Deep Dive into Radiant Capital: A DeFi Lending Protocol That Doesn't Rely on Additional Trust from Third-Party Cross-Chain Bridges

TechFlow Selected TechFlow Selected

Deep Dive into Radiant Capital: A DeFi Lending Protocol That Doesn't Rely on Additional Trust from Third-Party Cross-Chain Bridges

For a cross-chain lending protocol, the focus still lies on whether it can generate real lending demand and effectively retain users.

Radiant Capital is a cross-chain DeFi lending protocol that leverages LayerZero as its cross-chain infrastructure to enable omnichain leverage lending and composability. As an early mover in the cross-chain lending space, Radiant currently enjoys certain first-mover advantages. With future integrations of LayerZero's full-stack omnichain technology in its V3 and V4 versions, Radiant could reach new inflection points, further pushing its omnichain lending offering into the market—making it a project worth watching.

Investment Summary

As public chains and Layer 2 ecosystems continue evolving, liquidity fragmentation across ecosystems has become inevitable. Leading DeFi projects are responding accordingly: Compound Finance recently launched Gateway, a testnet for cross-chain lending; Aave’s V3 version will support cross-chain borrowing, with recent proposals passing votes to add Hashflow/Wormhole and Stargate as “whitelisted bridges” via V3 Portals; major DEXs like Uniswap and Sushiswap have already deployed on multiple chains. The participation of these established blue-chip DeFi players shows they don’t want to miss out on early multichain industry opportunities.

Radiant Capital is a cross-chain DeFi lending protocol positioning itself as an omnichain lending solution aiming to achieve leveraged lending and composability between different blockchains. It allows users to gain leverage within supported DeFi protocols while simplifying cross-chain asset operations.

Key highlights of Radiant Capital:

1) As the first cross-chain lending protocol launched on the LayerZero ecosystem, Radiant has successfully completed cold-start adoption, captured a significant user base and market share, and gained a clear first-mover advantage in this sector.

2) Improvements introduced in Radiant V2—such as extending the project’s lifecycle, mitigating $RDNT token inflation, and introducing dLP (dynamic liquidity provisioning)—are expected to bring more liquidity to the protocol over time. However, these effects are long-term and require further observation.

3) Built on LayerZero, Radiant enables shared liquidity across all LayerZero-supported chains through a unified token standard (OFT), eliminating reliance on third-party cross-chain bridges and their additional trust assumptions. If Radiant can secure oracle and relay safety assumptions at the contract level in its upcoming V3 and V4 versions, it may offer superior security compared to current mainstream solutions that depend on external cross-chain bridges for asset transfers.

Risks associated with the project:

1) The team remains anonymous. While Radiant provides brief introductions in official documentation and community channels, specific member backgrounds have not been disclosed.

2) Radiant does not introduce innovative technical advantages in the lending domain—it largely follows Aave’s design. Once Aave launches its own cross-chain lending feature, Portal, Radiant will face strong competition.

3) A large part of Radiant’s growth stems from high token incentives, along with favorable macro trends, Arbitrum’s popularity, and market enthusiasm around LayerZero’s omnichain vision. This has led to inflated expectations. Judging by the FDV/TVL ratio, as of April 25, 2023, Aave stands at 0.29, Compound at 0.3, while Radiant reaches approximately 1.68—indicating Radiant’s fully diluted valuation significantly exceeds its TVL, suggesting an overvalued market cap relative to peers.

4) Radiant relies on Chainlink oracles for price feeds within the LayerZero framework, but its choice of relayer remains undisclosed, leaving potential security vulnerabilities.

Overall, despite existing challenges, Radiant Capital holds promising potential due to LayerZero’s omnichain capabilities and its current first-mover edge. Therefore, it warrants attention.

Note: The final assessment of [Watch] / [Do Not Watch] by First Class Post is based on a comprehensive analysis of the project’s fundamentals under our evaluation framework—not a prediction of future token price movements. Token prices are influenced by many factors beyond fundamentals. A [Do Not Watch] rating does not imply the price will necessarily fall. Blockchain projects evolve dynamically. Projects previously rated [Do Not Watch] may be upgraded if fundamentals improve significantly, just as those rated [Watch] may be downgraded or flagged if serious issues arise.

1. Overview

1.1 Project Introduction

Radiant Capital is a cross-chain DeFi lending protocol positioning itself as an omnichain lending platform, aiming to enable leveraged lending and composability across different blockchains.

