Interview with DeFiance Capital Founder: Cold Reflections Behind the Bull Market Frenzy

TechFlow Selected TechFlow Selected

Interview with DeFiance Capital Founder: Cold Reflections Behind the Bull Market Frenzy

This conversation revolves around the current bull market frenzy, the cyclical characteristics of the crypto industry, emerging narratives, and investment strategies.

Host: QuanYu, Co-Founder & CIO of RootData

Guest: Arthur Cheong, Founder & CEO of DeFiance Capital

Compiled by: Scof, ChainCatcher

Recently, RootData hosted a Twitter Space titled "Cold Thoughts Behind the Bull Market Frenzy: Cyclical Features, New Narratives, and Investment Strategies," featuring Arthur Cheong, Founder and CEO of DeFiance Capital.

The discussion focused on the current bull market momentum, cyclical patterns in the crypto industry, emerging narratives, and investment strategies. ARTHUR shared his views on the sustainability of the current bull run, highlighting how U.S. policy changes and macroeconomic factors will have profound long-term impacts. He emphasized that DeFi, stablecoins, and public blockchains offer the strongest long-term value, while also noting the potential of decentralized science (DeSci). On investment strategy, ARTHUR stressed the importance of continuous learning, cautious use of leverage, and deep specialization in specific sectors. He also used Aave and Hyperliquid as examples to illustrate practical methods for project evaluation and relative valuation—especially how to uncover hidden potential through on-chain data and user experience when public information is limited.

Full Transcript:

QUANYU: It's great to have Arthur join us today. I'll be asking him some questions on behalf of our audience. After this Q&A session, feel free to ask Arthur any additional questions you may have.

My first question is about current market sentiment. We're seeing widespread enthusiasm, but also underlying concerns—many are wondering whether this bull market can last or reach new highs. What’s your view on the sustainability of this cycle? And what key indicators or events should we watch?

ARTHUR:

I'm glad to be part of this Twitter Space and engage in this conversation. The crypto industry has indeed undergone major transformations recently.

Structurally speaking, especially in the U.S., the regulatory and institutional framework has shifted significantly following the election and government transition. As the world's largest GDP economy, structural changes driven by the U.S. have deep and lasting implications for the industry. These shifts won't end quickly—they’re laying the foundation for long-term growth.

Despite strong recent performance—particularly the notable gains over the past six weeks—the full impact of these favorable structural developments hasn’t yet materialized. Such structural shifts take time to unfold and gradually release their true value into the market.

In the short term, uncertainty around Trump’s potential victory did influence market dynamics. However, if Republicans gain control of both the presidency and Congress, it would likely bring very positive outcomes for the industry. Additionally, Bitcoin’s price rise is closely tied to corporate adoption, such as MicroStrategy increasing its Bitcoin holdings. If the market prices in a Trump win, the current price action becomes understandable.

In summary, from both structural and short-term perspectives, the industry is at a highly promising stage with strong future potential.

QUANYU: Beyond geopolitical or political events, from an internal industry perspective, what key metrics do you think deserve attention? These could reflect trends or risks within the sector—we’d love to hear your insights.

ARTHUR:

On metrics, we analyze large volumes of data, particularly on-chain data. While on-chain data reflects industry growth to some extent, it requires careful filtering and analysis to extract meaningful insights.

From a DeFi standpoint, TVL (Total Value Locked) is a critical metric. User address counts are also useful, though they may include artificially inflated numbers from yield farming. With deeper analysis, however, we can usually distinguish genuine growth from anomalies. Performance differences across various public chains and their Layer 2 solutions also offer valuable market signals.

Another important area is the stock performance and quarterly reports of publicly traded companies like Coinbase. These often reveal finer details about industry growth. Additionally, funding rounds and project market caps reflect market confidence in the sector’s outlook.

Of course, Bitcoin remains the leader. Its market cap largely defines the ceiling for the entire crypto market. For example, post-election, Bitcoin’s market cap rose 40%–50%, indicating a significant expansion in the overall market ceiling and unlocked potential.

QUANYU: Over the past decade, crypto markets have shown clear cyclical patterns, typically repeating every four to five years. Bitcoin’s peak prices have historically been two to three times higher than the previous cycle’s high. In this current bull run, what new characteristics do you expect to emerge?

