizing on ideal timing and positioning. Here’s why Bluefin deserves your attention and how you can get involved now.

1. Business Overview

Bluefin is a decentralized exchange focused on derivatives and spot trading, delivering high-performance trading experiences. Bluefin accounts for over 85% of the derivatives market share in the Sui ecosystem and supports pre-market trading for Sui-based projects. Its spot automated market maker (AMM) launched just two weeks ago and has already achieved $130 million in trading volume. Furthermore, Bluefin has built comprehensive meme infrastructure aiming to become the central meme trading hub within the Sui ecosystem. Thus, Bluefin integrates derivatives, aggregators, and liquidity pools into one unified platform, combining on-chain market making with RWA narratives to form a full-featured on-chain exchange. Since launching in September 2023, Bluefin has recorded over $38 billion in total trading volume, attracted more than 72,000 users, and achieved $32.54 million in TVL (Total Value Locked).

2. Fundamental Highlights

Founded by a team from North America and Europe, Bluefin’s founders hold degrees from top universities such as the University of Pennsylvania and UC Berkeley. The project has received backing from leading institutions including Polychain, Brevan Howard, SIG, Tower Research, and Wintermute. Over the past three years, Bluefin has maintained an impeccable security record with zero incidents. It employs dedicated internal security engineers and collaborates with four premier security firms: Trail of Bits, PeckShield, Halborn, and Halborn.