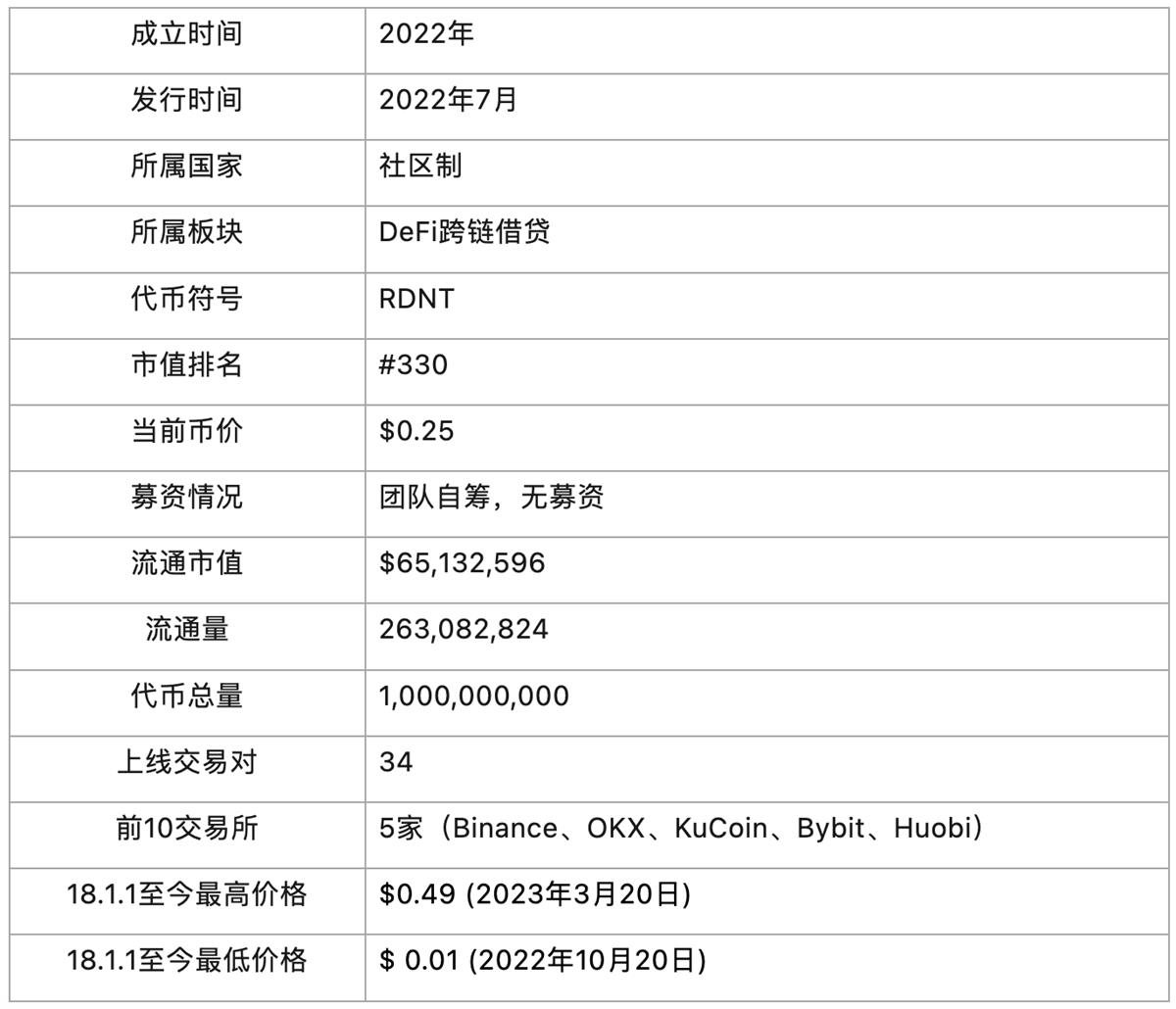

1.2 Basic Information

2. Project Details

2.1 Team

Radiant Capital’s official documentation lists 16 team members, showing only names and roles without disclosing individual resumes—effectively making it an anonymous team.

Additionally, in an April blog post, Radiant mentioned having a 14-member team composed of former employees from Morgan Stanley, Apple, and Google. The team has worked in DeFi since early summer 2020, with several members active in crypto since 2015.

Risks associated with an anonymous blockchain team include:

1) Trust Issues: Anonymity may erode investor and user confidence. Without verifiable identities or track records, stakeholders may suspect fraud, lowering trust in the project.

2) Accountability Problems: Anonymous teams may evade responsibility. If problems arise, users and investors may struggle to hold anyone accountable.

3) Lack of Transparency: Without disclosure of experience, skills, or education, investors cannot assess team credibility or expertise.

4) Marketing Challenges: Anonymous teams may face difficulties attracting investment or users, who often prefer transparent, identifiable teams.

In summary, anonymous teams may hinder project development. Investors and users should proceed with caution when engaging with such projects.

2.2 Funding

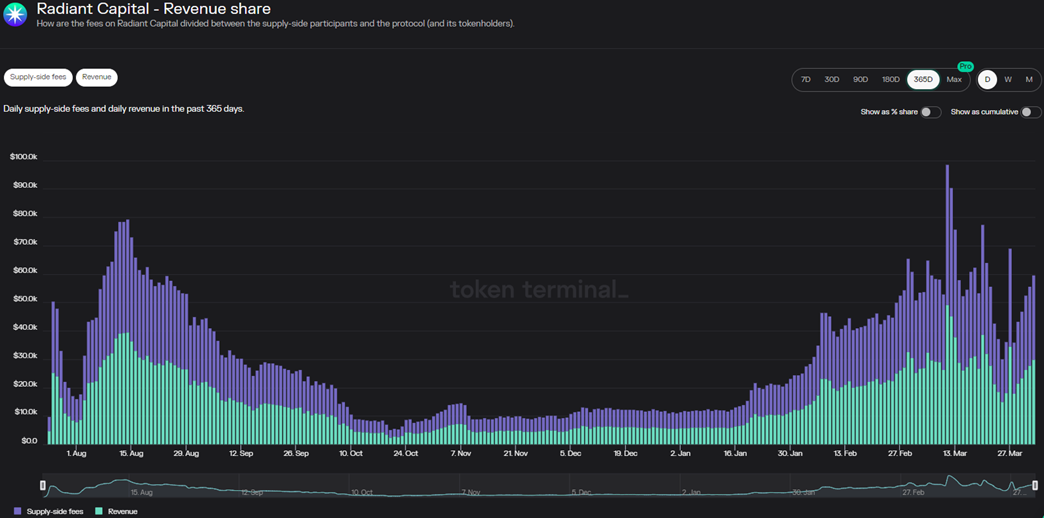

Radiant Capital has had no IDO, private sale, or venture capital involvement since inception—all initial operating costs were self-funded by the team. The protocol has successfully achieved cold-start adoption and attracted a user base sufficient to generate stable revenue (see Figure 2-1), covering some operational expenses. However, details about the treasury remain unknown.