ARTHUR:

First, I personally believe Bitcoin’s four-year cycle may no longer be as dominant as before—though this view isn’t mainstream yet. Historically, the four-year crypto cycle was Bitcoin-driven, rooted in its halving mechanism, which reduces new supply every four years and influences market sentiment and price.

But now, the impact of each halving on Bitcoin’s overall market cap and liquidity has diminished significantly. Bitcoin has reached a multi-hundred-billion-dollar scale—making it a major global asset. From the next halving onward, we may no longer see the traditional four-year cycle.

Even if cycles persist, their drivers will shift from Bitcoin halvings to broader macroeconomic forces. Given Bitcoin’s size and influence, it’s increasingly shaped by geopolitics and macro conditions—for instance, whether the U.S. government adds Bitcoin to its national reserves. If that happens, it would be a massive catalyst, potentially prompting other nations to follow. In such a scenario, the traditional four-year cycle could break down, and Bitcoin might behave more like gold—aligned with global financial cycles.

In short, Bitcoin’s future cycles will likely correlate more with macroeconomic and financial market cycles rather than just its internal halving mechanism.

QUANYU: You mentioned earlier that central banks might start buying Bitcoin—how likely do you think this is next year? If so, which countries might lead, and what would drive them?

ARTHUR:

We already know some governments hold Bitcoin. This includes countries leveraging cheap domestic energy—like hydropower—for mining. Bhutan, for example, has accumulated around $1 billion worth of Bitcoin using nearly free hydroelectric power. The U.S. government has also acquired roughly $10 billion worth of Bitcoin over the past 5–10 years through seized criminal assets, though some have since been auctioned.

There are also rumors that certain sovereign wealth funds have quietly purchased Bitcoin but haven’t disclosed it due to sensitivity. If the U.S., as a global economic powerhouse, formally adopts Bitcoin into its strategic reserves via legislation, that would be a landmark event.

However, I think this is more likely in late next year. Proposals to adopt Bitcoin as a national reserve asset require legislative processes—even with Republican control of Congress, it takes time. So while discussions may begin next year, actual implementation will likely need more preparation and time.

QUANYU: We’ve discussed external drivers. Internally, crypto markets are often propelled by trends or narratives—like DeFi and NFTs in the past. In this cycle, we’ve seen new trends like DePIN, RWA, and now AI.

Which of these concepts do you believe have real product value and long-term potential? And which might just be short-lived fads, like NFTs, destined to fade quickly?

ARTHUR:

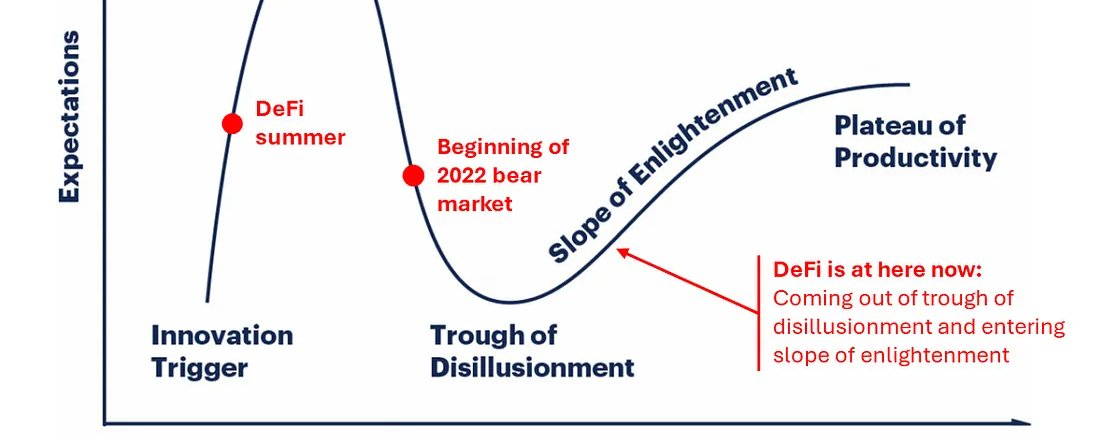

Great question. Personally, my top bet remains DeFi. It's one of the core application areas in crypto and a foundational narrative for on-chain economies. With improving U.S. regulations, I believe DeFi will enjoy greater freedom and room to grow. Recent market performance already reflects this—many DeFi projects have performed exceptionally well.

