Ethereum's New Whale Abraxas Capital: Accumulates Over 270,000 ETH in a Single Week, Tether's "Mysterious" Major Client

TechFlow Selected TechFlow Selected

Ethereum's New Whale Abraxas Capital: Accumulates Over 270,000 ETH in a Single Week, Tether's "Mysterious" Major Client

London-based asset management firm Abraxas Capital has become a focus in this rebound cycle due to its high-frequency on-chain activities and heavy positioning in Ethereum DeFi strategies.

Author: Nancy, PANews

Recently, Bitcoin and Ethereum have jointly driven a significant rebound in the crypto market, markedly increasing market liquidity and triggering frequent activities from major investors. Among them, London-based asset management firm Abraxas Capital has drawn attention during this upswing due to its high-frequency on-chain operations and heavy investment strategy in Ethereum DeFi.

Accumulated Over 270,000 ETH in a Single Week, Heavily Investing in Ethereum LST Ecosystem

In recent weeks, Abraxas Capital has been highly active on-chain.

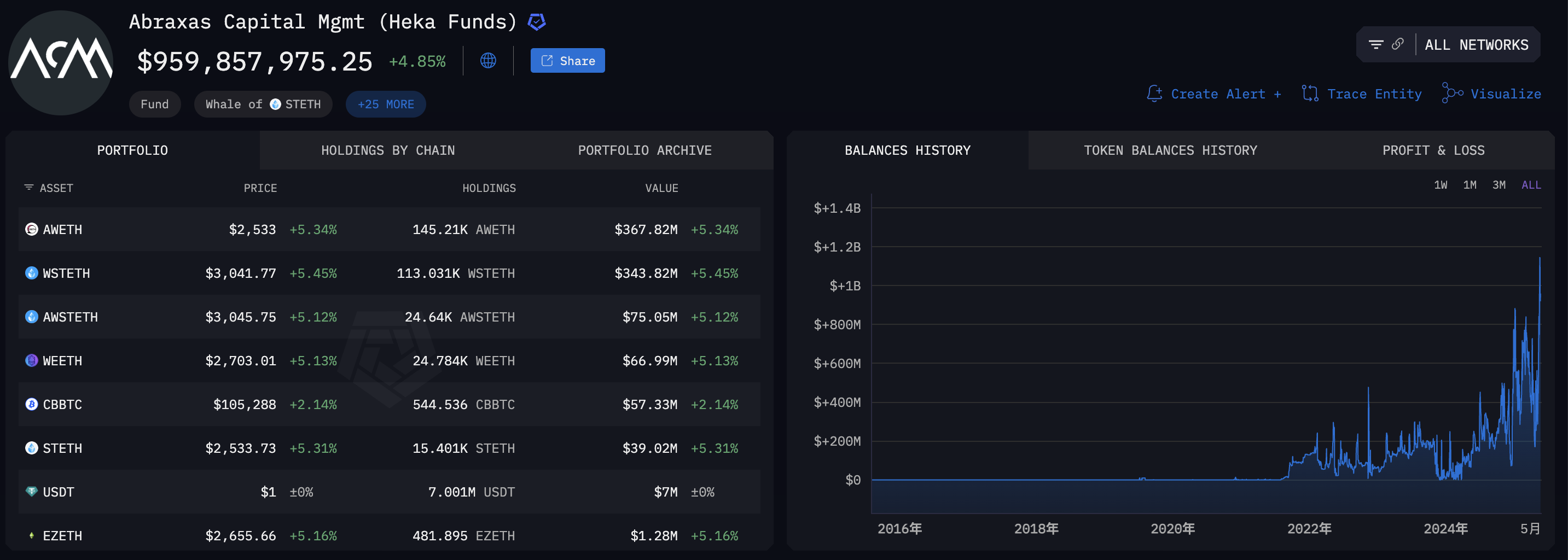

Overview of Assets Held by an Public Address of Abraxas Capital

According to Arkham data, as of May 20, the total value of crypto assets held across two known public addresses linked to Abraxas Capital has exceeded $1.15 billion, with cumulative profits of approximately $280 million.

In terms of asset composition, apart from over $190 million worth of Bitcoin, Abraxas Capital's portfolio is heavily concentrated in Ethereum liquid staking tokens (LSTs), which are used for staking or deposited as collateral in various DeFi protocols. Its main holdings include AwETH, wstETH, awstETH, and weETH, with combined holdings of AwETH and wstETH surpassing $700 million—constituting the vast majority of its overall assets. These assets offer both on-chain staking yields and secondary market liquidity, reflecting Abraxas Capital’s strategy balancing stable returns with flexible position management.