Figure 2-1 Radiant Capital Revenue Distribution

Furthermore, as an omnichain lending protocol on Arbitrum, Radiant received 3.34 million $ARB tokens during Arbitrum DAOs’ airdrop campaign—worth nearly $4 million as of April 7, 2023—ranking seventh among recipient DAOs.

2.3 Code

According to the team, Radiant Capital’s code is built upon Geist, a Fantom-based lending protocol from 2021, which itself was derived from Aave’s codebase [5].

Radiant Capital’s codebase is not yet open-source. However, the team discloses that Radiant v1 has been audited by PeckShield and Solidity Finance, while Radiant v2—largely using the same codebase—has undergone multiple comprehensive audits with PeckShield and Zokyo. Additionally, Radiant engaged BlockSec for white-hat attacks to test network security. Full audit reports are available via Radiant’s official documentation.

Currently, Radiant collaborates with Immunefi on a bug bounty program offering up to $200,000. It also uses OpenZeppelin Defender for continuous monitoring and rapid response to potential attacks or risks.

2.4 Product

Radiant Capital is a cross-chain DeFi lending protocol positioning itself as an omnichain solution enabling leveraged lending and composability across chains, allowing users to access leverage within supported DeFi protocols and simplifying cross-chain lending operations.

2.4.1 Operational Flow

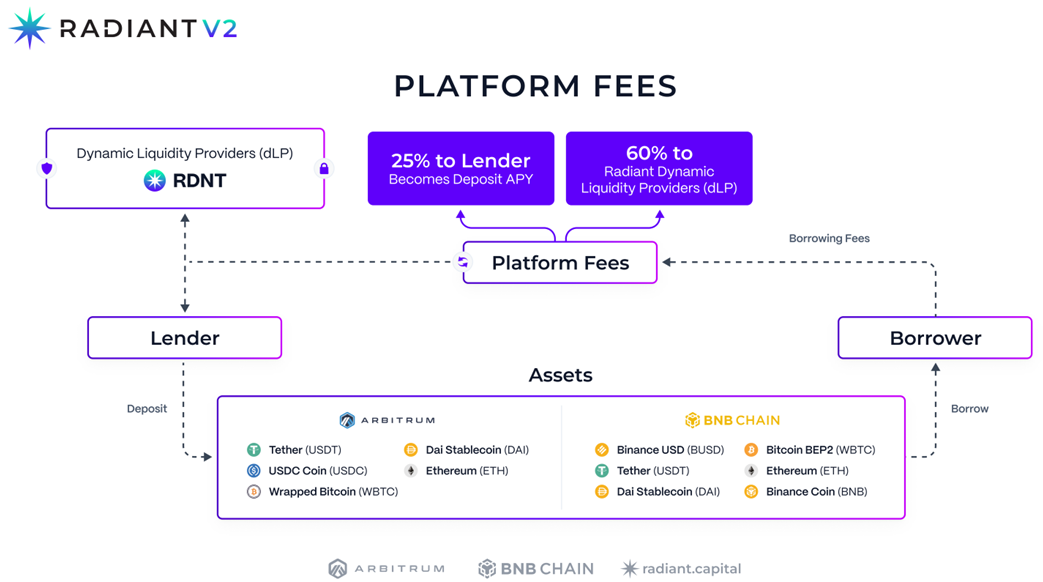

Figure 2-2 Radiant Capital Platform Fee Structure

Radiant’s mechanism resembles Figure 2-2 and is similar to existing lending protocols (e.g., Aave, Compound). The key difference is its aim to become an omnichain lending platform—users can deposit collateral on Chain A and borrow assets on Chain B.

The overall process is straightforward: To use Radiant’s cross-chain lending service, users must first deposit assets on supported chains (currently only Arbitrum and BNB Chain), becoming dynamic liquidity providers (dLP), before borrowing target assets on another chain. Fees earned by the Radiant V2 protocol are distributed as follows: 60% to dLPs, 25% to lenders, and 15% to a designated DAO-controlled operations wallet.

Additionally, Radiant offers a one-click looping function, allowing users to automatically deposit and borrow multiple times to increase collateral value (up to 5x leverage).

For example, a user can deposit ETH, WBTC, or other assets as collateral on Arbitrum and then borrow BNB on BSC, amplifying leverage. Throughout this process, users do not need to perform asset bridging (e.g., transferring ETH from Arbitrum to BSC beforehand). From the user’s perspective, they can complete cross-chain borrowing across different chains or L2s without manually moving assets.