3. Tokenomics

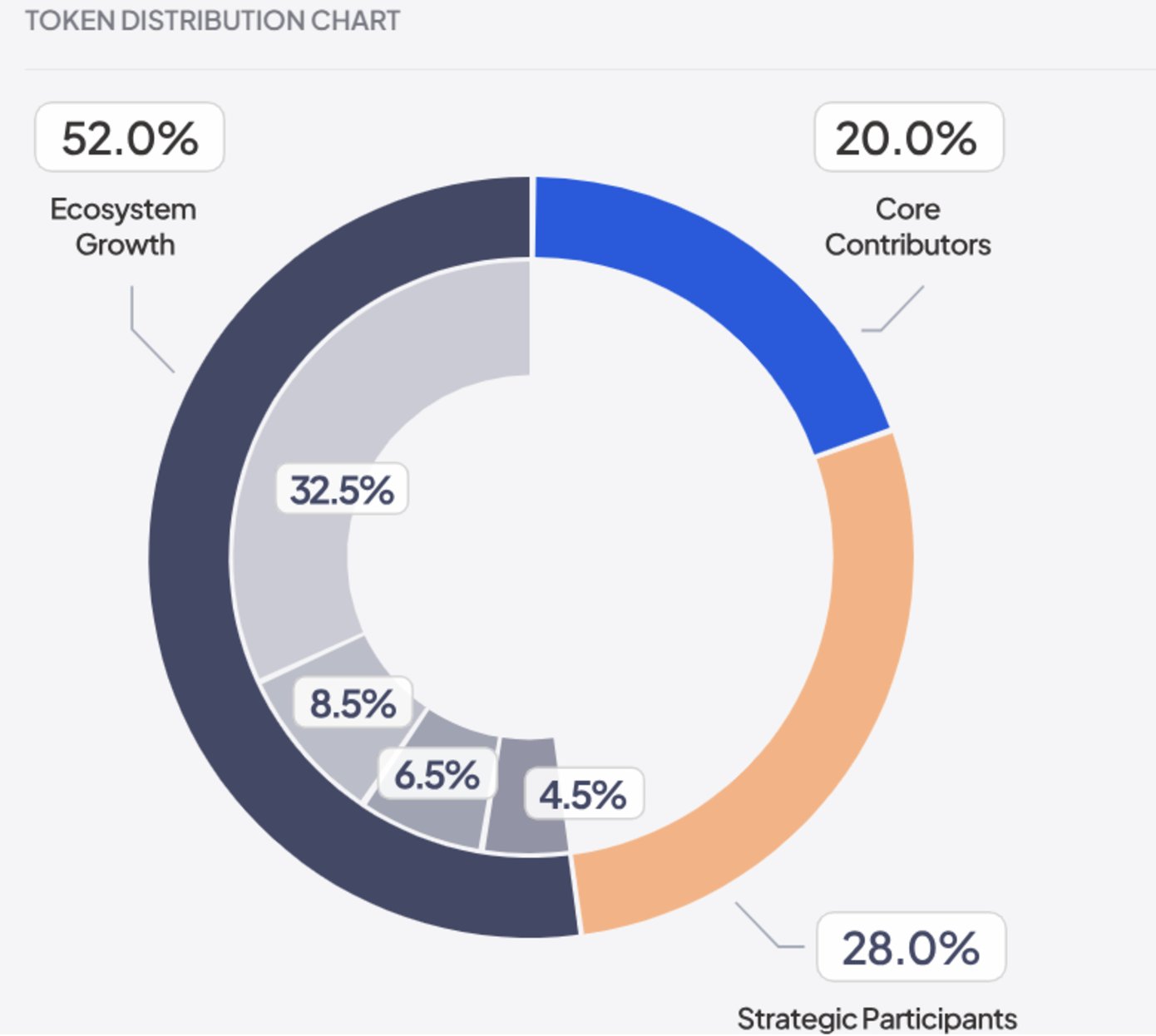

52% of tokens are allocated to ecosystem growth, 20% to core contributors (no vesting in Year 1, linear unlock over the next two years), and 28% to strategic partners (top-tier VCs and market makers, no vesting in Year 1, linear unlock over the following two years).

Tokens for ecosystem growth will primarily fund user incentives (32.5%, five-year unlock—19.68% via airdrop, 12.82% for future campaigns), protocol development (8.5%, one-third unlocked at TGE, remainder over two years), treasury (6.5%, linear unlock starting after 3 months over 36 months), and liquidity reserves (4.5%, fully unlocked at TGE, used for CEX market making and DeFi liquidity).

Bluefin demonstrates vision and fairness in allocating 19.68% of its supply for airdrops to both existing and new users. Confirmed portions of the airdrop include early community supporters of Bluefin (15.82%), users from SUI ecosystem partner platforms (1.67%), users from Solana and EVM partner ecosystems (1.4%), and NFT community partners (0.79%). Users can connect their Sui, EVM, Base, or SOL wallets to check eligibility—potentially unlocking unexpected rewards.

Airdrop Checker: http://trade.bluefin.io/airdrop

Bluefin’s tokenomics are thoughtfully designed: they reward early adopters while extending benefits to users across the Sui and other active ecosystems, helping attract valuable participants. A significant portion of tokens remains reserved for ongoing user incentives. With no unlocks for core contributors or strategic partners during the first year, the team and partners remain aligned with long-term protocol success, supporting sustainable development and protecting token holder interests.

4. How to Participate

The second phase of the Bluefin airdrop—Historical Rewards—is still actively accumulating. Users earn cumulative points and SUI rewards through interactions on Bluefin.

Current participation methods include:

4.1 Bluefin Derivatives Trading Mining

Earn SUI rewards and Blue Points based on trading fees paid. Users who have traded and earned on Bluefin this year receive a 20% bonus in points. Ideal for users regularly trading major cryptocurrencies and Sui ecosystem tokens.

4.2 Bluefin Stablecoin Pool

Deposit wUSDC to provide liquidity for top-tier market makers and earn SUI and Blue Points. APR varies dynamically. Withdrawals are subject to a time lock, but interest and points continue accruing during redemption periods.

4.3 Bluefin Spot Liquidity Pools

Provide spot liquidity to earn SUI and Blue Points, with funds withdrawable at any time.

Join Bluefin: https://trade.bluefin.io/referral/v2-rfw60l

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News