Regarding the pace of capital growth, since mid-February 2025, the firm’s asset size has grown significantly, briefly exceeding the $1 billion mark. In just the past week (May 13–20), its net worth increased by more than $130 million, primarily driven by substantial accumulation in AwSTETH (Aave v3 wstETH), amounting to over $120 million.

In terms of fund flows, within the past seven days, Abraxas Capital withdrew nearly 270,000 ETH from CEXs (centralized exchanges), completing around six buy transactions daily, totaling over $690 million in value. Based on its average purchase price of $2,573.80, compared to the current ETH market price of about $2,500, this position currently sits at a temporary unrealized loss of approximately $11 million.

Notably, Abraxas Capital significantly reduced its Bitcoin holdings within a month. On-chain data shows that over recent weeks, the firm transferred 2,000 BTC—worth over $190 million—to exchanges. However, it has recently resumed accumulating BTC, withdrawing Bitcoin worth approximately $85 million from exchanges.

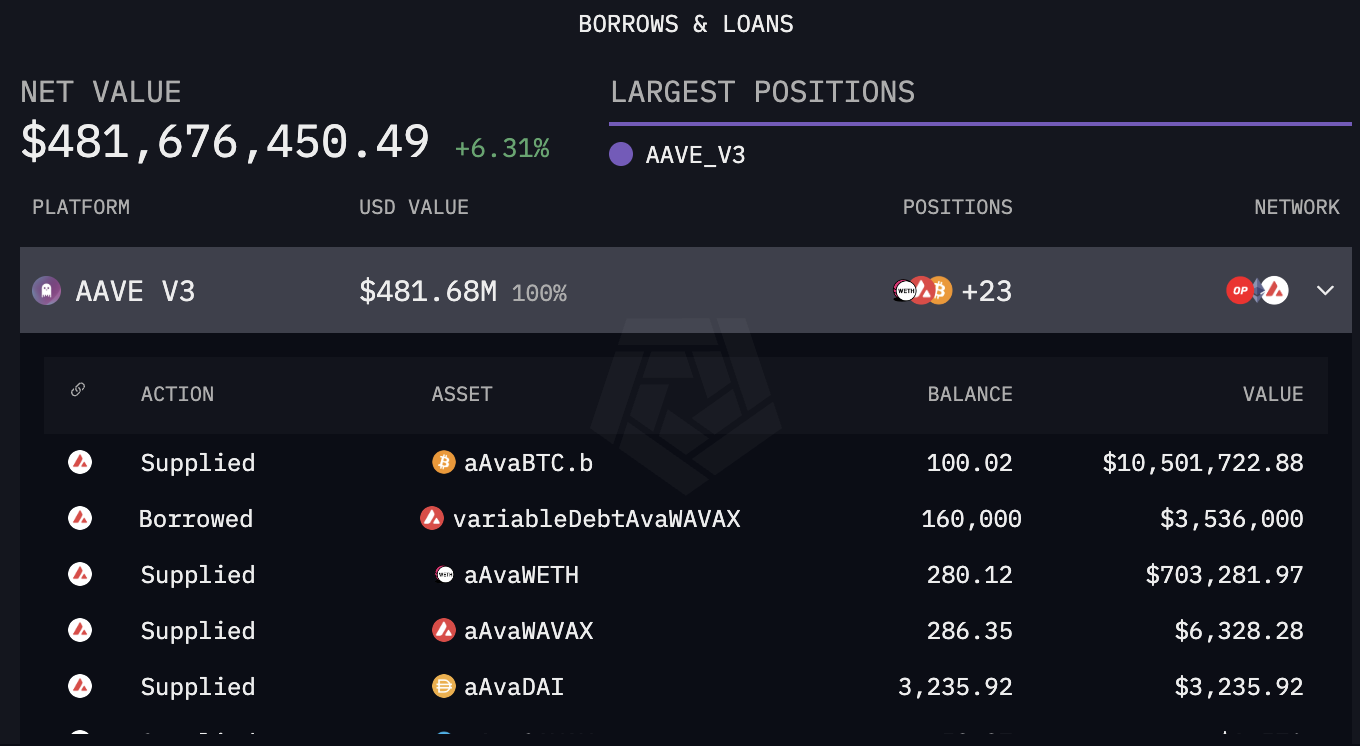

According to Arkham data, Abraxas Capital’s ETH funds are primarily flowing into Ethereum DeFi protocols. Over the past seven days, Abraxas Capital transferred more than 174,000 ETH into major DeFi platforms such as Aave, Ether.fi, and Compound, estimated at around $440 million based on current prices. Aave is particularly central to Abraxas Capital’s ETH holdings, where it currently holds asset positions exceeding $480 million on AAVE V3.

