Fresh Graduate as CEO: What's Behind Nexus, Backed by Pantera with $25 Million?

TechFlow Selected TechFlow Selected

Fresh Graduate as CEO: What's Behind Nexus, Backed by Pantera with $25 Million?

Do top Western VCs also favor elite school credentials?

By Walker, TechFlow

The secondary market feels dull, but the primary market keeps seeing big moves.

On June 11, modular zkVM project Nexus announced a $25 million Series A funding round led by top-tier VCs Pantera and LightSpeed, with participation from Dragonfly Capital, Faction Ventures, and Blockchain Builders Fund.

It's no secret that crypto VCs favor infrastructure projects—pouring capital into zero-knowledge proof (ZKP) infrastructure is entirely expected.

But investing in a project led by a CEO who is just a recent graduate? That’s somewhat surprising.

In Pantera’s public letter published the same day titled Why We Invested in Nexus, the firm highlighted that Nexus’ greatest strength lies in its team—composed of experts deeply specialized in cryptography and computer science.

And the CEO of this team is Daniel Marin—a recent Stanford University graduate.

Do elite Western VCs also have a soft spot for prestigious academic credentials?

Compared to the domestic environment where “PhDs are a dime a dozen” and job pressures are intense, a fresh international university graduate securing $25 million in startup funding seems almost unrealistically impressive.

So what exactly makes Nexus so attractive to these prominent investors? And what sets this graduate-led team apart?

What is Nexus?

Before diving into the team, it's crucial to understand what the project itself does.