2.4.2 Radiant V2

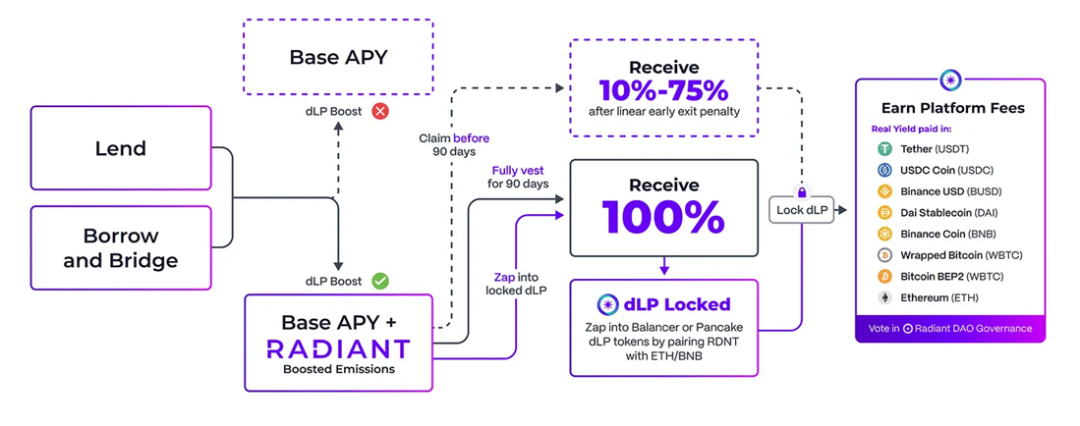

Figure 2-3 Radiant V2 Improvements

Figure 2-3 illustrates the improvements introduced in Radiant Capital’s V2 update on January 16, 2023.

Specifically, Radiant V2 differs from V1 in two main areas:

1) Economic Model

To address $RDNT inflation, Radiant introduced Dynamic Liquidity Provisioning (dLP). In V2, simple depositors earn only base interest rates and no longer receive $RDNT rewards. To qualify for $RDNT incentives, users must lock dLP tokens worth at least 5% of their total deposit value (since LP values fluctuate, it’s called “dynamic”). For every $100 deposited, users must hold at least $5 equivalent in dLP tokens to earn $RDNT rewards.

Currently, Radiant offers two locked LP pools:

• Arbitrum: Balancer 80/20 composition (80% RDNT & 20% ETH)

• BNB Chain: Pancakeswap 50/50 (50% RDNT & 50% BNB)

For instance, User A deposits $1 million on Radiant but locks $0 in dLP tokens—only earning base APY, with no $RDNT mining rewards.

User B deposits $1,000 and locks $50 worth of RDNT/BNB dLP—qualifying for $RDNT liquidity mining rewards (meets minimum 5% threshold).

In short, in V2, users must provide LP and stake a certain ratio of RDNT/ETH or RDNT/BNB dLP to earn $RDNT rewards.

dLP supports lock-up periods from 1–12 months, with longer locks receiving higher token incentives. Rewards are linearly vested over three months. Users may opt for early exit penalties to claim 10%–75% of rewards immediately (as shown in Figure 2-3).

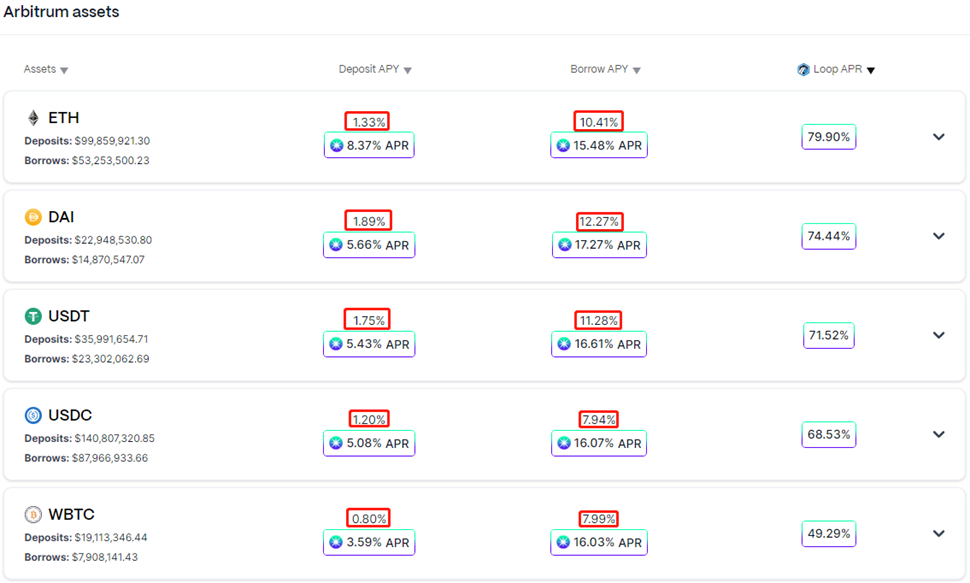

Figure 2-4 Radiant Official Website Interface

As shown in Figure 2-4, users who deposit without locking dLP earn only normal market lending rates on Radiant (red section). Those meeting dLP staking requirements receive additional $RDNT incentives (blue-purple APY section).

Overall, Radiant’s dLP mechanism requires depositors to provide liquidity proportional to their deposits to earn $RDNT rewards. This increases demand for $RDNT, boosts staking volume, enhances $RDNT liquidity, attracts long-term contributors, and fosters a symbiotic relationship with the platform.

