Pantera Capital: How Can the Vega Application Chain Transform Derivatives Trading Models?

TechFlow Selected TechFlow Selected

Pantera Capital: How Can the Vega Application Chain Transform Derivatives Trading Models?

What makes Vega so special?

Written by: Justin Chen, Jonathan Gieg

Compiled by: TechFlow

In recent years, the DeFi space has experienced significant growth and innovation. In this dynamic environment, Vega Protocol has built a native derivatives layer designed specifically for high-throughput trading. By leveraging the power of smart contracts and high-performance blockchain networks, Vega's platform enables users to create, trade, and access a wide range of financial products. Unlike traditional gated and centralized systems, Vega’s core principles include true decentralization, ensuring that decisions and governance are driven by the community. This approach empowers users with the freedom to create markets, design products, and foster ecosystem growth.

With the highly anticipated launch of Vega Protocol Alpha Mainnet just weeks ago, we’re excited to explore some of the protocol’s key features. Before diving in, it’s important to note that Vega’s Alpha Mainnet is an initial software release, where unstable edge cases are expected and require fixing. This period is particularly crucial for the project to gather real-world data, iterate, and improve Vega.

Vega is an Appchain—what does that mean?

An Appchain is a dedicated blockchain network designed for a specific application or use case. It can operate independently or as a sidechain, typically featuring its own consensus algorithm and specialized functionalities optimized for its intended purpose. Appchains provide a focused and efficient environment for running decentralized applications or executing specific functions such as derivatives trading, decentralized finance, gaming, or supply chain management. Key advantages include customizability for developers, improved performance and scalability, while still leveraging the security of a main blockchain.

Vega’s Appchain is a dedicated, standalone blockchain network purpose-built for derivatives trading. It operates as an independent PoS blockchain using the CometBFT consensus algorithm (formerly known as Tendermint). The Appchain architecture is optimized for high-performance trading and already integrates an Ethereum bridge, allowing participants to use ERC-20 assets on-chain. The Appchain provides a permissionless environment for market creation and currently enables users to customize and launch cash-settled futures contracts, with additional functionality—including spot trading, options, and perpetuals—planned for rollout in the coming months.

What makes Vega so special?

Founded in 2018, Vega Protocol stands out in the ecosystem by introducing a unique DeFi platform—a DEX (decentralized exchange) powered by decentralized infrastructure. Below, we delve into five key value propositions of the protocol:

