Canary Capital frequently files ETF applications—have altcoin ETF filings become a backdoor advertising business?

TechFlow Selected TechFlow Selected

Canary Capital frequently files ETF applications—have altcoin ETF filings become a backdoor advertising business?

Canary Capital, established just six months ago, has aggressively filed multiple applications for altcoin ETFs.

By Weilin, PANews

On March 20, U.S. financial firm Canary Capital filed an application with the Securities and Exchange Commission (SEC) for a Canary PENGU ETF, planning to launch an ETF that holds both Pudgy Penguins NFTs and $PENGU tokens. According to the filing, the ETF would allocate 80–95% of its assets to $PENGU tokens and 5–15% to Pudgy Penguins NFTs. The announcement immediately sparked widespread discussion within the Pudgy Penguins community and across the broader crypto market—Canary even changed its social media profile picture to a Pudgy Penguins NFT.

Founded just six months ago, Canary Capital has aggressively submitted multiple filings for altcoin ETFs. However, this strategy has drawn skepticism: how much real demand exists for such niche ETFs? Or is this merely a publicity stunt?

PENGU ETF Announcement Sparks Price Surge and Retreat – Will Traditional Investors Join In?

Following the news, $PENGU’s price initially surged nearly 10% to $0.0075, reflecting short-term market optimism. But by 7:30 PM on March 21, the price had fallen back to $0.0062, down 8.63% over 24 hours, indicating that enthusiasm was not sustained. Although capital inflows spiked after the announcement—with 24-hour trading volume reaching $135 million—the price failed to maintain momentum.

The proposed PENGU ETF has stirred debate within the Pudgy Penguins community. User @beast_ico commented: “$PENGU ETF might be the most ridiculous thing I’ve seen lately. We don’t need ETFs even for ‘ghost chains,’ let alone for a memecoin less than six months old. If those ‘Boomers’ (traditional investors) can’t even get excited about ETH—much less SOL—why would they ever touch something called PENGU?”

However, digital artist @Tuteth_ responded: “We’re truly doomed, guys. Seeing all the backlash against the $PENGU and Pudgy Penguins ETF talk—it’s all garbage takes. Some of these people are even my friends. But you don’t realize you’re feeding into ‘tall poppy syndrome’—mocking success and dragging down pioneers. Bitcoin was once laughed at as the dumbest thing in the world. The whole point of being in this space is embracing absurd-sounding possibilities that eventually come true, because we’ve seen it happen. After everything we’ve been through, now you draw the line here and say, ‘Oh no, this is too far’? Come on—you literally use an animal as your profile picture and spend your days chatting online about cryptocurrency. The entire thing is utterly absurd, yet you choose *this* moment to draw a boundary? That’s hilarious.”

Clearly, opinions within the Pudgy Penguins community are divided: some dismiss the ETF as a farcical hype play, while others see it as a natural evolution of NFT culture.

Low Barrier to S-1 Filings? Canary Capital's Wave of Altcoin ETF Applications

PANews previously covered Canary Capital in October 2024, when it had only existed for one month. The company’s founder and CEO is Steven McClurg, also a co-founder of Valkyrie Funds. Notably, Justin Sun is an investor in Valkyrie, which launched the first U.S. Bitcoin futures ETF approved in October 2021. McClurg left Valkyrie Funds in August 2024 and founded Canary Capital in September. On October 1, Canary announced the launch of the first U.S. HBAR trust. Since then, the firm has filed applications for SUI ETF, an ETF tracking Axelar (AXL), Litecoin (LTC) ETF, AXL Trust, Solana ETF, and XRP ETF.

Analysts suggest the low cost of filing S-1 forms may explain the recent surge in altcoin ETF applications. As analyst Jason Chen explained on March 7: “Filing an S-1 is the first step in registering an ETF. What are the hard requirements? Just two: being a U.S.-registered company with asset management or financial services licenses, and spending around $100,000 to draft the S-1 documents.”

On March 6, Canary filed for an ETF tracking cross-chain protocol Axelar. At the time, Chen noted: “After Canary submitted the S-1 for AXL, the token price jumped. I know this project—I’ve written two long analyses on it. Fundamentally, it’s decent, but nowhere near qualified for an ETF. And Canary itself was only founded in September 2024—less than half a year ago. So a six-month-old startup files for an ETF on a coin clearly unqualified, and major media outlets run with the story. Can you really believe there’s no ulterior motive here?”