To improve user experience, Radiant added "Zap" functions for nearly every component in V2: adding liquidity, looping loans, and locking dLP—including one-click looping with 5% dLP locking.

Additionally, to ensure economic sustainability, Radiant extended its original 2-year token release schedule to five years (until July 2027). It increased the reward vesting period from 28 to 90 days—early withdrawals receive only 10%-75% of linear rewards. Expired unclaimed rewards are removed from the pool. Users can re-stake via the interface. Protocol fees were adjusted accordingly, with dLPs becoming the largest beneficiaries. Overall, the V2 design is more balanced than V1.

2) Cross-Chain Mechanism

One of Radiant V2’s primary goals was converting the $RDNT token standard from ERC-20 to LayerZero OFT (Omnichain Fungible Token). In Radiant V1, cross-chain functionality relied mainly on Stargate’s routing. In V2, Radiant replaced Stargate’s interface for its native $RDNT token with LayerZero’s OFT standard. This enables faster deployment of $RDNT to new chains and gives Radiant control over its own cross-chain contracts. See the technical section below for details on LayerZero OFT mechanisms.

Summary:

Previously, rising $RDNT prices and liquidity mining incentives drove continuous TVL growth. However, history shows most liquidity mining leads only to temporary artificial prosperity—once yields drop, competitiveness declines. Radiant recognized this and implemented various V2 improvements—including extending $RDNT release schedules, adjusting fee distribution, modifying reward vesting, and introducing dLP—to promote sustainable development.

Theoretically, Radiant V2 alleviates $RDNT inflation concerns, and dLP design may boost protocol liquidity—but impacts are long-term and unproven in the short term, requiring further observation. Future developments should be monitored alongside broader ecosystem liquidity trends.

Moreover, for a cross-chain lending protocol, economic model enhancements and innovations are secondary. Ultimately, success depends on generating real borrowing demand and retaining users effectively. Take leading protocol Aave, for example—even without token incentives, its scale far surpasses newer competitors.

2.5 Technology

2.5.1 Interest Rate Model

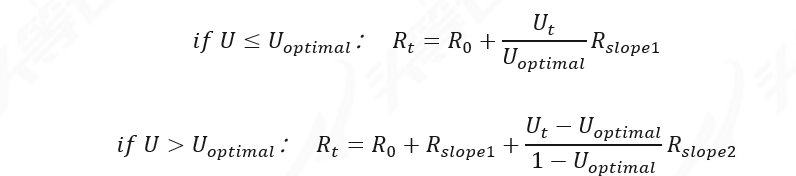

Borrowers pay interest, which accumulates into their loan balance. Radiant Capital’s interest rate model references Aave’s design (even directly citing Aave’s formula in documentation), adopting a dynamic interest rate model—a common approach among lending protocols aimed at maintaining optimal asset utilization levels.

Radiant’s interest rate algorithm is calibrated to manage liquidity risk and optimize utilization. Borrowing rates derive from utilization “U,” a metric indicating available funds in the pool.

The interest rate Rt follows this model:

Radiant’s interest rate model manages liquidity risk through user incentives. Rates adjust dynamically based on asset utilization—when utilization hits critical thresholds, rate changes influence user behavior to restore optimal levels:

If utilization U is below optimal levels, borrowing rates rise slowly, encouraging borrowing via lower costs.

If utilization exceeds optimal levels, borrowing rates spike rapidly, incentivizing deposits. High borrowing costs also prompt borrowers to repay debts promptly.

Since Radiant closely mirrors Aave’s contract design, refer to Aave’s official documentation [8] for further details.

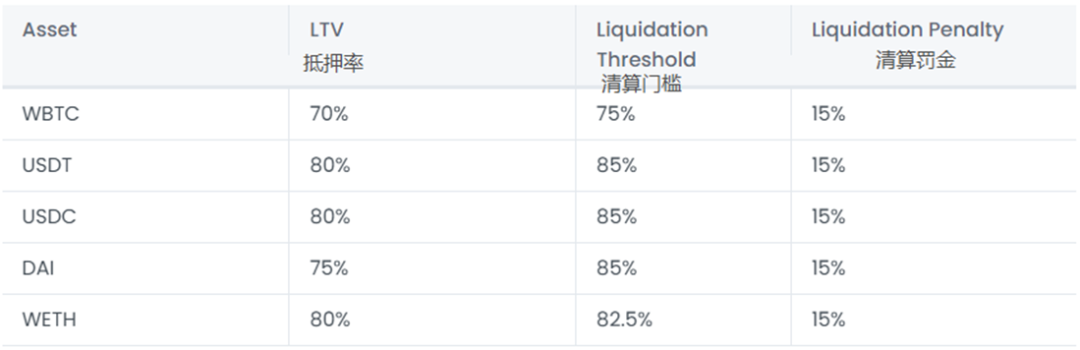

2.5.2 Liquidation Mechanism

Radiant’s liquidation mechanism resembles Aave’s, using a Health Factor metric to determine liquidation eligibility. When the Health Factor drops below 1—meaning collateral value falls below debt value—the user’s position becomes eligible for liquidation.

Collateral Value = Collateral × LTV; Debt Value = Loan Amount / Borrow Rate

Once triggered, liquidators can take over the borrower’s debt and collateral by repaying part of the loan and receiving discounted collateral in return (known as liquidation rewards). Like Compound and Aave, Radiant limits each liquidator to repaying up to 50% of a borrower’s outstanding debt per transaction.