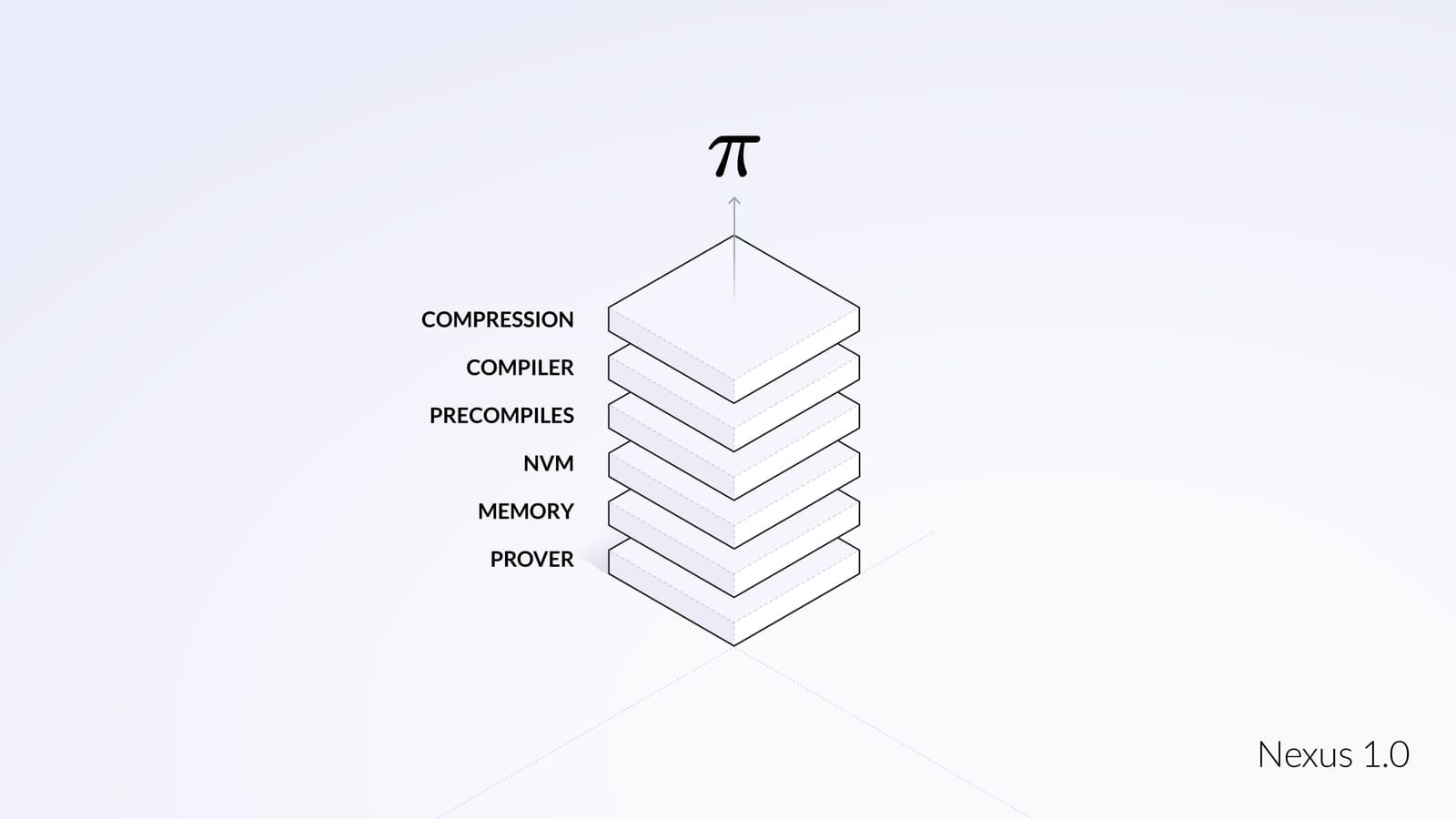

According to information from Nexus’ official social media, the current version (1.0) is a modular, scalable, open-source zkVM written in Rust, focused on high performance and security.

So, what exactly is a zkVM?

In blockchain and Web3, a virtual machine (VM) is a key component responsible for executing smart contracts—handling transactions and protocols without third-party intervention. The most well-known example is the Ethereum Virtual Machine (EVM).

Adding "zk" changes everything—especially regarding privacy:

- Privacy Protection: On public blockchains, all transaction data is visible. zk enables users to prove the validity of transactions without revealing any sensitive details.

- Improved Efficiency: zk reduces the computational resources needed to verify transactions and execute smart contracts—verifiers only need to check a cryptographic proof instead of re-executing the entire computation.

- Enhanced Security: zk ensures data authenticity and integrity without exposing the actual content.

Therefore, Nexus’ zkVM delivers these three benefits—allowing you to prove that a transaction or operation is valid without disclosing its specifics.

Moreover, Nexus zkVM acts like a multilingual interpreter—it can understand and run programs written in multiple programming languages such as Rust and C++. Developers can write smart contracts in their preferred language and deploy them directly on the zkVM.

Finally, think of Nexus zkVM as a Lego set—you can modularly add special function blocks to accelerate specific computations or extend new schemes.

Privacy protection, security, efficiency, and modularity—the narrative and value proposition of zkVMs are clearly compelling.