Stablecoins are another crucial area, deeply tied to DeFi. Stablecoins are inherently profitable—especially after rate cuts—and their network effects ensure strong earning potential. They also reinforce national monetary influence. For example, most global digital transactions are priced in USD-pegged stablecoins, reinforcing dollar dominance.

Market validation is growing too—one U.S. startup was recently acquired at a high valuation for its stablecoin payment solution, showing the space’s promise. Ethena, for instance, successfully combines DeFi, stablecoins, and Bitcoin-based yield—a convergence that made it a market favorite.

In the public chain space, no clear winner has emerged yet. Ethereum remains the largest smart contract platform, but others like Solana are matching or even surpassing it in user activity. The public chain narrative started 7–8 years ago but is far from over. New projects like Sui and Hyperliquid continue pushing boundaries. With Ethereum’s high valuation setting a precedent, this space still has immense headroom, attracting continuous innovation.

Bitcoin itself, as a standalone asset, has become a trend—no further explanation needed.

Other areas: DePIN has grown steadily over the past year but lacks strong flywheel effects, remaining in early development. DeSci is still very nascent, but its alignment with blockchain and crypto is clear—it could become a noteworthy field in the future.

Overall, my top picks are DeFi, stablecoins, public chains, and AI, with Bitcoin remaining the core asset. Other emerging trends need more time to prove their long-term viability.

QUANYU: Right now, Meme and AI are the hottest topics. Many see Meme projects as suitable only for short-term trading—driven by sentiment and community consensus, lacking long-term fundamentals. Meanwhile, AI, especially AI agents, has sparked wide interest and debate. VCs are discussing it heavily, but there’s still disagreement on its long-term potential. What’s your take on these two?

ARTHUR:

Let me start with Meme and AI—I’ll begin with Meme. Meme assets will persist, but I’m not an expert here. Many know Murad’s bullish stance—he sees it as an unavoidable sector. I broadly agree, especially regarding top-tier projects like Dogecoin, which sets a valuation benchmark. But for newer Meme coins, I’m skeptical whether they can achieve similar recognition and scale.

That said, new Meme projects can still surge from $100K–$1M market caps to hundreds of millions or even billions—these “explosive stories” will keep happening. Meme coins are like the gambling sector of crypto, offering people dreams of quick riches. But for larger institutions, the risk and uncertainty are too high for major capital allocation.

Now, AI. I’m generally optimistic, but few projects truly integrate AI and blockchain at a deep level. Many just attach “AI” to raise funds. Still, some stand out. Projects like Virtuals and Grass are good recent examples—effectively leveraging crypto’s flywheel to advance AI.

QUANYU: We've covered broad narratives. Now let’s dive into specific projects. Our audience is curious—how do seasoned investors like you approach researching a new project? What’s your methodology when evaluating a new token or startup?

ARTHUR:

When researching new projects or tokens, we rely on multiple information sources and analytical methods.

First, we invest in professional research reports and data services. These provide detailed on-chain metrics—volume, active users, transaction counts, etc. Take Solana: last November, its on-chain data—including DEX volume and daily active users—surpassed Ethereum across multiple indicators. By tracking such data continuously, we identify growth areas and adjust our focus accordingly.

Second, we value conversations with insiders—founders, VCs, and secondary-market investors. These exchanges help us understand which sectors are gaining traction and why, giving us a broader perspective.

Third, social media is a key input. We closely monitor platforms like Twitter for updates and trends. We also use specialized analytics tools like RootData, which greatly enhance our efficiency in analyzing data and tracking market shifts.

These approaches allow us to better assess a project’s potential and risks, supporting informed investment decisions.

QUANYU: Thank you, ARTHUR, for your support! For our platform, we aim to integrate news, research, team updates, and funding data to provide comprehensive, efficient search tools. These are exactly the core pieces investors need during project analysis.

At the project level, could you share some successful investments you’ve made this year? How did you evaluate them and decide to back them?