Figure 2-5 Radiant Capital Market Risk Parameters

To incentivize liquidators, Radiant imposes a 15% penalty on bad debt during liquidation. Half (7.5%) goes to the liquidator as a bonus, while the other half flows into the team treasury. Note: This design may encourage front-running of liquidation transactions and expose large depositors to greater losses. To ensure prompt execution, liquidators often pay high gas fees.

Example scenario:

Suppose User A deposits 10 ETH and borrows DAI worth 5 ETH on Radiant. During the loan period, ETH price plummets, causing User A’s Health Factor to drop below 1—triggering liquidation.

A liquidator may repay up to 50% of User A’s single loan (DAI worth 2.5 ETH). In return, the liquidator claims 2.5 + 0.1875 ETH (a 7.5% bonus on 2.5 ETH, totaling 15% penalty) as compensation.

After liquidation, User A retains 7.125 ETH (10 - 2.5 - 0.1875 - 0.1875) and owes DAI worth 2.5 ETH.

2.5.3 RDNT OFT (Omnichain Fungible Tokens)

As mentioned earlier, Radiant V2 converted the $RDNT token standard from ERC-20 to LayerZero OFT (Omnichain Fungible Token).

OFT (Omnichain Fungible Tokens)

OFT is a wrapped token enabling free movement across LayerZero-supported chains. OFT serves as a shared token standard across all LayerZero-enabled chains, allowing seamless transfer without extra costs (e.g., bridging fees). When transferred between chains, OFTs are burned on the source chain and minted on the destination chain (burn-and-mint mechanism).

Currently, Radiant V2 supports only the OFT form of its native $RDNT token, enabling composability, fragmentation, and reunification of $RDNT liquidity across chains. This gives $RDNT elastic supply on every chain, enabling more complex strategies and frequent arbitrage opportunities as $RDNT deploys across more chains and dApps—expanding its utility.

Going forward, Radiant plans to eliminate dependence on third-party bridges (like Stargate) in V3, fully integrating LayerZero to deliver seamless cross-chain experiences and support lending across more EVM chains. The biggest advantage of LayerZero integration is mitigating fragmentation by using a unified token standard across multiple chains (assuming broad LayerZero adoption). This would allow frictionless pledging and borrowing of native tokens from any LayerZero-supported network within Radiant’s lending system.

Editor’s note: LayerZero is an omnichain interoperability protocol designed for lightweight cross-chain messaging without running nodes on connected chains. It relies on oracles and relayers to transmit messages between endpoints on different chains [10]. Radiant Capital, built on LayerZero, uses Chainlink oracles to ensure accurate price feeds, while its choice of relayer remains undisclosed. We speculate Radiant may initially adopt LayerZero’s native relayer in V3. Thus, for cross-chain communication on Radiant, messages are forwarded only after both oracle and relayer validate successfully.

Summary:

Radiant’s early success stemmed largely from generous token incentives, combined with macro recovery, Arbitrum’s momentum, and market excitement around LayerZero’s omnichain vision. After achieving initial traction, the team acknowledged that unsustainable high incentives caused excessive inflation—prompting V2 improvements addressing prior shortcomings with a more rational design.

Currently, Radiant has undeniably achieved successful early-stage launch. However, technically speaking, it introduces no novel advantages in lending—it mostly replicates Aave’s design. Its future hinges on fully leveraging LayerZero’s omnichain technology to expand its market reach and capture genuine user demand.

3. Development

3.1 History

Table 3-1 Radiant Capital Major Milestones

3.2 Current Status

3.2.1 Business Data

As the first officially launched cross-chain lending project on the LayerZero ecosystem, Radiant Capital has delivered solid results so far.

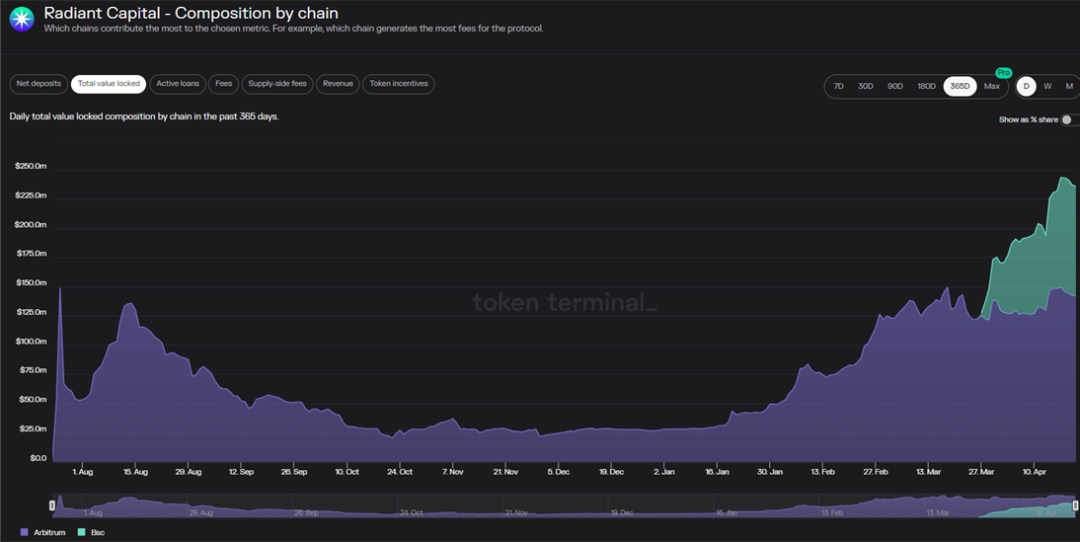

Figure 3-1 Radiant TVL Size

According to Token Terminal data, as of April 21, 2023, Radiant’s TVL was approximately $236 million—$142 million on Arbitrum and $93.9 million on BSC.