Overall, Abraxas Capital is emerging as one of the most active and heavily invested institutional players in the Ethereum ecosystem, enhancing asset liquidity and yield reuse through deep participation in DeFi markets.

Asset Scale Exceeds $3 Billion, Formerly a Major Tether Client

Abraxas Capital Management is a London-based asset management company regulated by the UK Financial Conduct Authority (FCA), aiming to build a top-tier asset management firm. It was co-founded in 2002 by Fabio Frontini and Luca Celati, who previously served as executives at Dresdner Kleinwort Wasserstein (DRKW) in London.

Abraxas Capital initially focused on traditional finance. On-chain data indicates that the company began investing in Bitcoin as early as late 2014. In 2017, Abraxas Capital announced a strategic shift toward digital assets.

Heka Funds is the core digital asset investment platform under Abraxas Capital, headquartered in Malta and regulated by the Malta Financial Services Authority (MFSA), managing over $3 billion in assets.

As a multi-fund investment firm, Heka currently manages three primary funds: The Elysium Global Arbitrage Fund, launched in 2017, was the first officially licensed and operational digital asset fund in the EU, achieving a return of 214.95% since inception. By the end of 2024, its AUM surpassed €1.2 billion. The Alpha Bitcoin Fund, established in 2022, focuses exclusively on Bitcoin investments and currently manages $2 billion. The Alpha Ethereum Fund, launched in 2023, targets Ethereum and currently has $4.8 million in AUM.

Among these, the Elysium Fund is the core business of Heka Funds. Initially entering the market with a Bitcoin arbitrage strategy inspired by a small arbitrage fund that bought Bitcoin cheaply on Western exchanges and resold them on Japanese platforms, Elysium initially focused on Bitcoin arbitrage. As arbitrage opportunities narrowed, the fund gradually shifted its strategy to stablecoin arbitrage.

In 2019, Fabio Frontini met Tether’s CFO Giancarlo Devasini and was invited to the Bahamas to meet with Deltec Bank, Tether’s banking partner. According to Frontini, Deltec showed him proof of Tether’s reserves—over 60% in cash and the remainder in short-term U.S. Treasuries—giving him full confidence in Tether’s 1:1 backing. Subsequently, Heka Funds verified Tether’s liquidity through a series of small test transactions, gradually scaling up its trading volume.