Crypto KOL @qinbafrank echoed similar sentiments recently: “Aside from the big three mutual fund firms—BlackRock, Franklin, Fidelity—and early BTC ETF-approved players like Bitwise, Grayscale, and Ark—if you see unknown fund companies suddenly announcing S-1 filings for obscure altcoin ETFs, it’s almost certain they’re being paid for promotion. Most likely, the main holders behind these coins are planning to pump and dump.”

SOL Futures See Weak Demand on Launch Day – Can Small-Cap Coins Sustain Institutional Interest?

In parallel, Solana futures began trading on March 17 at CME Group’s U.S. derivatives exchange—a key milestone toward a potential SOL spot ETF and a test of institutional demand.

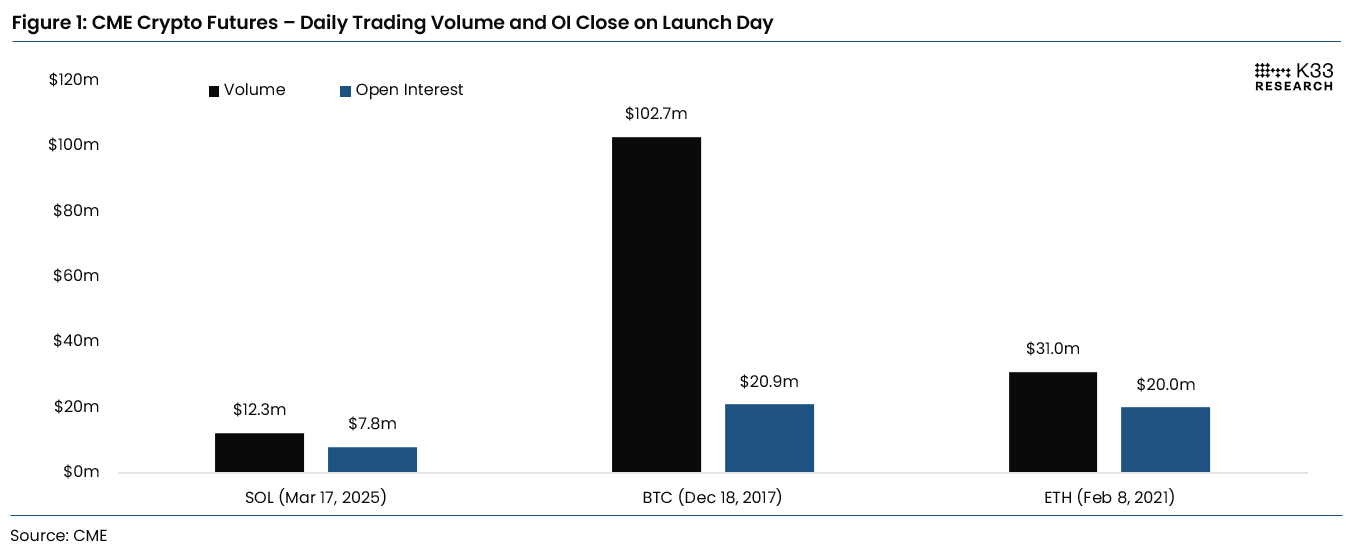

However, according to preliminary data from CME, only about 98,250 SOL (approximately $12 million) changed hands on the first day. Compared to major cryptocurrencies like Bitcoin and Ethereum, this initial performance was lackluster.

A report from research firm K33 showed that Solana futures traded $12.3 million on their debut, with $7.8 million in open interest. This pales in comparison to Bitcoin futures, which drew $102.7 million in volume and $20.9 million in open interest when they launched on CME in December 2017. Ethereum performed even better—its futures debuted in February 2021 with $31 million in volume and $20 million in open interest.

K33 analysts Vetle Lunde and David Zimmerman attributed the tepid reception to broader market conditions, noting Solana’s launch occurred during a period of low risk appetite—absent a strong bull run or altcoin rally. The report stated: “Although Solana’s performance appears more reasonable when adjusted for market cap, its absolute figures are far below previous futures launches.”

The analysts added that despite the weak start, the listing does follow patterns typically associated with eventual spot ETF approval. Still, they cautioned that Solana’s lower trading activity suggests any future ETF tied to the token may have a more muted impact on price compared to Bitcoin’s ETF-driven rally in early 2024.

In summary, the PENGU ETF debate reflects a cultural clash between NFT and memecoin communities and traditional finance, with strong and divergent views among users. Meanwhile, Canary Capital’s flurry of altcoin ETF filings raises questions: are these genuine innovations or mere marketing tactics? The future of altcoin ETFs will ultimately be shaped by the evolving dynamics of the crypto market, user sentiment, and regulatory decisions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News