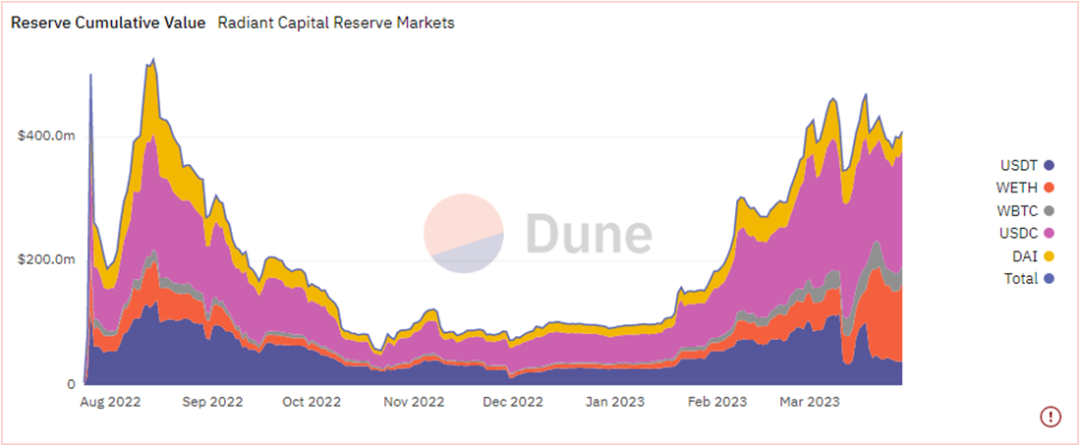

Figure 3-2 Radiant Capital Cumulative Reserves

Per Dune Analytics, as of March 30, 2023, total deposits on Radiant (on Ethereum) reached ~$435 million: USDC $190M, USDT $36.39M, DAI $34.68M, WETH $127M, WBTC $46.57M. Stablecoins accounted for 60.09% of total deposits.

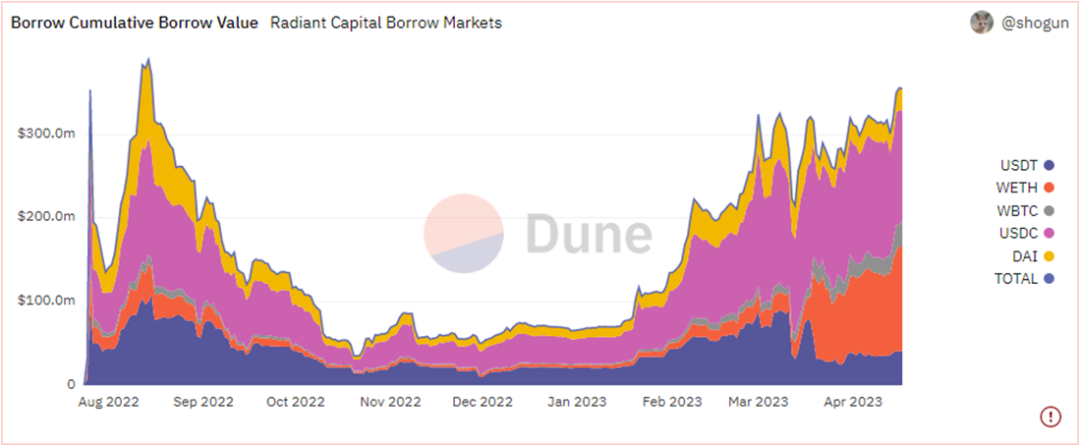

Figure 3-3 Radiant Capital Borrowing Activity

As of March 30, 2023, total borrowing on Radiant was ~$296 million: USDC $141M, USDT $37.1M, DAI $22.78M, WETH $792.1M, WBTC $16.39M. Stablecoin borrowings totaled ~67.71%.

Overall, Radiant’s fund utilization rate (total borrowing / total deposits) was ~68.05%, meaning for every $100 deposited, ~$68.05 was borrowed. According to official docs, LTV for USDC, USDT, and DAI is 80%—allowing up to $0.80 borrowed per $1 deposited. These stablecoins are nearly maxed out in utilization, suggesting much activity is driven by liquidity mining rather than genuine borrowing demand.

That said, even if much capital is mining-driven, it generates real revenue. As stated in Radiant’s April 2023 blog, the protocol has generated approximately $7 million in cumulative revenue.

Editor’s note: Since Dune’s Radiant Capital reserve data only goes up to March 30, 2023, borrowing figures here are also from that date for consistency. However, latest data shows as of April 19, 2023, total borrowing reached ~$355 million: USDC $131M, USDT $41.36M, DAI $26.33M, WETH $123M, WBTC $31.46M. Stablecoin borrowings now account for ~55.91%. This shift likely reflects rising real borrowing demand amid market volatility (note increased WETH borrowing in Figure 3-3), reducing stablecoin dominance.