ARTHUR:

Take Aave—as many asked, why were we so bullish in August or September? The market was weak from April to September, nearly all assets underperformed. But we noticed DeFi maintained steady growth in Q2 and Q3. Through on-chain and fundamental analysis, we saw Aave’s data rising consistently, and it was about to launch a tokenomics upgrade. Based on these, we identified strong potential and published a research report.

Another success was Hyperliquid. No VC backing, but strong product execution made it a leader in the Perp space. Community faith was high—after the airdrop, most users held instead of selling. On-chain data confirmed its leadership. Hyperliquid’s story highlights the power of product quality, data, and strong community support.

QUANYU: Fair enough. Besides these wins, were there any notable opportunities you missed this year?

ARTHUR:

Yes, a few stand out.

First, projects in the Solana ecosystem. Solana itself surged, with strong on-chain activity—but some ecosystem projects underperformed, like Raydium. That’s a red flag: if Solana’s ecosystem grows, its native projects should benefit too. It’s unlikely only SOL rises while ecosystem tokens stagnate. Despite lower liquidity, the disconnect between strong data and flat token prices represented a real opportunity we failed to capture.

Another clear miss was Sui. Its on-chain metrics—user count, transaction volume, DEX activity—grew steadily from Q1 to Q3. Yet its price didn’t reflect this. We noticed the data but didn’t prioritize deeper research due to bandwidth constraints. Also, Sui faced issues on Korean exchanges—we didn’t investigate thoroughly, which may have clouded our judgment.

Overall, Sui was one of our most obvious misses this year. The on-chain data clearly signaled growth, but we didn’t translate that insight into timely investment.

QUANYU: Indeed, the tokens you mentioned are mostly secondary market plays. I recall you initially focused on primary market investments, but now seem fully shifted to secondary—correct?

Also, there’s ongoing debate about VCs and the primary market. According to RootData’s data, despite rising prices of major coins like Bitcoin, primary market activity remains low. November’s primary market activity dropped 20%–30% YoY.

What drove your shift toward secondary markets? Does this reflect a broader industry trend?

ARTHUR:

I’ve been thinking about this for two years. Back in 2022, I noticed VC funding far exceeded the unlock capacity of new tokens in the secondary market—by 3x to 4x. This imbalance made it hard for retail to absorb selling pressure during bear markets, leading to insufficient demand.

This was one reason I gradually shifted to secondary markets. While primary still offers opportunities—like Eigenlayer and Celestia—the difficulty has increased. Gaps between fundraising and execution, fast-changing sector validation, and shifting priorities add uncertainty.

Take gaming and prediction markets: gaming’s breakout timing remains unclear; prediction markets only gained traction this year via Polymarket and the U.S. election. The core challenge in primary investing is—even if a sector eventually proves viable—you can’t predict when it will take off.

All things considered, secondary market strategies are currently more advantageous, allowing greater flexibility in a rapidly evolving landscape.

QUANYU: True—there’s widespread concern about VC-induced sell-side pressure. Do you think more projects like Hyperliquid—rising purely through community consensus without VC funding—will emerge in the future?

ARTHUR:

I believe this will happen more often, but whether it becomes mainstream is uncertain. Most projects need capital. Hyperliquid’s founder, reportedly a highly successful trader, had personal wealth and didn’t need VC money. But for most projects—especially public chains or L2s building ecosystems—large-scale funding is essential.

Still, the trend of avoiding VC funding is forming. I think ICOs may return—not as wild as 2017–2018, but with changing SEC regulations, more projects may choose ICOs for fundraising in the future.

QUANYU: Driving crypto’s mainstream adoption remains a hot topic. Many are trying consumer apps or education to attract users. In your view, what are the key bottlenecks preventing wider adoption?

ARTHUR:

Mainstream adoption varies by sector. Take DeFi—its historical weaknesses were security and user experience. Smart contracts were vulnerable to exploits, and code bugs led to fund losses. But over the past 3–6 months, we’ve seen clear improvement. Years of learning—from early projects like Aave and Uniswap—have enhanced protocol security. Wallet UX has also improved significantly, closing key gaps in DeFi.

Another bottleneck is aligning blockchain technology with real applications. We once tried applying blockchain everywhere, but not all industries suit deep integration. Blockchain works best in specific areas—finance, payments, and decentralized fundraising. These domains naturally align with blockchain’s strengths.