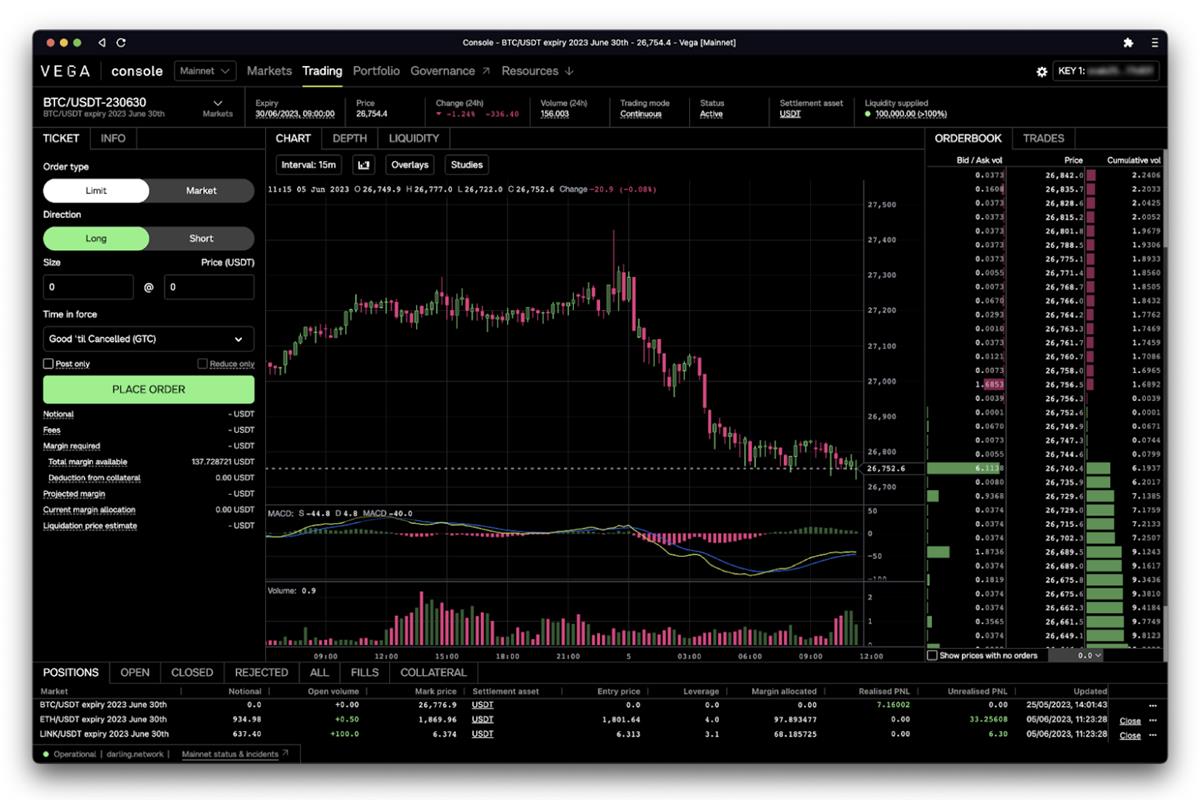

1. A Dedicated Blockchain with a Fully On-Chain Order Book

Unlike most decentralized trading platforms, Vega offers a fully on-chain order book. Key benefits include complete visibility into trading activity for users, ensuring transparency and eliminating information asymmetry. Other major advantages include enhanced liquidity, improved price discovery, reduced slippage, and seamless integration with smart contracts for more efficient trade execution.

2. Permissionless Creation of New Markets and Derivatives

In contrast to the gated nature of market creation and trading in traditional finance, Vega allows any user to build and trade various financial products, including new markets and derivatives. Users can create and customize strategies tailored to their specific needs. Unlike conventional DEXs, users can also create and trade derivatives linked to different asset classes such as cryptocurrencies, commodities, and traditional financial instruments.

3. Enhanced Trading Experience

Vega delivers an enhanced and cost-effective trading experience with ultra-low latency (block time under one second), a rich API similar to centralized exchanges, and no gas fees.

4. Feature-Rich Toolkit and Premium User Interface

Vega equips traders with a comprehensive toolkit offering advanced features such as cross-margining, interoperability, and portfolio risk assessment. Designed for simplicity and functionality, it aims to improve the DEX user experience and compete directly with centralized exchanges.

5. Open Participation and Community-Driven Principles

Many major protocols are limited by insufficient community-driven principles. In contrast, Vega empowers its community through robust governance, enabling participation in decision-making processes and workflows. Contributors can shape the future of the protocol by proposing new improvements, products, and markets.