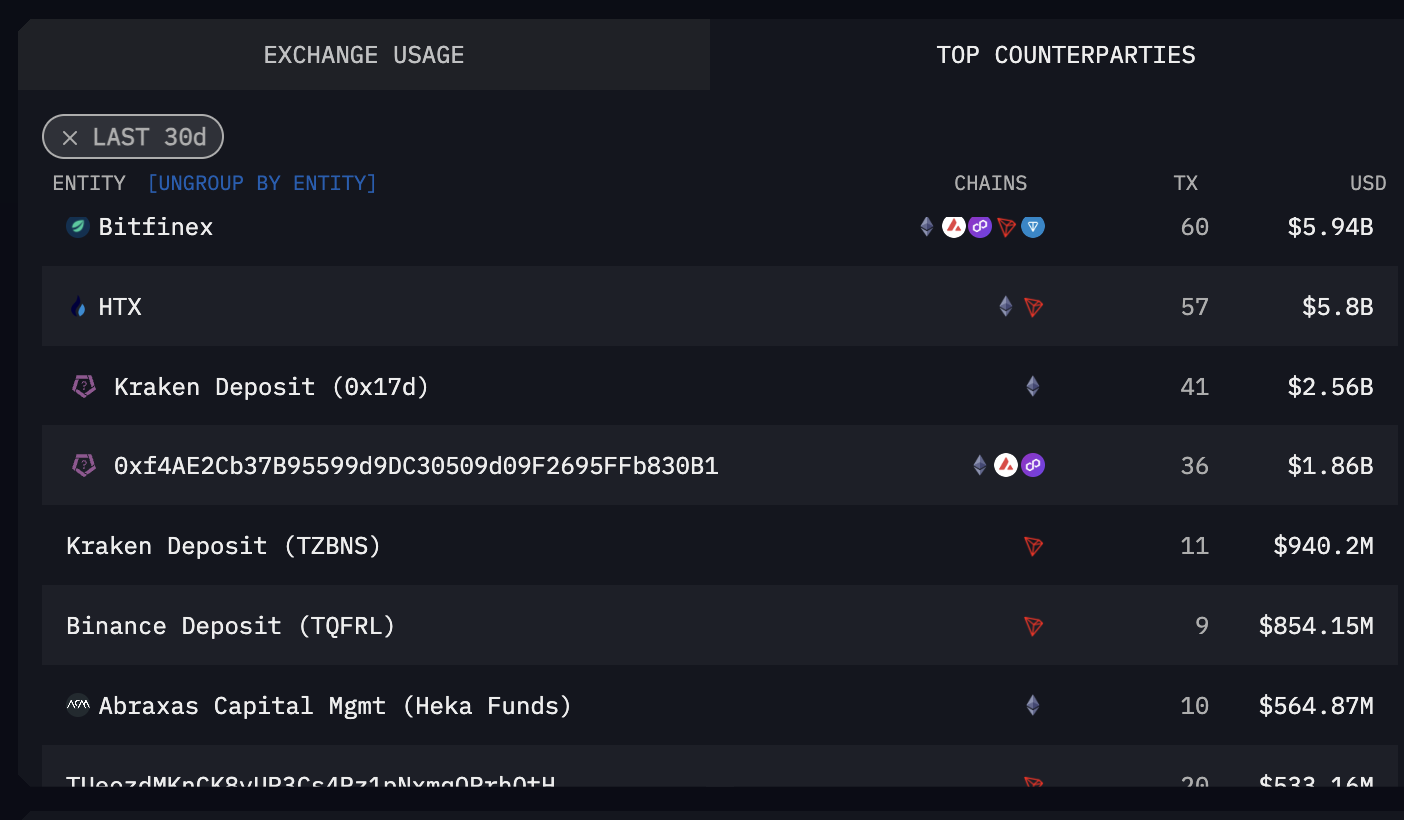

Through continuous trading and collaboration, Heka Funds grew into one of Tether’s largest institutional clients and can be seen as a key driver behind Tether’s rapid expansion. According to a 2021 research report by Protos, Heka Funds received over $1.5 billion in USDT at that time—accounting for about 1.5% of Tether’s total supply. That year, Heka Funds generated approximately $52 million in profit, far exceeding the $5.8 million earned by its parent company Abraxas, making it one of the group’s most successful funds. In the past 30 days, Arkham data shows Heka Funds ranked eighth among Tether’s main transaction counterparties, with transaction volumes reaching $564 million.

In an early 2025 interview with Protos, Frontini reiterated his confidence in Tether. He noted that Tether is earning substantial interest spreads in the current high U.S. interest rate environment, calling its business model extremely simple yet highly effective. He also cited comments made by Howard Lutnick (CEO of Cantor Fitzgerald) at the 2024 Davos Forum, stating that Tether’s assets are primarily held by Cantor, one of the largest U.S. Treasury dealers, further reinforcing his trust in Tether.

Notably, earlier this month, on-chain analyst @DesoGames traced Tether’s fund flows over a specific cycle and found they primarily flowed into Abraxas and Cumberland crypto entities. However, the funds were routed through multiple layers of accounts in complex and opaque ways, potentially aimed at concealing the origins of illicit transactions. The analyst further revealed that while HEKA Funds claims a net asset value of €1.3 billion, it purchased $1.5 billion worth of USDT (Tether issued about $2.5 billion during this period)—an amount clearly exceeding its financial capacity, raising suspicions. Additionally, HEKA Funds’ shareholders and directors were found listed in offshore leak databases, with complex backgrounds and untraceable true identities. HEKA Funds may merely be a shell fund used by Abraxas to obscure its real activities, lacking transparency and credibility.

Currently, judging from on-chain movements, as the crypto market continues to become more financialized and early stablecoin arbitrage opportunities shrink, Abraxas Capital is exploring expanding its strategies into the more sustainable Ethereum staking and lending ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News