After repeated trials since 2017, we now have a clearer understanding of where blockchain fits. The future lies in focusing on high-alignment areas, not forcing blockchain into every industry.

QUANYU: Recently, have you come across any innovative new products or projects? What aspects make them particularly noteworthy?

ARTHUR:

I believe DeSci is a highly innovative space—one I’ve been personally interested in lately. DeSci’s core idea is enabling broader participation in funding scientific research, especially niche projects that might otherwise be overlooked.

Traditionally, niche research often lacks funding because it’s hard to commercialize or has small markets. For example, some studies can’t easily turn into drugs or products, so big pharma ignores them. But that doesn’t mean they lack societal value or future potential. Even if only 0.001% of the world needs a drug, from a social perspective, such research deserves support.

DeSci innovates by using blockchain to allow smaller communities to fund such research. If 100,000 people could benefit from a study, they—or those who care about them—can pool funds via DeSci to advance it. This model could unlock new solutions and fill gaps in traditional research funding.

We’re already seeing projects emerge—Vitalik has highlighted DeSci, and figures like CZ show interest. This reflects growing belief that DeSci can democratize and diversify scientific research. I find this direction both fascinating and full of potential.

QUANYU: Shifting back to the secondary market—what investment experiences or strategies would you share with retail investors? Can these help them better capture market opportunities?

ARTHUR:

I’d be happy to share some lessons from seven years as a full-time crypto investor. One thing I’ve learned: success requires constant knowledge updating and mental model refinement.

Continuous Learning and Cognitive Upgrades

The industry evolves fast. You need not just finance knowledge, but also tech, policy, and trend awareness. For example, the U.S. election had a major market impact this year—we spent considerable time analyzing Trump’s odds and policy implications, becoming almost “experts” in U.S. politics. With new sectors like DeSci and DePIN emerging, we keep investing time to learn and understand them.

Cautious Use of Leverage

Leverage risk must be emphasized in every cycle. Just last week, altcoins corrected 20%–30%—positions with 3x+ leverage were likely liquidated. Even in bull markets, excessive leverage can cause devastating losses. I advise keeping leverage conservative, especially during volatile periods, and maintaining strong risk management.

Deep Dive Into Specific Sectors or Ecosystems

A major source of investment alpha comes from deep expertise in a particular sector or ecosystem. Pick a space you’re passionate about, study its tech, community, and ecosystem development, and even connect with key players. Though we’re a professional firm, we missed Sui’s move because we didn’t track its ecosystem closely. Meanwhile, dedicated community members likely spotted its undervaluation early and positioned themselves ahead of the rally.

Advantages of Retail Investors

Compared to institutions, retail investors have agility and faster decision-making. For example, Hyperliquid’s token launched Friday and tripled by weekend. Institutional investors, bound by lengthy approval processes, often can’t react quickly—while retail can act decisively based on conviction. This flexibility allows retail to sometimes outperform even professional funds.

In summary, successful strategies include continuous learning, prudent leverage, deep sector specialization, and leveraging retail agility to seize market opportunities.

QUANYU: Projects like Hyperliquid lacked public team or funding info early on. How should investors assess such projects and position early? What key signals or data can help uncover these opportunities?

ARTHUR:

For Hyperliquid, several factors stood out. First, as a user, you immediately notice its superior user experience—best-in-class among peers. This strong product foundation builds user confidence. Second, on-chain data showed leadership even before token launch: Hyperliquid led the Perp sector in TVL and trading volume. These metrics reinforced community trust.

While its post-launch price exceeded most expectations, users with strong conviction recognized its potential early and positioned themselves pre-launch. This powerful community support, combined with solid fundamentals, was key to Hyperliquid’s success.

QUANYU: But how do you value such a project?

ARTHUR:

I think systematic valuation frameworks for blockchain projects are still lacking. Most valuations today are relative. For Hyperliquid, people looked at its initial market cap and saw upside potential. Since Hyperliquid positions itself as a blockchain, many compared it to other successful chains to estimate its valuation.

This is essentially relative valuation. For example, Solana’s valuation evolved through comparison with Ethereum. This benchmark-based approach remains the dominant method in the blockchain space today.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News