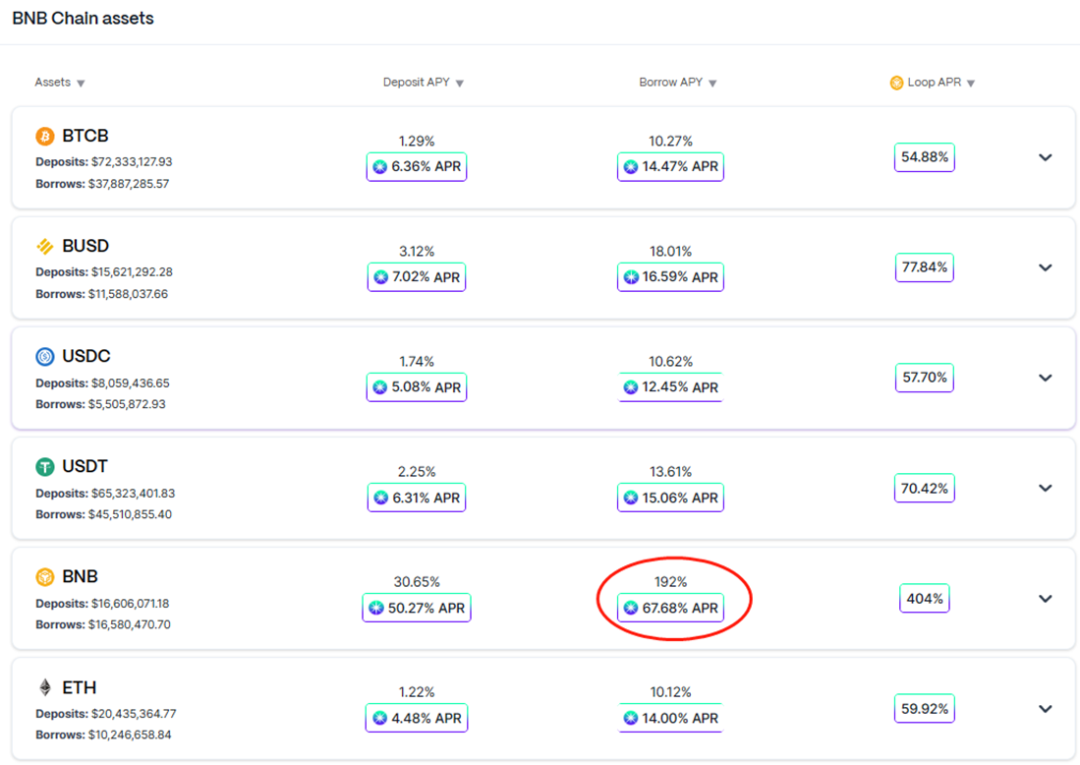

Currently, deposits and borrowings of USDC, USDT, DAI, ETH, WBTC, ARB, and wstETH on Radiant earn RDNT rewards through liquidity mining, and mining yields exceed borrowing costs for each asset—creating strong incentives for liquidity provision.

However, due to recent Binance Launchpad hype driving BNB demand, BNB borrowing rates on Radiant have surged. As of April 23, 2023, BNB borrowing APR hit 192%, while mining yield stood at only 67.68% (see Figure 3-4). Thus, looping BNB loans on Radiant is currently unprofitable. Users should conduct thorough research before participating.

Figure 3-4 Radiant BSC Lending Rates and Mining Yields

3.2.2 Users

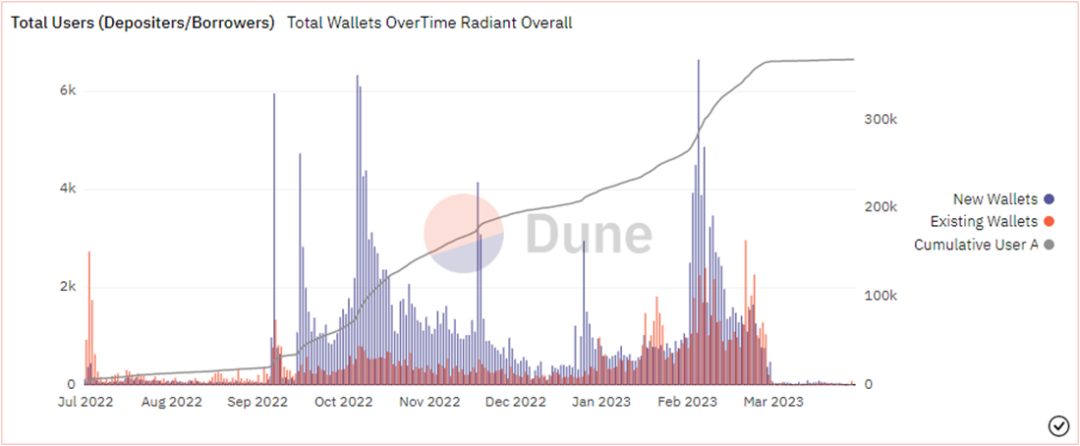

Figure 3-5 Radiant Capital User Metrics

Per Dune Analytics, since launch, Radiant saw slow initial growth followed by rapid user increases during Arbitrum booms in Q4 2022 and Q1 2023. However, as shown in Figure 3-5, user growth sharply slowed after the V2 launch on March 19, 2023 (black line). New

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News