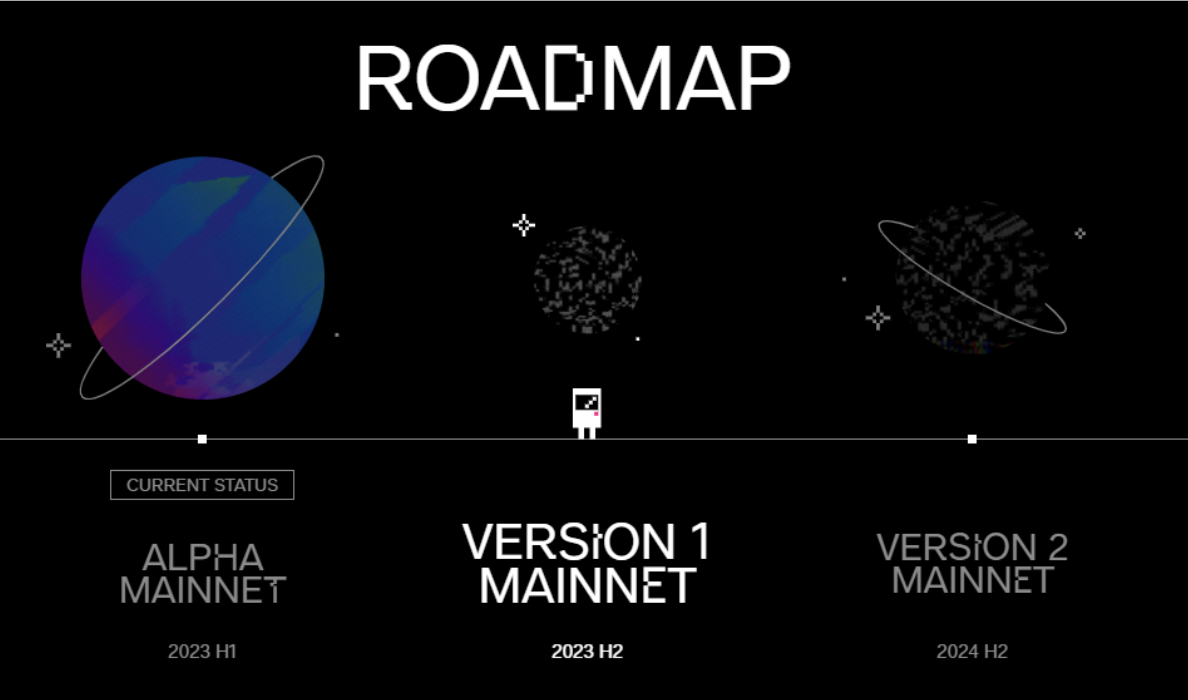

Roadmap

Looking ahead, Vega has laid out an extensive roadmap aimed at further expanding platform capabilities and enhancing user experience.

Vega is currently in the Alpha Mainnet phase, launched last week. In the second half of this year, Vega plans to release Mainnet V1.

The coming months will be among the most exciting for Vega, as critical new enhancements—such as successor markets, governance migration, stop-loss orders, and iceberg orders—are implemented based on collected feedback. Additional features like spot markets, perpetual contracts, liquidity service level agreements, upgraded liquidity provider mechanisms, Ethereum oracles, and isolated margin/isolated accounts are also planned. Beyond these, new features such as browser extensions and wallets, additional market types, and novel liquidity mechanisms will be introduced.

Participating in the early stages of the Vega Protocol ecosystem offers a unique opportunity to benefit from a suite of tailored incentive programs. Currently, rewards are primarily distributed in the form of Vega/USDT and fall into three main categories: takers, makers, and liquidity providers.

-

Takers: Rewards encourage market activity by incentivizing traders who remove liquidity from the order book, promoting active trading.

-

Makers: Rewards are given to participants who add liquidity to the order book, enhancing market depth and efficiency—critical for seamless trading and better price discovery.

-

Liquidity Providers: Vega encourages supplying liquidity across various markets within the protocol, fostering overall market stability and reducing price slippage.

Essentially, these rewards act as fee rebates—traders not only get refunds but can even earn net profits. This structure is enabled by protocol-issued funds from Vega’s treasury, incentivizing participation and contributions to a thriving trading ecosystem. This carefully designed model aims to reinforce the principles of decentralization, fairness, and user governance.

As Vega continues to evolve and mature, this rewards program is expected to become increasingly self-sustaining, further supporting the long-term success of the protocol.

Team

Behind Vega Protocol is a seasoned team of software engineers, financial mathematicians, and entrepreneurs. With a unique blend of skills and deep technical expertise, team members have previously worked at organizations such as Accenture, Capco, the University of Edinburgh, JPMorgan Chase, Chainspace, BNP Paribas, and Meta.

The launch of the Vega Protocol Alpha Mainnet marks a significant milestone in the evolution of decentralized trading. Vega has always been designed as a capital-efficient, user-governed market, enabling permissionless access and large-scale collective creation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News