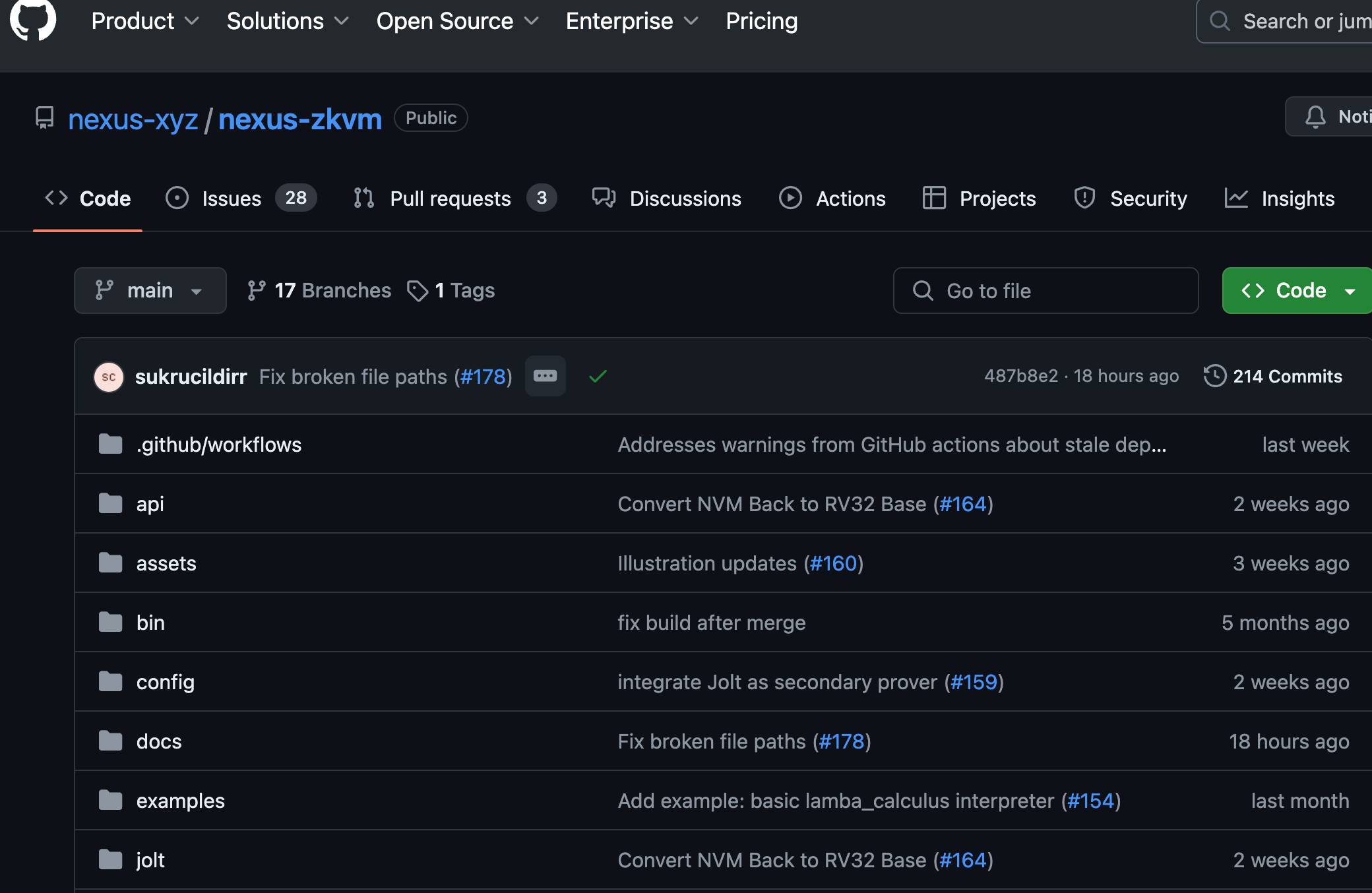

Currently, parts of Nexus 1.0’s codebase are already open-sourced on GitHub, demonstrating both confidence and technical capability.

Clearly, this is another foundational-layer project.

There are countless VMs, but effectively integrating zk technology requires serious technical chops.

Thus, having a technically strong and domain-specialized team becomes essential.

Top Graduate Takes Center Stage, Backed by Experts

Indeed, the CEO of Nexus is a young newcomer.

Pantera described Daniel Marin as a “recent Stanford graduate.”

But this so-called “rookie” is clearly an exceptionally bright one.

On Daniel’s LinkedIn profile, he lists two achievements typically seen only on recent graduates’ resumes—but they carry real weight:

Two bronze medals at the International Physics Olympiad.

Later, Daniel studied at Stanford’s School of Software Engineering, interning at both the university’s AI Lab and Google. Then, straight out of school, he became CEO of Nexus.

Beyond his impressive awards and internships, checking Daniel’s GitHub reveals consistent code contributions between 2020 and 2024—truly, a CEO who codes is a better engineer.

From publicly available information, we can reasonably conclude that this CEO has genuine skills—the technical foundation and competence are unquestionable.

A classic STEM major with perfect academic alignment. But leading a Web3 project as CEO still might seem like relying too much on a single pillar.

That’s why Nexus also has a team of expert advisors supporting him.

After introducing Daniel, Pantera specifically noted that he is advised and mentored by renowned cryptographer Dan Boneh.

And Dan Boneh is indeed a heavyweight—currently a professor of Computer Science at Stanford University, specializing in cryptography, computer security, and distributed systems. In 2016, he was elected to the National Academy of Engineering for his contributions to theory and practice in cryptography and computer security.

He has made significant contributions to widely used blockchain technologies such as elliptic curve cryptography and is one of the main pioneers in pairing-based cryptography.

Additionally, other core members of Nexus form a highly specialized cryptography team with extensive experience across the Web3 industry—including roles at Dfinity, Jump Crypto, Matter Labs, and the a16z crypto camp:

With expert backing, a promising graduate leading a zk-focused Web3 project becomes a powerful blend of academia, research, and practical execution.

Bet on Academics or Assemble a Resource Coalition?

Investing in projects means betting on people.

In the case of Nexus, VCs like Pantera clearly favor teams with deep domain expertise.

Cryptography students, world-renowned professors, experienced operators—this configuration makes a graduate CEO far less surprising. Letting a young leader take charge while being backed by seasoned professionals can create powerful synergies.

Regardless of structure, the team’s resumes and track records clearly demonstrate professionalism.

For infrastructure projects in clearly defined niches, VCs appear to trust academically trained specialists—aligning with the logic of “experts building advanced tech.”

In contrast, there’s another common approach: assembling a resource coalition.

Rewriting narratives, regrouping former teams, leveraging industry connections and information asymmetry—this model often appears in fast-moving, hype-driven projects that make loud promises but deliver little.

These projects focus more on asset creation and resource swapping—launching token mechanics quickly, with minimal emphasis on core technical depth.

Bet on academics or build a resource network? Crypto VCs are voting with their capital.

Yet in an industry obsessed with wealth effects, speed and hype grab attention. But for long-term sustainability, slowness and solidity remain the stronger antidote.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News